alstria office REIT-AG Agrees on the Acquisition of a German Office Real Estate Portfolio

13 December 2007 - 12:59AM

Business Wire

alstria office REIT-AG (symbol: AOX, ISIN: DE000A0LD2U1): alstria

office REIT-AG (alstria office), an internally managed Real Estate

Investment Trust (REIT) solely focused on acquiring, owning and

managing office real estate in Germany, announces the signature of

a purchase agreement with a leading German corporation for the

acquisition of a portfolio of 13 properties essentially used as

office properties. Both seller and alstria agreed not to disclose

the name of the seller. The assets will be acquired for an All-In

cost of approximately EUR 111.3 m (EUR 1,500 per sqm) and will

generate a passing rent of approximately EUR 7.7 m per annum

(average of EUR 9 per sqm per month). The closing of the

transaction is expected to occur in the course of 2008, and is

still subject to cartel office clearance. The transaction will be

financed through the existing credit facility. The properties are

located all across Germany. The total lettable area is of

approximately 74,500 sqm. The seller remains as a tenant in the

properties and will rent approximately 66 % of the space on five to

ten year leases; approximately 20.5 % is leased to third party

tenants and the remaining 13.5 % is vacant allowing additional

upside potential through active management. 'This transaction

demonstrates the ability of alstria to offer attractive terms to

German corporations willing to unlock the capital tight in their

office real estate. Exit tax benefit has again allowed both parties

to improve the economics demonstrating the unique competitive

advantage of REITs', says Olivier Elamine, CEO of alstria. 'The

acquisition of this portfolio presents a positive carry between

real estate initial yields and the marginal cost of debt

highlighting the ability of alstria to execute accretive deals'

added Alexander Dexne, CFO of alstria, 'it will have a positive

impact on our FFO and thus on our dividend for 2008.' alstria was

advised by Freshfields Bruckhaus Deringer. About the company

alstria office REIT-AG is an internally managed Real Estate

Investment Trust (REIT) solely focused on acquiring, owning and

managing office real estate in Germany. alstria was founded in

January 2006, its headquarters are based in Hamburg. alstria office

REIT-AG owns a diversified portfolio of properties across

attractive German office real estate markets. Its current portfolio

comprises 70 properties with an aggregate lettable space of

approximately 770,000 sqm and is valued at approximately Euro 1.6

billion. alstria intends to expand its portfolio significantly in

the upcoming years as part of a sustainable growth strategy based

on selective investments and active asset and portfolio management

as well as on establishing and maintaining good relationships with

its key customers and decision makers. For further information,

please visit: www.alstria.com This release constitutes neither an

offer to sell nor a solicitation of an offer to buy any securities.

The securities have already been sold. As far as this press release

contains forward-looking statements with respect to the business,

financial condition and results of operations of alstria office

REIT-AG (alstria), these statements are based on current

expectations or beliefs of alstria's management. These

forward-looking statements are subject to a number of risks and

uncertainties that could cause actual results or performance of the

Company to differ materially from those reflected in such

forward-looking statements. Apart from other factors not mentioned

here, differences could occur as a result of changes in the overall

economic situation and the competitive environment - especially in

the core business segments and markets of alstria. Also, the

development of the financial markets and changes in national as

well as international provisions particularly in the field of tax

legislation and financial reporting standards could have an effect.

Terrorist attacks and their consequences could increase the

likelihood and the extent of differences. alstria undertakes no

obligation to publicly release any revisions or updates to these

forward-looking statements to reflect events or circumstances after

the date hereof or to reflect the occurrence of unanticipated

events. Contact Dr. Charlotte Brigitte Loos Manager Public

Relations & Investor Relations Tel.: +49 - 40 - 226 341 329

Fax: +49 - 40 - 226 341 310 Email: pr@alstria.de -0- *T Language:

English Issuer: alstria office REIT-AG Fuhlentwiete 12 20355

Hamburg Deutschland Phone: +49 (0)40 226 341 300 Fax: +49 (0)40 226

341 310 E-mail: info@alstria.de Internet: www.alstria.de ISIN:

DE000A0LD2U1 WKN: A0LD2U Indices: SDAX, EPRA, German REIT Index

Listed: Regulierter Markt in Frankfurt (Prime Standard);

