Ascot Resources Ltd. (TSX: AOT; OTCQX: AOTVF)

(“

Ascot” or the “

Company”)

announces that the Company has submitted a financial hardship

exemption application to the Toronto Stock Exchange (the

“

TSX”) under Section 604(e) of the TSX Company

Manual (the “

Exemption”) in respect of its

previously announced brokered private placement and senior debt

financing (collectively, the “

Financing”) to raise

approximately C$52,000,000 in total (assuming the maximum Equity

Financing (as defined below)).

The Company expects to use the proceeds from the

Financing to advance the development of the Premier Northern Lights

mine (“PNL”), restart the mill and restart the Big

Missouri mine (“BM”) from the current state of

temporary care & maintenance.

Equity Financing

The Company has entered into an agreement, as

amended, with a syndicate of agents co-led by Desjardins Capital

Markets and BMO Capital Markets (collectively the

“Agents”) with respect to a brokered private

placement, to be marketed on a best-efforts basis, of common shares

of the Company (“Common Shares”) at a price of

C$0.16 per Common Share (the “Offer Price”) for

minimum gross proceeds of C$25,000,000 and up to a maximum of

C$42,000,000 (the “Equity Financing”). Closing of

the Equity Financing is conditional on: (i) the execution of all

necessary definitive documentation in respect of the Debt Financing

(as defined below); (ii) the deposit of the proceeds of the Debt

Financing into an escrow account; and (iii) receipt of the

necessary TSX approvals and exemptions, including the

Exemption.

The Common Shares issued pursuant to the Equity

Financing will be subject to a four-month hold period in accordance

with Canadian securities law.

Senior Secured Financing

The Company has entered into non-binding term

sheets with Sprott Private Resource Streaming and Royalty (B) Corp,

(“Sprott”) and Nebari (as defined below)

(collectively, the “Secured Creditors”) with

respect to a senior secured debt financing and amendments (the

“Debt Financing”).

The Debt Financing is conditional on certain

conditions precedent required by the Secured Creditors, including

the completion of the Equity Financing for a minimum amount of

approximately C$30,000,000, successful negotiation and execution of

definitive agreements in respect of the Debt Financing and the

receipt of the necessary TSX approvals and exemptions, including

the Exemption.

With respect, the non-binding indicative term

sheet with Sprott: the Company’s existing Purchase and Sale

Agreement #1 dated January 19, 2023 will be amended to, among other

things: (i) provide an additional US$7,500,000 advance to Ascot

(the “Additional Stream Amount”); and (ii) grant

an additional gold and silver stream percentage to Sprott of 0.50%

of all payable gold and 6.80% of all payable silver (or silver

equivalent) until Ascot has delivered 8,600 ounces of gold to

Sprott, at which time such additional stream percentages shall each

be reduced by 50%. On or before December 31, 2026, the Company has

the right to repurchase (and eliminate) the Additional Stream

Amount for US$9,700,000 and if Ascot does not exercise its

repurchase right, Sprott has a right to require Ascot to repurchase

(and eliminate) the Additional Stream Amount for a 12-month period

commencing on January 1, 2027. Subject to TSX approval, the Company

has agreed to an alignment fee of US$112,500 to be paid to Sprott

in Common Shares with an issue price equal to the 5-day VWAP on the

day prior to closing of the Equity Financing (the “Sprott

Alignment Fee”).

With respect, the non-binding indicative term

sheet with Nebari Gold Fund 1, LP, Nebari Natural Resources Credit

Fund II, LP and Nebari Collateral Agent LLC (collectively,

“Nebari”), in consideration for the waiver and

forbearance by Nebari of the Company’s existing cost overrun credit

agreement dated February 20, 2024 (the “COF”) and

credit agreement dated June 16, 2023, as amended on February 20,

2024 (the “Convertible Facility”), the COF will be

amended as follows:

- interest under

the COF shall be increased from 10.0% to 10.5% above SOFR;

- all interest and

amortisation payments due under the COF from September 2024 until

May 31, 2025, will be deferred and capitalized as part of the

outstanding principal (the “Deferred

Payments”);

- commencing on

May 31, 2025, the Deferred Payments will be payable in 10 monthly

instalments ending in February 2026, which payments will be in

addition to any regular interest payments being met; and

- an alignment fee

equal to US$1,000,000 will be paid in Common Shares at the Offer

Price on execution of definitive agreements (the “Nebari

Alignment Fee”).

