Ascot Resources Ltd. (

TSX: AOT; OTCQX:

AOTVF) (“

Ascot” or the

“

Company”) is pleased to announce the Company’s

unaudited financial results for the three and six months ended June

30, 2024 (“

Q2 2024”), located on Nisga’a Nation

Treaty Lands in the prolific Golden Triangle of northwestern

British Columbia. For details of the unaudited condensed interim

consolidated financial statements and Management's Discussion and

Analysis for the three and six months ended June 30, 2024, please

see the Company’s filings on SEDAR+ (www.sedarplus.ca).

All amounts herein are reported in $000s of

Canadian dollars (“C$”) unless otherwise

specified.

Q2 2024 AND RECENT HIGHLIGHTS

- On July 25,

2024, the Company closed the previously announced bought deal

financing, including the full exercise of the over-allotment

option, for gross proceeds of approximately $34,000 (the

“Offering”). The Offering consisted of 30,242,000 flow-through

units (the “Flow-Through Units”) at a price of C$0.496 per

Flow-Through Unit and 44,188,000 hard dollar units (the “HD Units”)

of the Company (together, the “Offered Securities”) of C$0.43 per

HD Unit. Each Offered Security consisted of one common share of the

company and one common share purchase warrant of the Company. Each

warrant entitled the holder to acquire one share (each, a “Warrant

Share”) at a price of C$0.52 per Warrant Share for a period of 24

months following closing.

- In Q2 2024, the

Big Missouri deposit delivered 47,158 wet tonnes of material. Total

mine development in Q2 achieved 1,764 meters of which 1,381 metres

related to Big Missouri and 383 metres relate to Premier Northern

Light (“PNL”). Significant progress in the second half of the

quarter has been made at PNL where the development rates have

increased to over 6 metres per day.

- The second

egress and exhaust vert raise at the Big Missouri deposit was

completed on June 18, 2024. The operation is moving from mining

lower-grade commissioning ore from the development headings to

mining of planned higher-grade stoping areas.

- During Q2 2024,

the plant processed 85,436 dry tonnes of mostly development ore in

the commissioning of the mill, containing an estimated total of

5,713 ounces of gold; poured 839 ounces of gold and 1,288 ounces of

silver, and an estimated 3,178 ounces of gold-in-process remained

as at June 30, 2024.

- In Q2, 2024, the

Company sold 735 ounces of gold to the offtaker and delivered 42

ounces of gold and 562 ounces of sliver pursuant to stream and

royalty arrangements.

- On May 7, 2024,

the Company announced a $5,000 non-brokered flow-through private

placement (the “Offering”), the proceeds of which will be used to

fund the 2024 exploration program at PGP. The Offering consisted of

6,024,096 common shares of the Company, which qualify as

"flow-through shares" within the meaning of the Income Tax Act

(Canada) (the “FT Shares”), at a price of C$0.83 per FT Share. The

first tranche of $1,000 was closed on May 29 and the second tranche

of $4,000 was closed on June 20, 2024.

- Rock was

introduced into the grinding circuit of the mill on March 31, 2024,

and first gold-bearing ore was introduced to the mills on April 5,

2024. On April 20, 2024, first gold was poured as a part of the

commissioning process. Commissioning of the processing plant at PGP

is ongoing, with commercial production anticipated in second half

of 2024.

- In July 2024,

the plant has shown an ability to operate for several days at its

design capacity in terms of tonnages put through the crushing and

grinding circuit; however there remains a number of challenges to

pour more gold. July’s gold production improved dramatically over

the prior months, but the operation is still struggling to

continuously run the gravity circuit and achieve regular stripping

schedule and gold pours.

- In July 2024,

the plant processed 40,304 dry tonnes of materials from a

combination of Big Missouri development ore and stoping ore and

surface stockpile material. A total of 1,670 ounces of gold and

3,157 ounces of silver were poured.

Overall, the commission process has gone slower

that expected due to a combination of challenges with process plant

and lower grades from the development ore from the Big Missouri

mine. The key challenge for the Company is to access higher grade

stopes from Big Missouri and mine enough material to feed the mills

until the PNL is brought into production which is anticipated in Q4

of 2024. In addition, the reliability of the plant in the gravity

circuit, the elution circuit and the tailing thickener need to

improve so the that the plant can operate continuously. The Company

continues to focus on addressing these challenges.

