Brookfield Renewable Partners L.P. (the “Partnership”) (NYSE: BEP;

TSX: BEP.UN) and Brookfield Renewable Corporation (NYSE: BEPC; TSX:

BEPC) (“BEPC”, and together with the Partnership, “Brookfield

Renewable”) are pleased to provide an update on the concurrent

equity offerings announced June 12, 2023 for aggregate gross

proceeds of $500 million (the “Offerings”) on a bought deal basis

by a syndicate of underwriters (collectively, the “Underwriters”)

co-led by Scotiabank, BMO Capital Markets, TD Securities Inc., CIBC

Capital Markets, and RBC Capital Markets.

The Offerings are comprised of 8,200,000 limited

partnership units of the Partnership (“LP Units”) and 7,430,000

class A exchangeable subordinate voting shares of BEPC

(“Exchangeable Shares”). The LP Units were sold at a price of

$30.35 per LP Unit (the “LP Unit Offering Price”), and the

Exchangeable Shares were sold at a price of $33.80 per Exchangeable

Share (the “Exchangeable Share Offering Price”).

Concurrently, a subsidiary of Brookfield

Reinsurance Ltd. (NYSE/TSX: BNRE) has agreed to purchase 5,148,270

LP Units at the LP Unit Offering Price (net of underwriting

commissions) (the “Concurrent Unit Private Placement”) for total

gross proceeds of approximately $150 million.

The aggregate gross proceeds of the Offerings

and the Concurrent Unit Private Placement will be approximately

$650 million.

Brookfield Renewable intends to use the net

proceeds of the Offerings, together with the proceeds of the

Concurrent Unit Private Placement, to fund current and future

investment opportunities and for general corporate purposes.

The Offerings and the Concurrent Unit Private

Placement are expected to close on or about June 16, 2023.

The Partnership and BEPC have granted the

Underwriters over-allotment options, exercisable in whole or in

part for a period of 30 days following closing of the Offerings, to

purchase up to 1,230,000 additional LP Units and 1,110,000

additional Exchangeable Shares at their respective offering prices.

If the over-allotment options are exercised in full, the aggregate

gross proceeds of the Offerings and the Concurrent Unit Private

Placement would increase to approximately $725 million.

Offer Documents

The Partnership and BEPC have filed Registration

Statements on Form F-3 (including prospectuses) with the United

States Securities and Exchange Commission (the “SEC”) in respect of

the Offerings. Before you invest, you should read the prospectus in

the relevant Registration Statement, the prospectus supplements

thereto in respect of the Offerings and other documents that the

Partnership and BEPC have filed with the SEC for more complete

information about Brookfield Renewable and the Offerings. Each of

the Partnership and BEPC will also be filing a prospectus

supplement relating to each Offering with securities regulatory

authorities in Canada. You may get any of these documents for free

by visiting EDGAR on the SEC website at www.sec.gov or via SEDAR at

www.sedar.com. Also, the Partnership, BEPC, any underwriter or any

dealer participating in the Offerings will arrange to send you the

prospectuses or you may request them in the United States from

Scotia Capital (USA) Inc., 250 Vesey Street, 24th Floor, New York,

NY 10281, Attention: Equity Capital Markets, or by telephone at

(212) 255-6854, or by email at us.ecm@scotiabank.com, from BMO

Nesbitt Burns Inc. at BMO Capital Markets Corp., Attention: Equity

Syndicate Department, 151 W 42nd St, 32nd floor, New York, NY

10036, or by telephone at 1-800-414-3627 or by email at

bmoprospectus@bmo.com, or from TD Securities (USA) LLC, Attention:

Equity Capital Markets, 1 Vanderbilt Avenue, New York, NY 10017, by

telephone at (855) 495-9846 or by email at

TD.ECM_Prospectus@tdsecurities.com, or from CIBC Capital Markets,

161 Bay Street, 5th Floor, Toronto, ON M5J 2S8 by telephone at

1-416-956-6378 or by email at Mailbox.USProspectus@cibc.com, or

from RBC Capital Markets, LLC, 200 Vesey Street, 8th Floor, New

York, NY 10281-8098, Attention: Equity Syndicate, Phone:

877-822-4089, Email: equityprospectus@rbccm.com; or in Canada from

Scotiabank by mail at 40 Temperance Street, 6th Floor, Toronto,

Ontario M5H 0B4, attn: Equity Capital Markets, by email at

equityprospectus@scotiabank.com or by telephone at (416) 863-7704,

or from BMO Nesbitt Burns Inc. at BMO Capital Markets, Attention:

