Bengal Energy Ltd. (TSX:BNG) ("Bengal" or the "Company") is pleased

to announce its financial and operating results for the first

fiscal 2014 quarter ended June 30, 2013.

FISCAL Q1 2014 HIGHLIGHTS:

During the first quarter of the Company's fiscal 2014 year,

Bengal continued its current strategy, resulting in further growth

in production and cash flow through the period. With the drilling

success realized to date in the Company's Cuisinier asset in the

Cooper Basin, Australia, understanding of the magnitude and lower

risk profile of this play has evolved, demonstrating that Cuisinier

represents a significant short and long term potential resource

play for Bengal.

Following are highlights of specific operational, financial and

corporate achievements that Bengal reached during the three months

ended June 30, 2013:

Financial Highlights:

-- Profitable Quarter + Higher Funds Flow from Operations -Bengal recorded

a profit in the quarter, with positive net income of $0.8 million,

compared to a loss of $0.2 million in Q1 of the prior year and a loss of

$0.6 million in the preceding quarter this year. Funds flow from

operations grew to $1.7 million, compared to a deficiency of $0.1

million in Q1 of the prior year and $1.1 million in the preceding

quarter this year.

-- Higher Revenue + Strong Netbacks - Bengal's realized revenue of $3.7

million was substantially higher than the $0.5 million realized in Q1 of

the prior year and 23% higher than the $3.0 million realized in the

preceding quarter this year, driven by higher production volumes and

very attractive realized pricing. Bengal's operating (field) netback in

Australia averaged $89.05 per barrel (bbl) (corporate average of

$79.82/bbl), reflecting the high quality of crude oil produced, which

was priced at a premium of almost $6.00 / bbl over the Brent benchmark.

-- Financing Activity Strengthens Balance Sheet - In April, Bengal raised

C$5.7 million through a brokered equity private placement, directing

proceeds to fund ongoing capital investments.

-- Increase in Cuisinier Working Interest- On June 26, Bengal announced

that it was exercising its pre-emptive right to purchase an additional

5.357% interest in the Cuisinier oil field and Authority to Prospect

("ATP") 752P in the Cooper Basin, which will bring the Company's total

ownership to 30.357%. Subsequent to quarter end, Bengal successfully

raised C$8 million through a private placement of non-convertible

unsecured notes to fund the acquisition of this additional interest,

which is expected to close in September 2013 and have an effective date

of March 15, 2013.

Operating Highlights:

-- Rising Production - Bengal's production averaged 356 boe/d for the

period, an increase of 300% over Q1 of the prior year and 10% over the

preceding quarter this year. This production level does not reflect the

incremental working interest to be acquired in Cuisinier, which would

have increased the quarterly oil production volumes by 21% or 67 b/d.

-- Continued 100% Drilling Success In Cuisinier - During the period ended

June 30, 2013, Bengal continued its 100% success rate in the Cuisinier

field, with five out of five wells drilled currently being completed as

oil producers and tied-in. This brings Bengal's total wells drilled in

Cuisinier to 13, with one additional well to be drilled in August.

Assuming this sixth well is a successful oil producer; production from

these wells is expected to be fully tied-in by early September, which

should positively impact volumes and cash flows for the balance of

calendar 2013 and into 2014. With the success to date in the Cuisinier

area it is now clear that the Company is participating in a significant,

seismically supported potential resource play.

-- Farmout and Joint Venture (JV) Agreement - On May 23, 2013, Bengal

entered into a binding letter of intent with Australia-based Beach

Energy Ltd for the exploration and development of Bengal's 100% owned

Tookoonooka Permit. Under the agreement terms, Beach will fund the

drilling of two new wells and acquire an additional 300 km2 of 3D

seismic, up to a maximum of AUD $11.5 million. One of the wells is

anticipated to be in the Caracal area near Bengal's existing oil

discovery, with the second well to be situated within the area covered

by the new 3D seismic. Subsequent to the end of the quarter, the JV

Agreement was finalized and the transaction closed.

-- Receipt of Petroleum License and Pipeline Commissioning - On April 8,

2013 the final approval of Petroleum Lease 303 ("PL303") for the

Cuisinier oil pool was granted, which allows all current and future

Cuisinier wells to produce for up to 21 years. Subsequently, on June 7,

the Cuisinier to Cook pipeline was commissioned allowing production from

all eight of Bengal's pre-2013 and subsequent wells to flow through the

pipeline, and eliminating capacity constraints from trucking for

transportation of the oil.

-- Onshore India Drilling Plan - In Bengal's onshore block in the Cauvery

Basin India, the Company intends to commence the drilling of its

exploration wells in the first quarter of calendar 2014. Continued

activity in onshore India for the balance of calendar 2014 and beyond

will depend on the results of the three wells drilled under the existing

work program.

