Conifex Timber Inc. (“Conifex”, “we” or “us”) (TSX: CFF) today

reported results for the first quarter ended March 31, 2023.

EBITDA* was negative $6.9 million for the quarter compared to

EBITDA of $20.1 million in the first quarter of 2022. Net loss

was $8.1 million or $0.20 per share for the quarter versus net

income of $11.4 million or $0.28 per share in the year-earlier

quarter. The results reflect reduced operating earnings on lower

lumber prices and reduced shipments reflecting transportation

challenges which impacted lumber production.

Selected Financial

Highlights

The following table summarizes our selected

financial information for the comparative periods. The financial

information reflects results of operations from our Mackenzie

sawmill and power plant.

|

Selected Financial Information |

|

|

|

|

|

(unaudited, in millions of dollars, except share andexchange rate

information) |

Q12023 |

Q42022 |

Q12022 |

|

| Revenue |

|

|

|

|

|

Lumber – Conifex produced |

26.0 |

|

22.1 |

|

52.6 |

|

|

Lumber – wholesale |

1.0 |

|

1.6 |

|

8.4 |

|

|

By-products and other |

8.4 |

|

2.8 |

|

2.8 |

|

|

Bioenergy |

4.5 |

|

0.2 |

|

8.0 |

|

|

|

39.9 |

|

26.7 |

|

71.8 |

|

|

Operating income (loss) |

(11.5 |

) |

|

(8.5 |

) |

|

|

17.1 |

|

|

EBITDA(1) |

(6.9 |

) |

|

2.3 |

|

|

|

20.1 |

|

|

Net income (loss) |

(8.1 |

) |

|

(0.2 |

) |

|

|

11.4 |

|

| Basic and diluted

earnings (loss) per share |

(0.20 |

) |

|

- |

|

|

|

0.28 |

|

| Cash dividends per

shares |

- |

|

|

- |

|

|

|

- |

|

|

Shares outstanding – weighted average (millions) |

39.8 |

|

|

39.9 |

|

|

|

40.1 |

|

| |

|

|

|

|

| Reconciliation of

EBITDA to net income (loss) |

|

|

|

|

| Net income (loss) |

(8.1 |

) |

(0.2 |

) |

11.4 |

|

| Add: Finance costs |

1.2 |

|

1.0 |

|

1.1 |

|

|

Amortization |

2.5 |

|

1.4 |

|

3.2 |

|

|

Deferred income tax expense (recovery) |

(2.5 |

) |

0.1 |

|

4.3 |

|

|

EBITDA(1) |

(6.9 |

) |

2.3 |

|

20.1 |

|

* Conifex's EBITDA calculation represents

earnings before finance costs, taxes, depreciation and

amortization. We disclose EBITDA as it is a measure used by

analysts and by our management to evaluate our performance. As

EBITDA is a non-GAAP measure that does not have any standardized

meaning prescribed by International Financial Reporting Standards,

it may not be comparable to EBITDA calculated by others and is not

a substitute for net earnings or cash flows, and therefore readers

should consider those measures in evaluating our performance.

Selected Operating

Information

|

|

Q12023 |

Q42022 |

Q12022 |

|

Production – WSPF lumber (MMfbm)(2) |

|

41.2 |

|

27.9 |

|

47.1 |

| Shipments – WSPF lumber

(MMfbm)(2) |

|

40.6 |

|

31.6 |

|

42.5 |

| Shipments – wholesale lumber

(MMfbm)(2) |

|

1.0 |

|

1.5 |

|

4.9 |

| Electricity production

(GWh) |

|

34.6 |

|

- |

|

53.9 |

| Average exchange rate –

$/US(3) |

|

0.740 |

|

0.736 |

|

0.790 |

| Average WSPF 2x4 #2 & Btr

lumber (US$)(4) |

$384 |

$402 |

$1,288 |

| Average

WSPF 2x4 #2 & Btr lumber price($)(5) |

$519 |

$546 |

$1,631 |

(1) Conifex's EBITDA calculation represents

earnings before finance costs, taxes, depreciation and

amortization.

(2) MMfbm represents million board feet.

(3) Bank of Canada, www.bankofcanada.ca.

(4) Random Lengths Publications Inc.