Brampton Distribution Centre C/O The Data Group of Companies, 9195

Torbram Road, Brampton, Ontario, L6S 6H2, or by telephone at

1-905-791-3151 Ext 4312 or by email at

torbramwarehouse@datagroup.ca, or from TD Securities Inc. at 1625

Tech Avenue, Mississauga ON L4W 5P5 Attention: Symcor, NPM, or by

telephone at (289) 360-2009 or by email at sdcconfirms@td.com, or

from CIBC Capital Markets, 161 Bay Street, 5th Floor, Toronto, ON

M5J 2S8, by telephone at 1-416-956-6378 or by email at

Mailbox.CanadianProspectus@cibc.com, or from RBC Dominion

Securities Inc., 180 Wellington Street West, 8th Floor, Toronto, ON

M5J 0C2, Attention: Distribution Centre, Phone: (416) 842-5349,

Email: Distribution.RBCDS@rbccm.com.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any securities of

Brookfield Renewable in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

Brookfield Renewable

Brookfield Renewable operates one of the world’s

largest publicly traded, pure-play renewable power platforms. Our

portfolio consists of hydroelectric, wind, utility-scale solar and

storage facilities in North America, South America, Europe and

Asia, and totals approximately 31,600 megawatts of installed

capacity and a development pipeline including approximately 131,900

megawatts of renewable power assets, 12 million metric tonnes per

annum ("MMTPA") of carbon capture and storage, 2 million tons of

recycled material, 4 million metric million British thermal units

of renewable natural gas pipeline, a solar manufacturing facility

capable of producing 5,000 MW of panels annually and 1 MMTPA green

ammonia facility powered entirely by renewable energy. Investors

can access its portfolio either through Brookfield Renewable

Partners L.P. (NYSE: BEP; TSX: BEP.UN), a Bermuda-based limited

partnership, or Brookfield Renewable Corporation (NYSE, TSX: BEPC),

a Canadian corporation.

Brookfield Renewable is the flagship listed

renewable power company of Brookfield Corporation, a leading global

alternative asset manager with over $825 billion of assets under

management.

|

Contact information: |

|

|

Media: |

Investors: |

|

Simon Maine |

Alex Jackson |

|

+44 7398 909 278 |

+ (416) 649-8172 |

|

simon.maine@brookfield.com |

alexander.jackson@brookfield.com |

Note: This news release contains forward-looking

statements and information within the meaning of applicable

securities laws. Forward-looking statements may include estimates,

plans, expectations, opinions, forecasts, projections, guidance or

other statements that are not statements of fact. Forward-looking

statements can be identified by the use of words such as “will”,

“intend” and “expect” or variations of such phrases and other

expressions which are predictions of or indicate future events,

trends or prospects, and which do not relate to historical matters.

Forward-looking statements in this news release include statements

regarding the Offerings and the Concurrent Unit Private Placement.

Although Brookfield Renewable believes that these forward-looking

statements and information are based upon reasonable assumptions

and expectations, no assurance is given that such expectations will

prove to have been correct. The reader should not place undue

reliance on forward-looking statements and information as such

statements and information involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of Brookfield Renewable to differ

materially from anticipated future results, performance or

achievement expressed or implied by such forward-looking statements

and information. The future performance and prospects of Brookfield

Renewable are subject to a number of known and unknown risks and

uncertainties. Factors that could cause actual results of

Brookfield Renewable to differ materially from those contemplated

or implied by the statements in this news release are described in

the documents filed by Brookfield Renewable with the securities

regulators in Canada and the United States including under “Risk

Factors” in each of the Partnership’s and BEPC’s most recent Form

20-F and other risks and factors that are described therein and in,

or incorporated by reference in, the Partnership’s and BEPC’s

Registration Statements and prospectus supplements relating to the

Offerings. Except as required by law, Brookfield Renewable does not

undertake any obligation to publicly update or revise any

forward-looking statements or information, whether written or oral,

whether as a result of new information, future events or

otherwise.

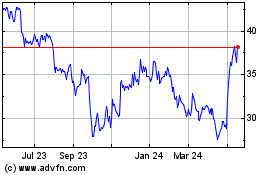

Brookfield Renewable Par... (TSX:BEP.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

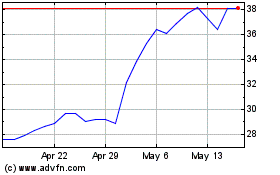

Brookfield Renewable Par... (TSX:BEP.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024