ArcelorMittal S.A.: ArcelorMittal reports third quarter 2024

results

Luxembourg, November 7,

2024 - ArcelorMittal (referred to as

“ArcelorMittal” or the “Company” or the "Group") (MT (New York,

Amsterdam, Paris, Luxembourg), MTS (Madrid)), the world’s leading

integrated steel and mining company, today announced

results1 for the three-month and nine-month periods

ended September 30, 2024.

3Q 2024 key highlights:

Safety focus: The Company-wide audit of safety

by dss+ is now complete. It has provided the Group with a clear set

of 6 recommendations which the Company is committed to implement.

LTIF2 rate of 0.88x in 3Q 2024 and 0.68x in 9M 2024

Structurally higher margins and resilient operating

results: Despite the challenging market environment, the

Company continues to demonstrate resilient performance benefiting

from regional diversification. Operating income of $0.7bn in 3Q

2024 (vs $1.0bn in 2Q 2024); EBITDA of $1.6bn in 3Q 2024 (vs.

$1.9bn in 2Q 2024) with EBITDA/t of $118/t in 3Q 2024 ($133/t in 9M

2024) and well above the Group's long-term historical

average18, reflecting structural improvements

Financial strength: Following the acquisition

of c.28.4% stake in Vallourec6 for $1.0bn and $0.3bn

share buybacks, net debt increased to $6.2bn at the end of the

quarter (gross debt of $11.3bn and cash and cash equivalents of

$5.1bn as of September 30, 2024) from $5.2bn as of June 30,

2024

Cash flow being reinvested for growth and shareholder

returns: Over the past 12 months, the Company has

generated investable cash flow7 of $2.8bn with a net

$0.6bn allocated to M&A, $1.5bn invested on strategic growth

capex projects8 and $2.0bn returns to ArcelorMittal

shareholders while maintaining a strong balance sheet

Consistent shareholder returns: The Company

will continue to return a minimum 50% of post-dividend FCF to

shareholders through its share buyback programs. The Company

repurchased 1.5% of its outstanding shares during 3Q 2024 (5.7%

during the 9M 2024) bringing the total reduction in fully diluted

share count to 37% since September 20209. To date, 73m

shares from the current 85m share buy-back program have been

repurchased

Outlook

Positive free cash flow outlook in 2024 and

beyond: FY 2024 capex is expected to be within the

previously communicated guidance range ($4.5bn-$5.0bn). The Company

expects the year to date investment in working capital to reverse

by year end, supporting the outlook for free cash flow generation.

The completion of the Company’s strategic growth projects is

expected to generate additional EBITDA and investable cash flow in

the coming periods10,16. ArcelorMittal continues to

optimize its decarbonization pathway to ensure that the Company can

remain competitive and achieve an appropriate return on

investment

Company believes current market conditions are

unsustainable: China’s excess production relative to

demand is resulting in very low domestic steel spreads (with the

majority of producers loss making) and aggressive exports; steel

prices particularly in Europe are well below the marginal cost

curve. The Company expects apparent demand in our aggregate markets

to be higher in 2H 2024 vs. 2H 2023 (reflecting no repeat of the

destock that impacted Europe ASC in 2H 2023 and YoY demand growth

in India and Brazil). As absolute inventory levels remain low,

particularly in Europe, the Company remains optimistic that

restocking activity will occur once real demand begins to

recover

Positive on medium/long term outlook: Through

its global asset portfolio, ArcelorMittal is uniquely positioned to

capture the anticipated growth in steel demand over the

medium/long-term; the Company’s strategic focus is on safety,

delivering its growth projects, and consistently returning capital

to shareholders whilst maintaining a strong balance sheet

Recently completed strategic projects are performing

well: The Group‘s portfolio of approved strategic growth

projects is estimated to increase EBITDA potential (relative to

historical normalized levels) by $1.8bn10

- Vega CMC (Brazil):

Increase galvanized and cold rolled coil capacity: 1st

continuous annealed commercial coil delivered in June 2024;

1st coated coil produced in July 2024 and

Magnelis® coil in September 2024

- India renewables:

Project combining solar and wind power (1GW) began commissioning in

June 2024, and commenced supply of power to AMNS India as of

September 2024, with the JV benefiting from green power at a lower

cost than accessing the grid

- Mexico HSM is

performing well and expected to achieve targeted profitability in

2024 ($0.3bn EBITDA), despite the disruptions caused by the illegal

blockade that impacted 2Q/3Q 2024 operations

Financial highlights (on the basis of

IFRS1):

|

(USDm) unless otherwise shown |

3Q 24 |

2Q 24 |

3Q 23 |

9M 24 |

9M 23 |

|

Sales |

15,196 |

16,249 |

16,616 |

47,727 |

53,723 |

|

Operating income |

663 |

1,046 |

1,203 |

2,781 |

4,320 |

|

Net income attributable to equity holders of the parent |

287 |

504 |

929 |

1,729 |

3,885 |

|

Adjusted net income attributable to equity holders of the

parent11 |

488 |

677 |

929 |

1,922 |

3,885 |

|

Basic earnings per common share (US$) |

0.37 |

0.63 |

1.11 |

2.18 |

4.59 |

|

Adjusted basic earnings per common share (US$)11 |

0.63 |

0.85 |

1.11 |

2.42 |

4.59 |

|

|

|

|

|

|

|

|

Operating income/tonne (US$/t) |

50 |

75 |

88 |

68 |

102 |

|

EBITDA3 |

1,581 |

1,862 |

2,150 |

5,399 |

7,288 |

|

EBITDA /tonne (US$/t) |

118 |

134 |

157 |

133 |

172 |

|

|

|

|

|

|

|

|

Crude steel production (Mt) |

14.8 |

14.7 |

15.2 |

43.9 |

44.4 |

|

Steel shipments (Mt) |

13.4 |

13.9 |

13.7 |

40.7 |

42.3 |

|

Total Group iron ore production (Mt) |

10.1 |

9.5 |

10.7 |

29.8 |

32.0 |

|

Iron ore production (Mt) (AMMC and Liberia only) |

6.6 |

5.9 |

6.7 |

19.0 |

19.8 |

|

Iron ore shipment (Mt) (AMMC and Liberia only) |

6.3 |

6.2 |

6.3 |

18.8 |

20.3 |

|

|

|

|

|

|

|

|

Weighted average common shares outstanding (in millions) |

778 |

794 |

838 |

794 |

847 |

Commenting, Aditya Mittal, ArcelorMittal

Chief Executive Officer, said:

“A key milestone during Q3 was the completion of the

comprehensive dss+ workplace safety audit. We are now working to

define the implementation plan for the six recommendations in an

accelerated manner and will provide updates on the progress.

