- Q4 GAAP revenue of $1.1 billion, up 1% on both a reported

basis and adjusted basis, excluding Iraq; full year GAAP revenue of

$4.2 billion, down 3% on a reported basis, and up 0.5% on an

adjusted basis, excluding Iraq

- Both Q4 and full year Branded Digital GAAP revenue grew 7%,

or 8% on an adjusted basis

- Q4 Consumer Services GAAP revenue grew 56%, or 23% on an

adjusted basis; full year GAAP revenue grew 28%, or 15% on an

adjusted basis

- Q4 GAAP EPS of $1.13 or adjusted EPS of $0.40; full year

GAAP EPS of $2.74 or adjusted EPS of $1.74

- Board of Directors approved a dividend of $0.235 per share

in the first quarter of 2025

The Western Union Company (the “Company” or “Western Union”)

(NYSE: WU) today reported fourth quarter and full year 2024

financial results.

The Company’s fourth-quarter revenue of $1.1 billion increased

1% on a reported basis. The revenue increase was driven by growth

in Consumer Services and Branded Digital. Results included a lower

contribution from Iraq compared to the prior year period, which

negatively impacted the revenue growth rate by 3 percentage

points.

“We concluded 2024 with a solid performance, marking our third

consecutive quarter of positive adjusted revenue growth, excluding

Iraq, which was bolstered by 15% adjusted revenue growth in

Consumer Services and the seventh consecutive quarter of

double-digit transaction growth in our Branded Digital business,”

said Devin McGranahan, President and Chief Executive Officer. “As

we enter the final year of our Evolve 2025 strategy, I am pleased

with the advancements we have achieved and the positive shift in

the Company’s growth trajectory. Looking ahead, I believe we are

poised to drive further improvements and efficiencies, and I am

confident in our ability to continue delivering value to our

investors and stakeholders.”

Fourth quarter GAAP EPS was $1.13, up from $0.35 in the prior

year period. GAAP EPS included a $0.75 tax benefit from the

reorganization of the Company’s international operations. Adjusted

EPS increased to $0.40 from $0.37 in the prior year period due to

higher adjusted operating profit, fewer shares outstanding, and a

lower adjusted effective tax rate.

The Board of Directors today approved the first quarter dividend

of $0.235 per common share, payable March 31, 2025, to shareholders

of record at the close of business on March 17, 2025.

Q4 Business Results

- The Company’s Consumer Money Transfer (CMT) segment revenue

decreased 4% on a reported basis, and was flat on an adjusted

basis, excluding Iraq, while transactions increased 3% compared to

the prior period.

- Branded Digital revenue increased 7% on a reported basis, or 8%

on an adjusted basis, with transaction growth of 13%. The Branded

Digital business represented 25% and 32% of total CMT revenues and

transactions, respectively.

- Consumer Services segment revenue grew 56% on a reported basis,

or 23% on an adjusted basis, benefiting from new and expanded

products led by the addition of the Company’s newly launched media

network business and the expansion of the Company’s retail foreign

exchange business, as well as the continued growth of the retail

money order business.

Q4 Financial Results

- GAAP operating margin in the quarter was 17%, compared to 15%

in the prior year period, while the adjusted operating margin was

17% compared to 16% in the prior year period. GAAP and adjusted

operating margin increased due to improved marketing and technology

efficiencies, partially offset by changes in foreign currencies and

a lower contribution from Iraq in the current period.

- The GAAP effective tax rate in the quarter was a benefit of

161%, compared to a provision of 12% in the prior year period. The

decrease in the GAAP effective rate was primarily related to the

recognition of deferred tax assets, net of valuation allowance,

associated with reorganizing the Company’s international operations

in the current period. The adjusted effective tax rate in the

quarter was 12%, compared to 14% in the prior year period, with the

decrease due to the mix of income and discrete tax benefits.

2024 Full Year Financial

Results

- The Company’s full year 2024 revenue of $4.2 billion declined

3% on a reported basis, or grew 0.5% on an adjusted basis,

excluding Iraq.

- GAAP operating margin was 17%, compared to 19% in the prior

year. The adjusted operating margin was 19% compared to 20% in the

prior year. The decrease in the GAAP and adjusted operating margin

was due to a lower contribution from Iraq in 2024, partially offset

by improved marketing and technology efficiencies.

- The GAAP effective tax rate for 2024 was a benefit of 51%

compared to a provision of 16% in the prior year. The GAAP

effective tax rate decreased primarily due to the tax benefits

associated with reorganizing the Company’s international operations

and a settlement with the U.S. Internal Revenue Service regarding

the Company’s 2017 and 2018 federal income tax returns, both

occurring in 2024. The adjusted effective tax rate was 13% compared

to 15% in the prior year, which decreased due to the mix of income

and discrete tax benefits.

- GAAP EPS was $2.74 compared to $1.68 in 2023. GAAP EPS included

a $0.75 tax benefit from the reorganization of the Company’s

international operations as well as a $0.40 benefit from the IRS

Settlement in 2024. Adjusted EPS was $1.74 in both 2024 and 2023,

with 2024 benefiting from fewer shares outstanding and a lower

adjusted effective tax rate, offset by a lower contribution from

Iraq.

- Cash flow from operating activities was $406 million for the

year, which included approximately $230 million in tax payments

related to the 2017 Tax Act and the Company’s settlement with the

U.S. Internal Revenue Service. In 2024, the Company returned

approximately $496 million to shareholders in dividends and share

repurchases, consisting of $318 million in dividends and $177

million in share repurchases.

2025 Outlook

The Company expects the following financial results for full

year 2025, which includes no material changes in macroeconomic

conditions, including changes in foreign currencies or Argentinian

inflation.

2025 Outlook

GAAP

Adjusted

Revenue1

$4,090 to $4,190

$4,115 to $4,215

Operating Margin

18% to 20%

19% to 21%

EPS2

$1.54 to $1.64

$1.75 to $1.85

1

In millions, adjusted revenue

excludes the impact of currency and Argentina inflation

2

The GAAP effective tax rate is

expected to be 20% to 22% and the adjusted effective tax rate is

expected to be 14% to 16%

Non-GAAP Measures

Western Union presents a number of non-GAAP financial measures

because management believes that these metrics provide meaningful

supplemental information in addition to the GAAP metrics and

provide comparability and consistency to prior periods. Constant

currency results assume foreign revenues are translated from

foreign currencies to the U.S. dollar, net of the effect of foreign

currency hedges, at rates consistent with those in the prior year.