Freiverkehr in Berlin, Hamburg, Munchen, Stuttgart *T alstria

office REIT-AG (symbol: AOX, ISIN: DE000A0LD2U1): alstria office

REIT-AG (alstria office), an internally managed Real Estate

Investment Trust (REIT) solely focused on acquiring, owning and

managing office real estate in Germany, announces the signature of

a purchase agreement with a leading German corporation for the

acquisition of a portfolio of 13 properties essentially used as

office properties. Both seller and alstria agreed not to disclose

the name of the seller. The assets will be acquired for an All-In

cost of approximately EUR 111.3 m (EUR 1,500 per sqm) and will

generate a passing rent of approximately EUR 7.7 m per annum

(average of EUR 9 per sqm per month). The closing of the

transaction is expected to occur in the course of 2008, and is

still subject to cartel office clearance. The transaction will be

financed through the existing credit facility. The properties are

located all across Germany. The total lettable area is of

approximately 74,500 sqm. The seller remains as a tenant in the

properties and will rent approximately 66 % of the space on five to

ten year leases; approximately 20.5 % is leased to third party

tenants and the remaining 13.5 % is vacant allowing additional

upside potential through active management. 'This transaction

demonstrates the ability of alstria to offer attractive terms to

German corporations willing to unlock the capital tight in their

office real estate. Exit tax benefit has again allowed both parties

to improve the economics demonstrating the unique competitive

advantage of REITs', says Olivier Elamine, CEO of alstria. 'The

acquisition of this portfolio presents a positive carry between

real estate initial yields and the marginal cost of debt

highlighting the ability of alstria to execute accretive deals'

added Alexander Dexne, CFO of alstria, 'it will have a positive

impact on our FFO and thus on our dividend for 2008.' alstria was

advised by Freshfields Bruckhaus Deringer. About the company

alstria office REIT-AG is an internally managed Real Estate

Investment Trust (REIT) solely focused on acquiring, owning and

managing office real estate in Germany. alstria was founded in

January 2006, its headquarters are based in Hamburg. alstria office

REIT-AG owns a diversified portfolio of properties across

attractive German office real estate markets. Its current portfolio

comprises 70 properties with an aggregate lettable space of

approximately 770,000 sqm and is valued at approximately Euro 1.6

billion. alstria intends to expand its portfolio significantly in

the upcoming years as part of a sustainable growth strategy based

on selective investments and active asset and portfolio management

as well as on establishing and maintaining good relationships with

its key customers and decision makers. For further information,

please visit: www.alstria.com This release constitutes neither an

offer to sell nor a solicitation of an offer to buy any securities.

The securities have already been sold. As far as this press release

contains forward-looking statements with respect to the business,

financial condition and results of operations of alstria office

REIT-AG (alstria), these statements are based on current

expectations or beliefs of alstria's management. These

forward-looking statements are subject to a number of risks and

uncertainties that could cause actual results or performance of the

Company to differ materially from those reflected in such

forward-looking statements. Apart from other factors not mentioned

here, differences could occur as a result of changes in the overall

economic situation and the competitive environment - especially in

the core business segments and markets of alstria. Also, the

development of the financial markets and changes in national as

well as international provisions particularly in the field of tax

legislation and financial reporting standards could have an effect.

Terrorist attacks and their consequences could increase the

likelihood and the extent of differences. alstria undertakes no

obligation to publicly release any revisions or updates to these

forward-looking statements to reflect events or circumstances after

the date hereof or to reflect the occurrence of unanticipated

events. Contact Dr. Charlotte Brigitte Loos Manager Public

Relations & Investor Relations Tel.: +49 - 40 - 226 341 329

Fax: +49 - 40 - 226 341 310 Email: pr@alstria.de Language: English

Issuer: alstria office REIT-AG Fuhlentwiete 12 20355 Hamburg

Deutschland Phone: +49 (0)40 226 341 300 Fax: +49 (0)40 226 341 310

E-mail: info@alstria.de Internet: www.alstria.de ISIN: DE000A0LD2U1

WKN: A0LD2U Indices: SDAX, EPRA, German REIT Index Listed:

Regulierter Markt in Frankfurt (Prime Standard); Freiverkehr in

Berlin, Hamburg, Munchen, Stuttgart

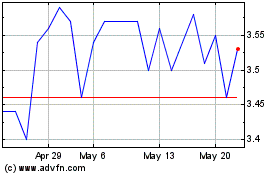

Alstria Office REIT (TG:AOX)

Historical Stock Chart

From Jan 2025 to Feb 2025

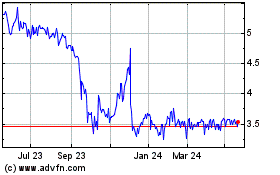

Alstria Office REIT (TG:AOX)

Historical Stock Chart

From Feb 2024 to Feb 2025