Conifex Announces Secured Term Loan

13 June 2024 - 6:10AM

Conifex Timber Inc. ("Conifex") (TSX: CFF) announced today that it

has completed a $25 million secured term loan (the "Term Loan")

with PenderFund Capital Management Ltd. ("Pender"), an independent

investment firm located in Vancouver, British Columbia. A portion

of the Term Loan was utilized to repay and retire Conifex's

existing lumber segment credit facility with Wells Fargo Capital

Finance Corporation Canada in the amount of approximately $11

million. The balance of the Term Loan will be available for working

capital and general corporate purposes.

“On behalf of the entire Conifex team, we are

delighted with the show of support PenderFund provided. They

studied our business structure and objectives and provided us a

tailored financing solution that provides our management team

significant flexibility to strengthen our operations in Mackenzie

and paves the way for improved operating results,” commented Ken

Shields, Conifex CEO and Chairman.

“We understand that British Columbia’s forestry

sector is currently facing challenges on several fronts, however we

are optimistic about the long-term value of Conifex’s business.

Amongst other strengths, Conifex enjoys excellent access to timber

supply and possesses an important diversifying income stream from

its power generation assets,” said Geoff Castle, Lead Portfolio

Manager, Fixed Income at PenderFund.

The Term Loan has a term of 5 years, bears

interest of 14% per annum and is substantially secured by Conifex's

lumber segment assets. Conifex has also agreed to issue 3.6 million

common share purchase warrants to Pender having a 5 year term. Each

warrant is exercisable into one common share for $0.75. Pursuant to

applicable securities laws, the warrants are subject to a hold

period of four months and one day from issuance.

Having completed the Term Loan, Conifex is now

evaluating opportunities to secure a working capital facility to

further help ensure sufficient liquidity to sustain operations

through a period of below normal lumber prices. Across its lumber

and power operations, Conifex's total long-term debt, including the

PenderFund Term Loan is approximately $75.3 million having a

weighted average interest rate of 9.29%.

Conifex also announced today that it expects to

hold its annual shareholders' meeting in or around the third

quarter of 2024. While Conifex typically holds its annual

shareholder meeting in summer, Conifex considered a later meeting

was necessary while it focused on completing the Term Loan and

continues to focus on evaluating a working capital facility and

other business opportunities.

Conifex was advised by Raymond James Ltd.

For further information, please contact:

Trevor PrudenChief Financial Officer(604)

216-2949

About Conifex Timber Inc.

Conifex and its subsidiaries' primary business

currently includes timber harvesting, reforestation, forest

management, sawmilling logs into lumber and wood chips, and value

added lumber finishing and distribution. Conifex's lumber products

are sold in the United States, Canadian and Japanese markets.

Conifex also produces bioenergy at its power generation facility at

Mackenzie, BC.

Forward-Looking

StatementsCertain statements in this news release may

constitute “forward-looking statements”. Forward-looking statements

are statements that address or discuss activities, events or

developments that Conifex expects or anticipates may occur in the

future. When used in this news release, words such as “estimates”,

“expects”, “plans”, “anticipates”, “projects”, “will”, “believes”,

“intends” “should”, “could”, “may” and other similar terminology

are intended to identify such forward-looking statements.

Forward-looking statements reflect the current expectations and

beliefs of Conifex’s management. Because forward-looking statements

involve known and unknown risks, uncertainties and other factors,

actual results, performance or achievements of Conifex or the

industry may be materially different from those implied by such

forward-looking statements. Examples of such forward-looking

information that may be contained in this news release include

statements regarding the purposes for which the Term Loan may be

used, the expected date of the AGM, and the ability of Conifex to

enter into a working capital facility. Assumptions underlying

Conifex's expectations regarding forward-looking information

contained in this news release include, among others, that Conifex

will successfully negotiate and execute definitive documentation

and complete a working capital facility. Forward-looking statements

involve significant uncertainties, should not be read as a

guarantee of future performance or results, and will not

necessarily be an accurate indication of whether or not such

results will be achieved. A number of factors could cause actual

results to differ materially from the results discussed in the

forward-looking statements, including, without limitation, that

Conifex will obtain all expected benefits from the Term Loan; and

other risk factors detailed in our filings with the Canadian

Securities Regulatory Authorities available on SEDAR+ at

www.sedarplus.ca. These risks, as well as others, could cause

actual results and events to vary significantly. Accordingly,

readers should exercise caution in relying upon forward-looking

statements and Conifex undertakes no obligation to publicly revise

them to reflect subsequent events or circumstances, except as

required by law.

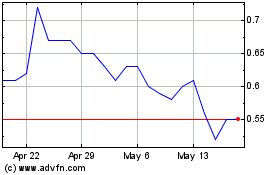

Conifex Timber (TSX:CFF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Conifex Timber (TSX:CFF)

Historical Stock Chart

From Feb 2024 to Feb 2025