"Economic sentiment remains subdued, but we have delivered a

resilient financial performance, reinforcing the structural

strength of the Group. Apparent demand is expected to be stronger

in the second half of this year compared with 2023, and inventory

levels are low, indicating that re-stocking will occur when real

demand recovers. The increased level of imports into Europe is a

concern and stronger trade measures are urgently required to

address this. Similarly, the CBAM needs further strengthening to

ensure it fulfills its aim of ensuring European steelmakers can

remain competitive versus higher-emissions imports.

“Our free cash flow generation enables us to continue to invest

in the business for strategic growth and return capital to

shareholders. Our first renewables project is now operating and

started supplying power to AMNS India in September. The Vega CMC

project is also fully up and running and produced its first

Magnelis® coil in September.

“Globally, the medium to long-term outlook for steel is

positive, and we are confident that ArcelorMittal will continue to

harness its unique geographic presence and strong research and

development capability to meet our stakeholders needs and produce

smarter steels for people and planet.”

Safety and sustainable development

Health and Safety focus:

Protecting employee health and safety remains the overarching

priority of the Company. LTIF rate of 0.88x in 3Q 2024 (vs. 0.57x

in 2Q 2024 and 0.94x in 3Q 2023).

The Company-wide independent safety audit by dss+ is complete.

It is a comprehensive independent safety audit, providing

ArcelorMittal with a clear set of recommendations which the Company

is committed to implement. See website for more details: dss+

safety audit recommendations

The Company is now defining the most effective ways to implement

these recommendations in an accelerated manner. The first phase

includes taking these recommendations to build customized, business

unit- specific work plans, to be incorporated into their five-year

planning cycle.

Own personnel and contractors – Lost

Time Injury Frequency rate

|

|

3Q 24 |

2Q 24 |

3Q 23 |

9M 24 |

9M 23 |

|

North America |

0.43 |

0.31 |

0.09 |

0.26 |

0.15 |

|

Brazil |

0.33 |

0.15 |

0.22 |

0.20 |

0.28 |

|

Europe |

1.47 |

1.06 |

1.50 |

1.25 |

1.42 |

|

Sustainable Solutions |

1.23 |

1.09 |

0.65 |

1.06 |

0.85 |

|

Mining |

0.14 |

0.15 |

0.19 |

0.15 |

0.14 |

|

Others |

1.20 |

0.47 |

1.45 |

0.80 |

0.92 |

|

Total |

0.88 |

0.57 |

0.94 |

0.68 |

0.78 |

Sustainable development

highlights12:

- ArcelorMittal is progressing the

engineering of its decarbonization projects globally to ensure that

it delivers economic decarbonization. Whilst engineering is

ongoing, the Company is engaging with the European Commission and

member states on the measures required to support a low carbon

competitive steel sector in Europe including more robust trade

defences and an effective carbon border adjustment mechanism.

- ArcelorMittal continues to build its

portfolio of renewable energy projects to secure and decarbonize

its future electricity needs. In August 2024, ArcelorMittal Brasil

signed contracts for the development of two solar energy projects

with a combined capacity of 465MW, equivalent to 14% of its current

electricity requirements in Brazil. ArcelorMittal will partner

through JVs with two different renewable companies; Casa dos Ventos

and Atlas Renewable Energy for the projects. This builds on the

554MW capacity wind power project in Brazil that is set to be

commissioned in 2025. The total 1GW Brazil renewable projects are

estimated to add ~$0.1 billion EBITDA benefit to ArcelorMittal.

Group renewable portfolio is now 2.1GW (including India and

investments in Brazil and Argentina17).

Analysis of results for 3Q 2024 versus 2Q

2024

Sales in 3Q 2024 declined by 6.5% to $15.2 billion as compared

to $16.2 billion in 2Q 2024.

Operating income of $0.7 billion in 3Q 2024 was 36.6% lower as

compared 2Q 2024 largely reflecting lower steel prices (-3.7%),

seasonally lower steel shipments (-3.6%), impairments of $36

million related to the closure of the coke oven battery in Krakow

(Poland) and exceptional items of $74 million due to restructuring

costs at the same site.

EBITDA in 3Q 2024 decreased by 15.1% to $1,581 million as

compared to $1,862 million in 2Q 2024, primarily due to weaker

results in North America (negative price-cost effect) and Europe

(seasonally lower steel shipments) offset in part by an improvement

in the Brazil segment primarily due to higher volumes and lower

costs.

Net interest cost of $8 million in 3Q 2024 is broadly stable as

compared to $7 million in 2Q 2024 and continues to benefit from the

capitalization of the interest cost related to certain long term

capex investments.

ArcelorMittal recorded net income in 3Q 2024 of $287 million,

lower as compared to $504 million in 2Q 2024. ArcelorMittal

recorded an adjusted net income11 (i.e., excluding the

impairments and exceptional items discussed above as well as

mark-to-market loss on purchase of Vallourec shares6) in

3Q 2024 of $488 million as compared to $677 million in 2Q 2024.

ArcelorMittal's basic earnings per common share for 3Q 2024 was

$0.37 (adjusted earnings per common share of $0.63) as compared to

$0.63 in 2Q 2024 (adjusted earnings per common share of $0.85).

Net cash provided by operating activities during 3Q 2024

amounted to $1.4 billion, and includes a $0.1 billion release of

working capital. Capex for the quarter amounted to $1.1 billion

(including $0.3 billion spent on strategic growth projects),

leading to a free cashflow of $0.3 billion. Cash outflows for the

purchase of the c.28.4% stake in Vallourec for $1.0 billion and

ongoing share buybacks ($0.3 billion), led to an increase in net

debt to $6.2 billion on September 30, 2024, as compared to $5.2

billion on June 30, 2024.

Analysis of

operations3

North America

|

(USDm) unless otherwise shown |

3Q 24 |

2Q 24 |

3Q 23 |

9M 24 |

9M 23 |

|

Sales |

2,762 |

3,162 |

3,188 |

9,271 |

10,036 |

|

Operating income |

229 |

338 |

520 |

1,152 |

1,637 |

|

Depreciation |

(129) |

(129) |

(125) |

(378) |

(378) |

|

EBITDA |

358 |

467 |

645 |

1,530 |

2,015 |

|

Crude steel production (Kt) |

1,652 |

1,823 |

2,122 |

5,655 |

6,542 |

|

- Flat shipments (Kt) |

1,960 |

1,865 |

1,938 |

6,070 |

6,192 |

|

- Long shipments (Kt) |

540 |

719 |

667 |

1,925 |

2,025 |

|

Steel shipments* (Kt) |

2,408 |

2,468 |

2,527 |

7,672 |

7,974 |

|

Average steel selling price (US$/t) |

955 |

1,040 |

1,043 |

1,014 |

1,049 |

* North America steel shipments include slabs

sourced by the segment from Group companies (mainly the Brazil

segment) and sold to the Calvert JV (eliminated in the Group

consolidation). These shipments can vary between periods due to

slab sourcing mix and timing of vessels: 3Q'24 577kt; 2Q'24 476kt;

3Q'23 393kt, 9M'24 1,534kt and 9M'23 1,227kt.

