Galaxy Entertainment Group Selected Unaudited Q3 2024 Financial

Data

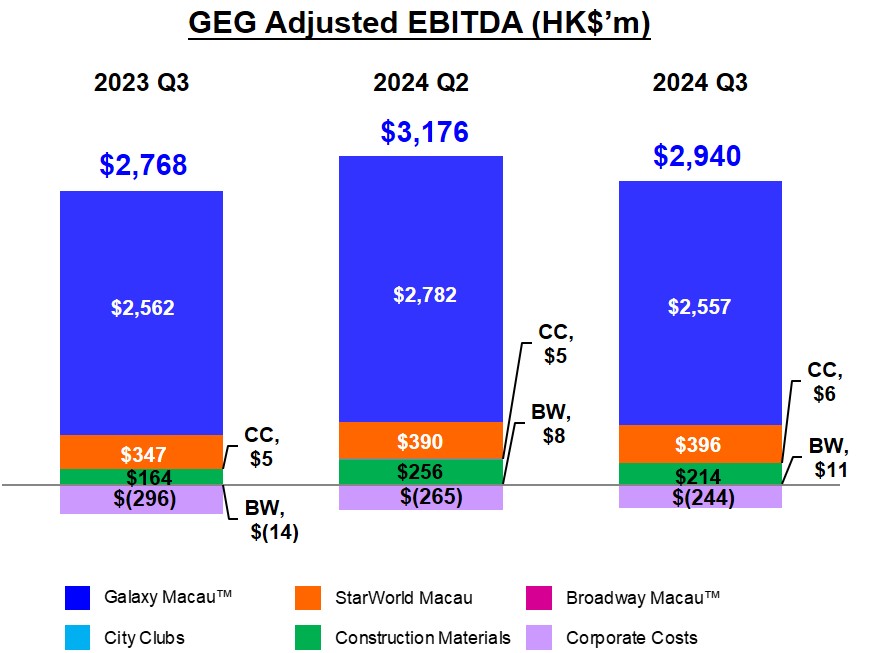

Q3 2024 Group Adjusted EBITDA of $2.9

Billion

up 6% Year-on-Year and Down 7%

Quarter-on-Quarter

Paid an Interim Dividend of $0.50 Per

Share on 25 October 2024

Continues fit out Capella at Galaxy Macau

& Construction of Phase 4

Ramping up Galaxy International

Convention Center and Galaxy Arena

Well Advanced Deploying Smart Tables

Across our Resorts

HONG KONG, Nov. 06, 2024 (GLOBE NEWSWIRE) --

Galaxy Entertainment Group (“GEG”, “Company” or the “Group”) (HKEx

stock code: 27) today reported results for the three-month period

ended 30 September 2024. (All amounts are expressed in Hong Kong

dollars unless otherwise stated)

Dr. Lui Che Woo, Chairman of GEG

said:

“Today I am pleased to report the third

quarter results for the Group in 2024. In Q3 2024 Group Net Revenue

increased 11% year-on-year to $10.7 billion and Adjusted EBITDA

increased 6% year-on-year to $2.9 billion, played unlucky in Q3

which decreased Adjusted EBITDA by approximately $165

million.

For the recent National Day Golden Week

holiday, we were pleased that Macau recorded a total of 993,117

visitor arrivals. The daily average number of visitor arrivals

during the seven-day period reached nearly 102% of the

corresponding period in pre-pandemic 2019. Macau hotels’ average

guestroom occupancy stood at 95% during the period.

Our balance sheet continued to be healthy

and liquid with total cash and liquid investments of $28.6 billion

and the net position was $27.4 billion after debt of $1.2 billion.

Our solid balance sheet and cash flow from operations allows us to

return capital to shareholders through dividends, fund our

development pipeline and pursue our international expansion

ambitions. On 25 October 2024, we paid the previously announced

interim dividend of $0.50 per share. These dividends demonstrate

our continued confidence in the longer-term outlook of Macau and

for the Company.

