0001136869false00011368692024-05-102024-05-100001136869zbh:OnePointOneSixFourPercentageNotesDueTwoThousandTwentySevenMember2024-05-102024-05-100001136869zbh:TwoPointFourTwoFivePercentageNotesDueTwoThousandTwentySixMember2024-05-102024-05-100001136869us-gaap:CommonStockMember2024-05-102024-05-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 10, 2024 |

ZIMMER BIOMET HOLDINGS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-16407 |

13-4151777 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

345 East Main Street |

|

Warsaw, Indiana |

|

46580 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (574) 373-3333 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.01 par value |

|

ZBH |

|

New York Stock Exchange |

2.425% Notes due 2026 |

|

ZBH 26 |

|

New York Stock Exchange |

1.164% Notes due 2027 |

|

ZBH 27 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

At the annual meeting of shareholders of Zimmer Biomet Holdings, Inc. (the “Company”) held on May 10, 2024 (the “Annual Meeting”), the Company’s shareholders approved the amended Zimmer Biomet Holdings, Inc. Employee Stock Purchase Plan (the “ESPP”). In February 2024, the Board of Directors of the Company approved proposed amendments to the ESPP and directed that the amended ESPP be submitted to shareholders of the Company for approval at the Annual Meeting. The amendments to the ESPP:

•increase the number of shares available for issuance and purchase by participants under the ESPP by 10,000,000 million shares; and

•modify certain other ESPP provisions to facilitate administration of the ESPP and implement best practice changes.

A more complete description of the terms of the amended ESPP can be found in “Proposal 4—Approval of the Amended Employee Stock Purchase Plan” in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on March 27, 2024. The foregoing description of the amended ESPP is qualified in its entirety by reference to the full text of the amended ESPP, a copy of which is filed as Exhibit 10.1 to this report.

Item 5.07 Submission of Matters to a Vote of Security Holders.

The Company held its annual meeting of shareholders on May 10, 2024. Shareholders took the following actions:

•elected ten (10) directors for one-year terms ending at the 2025 annual meeting of shareholders (Proposal 1);

•ratified the Audit Committee’s appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2024 (Proposal 2);

•approved, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in the Company’s proxy statement (Proposal 3); and

•approved the amended Employee Stock Purchase Plan (Proposal 4).

The vote tabulation for each proposal follows:

Proposal 1 – Election of Directors

|

|

|

|

|

Nominee |

For |

Against |

Abstain |

Broker Non-Votes |

Christopher B. Begley |

164,724,972 |

7,333,022 |

226,677 |

14,430,099 |

Betsy J. Bernard |

162,760,822 |

9,396,081 |

127,768 |

14,430,099 |

Michael J. Farrell |

167,518,122 |

4,633,274 |

133,275 |

14,430,099 |

Robert A. Hagemann |

162,464,750 |

9,591,079 |

228,842 |

14,430,099 |

Arthur J. Higgins |

166,306,021 |

5,846,729 |

131,921 |

14,430,099 |

Maria Teresa Hilado |

169,774,488 |

2,389,765 |

120,418 |

14,430,099 |

Syed Jafry |

170,362,310 |

1,786,113 |

136,248 |

14,430,099 |

Sreelakshmi Kolli |

162,271,545 |

9,878,950 |

134,176 |

14,430,099 |

Louis Shapiro |

171,579,592 |

573,252 |

131,827 |

14,430,099 |

Ivan Tornos |

169,580,110 |

2,565,650 |

138,911 |

14,430,099 |

Proposal 2 – Ratification of the Appointment of the Independent Registered Public Accounting Firm

|

|

|

|

For |

Against |

Abstain |

Broker Non-Votes |

180,021,848 |

6,535,348 |

157,574 |

0 |

Proposal 3 – Advisory Vote to Approve Named Executive Officer Compensation

|

|

|

|

For |

Against |

Abstain |

Broker Non-Votes |

156,440,914 |

15,603,941 |

239,816 |

14,430,099 |

Proposal 4 – Approval of the Amended Employee Stock Purchase Plan

|

|

|

|

For |

Against |

Abstain |

Broker Non-Votes |

171,503,181 |

603,453 |

178,037 |

14,430,099 |

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: May 15, 2024

|

|

|

|

ZIMMER BIOMET HOLDINGS, INC. |

|

|

|

|

By: |

/s/ Chad F. Phipps |

|

Name: |

Chad F. Phipps |

|

Title: |

Senior Vice President, General Counsel

and Secretary |

ZIMMER BIOMET HOLDINGS, INC.