Further, the terms of the Convertible Facility

will be amended as follows:

- all interest

payments payable during the period from September 2024 to May 2025

will be deferred and capitalized as part of the outstanding

principal, consistent with the terms of the COF;

- all capitalized

interest from the period September 2024 until May 31, 2025, will be

payable quarterly over the following 4 quarters, from May 2025 to

February 2026 (in addition to regular interest payments

owing);

- the conversion

price under the Convertible Facility for principal and interest

will be amended to C$0.192 (such amount representing a 20% premium

to the Offer Price), and the forced conversion option for Ascot

will be removed; and

- the Convertible

Facility will continue to be promoted into the senior position upon

repayment of the COF.

In addition, the exercise price of existing

warrants held by Nebari will be amended to C$0.192 (such amount

representing a 20% premium to the Offer Price).

The Debt Financing shall be pari passu with the

Company’s current stream security. The proceeds from the Debt

Financing will be deposited into an escrow account and released

following the satisfaction of certain key performance indicators

and receipt of any regulatory approvals and a non-appealable court

order, to the extent required, to establish the seniority of the

stream.

TSX Exemption from Shareholder Approval

Requirement1

Absent the Exemption, the Financing would

require the approval from the holders of a majority of the issued

and outstanding Common Shares, on a disinterested basis, excluding

the vote of Ccori Apu S.A.C (“Ccori Apu”), Equinox

Partners LLC (“Equinox Partners”) and any

subscribers under the Equity Financing.

Section 604(a)(i) of the TSX Company Manual

states that shareholder approval is required where a transaction

would materially affect control of the Company. Ccori Apu’s

participation in the Equity Financing is expected to materially

affect control of the Company since they will hold greater than 20%

of the issued and outstanding Common Shares upon closing of the

Financing. Prior to the Financing, Ccori Apu held 131,300,000

Common Shares and 10,500,000 warrants to purchase Common Shares,

representing 19.70% ownership, calculated on a partially diluted

basis in accordance with National Instrument 62-104, 18.52% on a

non-diluted basis or 16.15% ownership on a fully diluted basis. In

connection with the Equity Financing, Ccori Apu is expected to

acquire 86,250,000 Common Shares. Following the Financing, Ccori

Apu would then hold 217,550,000 Common Shares and 10,500,000

warrants to purchase Common Shares, representing 23% ownership,

calculated on a partially diluted basis in accordance with National

Instrument 62-104, 22.18% on a non-diluted basis or 18.30%

ownership on a fully diluted basis.