On the development front, we continue to

move forward with the fitting out of the Capella at Galaxy Macau

and Phase 4, which has a strong focus on non-gaming, primarily

targeting entertainment, family facilities and includes

gaming.

We were very pleased to celebrate the 75th

anniversary of the founding of the People’s Republic of China and

are pleased to welcome the 25th anniversary of Macau’s return to

the Motherland this December. Furthermore, we congratulate Mr. Sam

Hou Fai who was elected as the new Chief Executive of Macau

SAR.

Finally, I would like to thank all our team

members who deliver ‘World Class, Asian Heart’ service each and

every day and contribute to the success of the Group.”

Q3 2024 RESULTS HIGHLIGHTS

GEG: Well Positioned for Future

Growth

- Q3 Group Net Revenue of $10.7 billion, up 11% year-on-year and

down 2% quarter-on-quarter

- Q3 Group Adjusted EBITDA of $2.9 billion, up 6% year-on-year

and down 7% quarter-on-quarter

- Played unlucky in Q3 which decreased Adjusted EBITDA by

approximately $165 million, normalized Q3 Adjusted EBITDA of $3.1

billion, up 7% year-on-year and down 3% quarter-on-quarter

- Latest twelve months Adjusted EBITDA of $11.8 billion, up 68%

year-on-year and up 1% quarter-on-quarter

Galaxy Macau™: Well Positioned for Future

Growth

- Q3 Net Revenue of $8.4 billion, up 10% year-on-year and down 3%

quarter-on-quarter

- Q3 Adjusted EBITDA of $2.6 billion, flat year-on-year and down

8% quarter-on-quarter

- Played unlucky in Q3 which decreased Adjusted EBITDA by

approximately $180 million, normalized Q3 Adjusted EBITDA of $2.7

billion, up 2% year-on-year and down 3% quarter-on-quarter

- Hotel occupancy for Q3 across the seven hotels was 98%

StarWorld Macau: Well Positioned for

Future Growth

- Q3 Net Revenue of $1.3 billion, up 9% year-on-year and up 1%

quarter-on-quarter

- Q3 Adjusted EBITDA of $396 million, up 14% year-on-year, up 2%

quarter-on-quarter

- Played lucky in Q3 which increased Adjusted EBITDA by

approximately $15 million, normalized Q3 Adjusted EBITDA of $381

million, up 9% year-on-year and up 7% quarter-on-quarter

- Hotel occupancy for Q3 was 100%

Broadway Macau™, City Clubs and Construction Materials

Division (“CMD”)

- Broadway Macau™: Q3 Adjusted EBITDA was $11 million, versus

$(14) million in Q3 2023 and $8 million in Q2 2024

- City Clubs: Q3 Adjusted EBITDA was $6 million, up 20%

year-on-year and up 20% quarter-on-quarter

- CMD: Q3 Adjusted EBITDA was $214 million, up 30% year-on-year

and down 16% quarter-on-quarter

Balance Sheet: Healthy and Liquid Balance

Sheet

- As at 30 September 2024, cash and liquid investments were $28.6

billion and the net position was $27.4 billion after debt of $1.2

billion

- Paid an interim dividend of $0.50 per share on 25 October

2024

Development Update:

Opening Capella at Galaxy Macau in mid-2025; Ramping up

Galaxy International Convention Center (“GICC”), Galaxy Arena,

Raffles at Galaxy Macau and Andaz Macau; Progressing with Phase

4

- Announced the opening of Capella at Galaxy Macau in

mid-2025

- Cotai Phase 3 – Ramping up GICC, Galaxy Arena, Raffles at

Galaxy Macau and Andaz Macau

- Cotai Phase 4 – Our efforts are firmly focused on the

development of Phase 4. Phase 4 has a strong focus on non-gaming,

primarily targeting entertainment, family facilities and also

includes gaming

|

Market Overview

Based on DICJ reporting, Macau’s Gross Gaming

Revenue (“GGR”) for Q3 2024 was $54.0 billion, up 14% year-on-year

and down 1% quarter-on-quarter. In Q3 2024, visitor arrivals to

Macau were 9.2 million, up 11% year-on-year and up 17%

quarter-on-quarter. Visitor arrivals from the Mainland were 6.7

million, up 15% year-on-year and up 27% quarter-on-quarter. In the

first three quarters, visitors from Mainland China up 36%

year-on-year and visitor arrivals from the 10 cities that were

newly added to the Individual Visit Scheme (IVS) surged by 54%

year-on-year. Further, international visitors were up 95% for the

same period.

Group Financial Results

In Q3 2024, the Group posted Net Revenue of

$10.7 billion, up 11% year-on-year and down 2% quarter-on-quarter.

Adjusted EBITDA was $2.9 billion, up 6% year-on-year and down 7%

quarter-on-quarter. Galaxy Macau™’s Adjusted EBITDA was $2.6

billion, flat year-on-year and down 8% quarter-on-quarter.

StarWorld Macau’s Adjusted EBITDA was $396 million, up 14%

year-on-year and up 2% quarter-on-quarter. Broadway Macau™’s

Adjusted EBITDA was $11 million, versus $(14) million in Q3 2023

and $8 million in Q2 2024. Latest twelve months Adjusted EBITDA for

the Group was $11.8 billion, up 68% year-on-year and up 1%

quarter-on-quarter.

During Q3 2024, GEG played unlucky in its gaming

operations which decreased Adjusted EBITDA by approximately $165

million. Normalized Adjusted EBITDA was $3.1 billion, up 7%

year-on-year and down 3% quarter-on-quarter.

Summary Table of GEG Q3 2024

Adjusted EBITDA and Adjustments:

|

in HK$'m |

Q3 2023 |

Q2 2024 |

Q3 2024 |

YoY |

QoQ |

|

Adjusted EBITDA |

2,768 |

3,176 |

2,940 |

6% |

-7% |

|

Luck1 |

(122) |

(20) |

(165) |

- |

- |

|

Normalized Adjusted EBITDA |

2,890 |

3,196 |

3,105 |

7% |

-3% |

The Group’s total GGR in Q3 2024 was $10.2

billion, up 16% year-on-year and down 2% quarter-on-quarter. Mass

GGR was $8.4 billion, up 13% year-on-year and up 1%

quarter-on-quarter. VIP GGR was $1.1 billion, up 35% year-on-year

and down 21% quarter-on-quarter. Electronic GGR was $666 million,

up 35% year-on-year and up 1% quarter-on-quarter.

|

Group Key Financial Data |

|

|

|

| (HK$'m) |

Q3 2023 |

Q2 2024 |

Q3 2024 |

| Revenues: |

|

|

|

|

Net Gaming |

7,417 |

8,595 |

8,197 |

|

Non-gaming |

1,520 |

1,483 |

1,666 |

|

Construction Materials |

713 |

840 |

805 |

| Total Net Revenue |

9,650 |

10,918 |

10,668 |

| Adjusted EBITDA |

2,768 |

3,176 |

2,940 |

|

|

|

|

|

|

Gaming Statistics2 |

|

|

|

|

(HK$'m) |

|

|

|

|

|

Q3 2023 |

Q2 2024 |

Q3 2024 |

| Rolling

Chip Volume3 |

32,459 |

46,155 |

44,459 |

| Win Rate

% |

2.5% |

3.0% |

2.5% |

| Win |

813 |

1,391 |

1,100 |

|

|

|

|

|

| Mass

Table Drop4 |

29,906 |

32,370 |

31,726 |

| Win Rate

% |

24.9% |

25.6% |

26.4% |

| Win |

7,441 |

8,291 |

8,386 |

|

|

|

|

|

|

Electronic Gaming Volume |

14,298 |

22,370 |

26,503 |

| Win Rate

% |

3.4% |

2.9% |

2.5% |

| Win |

492 |

658 |

666 |

|

|

|

|

|

|

Total GGR Win5 |

8,746 |

10,340 |

10,152 |

Balance Sheet and Dividend

The Group’s balance sheet remains healthy and

liquid. As of 30 September 2024, cash and liquid investments were

$28.6 billion and the net position was $27.4 billion after debt of

$1.2 billion. Our strong balance sheet combined with substantial

cash flow from operations allows us to return capital to

shareholders via dividends and to fund our development pipeline.