"First quarter of fiscal 2014 was a successful period both

financially and operationally for Bengal," said Chayan Chakrabarty,

Bengal's President and CEO. "We continued to grow production and

generated very attractive netbacks, both of which contributed to a

profitable quarter. We reported 100% drilling success in Cuisinier

and announced an acquisition to increase our interest in that

field, meaning Bengal will realize a higher proportion of

production, reserves and cash flow from this important, potential

resource play going forward. Our JV agreement with Beach, which

closed after the quarter end, accelerates development at

Tookoonooka, and in concert with the financing activity undertaken

during the quarter, enables Bengal to preserve balance sheet

strength. I am very pleased with Bengal's progress and continuing

transition from exploration to development, and look forward to

updating our shareholders about ongoing developments."

For a discussion of the activities on each of the Company's

permits, refer to Bengal's management's discussion and analysis for

the first fiscal quarter 2014 ended June 30, 2013 filed on SEDAR at

www.sedar.com.

FINANCIAL & OPERATING HIGHLIGHTS

----------------------------------------------------------------------------

----------------------------------------------------------------------------

$000s except per share, volumes and

netback amounts Three Months Ended

June 30, June 30, March 31,

2013 2012 2013

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Revenue

Oil $ 3,626 $ 433 $ 2,946

Natural gas 65 39 67

Natural gas liquids 31 26 -

----------------------------------------------------------------------------

Total $ 3,722 $ 498 $ 3,013

----------------------------------------------------------------------------

Royalties 204 45 271

% of revenue 5.5 9.0 9.0

----------------------------------------------------------------------------

Operating & transportation 930 247 694

----------------------------------------------------------------------------

Netback $ 2,588 $ 206 $ 2,048

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Cash from (used in) operations: 1,249 (759) 119

Per share ($) (basic & diluted) 0.02 (0.01) (0.00)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Funds flow from (used in) operations 1,732 (62) 1,151

Per share ($) (basic & diluted) 0.03 (0.00) 0.02

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income (loss): 836 (211) (592)

Per share ($) (basic & diluted) 0.01 (0.00) (0.01)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Capital expenditures $ 5,435 $ 7,326 $ 1,280

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Volumes

Oil (bbl/d) 313 47 287

Natural gas (mcf/d) 240 225 229

Natural gas liquids (boe/d) 3 4 -

----------------------------------------------------------------------------

Total (boe/d @ 6:1) 356 89 325

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Netback ($/boe)

Revenue $ 114.83 $ 61.95 $ 102.88

Royalties 6.32 5.60 9.25

Operating & transportation 28.69 30.73 23.70

----------------------------------------------------------------------------

Total $ 79.82 $ 25.62 $ 69.93

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Bengal has filed its consolidated financial statements and

management's discussion and analysis for the first fiscal 2014

quarter ended June 30, 2013 with Canadian securities regulators.

The documents are available on SEDAR at www.sedar.com or by

visiting Bengal's website at www.bengalenergy.ca.

About Bengal

Bengal Energy Ltd. is an international junior oil and gas

exploration and production company with assets in Australia and

India. The company is committed to growing shareholder value

through international exploration, production and acquisitions.

Bengal trades on the TSX under the symbol BNG.

Additional information is available at www.bengalenergy.ca

Forward-Looking Statements

This news release contains certain forward-looking statements or

information ("forward-looking statements") as defined by applicable

securities laws that involve substantial known and unknown risks

and uncertainties, many of which are beyond Bengal's control. These

statements relate to future events or our future performance. All

statements other than statements of historical fact may be forward

looking statements. The use of any of the words "plan", "expect",

"prospective", "project", "intend", "believe", "should",

"anticipate", "estimate", or other similar words or statements that

certain events "may" or "will" occur are intended to identify

forward-looking statements. The projections, estimates and beliefs

contained in such forward looking statements are based on

management's estimates, opinions, and assumptions at the time the

statements were made, including assumptions relating to: the impact

of economic conditions in North America, Australia, India and

globally; industry conditions; changes in laws and regulations

including, without limitation, the adoption of new environmental

laws and regulations and changes in how they are interpreted and

enforced; increased competition; the availability of qualified

operating or management personnel; fluctuations in commodity

prices, foreign exchange or interest rates; stock market volatility

and fluctuations in market valuations of companies with respect to

announced transactions and the final valuations thereof; results of

exploration and testing activities; and the ability to obtain

required approvals and extensions from regulatory authorities. We

believe the expectations reflected in those forward-looking

statements are reasonable but, no assurances can be given that any

of the events anticipated by the forward-looking statements will

transpire or occur, or if any of them do so, what benefits that

Bengal will derive from them. As such, undue reliance should not be

placed on forward-looking statements. Forward-looking statements

contained herein include, but are not limited to, statements

regarding: the Tookoonooka joint venture; including without

limitation, the terms thereof and the location of the two wells;

the acquisition of the increased interest in ATP 752P and the

closing thereof; use of funds from the July 2013 private placement;

the timing and location of future wells; tie-in operations,

including, without limitation, the timing and benefit thereof; and

the commencement of drilling operations in India.