FINANCIAL RESULTS FOR THE THREE SIX

MONTHS ENDED JUNE 30, 2024

The Company reported a net income of $2,950 for

Q2 2024 compared to a net loss of $3,073 for Q2 2023. The decrease

in net loss of $6,023 for the current period is primarily

attributable to a combination of factors, including:

- First gold sale with revenue, net of transportation and

refinery costs, recognized of $2,419;

- A $2,262 decrease in the loss on extinguishment of debt;

and

- A $3,583 increase in fair value of derivatives mainly driven by

higher gold and silver prices, which is a non-cash item.

These positive factors were partially offset by

an increase in cost of sales of $2,362.

The Company reported a net loss of $3,258 for

the first half of 2024 compared to $10,662 for the first half of

2023. The decrease in net loss of $7,404 is primarily attributable

to a combination of factors including:

- First gold sale with revenue, net of transportation and

refinery costs, recognized of $2,419;

- A $1,128 decrease in financing costs;

- A $4,432 decrease in the loss of extinguishment of debt;

and

- An $4,152 increase in fair value of derivatives mainly driven

by higher gold and silver prices, which is a non-cash item.

These positive factors were partially offset by

an increase in cost of sales of $2,362 and foreign exchange loss of

$1,292.

LIQUIDITY AND CAPITAL

RESOURCES

As at June 30, 2024, the Company had cash &

cash equivalents of $12,710 and working capital deficiency (current

assets minus current liabilities) of $75,713. The working capital

deficiency is caused by an estimated $16,844 as the current portion

of the deferred revenue only to be settled with future production

from the Project, an estimated $7,167 as the current portion of

future extraction services and the $30,944 value of the Convertible

facility, which is classified as current due to the lender’s right

to exercise the conversion option at any time at a variable

exercise price. Excluding these non-cash current liabilities, the

working capital deficiency was $20,758. In H1 2024, the Company

issued 75,803,225 common shares, 10,164,528 warrants, and granted

210,000 stock options, 28,667 Deferred Share Units. Also, 3,965,015

stock options expired or were forfeited, 151,674 RSUs were

forfeited, 13,710,500 warrants expired and 371,369 stock options,

137,533 DSUs and 303,092 RSUs were exercised in H1 2024.

The Company has negative working capital at the

end of June and was in technical non-compliance with certain

covenants. The Company obtained waivers for this non-compliance

through the end of July. After the bought deal financing closed on

July 25, 2025, the Company was back in compliance with the

covenants. If production ramp up is further delayed, the Company

may be in non-compliance with such covenants. Additional waivers or

fundings may be required.

MANAGEMENT’S OUTLOOK FOR

2024

In 2024, the Company intends to transition from

the construction of the mine and related infrastructure to the

operation of the entire site and becoming a gold producer.

The key activities and priorities for the

remainder of 2024 include:

- In order to operate the processing

plant at 2,400 tpd (100 tph) the company needs to complete the mine

development of PNL, ensuring that it, in conjunction with Big

Missouri production, supplies sufficient mill feed to the

processing plant. Management is addressing this mine development by

developing over 6 m per day at PNL continuously with anticipation

of breakthrough to the Prew ore zone in early September, but the

key challenge will be to manage the operating costs effectively

until this development is completed.

- Implementing production mining in

the A6 and A5 zones across various areas in Big Missouri which is

expected to enhance the feed grades in Q3. To allow the mine to

develop into PNL and establish production horizons, the plant will

be operated on a bi-weekly basis until such time that PNL is

contributing to the mill feed.

- In conjunction with the above, and

to continue to optimize and improve the plant and ensure it

operates continuously, management is working on a two-week

maintenance period to address the capacity of the gravity circuit

by improving the screen openings to allow more flow, optimizing CIL

management and the reliability of elution circuit, and improving

the flocculant system for the thickener to ensure clean water is

effectively circulated through the processing plant

- Completing the exploration and

infill drilling program

- Finalizing the commission of the

Moving Bed Bio-Reactor (“MBBR”) portion of the water treatment

plant

Corporate Changes

- On July 26, 2024, Ascot relocated

to the 430 – 1095 West Pender Street, Vancouver, BC V6E 2M6

(previously suite 1050);

- On July 31, 2024, David Stewart,

Ascot’s VP Corporate Development and Shareholder Communications,

resigned from the Company for personal reasons.

