Calian® Group Ltd. (TSX:CGY), a diverse products and services

company providing innovative healthcare, communications, learning

and cybersecurity solutions, today released its results for the

first quarter ended December 31, 2024.

Q1-25 Highlights:

- Revenue up 3% to $185 million

- Gross margin at 31.8%, slightly down from 32.5% last year

- Adjusted EBITDA1 of $18 million, down from $21 million last

year

- Operating free cash flow1 of $13 million, down from $17 million

last year

- Net debt to adjusted EBITDA1 ratio of 0.6x

- Repurchased 101,350 shares in consideration of $4.9

million

- Guidance reiterated

- Announced new U.S. subsidiary to focus on U.S. government and

defence

| |

|

|

Financial Highlights |

Three months ended |

| (in millions of $, except per

share & margins) |

December 31, |

|

|

2024 |

|

20232 |

|

% |

|

Revenue |

185.0 |

|

179.2 |

|

3 |

% |

| Adjusted EBITDA1 |

17.8 |

|

21.4 |

|

(17) |

% |

| Adjusted EBITDA %1 |

9.6 |

% |

11.9 |

% |

(230)bps |

| Adjusted Net Profit1 |

10.5 |

|

14.0 |

|

(25) |

% |

| Adjusted EPS Diluted1 |

0.88 |

|

1.17 |

|

(25) |

% |

| Operating Free Cash Flow1 |

13.1 |

|

17.2 |

|

(24) |

% |

|

|

|

|

|

| |

|

|

|

1 This is a non-GAAP measure. Please refer to

the section “Reconciliation of non-GAAP measures to most comparable

IFRS measures” at the end of this press release.2 Certain

comparative figures have been reclassified to align with the

current year's presentation. For more information, please see the

selected consolidated financial information section of the

management discussion and analysis.

Access the full report on the Calian Financials

web page. Register for the conference call on Thursday,

February 13, 2025, 8:30 a.m. Eastern Time.

“We closed the quarter as expected and are

seeing positive momentum across our diverse end markets, while

continuing to benefit from the strong contributions of our recent

acquisitions in UK, the U.S. and Canada,” said Kevin Ford, Calian

CEO. “The accelerating global demand for defence solutions

positions Calian’s expanding footprint to play a critical role in

the years ahead. Additionally, discussions among Canadian leaders

about increasing military investment and accelerating initiatives

are a welcome development. We remain on track to deliver another

record year and are making progress against our long-term

objectives.”

First Quarter Results

Revenues increased 3%, from $179 million to $185

million, representing the highest first quarter revenue on record.

Acquisitive growth was 8% and was generated by the acquisitions of

Decisive Group, the nuclear assets from MDA Ltd and Mabway. Organic

growth was down 5%, as growth generated in global Defence was

offset by declines in the pace of domestic Defence training and

delays in large projects in its Space and IT infrastructure

markets.

Gross margin stood at 31.8% and represents the

11th quarter above the 30% mark. Adjusted EBITDA1 stood at $18

million, down 17% from $21 million last year, primarily impacted by

revenue mix and increased investments in our sales and delivery

capacity. As a result, adjusted EBITDA1 margin decreased to 9.6%,

from 11.9% last year.

Net profit stood at $(1) million, or $(0.08) per

diluted share, down from $6 million, or $0.46 per diluted share

last year. This decrease in profitability is primarily due to

increases in accounting charges related to amortization and deemed

compensation expenses from acquisitions as well as increased

operating expenses, which was offset by higher gross profit.

Adjusted net profit1 was $10 million, or $0.88 per diluted share,

down from $14 million, or $1.17 per diluted share last year.

Liquidity and Capital

Resources

“In the first quarter we generated $13 million

in operating free cash flow1, representing a 73% conversion rate

from adjusted EBITDA1,” said Patrick Houston, Calian CFO. “We used

our cash and a portion of our credit facility to pay contingent

earn out liabilities for $11 million and make capital expenditure

investments for $1 million. We also provided a return to

shareholders in the form of dividends for $3 million and share

buybacks for $5 million. We ended the quarter with a net debt to

adjusted EBITDA1 ratio of 0.6x, well-positioned to pursue our

growth objectives,” concluded Mr. Houston.

Normal Course Issuer Bid

In the three-month period ended December 31,

2024, the Company repurchased 101,350 shares for cancellation in

consideration of $4.9 million.

Announced U.S. Subsidiary to Focus on U.S. Government

and Defence

On December 4, 2024, Calian announced the launch

of an independent U.S.-focused subsidiary, Calian US, Inc. It is

committed to securing U.S. government contracts by ensuring full

compliance with all relevant regulations. To facilitate this,

Calian US will be established as an independent subsidiary and will

pursue the necessary certifications to operate effectively within

the U.S. market.

Quarterly Dividend

On February 12, 2025, Calian declared a

quarterly dividend of $0.28 per share. The dividend is payable

March 12, 2025, to shareholders of record as of February 26, 2025.

Dividends paid by the Company are considered “eligible dividend”

for tax purposes.

Guidance Reiterated

The table below presents the FY25 guidance based

on the new definition of adjusted EBITDA.

|

|

Guidance for the year ended September 30,

2025 |

FY24 Results |

|

YOY Growth at Midpoint |

|

(in thousands of $) |

Low |

|

Midpoint |

|

High |

|

|

|

Revenue |

800,000 |

|

840,000 |

|

880,000 |

|

746,611 |

|

12 |

% |

|

Adj. EBITDA1 |

96,000 |

|

101,000 |

|

106,000 |

|

92,159 |

|

10 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This guidance includes the full-year

contribution from the Decisive Group acquisition, closed on

December 1, 2023, the nuclear asset acquisition from MDA Ltd.,

closed on March 5, 2024 and the Mabway acquisition, closed on May

9, 2024. It does not include any other further acquisitions that

may close within the fiscal year. The guidance reflects another

record year for the Company and positions it well to achieve its

long-term growth targets.