EMPLOYEE STOCK PURCHASE PLAN

(As amended and restated effective May 10, 2024)

Section 1. Designation and Purpose. The name of this Plan is the Zimmer Biomet Holdings, Inc. Employee Stock Purchase Plan. The purpose of the Plan is to provide Employees of the Company and its Designated Subsidiaries with an opportunity to purchase Common Stock of the Company. The Plan is intended to qualify as an "Employee Stock Purchase Plan" under Code Section 423. The provisions of the Plan will, accordingly, be construed so as to extend and limit participation in a manner within the requirements of that section of the Code. However, the Company makes no undertaking or representation to maintain such qualification. In addition, this Plan authorizes the grant of options and issuance of Common Stock that do not qualify under Code Section 423 pursuant to rules, procedures, agreements, appendices, or sub-plans adopted by the Committee for such purpose, including, without limitation, to achieve desired tax or other objectives in particular locations outside the United States.

For purposes of this Plan and with respect to the Code Section 423 component of the Plan, unless the Committee otherwise determines, each Designated Subsidiary (as defined in Section 2(l) below) shall be deemed to participate in a separate offering from the Company or any other Designated Subsidiary, provided that the terms of participation within any such offering are the same for all Employees in such offering, as determined under Code Section 423.

Section 2. Definitions. As used in the Plan, the following terms, when capitalized, have the following meanings:

(a)"Beneficiary" means, with respect to a Participant, the individual or estate designated, pursuant to Section 12, to receive the Participant's Payroll Deduction Account balance and Common Stock Account assets after the Participant's death.

(b)"Board" means the Board of Directors of the Company.

(c)"Code" means the U.S. Internal Revenue Code of 1986, as amended from time to time, and its interpretive rules and regulations.

(d)"Committee" means a committee established pursuant to Section 13 to administer the Plan.

(e)"Common Stock" means the common stock of the Company or any stock into which that common stock may be converted.

(f)"Common Stock Account" means the account established for each Participant to hold Common Stock purchased under the Plan pursuant to Section 6.

(g)"Company" means Zimmer Biomet Holdings, Inc, a Delaware corporation, and any successor by Corporate Transaction.

(h)"Compensation" means the total cash compensation received by an Employee from the Company, a partnership of which the Company is a general partner, or a Designated Subsidiary, including an Employee's salary, wages, overtime, shift differentials, bonuses, commissions, and incentive compensation, but excluding relocation and expense reimbursements, tuition reimbursements, scholarship grants, and income realized as a result of participation in any stock option, stock purchase, or similar plan of the Company or any Subsidiary.

(i)"Contributions" means all amounts made by a Participant and credited to the Participant's Payroll Deduction Account pursuant to the Plan (whether via payroll deductions, check or other means determined by the Committee).

(j)"Corporate Transaction" means a sale of all or substantially all of the Company's assets, or a merger, consolidation, or other capital reorganization of the Company with or into another corporation.

(k)"Designated Broker" means a broker (or any successor or replacement broker) selected by the Committee from time to time to serve as the designated broker under the terms of the Plan.

(l)"Designated Subsidiary" means a Subsidiary that has been designated by the Board or the Committee, in their sole discretion, as eligible to participate in the Plan with respect to its Employees.