Sales in 3Q 2024 decreased by 12.7% to $2.8

billion, as compared to $3.2 billion in 2Q 2024 primarily on

account of 8.3% decrease in average steel selling prices and 2.4%

decrease in steel shipments.

As previously communicated on July 19, 2024,

ArcelorMittal Mexico announced that it had reached a settlement

with unions with an agreement to end an illegal blockade at the

site. The electric arc furnace EAF (for slab production) and hot

strip mill resumed normal operations in August 2024. As a result,

3Q 2024 performance was impacted by ~0.4Mt production and EBITDA by

$0.1 billion (same impacts as 2Q 2024).

Operating income in 3Q 2024 decreased by 32.2%

to $229 million as compared to $338 million in 2Q 2024, primarily

due to a negative price-cost impact.

EBITDA in 3Q 2024 of $358 million was 23.5%

lower as compared to $467 million in 2Q 2024.

Brazil13

|

(USDm) unless otherwise shown |

3Q 24 |

2Q 24 |

3Q 23 |

9M 24 |

9M 23 |

|

Sales |

3,218 |

3,243 |

3,560 |

9,512 |

10,454 |

|

Operating income |

414 |

325 |

414 |

1,041 |

1,290 |

|

Depreciation |

(83) |

(88) |

(87) |

(265) |

(264) |

|

EBITDA |

497 |

413 |

501 |

1,306 |

1,554 |

|

Crude steel production (Kt) |

3,842 |

3,607 |

3,669 |

11,013 |

10,453 |

|

- Flat shipments (Kt) |

2,464 |

2,441 |

2,328 |

7,042 |

6,431 |

|

- Long shipments (Kt) |

1,335 |

1,215 |

1,283 |

3,611 |

3,734 |

|

Steel shipments (Kt) |

3,787 |

3,637 |

3,599 |

10,604 |

10,119 |

|

Average steel selling price (US$/t) |

787 |

826 |

932 |

830 |

970 |

Sales in 3Q 2024 remained broadly stable at $3.2 billion as

compared to 2Q 2024, primarily due to a 4.1% increase in steel

shipments largely offsetting a 4.7% decline in average steel

selling prices.

Operating income in 3Q 2024 of $414 million was 27.3% higher as

compared to $325 million in 2Q 2024, due to higher shipments and a

positive price-cost effect (lower costs more than offsetting lower

selling prices).

EBITDA in 3Q 2024 increased by 20.3% to $497 million as compared

to $413 million in 2Q 2024.

Europe

|

(USDm) unless otherwise shown |

3Q 24 |

2Q 24 |

3Q 23 |

9M 24 |

9M 23 |

|

Sales |

7,141 |

7,822 |

7,302 |

22,810 |

25,068 |

|

Operating income |

12 |

194 |

139 |

275 |

883 |

|

Depreciation |

(281) |

(268) |

(278) |

(823) |

(811) |

|

Impairment items |

(36) |

— |

— |

(36) |

— |

|

Exceptional items |

(74) |

— |

— |

(74) |

— |

|

EBITDA |

403 |

462 |

417 |

1,208 |

1,694 |

|

Crude steel production (Kt) |

7,870 |

8,041 |

7,398 |

23,515 |

21,906 |

|

- Flat shipments (Kt) |

4,897 |

5,206 |

4,483 |

15,405 |

15,000 |

|

- Long shipments (Kt) |

1,907 |

2,204 |

1,945 |

6,050 |

6,161 |

|

Steel shipments (Kt) |

6,803 |

7,407 |

6,425 |

21,446 |

21,152 |

|

Average steel selling price (US$/t) |

915 |

929 |

980 |

930 |

1,012 |

Sales in 3Q 2024 declined by 8.7% to $7.1 billion, as compared

to $7.8 billion in 2Q 2024, primarily due to a 8.2% decline in

steel shipment volumes due to seasonality and maintenance in the

long products and a 1.5% decline in average steel selling

prices.

Operating income in 3Q 2024 was $12 million as compared to $194

million in 2Q 2024 primarily due to seasonally lower steel

shipments, impairments of $36 million related to the closure of the

coke oven battery in Krakow (Poland) and exceptional items of $74

million due to restructuring costs at the same site.

EBITDA in 3Q 2024 of $403 million decreased by 12.7% as compared

to $462 million in 2Q 2024 primarily due to seasonally lower steel

shipments.

India and JVs

Income from associates, joint ventures and other

investments (excluding impairments and exceptional items, of which

none in the periods) for 3Q 2024 was $162 million as compared to

$181 million in 2Q 2024, primarily due to lower contributions from

AMNS India.

ArcelorMittal has investments in various joint

venture and associate entities globally. The Company considers

Calvert (50% equity interest) and AMNS India (60% equity interest)

joint ventures to be of particular strategic importance, warranting

more detailed disclosures to improve the understanding of their

operational performance and value to the Company.

AMNS India

|

(USDm) unless otherwise shown |

3Q 24 |

2Q 24 |

3Q 23 |

9M 24 |

9M 23 |

|

Production (Kt) (100% basis) |

1,743 |

1,867 |

1,942 |

5,594 |

5,500 |

|

Shipments (Kt) (100% basis) |

1,887 |

1,892 |

1,874 |

5,795 |

5,383 |

|

Sales (100% basis) |

1,537 |

1,580 |

1,680 |

4,932 |

4,998 |

|

EBITDA (100% basis) |

162 |

237 |

533 |

711 |

1,437 |

Sales in 3Q 2024 declined by 2.8% to $1.5

billion as compared to $1.6 billion in 2Q 2024, primarily due to

lower average steel selling prices.

EBITDA during 3Q 2024 declined by 31.3% to $162

million as compared to $237 million in 2Q 2024, driven by a

negative price-cost effect.

Calvert14

|

(USDm) unless otherwise shown |

3Q 24 |

2Q 24 |

3Q 23 |

9M 24 |

9M 23 |

|

Production (Kt) (100% basis) |

1,094 |

1,202 |

1,178 |

3,512 |

3,602 |

|

Shipments (Kt) (100% basis) |

1,015 |

1,145 |

1,063 |

3,291 |

3,390 |

|

Sales (100% basis) |

1,054 |

1,244 |

1,195 |

3,534 |

3,746 |

|

EBITDA (100% basis) |

126 |

166 |

105 |

480 |

284 |

Sales in 3Q 2024 declined by 15.3% to $1.1 billion as compared

to $1.2 billion in 2Q 2024 primarily due to lower shipments driven

by weaker demand.

EBITDA during 3Q 2024 of $126 million was 24.2% lower as

compared to $166 million in 2Q 2024, primarily due to lower steel

shipments and a negative price-cost effect.

