Quarterly revenue of $111.0 million

Full-year revenue of $474.0 million

Full-year net loss of ($12.9) million, or net

loss margin of (3)%

Full-year Adjusted EBITDA of $78.0 million, or

Adjusted EBITDA margin of 16%

ZipRecruiter® (NYSE: ZIP), a leading online employment

marketplace, today announced financial results for the quarter and

full year ended December 31, 2024. ZipRecruiter’s complete fourth

quarter and full year 2024 results, financial guidance, and

management commentary can be found by accessing ZipRecruiter’s

shareholder letter on the quarterly results page of the Investor

Relations website at investors.ziprecruiter.com.

“In 2024, ZipRecruiter delivered multiple improvements to our

marketplace. This included new product launches, advancements to

our existing products, and leveraging M&A as a tool to expand

our product suite. We made these gains against a difficult hiring

environment. Our business remains resilient, as we managed down

operating expenses while continuing to invest in product and

technology,” said Ian Siegel, CEO of ZipRecruiter. “Despite the

protracted labor market downturn, we enter 2025 with cautious

optimism on improving revenue trends from both internal and

external indicators. Our Q1 revenue guidance of $109 million at the

midpoint is down 2% versus Q4’24. By contrast, Q1 revenue declined

sequentially by 13% and 10% in 2023 and 2024, respectively. We

remain nimble and believe our balance sheet provides a solid

foundation to capture market share when hiring activity returns.

Through all labor market cycles, our mission of actively connecting

people to their next great opportunity remains the foundation of

our strategy.”

Conference Call Details

ZipRecruiter will host a conference call today, February 25, at

2:00 p.m. Pacific Time to discuss its financial results. A live

webcast of the call can be accessed from ZipRecruiter’s Investor

Relations website at investors.ziprecruiter.com. An archived

version will be available on the website two hours after the

completion of the call. Investors and analysts can participate in

the conference call by dialing +1 (888) 440-4199, or +1 (646)

960-0818 for callers outside the United States and use the

Conference ID 9351892. To listen to the telephonic replay,

available until Tuesday, March 4, 2025, please dial +1 (800)

770-2030 or +1 (609) 800-9909 for callers outside the United States

and use the Conference ID 9351892.

Forward-Looking

Statements

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

All statements contained in this press release that do not relate

to matters of historical fact should be considered forward-looking

statements, including statements regarding expected hiring activity

and our market share, the future of the U.S. labor market, our

investment in product and technology and other statements that

reflect ZipRecruiter’s current expectations and projections with

respect to, among other things, its financial condition, results of

operations, plans, objectives, future performance, and business.

These statements may be preceded by, followed by or include the

words “aim,” “anticipate,” “believe,” “estimate,” “expect,”

“forecast,” “intend,” “likely,” “outlook,” “plan,” “potential,”

“project,” “projection,” “seek,” “can,” “could,” “may,” “should,”

“would,” “will,” the negatives thereof and other words and terms of

similar meaning. Such forward-looking statements are subject to

various risks and uncertainties. Accordingly, there are or will be

important factors that could cause actual outcomes or results to

differ materially from those indicated in these statements,

including our ability to attract and retain employers and job

seekers; our ability to compete with well-established competitors

and new entrants; our ability to achieve and/or maintain

profitability; our ability to maintain, protect and enhance our

brand and intellectual property; our dependence on macroeconomic

factors; our ability to maintain and improve the quality of our

platform; our dependence on the interoperability of our platform

with mobile operating systems that we do not control; our ability

to successfully implement our business plan during a global

economic downturn that may impact the demand for our services or

have a material adverse impact on our and our business partners’

financial condition and results of operations; our ability and the

ability of third parties to protect our users’ personal or other

data from a security breach and to comply with laws and regulations

relating to consumer data privacy and data protection; our ability

to detect errors, defects or disruptions in our platform; our

ability to comply with the terms of underlying licenses of open

source software components on our platform; our ability to expand

into markets outside the United States; our ability to achieve

desired operating margins; our compliance with a wide variety of

U.S. and international laws and regulations; our reliance on Amazon

Web Services; our ability to mitigate payment and fraud risks; our

dependence on our senior management and our ability to attract and

retain new talent; and the other important factors discussed under

the caption “Risk Factors” in our Annual Report on Form 10-K for

the twelve months ended December 31, 2023 and our Quarterly Reports

on Form 10-Q for the three months ended March 31, 2024, June 30,

2024, and September 30, 2024, in each case, that we filed with the

U.S. Securities and Exchange Commission, and our Annual Report on

Form 10-K for the twelve months ended December 31, 2024 that we

will file with the U.S. Securities and Exchange Commission. There

is no assurance that any forward-looking statements will

materialize. You are cautioned not to place undue reliance on

forward-looking statements, which reflect expectations only as of

this date. ZipRecruiter does not undertake any obligation to

publicly update or review any forward-looking statement, whether as

a result of new information, future developments, or otherwise.

