- Delivered revenue of $315M, up 50% Y/Y in 4Q’24, and $1,006M,

up 38% Y/Y in 2024

- Increased Scaled Customer count 17% Y/Y and Super-Scaled

Customer count 13% Y/Y

- Grew Scaled Customer ARPU 19% Y/Y to $1.87M in 2024

- Generated cash flow from operating activities of $44M in 4Q’24,

and $134M in 2024

- Guiding to sixth consecutive year of 20%+ revenue growth

Zeta Global (NYSE: ZETA), the AI Marketing Cloud, today

announced financial results for the fourth quarter and full year

ended December 31, 2024.

“At Zeta, we’ve consistently skated to where the puck is going.

Our early investments in AI and first-party data are resonating

with customers and prospects, fueling our record fourth quarter

results and contributing to our market share gains,” said David A.

Steinberg, Co-Founder, Chairman, and CEO of Zeta. “We believe these

investments will propel us to over $2 billion in annual revenue by

2028, as outlined in our Zeta 2028 plan.”

“Our performance is best summed up by consistency and momentum,”

said Chris Greiner, Zeta’s CFO. “We exited the year at our highest

ever growth rate of 50%, while notching our 14th straight quarter

of beat and raise guidance. But more importantly, we are in

rarified air when it comes to delivering 20% revenue growth and

free cash flow margin expansion annually from 2021 through 2025–an

accomplishment only 7 other public technology companies can point

to, out of more than 500 in the US. And to put an exclamation point

on it, our newly announced Zeta 2028 plan targets doing the same

for the next 4 years.”

Fourth Quarter 2024 Highlights

- Total revenue of $315 million, increased 50% Y/Y.

- Scaled Customer count increased to 527 from 475 in 3Q’24 and

452 in 4Q’23.

- Super-Scaled Customer count increased to 148 from 144 in 3Q’24

and 131 in 4Q’23.

- Quarterly Scaled Customer ARPU of $577,000, increased 27%

Y/Y.

- Quarterly Super-Scaled Customer ARPU of $1.73 million,

increased 31% Y/Y.

- Direct platform revenue mix of 74% of total revenue, compared

to 70% in 3Q’24 and 73% in 4Q’23.

- GAAP cost of revenue percentage of 40.0%, a 20 basis point

improvement Y/Y, and up 60 basis points Q/Q.

- GAAP net income of $15 million, or 5% of revenue; compared to

GAAP net loss in 4Q’23 of $35 million, or 17% of revenue.

- GAAP diluted earnings per share of $0.06, compared to a GAAP

loss per share of $0.22 in 4Q’23.

- Cash flow from operating activities of $44 million, compared to

$27 million in 4Q’23.

- Free Cash Flow1 of $32 million, compared to $18 million in

4Q’23.

- Repurchased $31 million worth of shares through our share

repurchase program.

- Adjusted EBITDA1 of $70.4 million, increased 57% Y/Y from $44.8

million in 4Q’23.

- Adjusted EBITDA margin1 of 22.4%, increased from 21.3% in

4Q’23.

Full Year 2024 Highlights

- Total revenue of $1,006 million, increased 38% Y/Y.

- Scaled Customer ARPU of $1.87 million, increased of 19%

Y/Y.

- Super Scaled Customer ARPU of $5.71 million, increased of 26%

Y/Y.

- Direct platform revenue mix of 70% of total revenue, compared

to 72% in 2023.

- Net Revenue Retention of 114%, compared to 111% in 2023.

- GAAP cost of revenue percentage of 39.7%, increased 210 basis

points Y/Y.

- GAAP net loss of $70 million, or 7% of revenue, was driven

primarily by $195 million of stock-based compensation. The net loss

in 2023 was $187 million, or 26% of revenue.

- GAAP loss per share of $0.38, compared to a GAAP loss per share

of $1.20 in 2023.

- Cash flow from operating activities of $134 million, compared

to $91 million in 2023.

- Free Cash Flow1 of $92 million, compared to $55 million in

2023.

- Repurchased $41 million worth of shares through our share

repurchase program.