Sustainable

Solutions15

|

(USDm) unless otherwise shown |

3Q 24 |

2Q 24 |

3Q 23 |

9M 24 |

9M 23 |

|

Sales |

2,542 |

2,891 |

2,680 |

8,322 |

9,010 |

|

Operating income |

17 |

55 |

21 |

98 |

210 |

|

Depreciation |

(38) |

(40) |

(35) |

(122) |

(105) |

|

EBITDA |

55 |

95 |

56 |

220 |

315 |

Sales in 3Q 2024 declined by 12.1% to $2.5 billion as compared

to $2.9 billion in 2Q 2024.

Operating income in 3Q 2024 was lower at $17 million as compared

to $55 million in 2Q 2024, mainly in the Projects business,

impacted by seasonality.

EBITDA in 3Q 2024 of $55 million was 42.1% lower as compared to

$95 million in 2Q 2024.

Mining

|

(USDm) unless otherwise shown |

3Q 24 |

2Q 24 |

3Q 23 |

9M 24 |

9M 23 |

|

Sales |

589 |

641 |

729 |

1,959 |

2,313 |

|

Operating income |

128 |

150 |

275 |

524 |

874 |

|

Depreciation |

(65) |

(66) |

(57) |

(196) |

(169) |

|

EBITDA |

193 |

216 |

332 |

720 |

1,043 |

|

Iron ore production (Mt) |

6.6 |

5.9 |

6.7 |

19.0 |

19.8 |

|

Iron ore shipment (Mt) |

6.3 |

6.2 |

6.3 |

18.8 |

20.3 |

Note: Mining segment comprises iron ore operations of

ArcelorMittal Mines Canada (AMMC) and ArcelorMittal Liberia.

Sales in 3Q 2024 declined by 8.0% to $589 million as compared to

$641 million in 2Q 2024 primarily due to lower iron ore reference

prices (-10.8%).

Iron ore production in 3Q 2024 increased by 13.1% to 6.6Mt as

compared to 5.9Mt in 2Q 2024 primarily due to a recovery in

ArcelorMittal Mines Canada which had been impacted by wildfires in

the Port Cartier region in June leading to Port disruption, as well

as maintenance.

Operating income in 3Q 2024 declined by 14.6% to $128 million as

compared to $150 million in 2Q 2024 driven by lower iron ore

reference prices offset in part by lower costs as production

volumes recovered.

EBITDA in 3Q 2024 of $193 million was 11.0% lower as compared to

$216 million in 2Q 2024.

Other recent developments

On October 11, 2024, ArcelorMittal announced that it had entered

into a definitive Equity Purchase Agreement (the “Agreement”) with

Nippon Steel Corporation (“NSC”) pursuant to which ArcelorMittal

will purchase NSC’s 50% equity interest in the AM/NS Calvert Joint

Venture (the “Transaction”). The Transaction has been entered into

at the request of NSC to address regulatory concerns pursuant to

its agreed acquisition of US Steel. The Transaction is subject to

NSC completing its pending acquisition of US Steel, which is

subject to various other regulatory requirements.

Under the terms of the agreement, ArcelorMittal will pay $1

consideration for the Transaction; further, NSC will inject cash

and forgive partner loans in an amount estimated to be

approximately $0.9 billion.

There are no assurances or guarantees that NSC will complete its

acquisition of US Steel. Should NSC not complete its acquisition of

US Steel, then the Agreement will not come into effect and the

AM/NS Calvert JV will continue.