(m)"Employee" means any person, including an Officer, who performs services for the Company or a Subsidiary and who is initially classified as an employee on the payroll records of the Company or a Designated Subsidiary. If the Company or a Designated Subsidiary treats a person as an independent contractor for tax or labor law purposes, and that person is subsequently determined to be an employee of the Company or a Designated Subsidiary by the Internal Revenue Service or any other federal, state, or local government agency or court of competent authority, that person will become an Employee on the date that the determination is finally adjudicated or otherwise accepted by the Company or the affected Designated Subsidiary, as long as he or she otherwise meets the requirements of this Section 2(m). Such a person will not, under any circumstances, be treated as an Employee for the period of time during which the Company or Designated Subsidiary treated the person as an independent contractor, even if the determination of employee status has retroactive effect.

(n)"Exchange Act" means the U.S. Securities Exchange Act of 1934, as amended from time to time, and its interpretive rules and regulations.

(o)"Fair Market Value" means, with respect to any date, the closing price of the Common Stock for that date (or, in the event that the Common Stock is not traded on that date, the closing price on the immediately preceding trading date), as reported by the New York Stock Exchange. If the Common Stock is no longer traded on the New York Stock Exchange, then "Fair Market Value" means, with respect to any date, the fair market value of the Common Stock as determined by the Committee in good faith. The Committee's determination will be conclusive and binding on all persons.

(p)"Offering Date" means the first business day of each Offering Period of the Plan.

(q)"Offering Period" means a period of six (6) months commencing on January 1 and July 1 of each year, or such other period as determined by the Committee, provided, however, that in no event will the Offering Period be a period longer than twenty-seven (27) months.

(r)"Officer" means a person who is an officer of the Company within the meaning of Section 16 of the Exchange Act.

(s)"Payroll Deduction Account" means the account established for a Participant to hold the Participant's Contributions pursuant to Section 5.

(t)"Participant" means an Employee who elects to participate in the Plan.

(u)"Plan" means the Zimmer Biomet Holdings, Inc. Employee Stock Purchase Plan, as amended and restated, and as may be further amended from time to time.

(v)"Purchase Date" means the last day of each Offering Period of the Plan.

(w)"Purchase Price" means an amount equal to eighty-five percent (85%) of the Fair Market Value of a Share of Common Stock on the Offering Date or on the Purchase Date, whichever is lower; provided, however, that in the event (i) of any stockholder-approved increase in the number of Shares available for issuance under the Plan, (ii) all or a portion of such additional Shares are to be issued with respect to the Offering Period that is underway at the time of such increase ("Additional Shares"), and (iii) the Fair Market Value of a Share of Common Stock on the date of such increase (the "Approval Date Fair Market Value") is higher than the Fair Market Value on the Offering Date for any such Offering Period, then in such instance, the Purchase Price with respect to the Additional Shares will be eighty-five percent (85%) of the Approval Date Fair Market Value or the Fair Market Value of a Share of Common Stock on the Purchase Date, whichever is lower.

(x)"Share" means a share of Common Stock, as adjusted in accordance with Section 18 of the Plan.

(y)"Subsidiary" means a domestic or foreign corporation of which not less than fifty percent (50%) of the voting shares are held by the Company or a Subsidiary, within the meaning of Code Section 424(f), whether or not such corporation now exists or is hereafter organized or acquired by the Company or a Subsidiary; provided, however, that solely for purposes of the non-Code Section 423 component of the Plan, "Subsidiary" will include any entity that is directly or indirectly controlled by the Company.

(z)"Tax-Related Items" means any income tax, social insurance, payroll tax, payment on account or other tax-related items arising in relation to the Participant's participation in the Plan.

Section 3. Eligibility.