- Adjusted EBITDA1 of $193.0 million, an increase of 49% compared

to $129.4 million in 2023.

- Adjusted EBITDA margin1 of 19.2%, compared to 17.8% in

2023.

Guidance

First Quarter 2025

- Revenue of $253 million to $255 million, representing a

year-over-year increase of 30% to 31%.

- Adjusted EBITDA of $44.2 million to $44.8 million, representing

a year-over-year increase of 45% to 47%, and an Adjusted EBITDA

margin of 17.3% to 17.7%.

Full Year 2025

- Revenue of $1,235 million to $1,245 million, representing a

year-over-year increase of 23% to 24%.

- Adjusted EBITDA of $255.5 million to $257.5 million,

representing a year-over-year increase of 32% to 33%, and an

Adjusted EBITDA margin of 20.5% to 20.8%.

- Free Cash Flow of $127.5 million to $131.5 million.

Zeta 2028

- Revenue of at least $2.1 billion; implied 20% organic CAGR

- Adjusted EBITDA of at least $525 million; implied margin of

25%

- Free Cash Flow of at least $340 million; implied margin of 16%

and implied Free Cash Flow to Adjusted EBITDA ratio of 65%

Investor Conference Call and Webcast

Zeta will host a conference call today, Tuesday, February 25,

2025, at 4:30 p.m. Eastern Time to discuss financial results for

the fourth quarter and full year 2024. A supplemental earnings

presentation and a live webcast of the conference call can be

accessed from the Company’s investor relations website

(https://investors.zetaglobal.com/) where they will remain

available for one year.

About Zeta

Zeta Global (NYSE: ZETA) is the AI Marketing Cloud that

leverages advanced artificial intelligence (AI) and trillions of

consumer signals to make it easier for marketers to acquire, grow,

and retain customers more efficiently. Through the Zeta Marketing

Platform (ZMP), our vision is to make sophisticated marketing

simple by unifying identity, intelligence, and omnichannel

activation into a single platform – powered by one of the

industry’s largest proprietary databases and AI. Our enterprise

customers across multiple verticals are empowered to personalize

experiences with consumers at an individual level across every

channel, delivering better results for marketing programs. Zeta was

founded in 2007 by David A. Steinberg and John Sculley and is

headquartered in New York City with offices around the world. To

learn more, go to www.zetaglobal.com.

Forward-Looking Statements

This press release, together with other statements and

information publicly disseminated by the Company, contains certain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The Company intends

such forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 and includes this

statement for purposes of complying with these safe harbor

provisions. Any statements made in this press release or during the

earnings call that are not statements of historical fact, including

statements about our 2025 guidance, the Zeta 2028 plan, the

financial targets and underlying assumptions of the Zeta 2028 plan

and the timing of when we will achieve the Zeta 2028 plan, the

impacts of our prior investments on accelerating the timing of the

marketing cloud replacement cycle, our products capabilities to

provide strong investment returns to our customers, our strong

competitive position, visibility of our current and new customers,

expansion of existing customers, the capabilities of AI and Zeta’s

platform, the acceleration of the digital transformation and our

business, and the growth and expansion of AI and the Zeta Marketing

Platform, are forward-looking statements and should be evaluated as

such. Forward-looking statements include information concerning our

anticipated future financial performance, our market opportunities

and our expectations regarding our business plan and strategies.

These statements often include words such as “anticipate,”

“expect,” “suggests,” “plan,” “believe,” “intend,” “estimates,”

“targets,” “projects,” “should,” “could,” “would,” “may,” “will,”

“forecast,” “outlook,” “guidance” and other similar expressions. We

base these forward-looking statements on our current expectations,

plans and assumptions that we have made in light of our experience

in the industry, as well as our perceptions of historical trends,

current conditions, expected future developments and other factors

we believe are appropriate under the circumstances at such time.

Although we believe that these forward-looking statements are based

on reasonable assumptions at the time they are made, you should be

aware that many factors could affect our business, results of

operations and financial condition and could cause actual results

to differ materially from those expressed in the forward-looking

statements. These statements are not guarantees of future

performance or results.