Section 607(g)(i) of the TSX Company Manual

states that shareholder approval is required where the number of

listed securities issuable exceeds 25% of the number of shares

issued and outstanding prior to the transaction. The aggregate

number of Common Shares made issuable in connection with the

Financing is greater than 25% of the number of issued and

outstanding Common Shares as of the date hereof. The maximum amount

of 262,500,000 Common Shares to be issued upon closing of the

Equity Financing, on its own, would represent 37.02% of the issued

and outstanding Common Shares as of the date hereof. The estimated

aggregate of 155,554,796 Common Shares issued or issuable under the

Debt Financing, with approximately 146,226,416 Common Shares

issuable upon conversion of the Convertible Facility, approximately

8,636,250 Common Shares issued to Nebari for the Nebari Alignment

Fee and approximately 692,130 Common Shares issued to Sprott for

the Sprott Alignment Fee, on its own, would represent 21.94% of the

issued and outstanding Common Shares as of the date hereof. As a

result, the aggregate number of Common Shares made issuable in

connection with the Financing would represent 58.95% of the issued

and outstanding Common Shares as of the date hereof. If the maximum

number of Common Shares issuable pursuant to the conversion of the

Convertible Facility, being 155,000,000 (instead of the estimated

146,226,416 Common Shares used in this section), were issued, the

aggregate number of Common Shares made issuable in connection with

the Financing would represent 60.19% of the issued and outstanding

Common Shares as of the date hereof. For the purposes of the TSX

Company Manual, the amendment to the Convertible Facility is

treated as a new private placement. As a result, the above

calculations do not take into account the potential dilution

already represented by the Convertible Facility prior to the Debt

Financing. Prior to the closing of the Financing, full conversion

of the Convertible Facility represents potential dilution of 6.61%

of the Common Shares on an otherwise non-diluted basis. Following

the closing of the Financing, full conversion of the Convertible

Facility will represent potential dilution of 12.97% on an

otherwise non-diluted basis. In aggregate, an estimated additional

367,896,662 Common Shares will be issued or made issuable in

connection with the Financing, representing potential dilution of

41.9% to holders of Common Shares as of the date hereof, on a fully

diluted basis. If the maximum number of Common Shares issuable

pursuant to the conversion of the Convertible Facility, being

155,000,000 (instead of the estimated 146,226,416 Common Shares

used in this section), an estimated additional 376,670,246 Common

Shares will be issued or made issuable in connection with the

Financing, representing potential dilution of 42.48% to holders of

Common Shares as of the date hereof, on a fully diluted basis.

Section 607(g)(ii) of the TSX Company Manual

states that shareholder approval is required for the issuance to

insiders of shares in excess of 10% of the issued and outstanding

Common Shares during any six-month period. Insider participation in

the Equity Financing will result in insiders having acquired

greater than 10% of the issued and outstanding Common Shares of the

Company in a six-month period. On July 25, 2024, Ccori Apu acquired

10,500,000 Common Shares and 10,500,000 warrants to purchase Common

Shares. In connection with the Equity Financing, Ccori Apu will

acquire 86,250,000 Common Shares. On July 25, 2024, Equinox

Partners acquired 1,499,000 Common Shares and 1,499,000 warrants to

purchase Common Shares. In connection with the Equity Financing,

Equinox Partners will acquire 75,000,000 Common Shares. In

connection with the Equity Financing, certain directors and

officers of the Company will acquire 830,000 Common Shares.

Following closing of the Financing, Ccori Apu will have acquired

15.31% of the Common Shares outstanding as of July 25, 2024,

calculated on a non-diluted basis, or 16.97% of the Common Shares

outstanding as of July 25, 2024, calculated assuming exercise of

their warrants (for certainty, without giving effect to the

exercise of any warrants). Following closing of the Financing,

Equinox Partners will have acquired (excluding open market

purchases) 12.11% of the Common Shares outstanding as of July 25,

2024, calculated on a non-diluted basis, or 12.34% of the Common

Shares outstanding as of July 25, 2024, calculated assuming

exercise of their warrants (for certainty, without giving effect to

the exercise of any warrants). Following closing of the Financing,

directors and officers will have acquired 0.13% of the Common

Shares outstanding as of July 25, 2024, calculated on a non-diluted

basis. In aggregate, insiders will have acquired 27.55% of the

Common Shares outstanding as of July 25, 2024, calculated on a

non-diluted basis, or 29,45% of the Common Shares outstanding as of

July 25, 2024, calculated assuming exercise of Ccori Apu and

Equinox Partners’ warrants (for certainty, without giving effect to

the exercise of any warrants).

Section 607(e) of the TSX Company Manual states

that shareholder approval is required if the price per share is

lower than the market price (as defined by TSX) less the applicable

discount. The Equity Financing and the Debt Financing were

announced concurrently and, pursuant to the rules and polices of

the TSX, the 5-day VWAP on such date may not represent market price

(as defined by TSX). As a result, the Offer Price of the Equity

Financing and the price of the Common Shares issuable to Nebari for

the Nebari Alignment Fee may represent a price per Common Share

that is lower than the market price (as defined by TSX) less the

applicable discount pursuant to the TSX Company Manual.

