Baytex Energy Corp. (“Baytex”)(TSX, NYSE: BTE) and Raging River

Exploration Inc. (“Raging River”)(TSX: RRX) are pleased to announce

that two leading independent proxy advisory firms that provide

voting recommendations to institutional investors, Institutional

Shareholder Services Inc. (“ISS”) and Glass Lewis & Co. (“Glass

Lewis”), have each recommended that shareholders vote in favour of

the proposed plan of arrangement (the “Arrangement”) involving

Baytex and Raging River.

Recommendation to Raging River

Shareholders

ISS and Glass Lewis have recommended that

shareholders of Raging River vote FOR the special resolution to

approve the proposed Arrangement.

ISS noted, “The Arrangement makes strategic

sense as the combined company is expected to be a larger and more

diversified company and will have greater exposure to Canadian and

foreign institutional investors, thereby improving the company's

cost of capital. As current Raging River shareholders will own 57%

of the company they will continue to participate in the growth

opportunities associated with Raging River's historic business and

Baytex's business, while also continuing to have significant

representation of Raging River management and the Raging River

board on management and the Baytex board.”

Glass Lewis noted, “The combination offers

several benefits for Raging River shareholders, including

diversification to a high-quality asset portfolio with attractive

cash flow generation and growth potential, as well as scale and

capital which is required to develop the East Duvernay Shale oil

play assets. The structure and terms of the transaction enable

Raging River shareholders to retain meaningful ownership in a

larger, internally-funded and diversified asset portfolio, and to

participate in any revaluation potential and improved trading

liquidity, while also valuing Raging River at a modest premium to

its unaffected trading price.”

Recommendation to Baytex

Shareholders

ISS and Glass Lewis have recommended that

shareholders of Baytex vote FOR the ordinary resolution to approve

the issuance of Baytex shares to Raging River shareholders pursuant

to the Arrangement (the “Issuance Resolution”).

ISS noted, “The Arrangement makes strategic

sense as it is expected to create a larger North American oil

producer with a considerable capital market presence. The combined

company is expected to be larger, stronger, and more diverse than

Baytex on a stand-alone basis, with improvements in terms of

operating efficiencies and a strengthened balance sheet.”

Glass Lewis noted, “Given the opportunity to

participate as investors in a larger, more diversified,

better-funded and higher-profile company, we believe the proposed

arrangement is strategically and financially compelling. In our

opinion, the proposed exchange ratio represents a reasonable price

to pay given the expected strategic and financial benefits and the

opportunity to enhance shareholder value. Based on these factors,

along with the support of the board, we believe the proposed

arrangement is in the best interests of shareholders.”

YOUR VOTE IS IMPORTANT - PLEASE VOTE

TODAY

For Raging River shareholders, the proxy voting

deadline is 9:30 a.m. (Calgary time) on Friday, August 17,

2018.

The Board of Directors of Raging River

UNANIMOUSLY recommends thatRaging River Shareholders vote IN FAVOUR

of the Arrangement

For Baytex shareholders, the proxy voting

deadline is 10:30 a.m. (Calgary time) on Friday, August 17,

2018.

The Board of Directors of Baytex UNANIMOUSLY

recommends thatBaytex Shareholders vote IN FAVOUR of the Issuance

Resolution

Raging River Meeting

The special meeting of Raging River shareholders

is scheduled to be held at 9:30 a.m. (Calgary time) on Tuesday,

August 21, 2018 in the Devonian Room at the Calgary Petroleum Club

located at 319 – 5th Avenue S.W., Calgary, Alberta.

Baytex Meeting

The special meeting of Baytex shareholders is

scheduled to be held at 10:30 a.m. (Calgary time) on Tuesday,

August 21, 2018 in the Devonian Room at the Calgary Petroleum Club

located at 319 – 5th Avenue S.W., Calgary, Alberta.

Additional information concerning the

Arrangement and the Issuance Resolution can be found in the joint

management information circular of Baytex and Raging River dated

July 12, 2018 (the "Circular"). An electronic copy of the Circular

is available on Baytex’s website at www.baytexenergy.com and on

Raging River’s website at www.rrexploration.com. The Circular is

also available on SEDAR under the issuer profiles of both companies

at www.sedar.com and on EDGAR under Baytex’s profile at

www.sec.gov/edgar.shtml.