ArcelorMittal Condensed Consolidated Statements of

Financial Position1

|

In millions of U.S. dollars |

Sept 30, 2024 |

Jun 30, 2024 |

Dec 31, 2023 |

|

ASSETS |

|

|

|

|

Cash and cash equivalents |

5,094 |

5,903 |

7,783 |

|

Trade accounts receivable and other |

4,238 |

4,186 |

3,661 |

|

Inventories |

18,474 |

17,690 |

18,759 |

|

Prepaid expenses and other current assets |

3,255 |

3,229 |

3,037 |

|

Total Current Assets |

31,061 |

31,008 |

33,240 |

|

|

|

|

|

|

Goodwill and intangible assets |

4,762 |

4,947 |

5,102 |

|

Property, plant and equipment |

34,535 |

33,142 |

33,656 |

|

Investments in associates and joint ventures6 |

11,304 |

10,168 |

10,078 |

|

Deferred tax assets |

9,525 |

9,563 |

9,469 |

|

Other assets |

1,981 |

2,019 |

2,372 |

|

Total Assets |

93,168 |

90,847 |

93,917 |

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

Short-term debt and current portion of long-term debt |

2,356 |

2,357 |

2,312 |

|

Trade accounts payable and other |

13,164 |

12,493 |

13,605 |

|

Accrued expenses and other current liabilities |

5,761 |

5,456 |

5,852 |

|

Total Current Liabilities |

21,281 |

20,306 |

21,769 |

|

|

|

|

|

|

Long-term debt, net of current portion |

8,903 |

8,770 |

8,369 |

|

Deferred tax liabilities |

2,318 |

2,270 |

2,432 |

|

Other long-term liabilities |

5,302 |

5,202 |

5,279 |

|

Total Liabilities |

37,804 |

36,548 |

37,849 |

|

|

|

|

|

|

Equity attributable to the equity holders of the parent |

53,308 |

52,204 |

53,961 |

|

Non-controlling interests |

2,056 |

2,095 |

2,107 |

|

Total Equity |

55,364 |

54,299 |

56,068 |

|

Total Liabilities and Shareholders’ Equity |

93,168 |

90,847 |

93,917 |

ArcelorMittal Condensed Consolidated Statements of

Operations1

|

|

Three months ended |

Nine months ended |

|

In millions of U.S. dollars unless otherwise

shown |

Sept 30, 2024 |

Jun 30, 2024 |

Sept 30, 2023 |

Sept 30, 2024 |

Sept 30, 2023 |

|

Sales |

15,196 |

16,249 |

16,616 |

47,727 |

53,723 |

|

Depreciation (B) |

(646) |

(635) |

(662) |

(1,923) |

(1,972) |

|

Impairment items4 (B) |

(36) |

— |

— |

(36) |

— |

|

Exceptional items5 (B) |

(74) |

— |

— |

(74) |

— |

|

Operating income (A) |

663 |

1,046 |

1,203 |

2,781 |

4,320 |

|

Operating margin % |

4.4 % |

6.4 % |

7.2 % |

5.8 % |

8.0 % |

|

|

|

|

|

|

|

|

Income from associates, joint ventures and other investments

(excluding impairments and exceptional items) (C) |

162 |

181 |

285 |

585 |

996 |

|

Net interest expense |

(8) |

(7) |

(31) |

(78) |

(142) |

|

Foreign exchange and other net financing loss |

(112) |

(260) |

(224) |

(633) |

(474) |

|

Non-cash mark-to-market loss until acquisition of c.28.4% Vallourec

shares6 |

(91) |

(173) |

— |

(83) |

— |

|

Income before taxes and non-controlling

interests |

614 |

787 |

1,233 |

2,572 |

4,700 |

|

Current tax expense |

(164) |

(179) |

(282) |

(664) |

(880) |

|

Deferred tax (expense)/benefit |

(151) |

(96) |

10 |

(123) |

188 |

|

Income tax expense (net) |

(315) |

(275) |

(272) |

(787) |

(692) |

|

Income including non-controlling interests |

299 |

512 |

961 |

1,785 |

4,008 |

|

Non-controlling interests income |

(12) |

(8) |

(32) |

(56) |

(123) |

|

Net income attributable to equity holders of the

parent |

287 |

504 |

929 |

1,729 |

3,885 |

|

|

|

|

|

|

|

|

Basic earnings per common share ($) |

0.37 |

0.63 |

1.11 |

2.18 |

4.59 |

|

Diluted earnings per common share ($) |

0.37 |

0.63 |

1.10 |

2.17 |

4.57 |

|

|

|

|

|

|

|

|

Weighted average common shares outstanding (in millions) |

778 |

794 |

838 |

794 |

847 |

|

Diluted weighted average common shares outstanding (in

millions) |

781 |

797 |

841 |

796 |

850 |

|

|

|

|

|

|

|

|

OTHER INFORMATION |

|

|

|

|

|

|

EBITDA (A-B+C) |

1,581 |

1,862 |

2,150 |

5,399 |

7,288 |

|

EBITDA Margin % |

10.4 % |

11.5 % |

12.9 % |

11.3 % |

13.6 % |

|

|

|

|

|

|

|

|

Total Group iron ore production (Mt) |

10.1 |

9.5 |

10.7 |

29.8 |

32.0 |

|

Crude steel production (Mt) |

14.8 |

14.7 |

15.2 |

43.9 |

44.4 |

|

Steel shipments (Mt) |

13.4 |

13.9 |

13.7 |

40.7 |

42.3 |

ArcelorMittal Condensed Consolidated Statements of Cash

flows1

|

|

Three months ended |

Nine months ended |

|

In millions of U.S. dollars |

Sept 30, 2024 |

Jun 30, 2024 |

Sept 30, 2023 |

Sept 30, 2024 |

Sept 30, 2023 |

|

Operating activities: |

|

|

|

|

|

|

Income attributable to equity holders of the

parent |

287 |

504 |

929 |

1,729 |

3,885 |

|

Adjustments to reconcile net income to net cash provided by

operations: |

|

|

|

|

|

|

Non-controlling interests income |

12 |

8 |

32 |

56 |

123 |

|

Depreciation and impairments4 |

682 |

635 |

662 |

1,959 |

1,972 |

|

Exceptional items5 |

74 |

— |

— |

74 |

— |

|

Income from associates, joint ventures and other investments |

(162) |

(181) |

(285) |

(585) |

(996) |

|

Deferred tax expenses/(benefit) |

151 |

96 |

(10) |

123 |

(188) |

|

Change in working capital |

132 |

84 |

(269) |

(1,503) |

(866) |

|

Other operating activities (net) |

235 |

(73) |

222 |

531 |

387 |

|

Net cash provided by operating activities (A) |

1,411 |

1,073 |

1,281 |

2,384 |

4,317 |

|

Investing activities: |

|

|

|

|

|

|

Purchase of property, plant and equipment and intangibles (B) |

(1,051) |

(985) |

(1,165) |

(3,272) |

(3,163) |

|

Other investing activities (net)6 |

(814) |

(57) |

187 |

(597) |

(1,699) |

|

Net cash used in investing activities |

(1,865) |

(1,042) |

(978) |

(3,869) |

(4,862) |

|

Financing activities: |

|

|

|

|

|

|

Net (payments) proceeds relating to payable to banks and long-term

debt |

(109) |

1,007 |

262 |

564 |

(1,139) |

|

Dividends paid to ArcelorMittal shareholders |

— |

(200) |

— |

(200) |

(185) |

|

Dividends paid to minorities shareholders (C) |

(85) |

(7) |

(66) |

(169) |

(131) |

|

Share buyback |

(277) |

(293) |

(38) |

(1,167) |

(742) |

|

Lease payments and other financing activities (net) |

(62) |

7 |

(56) |

(107) |

(540) |

|

Net cash (used) provided by financing

activities |

(533) |

514 |

102 |

(1,079) |

(2,737) |

|

Net (decrease)/increase in cash and cash equivalents |

(987) |

545 |

405 |

(2,564) |

(3,282) |

|

Effect of exchange rate changes on cash |

147 |

(81) |

(85) |

(124) |

127 |

|

Change in cash and cash equivalents |

(840) |

464 |

320 |

(2,688) |

(3,155) |

|

|

|

|

|

|

|

|

Free cash flow (A+B+C) |

275 |

81 |

50 |

(1,057) |

1,023 |

Appendix 1: Capital

expenditures1

|

(USD million) |

3Q 24 |

2Q 24 |

3Q 23 |

9M 24 |

9M 23 |

|

North America |

50 |

100 |

72 |

261 |

309 |

|

Brazil |

213 |

211 |

243 |

627 |

625 |

|

Europe |

374 |

275 |

367 |

1,092 |

1,000 |

|

Sustainable Solutions |

75 |

80 |

150 |

315 |

289 |

|

Mining |

268 |

262 |

207 |

765 |

579 |

|

Others |

71 |

57 |

126 |

212 |

361 |

|

Total |

1,051 |

985 |

1,165 |

3,272 |

3,163 |

Appendix 2: Debt repayment schedule as of September 30,

2024

|

(USD billion) |

2024 |

2025 |

2026 |

2027 |

≥2028 |

Total |

| Bonds |

— |

1.0 |

1.1 |

1.2 |

3.7 |

7.0 |

|

Commercial paper |

1.2 |

— |

— |

— |

— |

1.2 |

|

Other loans |

0.3 |

0.8 |

0.3 |

0.8 |

0.9 |

3.1 |

|

Total gross debt |

1.5 |

1.8 |

1.4 |

2.0 |

4.6 |

11.3 |

As of September 30, 2024, the average debt maturity is 6.7

years.