(5) Average SPF 2x4 #2 & Btr lumber prices

(US$) divided by average exchange rate.

Summary of First Quarter 2023

Results

Consolidated Net EarningsDuring the first

quarter of 2023, we incurred a net loss of $8.1 million or $0.20

per share compared to $0.2 million or nil per share in the previous

quarter and net income of $11.4 million or $0.28 per share in the

first quarter of 2022.

Lumber Operations

North American lumber market prices continued to

experience weakness in the first quarter of 2023. Canadian

dollar-denominated benchmark Western Spruce/Pine/Fir

(“WSPF”) prices, which averaged $519 in the first

quarter of 2023, decreased by 5% or $27 from the previous quarter

and by 68% or $1,112 from the first quarter of 2022 1. The market

price decline was fueled by a slowdown in new home construction

demand in the US from higher mortgage rates and reduced

affordability and an overall over-supply in the market. US housing

starts on a seasonally adjusted annual basis remained steady,

averaging 1,280,000 in the first quarter of 2023, down 9% from the

previous quarter and up 26% from the first quarter of 2022 2.

Our lumber production in the first quarter of

2023 totalled approximately 41.2 million board feet, representing

operating rates of approximately 69% of annualized capacity. Lumber

production in the quarter reflected a ten-day temporary curtailment

to address unsustainable inventory levels. In the previous quarter,

27.9 million board feet of lumber was produced, which reflected a

two-week curtailment of our Mackenzie sawmill, as well as

production being affected by overall depressed operating rates.

Lumber production of 47.1 million board feet or approximately 79%

of operating capacity in the first quarter of 2022 benefited from

continuous sawmill operations through the quarter and the easing of

COVID-19 shift reductions.

Shipments of Conifex produced lumber totaled

40.6 million board feet in the first quarter of 2023, representing

an increase of 28% from the 31.6 million board feet shipped in the

previous quarter and a decrease of 4% from the 42.5 million board

feet of lumber shipped in the first quarter of 2022. Shipments of

Conifex produced lumber in the first quarter of 2023 increased

relative to the previous quarter as a result of stronger lumber

production and the easing of railcar supply constraints in the

second half of the quarter and was in line with shipment volumes in

the prior year comparative quarter.

Our wholesale lumber program shipped 1.0 million

board feet in the first quarter of 2023, representing a decrease of

33% from the 1.5 million board feet shipped in the fourth quarter

of 2022 and a decrease of 80% from the 4.9 million board feet

shipped in the first quarter of 2022. Wholesale lumber shipments

were negatively impacted by a slowdown in construction activity in

Asia.

Revenues from lumber products were $27.0 million

in the first quarter of 2023 representing an increase of 14% from

the previous quarter and a decrease of 56% from the first quarter

of 2022. Compared to the previous quarter, higher shipment volumes

offset the softer mill net realizations on lower lumber market

prices. The revenue decrease in the current quarter over the same

period in the prior year was largely the result of both weaker

benchmark lumber prices and decreased lumber shipments.

Cost of goods sold in the first quarter of 2023

increased by 47% from the previous quarter and by 1% from the first

quarter of 2022. The increase in cost of goods sold from the prior

quarter was mainly due to higher shipment volumes in the current

quarter and higher unit log costs. Unit manufacturing costs

decreased in comparison to the previous quarter as a result of

improved operating rates leading to lower fixed cost absorption as

production challenges and mechanical issues experienced in the

fourth quarter of 2022 were largely resolved. We recorded inventory

valuation reserves of $0.2 million and $1.8 million in the current

and previous quarter, respectively, as a result of the decline in

lumber pricing at the end of the respective quarters which

adversely impacted cost of goods sold.

We expensed countervailing

(“CV”) and anti-dumping (“AD”)

duty deposits of $1.2 million in the first quarter of 2023, $1.1

million in the previous quarter and $5.0 million in the first

quarter of 2022. The duty deposits were based on a combined rate of

17.91% until August 8, 2022 and 8.59% thereafter. The export taxes

during the first quarter of 2023 were higher than the previous

quarter due to the lumber shipment volumes made to the US market

and were significantly lower than the first quarter of 2022 largely

due to the decreased lumber market price and cash deposit rate in

effect.