The Group paid an interim dividend of $0.50 per share on 25 October

2024.

Galaxy Macau™

Galaxy Macau™ is the primary contributor to the

Group’s revenue and earnings. Net Revenue in Q3 2024 was $8.4

billion, up 10% year-on-year and down 3% quarter-on-quarter.

Adjusted EBITDA as $2.6 billion, flat year-on-year and down 8%

quarter-on-quarter.

Galaxy Macau™ played unlucky in its gaming

operations which decreased its Adjusted EBITDA by approximately

$180 million in Q3 2024. Normalized Adjusted EBITDA was $2.7

billion, up 2% year-on-year and down 3% quarter-on-quarter.

Hotel occupancy for Q3 2024 across the seven

hotels was 98%.

| Galaxy

Macau™ Key Financial Data |

|

|

|

(HK$'m) |

|

|

|

| |

Q3 2023 |

Q2 2024 |

Q3 2024 |

| Revenues: |

|

|

|

|

Net Gaming |

6,258 |

7,347 |

6,934 |

|

Hotel / F&B / Others |

1,004 |

971 |

1,125 |

|

Mall |

366 |

326 |

347 |

| Total Net Revenue |

7,628 |

8,644 |

8,406 |

| |

|

|

|

| Adjusted EBITDA |

2,562 |

2,782 |

2,557 |

| Adjusted EBITDA Margin |

34% |

32% |

30% |

|

|

|

|

|

|

Gaming Statistics6 |

|

|

|

|

(HK$'m) |

|

|

|

|

|

Q3 2023 |

Q2 2024 |

Q3 2024 |

| Rolling

Chip Volume7 |

31,090 |

44,577 |

42,887 |

| Win Rate

% |

2.5% |

2.9% |

2.4% |

| Win |

778 |

1,287 |

1,027 |

|

|

|

|

|

| Mass

Table Drop8 |

22,812 |

24,647 |

24,591 |

| Win Rate

% |

27.2% |

28.6% |

29.0% |

| Win |

6,197 |

7,047 |

7,123 |

|

|

|

|

|

|

Electronic Gaming Volume |

10,188 |

14,772 |

16,743 |

| Win Rate

% |

4.0% |

3.5% |

2.9% |

| Win |

411 |

524 |

490 |

|

|

|

|

|

|

Total GGR Win |

7,386 |

8,858 |

8,640 |

StarWorld Macau

StarWorld Macau’s Net Revenue in Q3 2024 was

$1.3 billion, up 9% year-on-year, up 1% quarter-on-quarter.

Adjusted EBITDA was $396 million, up 14% year-on-year, up 2%

quarter-on-quarter.

StarWorld Macau played lucky in its gaming

operations which increased its Adjusted EBITDA by approximately $15

million in Q3 2024. Normalized Adjusted EBITDA was $381 million, up

9% year-on-year and up 7% quarter-on-quarter.

