A Slice of Snails? Sluggish Demand Mires Pizza Hut, KFC in China

04 September 2018 - 12:11AM

Dow Jones News

By Ese Erheriene

China's once voracious appetite for American fast food is waning

as consumers are lured away by emerging domestic chains and

food-delivery apps.

Two years after owner Yum Brands Inc. spun off its China

business, sales growth is slowing at its KFC and Pizza Hut outlets

in China, as homegrown rivals target young people and an army of

motorcycle couriers make available greater takeout choices.

Yum China Holdings Inc. continues to open dozens of new stores

every month. It has invested in mobile payments, new seasonal menu

items such as abalone--or sea-snail--pizza, and marketing using

online games and pop stars to draw younger diners. Yet sales fell

in the quarter ending June 30, after growth slowed in the two

previous quarters.

Shares in Yum China have slipped 20% since a January high,

bouncing back slightly after a bid by a consortium, led by

Hillhouse Capital Group and which included private-equity firm KKR

& Co., to take the company private. The Wall Street Journal

reported last week that Yum China rejected the bid, which valued

the restaurant operator at more than $17 billion. It would have

been the largest ever take-private deal in Asia, according to data

provider Dealogic.

The consortium believes Yum China has strong brands but needs to

invest to counter pressure from greater local and global

competition, according to a person familiar with the situation.

A Yum China spokesman said that China's rising urban and

middle-class population offered opportunities for growth and that

the company's long-term target was to reach 20,000 stores from just

over 8,000 now. In an August earnings release, Yum China Chief

Executive Joey Wat told investors and analysts that she was

confident in KFC but that Pizza Hut continued to face challenges in

the casual-dining market. The company is still the biggest player

in the country's $600 billion dollar restaurant industry, according

to research by Morningstar.

Louisville, Ky.-based Yum Brands spun off Yum China in late 2016

in a bid to shield itself from the unit's volatile performance,

opting to franchise Chinese operations and collect a royalty

instead. In 1987, Yum Brands was the first major Western fast-food

operator to do business in China. Its China business accounted for

about half the company's revenue before the spinoff.

While KFC has averaged 4% growth since the spinoff, Pizza Hut

has logged only two quarters of same-store sales growth in the past

seven quarters. Total food and beverage sales in China are rising

at more than 10% annually, according to China's statistics

bureau.

The dwindling cachet of American food, safety scares and

changing consumer tastes have made the region a harder place to do

business.

"This is American junk food," said Zhao Yueru, a 24-year-old

education-industry worker, as she tucked into a spicy chicken

sandwich and french fries in KFC in western Shanghai's Changning

district last week. "People with even slightly better tastes eat at

more fancy places."

Food-delivery apps--such as Meituan and Ele.me, which are backed

by technology giants Tencent Holdings Ltd. and Alibaba Group

Holding Ltd. respectively--make it easier for consumers to order

food directly from a vast range of outlets. Yum China has been

expanding delivery capabilities through its KFC and Pizza Hut apps,

which have a combined 180 million users. That has helped lift

delivery sales to 14% of company sales in 2017 from 10% in

2016.

Competition is also rising from homegrown food chains selling

noodles, fast Chinese food and Asian twists on pizza. One of Pizza

Hut's biggest challengers is Shenzhen-based La Cesar Pizzeria,

which serves popular pizzas topped with durian, a pungent Asian

fruit.

Pizza Hut also began offering durian pizzas, as well as other

popular ingredients such as crayfish and abalone. KFC has rebooted

its breakfast offering by selling wrap-style rice rolls filled with

chicken.

"There are more competitors, and consumers are getting more

picky," said Zhou Yang, a food and beverage researcher at market

research firm Dataway Horizon. Ms. Zhou said Yum China's efforts to

connect with younger generations--such as through the popular

online game Onmyoji--haven't had much success.

The rapid expansion of KFC may also have cannibalized sales,

analysts including Bernstein said, with a wave of new store

openings too close to established locations. Sales growth at KFC

stores open for at least a year shrank to zero in the last

quarter.

Yum China said it plans to open between 600 and 650 new stores

in 2018, which is less than last year but up from 2016.

"When I was traveling in foreign countries, I did not see many

Pizza Huts," said Shirley Chen, a 19-year-old college student

munching on margherita pizza, chicken wings, and fried shrimp at a

Shanghai outlet. "But here in China, we have a lot of them. Every

mall has a Pizza Hut. I think it is a Chinese restaurant."

Zhou Wei in Shanghai contributed to this article.

Write to Ese Erheriene at ese.erheriene@wsj.com

(END) Dow Jones Newswires

September 03, 2018 09:56 ET (13:56 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

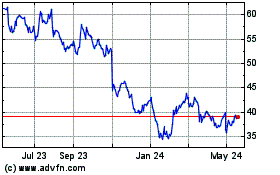

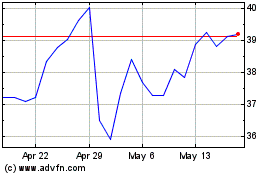

Yum China (NYSE:YUMC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Yum China (NYSE:YUMC)

Historical Stock Chart

From Jul 2023 to Jul 2024