The forward-looking statements are subject to and involve risks,

uncertainties and assumptions, and you should not place undue

reliance on these forward-looking statements. Factors that may

materially affect such forward-looking statements include, but are

not limited to: global supply chain disruptions; macroeconomic and

industry trends and adverse developments in the debt, consumer

credit and financial services markets and other macroeconomic

factors beyond Zeta’s control; increases in our borrowing costs as

a result of changes in interest rates and other factors; the impact

of inflation on us and on our customers; potential fluctuations in

our operating results, which could make our future operating

results difficult to predict; underlying circumstances, including

cash flows, cash position, financial performance, market conditions

and potential acquisitions; prevailing stock prices, general

economic and market condition; the impact of future pandemics,

epidemics and other health crises on the global economy, our

customers, employees and business; domestic and international

political and geopolitical conditions or uncertainty, including

political or civil unrest or changes in trade policy; our ability

to innovate and make the right investment decisions in our product

offerings and platform; the impact of new generative AI

capabilities and the proliferation of AI on our business; our

ability to attract and retain customers, including our scaled and

super-scaled customers; our ability to manage our growth

effectively; our ability to identify and integrate acquisitions or

strategic investments; our ability to collect and use data online;

the standards that private entities and inbox service providers

adopt in the future to regulate the use and delivery of email may

interfere with the effectiveness of our platform and our ability to

conduct business; a significant inadvertent disclosure or breach of

confidential and/or personal information we process, or a security

breach of our or our customers’, suppliers’ or other partners’

computer systems; and any disruption to our third-party data

centers, systems and technologies. These cautionary statements

should not be construed by you to be exhaustive and the

forward-looking statements are made only as of the date of this

press release. We undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable law.

If we update one or more forward-looking statements, no inference

should be drawn that we will make additional updates with respect

to those or other forward-looking statements.

The first quarter and full year 2025 guidance and the Zeta 2028

targets provided herein are based on Zeta’s current estimates and

assumptions and are not a guarantee of future performance. The

guidance and the Zeta 2028 targets provided are subject to

significant risks and uncertainties, including the risk factors

discussed in the Company's reports on file with the Securities and

Exchange Commission (“SEC”), that could cause actual results to

differ materially. There can be no assurance that the Company will

achieve the results expressed by this guidance or the targets.

Availability of Information on Zeta’s Website and Social

Media Profiles

Investors and others should note that Zeta routinely announces

material information to investors and the marketplace using SEC

filings, press releases, public conference calls, webcasts and the

Zeta investor relations website at https://investors.zetaglobal.com

(“Investors Website”). We also intend to use the social media

profiles listed below as a means of disclosing information about us

to our customers, investors and the public. While not all of the

information that the Company posts to the Investors Website or to

social media profiles is of a material nature, some information

could be deemed to be material. Accordingly, the Company encourages

investors, the media, and others interested in Zeta to review the

information that it shares on the Investors Website and to

regularly follow our social media profile links located at the

bottom of the page on www.zetaglobal.com. Users may automatically

receive email alerts and other information about Zeta when

enrolling an email address by visiting "Investor Email Alerts" in

the "Resources" section of the Investors Website.

Social Media Profiles: www.x.com/zetaglobal

www.facebook.com/ZetaGlobal/ www.linkedin.com/company/zetaglobal

www.instagram.com/zetaglobal/

The Following Definitions Apply to the Terms Used Throughout

this Release, the Supplemental Earnings Presentation and Investor

Conference Call

- Direct Platform and Integrated Platform: When the Company generates

revenues entirely through the Company platform, the Company

considers it direct platform revenue. When the Company generates

revenue by leveraging its platform’s integration with third

parties, it is considered integrated platform revenue.

- Cost of revenue (excluding depreciation

and amortization): Cost of revenue excludes depreciation and

amortization and consists primarily of media and marketing costs

and certain employee-related costs. Media and marketing costs

consist primarily of fees paid to third-party publishers, media

owners or managers, and strategic partners that are directly

related to a revenue-generating event. We pay these third-party

publishers, media owners or managers and strategic partners on a

revenue-share, a cost-per-lead, cost-per-click, or

cost-per-thousand-impressions basis. Employee-related costs

included in cost of revenues include salaries, bonuses,

commissions, stock-based compensation and employee benefit costs

primarily related to individuals directly associated with providing

services to our customers.