Bioenergy Operations

Our Mackenzie power plant sold 34.6 gigawatt

(“GWh”) hours of electricity under our Electricity

Purchase Agreement (“EPA”) with British Columbia

Hydro and Power Authority (“BC Hydro”) in the

first quarter of 2023 representing approximately 60% of targeted

operating rates Our power plant sold nil and 53.9 GWh of

electricity in the previous quarter and first quarter of 2022,

respectively. Production in the first quarter of 2023 and the

fourth quarter of 2022 was negatively affected by a temporary

shutdown of the power plant caused by damage to the power plant's

turbine discovered in July 2022, which was successfully

recommissioned on January 31, 2023.

Electricity production contributed revenues of

$4.5 million in the first quarter of 2023, $0.2 million in the

previous quarter and $8.0 million in the first quarter of 2022. Due

to the power plant being inoperable from the second half of 2022 to

January 31, 2023, electricity production revenue for the current

and previous quarters were significantly reduced.

We submitted an insurance claim for physical

damage to our equipment and for loss of revenues from the

interruption of operations as a result of the turbine damage. We

expect to be fully reimbursed for capital expenditures related to

the repair of the turbine, subject to deductible amounts, and for

lost income for the period covered under our business interruption

policy, being the period between the expiry of the waiting period

and the recommencement of the power plant. We recognized $2.2

million as other income on our statement of net income and

comprehensive income in the first quarter of 2023 and $9.6 million

in 2022 to reflect the estimated settlement for lost income under

our business interruption policy. Final settlements of the physical

damage and business interruption claims are anticipated to be

completed by the third quarter of 2023.

Our EPA with BC Hydro, similar to other

electricity purchase agreements, provides BC Hydro with the option

to “turn down” electricity purchased from us during periods of low

demand by issuing a “dispatch order”. In April 2022, BC Hydro

issued a dispatch order for 61 days, from May 5 to July 4, 2022. In

2021, our power plant was dispatched for 61 days, from May 1 to

June 30, 2021. We continue to be paid revenues under the EPA based

upon a reduced rate and on volumes that are generally reflective of

contracted amounts. During any dispatch period, we continue to

produce electricity to fulfill volume commitments under our Load

Displacement Agreement with BC Hydro.

Selling, General and Administrative Costs

Selling, general and administrative

(“SG&A”) costs were $3.2 million in the first

quarter of 2023, $1.4 million in the previous quarter and $3.3

million in the first quarter of 2022. The higher SG&A costs

relative to the previous quarter are primarily attributable to

higher salary and wages to adequately support our operations and

variable compensation costs, including non-cash equity-based

compensation, and legal costs associated with the legal action we

commenced in connection with our high-performance computing

(“HPC”) business. SG&A costs for the current

quarter were comparable to the first quarter of 2022.

Finance Costs and Accretion

Finance costs and accretion totaled $1.2 million

in the first quarter of 2023, $1.0 million in the previous quarter

and $1.1 million in the first quarter of 2022. Finance costs and

accretion relate primarily to our term loan supporting our

bioenergy operations (the “Power Term Loan”).

Other Income

We recognized other income of $2.2 million in

the first quarter of 2023, $9.6 million in the previous quarter and

nil in the first quarter of 2022. Other income primarily consists

of our business interruption claim in respect of the turbine

failure at the power plant.

Foreign Exchange Translation Gain or Loss

The foreign exchange translation gain or loss

recorded for each period on our statement of net income results

from the revaluation of US dollar-denominated cash and working

capital balances to reflect the change in the value of the Canadian

dollar relative to the value of the US dollar. US

dollar-denominated monetary assets and liabilities are translated

using the period end rate.

The US dollar averaged US$0.740 for each

Canadian dollar during the first quarter of 2023, a level which

represented a modest strengthening of the Canadian dollar over the

previous quarter 3.

The foreign exchange translation impacts arising

from the variability in exchange rates at each measurement period

on cash and working capital balances resulted in a foreign exchange

translation loss of nil in the first quarter of 2023, compared to a

foreign exchange translation loss of $0.2 million in the previous

quarter and $0.2 million in the first quarter of 2022.

