Allied Properties REIT (TSX: AP.UN) today announced results for its

fourth quarter and year ended December 31, 2010. Allied also

provided a further update on its preparation for adoption of

International Financial Reporting Standards ("IFRS").

"2010 was pivotal for Allied Properties REIT," said Michael

Emory, President & CEO. "At the operations level, we moderated

our lease-maturity schedule and continued to demonstrate publicly

the durability of our asset class. At the asset level, we

accelerated our value-creation activities and propelled our urban

office platform to a national scale. At the management level, we

bolstered and realigned our leadership team with a view to

facilitating our next phase of evolution and growth."

Leasing

Allied leased over 1.1 million square feet of space in 2010, a

full 18% of its entire rental portfolio. With that and subsequent

leasing, it has reduced lease-maturities in the next three year by

12% and reduced the average annual amount of lease-maturity in the

next five years to 9.8% of its portfolio.

Allied finished 2010 with leased area of 91.4%, having renewed

or replaced 72% of the leases that matured over the course of the

year, in most cases at net rental rates equal to or above in-place

rents. This resulted in a slight overall increase in net rental

income per square foot for the affected space.

Allied decided mid-year not to renew a large lease at Cite

Multimedia, which resulted in the temporary decline in its leased

area at year-end. Allied re-leased one and one-half of the six

office floors affected to an existing tenant, SAP Labs, for a term

of 10 years commencing September 1, 2010. This left Allied with

four and one-half floors to fill as 2011 got underway. It has since

leased two floors to a high-profile new tenant for a term of 10

years commencing on January 1, 2012, leaving it with two and

one-half floors to fill. Allied is well advanced in negotiations

with another new tenant with a two-floor requirement and another

existing tenant with a one-floor expansion requirement. Allied will

only be able to accommodate one of these requirements, which will

leave it with a small amount of residual space to re-lease. The

annual net rental rates achieved or under negotiation fully

validate Allied's decision last year not to renew the large

lease.

Financial Results

The financial results for 2010 are summarized below and compared

to 2009:

(In thousands except for per

unit and % amounts) 2010 2009 Change %Change

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Net income 18,540 16,299 2,241 13.7%

Management restructuring costs 1,407 - 1,407 -

Normalized net income 19,947 16,299 3,648 22.4%

Funds from operations ("FFO") 65,529 57,429 8,100 14.1%

FFO per unit (diluted) $1.63 $1.73 ($0.10) (5.8%)

FFO pay-out ratio 80.6% 76.2% 4.4%

Normalized FFO 66,936 57,429 9,507 16.6%

Normalized FF0 per unit

(diluted) $1.67 $1.73 ($0.06) (3.5%)

Normalized FFO pay-out ratio 78.9% 76.2% 2.7%

Adjusted FFO ("AFFO") 48,674 50,564 (1,890) (3.7%)

AFFO per unit (diluted) $1.21 $1.52 ($0.31) (20.4%)

AFFO pay-out ratio 108.5% 86.5% 22.0%

Normalized AFFO 50,081 50,564 (483) (1.0%)

Normalized AFFO per unit

(diluted) $1.25 $1.52 ($0.27) (17.8%)

Normalized AFFO pay-out ratio 105.4% 86.5% 18.9%

---------------------------------------------------------------------------

Debt ratio 47.9% 47.0% 0.9%

---------------------------------------------------------------------------

Allied incurred restructuring costs in 2010 in connection with

reconfiguring its leadership team. In addition to the normal

presentation, Allied's key financial performance measures have also

been provided and on a normalized basis as though the restructuring

costs were not incurred.