The Company estimates Argentina inflation as the revenue growth not

attributable to either transaction growth or the change in price

(revenue divided by principal).

Reconciliations of non-GAAP to comparable GAAP measures are

available in the accompanying schedules and in the “Investor

Relations” section of the Company’s website at

https://ir.westernunion.com.

Additional Statistics

Additional key statistics for the quarter and historical trends

can be found in the supplemental tables included with this press

release. All amounts included in the supplemental tables to this

press release are rounded to the nearest tenth of a million, except

as otherwise noted. As a result, the percentage changes and margins

disclosed herein may not recalculate precisely using the rounded

amounts provided.

Investor and Analyst Conference Call

and Presentation

The Company will host a conference call and webcast at 4:30 p.m.

ET today.

The webcast and presentation will be available at

https://ir.westernunion.com. Registration for the event is

required, so please register at least 15 minutes prior to the

scheduled start time. A webcast replay will be available shortly

after the event.

To listen to the webcast, please visit the Investor Relations

section of the Company’s website or use the following link: Webcast

Link. Alternatively, participants may join via telephone. In the

U.S., dial +1 (719) 359-4580, followed by the meeting ID, which is

992 3140 1790, and the passcode, which is 250832. For participants

outside the U.S., dial the country number from the international

directory, followed by the meeting ID, which is 992 3140 1790, and

the passcode, which is 250832.

Safe Harbor Compliance Statement for Forward-Looking

Statements

This press release contains certain statements that are

forward-looking within the meaning of the Private Securities

Litigation Reform Act of 1995. These statements are not guarantees

of future performance and involve certain risks, uncertainties, and

assumptions that are difficult to predict. Actual outcomes and

results may differ materially from those expressed in, or implied

by, our forward-looking statements. Words such as “expects,”

“intends,” “targets,” “anticipates,” “believes,” “estimates,”

“guides,” “provides guidance,” “provides outlook,” “projects,”

“designed to,” and other similar expressions or future or

conditional verbs such as “may,” “will,” “should,” “would,”

“could,” and “might” are intended to identify such forward-looking

statements. Readers of this press release of The Western Union

Company (the “Company,” “Western Union,” “we,” “our,” or “us”)

should not rely solely on the forward-looking statements and should

consider all uncertainties and risks discussed in the Risk Factors

section of our Annual Report on Form 10-K for the year ended

December 31, 2023 and in our subsequent filings the Securities and

Exchange Commission. The statements are only as of the date they

are made, and the Company undertakes no obligation to update any

forward-looking statement.

Possible events or factors that could cause results or

performance to differ materially from those expressed in our

forward-looking statements include the following: changes in

economic conditions, trade disruptions, or significantly slower

growth or declines in the money transfer, payment service, and

other markets in which we operate; interruptions in migration

patterns or other events, such as public health emergencies, any

changes arising as a result of the recent United States’ elections,

civil unrest, war, terrorism, natural disasters, or non-performance

by our banks, lenders, insurers, or other financial services

providers; failure to compete effectively in the money transfer and

payment service industry, including among other things, with

respect to digital, mobile and internet-based services, card

associations, and card-based payment providers, and with digital

currencies, including cryptocurrencies; geopolitical tensions,

political conditions and related actions, including trade

restrictions, tariffs, and government sanctions; deterioration in

customer confidence in our business; failure to maintain our agent

network and business relationships; our ability to adopt new

technology; the failure to realize anticipated financial benefits

from mergers, acquisitions and divestitures; decisions to change

our business mix; exposure to foreign exchange rates; changes in

tax laws, or their interpretation, and unfavorable resolution of

tax contingencies; cybersecurity incidents involving any of our

systems or those of our vendors or other third parties; cessation

of or defects in various services provided to us by third-party

vendors; our ability to realize the anticipated benefits from

restructuring-related initiatives; our ability to attract and

retain qualified key employees; failure to manage credit and fraud

risks presented by our agents, clients, and consumers; adverse

rating actions by credit rating agencies; our ability to protect

our intellectual property rights, and to defend ourselves against

potential intellectual property infringement claims; material

changes in the market value or liquidity of securities that we

hold; restrictions imposed by our debt obligations; liabilities or

loss of business resulting from a failure by us, our agents, or

their subagents to comply with laws and regulations and regulatory

or judicial interpretations thereof; increased costs or loss of

business due to regulatory initiatives and changes in laws,

regulations, and industry practices and standards; developments

resulting from governmental investigations and consent agreements

with, or investigations or enforcement actions by, regulators and

other government authorities; liabilities resulting from

litigation; failure to comply with regulations and evolving

industry standards regarding data privacy; failure to comply with

consumer protection laws; effects of unclaimed property laws or

their interpretation or the enforcement thereof; failure to comply

with working capital requirements; changes in accounting standards,

rules and interpretations; and other unanticipated events and

management’s ability to identify and manage these and other

risks.

About Western Union

The Western Union Company (NYSE: WU) is committed to helping

people around the world who aspire to build financial futures for

themselves, their loved ones and their communities. Our leading

cross-border, cross-currency money movement, payments and digital

financial services empower consumers, businesses, financial

institutions and governments—across more than 200 countries and

territories and over 130 currencies—to connect with billions of

bank accounts, millions of digital wallets and cards, and a global

footprint of hundreds of thousands of retail locations. Our goal is

to offer accessible financial services that help people and

communities prosper. For more information, visit

www.westernunion.com.

