Axis Provides Business Update and Announces Closing of $2.67 Million Private Placement of Unsecured Subordinated Debentures

12 September 2023 - 7:01AM

Axis Auto Finance Inc. ("

Axis" or the

"

Company") [TSX: AXIS], a financial technology

company changing the way Canadians purchase and finance used

vehicles, is pleased to provide a business update and announce the

closing of a private placement (the "

Private

Placement") of unsecured subordinated debentures (the

"

Debentures").

Business Update

Over the last 12 months, elevated inflation

levels, supply chain disruption and rapidly rising interest rates

have created challenges in the non-prime auto finance market.

Inflation resulted in more borrower defaults leading to higher

credit loss rates, supply chain issues affected vehicle

availability as well as affordability and rising interest rates

increased borrowing costs.

Axis has responded to these challenges

implementing certain initiatives, including, but not limited

to:

- Increased pricing on new

originations to compensate for the increase in the cost of

borrowing

- Adjust underwriting criteria to

reflect elevated credit risks due to inflation

- Streamline operations by exiting

certain markets and discontinuing non-performing product lines

- Cut costs through workforce

reductions and decreases to executive pay

- Continue to improve operational

efficiencies through process automation

Management of Axis is continuously monitoring

portfolio and company performance and is committed to additional

changes, if required. This process ensures that Axis is well

positioned to withstand current macroeconomic challenges and thrive

in the future.

Closing of $2.67 Million Private

Placement of Unsecured Subordinated Debentures

The Company also announced today that it has

completed a private placement financing of $2.67 million principal

amount of Debentures. The Debentures mature on September 30, 2025

(the "Maturity Date") and carry an annual interest

rate of 12%, accrued and payable quarterly in arrears on each March

31, June 30, September 30 and December 31, in cash. Subject to

certain conditions, the Company will have the right to prepay any

or part of the Debentures at any time prior to the Maturity Date by

paying the principal amount and accrued and unpaid interest. The

principal amount of the Debentures is not convertible into common

shares or any other securities of the Company.

In addition to the Debentures, the Company has

issued to subscribers an aggregate of 12,015,000 common share

purchase warrants (the "Warrants"), each of which

entitles the holder thereof to purchase one common share of the

Company (collectively, the "Warrant Shares") at an

exercise price of $0.16 per share for a period of three years from

the date of issuance.

The Debentures, Warrants and Warrant Shares are

subject to a four-month statutory hold period commencing on the

date of their issuance. An aggregate of $600,000 principal amount

of the Debentures and 2,700,000 Warrants were purchased by officers

and directors of the Company and are exempt from the formal

valuation and minority approval provisions of National Instrument

61-101 – Protection of Minority Security Holder in Special

Transactions.

The Company intends to use the net proceeds from

the Private Placement to refinance existing indebtedness.

About Axis Auto Finance

Axis is a financial technology company changing

the way Canadians buy and finance used vehicles. Through our

direct-to-consumer portal, DriveAxis.ca, customers can choose their

next used vehicle, arrange financing, and get the car delivered to

their home. In addition, the company continues to grow B2B

non-prime auto loan originations by delivering innovative

technology solutions and superior service to its Dealer Partner

Network. All Axis auto loans report to Equifax, resulting in over

70% of customers seeing a significant improvement of their credit

scores. Further information on the Company can be found at

https://www.axisfinancegroup.com/investors-press-releases/.

The TSX Exchange has neither approved nor

disapproved the contents of this press release. Neither the

Exchange nor its Regulation Services Provider (as that term is

defined in the policies of the Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Axis Auto Finance Inc.Todd Hudson CEO (416)

633-5626ir@axisautofinance.com

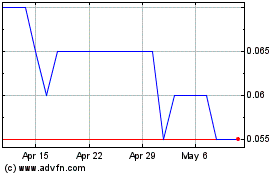

Axis Auto Finance (TSX:AXIS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Axis Auto Finance (TSX:AXIS)

Historical Stock Chart

From Jan 2024 to Jan 2025