- Net Revenue Retention (“NRR”): We

use an annual NRR rate as a measure of our ability to retain and

expand business generated from our existing customer base. We

calculate our NRR rate by dividing current year revenue earned from

customers from which we also earned revenue in the prior year, by

the prior year revenue from those same customers. We exclude

political and advocacy customers from our calculation of NRR rate

because of the biennial nature of these customers.

- Scaled Customers: We define scaled

customers as customers from which we generated at least $100,000 in

revenue on a trailing twelve-month basis. We calculate the number

of scaled customers at the end of each quarter and on an annual

basis as the number of customers billed during each applicable

period. We believe the scaled customers measure is both an

important contributor to our revenue growth and an indicator to

investors of our measurable success.

- Super-Scaled Customers: We define

super-scaled customers, which is a subset of Scaled Customers, as

customers from which we generated at least $1,000,000 in revenue on

a trailing twelve-month basis. We calculate the number of

super-scaled customers at the end of each quarter and on an annual

basis as the number of customers billed during each applicable

period. We believe the super-scaled customers measure is both an

important contributor to our revenue growth and an indicator to

investors of our measurable success.

- Scaled Customer ARPU: We calculate

the scaled customer average revenue per user (“ARPU”) as revenue

for the corresponding period divided by the number of scaled

customers at the end of that period. We believe that scaled

customer ARPU is useful for investors because it is an indicator of

our ability to increase revenue and scale our business.

- Super-Scaled Customer ARPU: We

calculate the super-scaled customer ARPU as revenue for the

corresponding period divided by the number of super-scaled

customers at the end of that period. We believe that super-scaled

customer ARPU is useful for investors because it is an indicator of

our ability to increase revenue and scale our business.

- Zeta 2028: Zeta 2028 is the

Company’s next medium-term plan with targets for business, product,

and industry leadership. See “Zeta 2028” above for the financial

targets of this plan.

Non-GAAP Measures

In order to assist readers of our consolidated financial

statements in understanding the core operating results that our

management uses to evaluate the business and for financial planning

purposes, we describe our non-GAAP measures below. We believe these

non-GAAP measures are useful to investors in evaluating our

performance by providing an additional tool for investors to use in

comparing our financial performance over multiple periods.

- Adjusted EBITDA is a non-GAAP

financial measure defined as net income / (loss) adjusted for

interest expense, depreciation and amortization, stock-based

compensation, income tax (benefit) / provision, acquisition-related

expenses, restructuring expenses, change in fair value of warrants

and derivative liabilities, certain dispute settlement expenses,

gain on extinguishment of debt, certain non-recurring capital raise

related (including IPO) expenses, including the payroll taxes

related to vesting of restricted stock and restricted stock units

upon the completion of the IPO, and other expenses.

Acquisition-related expenses and restructuring expenses primarily

consist of professional services fees, severance and other

employee-related costs, which may vary from period to period

depending on the timing of our acquisitions and restructuring

activities and distort the comparability of the results of

operations. Change in fair value of warrants and derivative

liabilities is a non-cash expense related to periodically recording

“mark-to-market” changes in the valuation of derivatives and

warrants. Other expenses consist of non-cash expenses such as

changes in fair value of acquisition-related liabilities, gains and

losses on extinguishment of acquisition-related liabilities, gains

and losses on sales of assets and foreign exchange gains and

losses. In particular, we believe that the exclusion of stock-based

compensation, certain dispute settlement expenses and non-recurring

capital raise related (including IPO) expenses that are not related

to our core operations provides measures for period-to-period

comparisons of our business and provides additional insight into

our core controllable costs. We exclude these charges because these

expenses are not reflective of ongoing business and operating

results.

- Adjusted EBITDA margin is a

non-GAAP financial measure defined as Adjusted EBITDA divided by

the total revenues for the same period.