WU-G

THE WESTERN UNION

COMPANY

CONSOLIDATED STATEMENTS OF

INCOME

(Unaudited)

(in millions, except per share

amounts)

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2024

2023

% Change

2024

2023

% Change

Revenues $

1,058.2

$

1,052.3

1

%

$

4,209.7

$

4,357.0

(3)

%

Expenses: Cost of services

661.7

656.1

1

%

2,620.5

2,671.7

(2)

%

Selling, general, and administrative

218.4

236.9

(8)

%

863.4

867.8

(1)

%

Total expenses

880.1

893.0

(1)

%

3,483.9

3,539.5

(2)

%

Operating income

178.1

159.3

12

%

725.8

817.5

(11)

%

Other income/(expense): Gain on divestiture of business (a)

—

—

(c)

—

18.0

(c)

Interest income

2.3

4.6

(51)

%

11.9

15.6

(24)

%

Interest expense

(30.4

)

(26.3

)

16

%

(119.8

)

(105.3

)

14

%

Other income/(expense), net

(2.3

)

6.5

(c)

0.7

—

(c)

Total other expense, net

(30.4

)

(15.2

)

(c)

(107.2

)

(71.7

)

50

%

Income before income taxes

147.7

144.1

2

%

618.6

745.8

(17)

%

Provision for/(benefit from) income taxes (b)

(238.0

)

17.1

(c)

(315.6

)

119.8

(c)

Net income $

385.7

$

127.0

(c)

$

934.2

$

626.0

49

%

Earnings per share: Basic $

1.14

$

0.35

(c)

$

2.75

$

1.69

63

%

Diluted $

1.13

$

0.35

(c)

$

2.74

$

1.68

63

%

Weighted-average shares outstanding: Basic

338.4

359.7

340.0

370.8

Diluted

339.8

361.1

341.1

371.8

____________________

(a)

On July 1, 2023, the Company

completed the final close of the sale of its Business Solutions

business to Goldfinch Partners LLC and The Baupost Group LLC.

(b)

During the three months ended

December 31, 2024, the Company recognized a net tax benefit of

$255.2 million from deferred tax assets associated with the

reorganization of the Company's international operations.

Additionally, in the twelve months ended December 31, 2024, the

Company entered into a settlement with the U.S. Internal Revenue

Service (“IRS”) regarding the Company’s 2017 and 2018 federal

income tax returns and recognized a tax benefit of $137.8

million.

(c)

Calculation not meaningful.

THE WESTERN UNION

COMPANY

CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(in millions, except per share

amounts)

December 31,

December 31,

2024

2023

Assets Cash and cash equivalents $

1,474.0

$

1,268.6

Settlement assets

3,360.8

3,687.0

Property and equipment, net of accumulated depreciation of $454.9

and $438.8, respectively

84.2

91.4

Goodwill

2,059.6

2,034.6

Other intangible assets, net of accumulated amortization of $599.0

and $685.9, respectively

315.4

380.2

Deferred tax asset, net

265.0

—

Other assets

811.5

737.0

Total assets $

8,370.5

$

8,198.8

Liabilities and stockholders' equity Liabilities: Accounts

payable and accrued liabilities $

407.9

$

453.0

Settlement obligations

3,360.8

3,687.0

Income taxes payable

272.2

659.5

Deferred tax liability, net

155.6

147.6

Borrowings

2,940.8

2,504.6

Other liabilities

264.3

268.1

Total liabilities

7,401.6

7,719.8

Stockholders' equity: Preferred stock, $1.00 par value; 10

shares authorized; no shares issued

—

—

Common stock, $0.01 par value; 2,000 shares authorized; 337.9

shares and 350.5 shares issued and outstanding as of December 31,

2024 and 2023, respectively

3.4

3.5

Capital surplus

1,070.8

1,031.9

Retained earnings/(accumulated deficit)

35.2

(389.1

)

Accumulated other comprehensive loss

(140.5

)

(167.3

)

Total stockholders' equity

968.9

479.0

Total liabilities and stockholders' equity $

8,370.5

$

8,198.8

THE WESTERN UNION

COMPANY

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

(in millions)

Year Ended

December 31,

2024

2023

Cash flows from operating activities Net income $

934.2

$

626.0

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization

179.1

183.6

Gain on divestiture of business, excluding transaction costs

—

(18.0

)

Deferred income tax benefit

(248.8

)

(11.0

)

Other non-cash items, net

123.5

113.9

Increase/(decrease) in cash, excluding the effects of acquisitions

and divestitures, resulting from changes in: Other assets

(125.7

)

(36.3

)

Accounts payable and accrued liabilities

(46.4

)

(22.4

)

Income taxes payable

(394.6

)

(68.1

)

Other liabilities

(15.0

)

15.4

Net cash provided by operating activities

406.3

783.1

Cash flows from investing activities Capital expenditures

(130.6

)

(147.8

)

Purchases of settlement investments

(396.7

)

(495.3

)

Proceeds from the sale of settlement investments

356.0

262.0

Maturities of settlement investments

170.2

144.0

Proceeds from the sale of non-settlement investments

—

100.0

Other investing activities

(15.2

)

(3.7

)

Net cash used in investing activities

(16.3

)

(140.8

)

Cash flows from financing activities Cash dividends and

dividend equivalents paid

(321.5

)

(349.0

)

Common stock repurchased

(186.2

)

(308.4

)

Net (repayments of)/proceeds from commercial paper

(364.9

)

184.9

Net proceeds from issuance of borrowings

798.1

—

Principal payments on borrowings

—

(300.0

)

Net change in settlement obligations

6.1

(122.8

)

Other financing activities

(0.9

)

(1.5

)

Net cash used in financing activities

(69.3

)

(896.8

)

Net change in cash and cash equivalents, including settlement, and

restricted cash

320.7

(254.5

)

Cash and cash equivalents, including settlement, and restricted

cash at beginning of period

1,786.2

2,040.7

Cash and cash equivalents, including settlement, and restricted

cash at end of period $

2,106.9

$

1,786.2

December 31,

2024

2023

Reconciliation of balance sheet cash and cash equivalents to

cash flows: Cash and cash equivalents on balance sheet $

1,474.0

$

1,268.6

Settlement cash and cash equivalents

631.6

496.0

Restricted cash in Other assets

1.3

21.6

Cash and cash equivalents, including settlement, and restricted

cash at end of period $

2,106.9

$

1,786.2

THE WESTERN UNION

COMPANY

SUMMARY SEGMENT DATA

(Unaudited)

(in millions, unless indicated

otherwise)

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2024

2023

% Change

2024

2023

% Change

Revenues: Consumer Money Transfer $

938.8

$

975.5

(4)

%

$

3,798.0

$

4,005.0

(5)

%

Consumer Services

119.4

76.8

56

%

411.7

322.3

28

%

Business Solutions (a)

—

—

(g)

—

29.7

(g)

Total consolidated revenues $

1,058.2

$

1,052.3

1

%

$

4,209.7

$

4,357.0

(3)

%

Segment operating income: Consumer Money Transfer $

170.0

$

148.9

14

%

$

737.4

$

750.8

(2)

%

Consumer Services

13.4

20.4

(34)

%

52.3

92.5

(43)

%

Business Solutions (a)

