CAPREIT Announces $104 Million Non-Core Disposition in Montréal

17 December 2024 - 3:19AM

Canadian Apartment Properties Real Estate Investment Trust

(“

CAPREIT”) (TSX:CAR.UN) announced today that the

City of Montréal has announced its intention to exercise its

pre-emptive right with respect to the sale of an off-strategy

portfolio containing 717 residential suites located in Montréal,

Québec. The portfolio is expected to be sold for a price, net of

certain estimated adjustments, of $103.8 million, with $27.2

million in total mortgage debt to be repaid (all amounts excluding

transaction costs and other customary adjustments). Subject to the

receipt of all regulatory approvals and satisfaction of closing

conditions, the disposition is expected to close in the first

quarter of 2025. There can be no assurance that all requirements

for closing will be obtained, satisfied or waived.

“We’re proud to be passing along these

properties to the City of Montréal’s affordable housing initiative,

and we’re looking forward to collaborating on this important sale,”

commented Mark Kenney, President and Chief Executive Officer.

“Contributing to the alleviation of Canada’s housing crisis is a

key priority for us, and transferring more of our non-core

buildings to organizations and programs established to promote

high-quality, safe and affordable residential housing for Canadians

is one of the ways in which we can help with the solution. We are

committed to ensuring a smooth and successful transition of this

portfolio to an administration focused on preserving the

affordability of these homes in perpetuity, alongside the

enjoyment, safety and satisfaction of its residents.”

ABOUT CAPREITCAPREIT is

Canada’s largest publicly traded provider of quality rental

housing. As at September 30, 2024, CAPREIT owns approximately

63,400 residential apartment suites, townhomes and manufactured

home community sites, including approximately 15,400 suites and

sites classified as assets held for sale, that are well-located

across Canada and the Netherlands, with a total fair value of

approximately $16.9 billion, including approximately $1.9 billion

of assets held for sale. For more information about CAPREIT, its

business and its investment highlights, please visit our website at

www.capreit.ca and our public disclosure which can be found under

our profile at www.sedarplus.ca.

CAUTIONARY

STATEMENTS REGARDING FORWARD-LOOKING STATEMENTSCertain

statements contained in this press release constitute

forward-looking statements within the meaning of applicable

Canadian securities laws which reflect CAPREIT’s current

expectations and projections about future results. Forward-looking

statements generally can be identified by the use of

forward-looking terminology such as “outlook”, “objective”, “may”,

“will”, “expect”, “intent”, “estimate”, “anticipate”, “believe”,

“consider”, “should”, “plans”, “predict”, “estimate”, “forward”,

“potential”, “could”, “likely”, “approximately”, “scheduled”,

“forecast”, “variation” or “continue”, or similar expressions

suggesting future outcomes or events. The forward-looking

statements made in this press release relate only to events or

information as of the date on which the statements are made in this

press release. Actual results and developments are likely to

differ, and may differ materially, from those expressed or implied

by the forward-looking statements contained in this press release.

Any number of factors could cause actual results to differ

materially from these forward-looking statements. Although CAPREIT

believes that the expectations reflected in forward-looking

statements are reasonable, it can give no assurances that the

expectations of any forward-looking statements will prove to be

correct. Such forward-looking statements are based on a number of

assumptions that may prove to be incorrect, including with regards

to the expected completion and timing of the pending disposition.

Accordingly, readers should not place undue reliance on

forward-looking statements.

Forward looking statements in this press release

are subject to certain risks and uncertainties, many of which are

beyond CAPREIT’s control, which could result in actual results

differing materially from these forward-looking statements. These

risks and uncertainties include, but are not limited to, the risks

and uncertainties described under the heading “Risks and

Uncertainties” in CAPREIT’s 2023 Annual Report and under the

heading “Risk Factors” in CAPREIT’s Annual Information Form for the

year ended December 31, 2023, each of which is available under

CAPREIT’s profile on SEDAR+ at www.sedarplus.ca.

Except as specifically required by applicable

Canadian securities law, CAPREIT does not undertake any obligation

to update or revise publicly any forward-looking statements,

whether as a result of new information, future events or otherwise,

after the date on which the statements are made or to reflect the

occurrence of unanticipated events. These forward-looking

statements should not be relied upon as representing CAPREIT’s

views as of any date subsequent to the date of this press

release.

| For more information, please

contact: |

| |

|

|

|

|

| CAPREIT Dr. Gina Parvaneh Cody Chair of the Board of

Trustees(437) 219-1765 |

|

CAPREIT Mr. Mark Kenney President & Chief Executive

Officer(416) 861-9404 |

|

|

| |

|

|

|

|

| CAPREIT Mr. Stephen Co Chief Financial Officer(416)

306-3009 |

|

CAPREIT Mr. Julian Schonfeldt Chief Investment Officer (647)

535-2544 |

|

|

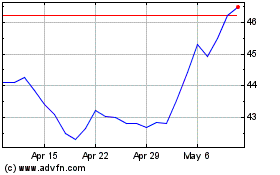

Canadian Apartment Prope... (TSX:CAR.UN)

Historical Stock Chart

From Dec 2024 to Jan 2025

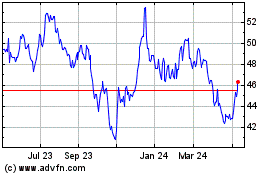

Canadian Apartment Prope... (TSX:CAR.UN)

Historical Stock Chart

From Jan 2024 to Jan 2025