Qualified Person

John Kiernan, P.Eng., Chief Operating Officer of

the Company is the Company’s Qualified Person (QP) as defined by

National Instrument 43-101 and has reviewed and approved the

technical contents of this news release.

On behalf of the Board of Directors of

Ascot Resources Ltd.“Derek C. White”President &

CEO

For further information

contact:

Derek WhitePresident & CEOinfo@ascotgold.com778-725-1060

ext. 1010

About Ascot Resources Ltd.

Ascot is a Canadian mining company focused on

commissioning its 100%-owned Premier Gold Mine, which poured first

gold in April 2024 and is located on Nisga’a Nation Treaty Lands,

in the prolific Golden Triangle of northwestern British Columbia.

Concurrent with commissioning Premier towards commercial

production, the Company continues to explore its properties for

additional high-grade gold mineralization. Ascot’s corporate office

is in Vancouver, and its shares trade on the TSX under the ticker

AOT and on the OTCQX under the ticker AOTVF. Ascot is committed to

the safe and responsible operation of the Premier Gold Mine in

collaboration with Nisga’a Nation and the local communities of

Stewart, BC and Hyder, Alaska.

For more information about the Company, please

refer to the Company’s profile on SEDAR+ at www.sedarplus.ca or

visit the Company’s web site at www.ascotgold.com.

The TSX has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information

All statements and other information contained

in this press release about anticipated future events may

constitute forward-looking information under Canadian securities

laws ("forward-looking statements"). Forward-looking statements are

often, but not always, identified by the use of words such as

"seek", "anticipate", "believe", "plan", "estimate", "expect",

"targeted", "outlook", "on track" and "intend" and statements that

an event or result "may", "will", "should", "could", “would” or

"might" occur or be achieved and other similar expressions. All

statements, other than statements of historical fact, included

herein are forward-looking statements, including statements in

respect of advancement and development of the PGP and the timing

related thereto, the completion of the PGP mine, the production of

gold, the use of proceeds from our financings, our ability to

secure additional financing, our financing needs, the resolution of

commissioning challenges, the anticipated grade of mineral

production, the operation of the mill and management’s outlook for

the remainder of 2024 and beyond. These statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements, including risks

associated with uncertainties relating to the grade of mineral

deposits; the inability to resolve commissioning challenges; lack

of liquidity; being in default under our credit facilities; the

need to obtain additional financing to develop properties and

uncertainty as to the availability and terms of future financing;

the possibility of delay in exploration or development programs and

uncertainty of meeting anticipated program milestones; risks

related to exploration and potential development of Ascot's

projects; business and economic conditions in the mining industry

generally; fluctuations in commodity prices and currency exchange

rates; uncertainties relating to interpretation of drill results

and the geology and continuity of mineral deposits; the need for

cooperation of government agencies and indigenous groups in the

exploration and development of Ascot’s properties and the issuance

of required permits; uncertainty as to timely availability of

permits and other governmental approvals; and other risk factors as

detailed from time to time in Ascot's filings with Canadian

securities regulators, available on Ascot's profile on SEDAR+ at

www.sedarplus.ca including the Annual Information Form of the

Company dated March 25, 2024 in the section entitled "Risk

Factors". Forward-looking statements are based on assumptions made

with regard to: the grade of mineral production; the capacity and

operation of the mill; production results and aggregate gold sales;

the estimated costs associated with construction of the Project;

the ability to maintain throughput and production levels at the PGP

mill; the tax rate applicable to the Company; future commodity

prices; the grade of mineral resources and mineral reserves; the

ability of the Company to convert inferred mineral resources to

other categories; the ability of the Company to reduce mining

dilution; the ability to reduce capital costs; and exploration

plans. Forward-looking statements are based on estimates and

opinions of management at the date the statements are made.

Although Ascot believes that the expectations reflected in such

forward-looking statements and/or information are reasonable, undue

reliance should not be placed on forward-looking statements since

Ascot can give no assurance that such expectations will prove to be

correct. Ascot does not undertake any obligation to update

forward-looking statements, other than as required by applicable

laws. The forward-looking information contained in this news

release is expressly qualified by this cautionary statement.

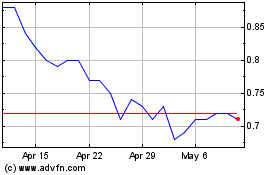

Ascot Resources (TSX:AOT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ascot Resources (TSX:AOT)

Historical Stock Chart

From Feb 2024 to Feb 2025