—

—

(g)

—

3.7

(g)

Total segment operating income

183.4

169.3

8

%

789.7

847.0

(7)

%

Redeployment program costs (b)

—

(10.0

)

(g)

(41.4

)

(29.5

)

(g)

Severance costs (c)

(1.2

)

—

(g)

(1.2

)

—

(g)

Acquisition, separation, and integration costs (d)

(1.8

)

—

(g)

(4.1

)

—

(g)

Amortization and impairment of acquisition-related intangible

assets (e)

(0.2

)

—

(g)

(2.4

)

—

(g)

Russia asset impairments and termination costs (f)

(2.1

)

—

(g)

(14.8

)

—

(g)

Total consolidated operating income $

178.1

$

159.3

12

%

$

725.8

$

817.5

(11)

%

Segment operating income margin Consumer Money Transfer

18

%

15

%

3

%

19

%

19

%

0

%

Consumer Services

11

%

27

%

(16)

%

13

%

29

%

(16)

%

Business Solutions (a)

—

—

(g)

—

12

%

(g)

____________________

(a)

On August 4, 2021, the Company

entered into an agreement to sell its Business Solutions business.

The sale was completed with the final closing on July 1, 2023.

(b)

Represented severance, expenses

associated with streamlining the Company's organizational and legal

structure, and other expenses associated with the Company's program

which redeployed expenses in its cost base through optimizations in

vendor management, real estate, marketing, and people strategy, as

previously announced in October 2022. Expenses incurred under the

program also included non-cash impairments of operating lease

right-of-use assets and property and equipment.

(c)

Represents severance costs which

have been excluded from the segments as management excludes

severance in making operating decisions, including allocating

resources to the Company's segments.

(d)

Represents the impact from

expenses incurred in connection with the Company's acquisition and

divestiture activity, including for the review and closing of these

transactions, and integration costs directly related to the

Company’s acquisitions.

(e)

Represents the non-cash

amortization and impairment of acquired intangible assets in

connection with recent business acquisitions.

(f)

Represents asset impairments

related to the Company's assets in Russia and the costs associated

with operating the Russian entity. While the Company had previously

made a decision to suspend its operations in Russia, in the third

quarter of 2024, the Company decided to pursue either liquidating

or selling the Russian assets, which triggered a review of the

carrying value of these assets.

(g)

Calculation not meaningful.

THE WESTERN UNION

COMPANY

KEY STATISTICS

(Unaudited)

Notes*

4Q23

FY2023

1Q24

2Q24

3Q24

4Q24

FY2024

Consolidated Metrics Revenues (GAAP) - YoY % change

(4)%

(3)%

1%

(9)%

(6)%

1%

(3)%

Adjusted revenues (non-GAAP) - YoY % change

(a)

(1)%

1%

3%

(7)%

(6)%

(1)%

(3)%

Adjusted revenues, excluding Iraq (non-GAAP) - YoY % change

(a)

(4)%

(4)%

(1)%

0%

1%

1%

0%

Operating margin (GAAP)

15%

19%

18%

18%

16%

17%

17%

Adjusted operating margin (non-GAAP)

(b)

16%

20%

20%

19%

19%

17%

19%

Consumer Money Transfer (CMT) Segment Metrics

Revenues (GAAP) - YoY % change

(1)%

0%

3%

(10)%

(9)%

(4)%

(5)%

Adjusted revenues (non-GAAP) - YoY % change

(g)

(1)%

0%

3%

(9)%

(8)%

(3)%

(4)%

Adjusted revenues, excluding Iraq (non-GAAP) - YoY % change

(g)

(4)%

(6)%

(1)%

(1)%

0%

0%

(1)%

Transactions (in millions)

72.9

279.4

69.0

73.3

72.6

75.0

289.9

Transactions - YoY % change

5%

2%

6%

4%

3%

3%

4%

Cross-border principal, as reported - YoY % change

8%

9%

7%

(6)%

0%

5%

1%

Cross-border principal (constant currency) - YoY % change

(h)

7%

9%

7%

(5)%

0%

6%

2%

Operating margin

15%

19%

19%

20%

20%

18%

19%

Branded Digital revenues (GAAP) - YoY % change

(gg)

4%

0%

9%

5%

8%

7%

7%

Branded Digital foreign currency translation and Argentina

inflation impact

(k)

0%

0%

0%

2%

1%

1%

1%

Adjusted Branded Digital revenues (non-GAAP) - YoY % change

(gg)

4%

0%

9%

7%

9%

8%

8%

Branded Digital transactions - YoY % change

(gg)

13%

11%

13%

13%

15%

13%

13%

CMT Segment Regional Metrics - YoY % change

NA region revenues (GAAP)

(aa), (bb)

(1)%

(5)%

2%

1%

(3)%

(5)%

(1)%

NA region foreign currency translation impact

(k)

0%

0%

0%

0%

0%

0%

0%

Adjusted NA region revenues (non-GAAP)

(aa), (bb)

(1)%

(5)%

2%

1%

(3)%

(5)%

(1)%

NA region transactions

(aa), (bb)

6%

5%

6%

6%

3%

0%

3%

EU & CIS region revenues (GAAP)

(aa), (cc)

(8)%

(11)%

(5)%

(6)%

0%

3%

(2)%

EU & CIS region foreign currency translation impact

(k)

(1)%

0%

0%

2%

1%

1%

1%

Adjusted EU & CIS region revenues (non-GAAP)

(aa), (cc)

(9)%

(11)%

(5)%

(4)%

1%

4%

(1)%

EU & CIS region transactions

(aa), (cc)

4%

(6)%

5%

3%

6%

8%

5%

MEASA region revenues (GAAP)

(aa), (dd)

12%

31%

16%

(35)%

(32)%

(10)%

(19)%

MEASA region foreign currency translation impact

(k)

0%

1%

1%

0%

1%

0%

1%

Adjusted MEASA region revenues (non-GAAP)

(aa), (dd)

12%

32%

17%

(35)%

(31)%

(10)%

(18)%

MEASA region transactions

(aa), (dd)

7%

6%

6%

0%

0%

7%

3%

LACA region revenues (GAAP)

(aa), (ee)

2%

8%

7%

8%

(2)%

(3)%

2%

LACA region foreign currency translation and Argentina inflation

impact

(k)

(4)%

(3)%

(2)%

0%

1%

2%

1%

Adjusted LACA region revenues (non-GAAP)