- Free Cash Flow is a non-GAAP

financial measure defined as cash from operating activities, less

capital expenditures and website and software development costs,

adjusted for the effect of exchange rates on cash and cash

equivalents.

Adjusted EBITDA, Adjusted EBITDA margin, and Free Cash Flow

provide us with useful measures for period-to-period comparisons of

our business as well as comparison to our peers. We believe that

these non-GAAP financial measures are useful to investors in

analyzing our financial and operational performance. Nevertheless

our use of Adjusted EBITDA, Adjusted EBITDA margin, and Free Cash

Flow has limitations as an analytical tool, and you should not

consider these measures in isolation or as a substitute for

analysis of our financial results as reported under GAAP. Other

companies may calculate similarly-titled non-GAAP financial

measures differently than us, thereby limiting the usefulness of

these non-GAAP financial measures as a comparative tool. Because of

these and other limitations, you should consider our non-GAAP

measures only as supplemental to other GAAP-based financial

performance measures, including revenues and net income /

(loss).

We calculate forward-looking Adjusted EBITDA, Adjusted EBITDA

margin, and Free Cash Flow based on internal forecasts that omit

certain amounts that would be included in forward-looking GAAP net

income / (loss). We do not attempt to provide a reconciliation of

forward-looking Adjusted EBITDA, Adjusted EBITDA margin, and Free

Cash Flow guidance and targets to forward looking GAAP net income /

(loss), GAAP net income / (loss) margin or GAAP cash flows from

operating activities, respectively, because forecasting the timing

or amount of items that have not yet occurred and are out of our

control is inherently uncertain and unavailable without

unreasonable efforts. Further, we believe that such reconciliations

would imply a degree of precision and certainty that could be

confusing to investors. Such items could have a substantial impact

on GAAP measures of financial performance.

Zeta Global Holdings

Corp.

Consolidated Balance

Sheets

(In thousands, except share

and per share amounts)

As of December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

366,157

$

131,732

Accounts receivable, net of

allowance of $4,291 and $3,564 as of December 31, 2024 and 2023,

respectively

235,227

170,131

Prepaid expenses

13,348

6,269

Other current assets

1,808

1,622

Total current assets

$

616,540

$

309,754

Non-current assets:

Property and equipment, net

8,856

7,452

Website and software development

costs, net

28,949

32,124

Right-to-use assets - operating

leases, net

8,806

6,603

Intangible assets, net

115,180

48,781

Goodwill

325,992

140,905

Deferred tax assets, net

619

728

Other non-current assets

6,431

4,367

Total non-current assets

$

494,833

$

240,960

Total assets

$

1,111,373

$

550,714

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

43,665

$

63,572

Accrued expenses

121,400

85,455

Acquisition-related

liabilities

12,727

17,234

Deferred revenue

10,348

3,301

Other current liabilities

11,197

6,823

Total current liabilities

$

199,337

$

176,385

Non-current liabilities:

Long-term borrowings

196,288

184,147

Acquisition-related

liabilities

29,137

3,060

Other non-current liabilities

9,810

6,602

Total non-current liabilities

$

235,235

$

193,809

Total liabilities

$

434,572

$

370,194

Stockholders’ equity:

Class A Common Stock $0.001 per

share par value, up to 3,750,000,000 shares authorized, 213,175,179

and 188,631,432 shares issued and outstanding as of December 31,

2024 and 2023, respectively

213

189

Class B Common Stock $0.001 per

share par value, up to 50,000,000 shares authorized, 24,095,071 and

29,055,489 shares issued and outstanding as of December 31, 2024

and 2023, respectively

24

29

Additional paid-in capital

1,706,885

1,140,849

Accumulated deficit

(1,028,308

)

(958,537

)

Accumulated other comprehensive

loss

(2,013

)

(2,010

)

Total stockholders’ equity

$

676,801

$

180,520

Total liabilities and

stockholders' equity

$

1,111,373

$

550,714

Consolidated Statements of

Operations and Comprehensive Loss

(In thousands, except share

and per share amounts)