(a)Any person who is an Employee as of an Offering Date in a given Offering Period will be eligible to participate in the Plan for that Offering Period, subject to the requirements of Section 4, and for purposes of the Code Section 423 component of the Plan, the limitations imposed by Code Section 423(b). Notwithstanding the foregoing, (1) the Committee may restrict participation in the Plan to full-time Employees pursuant to criteria and procedures established by the Committee, and (2) the Committee may establish administrative rules and may impose an eligibility service requirement of up to two years of employment with the Company or a Designated Subsidiary with respect to participation on any prospective Offering Date. The Board may also determine that a designated group of highly compensated employees is ineligible to participate in the Plan, so long as the excluded category fits within the definition of "highly compensated employee" in Code Section 414(q). For purposes of the Plan, an Employee will be considered a full-time Employee unless his or her customary employment is less than 20 hours per week or five months per year. Further, subject to Section 2(y) of the Plan, the Committee may designate whether a Subsidiary is a Designated Subsidiary for purposes of the Code Section 423 or non-Code Section 423 component, and in the case of the non-Code Section 423 component, an Employee (or group of Employees) may be excluded from participation in the Plan or an offering thereunder if the Committee has determined, in its sole discretion, that participation of such Employee(s) is not advisable or practicable for any reason, notwithstanding anything to the contrary herein.

(b)Notwithstanding any other provision of the Plan, no Employee will be eligible to participate in the Plan if the Employee (or any other person whose stock would be attributed to the Employee pursuant to Code Section 424(d)) owns capital stock of the Company and/or holds outstanding options to purchase stock possessing five percent (5%) or more of the total combined voting power or value of all classes of stock of the Company or of any Subsidiary of the Company.

Section 4. Participation. An Employee may become a Participant in the Plan by completing a subscription agreement that authorizes payroll deductions and any other required documents ("Enrollment Documents") provided by the Committee or its designee and submitting them to the Committee (or its designee) or the Designated Broker, pursuant to the rules prescribed by the Committee, during the 30-day period prior to the applicable Offering Date, unless a different time for submission of the Enrollment Documents is set by the Board or the Committee for all Employees with respect to a given offering. The Enrollment Documents will set forth the amount of the Participant's Compensation, up to one hundred percent (100%) or such lower limit as is designated by the Committee, that the Participant elects to be paid as Contributions pursuant to the Plan. The Committee may provide for a separate election (of a different percentage) for a specified item or items of Compensation, (on a uniform and nondiscriminatory basis for purposes of the Code Section 423 component of the Plan). In countries where payroll deductions are not feasible, or as otherwise determined necessary for legal or administrative reasons, the Committee may permit an Employee to participate in the Plan by an alternative means, such as by check, subject to compliance with Code Section 423(b) with respect to an offering under the Code Section 423 component of the Plan.

Section 5. Method of Payment of Contributions.

(a)A Participant's payroll deductions will begin either on the first pay date following the Offering Date or the date on which the Participant submits Enrollment Documents in accordance with Section 4, whichever is later, and will end on the last pay date on or prior to the Purchase Date of the Offering Period to which the Enrollment Documents are applicable (or such earlier pay date as may be prescribed by the Committee), unless the Participant elects to withdraw from the Plan as provided in Section 8. A Participant's Enrollment Documents will remain in effect for successive Offering Periods unless the Participant elects to withdraw from the Plan as provided in Section 8 or unless the Participant timely submits new Enrollment Documents to change the rate of payroll deductions for a subsequent Offering Period in accordance with rules established by the Committee.

(b)All Contributions made by a Participant will be held by the Company as part of its general assets; however, the Company will establish a Payroll Deduction Account for each Participant and credit each Participant's Contributions to the Participant's Payroll Deduction Account. A Participant may not make any additional payments to the Participant's Payroll Deduction Account, except as authorized by the Committee in countries where payroll deductions are not feasible, or as otherwise determined necessary by the Committee for legal or administrative reasons.

(c)No interest will accrue on a Participant's Contributions to the Plan, unless required by local law and specified by the Committee.

(d)Except as otherwise specified by the Committee, payroll deductions made with respect to Employees paid in currencies other than U.S. dollars will be accumulated in local (non-U.S.) currency and converted to U.S. dollars as of the Purchase Date.

Section 6. Participant Purchases and Common Stock Accounts. On each Purchase Date, each Participant will be deemed, without further action, to have elected to purchase Shares with the entire balance in the Participant's Payroll Deduction Account, and the Designated Broker will credit the purchased Shares to the Participant's Common Stock Account.