Income Tax

We recorded income tax recovery of $2.5 million

in the first quarter of 2023, and income tax expense of $0.1

million in the previous quarter and $4.3 million in the first

quarter of 2022.

Deferred income taxes reflect the net tax

effects of temporary differences between the carrying amounts of

assets and liabilities on our balance sheet and the amounts used

for income tax purposes. As at March 31, 2023, we have recognized a

deferred income tax liability of $6.4 million.

Financial Position and

Liquidity

Overall debt was $67.4 million at March 31, 2023

compared to $62.7 million at December 31, 2022, with the change

mainly driven by the $6.0 million drawn against our $25.0 million

secured revolving credit facility with Wells Fargo Finance

Corporation Canada (the “Revolving Credit

Facility”) in the quarter to bolster operating working

capital. The increase in debt was partially offset by net lease

repayments of $0.2 million and Power Term Loan payments of $1.3

million. Our Power Term Loan, which is largely non-recourse to our

lumber operations, represents substantially all of our outstanding

long-term debt. At March 31, 2023, we had $52.6 million outstanding

on our Power Term Loan, while our remaining long-term debt,

consisting of leases, was $2.2 million.

At March 31, 2023, we had total liquidity of

$17.7 million, compared to $16.9 million at December 31, 2022 and

$23.3 million at March 31, 2022. Liquidity at March 31, 2023 was

comprised of unrestricted cash of $5.2 million and unused

availability of $12.5 million under our Revolving Credit

Facility.

Like other Canadian lumber producers, we were

required to begin depositing cash on account of softwood lumber

duties imposed by the United States government in April 2017.

Cumulative duties of US$32.2 million paid by us, net of sales of

the right to certain refunds, since the inception of the current

trade dispute remain held in trust by the US pending administrative

reviews and the conclusion of all appeals of US decisions. We

expect future cash flows will continue to be adversely impacted by

the CV and AD duty deposits to the extent additional costs on US

destined shipments are not mitigated by higher lumber prices.

Outlook

We expect lumber markets to continue to

experience weakness through 2023 as global market conditions

continue to evolve. The effect of inflationary pressures and higher

interest rates affecting consumer spending in the housing and

repairs and remodeling markets have resulted in weaker lumber

market prices than seen in recent years and is expected to persist

through the remainder of the year. While lagging US housing

completions and tempered repair and remodeling activity, as well as

elevated levels of offshore lumber imports have affected market

demand for lumber products, demand and market prices are expected

to see a gradual increase in the second half of 2023.

At our Mackenzie sawmill, we expect to see an

increase in lumber production over 2022, with the expectation of

achieving annualized operating rates of approximately 85% for the

remaining nine months of 2023 on improved sawmill operating rates.

We anticipate an improvement in operating costs in 2023 as a result

of decreased unit fixed costs on higher lumber production volumes

and availability of sufficient logs for continuous operations at

our sawmill. We are optimistic that we will realize a high volume

of lumber shipments in 2023 that matches our sawmill production as

the transportation challenges faced in 2022 have largely been

resolved.

Our power plant is forecasted to generate a

steady and diversified source of cash flow throughout 2023

following its restart on January 31, 2023. We expect our power

plant to average uptime in excess of 90% for the remainder of 2023.

We anticipate that BC Hydro may not exercise its turn down option

in 2023 based on anticipated energy requirements and expect that

our power plant will largely be generating electricity continuously

through 2023.

We anticipate maintaining high levels of working

capital through the balance of 2023 and anticipate that operating

cash flow levels and available liquidity will be supported by our

working capital levels as we progress through the year. We continue

to prioritize funding quick payback sawmill upgrades and exploring

the potential development of our HPC business.

Annual Allowable Cut (“AAC”)

Determination Released

On May 4, 2023, the Chief Forester's Rationale

for Allowable Annual Cut (AAC) Determination for the Mackenzie

Timber Supply Area was released. Effective from the release date,

the new AAC for the Mackenzie Timber Supply Area

(“TSA”) will be 2.39 million cubic metres per

year. This AAC will remain in effect until a new AAC determination

is made, which generally must take place within ten years of this

determination.