Three months ended December

31,

Year ended December

31,

2024

2023

2024

2023

Revenues

$

314,673

$

210,320

$

1,005,754

$

728,723

Operating expenses:

Cost of revenues (excluding

depreciation and amortization)

125,945

84,615

399,552

274,482

General and administrative

expenses

54,136

51,397

204,595

205,419

Selling and marketing

expenses

82,947

72,727

314,514

288,441

Research and development

expenses

24,272

19,945

90,679

73,869

Depreciation and amortization

16,805

13,495

56,100

51,149

Acquisition-related expenses

3,646

—

8,229

203

Restructuring expenses

—

—

—

2,845

Total operating

expenses

$

307,751

$

242,179

$

1,073,669

$

896,408

Income / (loss) from

operations

6,922

(31,859

)

(67,915

)

(167,685

)

Interest expense, net

17

2,800

7,147

10,939

Other (income) / expenses

(2,073

)

682

(115

)

7,820

Total other (income) /

expenses

$

(2,056

)

$

3,482

$

7,032

$

18,759

Income / (loss) before income

taxes

8,978

(35,341

)

(74,947

)

(186,444

)

Income tax (benefit) /

provision

(6,258

)

(60

)

(5,176

)

1,037

Net income / (loss)

$

15,236

$

(35,281

)

$

(69,771

)

$

(187,481

)

Other comprehensive (income) /

loss:

Foreign currency translation

adjustment

150

(113

)

3

(35

)

Total comprehensive (loss) /

income

$

15,086

$

(35,168

)

$

(69,774

)

$

(187,446

)

Net income / (loss) per

share

Net income / (loss) available

to common stockholders

$

15,236

$

(35,281

)

$

(69,771

)

$

(187,481

)

Basic (loss) / earnings per

share

$

0.07

$

(0.22

)

$

(0.38

)

$

(1.20

)

Diluted (loss) / earnings per

share

$

0.06

$

(0.22

)

$

(0.38

)

$

(1.20

)

Weighted average number of

shares used to compute net (loss) / earnings per share

Basic

206,349,816

163,922,676

185,984,107

156,697,308

Diluted

250,320,459

163,922,676

185,984,107

156,697,308

The Company recorded stock-based compensation under respective

lines of the above consolidated statements of operations and

comprehensive loss:

Three months ended December

31,

Year ended December

31,

2024

2023

2024

2023

Cost of revenues (excluding

depreciation and amortization)

$

339

$

404

$

1,503

$

2,502

General and administrative

expenses

15,003

22,244

65,339

88,465

Selling and marketing

expenses

21,186

31,799

99,577

124,732

Research and development

expenses

6,482

8,688

28,565

27,182

Total

$

43,010

$

63,135

$

194,984

$

242,881

Consolidated Statements of

Cash Flows

(In thousands)

Year ended December

31,

2024

2023

Cash flows from operating

activities:

Net loss

$

(69,771

)

$

(187,481

)

Adjustments to reconcile net loss

to net cash provided by operating activities:

Depreciation and amortization

56,100

51,149

Stock-based compensation

194,984

242,881

Deferred income taxes

(7,260

)

11

Change in fair value of

acquisition-related liabilities

(979

)

7,200

Others, net

(7

)

2,015

Change in non-cash working

capital (net of acquisitions):

Accounts receivable

(41,836

)

(64,052

)

Prepaid expenses

(6,267

)

1,061

Other current assets

103

243

Other non-current assets

(2,054

)

(1,526

)

Deferred revenue

6,256

807

Accounts payable

(28,580

)

26,262

Accrued expenses and other

current liabilities

32,581

12,443

Other non-current liabilities

591

(490

)

Net cash provided by operating

activities

$

133,861

$

90,523

Cash flows from investing

activities:

Capital expenditures

(25,727

)

(20,483

)

Website and software development

costs

(16,040

)

(15,487

)

Acquisitions and other

investments, net of cash acquired

(55,819

)

(18,245

)

Net cash used for investing

activities

$

(97,586

)

$

(54,215

)

Cash flows from financing

activities:

Cash paid for acquisition-related

liabilities

(7,032

)

(15,508

)

Proceeds from credit facilities,

net of issuance cost

209,103

11,250

Issuances under employee stock

purchase plan

3,406

3,058

Exercise of options and

warrants

3,175

241

Proceeds from equity capital

raise, net of issuance cost

228,956

—

Repurchase of shares

(42,185

)

(13,443

)

Repayments against the credit

facilities

(197,500

)

(11,250

)

Net cash provided by / (used

for) financing activities

$

197,923

$

(25,652

)

Effect of exchange rate changes

on cash and cash equivalents

227

(34

)

Net increase in cash and cash

equivalents

$

234,425

$

10,622

Cash and cash equivalents,

beginning of period

131,732

121,110

Cash and cash equivalents, end

of period

$

366,157

$

131,732

Supplemental cash flow

disclosures including non-cash activities:

Cash paid for interest, net

$

7,348

$

10,481

Cash paid for income taxes,

net

$

1,886

$

1,900

Liability established in

connection with acquisitions

$

30,269

$

8,189

Capitalized stock-based

compensation as website and software development

$

2,890

$

3,790

Shares issued in connection with

acquisitions and other agreements

$

173,724

$

5,387

Right-to-use assets

established

$

5,019

$

165

Operating lease liabilities

established

$

5,019

$

165

Non-cash consideration for

website and software development

$

1,011

$

963

Reconciliation of GAAP to Non-GAAP Financial

Measures (In thousands)

The following table reconciles adjusted EBITDA and adjusted

EBITDA margin to net income / (loss) and net income / (loss)

margin, respectively, the most directly comparable financial

measure calculated and presented in accordance with GAAP.

Three months ended December

31,

Year ended

December 31,

2024

2023

2024

2023

Net income / (loss)

$

15,236

$

(35,281)

$

(69,771)

$

(187,481)

Net income / (loss)

margin

4.8%

(16.8)%

(6.9)%

(25.7)%

Add back:

Depreciation and amortization

16,805

13,495

56,100

51,149

Restructuring expenses

—

—

—

2,845

Acquisition-related expenses

3,646

—

8,229

203

Capital raise related

expenses

—

—

1,624

—

Stock-based compensation

43,010

63,135

194,984

242,881

Other (income) / expenses

(2,073)

682

(115)

7,820

Interest expense, net

17

2,800

7,147

10,939

Income tax (benefit) /

provision

(6,258)

(60)

(5,176)

1,037

Adjusted EBITDA

$

70,383

$

44,771

$

193,022

$

129,393

Adjusted EBITDA margin

22.4%

21.3%

19.2%

17.8%

The following table reconciles net cash provided by operating

activities in the Consolidated Statements of Cash Flows to free

cash flow:

Three months ended

December 31,

Year ended

December 31,

2024

2023

2024

2023

Net cash provided by operating

activities

$

43,683

$

26,962

$

133,861

$

90,523

Capital expenditures

(8,269)

(5,597)

(25,727)

(20,483)

Website and software development

costs

(3,930)

(3,143)

(16,040)

(15,487)

Effect of exchange rate changes

on cash and cash equivalents

184

(41)

227

(34)

Free Cash Flow

$

31,668

$

18,181

$

92,321

$

54,519

____________________________________ 1 Free Cash Flow, Adjusted

EBITDA, and Adjusted EBITDA margin are not measures of financial

performance prepared in accordance with GAAP. See “Non-GAAP

Measures” for more information and, where applicable,

reconciliations to the most directly comparable GAAP financial

measures at the end of this release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225432402/en/

Investor Relations Matt Pfau ir@zetaglobal.com

Press Candace Dean press@zetaglobal.com

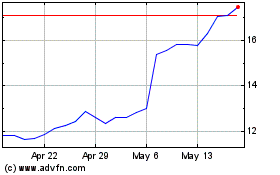

Zeta Global (NYSE:ZETA)

Historical Stock Chart

From Feb 2025 to Mar 2025

Zeta Global (NYSE:ZETA)

Historical Stock Chart

From Mar 2024 to Mar 2025