(a)The Participant will be credited with the number of whole and fractional Shares (rounded to the nearest thousandth) that the Participant's Payroll Deduction Account balance can purchase at the Purchase Price on that Purchase Date.

(b)Expenses incurred in the purchase of Shares and the expenses of the Designated Broker will be paid by the Participant.

(c)A Participant will have no interest or voting right in a Share until a Share has been purchased on the Participant's behalf under the Plan.

(d)Shares held in a Participant's Common Stock Account will be registered in the name of the Designated Broker or its nominee for the benefit of the Participant. Shares to be delivered to a Participant under the Plan will be reregistered in the name of the Participant or in the name of the Participant and the Participant's spouse.

Section 7. Limitation on Purchases. Participant purchases are subject to the following limitations:

(a)During any one calendar year, a Participant may not purchase, under the Plan, or under any other plan qualified under Code Section 423, Shares having a Fair Market Value on the applicable Offering Date in excess of $25,000. In addition, in no event shall the number of Shares that a Participant may purchase during any Offering Period under the Plan exceed 5,000 Shares.

(b)A Participant's Payroll Deduction Account may not be used to purchase Common Stock on any Purchase Date to the extent that, after such purchase, the Participant would own (or be considered as owning within the meaning of Code Section 424(d)) stock possessing five percent (5%) or more of the total combined voting power or value of all classes of stock of the Company or of any Subsidiary of the Company. For this purpose, stock that the Participant may purchase under any outstanding option will be treated as owned by that Participant.

(c)As of the first Purchase Date on which this Section limits a Participant's ability to purchase Common Stock, the Participant's Contributions will terminate, and the Participant will receive a refund of the balance in the Participant's Payroll Deduction Account as soon as practicable after the Purchase Date.

(d)In no event will the aggregate amount of purchases of Common Stock pursuant to the Plan equal or exceed twenty percent (20%) of the outstanding stock of the Company.

Section 8. Withdrawal from Participation.

(a)A Participant may withdraw all, but not less than all, of the Contributions credited to the Participant's Payroll Deduction Account at any time prior to a Purchase Date by notifying the Committee or its designee or the Designated Broker of the Participant's election to withdraw, pursuant to rules prescribed by the Committee. If a Participant elects to withdraw, all of the Participant's Contributions credited to the Participant's Payroll Deduction Account will be returned to the Participant and the Participant may not make any further Contributions to the Plan for the purchase of Shares during that Offering Period.

(b)A Participant's voluntary withdrawal during an Offering Period will not have any effect upon the Participant's eligibility to participate in the Plan during a subsequent Offering Period or in the Participant's ability to retain Common Stock previously credited to the Participant in the Participant's Common Stock Account.

Section 9. Stock Purchases by Designated Broker. As of each Purchase Date, the Designated Broker will acquire, using the accumulated balances of all Participants' Payroll Deduction Accounts, Shares to be credited to those Participants' Common Stock Accounts.

(a)The Designated Broker will acquire Shares that are newly issued or held as treasury shares by the Company or, if directed by the Committee, will acquire Shares by purchases on the open market or in private transactions.

(b)If Shares are purchased in one or more transactions on the open market or in private transactions at the direction of the Committee, the Company will pay the Designated Broker the difference between the Purchase Price and the price at which the Shares are purchased for Participants.

Section 10. Common Stock Account Withdrawals. Except as otherwise provided in this Section, upon 14 days advance written notice to the Designated Broker (or upon such other notice period as may be prescribed by the Designated Broker or the Company), a Participant may elect to withdraw the assets in the Participant's Common Stock Account.

(a)A Participant may elect to obtain a certificate (which may be provided in electronic form) for the whole Shares credited to the Participant's Common Stock Account. As a condition of participation in the Plan, each Participant will agree to notify the Company if the Participant sells or otherwise disposes of any of the Participant's Shares within two years of the Purchase Date on which the Shares were purchased.

(b)A Participant may elect that all Shares in the Participant's Common Stock Account be sold and that the proceeds, less expenses of sale, be remitted to the Participant.