(aa), (ee)

(2)%

5%

5%

8%

(1)%

(1)%

3%

LACA region transactions

(aa), (ee)

4%

7%

3%

2%

(2)%

(3)%

0%

APAC region revenues (GAAP)

(aa), (ff)

(7)%

(7)%

(10)%

(11)%

(2)%

(6)%

(7)%

APAC region foreign currency translation impact

(k)

2%

2%

4%

6%

3%

2%

4%

Adjusted APAC region revenues (non-GAAP)

(aa), (ff)

(5)%

(5)%

(6)%

(5)%

1%

(4)%

(3)%

APAC region transactions

(aa), (ff)

6%

1%

7%

6%

11%

7%

8%

% of CMT Revenue

NA region revenues

(aa), (bb)

39%

37%

38%

40%

39%

39%

39%

EU & CIS region revenues

(aa), (cc)

25%

25%

24%

25%

27%

27%

26%

MEASA region revenues

(aa), (dd)

18%

21%

21%

18%

17%

17%

18%

LACA region revenues

(aa), (ee)

12%

11%

12%

12%

11%

12%

12%

APAC region revenues

(aa), (ff)

6%

6%

5%

5%

6%

5%

5%

Branded Digital revenues

(aa), (gg)

23%

22%

23%

24%

25%

25%

24%

Consumer Services (CS)

Revenues (GAAP) - YoY % change

(1)%

13%

5%

21%

32%

56%

28%

Adjusted revenues (non-GAAP) - YoY % change

(i)

6%

17%

8%

14%

15%

23%

15%

Operating margin

27%

29%

21%

11%

9%

11%

13%

% of Total Company Revenue (GAAP) Consumer Money

Transfer segment revenues

93%

92%

92%

90%

90%

89%

90%

Consumer Services segment revenues

7%

7%

8%

10%

10%

11%

10%

Business Solutions segment revenues

0%

1%

0%

0%

0%

0%

0%

____________________ * See the “Notes to Key Statistics” section of

the press release for the applicable Note references and the

reconciliation of non-GAAP financial measures, unless already

reconciled herein.

THE WESTERN UNION COMPANY NOTES TO

KEY STATISTICS (Unaudited) (in millions, unless

indicated otherwise)

Western Union’s management believes the non-GAAP financial

measures presented within this press release and related tables

provide meaningful supplemental information regarding the Company’s

results to assist management, investors, analysts, and others in

understanding the Company’s financial results and to better analyze

operating, profitability, and other financial performance trends in

the Company’s underlying business because they provide consistency

and comparability to prior periods or eliminate currency

volatility, increasing the comparability of the Company's

underlying results and trends.

A non-GAAP financial measure should not be considered in

isolation or as a substitute for the most comparable GAAP financial

measure. A non-GAAP financial measure reflects an additional way of

viewing aspects of the Company’s operations that, when viewed with

the Company’s GAAP results and the reconciliation to the

corresponding GAAP financial measure, provides a more complete

understanding of the Company’s business. Users of the financial

statements are encouraged to review the Company’s financial

statements and publicly-filed reports in their entirety and not to

rely on any single financial measure. A reconciliation of non-GAAP

financial measures to the most directly comparable GAAP financial

measures is included below, where not previously reconciled

above.

Notes

4Q23

FY2023

1Q24

2Q24

3Q24

4Q24

FY2024

Consolidated Metrics

(a)

Revenues (GAAP) $

1,052.3

$

4,357.0

$

1,049.1

$

1,066.4

$

1,036.0

$

1,058.2

$

4,209.7

Foreign currency translation and Argentina inflation impact (k)

1.2

15.4

5.6

6.4

(5.5

)

(17.6

)

(11.1

)

Revenues, constant currency, net of Argentina inflation (non-GAAP)

1,053.5

4,372.4

1,054.7

1,072.8

1,030.5

1,040.6

4,198.6

Less Business Solutions revenues, constant currency (non-GAAP) (k),

(n)

—

(29.9

)

—

—

—

—

—

Adjusted revenues (non-GAAP) $

1,053.5

$

4,342.5

$

1,054.7

$

1,072.8

$

1,030.5

$

1,040.6

$

4,198.6

Less Iraq revenues (GAAP) (t)

(32.5

)

(263.0

)

(64.9

)

(34.3

)

(9.5

)

(6.6

)

(115.3

)

Adjusted revenues, excluding Iraq (non-GAAP) $

1,021.0

$

4,079.5

$

989.8

$

1,038.5

$

1,021.0

$

1,034.0

$

4,083.3

Prior year revenues (GAAP) $

1,091.9

$

4,475.5

$

1,036.9

$

1,170.0

$

1,097.8

$

1,052.3

$

4,357.0

Less prior year revenues from Business Solutions (GAAP) (n)

(29.5

)

(196.9

)

(15.4

)

(14.3

)

—

—

(29.7

)

Adjusted prior year revenues (non-GAAP) $

1,062.4

$

4,278.6

$

1,021.5

$

1,155.7

$

1,097.8

$

1,052.3

$

4,327.3

Less prior year revenues from Iraq (GAAP) (t)

(4.0

)

(15.1

)

(25.3

)

(118.4

)

(86.8

)

(32.5

)

(263.0

)

Adjusted prior year revenues, excluding Iraq (non-GAAP) $

1,058.4

$

4,263.5

$

996.2

$

1,037.3

$

1,011.0

$

1,019.8

$

4,064.3

Revenues (GAAP) - YoY % change

(4)

%

(3)

%

1

%

(9)

%

(6)

%

1

%

(3)

%

Revenues, constant currency, net of Argentina inflation (non-GAAP)

- YoY% change

(4)

%

(2)

%

2

%

(8)

%

(6)

%

(1)

%

(4)

%

Adjusted revenues (non-GAAP) - YoY % change

(1)

%

1

%

3

%

(7)

%

(6)

%

(1)

%

(3)

%

Adjusted revenues, excluding Iraq (non-GAAP) - YoY % change

(4)

%

(4)

%

(1)

%

0

%

1

%

1

%

0

%

(b)

Operating income (GAAP) $

159.3

$

817.5

$

192.1

$

190.7

$

164.9

$

178.1

$

725.8

Acquisition, separation, and integration costs (m)

0.2

3.1

0.1

0.5

1.7

1.8

4.1

Amortization and impairment of acquisition-related intangible

assets (p)