Section 607(i) of the TSX Company Manual states

that shareholder approval is required where warrants to purchase

shares are issued with a warrant exercise price that is less than

the market price (as defined by TSX) of the underlying share.

Section 610(a) of the TSX Company Manual states that shareholder

approval is required where the basis for determining the conversion

price of a convertible security could result in a conversion price

lower than (i) either of, but not the lower of, market price (as

defined by TSX) less the applicable discount, at the time of

issuance of the convertible security or at the time of conversion

of such security; or (ii) the lower of market price (as defined by

TSX), without any applicable discount, at the time of the issuance

of convertible security or at the time of conversion of such

security. While both the exercise price for the amended Nebari

warrants and the conversion price for the amended Convertible

Facility represent a 20% premium to the Offer Price, since the

Equity Financing and the Debt Financing were announced

concurrently, pursuant to the rules and polices of the TSX, the

5-day VWAP on such date may not represent market price (as defined

by TSX). In addition, interest that has already accrued, or will

accrue in the future, on the principal amount of the Convertible

Facility will be convertible for Common Shares at a 20% premium to

the Offer Price, which may be less than the market price (as

defined by TSX) at the time accrued interest was or will be

capitalized and Common Shares became or become issuable on

conversion of such interest.

The Company has applied to the TSX, pursuant to

the provisions of Section 604(e) of the TSX Company Manual, for a

“financial hardship” exemption from these requirements to obtain

shareholder approval, on the basis that the Company is in serious

financial difficulty and the Financing is designed to address these

financial difficulties in a timely manner.

The board of directors of the Company (the

“Board”) has established a special committee of

independent directors, free from any material interest in the

Financing and unrelated to the parties to the Financing (the

“Special Committee”) to consider and assess the

Company’s financial situation and the Company’s proposed

application to the TSX for the Exemption.

The Special Committee has considered and

reviewed the circumstances currently surrounding the Company and

the Financing including, among other factors: the Company's current

financial difficulties and immediate capital requirements; the lack

of alternate financing arrangements available; and the fact that

the Financing is the only viable financing option at the present

time. The Special Committee has considered and assessed the

Company’s financial situation and the proposed application for the

Exemption, and made a unanimous recommendation to the Board that

the Company make the application to the TSX for the Exemption. The

Board, upon the recommendation of the Special Committee, has

determined that: (i) Ascot is in serious financial difficulty; (ii)

the Financing is designed to improve Ascot’s financial situation

and (iii) based on the determination of the Special Committee, the

Financing is reasonable for Ascot in the circumstances.

The Company’s current financial difficulties are

based on a number of factors since January 22, 2024, when the

Company stated in its LIFE exemption document that it reasonably

believed it raised sufficient funds to meet its business objectives

and liquidity requirements for a period of 12 months following such

offering.

The Company has historically relied upon a

combination of new capital through equity and debt markets to meet

its financial obligations. The Company poured first gold at its

mineral project in April 2024 but has not generated sufficient

revenue from operations to offset a number of adverse events that

have occurred over the last several months.

On August 9, 2024, the Company announced that

the commissioning process had gone slower that expected due to a

combination of challenges with the process plant and lower grades

from the development ore from BM.

On September 6, 2024, the Company announced the

amount of mine development at BM had fallen behind schedule by

approximately one to two months, and with the delay in the start of

the PNL ramp from July to December of 2023, this delayed the PNL

production. As a result, the number of stoping areas was not

sufficient to provide enough production to adequately feed the

mill. Although the Company was on track for first development ore

at PNL in September, it determined that further development was

required to access deeper ore than was initially planned, and to

extend the timing to complete the development and ramp up of PNL.

The Company decided, after careful consideration, that to enable

sufficient mine development, it would suspend operations.

The Company is required to comply with certain

financial and non-financial covenants under the Company’s COF and

Convertible Facility, which, if violated, could result in the

amounts borrowed being due and payable to Nebari on demand.