The forward looking statements contained herein are subject to

numerous known and unknown risks and uncertainties that may cause

Bengal's actual financial results, performance or achievement in

future periods to differ materially from those expressed in, or

implied by, these forward-looking statements, including but not

limited to, risks associated with: the failure to obtain required

regulatory approvals or extensions; failure to satisfy the

conditions under farm-in and joint venture agreements; failure to

secure required equipment and personnel; changes in general global

economic conditions including, without limitations, the economic

conditions in North America, Australia, India; increased

competition; the availability of qualified operating or management

personnel; fluctuations in commodity prices, foreign exchange or

interest rates; changes in laws and regulations including, without

limitation, the adoption of new environmental and tax laws and

regulations and changes in how they are interpreted and enforced;

the results of exploration and development drilling and related

activities; the ability to access sufficient capital from internal

and external sources; and stock market volatility. Readers are

encouraged to review the material risks discussed in Bengal's

Annual Information Form under the heading "Risk Factors" and in

Bengal's annual MD&A under the heading "Risk Factors". The

Company cautions that the foregoing list of assumptions, risks and

uncertainties is not exhaustive. The forward-looking statements

contained in this news release speak only as of the date hereof and

Bengal does not assume any obligation to publicly update or revise

them to reflect new events or circumstances, except as may be

require pursuant to applicable securities laws.

Barrels of Oil Equivalent

When converting natural gas to equivalent barrels of oil, Bengal

uses the widely recognized standard of 6 thousand cubic feet (mcf)

to one barrel of oil (boe). However, a boe may be misleading,

particularly if used in isolation. A boe conversion ratio of 6 mcf:

1 bbl is based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value

equivalency at the wellhead. Given that the value ratio based on

the current price of crude oil as compared to natural gas is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.

Certain Defined Terms

boe - barrels of oil equivalent

boe/d - barrels of oil equivalent per day

bbl - barrel

bbl/d - barrels per day

mcf - thousand cubic feet

mcf/d - thousand cubic feet per day

Non-IFRS Measurements

Within this release references are made to terms commonly used

in the oil and gas industry. Funds from operations, funds from

operations per share and netbacks do not have any standardized

meaning under International Financial Reporting Standards (IFRS)

and previous generally accepted accounting principles (GAAP) and

are referred to as non-IFRS measures. Funds from operations per

share is calculated based on the weighted average number of common

shares outstanding consistent with the calculation of net income

(loss) per share. Netbacks equal total revenue less royalties and

operating and transportation expenses calculated on a boe basis.

Management utilizes these measures to analyze operating

performance. The Company's calculation of the non-IFRS measures

included herein may differ from the calculation of similar measures

by other issuers. Therefore, the Company's non-IFRS measures may

not be comparable to other similar measures used by other issuers.

Funds from operations is not intended to represent operating profit

for the period nor should it be viewed as an alternative to

operating profit, net income, cash flow from operations or other

measures of financial performance calculated in accordance with

IFRS. Non-IFRS measures should only be used in conjunction with the

Company's annual audited and interim financial statements. A

reconciliation of these measures can be found in the table on page

5 of Bengal's Q1 fiscal 2014 MD&A.

Contacts: Bengal Energy Ltd. Chayan Chakrabarty President &

Chief Executive Officer (403) 205-2526 Bengal Energy Ltd. Bryan

Goudie Chief Financial Officer (403)

205-2526investor.relations@bengalenergy.ca www.bengalenergy.ca

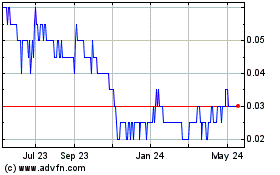

Bengal Energy (TSX:BNG)

Historical Stock Chart

From Jan 2025 to Feb 2025

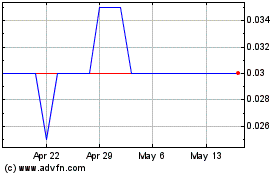

Bengal Energy (TSX:BNG)

Historical Stock Chart

From Feb 2024 to Feb 2025