Non-GAAP Financial

Measures

This release includes certain non-GAAP financial measures,

including Adjusted EBITDA and Adjusted EBITDA margin.

We define Adjusted EBITDA as our net income (loss) before

interest expense, other income (expense), net, income tax expense

(benefit) and depreciation and amortization, adjusted to eliminate

stock-based compensation expense. Adjusted EBITDA margin represents

Adjusted EBITDA as a percentage of revenue for the same period.

Management and our board of directors use these non-GAAP

financial measures as supplemental measures of our performance

because they assist us in comparing our operating performance on a

consistent basis, as they remove the impact of some items not

directly resulting from our core operations. We also use these

non-GAAP financial measures for planning purposes, including the

preparation of our internal annual operating budget and financial

projections, to evaluate the performance and effectiveness of our

strategic initiatives and to evaluate our capacity for capital

expenditures to expand our business.

Adjusted EBITDA and Adjusted EBITDA margin should not be

considered in isolation, as an alternative to, or superior to net

income (loss), revenue, cash flows or other measures derived in

accordance with GAAP. These non-GAAP measures are frequently used

by analysts, investors and other interested parties to evaluate

companies in our industry. Management believes that the

presentation of non-GAAP financial measures is an appropriate

measure of operating performance because they eliminate the impact

of some expenses that do not relate directly to the performance of

our underlying business.

These non-GAAP financial measures should not be construed as an

inference that our future results will be unaffected by unusual or

other items. Additionally, Adjusted EBITDA and Adjusted EBITDA

margin are not intended to be a measure of free cash flow for

management’s discretionary use, as they do not reflect our tax

payments and certain other cash costs that may recur in the future,

including, among other things, cash requirements for costs to

replace assets being depreciated and amortized. Management

compensates for these limitations by relying on our GAAP results in

addition to using Adjusted EBITDA and Adjusted EBITDA margin as

supplemental measures of our performance. Our measures of Adjusted

EBITDA and Adjusted EBITDA margin used herein are not necessarily

comparable to similarly titled captions of other companies due to

different methods of calculation.

RECONCILIATION OF GAAP NET INCOME

(LOSS) TO ADJUSTED EBITDA (UNAUDITED)

(in thousands, except net income (loss)

margin and Adjusted EBITDA margin data)

Year Ended

December 31,

2024

GAAP net income (loss)

$(12,854)

Stock-based compensation

64,453

Depreciation and amortization

12,291

Interest expense

29,597

Other (income) expense, net

(21,838)

Income tax expense (benefit)

6,357

Adjusted EBITDA

$ 78,006

Net income (loss) margin

(3)%

Adjusted EBITDA margin

16%

About ZipRecruiter

ZipRecruiter® (NYSE:ZIP) is a leading online employment

marketplace that actively connects people to their next great

opportunity. ZipRecruiter’s powerful matching technology improves

the job search experience for job seekers and helps businesses of

all sizes find and hire the right candidates quickly. ZipRecruiter

has been the #1 rated job search app on iOS & Android for the

past eight years1 and is rated the #1 employment job site by G2.2

For more information, visit www.ziprecruiter.com.

1 Based on job seeker app ratings, during the period of January

2017 to January 2025 from AppFollow for ZipRecruiter,

CareerBuilder, Glassdoor, Indeed, LinkedIn, and Monster.

2 Based on G2 satisfaction ratings as of January 10, 2025.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224397363/en/

Investors: Drew Haroldson The

Blueshirt Group, for ZipRecruiter ir@ziprecruiter.com

Corporate Communications: Claire

Walsh Press Relations press@ziprecruiter.com

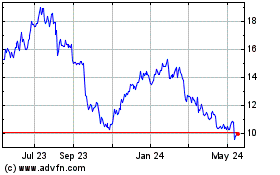

ZipRecruiter (NYSE:ZIP)

Historical Stock Chart

From Feb 2025 to Mar 2025

ZipRecruiter (NYSE:ZIP)

Historical Stock Chart

From Mar 2024 to Mar 2025