Hotel occupancy for Q3 2024 was 100%.

| StarWorld

Macau Key Financial Data |

|

|

|

(HK$'m) |

|

|

|

| |

Q3 2023 |

Q2 2024 |

Q3 2024 |

| Revenues: |

|

|

|

|

Net Gaming |

1,101 |

1,190 |

1,205 |

|

Hotel / F&B / Others |

121 |

128 |

126 |

|

Mall |

6 |

5 |

6 |

| Total Net Revenue |

1,228 |

1,323 |

1,337 |

| |

|

|

|

| Adjusted EBITDA |

347 |

390 |

396 |

| Adjusted EBITDA Margin |

28% |

29% |

30% |

|

|

|

|

|

|

Gaming Statistics9 |

|

|

|

|

(HK$'m) |

|

|

|

|

|

Q3 2023 |

Q2 2024 |

Q3 2024 |

| Rolling

Chip Volume10 |

1,369 |

1,578 |

1,572 |

| Win Rate

% |

2.6% |

6.5% |

4.7% |

| Win |

35 |

104 |

73 |

|

|

|

|

|

| Mass

Table Drop11 |

6,830 |

7,467 |

6,884 |

| Win Rate

% |

17.6% |

16.2% |

17.8% |

| Win |

1,204 |

1,207 |

1,226 |

|

|

|

|

|

|

Electronic Gaming Volume |

2,981 |

6,325 |

8,511 |

| Win Rate

% |

2.1% |

1.8% |

1.8% |

| Win |

62 |

113 |

155 |

|

|

|

|

|

|

Total GGR Win |

1,301 |

1,424 |

1,454 |

Broadway Macau™

Broadway Macau™ is a unique family friendly,

street entertainment and food resort supported by Macau SMEs. The

property’s Net Revenue in Q3 2024 was $62 million, up 158%

year-on-year and up 15% quarter-on-quarter. Adjusted EBITDA was $11

million, versus $(14) million in Q3 2023 and $8 million in Q2

2024.

City Clubs

In Q3 2024, City Clubs Adjusted EBITDA was $6

million, up 20% year-on-year and up 20% quarter-on-quarter.

Construction Materials

Division

CMD contributed Adjusted EBITDA of $214 million

in Q3 2024, up 30% year-on-year and down 16% quarter-on-quarter. Q3

2024 was seasonally softer due to rainstorms and typhoons which

adversely impact construction works.

Development Update

Galaxy Macau™ and StarWorld Macau

We continue to make ongoing progressive

enhancements to our resorts to ensure that they remain competitive

and appealing to our guests with a particular focus on adding new

and innovative F&B and retail offerings. At StarWorld Macau we

are evaluating a range of major upgrades, that includes the main

gaming floor, the lobby arrival experience and increasing the

F&B options. We have completed the upgrade of Level 3 and

StarWorld Macau now hosts one of the largest-scale Live Table Games

(LTG) terminals in Macau.

Cotai – The Next Chapter

The targeted opening of Capella at Galaxy Macau

is in mid-2025. The 17-storey property offers approximately 100

ultra-luxury sky villas and suites. Each Sky Villa features a

light-filled balcony with a transparent infinity-edge pool, outdoor

lounge, sunroom and hidden winter garden, among others. Capella at

Galaxy Macau promises to bring a new level of elegance and luxury

to Macau.

We are ramping up GICC, Galaxy Arena, Raffles at

Galaxy Macau and Andaz Macau. We are now firmly focused on the

development of Phase 4, which is already well under way. Phase 4

will include multiple high-end hotel brands new to Macau, together

with an up to 5000-seat theater, extensive F&B, retail,

non-gaming amenities, landscaping, a water resort deck and a

casino. Phase 4 is approximately 600,000 square meters of

development and is scheduled to complete in 2027. We remain highly

confident about the future of Macau where Phases 3 & 4 will

support Macau’s vision of becoming a World Centre of Tourism and

Leisure.