(c)In either event, the Designated Broker will sell any fractional Shares held in the Common Stock Account and remit the proceeds of such sale, less selling expenses, to the Participant.

Notwithstanding the foregoing, the Committee may require that Shares credited to a Participant's Common Stock Account be retained by the Designated Broker for a designated period of time and may restrict dispositions during that period, and/or the Committee may establish other procedures to permit tracking of disqualifying dispositions of the Shares or to restrict transfer of the Shares.

Section 11. Cessation of Participation. If a Participant dies or terminates employment, the Participant will cease to participate in the Plan, the Company or its designee will refund the balance in the Participant's Payroll Deduction Account, and the Designated Broker will distribute the assets in the Participant's Common Stock Account.

(a)In the event of a Participant's death, the Participant's Payroll Deduction Account balance and the Participant's Common Stock Account assets will be distributed to the Participant's Beneficiary.

(b)If a Participant terminates employment, the Participant's Payroll Deduction Account balance and the Participant's Common Stock Account assets will be distributed to the Participant. For purposes of this Section 11, unless otherwise determined by the Committee, a Participant’s employment will not be considered terminated in the case of a transfer of employment between the Company or any Subsidiary or between Subsidiaries, provided that in order to continue participation in the Plan, any Subsidiary to which a Participant transfers must be a Designated Subsidiary. However, in the event of a transfer of employment, the Committee may transfer a Participant’s participation to a separate offering or non-Code Section 423 offering that the entity the Participant is being transferred to participates in, if advisable or necessary considering the application of local law and the Code Section 423 requirements.

(c)Upon distribution, the Participant or, in the event of the Participant's death, the Participant's Beneficiary, may elect to obtain a certificate (which may be provided in electronic form) for the whole Shares credited to the Participant's Common Stock Account or may elect that any whole Shares in the Participant's Common Stock Account be sold. In that event, the Designated Broker will sell such whole Shares and any fractional Shares held in the Common Stock Account and remit the proceeds of such sale, less selling expenses, to the Participant or Beneficiary.

Notwithstanding the foregoing, if a Participant dies or terminates employment, the Committee may require that Shares credited to the Participant's or Beneficiary's Common Stock Account be retained by the Designated Broker for a designated period of time and may restrict dispositions during that period, and/or the Committee may establish other procedures to permit tracking of disqualifying dispositions of the Shares or to restrict transfer of the Shares.

Section 12. Designation of Beneficiary. Each Payroll Deduction Account and each Common Stock Account will be in the name of the Participant. To the extent permitted by the Committee, a Participant may designate a Beneficiary to receive the Participant's interests in both accounts in the event of the Participant's death by complying with procedures prescribed by the Committee. If a Participant is married and the designated Beneficiary is not the spouse, spousal

consent may be required for such designation to be effective. A Participant may change a Beneficiary designation (with spousal consent if necessary) at any time by complying with the procedures prescribed by the Committee. If a Participant dies without having designated a Beneficiary, or if the Beneficiary does not survive the Participant, the Participant's estate will be the Participant's Beneficiary.

Section 13. Administration of the Plan. The Plan will be administered by the Committee, consisting of not less than three members appointed by the Board.

(a)The Committee will be the Compensation and Management Development Committee of the Board unless the Board appoints another committee to administer the Plan. The Board from time to time may fill vacancies on the Committee.

(b)Subject to the express provisions of the Plan, the Committee will have the discretionary authority to take any and all actions (including directing the Designated Broker as to the acquisition of Shares) necessary to implement the Plan and to interpret the Plan; to prescribe, amend, and rescind rules and regulations relating to it; and to make all other determinations necessary or advisable in administering the Plan. All such determinations will be final and binding upon all persons.

(c)A quorum of the Committee will consist of a majority of its members and the Committee may act by vote of a majority of its members at a meeting at which a quorum is present, or without a meeting by a written consent to their action taken signed by all members of the Committee.

