Axis Auto Finance Inc. (“Axis” or the “Company”) (TSX: AXIS), is

pleased to announce that further to its press releases dated August

20, 2024 and May 15, 2024, the Company and its operating

subsidiaries involved in the Company's auto finance business have

entered into an asset purchase agreement with Fionic Canada Ltd.

("Fionic") and an affiliate of Fionic in respect of their

acquisition of the auto loan assets and undertaking of Axis through

the acquisition of certain assets and assumption of certain

liabilities of Axis and it subsidiaries relating to the Company's

auto finance business. The base purchase price for the assets is

approximately $114,000,000 (subject to adjustments for changes in

the composition of the auto loans assets and fair market value of

inventory since December 31, 2023). Fionic is an arm's length party

to Axis and its affiliates and the transaction was negotiated on an

arm's length basis.

The Company intends to mail a management information circular

("Circular") to shareholders in connection with a shareholders

meeting to be held in connection with the approval of the proposed

transaction in the coming weeks and expects to hold a meeting of

shareholders in late November. Additional details regarding the

terms and conditions of the transaction as well as the rationale

for the approvals made by the Special Committee and the Board will

be set out in the Circular which, together with the asset purchase

agreement, will be available under the Company's SEDAR+ profile at

www.sedarplus.ca.

Special Committee and Board Approval

The Company formed a special committee led by Wes Neichenbauer

and composed of two other independent directors of the Company to

assist with the Company's strategic review and the review of the

proposed transaction. After receiving a fairness opinion from Evans

& Evans, Inc. ("Evans & Evans"), with respect to the

consideration being received in respect of the proposed

transaction, the Special Committee unanimously recommended that the

board of directors of the Company (the "Board") approve the

proposed transaction. After receiving the fairness opinion from

Evans & Evans, legal and financial advice, the recommendation

of the Special Committee and after taking into account the

alternatives available to the Company, the Board unanimously

determined that the proposed transaction is in the best interests

of the Company and is fair to the Company's securityholders.

Shareholder and Debenture Holder Approval

Given that the proposed transaction involves the sale of all or

substantially all of the Company's assets, the transaction will

require the approval of two-thirds of votes cast by shareholders of

the Company at a meeting expected to be held in early December. In

connection with the execution of the agreement Axis has obtained

voting support agreements from the holders of approximately 47% of

the Company's outstanding shares pursuant to which they have

agreed, subject to the terms thereof, to vote in favour of the

proposed transaction.

In addition, as a condition to the closing of the transaction

the Company has obtained the approval of the requisite majority of

the holders of its outstanding debentures to revise the terms of

such debentures to provide for a redemption right that will allow

the Company to redeem the outstanding debentures (if the proposed

transaction closes on or before December 31, 2024) in exchange for

a payment equal to the outstanding interest owing up to the

redemption date and further payments against principal of between

80-85% percent of the principal amount thereof. The debentures at

issue are both the unsecured subordinated debentures issued on

September 11, 2023 (the "September 2023 Debentures") and the

7.5% Extendible Unsecured Convertible Subordinated Debentures

issued in April 2018 (the "April 2018 Debentures").

At present it is not anticipated that there will be any assets

remaining for shareholders following the repayment of amounts owing

to the Company's creditors and it is expected that the Company's

common shares will be delisted from the Toronto Stock Exchange

shortly following the closing.

Fairness Opinion

The Special Committee retained Evans & Evans to provide a

fairness opinion with respect to the fairness of the proposed

transaction from a financial standpoint to Axis and the

shareholders of Axis. Evans & Evans provided an opinion that,

based upon and subject to the assumptions, limitations and

qualifications contained in Evans & Evans' written fairness

opinion, the purchase price is fair, from a financial point of view

to the Axis shareholders. The fairness opinion will be included in

the Circular.

Related Party Transaction

Approximately $3,292,000 principal amount of debentures are held

by certain officers and directors of the Company or their

affiliates. Specifically $1,572,000 principal amount of the April

2018 Debentures are held by related parties (being $1,068,000 held

by affiliates of Wes Neichenbauer and $504,000 held by affiliates

of Todd Hudson) and $1,720,000 principal amount of the September

2023 Debentures are held by related parties (being $1,320,000 held

by affiliates of Ian Anderson and Paul Kerwin, $200,000 held by

affiliates of Wes Neichenbauer, $100,000 held by Ilja Troitschanski

and $100,000 held by Todd Hudson). Those related parties who are

also directors of the Company recused themselves from voting on the

approval of the amendments to the terms of the debentures. The

above referenced amendments to the April 2018 and September 2023

Debentures may be considered to be related party transactions for

the purposes of National Instrument 61-101 – Protection of Minority

Security Holders in Special Transactions and the Company will rely

on the exemptions from the valuation and minority approval

requirements contained in Sections 5.5(g) and 5.7(1)(e) of National

Instrument 61-101 (financial hardship), respectively.