Appendix 3: Reconciliation of gross debt to net

debt

|

(USD million) |

Sept 30, 2024 |

Jun 30, 2024 |

Dec 31, 2023 |

|

Gross debt |

11,259 |

11,127 |

10,681 |

|

Less: Cash and cash equivalents |

(5,094) |

(5,903) |

(7,783) |

|

Net debt |

6,165 |

5,224 |

2,898 |

|

|

|

|

|

|

Net debt / LTM EBITDA |

0.9 |

0.7 |

0.3 |

Appendix 4: Adjusted net income and adjusted basic

EPS

|

(USD million) |

3Q 24 |

2Q 24 |

3Q 23 |

9M 24 |

9M 23 |

|

Net income attributable to equity holders of the

parent |

287 |

504 |

929 |

1,729 |

3,885 |

|

Impairment items4 |

(36) |

— |

— |

(36) |

— |

|

Exceptional items5 |

(74) |

— |

— |

(74) |

— |

|

Mark-to-market loss on purchase of c.28.4% stake in

Vallourec6 |

(91) |

(173) |

— |

(83) |

— |

|

Adjusted net income attributable to equity holders of the

parent |

488 |

677 |

929 |

1,922 |

3,885 |

|

|

|

|

|

|

|

|

Weighted average common shares outstanding (in millions) |

778 |

794 |

838 |

794 |

847 |

|

Adjusted basic EPS $/share |

0.63 |

0.85 |

1.11 |

2.42 |

4.59 |

Appendix 5: Terms and

definitions

Unless indicated otherwise, or the context otherwise requires,

references in this earnings release to the following terms have the

meanings set out next to them below:

Adjusted basic EPS: refers to adjusted net

income divided by the weighted average common shares

outstanding.

Adjusted net income: refers to reported net income

less impairment items and exceptional items and mark-to-market loss

on purchase of c.28.4% shares in Vallourec

Apparent steel consumption: calculated as the sum

of production plus imports minus exports.

Average steel selling prices: calculated as steel

sales divided by steel shipments.

Cash and cash equivalents: represents cash and

cash equivalents, restricted cash and short-term investments.

Capex: represents the purchase of property, plant

and equipment and intangibles. The Group’s capex figures do not

include capex at the JVs level (i.e.: AMNS India and Calvert).

Crude steel production: steel in the first solid

state after melting, suitable for further processing or for

sale.

Depreciation: refers to amortization and

depreciation.

EPS: refers to basic or diluted earnings per

share.

EBITDA: defined as operating result plus

depreciation, impairment items and exceptional items and result

from associates, joint ventures and other investments (excluding

impairments and exceptional items if any).

EBITDA/tonne: calculated as EBITDA divided by

total steel shipments.

Exceptional items: income / (charges) relate to

transactions that are significant, infrequent or unusual and are

not representative of the normal course of business of the

period.

Free cash flow (FCF): refers to net cash provided

by operating activities less capex less dividends paid to minority

shareholders.

Foreign exchange and other net financing

income(loss): include foreign currency exchange impact,

bank fees, interest on pensions, impairment of financial assets,

revaluation of derivative instruments and other charges that cannot

be directly linked to operating results.

Gross debt: long-term debt and short-term

debt.

Impairment items: refers to impairment charges net

of reversals.

Income from associates, joint ventures and other

investments: refers to income from associates, joint

ventures and other investments (excluding impairments and

exceptional items if any).

Investable cash flow: refers to net cash provided

by operating activities less maintenance/normative capex.

Iron ore reference prices: refers to iron ore

prices for 62% Fe CFR China. Pricing is generally linked to market

price indexes and uses a variety of mechanisms, including current

spot prices and average prices over specified periods. Therefore,

there may not be a direct correlation between market reference

prices and actual selling prices in various regions at a given

time.

Kt: refers to thousand metric tonnes.

Liquidity: cash and cash equivalents plus

available credit lines excluding back-up lines for the commercial

paper program.

LTIF: refers to lost time injury frequency rate

equals lost time injuries per 1,000,000 worked hours, based on own

personnel and contractors.

Maintenance/normative capex: refers to recurring

expenditures required for a company to continue operating and

sustain its growth.

Mt: refers to million metric tonnes.

Net debt: long-term debt and short-term debt less

cash and cash equivalents.

Net debt/LTM EBITDA: refers to Net debt divided by

EBITDA for the last twelve months.

Net interest expense: includes interest expense

less interest income.

On-going projects: refer to projects for which

construction has begun (excluding various projects that are under

development), even if such projects have been placed on hold

pending improved operating conditions.

Operating results: refers to operating

income(loss).

Operating segments: North America segment includes

the Flat, Long and Tubular operations of Canada and Mexico; and

also includes all Mexico mines. The Brazil segment includes the

Flat, Long and Tubular operations of Brazil and its neighboring

countries including Argentina, Costa Rica, Venezuela; and also

includes Andrade and Serra Azul captive iron ore mines. The Europe

segment includes the Flat, Long and includes Bosnia and Herzegovina

captive iron ore mines; Sustainable Solutions division includes

Downstream Solutions and Tubular operations of the European

business. The Others segment includes the Flat, Long and Tubular

operations of Kazakhstan (till December 7, 2023), Ukraine and South

Africa; and also includes the captive iron ore mines in Ukraine and

iron ore and coal mines in Kazakhstan (till December 7, 2023).

Mining segment includes iron ore operations of ArcelorMittal Mines

Canada and ArcelorMittal Liberia.

Own iron ore production: includes total of all

finished production of fines, concentrate, pellets and lumps and

includes share of production.

Price-cost effect: a lack of correlation or a lag

in the corollary relationship between raw material and steel

prices, which can either have a positive (i.e. increased spread

between steel prices and raw material costs) or negative effect

(i.e. a squeeze or decreased spread between steel prices and raw

material costs).

Shipments: information at segment and Group level

eliminates intra-segment shipments (which are primarily between

Flat/Long plants and Tubular plants) and inter-segment shipments

respectively. Shipments of Downstream Solutions are excluded.

Working capital change (working capital investment /

release): Movement of change in working capital - trade

accounts receivable plus inventories less trade and other accounts

payable.

Footnotes

- The financial information in this

press release has been prepared consistently with International

Financial Reporting Standards (“IFRS”) as issued by the

International Accounting Standards Board (“IASB”) and as adopted by

the European Union. The interim financial information included in

this announcement has also been prepared in accordance with IFRS

applicable to interim periods, however this announcement does not

contain sufficient information to constitute an interim financial

report as defined in International Accounting Standard 34, “Interim

Financial Reporting”. The numbers in this press release have not

been audited. The financial information and certain other

information presented in a number of tables in this press release

have been rounded to the nearest whole number or the nearest

decimal. Therefore, the sum of the numbers in a column may not

conform exactly to the total figure given for that column. In

addition, certain percentages presented in the tables in this press

release reflect calculations based upon the underlying information

prior to rounding and, accordingly, may not conform exactly to the

percentages that would be derived if the relevant calculations were

based upon the rounded numbers. Segment information presented in

this press release is prior to inter-segment eliminations and

certain adjustments made to operating results of the segments to

reflect corporate costs, income from non-steel operations (e.g.

logistics and shipping services) and the elimination of stock

margins between the segments.

- LTIF refers to lost time injury frequency rate equals lost time

injuries per 1,000,000 worked hours, based on own personnel and

contractors.