(d)The Committee may request advice or assistance or employ or designate such other persons as are necessary for proper administration of the Plan. Further, to the extent not prohibited by applicable law, the Committee may, from time to time, delegate some or all of its authority under the Plan to a subcommittee or subcommittees of the Committee, one or more officers of the Company or other persons or groups of persons as it deems necessary, appropriate or advisable under conditions or limitations that it may set at or after the time of the delegation. For purposes of the Plan, reference to the Committee will be deemed to refer to any subcommittee, subcommittees, or other persons or groups of persons to whom the Committee delegates authority pursuant to this Section 13(d).

Section 14. Non-U.S. Sub-Plans. The Committee may adopt such rules, procedures, agreements, appendices, or sub-plans (collectively, "Sub-Plans") relating to the operation and administration of the Plan to accommodate local laws, customs and procedures for jurisdictions outside of the United States, the terms of which Sub-Plans may take precedence over other provisions of this Plan, with the exception of Section 17 hereof, but unless otherwise superseded by the terms of such Sub-Plan, the provisions of this Plan will govern the operation of such Sub-Plan. To the extent inconsistent with the requirements of Code Section 423(b), any such Sub-Plan will be considered part of an offering under the non-Code Section 423 component of the Plan, and options granted thereunder will not be required by the terms of the Plan to comply with Code Section 423(b). Without limiting the generality of the foregoing, the Committee is authorized to adopt Sub-Plans for particular non-U.S. jurisdictions that modify or supplement

the terms of the Plan to meet applicable local requirements, customs or procedures regarding, without limitation, (a) eligibility to participate, (b) the definition of Compensation, (c) the dates and duration of Offering Periods or other periods during which Participants may make Contributions towards the purchase of Shares, (d) the method of determining the Purchase Price and the discount from Fair Market Value at which Shares may be purchased, (e) the handling of payroll deductions, (f) establishment of bank, building society or trust accounts to hold Contributions, (g) payment of interest, (h) obligations to pay payroll tax, (i) determination of beneficiary designation requirements, (j) withholding procedures and (k) handling of Share issuances.

Section 15. Taxes. At the time a Participant's option is exercised, in whole or in part, or at the time a Participant disposes of some or all of the Shares acquired under the Plan, the Participant will make adequate provision for any Tax-Related Items. In their sole discretion, and except as otherwise determined by the Committee, the Company or the Designated Subsidiary that employs the Participant may satisfy their obligations to withhold Tax-Related Items by (a) withholding from the Participant's wages or other compensation, (b) withholding a sufficient number of Shares otherwise issuable following purchase having an aggregate Fair Market Value sufficient to pay the Tax-Related Items required to be withheld with respect to the Shares, (c) withholding from proceeds from the sale of Shares issued upon purchase, either through a voluntary sale or a mandatory sale arranged by the Company, or (d) any other method deemed acceptable by the Committee and permitted under applicable law.

Section 16. Rights Not Transferable. Rights under the Plan are not transferable by a Participant.

Section 17. Shares Reserved for the Plan. Subject to the following sentence and any adjustments as provided in Section 18, the maximum number of Shares that will be made available for purchase under the Plan as of May 10, 2024 will be 13,000,000 Shares. For avoidance of doubt, up to the maximum number of Shares reserved under this Section 17 may be used to satisfy purchases of Shares under the Code Section 423 component of the Plan and any remaining portion of such maximum number of Shares may be used to satisfy purchases of Shares under the non-Code Section 423 component.

Section 18. Change in Capital Structure. Despite anything in the Plan to the contrary, the Committee may take the following actions without the consent of any Participant or Beneficiary, and the Committee's determination will be conclusive and binding on all persons for all purposes.

(a)In the event of a Common Stock dividend, Common Stock split, or any combination of Shares, a Corporate Transaction in which the Company is the surviving corporation, or any other change in the Company's capital stock (including, but not limited to, the creation or issuance to stockholders generally of rights, options or warrants for the purchase of common stock or preferred stock of the Company), the number and kind of shares of stock or securities of the Company to be subject to the Plan, the maximum number of shares or securities that may be delivered under the Plan,

and the selling price and other relevant provisions of the Plan will be appropriately adjusted by the Committee, whose determination will be binding on all persons.