—

—

—

2.0

0.2

0.2

2.4

Redeployment program costs (o)

10.0

29.5

14.0

9.4

18.0

—

41.4

Severance costs (u)

—

—

—

—

—

1.2

1.2

Russia asset impairments and termination costs (r)

—

—

—

—

12.7

2.1

14.8

Less Business Solutions operating income (n)

—

(3.6

)

—

—

—

—

—

Adjusted operating income (non-GAAP) $

169.5

$

846.5

$

206.2

$

202.6

$

197.5

$

183.4

$

789.7

Operating margin (GAAP)

15

%

19

%

18

%

18

%

16

%

17

%

17

%

Adjusted operating margin (non-GAAP)

16

%

20

%

20

%

19

%

19

%

17

%

19

%

(c)

Net income (GAAP) $

127.0

$

626.0

$

142.7

$

141.0

$

264.8

$

385.7

$

934.2

Acquisition, separation, and integration costs (m)

0.2

3.1

0.1

0.5

1.7

1.8

4.1

Amortization and impairment of acquisition-related intangible

assets (p)

—

—

—

2.0

0.2

0.2

2.4

Business Solutions gain (n)

—

(18.0

)

—

—

—

—

—

Redeployment program costs (o)

10.0

29.5

14.0

9.4

18.0

—

41.4

Severance costs (u)

—

—

—

—

—

1.2

1.2

Russia asset impairments, termination costs, and currency

remeasurement (r)

—

—

—

—

13.7

3.0

16.7

IRS settlement (s)

—

—

—

—

(137.8

)

—

(137.8

)

Non-cash tax impacts of international reorganization (v)

—

—

—

—

—

(255.2

)

(255.2

)

Income tax expense/(benefit) from other adjustments (m), (n), (o),

(p), (q), (r), (u)

(4.6

)

4.6

(1.5

)

(4.0

)

(5.6

)

(1.1

)

(12.2

)

Adjusted net income (non-GAAP) $

132.6

$

645.2

$

155.3

$

148.9

$

155.0

$

135.6

$

594.8

(d)

Net income (GAAP) $

127.0

$

626.0

$

142.7

$

141.0

$

264.8

$

385.7

$

934.2

Provision for/(benefit from) income taxes

17.1

119.8

27.3

24.2

(129.1

)

(238.0

)

(315.6

)

Interest income

(4.6

)

(15.6

)

(3.1

)

(3.7

)

(2.8

)

(2.3

)

(11.9

)

Interest expense

26.3

105.3

26.1

31.1

32.2

30.4

119.8

Depreciation and amortization

45.1

183.6

46.6

46.1

43.0

43.4

179.1

Stock-based compensation expense

8.7

35.9

8.7

10.2

9.5

10.5

38.9

Other (income)/expense, net

(6.5

)

—

(0.9

)

(1.9

)

(0.2

)

2.3

(0.7

)

Business Solutions gain (n)

—

(18.0

)

—

—

—

—

—

Acquisition, separation, and integration costs (m)

0.2

3.1

0.1

0.5

1.7

1.8

4.1

Amortization and impairment of acquisition-related intangible

assets (p)

—

—

—

2.0

0.2

0.2

2.4

Redeployment program costs (o)

10.0

29.5

14.0

9.4

18.0

—

41.4

Severance costs (u)

—

—

—

—

—

1.2

1.2

Russia asset impairments and termination costs (r)

—

—

—

—

12.7

2.1

14.8

Less Business Solutions operating income (n)

—

(3.6

)

—

—

—

—

—

Adjusted EBITDA (non-GAAP) (l) $

223.3

$

1,066.0

$

261.5

$

258.9

$

250.0

$

237.3

$

1,007.7

(e)

Effective tax rate (GAAP)

12

%

16

%

16

%

15

%

(95)

%

(161)

%

(51)

%

IRS settlement (s)

0

%

0

%

0

%

0

%

102

%

0

%

22

%

Non-cash tax impacts of international reorganization (v)

0

%

0

%

0

%

0

%

0

%

173

%

41

%

Other adjustments (m), (n), (o), (p), (q), (r), (u)

2

%

(1)

%

0

%

1

%

1

%

0

%

1

%

Adjusted effective tax rate (non-GAAP)

14

%

15

%

16

%

16

%

8

%

12

%

13

%

(f)

Diluted earnings per share (GAAP) ($- dollars) $

0.35

$

1.68

$

0.41

$

0.41

$

0.78

$

1.13

$

2.74

Pretax impacts from the following:

Acquisition, separation, and integration costs (m)

—

0.01

—

—

—

0.01

0.01

Amortization and impairment of acquisition-related intangible

assets (p)

—

—

—

0.01

—

—

0.01

Business Solutions gain (n)

—

(0.05

)

—

—

—

—

—

Redeployment program costs (o)

0.03

0.08

0.04

0.03

0.05

—

0.12

Severance costs (u)

—

—

—

—

—

—

—

Russia asset impairments, termination costs, and currency

remeasurement (r)

—

—

—

—

0.04

0.01

0.05

Income tax expense/(benefit) impacts from the following:

IRS settlement (s)

—

—

—

—

(0.40

)

—

(0.40

)

Non-cash tax impacts of international reorganization (v)

—

—

—

—

—

(0.75

)

(0.75

)

Other adjustments (m), (n), (o), (p), (q), (r), (u)

(0.01

)

0.02

—

(0.01

)

(0.01

)

—

(0.04

)

Adjusted diluted earnings per share (non-GAAP) ($- dollars) $

0.37

$

1.74

$

0.45

$

0.44

$

0.46

$

0.40

$

1.74

CMT Segment Metrics

(g)

Revenues (GAAP) $

975.5

$

4,005.0

$

962.0

$

965.0

$

932.2

$

938.8

$

3,798.0

Foreign currency translation and Argentina inflation impact (k)

(3.4

)

4.6

2.5

12.7

7.4

7.5

30.1

Revenues, constant currency, net of Argentina inflation (non-GAAP)

972.1

4,009.6

964.5

977.7

939.6

946.3

3,828.1

Less Iraq revenues (GAAP) (t)

(32.5

)

(263.0

)

(64.9

)

(34.3

)

(9.5

)

(6.6

)

(115.3

)