The financial results for the fourth quarter are summarized

below and compared to the prior quarter and the same quarter in

2009:

(In thousands except for per unit

and % amounts) Q4 2010 Q3 2010 Change %Change

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Net income 3,889 5,462 (1,573) (28.8%)

Management restructuring costs 1,407 - 1,407 -

Normalized net income 5,296 5,462 (166) (3.0%)

Funds from operations ("FFO") 16,292 16,486 (194) (1.2%)

FFO per unit (diluted) $0.39 $0.41 ($0.02) (4.9%)

FFO pay-out ratio 85.0% 80.1% 4.9%

Normalized FFO 17,699 16,486 1,213 7.4%

Normalized FF0 per unit (diluted) $0.42 $0.41 $0.01 2.4%

Normalized FFO pay-out ratio 78.3% 80.1% (1.8%)

Adjusted FFO ("AFFO") 10,881 11,472 (591) (5.2%)

AFFO per unit (diluted) $0.26 $0.29 ($0.03) (10.3%)

AFFO pay-out ratio 127.3% 115.1% 12.2%

Normalized AFFO 12,288 11,472 816 7.1%

Normalized AFFO per unit (diluted) $0.29 $0.29 $0.00 0.0%

Normalized AFFO pay-out ratio 112.7% 115.1% (2.4%)

---------------------------------------------------------------------------

Debt ratio 47.9% 46.1% 1.8%

---------------------------------------------------------------------------

(In thousands except for per unit

and % amounts) Q4 2010 Q4 2009 Change %Change

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Net income 3,889 4,684 (795) (17.0%)

Management restructuring costs 1,407 - 1,407 -

Normalized net income 5,296 4,684 612 13.1%

Funds from operations ("FFO") 16,292 16,092 200 1.2%

FFO per unit (diluted) $0.39 $0.41 ($0.02) (4.9%)

FFO pay-out ratio 85.0% 79.8% 5.2%

Normalized FFO 17,699 16,092 1,607 10.0%

Normalized FF0 per unit (diluted) $0.42 $0.41 $0.01 2.4%

Normalized FFO pay-out ratio 78.3% 79.8% (1.5%)

Adjusted FFO ("AFFO") 10,881 13,261 (2,380) (17.9%)

AFFO per unit (diluted) $0.26 $0.34 ($0.08) (23.5%)

AFFO pay-out ratio 127.3% 96.8% 30.5%

Normalized AFFO 12,288 13,261 (973) (7.3%)

Normalized AFFO per unit

(diluted) $0.29 $0.34 ($0.05) (14.7%)

Normalized AFFO pay-out ratio 112.7% 96.8% 15.9%

---------------------------------------------------------------------------

Debt ratio 47.9% 47.0% 0.9%

---------------------------------------------------------------------------

The higher than normal AFFO pay-out ratios stemmed directly from

our leasing success in 2010 and the corresponding abnormal level of

leasing expenditures.

Value-Creation

Allied creates value for its unitholders by upgrading rental

properties, by putting properties to a higher and better use

(redevelopment) or by expanding properties to utilize more fully

the density permitted on the underlying land (intensification). In

2010, Allied accelerated its value-creation activity as part of an

ongoing effort to build a value-creation pipeline that in time will

make a recurring, annual contribution to the growth of its

business.

Allied acquired 645 Wellington Street in Montreal and rapidly

initiated an upgrade and re-leasing program that will boost NOI and

add value to the property. With respect to redevelopment, it

completed the retrofit necessary to put 60,000 square feet of space

at 905 King Street West in Toronto to a higher and better use,

significantly increasing its income generating potential, and

completed the transformation of 47 and 47A Fraser Avenue and 544

King Street West in Toronto. With respect to intensification, it

initiated the pre-leasing of QRC West, Phase I, met the

requirements for site-plan approval and moved steadily toward the

completion of building-permit drawings. Allied expects to be in a

position to commence construction as early as the second quarter of

this year.

Portfolio Growth

Allied completed $104 million in acquisitions in 2010. Late in

the year, it completed its first acquisitions in downtown Calgary

and downtown Vancouver, establishing solid footholds there and

effectively propelling its urban office platform to a national

scale.

Leadership Team

From inception, Allied's management team has been an integral

part of its platform. In slightly over eight years, it helped

propel Allied's business from a small, local portfolio of

specialized office assets to one of the leading downtown office

platforms in Canada. Going forward, Allied is determined to

maintain a high rate of growth, broaden and deepen its platform and

accelerate its value-creation activities. To facilitate these

ambitious goals, Allied systematically bolstered and realigned its

leadership team in 2010.