The Company is party to purchase and sale

agreements dated as of January 19, 2023 (the “Purchase and

Sale Agreements”). The Purchase and Sale Agreements

require that the Company deliver certain amounts of refined gold

and refined silver to Sprott. Pursuant to the terms the Purchase

and Sale Agreements, the Company is required to maintain certain

financial and non-financial covenants, which, if violated, could

result Sprott demanding all amounts and deliveries owing and

demanding payment of all losses, including the greater of a

specified early termination amount or the net present value of the

Purchase and Sale Agreements.

As of the date hereof, the aggregate amount of

the uncredited balance under the Purchase and Sale Agreements is

approximately US$127,000,000.

As of the date hereof, US$37,000,000 is

outstanding (including accrued interest and fees) under the COF and

Convertible Facility.

The Company is not currently generating

sufficient cash from its operations to fund the payment of interest

under the COF and Convertible Facility and to otherwise meet its

financial and non-financial obligations under the Purchase and Sale

Agreements, the COF and Convertible Facility. The Company’s ability

to meet these obligations are at risk given the Company’s mining

operations are currently on care and maintenance.

The Company’s Secured Creditors have extended

the waiver and forbearance agreements previously granted relating

to certain additional pre-existing defaults and potential future

defaults under the Purchase and Sale Agreements, the COF and

Convertible Facility until November 18, 2024.

Upon expiry of such temporary waivers, the

Secured Creditors can enforce the repayment of the amounts

outstanding upon the expiry of the current waivers, which

obligation the Company will not have the ability to meet given its

current cash available.

As part of the transactions, the Company’s

Secured Creditors would extend their existing waiver and

forbearance conditions until May 31, 2025.

The Company’s vendors are currently owed

approximately C$27,000,000 and such amount continues to increase.

Additionally, C$2,000,000 of the Company’s accounts payable are

over 90 days past due.

All of the factors described above have

contributed to placing Ascot in its current situation of serious

financial difficulty.

There can be no assurance that the TSX will

accept the application for the Exemption. The Company expects that

as a consequence of its application and intention to rely on the

Exemption, the TSX will place the Company’s listing of its Common

Shares under delisting review, which is customary practice when a

listed issuer seeks to rely on the Exemption. No assurance can be

provided as to the outcome of such review and therefore continued

qualification for listing of the Common Shares on the TSX. The

Company may delist from the TSX and pursue an alternative listing

on the TSX Venture Exchange.

Assuming TSX conditional approval for the

Financing and the Exemption is obtained, it is anticipated that the

Financing will be completed on or about November 18, 2024.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of the securities in the United States or in any other

jurisdiction in which such offer, solicitation or sale would be

unlawful. The securities offered have not been, and will not be,

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”) or any U.S.

state securities laws, and may not be offered or sold in the United

States or to, or for the account or benefit of, United States

persons absent registration or any applicable exemption from the

registration requirements of the U.S. Securities Act and applicable

U.S. state securities laws.

Qualified Person

John Kiernan, P.Eng., Chief Operating Officer of

the Company is the Company’s Qualified Person (QP) as defined by

National Instrument 43-101 and has reviewed and approved the

technical contents of this news release.

On behalf of the Board of Directors of

Ascot Resources Ltd.

“Derek C. White”

President & CEO, Director

For further information contact:

Kristina HoweVP, Communicationsinfo@ascotgold.com

Tel : 778-725-1060

About Ascot

Ascot is a Canadian mining company headquartered

in Vancouver, British Columbia, and its shares trade on the TSX

under the ticker AOT and on the OTCQX under the ticker AOTVF. Ascot

is the 100% owner of the Premier Gold Mine, which poured first gold

in April 2024 and is located on Nisga’a Nation Treaty Lands, in the

prolific Golden Triangle of northwestern British Columbia.

For more information about the Company, please

refer to the Company’s profile on SEDAR+ at www.sedarplus.ca or

visit the Company’s web site at www.ascotgold.com.

The TSX has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information

All statements and other information contained

in this press release about anticipated future events may

constitute forward-looking information under Canadian securities

laws ("forward-looking statements").