Adjusted revenues, excluding Iraq (non-GAAP) $

939.6

$

3,746.6

$

899.6

$

943.4

$

930.1

$

939.7

$

3,712.8

Prior year revenues (GAAP) $

985.2

$

3,993.5

$

938.3

$

1,072.2

$

1,019.0

$

975.5

$

4,005.0

Less prior year revenues from Iraq (GAAP) (t)

(4.0

)

(15.1

)

(25.3

)

(118.4

)

(86.8

)

(32.5

)

(263.0

)

Prior year revenues, excluding Iraq (non-GAAP) $

981.2

$

3,978.4

$

913.0

$

953.8

$

932.2

$

943.0

$

3,742.0

Revenues (GAAP) - YoY % change

(1)

%

0

%

3

%

(10)

%

(9)

%

(4)

%

(5)

%

Adjusted revenues (non-GAAP) - YoY % change

(1)

%

0

%

3

%

(9)

%

(8)

%

(3)

%

(4)

%

Adjusted revenues, excluding Iraq (non-GAAP) - YoY % change

(4)

%

(6)

%

(1)

%

(1)

%

0

%

0

%

(1)

%

(h)

Cross-border principal, as reported ($- billions) $

25.2

$

101.7

$

24.6

$

25.9

$

25.9

$

26.5

$

102.9

Foreign currency translation impact (k)

(0.2

)

0.0

0.0

0.3

0.1

0.2

0.6

Cross-border principal, constant currency ($- billions) $

25.0

$

101.7

$

24.6

$

26.2

$

26.0

$

26.7

$

103.5

Prior year cross-border principal, as reported ($- billions) $

23.4

$

93.6

$

23.0

$

27.5

$

26.0

$

25.2

$

101.7

Cross-border principal, as reported - YoY % change

8

%

9

%

7

%

(6)

%

0

%

5

%

1

%

Cross-border principal, constant currency - YoY % change

7

%

9

%

7

%

(5)

%

0

%

6

%

2

%

CS Segment Metrics

(i)

Revenues (GAAP) $

76.8

$

322.3

$

87.1

$

101.4

$

103.8

$

119.4

$

411.7

Foreign currency translation and Argentina inflation impact (k)

4.8

10.7

3.0

(6.2

)

(12.9

)

(25.1

)

(41.2

)

Revenues, constant currency, net of Argentina inflation (non-GAAP)

$

81.6

$

333.0

$

90.1

$

95.2

$

90.9

$

94.3

$

370.5

Prior year revenues (GAAP) $

77.2

$

285.1

$

83.2

$

83.5

$

78.8

$

76.8

$

322.3

Revenues (GAAP) - YoY % change

(1)

%

13

%

5

%

21

%

32

%

56

%

28

%

Adjusted revenues (non-GAAP) - YoY % change

6

%

17

%

8

%

14

%

15

%

23

%

15

%

Business Solutions Segment Metrics

(j)

Revenues (GAAP) $

—

$

29.7

$

—

$

—

$

—

$

—

$

—

Foreign currency translation impact (k)

—

0.2

—

—

—

—

—

Revenues, constant currency (non-GAAP) $

—

$

29.9

$

—

$

—

$

—

$

—

$

—

2025 Consolidated Outlook Metrics

Notes

Range

Revenues (GAAP) $

4,090

$

4,190

Foreign currency translation and Argentina inflation impact

(k)

25

25

Revenues, adjusted (non-GAAP)

$

4,115

$

4,215

Range

Operating margin (GAAP)

18

%

20

%

Severance costs

(u)

1

%

1

%

Acquisition, separation, and integration costs

(m)

0

%

0

%

Amortization and impairment of acquisition-related intangible

assets

(p)

0

%

0

%

Russia asset impairments and termination costs

(r)

0

%

0

%

Operating margin, adjusted (non-GAAP)

19

%

21

%

Range

Effective tax rate (GAAP)

20

%

22

%

Non-cash tax impacts of international reorganization

(v)

(6)

%

(6)

%

Other adjustments

(m), (p), (r), (u)

0

%

0

%

Effective tax rate (non-GAAP)

14

%

16

%

Range

Earnings per share (GAAP) ($- dollars)

$

1.54

$

1.64

Severance costs

(u)

0.08

0.08

Acquisition, separation, and integration costs

(m)

—

—

Amortization and impairment of acquisition-related intangible

assets

(p)

—

—

Russia asset impairments, termination costs, and currency

remeasurement

(r)

—

—

Income taxes associated with these adjustments

(m), (p), (r), (u)

—

—

Non-cash tax impacts of international reorganization

(v)

0.13

0.13

Earnings per share, adjusted (non-GAAP) ($- dollars) $

1.75

$

1.85

Non-GAAP related

notes:

(k)

Represents the impact from the

fluctuation in exchange rates between all foreign currency

denominated amounts and the United States dollar. Constant currency

results exclude any benefit or loss caused by foreign exchange

fluctuations between foreign currencies and the United States

dollar, net of foreign currency hedges, which would not have

occurred if there had been a constant exchange rate. Constant

currency results also reflect the impact of Argentina inflation,

where indicated, due to its economy being hyperinflationary. The

Company estimates Argentina inflation as the revenue growth not

attributable to either transaction growth or the change in price

(revenue divided by principal). Argentina inflation has

historically had a more significant impact to revenues in the

Company's Consumer Services segment, as proportionally, there are

higher revenues generated from Argentina in the Company's Consumer

Services segment, relative to its Consumer Money Transfer

segment.

(l)

Earnings before Interest, Taxes,

Depreciation, and Amortization (“EBITDA”) results from taking

operating income and adjusting for non-cash depreciation and

amortization and stock-based compensation expenses. EBITDA results

provide an additional performance measurement calculation which

helps neutralize the operating income effect of assets acquired in

prior periods.

(m)

Represents the impact from

expenses incurred in connection with the Company's acquisition and

divestiture activity, including for the review and closing of these

transactions, and integration costs directly related to the

Company's acquisitions. Beginning in 2024, the expenses are not

included in the measurement of segment operating income provided to

the Chief Operating Decision Maker (“CODM”) for purposes of

performance assessment and resource allocation.

(n)

During 2021, the Company entered

into an agreement to sell its Business Solutions business to

Goldfinch Partners LLC and The Baupost Group LLC. The sale was

completed in three closings, the first of which occurred on March

1, 2022 with the entirety of the cash consideration collected at

that time and allocated to the closings on a relative fair value

basis. The final closing, which included the European Union

operations, occurred on July 1, 2023 and resulted in a gain of

$18.0 million. Revenues have been adjusted to exclude the carved

out financial information for the Business Solutions business to

compare the year-over-year changes and trends in the Company's

continuing businesses, excluding the effects of this

divestiture.