Credit Agreement Update

Although the Company has not received a formal waiver of the

covenant breaches under its senior credit facility past October 1,

2024, the Company has received confirmation from its funding

syndicate that they are supportive of the proposed transaction. The

Company continues to work with its funders under the senior credit

facility to obtain a formal waiver that will extend to a date that

will permit the closing of the proposed transaction. One of funders

in the senior credit facility funding syndicate independently holds

the Master Loan Program Agreement (“MLPA”) funding facility, which

was also in covenant breach at the time the Company reported its

2024 fiscal year end financial results on September 27, 2024, and

this continues to be the case. The Company has received

confirmation from its MLPA funding partner that they are supportive

of the proposed transaction and continues to work with this funding

partner to obtain a formal waiver of the breach, that will permit

the closing of the proposed transaction. The Company will provide a

further update if and when formal waivers are obtained.

About Axis Auto Finance

Axis is a fintech lender providing alternative used vehicle

financing options to non-prime borrowers. Axis loans are offered

through automotive dealers to approximately 30% of Canadians

(Source: Equifax) that have credit scores in the non-prime range.

All Axis auto loans report to the credit bureau, resulting in over

70% of customers seeing a significant improvement of their credit

scores. Further information on the Company can be found at

https://www.axisfinancegroup.com/investors-press-releases/.

The TSX Exchange has neither approved nor disapproved the

contents of this press release. Neither the Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the Exchange) accepts responsibility for the adequacy

or accuracy of this release.

Notice Regarding Forward-Looking Statements

This news release contains forward-looking information and

forward-looking statements (collectively, "forward-looking

statements") within the meaning of applicable securities laws,

regarding the Company's business and operations. In this news

release, forward-looking statements relate to, among other things,

information regarding: (a) the terms and conditions of the proposed

asset sale transaction; (b) the satisfaction of the conditions

precedent to the proposed asset sale transaction, including

obtaining the requisite shareholder approval; (c) the timing and

completion of the closing of the proposed transaction; (d) the

timing of the proposed meeting of shareholders of the Company; (e)

expectations regarding the consideration to be paid to holders of

April 2018 Debentures and September 2023 Debentures; (f) the

Company's intention to cease to be listed on the TSX and; and (g)

waivers of defaults of the Company's credit facilities.

Forward-looking statements are necessarily based on a number of

estimates and assumptions that the Company considered appropriate

and reasonable as of the date such information is given, including

but not limited to the assumptions that the transaction will

proceed according to the Company's anticipated timelines; all

conditions to the closing of the transaction will be met; the

transaction will be completed on the terms currently contemplated;

the asset purchase agreement will not be terminated prior to

closing; and that required votes for shareholder approval of the

transaction and other matters to be considered at the shareholders

meeting will be obtained. Forward-looking statements are subject to

known and unknown risks, uncertainties, and other factors, many of

which are beyond the Company's control, that may cause actual

results, performance or achievements to be materially different

from those expressed or implied by such forward-looking statements,

including but not limited to the risk that the Company's

assumptions on which its forward-looking statements are based may

not be accurate; the inability to receive, in a timely manner and

on satisfactory terms, the necessary approvals for the transaction

and other matters to be considered at the meeting of shareholders

of the Company; the inability to satisfy, in a timely manner, all

other conditions to the completion of the transaction; the ability

of the Board to consider and approve, subject to compliance by the

Company of its obligations in this respect under the asset purchase

agreement, a superior proposal for the Company; and the risk

factors disclosed in the Company's periodic reports publicly filed

and available on its SEDAR+ profile at www.sedarplus.ca. The

anticipated dates indicated above may change for a number of

reasons, including delays in preparing materials in connection with

the transaction, the inability to receive the necessary approvals

in a timely manner, or the need for additional time to satisfy the

conditions to the completion of the transaction. No assurance can

be given that any of the events anticipated by the forward-looking

statements will transpire or occur. There is no assurance that the

proposed transaction will be completed in accordance with its terms

or at all. The forward-looking statements contained in this news

release are made as of the date of this announcement and the

Company does not undertake any obligation to update such

forward-looking statements, whether as a result of new information,

future events or otherwise, except as expressly required by

applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021232273/en/

For further information: Axis Auto Finance Inc. Todd Hudson CEO

(416) 633-5626 ir@axisautofinance.com

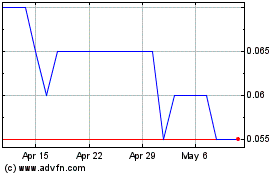

Axis Auto Finance (TSX:AXIS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Axis Auto Finance (TSX:AXIS)

Historical Stock Chart

From Nov 2023 to Nov 2024