Forward-looking statements are often, but not always, identified by

the use of words such as "seek," "anticipate," "believe," "plan,"

"estimate," "expect," "targeted," "outlook," "on track" and

"intend" and statements that an event or result "may," "will,"

"should," "could," "would" or "might" occur or be achieved and

other similar expressions. All statements, other than statements of

historical fact, included herein are forward-looking statements,

including statements in respect of the terms and conditions of the

Financing, the ability to raise additional funds and any future

financing, the completion of the Financing, details in respect of

participation in the Financing and anticipated dilution, the future

performance, defaults and obligations of Ascot under agreements

with the Secured Creditors; future waivers or forbearance

agreements relating to such agreements, including any discussions

with the Secured Creditors; the anticipated use of proceeds from

the Financing and the ability of the Company to accomplish its

business objectives and the intentions described herein, the TSX’s

remedial delisting review of the Common Shares and future plans,

development and operations of the Company. These statements involve

known and unknown risks, uncertainties and other factors that may

cause actual results or events to differ materially from those

anticipated in such forward-looking statements, including risks

related to whether the Financing will be completed on the terms

described or at all; business and economic conditions in the mining

industry generally; fluctuations in commodity prices and currency

exchange rates; uncertainty of estimates and projections relating

to development, production, costs and expenses, and health, safety

and environmental risks; uncertainties relating to interpretation

of drill results and the geology, continuity and grade of mineral

deposits; the need for cooperation of government agencies and

indigenous groups in the exploration and development of Ascot’s

properties and the issuance of required permits; the need to obtain

additional financing to finance operations and uncertainty as to

the availability and terms of future financing; the possibility of

delay in future plans and uncertainty of meeting anticipated

program milestones; uncertainty as to timely availability of

permits and other governmental approvals; the need for TSX

approval, including pursuant to financial hardship exemptions, and

other regulatory approvals and other risk factors as detailed from

time to time in Ascot's filings with Canadian securities

regulators, available on Ascot's profile on SEDAR+ at

www.sedarplus.ca including the Annual Information Form of the

Company dated March 25, 2024, in the section entitled "Risk

Factors". Forward-looking statements are based on assumptions made

with regard to: the estimated costs associated with the care and

maintenance plans; the ability to maintain throughput and

production levels at BM and PNL; the tax rate applicable to the

Company; future commodity prices; the grade of mineral resources

and mineral reserves; the ability of the Company to convert

inferred mineral resources to other categories; the ability of the

Company to reduce mining dilution; the ability to reduce capital

costs; the ability of the Company to raise additional financing;

compliance with the covenants in Ascot’s credit agreements; and

exploration plans. Forward-looking statements are based on

estimates and opinions of management at the date the statements are

made. Although Ascot believes that the expectations reflected in

such forward-looking statements and/or information are reasonable,

undue reliance should not be placed on forward-looking statements

since Ascot can give no assurance that such expectations will prove

to be correct. Ascot does not undertake any obligation to update

forward-looking statements, other than as required by applicable

laws. The forward-looking information contained in this news

release is expressly qualified by this cautionary statement.

1 For the purposes of this section, the Company

has assumed: (i) the market price (as defined by TSX) prior to

closing of the Financing will be C$0.2246, which represents the

30-day VWAP as of 11/6/2024; (ii) a USD to CAD exchange rate of

1.3818, which represents the 30-day average reported by the Bank of

Canada as of 11/6/2024; (iii) that interest on the Convertible

Facility will accrue based on a SOFR forecast rate of 3.809425%;

(iv) 146,226,416 Common Shares are issuable upon full conversion of

the Convertible Facility; and (v) the Company will issue

262,500,000 Common Shares pursuant to the Equity Financing. The

numerical values in this section may change if these assumptions

are incorrect, provided, however, that in respect of (iv), the

maximum number of Common Shares issuable pursuant to conversion of

the Convertible Facility shall not exceed 155,000,000.

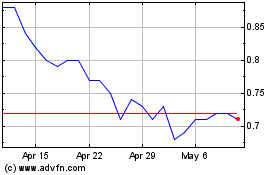

Ascot Resources (TSX:AOT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ascot Resources (TSX:AOT)

Historical Stock Chart

From Feb 2024 to Feb 2025