false000185100300018510032024-10-212024-10-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 21, 2024 |

ZETA GLOBAL HOLDINGS CORP.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40464 |

80-0814458 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

3 Park Ave, 33rd Floor |

|

New York, New York |

|

10016 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 212 967-5055 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A common stock, par value $0.001 per share |

|

ZETA |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 8.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02.

Item 7.01 Regulation FD Disclosure.

On October 21, 2024, Zeta Global Holdings Corp. (“Zeta”) issued a press release announcing that the previously announced agreement to acquire LiveIntent, Inc. (“LiveIntent”) has closed. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

On October 21, 2024, Zeta completed its previously announced acquisition of LiveIntent, pursuant to an Agreement and Plan of Merger and Reorganization, dated as of October 7, 2024 (the “Merger Agreement”). At the closing of the acquisition, all outstanding shares of LiveIntent capital stock, restricted stock units representing the right to receive LiveIntent capital stock, options to purchase LiveIntent capital stock and warrants to purchase LiveIntent capital stock were cancelled in exchange for aggregate consideration of $250 million, plus potential earnout payments of up to $75 million based on the achievement of certain performance targets. $77.5 million of the purchase price was paid in cash consideration and $172.5 million of the purchase price was paid in the form of approximately 5.9 million shares of Class A common stock of Zeta, par value $0.001 per share (such issued shares, the “Stock Consideration”), in each case subject to customary adjustments and holdback arrangements in accordance with the Merger Agreement.

The issuance of the Stock Consideration was made in reliance upon the exemptions from registration afforded by Section 4(a)(2), Rule 506 of Regulation D promulgated under the Securities Act, and/or Regulation S promulgated under the Securities Act.

Forward-Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including the amount and timing of earnout payments, if any. Statements regarding future events are based on Zeta’s current expectations and are necessarily subject to associated risks related to, among other things, general economic conditions. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. For information regarding other related risks, see the “Risk Factors” section of Zeta’s most recent annual report on Form 10-K and quarterly reports on Form 10-Q. The forward-looking statements included herein are made only as of the date hereof, and Zeta undertakes no obligation to revise or update any forward-looking statements, except as required by applicable law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Zeta Global Holdings Corp. |

|

|

|

|

Date: |

October 21, 2024 |

By: |

/s/ Christopher Greiner |

|

|

|

Christopher Greiner

Chief Financial Officer |

Zeta Global Completes Acquisition of LiveIntent

October 21, 2024 (NEW YORK, NY) – Zeta Global (NYSE: ZETA), the AI-Powered Marketing Cloud, today announced it has successfully completed its acquisition of LiveIntent, a pioneer in people-based marketing.

The addition of LiveIntent’s assets, publisher network, and channel capabilities will bolster the Zeta Marketing Platform, strengthen the Zeta Data Cloud, and advance Zeta’s position in AI-powered marketing. For more information on the acquisition, read here.

“Acquiring LiveIntent is not only accretive to our financial profile, it also strengthens the value we deliver to enterprises, extends our platform to the publisher ecosystem and widens our moat,” said David A. Steinberg, co-founder, Chairman and CEO of Zeta Global. “We’re delighted to add LiveIntent’s vast data assets, direct channel capabilities and premium publisher network to the Zeta Marketing Platform (ZMP). The integration of LiveIntent into the ZMP will expand gross margins while accelerating the shift of our revenue derived from agency customers to direct channels.”

Transaction details are available in Zeta’s Press Release and 8-K filed with the Securities and Exchange Commission on October 8, 2024.

About Zeta Global

Zeta Global (NYSE: ZETA) is the AI-Powered Marketing Cloud that leverages advanced artificial intelligence (AI) and trillions of consumer signals to make it easier for marketers to acquire, grow and retain customers more efficiently. Through the Zeta Marketing Platform (ZMP), our vision is to make sophisticated marketing simple by unifying identity, intelligence and omnichannel activation into a single platform – powered by one of the industry’s largest proprietary databases and AI. Our enterprise customers across multiple verticals are empowered to personalize experiences with consumers at an individual level across every channel, delivering better results for marketing programs. Zeta was founded in 2007 by David A. Steinberg and John Sculley and is headquartered in New York City with offices around the world.

Forward-Looking Statements

This press release, together with other statements and information publicly disseminated by the Company, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with these safe harbor provisions. Any statements made in this press release that are not statements of historical fact, including statements about our acquisition of LiveIntent and the anticipated synergies, accretive value, impact on Zeta’s product portfolio and market position, gross margin growth and revenue shift acceleration from agencies to direct customers, are forward-looking statements and should be evaluated as such. Forward-looking statements include information concerning our anticipated future financial performance, our market opportunities and our expectations regarding our

business plan and strategies resulting from our acquisition of LiveIntent. We base these forward-looking statements on our current expectations, plans and assumptions that we have made in light of our experience in the industry, as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances at such time. Although we believe that these forward-looking statements are based on reasonable assumptions at the time they are made, you should be aware that many factors could affect our business, results of operations and financial condition and could cause actual results to differ materially from those expressed in the forward-looking statements. For information regarding other related risks, see the “Risk Factors” section of Zeta’s most recent annual report on Form 10-K and quarterly reports on Form 10-Q. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

Contacts:

Investor Relations

Madison Serras

ir@zetaglobal.com

Press

Candace Dean

press@zetaglobal.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

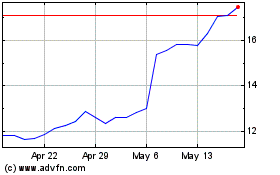

Zeta Global (NYSE:ZETA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Zeta Global (NYSE:ZETA)

Historical Stock Chart

From Nov 2023 to Nov 2024