Selected Major Awards in 2024

|

AWARD |

PRESENTER |

|

GEG |

|

2024 IAG Academy IR Awards

- Best Integrated Resort – Galaxy Macau™

- Best Overall F&B Offering by an IR - Galaxy Macau™

- Best Hotel Attached to an IR - Raffles at Galaxy Macau

|

Inside Asian Gaming |

|

2024 PATA Gold Award - Gold Award for Youth Empowerment

Initiative |

Pacific Asia Travel Association |

|

Sustainability Award |

International Gaming Awards 2024 |

|

Casino Operator of the Year |

Global Gaming Awards Asia-Pacific 2024 |

|

2024 Macao International Environmental Co-operation Forum &

Exhibition - Green Booth Award |

Macau Fair & Trade Association |

|

GALAXY MACAU™ |

MICHELIN One-Star Restaurant

- 8½ Otto e Mezzo BOMBANA

- Lai Heen

Selected Restaurants

- Terrazza Italian Restaurant

- The Ritz-Carlton Cafe

- Saffron

|

The MICHELIN Guide Hong Kong Macau 2024 |

Five Star Hotel

- Galaxy Hotel™

- Hotel Okura Macau

- Banyan Tree Macau

- The Ritz-Carlton Macau

Five-Star Restaurant

- 8½ Otto e Mezzo BOMBANA

- Lai Heen

Five-Star Spa

- The Ritz-Carlton Spa, Macau

- Banyan Tree Spa Macau

|

2024 Forbes Travel Guide |

|

Black Pearl Restaurant Guide 2024 – One Diamond – 8½ Otto e Mezzo

BOMBANA |

Mei Tuan |

|

Macau Energy Saving Activity 2023 – Energy Saving Concept Award –

Galaxy Macau™ |

CEM – Companhia de Electricidade de Macau |

EarthCheck Gold Certification

EarthCheck Silver Certification

- Galaxy Hotel™

- Hotel Okura Macau

|

EarthCheck |

|

Macao Green Hotel Awards – Gold Award – Galaxy Hotel™ |

Environmental Protection Bureau of the Macau SAR Government |

|

STARWORLD MACAU |

|

MICHELIN Two-Star Restaurant – Feng Wei Ju |

The MICHELIN Guide Hong Kong Macau 2024 |

|

Black Pearl Restaurant Guide 2024 – One Diamond – Feng Wei Ju |

Mei Tuan |

|

BROADWAY MACAU™ |

|

Macau Energy Saving Activity 2023 – Energy Saving Award (Hotel

Group B) – 1st Runner Up – Broadway Macau™ |

CEM - Companhia de Electricidade de Macau |

|

CMD |

|

Caring Company Scheme – 20 Years Plus Caring Company Logo |

The Hong Kong Council of Social Service |

Outlook

In late September, the People’s Bank of China

announced a range of measures to support the economy. These

including a reduction in the banking system's reserve ratio, a cut

in the benchmark rate, a reduction of rates on existing mortgages,

increased liquidity to brokers and insurance companies and an

increase in listed state-owned enterprise share buybacks to

stimulate the Chinese economy and stock market. We welcome these

stimulation policies which are positive for consumer and investment

sentiments.

In May, the Central Government further expanded

the Individual Visit Scheme (IVS) to 59 eligible cities with a

total combined population of approximately 500 million people.

Also, the Macau Government continues to explore international

tourist markets, especially in Northeast Asia, Southeast Asia and

South Asia. The Government continues to improve infrastructure,

including airport expansion and an improved international flight

network, to facilitate greater access for international

visitors.

We were pleased that Macau’s fourth sea bridge

opened to traffic on 1 October. The new bridge reduces travel time

between Cotai and the Macau Peninsula. Furthermore, the Macau

International Airport expansion and reclamation project will

commence this year. It is estimated that the annual passenger

capacity will increase to 15 million passengers, representing an

increase of more than 50% over current capacity.

To enrich the tourism product offerings, we

continue to ramp up our GICC and Galaxy Arena. In April, Galaxy

Arena hosted the International Table Tennis Federation Men’s and

Women’s World Cup Macao 2024. During National Day Golden Week, one

of Hong Kong’s famous singer Mr. Andy Lau held a series of concerts

in Galaxy Arena. This resulted in driving additional customers

across our resort facilities, including gaming, retail, F&B and

hotels. Further we have scheduled a number of shows and

entertainment events to be held in Q4 2024, including concerts,

talk shows, opera and sporting events. One of the events is the UFC

(Ultimate Fighting Championship) fight night which we believe will

prove to be very popular.