(o)

Represented severance, expenses

associated with streamlining the Company's organizational and legal

structure, and other expenses associated with the Company's program

which redeployed expenses in its cost base through optimizations in

vendor management, real estate, marketing, and people strategy as

previously announced in October 2022. Expenses incurred under the

program also included non-cash impairments of operating lease

right-of-use assets and property and equipment. The expenses were

not included in the measurement of segment operating income

provided to the CODM for purposes of performance assessment and

resource allocation. The Company had also excluded a tax benefit

directly associated with streamlining the Company’s legal structure

in the fourth quarter of 2023 from its measures of adjusted net

income, adjusted effective tax rate, and adjusted diluted earnings

per share.

(p)

Represents the non-cash

amortization and impairment of acquired intangible assets in

connection with recent business acquisitions. The expenses are not

included in the measurement of segment operating income provided to

the CODM for purposes of performance assessment and resource

allocation. These expenses are therefore excluded from the

Company's segment operating income results.

(q)

In addition to the income tax

effects of the adjustments described above, the second quarter and

full year of 2024 included an adjustment to exclude an income tax

benefit of $2.6 million related to the non-cash impact of

remeasuring the Company’s deferred tax assets and liabilities for

tax law changes that were enacted in that period in Barbados.

(r)

While the Company had previously

made a decision to suspend its operations in Russia, in the third

quarter of 2024, the Company decided to pursue either liquidating

or selling the Russian assets, which triggered a review of the

carrying value of these assets. In the third and fourth quarter of

2024, the Company recorded asset impairments of $12.0 million and

$1.4 million, respectively, related to its assets in Russia.

Amounts presented also include the costs associated with operating

the Russian entity which are no longer needed for the Company’s

ongoing operations. Beginning with the third quarter of 2024, the

expenses have only been incurred in order to complete the

liquidation or possible sale of the Russian assets. Additionally,

where indicated, the Company has excluded the impact of the foreign

currency remeasurement of the Russian ruble because of the decision

to liquidate or sell the Russian assets. These costs are not

included in the measurement of segment operating income provided to

the CODM for purposes of performance assessment and resource

allocation.

(s)

In the third quarter of 2024, the

Company entered into a settlement with the IRS regarding the

Company’s 2017 and 2018 federal income tax returns. The Company is

contesting the one remaining unagreed adjustment at the IRS Appeals

level and has fully reserved for this unagreed adjustment. The

Company has excluded the non-cash reversal of the uncertain tax

position liability associated with the settlement because of the

significance of this settlement on its reported results.

(t)

Represents revenues from

transactions originated in Iraq. Beginning in March 2023, the

Company experienced a significant increase in its business

originating from Iraq. The Company believes this volume to have

been the effect of policy changes by United States and Iraqi

regulators. For several months, the Company has been in regular

discussions with policymakers in both the United States and Iraq

about the remittance volumes flowing through its network in Iraq.

In July 2023, the United States Treasury and the Federal Reserve

Bank of New York announced actions that banned 14 Iraqi banks, some

of whom were the Company's agents, from conducting U.S. dollar

transactions. Additionally, in October 2023, the Central Bank of

Iraq suspended the Company's largest agent in the country, although

that agent was later reinstated and resumed offering the Company's

services. The effect of fluctuations between the Iraqi dinar and

United States dollar on reported revenues was not significant for

these periods. Because of the significant volatility in revenues

and challenges in offering the Company's services in the country,

management believes that revenue measures that exclude the Iraq

revenues provide better consistency and comparability to prior

periods and assist in understanding trends in the Company’s ongoing

revenues.

(u)

Represents severance costs, which

have been excluded from the segments as management excludes

severance in making operating decisions, including allocating

resources to the Company's segments. Management excludes severance

costs in its measurement of non-GAAP profitability to focus on

those factors it believes to be most relevant to the Company’s

operations.

(v)

In the fourth quarter of 2024,

the Company reorganized the international operations of its

business to realign and consolidate the Company's international

activities. The Company recognized deferred tax assets, net of

valuation allowance, associated with this reorganization, including

from the step-up in tax basis associated with the reorganization.

The Company has excluded the non-cash recognition of the deferred

tax assets associated with this reorganization because of the

significance of this recognition on its reported results. The

Company has also removed the expected non-cash reversal of these

deferred tax assets from its 2025 adjusted effective tax rate and

adjusted earnings per share outlook.

Other notes:

(aa)

Geographic split for transactions

and revenue, including transactions initiated digitally, as earlier

defined, is determined entirely based upon the region where the

money transfer is initiated.

(bb)

Represents the North America

(United States and Canada) (“NA”) region of the Company's Consumer

Money Transfer segment.

(cc)

Represents the Europe and the

Commonwealth of Independent States (“EU & CIS”) region of the

Company's Consumer Money Transfer segment.

(dd)

Represents the Middle East,

Africa, and South Asia (“MEASA”) region of the Company's Consumer

Money Transfer segment, including India and certain South Asian

countries, which consist of Bangladesh, Bhutan, Maldives, Nepal,

and Sri Lanka.

(ee)

Represents the Latin America and

the Caribbean (“LACA”) region of the Company’s Consumer Money

Transfer segment, including Mexico.

(ff)

Represents the Asia Pacific

(“APAC”) region of the Company’s Consumer Money Transfer

segment.

(gg)

Represents transactions conducted

and funded through websites and mobile applications marketed under

the Company’s brands (“Branded Digital”).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250204893052/en/

Media Relations: Brad Jones media@westernunion.com

Investor Relations: Tom Hadley

WesternUnion.IR@westernunion.com

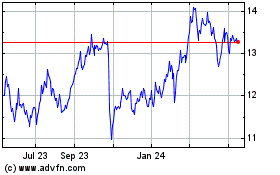

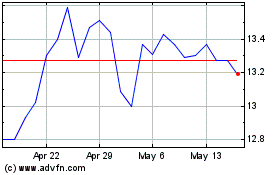

Western Union (NYSE:WU)

Historical Stock Chart

From Jan 2025 to Feb 2025

Western Union (NYSE:WU)

Historical Stock Chart

From Feb 2024 to Feb 2025