Arsenal Energy Inc. Announces $4 Million Bought Deal Financing

11 June 2014 - 9:56PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE U.S.

Arsenal Energy Inc. ("Arsenal" or the "Corporation") (TSX:AEI) announces it has

entered into an equity financing agreement, on a bought deal basis, with Acumen

Capital Finance Partners Limited, as lead underwriter on behalf of a syndicate

of underwriters including National Bank Financial Inc., Industrial Alliances

Securities Inc. and PI Financial Corp. (collectively, the "Underwriters").

Under the terms of the agreement Arsenal will issue 428,000 common shares to be

issued on a "flow-through" basis pursuant to the Income Tax Act (Canada) in

respect of Canadian exploration expenses (the "CEE FT Shares") at a price of

$9.35 per CEE FT Share (the "Offering Price") for gross proceeds of $4,001,800.

The Underwriters have been granted an option by the Company (the "Over-Allotment

Option") to acquire up to an additional 64,200 CEE FT Shares at the Offering

Price, as applicable. The Over-Allotment Option is exercisable in whole or in

part for a period of 30 days from closing of the offering.

The financing is expected to close on or about July 3, 2014 and is subject to

approval of the Toronto Stock Exchange, receipt of all necessary regulatory

approvals and other customary conditions.

The gross proceeds from the sale of the CEE FT Shares will be used to incur

Canadian exploration expenses ("CEE") for the purposes of the Income Tax Act

(Canada) and such CEE will be renounced to subscribers for the 2014 tax year.

Forward-Looking Information

This news release contains forward-looking information which is not comprised of

historical facts. Forward-looking information involves risks, uncertainties and

other factors that could cause actual events, results, performance, prospects

and opportunities to differ materially from those expressed or implied by such

forward-looking information. Forward-looking information in this news release

includes statements with respect to the Corporation's intention to complete the

offering, the anticipated closing date of the offering, the use of proceeds from

the offering and the renunciation of qualifying expenditures. Material

assumptions and factors that could cause actual results to differ materially

from such forward-looking information includes the performance of the

underwriters' and the Corporation's obligations in relation to the offering; the

failure to obtain approval from the TSX; and the failure by the Corporation to

renounce the qualifying expenditures as planned. Although the Corporation

believes that the material assumptions and factors used in preparing the

forward-looking information in this news release are reasonable, undue reliance

should not be placed on such information, which only applies as of the date of

this news release, and no assurance can be given that such events will occur.

Arsenal disclaims any intention or obligation to update or revise any

forward-looking information, whether as a result of new information, future

events or otherwise, other than as required by law.

THE SECURITIES OFFERED HAVE NOT BEEN REGISTERED UNDER THE U.S. SECURITIES ACT OF

1933, AS AMENDED, AND MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES ABSENT

REGISTRATION OR AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS. THIS PRESS

RELEASE SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO

BUY NOR SHALL THERE BE ANY SALE OF THE SECURITIES IN ANY STATE IN WHICH SUCH

OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL.

FOR FURTHER INFORMATION PLEASE CONTACT:

Tony van Winkoop

President & CEO

Arsenal Energy Inc.

P: (403) 262-4854

Suite 1900, 639 5th Avenue S.W., Calgary, Alberta T2P 0M9

www.arsenalenergy.com

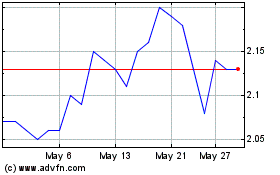

Centamin (TSX:CEE)

Historical Stock Chart

From Jan 2025 to Feb 2025

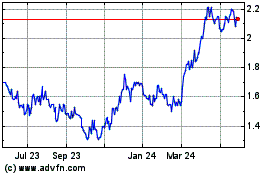

Centamin (TSX:CEE)

Historical Stock Chart

From Feb 2024 to Feb 2025