- As announced with ArcelorMittal’s fourth quarter 2023 financial

results, the Company has amended its presentation of reportable

segments and EBITDA. The changes, applied as from January 1, 2024,

are as follows: EBITDA is defined as operating result plus

depreciation, impairment items and exceptional items and result

from associates, joint ventures and other investments (excluding

impairments and exceptional items if any); The NAFTA segment has

been renamed "North America", a core growth region for the Company;

A new ‘Sustainable Solutions’ segment is composed of a number of

high-growth, niche, capital light businesses, playing an important

role in supporting climate action (including renewables, special

projects and construction business). Previously reported within the

Europe segment, this is a growth vector of the Company and

represents businesses employing over 12,000 people at more than 260

commercial and production sites across 60+ countries. Following the

sale of the Company’s operations in Kazakhstan, the remaining parts

of the former ‘ACIS’ segment have been assigned to ‘Others’; there

are no changes to the ‘Brazil’ and ‘Mining’ segments. ‘India and

JVs’ is now presented and the share of net income of AMNS India and

AMNS Calvert as well as the other associates, joint ventures and

other investments is included in EBITDA. India is a high growth

vector of the Company, with our assets well-positioned to grow with

the domestic market. These changes have been applied as from

January 1, 2024, and the comparative periods of 2023 shown herein

have been retrospectively recast.

- Impairment charges (included in operating income) for 3Q 2024

of $36 million related to the closure of the coke oven battery in

Krakow (Poland).

- Exceptional items (included in operating income) for 3Q 2024 of

$74 million related to restructuring costs in Krakow (Poland).

- On August 6, 2024, ArcelorMittal announced that following the

signature of a Share Purchase Agreement on March 12, 2024, and

after the approval of relevant antitrust authorities and clearances

under foreign investment regulations, it had completed the

acquisition of 65,243,206 shares, representing c.28.4% equity

interest in Vallourec, for €14.64 per share from funds managed by

Apollo Global Management Inc., for a total consideration of

approximately €955 million. Vallourec share price increased to

€17.20 as of March 31, 2024, as compared to €14.64 contractually

agreed at the signing of the share price agreement for 65.2 million

shares on March 12, 2024 generating a non-cash mark-to-market gain

of $181 million as of March 31, 2024. The Vallourec share price

decreased to €14.76 as of June 30, 2024 (causing a non-cash

mark-to-market loss of $173 million in 2Q 2024), and decreased to

€13.47 as at the date of the finalization of the acquisition on

August 6, 2024 (causing a non-cash mark-to-market loss of $91

million in 3Q 2024). In accordance with IFRS, the Company

recognized this net loss as a decrease in the investment cost to

reflect the fair value of the forward at acquisition date.

- Investable cash flow is defined as net cash provided by

operating activities less maintenance/normative capex. From

September 30, 2023 to September 30, 2024, the net cash provided by

operating activities totalled $5.7 billion. Total capex during this

period was $4.7 billion of which maintenance/normative capex was

$2.9 billion, strategic capex of $1.5 billion and decarbonization

of $0.3 billion.

- 3Q 2024 included decarbonization

capex of $0.1 billion, strategic growth capex of $0.3 billion and

maintenance/normative capex of $0.7 billion. 9M 2024 includes

decarbonization capex of $0.2 billion, strategic growth capex of

$1.0 billion and maintenance/normative capex of $2.1 billion.

Strategic projects capex in 3Q 2024 primarily include investments

for the Liberia expansion project (first concentrate), Mardyck

electrical steels, Barra Mansa and Serra Azul. Strategic projects

capex in 9M 2024 primarily included investments for the Liberia

expansion project (first concentrate), the renewables energy

project in India and Mardyck electrical steels.

- September 2020 was the inception

date of the ongoing share buyback programs. The Company has

repurchased 47 million shares during 9M 2024; totalling 73 million

shares from the current 85 million share buyback program.

- Following the completion of detailed

engineering, the Monlevade expansion project in Brazil has been put

“on hold” (seeking lower capex intensive options). The Company

anticipates approving projects of a similar scale (capex and EBITDA

impact) during its forthcoming strategic planning cycle, hence no

change to the expected $1.8 billion impact on EBITDA from strategic

growth investments. Out of the total $1.8 billion EBITDA potential,

it is considered that $0.3 billion has been achieved to date from

the completion of the Mexico HSM project on an observed run-rate

basis. Vallourec transaction closed in 3Q 2024 and ArcelorMittal’s

c.28.4% share of consensus 2025 net income (based on consensus

figures from a panel of independent analysts) is ~$0.15 billion.

Together with Italpannelli acquisition expected to contribute $0.2

billion to EBITDA.

- See Appendix 4 for reconciliation of

adjusted net income and adjusted basic earnings per share.

- XCarb® is designed to

bring together all of ArcelorMittal’s reduced, low and zero-carbon

products and steelmaking activities, as well as wider initiatives

and green innovation projects, into a single effort focused on

achieving demonstrable progress towards carbon neutral steel.

Alongside the new XCarb® brand, we have launched three

XCarb® initiatives: the XCarb® innovation

fund, XCarb® green steel certificates and

XCarb® recycled and renewably produced for products made

via the Electric Arc Furnace route using scrap. The Company is

offering green steel using a system of certificates

(XCarb® green certificates). These are issued by an

independent auditor to certify tonnes of CO2 savings achieved

through the Company’s investment in decarbonization technologies in

Europe. Net-zero equivalence is determined by assigning CO2 savings

certificates equivalent to CO2 per tonne of steel produced in 2018

as baseline. The certificates relate to the tonnes of CO2 saved in

total, as a direct result of the decarbonization projects being

implemented across a number of its European sites.

- On March 9, 2023, ArcelorMittal

announced that following receipt of customary regulatory approvals

it had completed the acquisition of Companhia Siderúrgica do Pecém

(‘CSP’) in Brazil for an enterprise value of approximately $2.2

billion.

- Production: Including all production

of the hot strip mill including processing of slabs on a hire work

basis for ArcelorMittal Group entities and third parties, including

stainless steel slabs. Shipments: including shipments of finished

products processed on a hire work basis for ArcelorMittal Group

entities and third parties, including stainless steel products.

EBITDA of Calvert presented here on a 100% basis as a stand-alone

business and in accordance with the Company's policy, applying the

weighted average method of accounting for inventory.

- Sustainable Solutions is focused on

growing niche businesses providing vital added-value support to

growing sustainable related applications from a low-carbon, capital

light asset base. These businesses include: a) Construction

solutions: Product offerings include sandwich panels (e.g.

insulation), profiles, turnkey pre-fabrication solutions, etc., to

assist building in smarter ways and reduce the carbon footprint of

buildings; b) Projects: Product range includes plates, pipes &

tubes, wire ropes, reinforced steels, providing high-quality &

sustainable steel solutions for energy projects and supporting

offshore wind, energy transition and onshore construction; c)

Industeel: EAF based capacity: High quality steel grades designed

to meet demanding customer specifications (e.g. XCarb®

for wind turbines); Supplying wide range of industries; energy,

chemicals, mechanical engineering, machinery, infrastructure,

defence & security; d) Renewables: investments in renewable

energy projects; e) Metallics: investment and development of the

Company’s scrap recycling and collection capabilities; f)

Distribution & service centers: European services processor

including slitting, cut-to-length, multi blanking, and press

blanking and operating through an extensive network.