(b)If the Company is a party to a Corporate Transaction in which the Company is not the surviving corporation, the Committee may take such actions with respect to the Plan as the Committee deems appropriate.

Section 19. Amendment of the Plan. The Board may at any time, or from time to time, amend the Plan in any respect. The stockholders of the Company, however, must approve any amendment that would increase the number of Shares that may be issued under the Plan (other than an increase merely reflecting a change in capitalization of the Company pursuant to Section 18) or a change in the designation of any corporations (other than a Subsidiary) whose employees become Employees under the Plan.

Section 20. Termination of the Plan. The Plan and all rights of Employees and Beneficiaries under the Plan will terminate:

(a)on the Purchase Date that Participants become entitled to purchase a number of Shares greater than the number of reserved Shares remaining available for purchase as set forth in Section 17, or

(b)at any date at the discretion of the Board.

In the event that the Plan terminates under circumstances described in (a) above, reserved Shares remaining as of the termination date will be credited to Participants' Common Stock Accounts on a prorata basis. Upon termination of the Plan, each Participant will receive the balance in the Participant's Payroll Deduction Account and all Shares in the Participant's Common Stock Account.

Section 21. Indemnification of Committee. Service on the Committee will constitute service as a director of the Company so that members of the Committee will be entitled to indemnification and reimbursement as directors of the Company pursuant to its Certificate of Incorporation and Bylaws.

Section 22. Government Regulations. The Plan, the grant and exercise of the rights to purchase Shares under the Plan, and the Company's or Designated Broker's obligation to sell and deliver Shares upon the exercise of rights to purchase Shares, will be subject to all applicable federal, state and foreign laws, rules and regulations, and to such approvals by any regulatory or government agency as may, in the opinion of counsel for the Company, be required.

Section 23. Reports. Statements of account will be provided to Participants by the Committee or the Designated Broker at least annually, which statements will set forth the amounts of Contributions, the per Share Purchase Price, the number of Shares purchased and credited to Participants' Common Stock Accounts, and the remaining cash balance, if any, in Participants' Payroll Deduction Accounts.

Section 24. Governing Law. Except to the extent that provisions of this Plan are governed by applicable provisions of the Code or any other substantive provision of United States federal law, this Plan will be governed by and construed in accordance with the internal laws of the state of Indiana without giving effect to the conflict of laws principles thereof.

Section 25. Tax Qualification. Although the Company may endeavor to (a) qualify an option to purchase Shares for favorable tax treatment under the laws of the United States or jurisdictions outside of the United States or (b) avoid adverse tax treatment (e.g., under Code Section 409A), the Company makes no representation to that effect and expressly disavows any covenant to maintain favorable or avoid unfavorable tax treatment, notwithstanding anything to the contrary in this Plan. The Company will be unconstrained in its corporate activities without regard to the potential negative tax impact on Participants under the Plan.

Section 26. Effective Date. This Plan as amended and restated by the Board on February 20, 2024, shall be effective upon its approval by the stockholders of the Company at the Company's annual meeting of stockholders in 2024.

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=zbh_TwoPointFourTwoFivePercentageNotesDueTwoThousandTwentySixMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=zbh_OnePointOneSixFourPercentageNotesDueTwoThousandTwentySevenMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

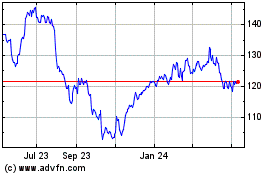

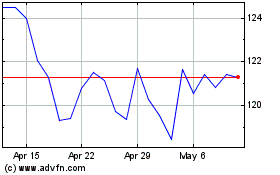

Zimmer Biomet (NYSE:ZBH)

Historical Stock Chart

From Apr 2024 to May 2024

Zimmer Biomet (NYSE:ZBH)

Historical Stock Chart

From May 2023 to May 2024