In-line with our policy to continually improving

and enhancing our resort offerings at Galaxy Macau™, we fitted out

a new high-limit slot area which opened in late September. We also

continue to rollout smart tables across our resorts and anticipate

to complete the full rollout by year end.

We successfully opened overseas business

development offices in Tokyo, Seoul and Bangkok, this is in-line

with our commitment to the Government to further increase the

number and flow of high value international visitors to Macau and

we continue to explore international development opportunities.

About Galaxy Entertainment Group (HKEx stock code:

27)

Galaxy Entertainment Group Limited (“GEG” or the

“Company”) and its subsidiaries (“GEG” or the “Group”) is one of

the world’s leading resorts, hospitality and gaming companies. The

Group primarily develops and operates a large portfolio of

integrated resort, retail, dining, hotel and gaming facilities in

Macau. GEG is listed on the Hong Kong Stock Exchange and is a

constituent stock of the Hang Seng Index.

GEG through its subsidiary, Galaxy Casino S.A.,

is one of the three original concessionaires in Macau when the

gaming industry was liberalized in 2002. In 2022, GEG was awarded a

new gaming concession valid from January 1, 2023, to December 31,

2032. GEG has a successful track record of delivering innovative,

spectacular and award-winning properties, products and services,

underpinned by a “World Class, Asian Heart” service philosophy,

that has enabled it to consistently outperform the market in

Macau.

The Group operates three flagship destinations

in Macau: on Cotai, Galaxy Macau™, one of the world’s largest

integrated destination resorts, and the adjoining Broadway Macau™,

a unique landmark entertainment and food street destination; and on

the Peninsula, StarWorld Macau, an award-winning premium

property.

The Group has the largest development pipeline

of any concessionaire in Macau. When The Next Chapter of its Cotai

development is completed, GEG’s resorts footprint on Cotai will be

more than 2 million square meters, making the resorts,

entertainment and MICE precinct one of the largest and most diverse

integrated destinations in the world. GEG also considers

opportunities in the Greater Bay Area and internationally. These

projects will help GEG develop and support Macau in its vision of

becoming a World Centre of Tourism and Leisure.

In July 2015, GEG made a strategic investment in

Société Anonyme des Bains de Mer et du Cercle des Étrangers à

Monaco (“Monte-Carlo SBM”), a world renowned owner and operator of

iconic luxury hotels and resorts in the Principality of Monaco. GEG

continues to explore a range of international development

opportunities with Monte-Carlo SBM.

GEG is committed to delivering world class

unique experiences to its guests and building a sustainable future

for the communities in which it operates.

For more information about the Group, please

visit www.galaxyentertainment.com

1 Reflects luck adjustments associated with our

rolling chip program.

2 Gaming statistics are presented before deducting

commission and incentives.

3 Represents sum of promotor and inhouse premium

direct.

4 Mass table drop includes the amount of table drop plus

cash chips purchased at the cage.

5 Total GGR win includes gaming win from City Clubs.

6 Gaming statistics are presented before deducting

commission and incentives.

7 Represents sum of promotor and inhouse premium

direct.

8 Mass table drop includes the amount of table drop plus

cash chips purchased at the cage.

9 Gaming statistics are presented before deducting

commission and incentives.

10 Represents sum of promotor and inhouse premium

direct.

11 Mass table drop includes the amount of table drop

plus cash chips purchased at the cage.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/eb688a29-8581-4c32-a266-31fc4f40b4b3

Galaxy Entertainment (TG:KW9A)

Historical Stock Chart

From Nov 2024 to Dec 2024

Galaxy Entertainment (TG:KW9A)

Historical Stock Chart

From Dec 2023 to Dec 2024