- Other projects under development

include: ArcelorMittal Texas: Plans under development to double

capacity and add CCS capability; Calvert (US): Option to add a

second 1.5Mt EAF at lower capex intensity; Electrical steels US

(Alabama): 150kt NGO electrical steels for automotive with

government support received; Liberia further expansion to 30Mt; and

India further expansion: Hazira to 20Mt and Greenfield on the east

coast of India.

- In Argentina, ArcelorMittal has developed a partnership with

PCR for a 130MW solar and wind capacity project. The project is

operational and supplies over 30% of ArcelorMittal's local

electricity requirements.

- Compared to the historical average EBITDA per tonne of $89/t

during the 2012-2019 period.

Third quarter 2024 earnings analyst

conference call

ArcelorMittal Management will host a conference call for members of

the investment community to present and comment on the three-month

period ended September 30, 2024 on: Thursday November 7,

2024, at 9.30am US Eastern time. 14.30pm London time and 15.30pm

CET.

To access via the conference call and ask a question during the

Q&A, please register in advance:

https://register.vevent.com/register/BIa7b975369f7541cfb574031a9e8a264d

Alternatively, the webcast can be accessed live on the day:

https://edge.media-server.com/mmc/p/t6z858m6

Forward-Looking Statements

This document contains forward-looking information and

statements about ArcelorMittal and its subsidiaries. These

statements include financial projections and estimates and their

underlying assumptions, statements regarding plans, objectives and

expectations with respect to future operations, products and

services, and statements regarding future performance.

Forward-looking statements may be identified by the words

“believe”, “expect”, “anticipate”, “target” or similar expressions.

Although ArcelorMittal’s management believes that the expectations

reflected in such forward-looking statements are reasonable,

investors and holders of ArcelorMittal’s securities are cautioned

that forward-looking information and statements are subject to

numerous risks and uncertainties, many of which are difficult to

predict and generally beyond the control of ArcelorMittal, that

could cause actual results and developments to differ materially

and adversely from those expressed in, or implied or projected by,

the forward-looking information and statements. These risks and

uncertainties include those discussed or identified in the filings

with the Luxembourg Stock Market Authority for the Financial

Markets (Commission de Surveillance du Secteur Financier) and the

United States Securities and Exchange Commission (the “SEC”) made

or to be made by ArcelorMittal, including ArcelorMittal’s latest

Annual Report on Form 20-F on file with the SEC. ArcelorMittal

undertakes no obligation to publicly update its forward-looking

statements, whether as a result of new information, future events,

or otherwise.

Non-GAAP/Alternative Performance

Measures

This press release also includes certain non-GAAP

financial/alternative performance measures. ArcelorMittal presents

EBITDA and EBITDA/tonne, free cash flow (FCF), adjusted net income,

adjusted basic earnings per share and the ratio of net debt/LTM

EBITDA which are non-GAAP financial/alternative performance

measures, as additional measures to enhance the understanding of

its operating performance. As announced previously, the definition

of EBITDA has been revised to include income from share of

associates, JVs and other investments (excluding impairments and

exceptional items if any, of associates, JVs and other investments)

because the Company believes this information provides investors

with additional information to understand its results, given the

increasing significance of its joint ventures. ArcelorMittal

believes such indicators are relevant to provide management and

investors with additional information. ArcelorMittal also presents

net debt and change in working capital as additional measures to

enhance the understanding of its financial position, changes to its

capital structure and its credit assessment. Investable cashflow is

defined as net cash provided by operating activities less

maintenance/normative capex, and the Company thus believes that it

represents a cashflow that is available for allocation at

management’s discretion. The Company’s guidance as to additional

EBITDA estimated to be generated from certain projects and with

respect to working capital for the fourth quarter of 2024, is based

on the same accounting policies as those applied in the Company’s

financial statements prepared in accordance with IFRS.

ArcelorMittal is unable to reconcile, without unreasonable effort,

such guidance to the most directly comparable IFRS financial

measure, due to the uncertainty and inherent difficulty of

predicting the occurrence and the financial impact of items

impacting comparability. For the same reasons, ArcelorMittal is

unable to address the significance of the unavailable information.

Non-GAAP financial/alternative performance measures should be read

in conjunction with, and not as an alternative to, ArcelorMittal's

financial information prepared in accordance with IFRS. Comparable

IFRS measures and reconciliations of non-GAAP financial/alternative

performance measures are presented herein.

About ArcelorMittal

ArcelorMittal is one of the world's leading steel and mining

companies, with a presence in 60 countries and primary steelmaking

facilities in 15 countries. In 2023, ArcelorMittal had revenues of

$68.3 billion and crude steel production of 58.1 million metric

tonnes, while iron ore production reached 42.0 million metric

tonnes.

Our goal is to help build a better world with smarter steels.

Steels made using innovative processes which use less energy, emit

significantly less carbon and reduce costs. Steels that are

cleaner, stronger and reusable. Steels for electric vehicles and

renewable energy infrastructure that will support societies as they

transform through this century. With steel at our core, our

inventive people and an entrepreneurial culture at heart, we will

support the world in making that change. This is what we believe it

takes to be the steel company of the future.

ArcelorMittal is listed on the stock exchanges of New York (MT),

Amsterdam (MT), Paris (MT), Luxembourg (MT) and on the Spanish

stock exchanges of Barcelona, Bilbao, Madrid and Valencia (MTS).

For more information about ArcelorMittal please visit:

https://corporate.arcelormittal.com/

Enquiries

ArcelorMittal investor relations: +44 207 543 1128; Retail: +44

207 543 1156; SRI: +44 207 543 1156 and Bonds/credit: +33 1 71 92

10 26.

ArcelorMittal corporate communications (e-mail:

press@arcelormittal.com) +44 207 629 7988. Contact: Paul Weigh +44

203 214 2419

- 3Q24 Earnings release FINAL.pdf

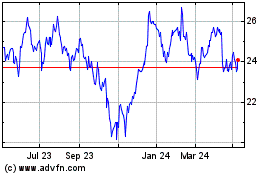

ArcelorMittal (TG:ARRD)

Historical Stock Chart

From Feb 2025 to Mar 2025

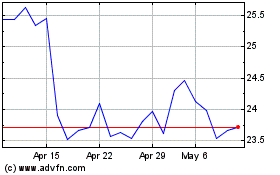

ArcelorMittal (TG:ARRD)

Historical Stock Chart

From Mar 2024 to Mar 2025