The new AAC for the Mackenzie TSA is below the

current AAC and the base case harvest projection released in July

2022. However, the actual harvest within the Mackenzie TSA over the

past 20 years averaged 2.5 million cubic metres per year, which is

in line with the current AAC determination. Further, the abolition

of a biological or salvage partition means our harvest will be

directed entirely at a "green" timber profile. The Chief Forester

has also set a maximum of 1.17 million cubic metres that may be

harvested in the southwestern area of the Mackenzie TSA (the area

that is west of Williston Reservoir and south of Omineca Provincial

Park and Omineca Arm). We believe the specified partition should

assist the economic sustainability of our lumber manufacturing and

power plant operations.

The harvest level determination also implies

sawlog surpluses are likely to persist in Mackenzie relative to

current local milling capacity and sawlog demand. This fact is

unique compared to other TSAs in the BC interior, where sawlog

availability is insufficient to support capacity operations at

converting facilities. As a result, we have the potential to grow

our traditional forestry business in Mackenzie by modernizing and

expanding our sawmill complex once the Ministry of Forest's

apportionment and related regulatory decisions, if any, are

settled.

Revenue Diversification

Opportunity

In March 2023, we entered into a hosting

services agreement with Greenidge Generation Holdings Inc.

("Greenidge"), a NASDAQ listed datacenter and

power generation company. Tsay Keh Dene Nation is collaborating

with us in supplying hosting services to Greenidge. Under the

agreement, we expect to host 750 miners at our 3-megawatt HPC site

located on our Mackenzie property. Our hosting services include the

supply, maintenance and operation of critical electrical

infrastructure and the performance of certain datacenter services

related to security, safety, information technology and ongoing

operations. In return for our services, we will be paid a hosting

fee and a market-based performance fee.

On December 21, 2022, the Lieutenant-Governor in

Council for the Province of British Columbia

(“LGIC”) issued an order in council (the

“OIC”) directing the British Columbia Utilities

Commission to, among other things, accept BC Hydro's request to

suspend its obligation to supply service to certain new

cryptocurrency mining projects in British Columbia for a period of

18 months.

Two of our proposed HPC projects were impacted

by the OIC. As a result, in April 2023, we filed a petition in the

Supreme Court of British Columbia seeking judicial review of the

OIC. We believe that the OIC exceeds the statutory powers granted

to the LGIC under the Utilities Commission Act, is discriminatory

and breaches statutory and common law restraints on the LGIC’s

delegated power. We are seeking an order quashing and setting aside

the OIC as unauthorized or otherwise invalid.

Concurrently, we filed a notice of civil claim

against BC Hydro in the Supreme Court of British Columbia seeking

an order requiring BC Hydro to supply service to our HPC projects.

The claim also seeks general damages. The notice of civil claim

alleges that BC Hydro’s failure and refusal to supply service to

our HPC projects is in breach of BC Hydro’s common law obligation

to supply electricity and unfairly discriminates against Conifex

vis-à-vis other commercial customers.

Conference Call

We have scheduled a conference call on Tuesday,

May 9 at 2:00 PM Pacific time / 5:00 PM Eastern time to discuss the

first quarter 2023 financial and operating results. To participate

in the call, please dial 416-340-2217 or toll free 1-800-806-5484

and entering participant passcode 9831403#. The call will also be

available on instant replay access until June 8, 2023 by dialling

905-694-9451 or 1-800-408-3053 and entering participant passcode

7214513#.

Our management's discussion and analysis and

financial statements for the quarter ended March 31, 2023 are

available under our profile on SEDAR.

For further information, please contact:

Winny TangChief Financial Officer(604)

216-2949

About Conifex Timber Inc.

Conifex and its subsidiaries' primary business

currently includes timber harvesting, reforestation, forest

management, sawmilling logs into lumber and wood chips, and value

added lumber finishing and distribution. Conifex's lumber products

are sold in the United States, Canadian and Japanese markets.

Conifex also produces bioenergy at its power generation facility at

Mackenzie, BC.

Forward-Looking Statements

Certain statements in this news release may

constitute “forward-looking statements”. Forward-looking statements

are statements that address or discuss activities, events or

developments that Conifex expects or anticipates may occur in the

future. When used in this news release, words such as “estimates”,

“expects”, “plans”, “anticipates”, “projects”, “will”, “believes”,

“intends” “should”, “could”, “may” and other similar terminology

are intended to identify such forward-looking statements.