Peter Sweeney joined as Vice President and Chief Financial

Officer, and Tom Burns joined as Executive Vice President,

Operations and Leasing, each bringing an exceptional range of

capabilities and highly developed leadership skills to Allied's

business. Wayne Jacobs, a long-standing member of the leadership

team, was appointed Executive Vice President, Acquisitions. In

addition to remaining involved with leasing on a transitional

basis, Wayne will allocate progressively more of his time to

acquisitions. Jennifer Irwin also joined Allied's leadership team

as Vice President, Human Resources and Communications.

International Financial Reporting Standards

Allied has chosen the "Fair Value" approach to investment

properties for its going-forward IFRS financial statements. This

accounting policy choice means that, starting in 2011, investment

properties will be recorded at fair value on the Statement of

Financial Position. Periodic changes in fair value will be recorded

in the Statement of Operations. This could lead to increased

volatility in reported net income and net income per unit but

should not impact FFO or AFFO.

As part of its preparation for the adoption of IFRS, Allied

completed an external valuation of its portfolio as at December 31,

2009, indicating an un-audited value of $1.3 billion, and an

external valuation of its portfolio as at December 31, 2010,

indicating an un-audited value of $1.55 billion. $104 million of

the year-over-year increase resulted from acquisitions, with the

remaining $146 million resulting from appreciation in value. In

establishing the un-audited value at the end of 2010, the appraiser

used capitalization rates ranging from 6% to 9.3%, with the

high-point being the capitalization rate associated with 151 Front

Street West in Toronto. The weighted average capitalization rate

for the portfolio was 7.9%.

Cautionary Statements

FFO and AFFO are not financial measures defined by Canadian

GAAP. Please see Allied's MD&A for a description of these

measures and their reconciliation to net income or cash flow from

operations, as presented in Allied's consolidated financial

statements for the quarter and year ended December 31, 2010. These

statements, together with accompanying notes and MD&A, have

been filed with SEDAR, www.sedar.com, and are also available on

Allied's web-site, www.alliedpropertiesreit.com.

This press release may contain forward-looking statements with

respect to Allied, its operations, strategy, financial performance

and condition. These statements generally can be identified by use

of forward looking words such as "may", "will", "expect",

"estimate", "anticipate", intends", "believe" or "continue" or the

negative thereof or similar variations. Allied's actual results and

performance discussed herein could differ materially from those

expressed or implied by such statements. Such statements are

qualified in their entirety by the inherent risks and uncertainties

surrounding future expectations, including that the transactions

contemplated herein are completed. Important factors that could

cause actual results to differ materially from expectations

include, among other things, general economic and market factors,

competition, changes in government regulations and the factors

described under "Risk Factors" in the Allied's Annual Information

Form which is available at www.sedar.com. The cautionary statements

qualify all forward-looking statements attributable to Allied and

persons acting on its behalf. Unless otherwise stated, all

forward-looking statements speak only as of the date of this press

release, and Allied has no obligation to update such

statements.

Allied Properties REIT is a leading owner, manager and developer

of urban office environments that enrich experience and enhance

profitability for business tenants operating in Canada's major

cities. Its objectives are to provide stable and growing cash

distributions to unitholders and to maximize unitholder value

through effective management and accretive portfolio growth.

Contacts: Allied Properties REIT Michael R. Emory President and

Chief Executive Officer (416) 977-9002

memory@alliedpropertiesreit.com

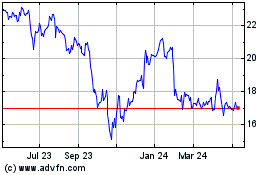

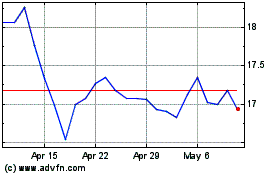

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024