Shareholder Information and

Questions

Baytex and Raging River shareholders who need

assistance with voting their shares or making the appropriate

election can contact our proxy solicitation agent, Laurel Hill

Advisory Group:

Laurel Hill Advisory GroupNorth America Toll

Free: 1-877-452-7184Collect Calls Outside North America:

1-416-304-0211Email: assistance@laurelhill.com

Shareholders are encouraged to vote today using

the internet, telephone or facsimile.

Advisory Regarding Forward-Looking

Statements

In the interest of providing the shareholders of

Baytex and Raging River and potential investors with information

regarding Baytex, Raging River and the combined company resulting

from the Arrangement, including management's assessment of future

plans and operations, certain statements in this press release are

"forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

"forward-looking information" within the meaning of applicable

Canadian securities legislation (collectively, "forward-looking

statements"). In some cases, forward-looking statements can be

identified by terminology such as "anticipate", "believe",

"continue", "could", "estimate", "expect", "forecast", "intend",

"may", "objective", "ongoing", "outlook", "potential", "project",

"plan", "should", "target", "would", "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.

Specifically, this press release contains

forward-looking statements relating to but not limited to: the

proxy voting deadline and certain matters relating to the

Arrangement.

These forward-looking statements are based on

certain key assumptions regarding, among other things: the timing

of receipt of regulatory and shareholder approvals for the

Arrangement. Readers are cautioned that such assumptions, although

considered reasonable by Baytex and Raging River at the time of

preparation, may prove to be incorrect.

Actual results achieved will vary from the

information provided herein as a result of numerous known and

unknown risks and uncertainties and other factors. Such factors

include, but are not limited to: completion of the Arrangement

could be delayed if parties are unable to obtain the necessary

regulatory, stock exchange, shareholder and court approvals on the

timeline planned; the Arrangement will not be completed if all of

these approvals are not obtained or some other condition of closing

is not satisfied; and other factors, many of which are beyond

control. These and additional risk factors are discussed in

Baytex's Annual Information Form, Annual Report on Form 40-F and

Management's Discussion and Analysis for the year ended December

31, 2017, filed with Canadian securities regulatory authorities and

the U.S. Securities and Exchange Commission and in Raging River's

Annual Information Form for the year ended December 31, 2017, filed

with Canadian securities regulatory authorities and in Baytex's and

Raging River's other public filings.

The above summary of assumptions and risks

related to forward-looking statements has been provided in order to

provide shareholders and potential investors with a more complete

perspective on the combined company's current and future operations

and such information may not be appropriate for other purposes.

There is no representation by Baytex or Raging

River that actual results achieved will be the same in whole or in

part as those referenced in the forward-looking statements and

neither Baytex nor Raging River undertake any obligation to update

publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required by applicable securities

law.

Baytex Energy Corp.

Baytex is an oil and gas corporation based in

Calgary, Alberta. The company is engaged in the acquisition,

development and production of crude oil and natural gas in the

Western Canadian Sedimentary Basin and in the Eagle Ford in the

United States. Approximately 80% of Baytex’s production is weighted

toward crude oil and natural gas liquids. Baytex’s common shares

trade on the Toronto Stock Exchange and the New York Stock Exchange

under the symbol BTE.

For further information about Baytex, please

visit the company website at www.baytexenergy.com or contact:

Brian Ector, Senior Vice President,

Capital Markets and Public Affairs

Toll Free Number: 1-800-524-5521Email:

investor@baytexenergy.com

Raging River Exploration Inc.

Raging River is a crude oil and natural gas

exploration, development and production company based in Calgary,

Alberta, Canada. The Company’s operations are in the Viking light

oil resource play in western Canada in addition to the recently

added East Duvernay Shale oil play. Raging River’s common shares

trade on the Toronto Stock Exchange under the symbol RRX.

For further information about Raging River,

please visit the company website at www.rrexploration.com or

contact:

|

Neil Roszell, P. Eng.CEO and Executive

ChairmanTel: (403) 767-1250 |

Bruce Beynon, P.

GeolPresidentTel: (403) 767-1251 |

Jerry Sapieha,

CAVice President, Finance & Chief Financial

OfficerTel: (403) 767-1265 |

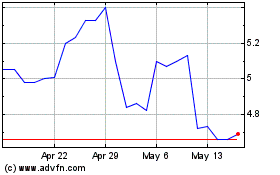

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Jan 2025 to Feb 2025

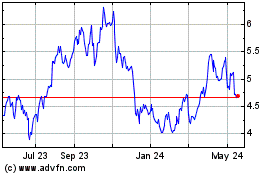

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Feb 2024 to Feb 2025