Forward-looking statements reflect the current expectations and

beliefs of Conifex’s management. Because forward-looking statements

involve known and unknown risks, uncertainties and other factors,

actual results, performance or achievements of Conifex or the

industry may be materially different from those implied by such

forward-looking statements. Examples of such forward-looking

information that may be contained in this news release include

statements regarding: the realization of expected benefits of

completed, current and any contemplated capital projects and the

expected timing and budgets for such projects, including the

build-out of any high-performance computing or data center

operations; the growth and future prospects of our business; our

expectations regarding our results of operations and performance;

our planned operating format and expected operating rates; our

perception of the industries or markets in which we operate and

anticipated trends in such markets and in the countries in which we

do business; our ability to supply our manufacturing operations

with wood fibre and our expected cost of wood fibre; our

expectation for market volatility associated with, among other

things, the softwood lumber dispute with the United States of

America; that we could be negatively impacted by the duties or

other protective measures on our products, such as antidumping

duties or countervailing duties on softwood lumber; continued

positive relations with Indigenous groups; the development of a

longer-term capital plan and the expected benefits therefrom;

demand and prices for our products; our ability to develop new

revenue streams; our ability to receive, under our insurance

policies, full reimbursement of losses suffered from the disruption

of operations at our Mackenzie power plant; the outcome of any

actual or potential litigation; the availability and use of credit

facilities or proceeds therefrom; future capital expenditures;

expectations regarding our liquidity levels; and our expectations

for U.S. dollar benchmark prices. Material factors or assumptions

that were applied in drawing a conclusion or making an estimate set

out in the forward-looking statements may include, but are not

limited to, our future debt levels; that we will complete our

projects in the expected timeframes and as budgeted; that we will

effectively market our products; that capital expenditure levels

will be consistent with those estimated by our management; our

ability to obtain and maintain required governmental and community

approvals; the impact of changing government regulations and

shifting political climates; that the US housing market will

continue to improve; our ability to ship our products in a timely

manner; that there will be no additional unforeseen disruptions

affecting the operation of our Mackenzie power plant and that we

will be able to continue to deliver power therefrom; our ability to

obtain financing on acceptable terms, or at all; that interest and

foreign exchange rates will not vary materially from current

levels; the general health of the capital markets and the lumber

industry; and the general stability of the economic environments

within the countries in which we operate or do business.

Forward-looking statements involve significant uncertainties,

should not be read as a guarantee of future performance or results,

and will not necessarily be an accurate indication of whether or

not such results will be achieved. A number of factors could cause

actual results to differ materially from the results discussed in

the forward-looking statements, including, without limitation:

those relating to potential disruptions to production and delivery,

including as a result of equipment failures, labour issues, the

complex integration of processes and equipment and other similar

factors; labour relations; failure to meet regulatory requirements;

changes in the market; potential downturns in economic conditions;

fluctuations in the price and supply of required materials,

including log costs; fluctuations in the market price for products

sold; foreign exchange fluctuations; trade restrictions or import

duties imposed by foreign governments; availability of financing

(as necessary); and other risk factors detailed in our 2022 annual

information form dated March 30, 2023 and our management's

discussion and analysis for the year ended December 31, 2022 and

the quarter ended March 31, 2023 available on SEDAR at

www.sedar.com and other filings with the Canadian securities

regulatory authorities. These risks, as well as others, could cause

actual results and events to vary significantly. Accordingly,

readers should exercise caution in relying upon forward-looking

statements and Conifex undertakes no obligation to publicly revise

them to reflect subsequent events or circumstances, except as

required by applicable securities laws.

____________________________

1 Source: Random Lengths Publications Inc.

2 Source: Forest Economic Advisors, LLC.

3 Source: Bank of Canada, www.bankofcanada.ca

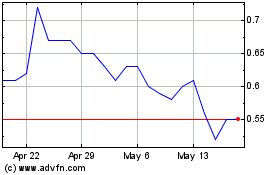

Conifex Timber (TSX:CFF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Conifex Timber (TSX:CFF)

Historical Stock Chart

From Dec 2023 to Dec 2024