At the midpoint of the range, this guidance

reflects revenue and adjusted EBITDA1 growth of 12% and 10%,

respectively, and an adjusted EBITDA1 margin of 12.0%. It would

represent the 8th consecutive year of double-digit revenue growth

and record revenue and adjusted EBITDA1 levels.

About Calian

www.calian.com

We keep the world moving forward. Calian® helps

people communicate, innovate, learn and lead safe and healthy

lives. Every day, our employees live our values of customer

commitment, integrity, innovation, respect and teamwork to engineer

reliable solutions that solve complex challenges. That’s

Confidence. Engineered. A stable and growing 40-year company, we

are headquartered in Ottawa with offices and projects spanning

North American, European and international markets. Visit

calian.com to learn about innovative healthcare, communications,

learning and cybersecurity solutions.

Product or service names mentioned herein may be

the trademarks of their respective owners.

Media inquiries:media@calian.com 613-599-8600

Investor Relations inquiries:ir@calian.com

-----------------------------------------------------------------------------

DISCLAIMER

Certain information included in this press

release is forward-looking and is subject to important risks and

uncertainties. The results or events predicted in these statements

may differ materially from actual results or events. Such

statements are generally accompanied by words such as “intend”,

“anticipate”, “believe”, “estimate”, “expect” or similar

statements. Factors which could cause results or events to differ

from current expectations include, among other things: the impact

of price competition; scarce number of qualified professionals; the

impact of rapid technological and market change; loss of business

or credit risk with major customers; technical risks on fixed price

projects; general industry and market conditions and growth rates;

international growth and global economic conditions, and including

currency exchange rate fluctuations; and the impact of

consolidations in the business services industry. For additional

information with respect to certain of these and other factors,

please see the Company’s most recent annual report and other

reports filed by Calian with the Ontario Securities Commission.

Calian disclaims any intention or obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise. No assurance can be given

that actual results, performance or achievement expressed in, or

implied by, forward-looking statements within this disclosure will

occur, or if they do, that any benefits may be derived from

them.

Calian · Head Office · 770 Palladium Drive ·

Ottawa · Ontario · Canada · K2V 1C8 Tel: 613.599.8600 · Fax:

613-592-3664 · General info email:

info@calian.com

|

CALIAN GROUP LTD. |

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF

FINANCIAL POSITION |

|

As at December 31, 2024 and September 30,

2024 |

|

(Canadian dollars in thousands, except per share

data) |

|

|

|

|

|

|

|

|

|

| |

December 31, |

|

September 30, |

|

|

2024 |

|

2024 |

| ASSETS |

|

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

61,040 |

|

|

$ |

51,788 |

|

|

Accounts receivable |

|

157,542 |

|

|

|

157,376 |

|

|

Work in process |

|

20,205 |

|

|

|

20,437 |

|

|

Inventory |

|

29,442 |

|

|

|

23,199 |

|

|

Prepaid expenses |

|

23,805 |

|

|

|

23,978 |

|

|

Derivative assets |

|

31 |

|

|

|

32 |

|

|

Total current assets |

|

292,065 |

|

|

|

276,810 |

|

| NON-CURRENT ASSETS |

|

|

|

|

|

|

|

|

Property, plant and equipment |

|

41,234 |

|

|

|

40,962 |

|

|

Right of use assets |

|

41,746 |

|

|

|

36,383 |

|

|

Prepaid expenses |

|

7,157 |

|

|

|

7,820 |

|

|

Deferred tax asset |

|

3,376 |

|

|

|

3,425 |

|

|

Investments |

|

3,875 |

|

|

|

3,875 |

|

|

Acquired intangible assets |

|

123,297 |

|

|

|

128,253 |

|

|

Goodwill |

|

213,925 |

|

|

|

210,392 |

|

|

Total non-current assets |

|

434,610 |

|

|

|

431,110 |

|

| TOTAL

ASSETS |

$ |

726,675 |

|

|

$ |

707,920 |

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

$ |

123,945 |

|

|

$ |

124,884 |

|

|

Provisions |

|

2,454 |

|

|

|

3,075 |

|

|

Unearned contract revenue |

|

40,263 |

|

|

|

41,723 |

|

|

Lease obligations |

|

5,556 |

|

|

|

5,645 |

|

|

Contingent earn-out |

|

29,709 |

|

|

|

39,136 |

|

|

Derivative liabilities |

|

169 |

|

|

|

92 |

|

|

Total current liabilities |

|

202,096 |

|

|

|

214,555 |

|

| NON-CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

Debt facility |

|

115,750 |

|

|

|

89,750 |

|

|

Lease obligations |

|

39,425 |

|

|

|

33,798 |

|

|

Unearned contract revenue |

|

17,256 |

|

|

|

14,503 |

|

|

Contingent earn-out |

|

2,773 |

|

|

|

2,697 |

|

|

Deferred tax liabilities |

|

23,738 |

|

|

|

25,862 |

|

|

Total non-current liabilities |

|

198,942 |

|

|

|

166,610 |

|

| TOTAL

LIABILITIES |

|

401,038 |

|

|

|

381,165 |

|

| |

|

|

|

|

|

|

|

| SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

Issued capital |

|

227,561 |

|

|

|

225,747 |

|

|

Contributed surplus |

|

4,555 |

|

|

|

6,019 |

|

|

Retained earnings |

|

84,038 |

|

|

|

91,268 |

|

|

Accumulated other comprehensive income (loss) |

|

9,483 |

|

|

|

3,721 |

|

| TOTAL

SHAREHOLDERS’ EQUITY |

|

325,637 |

|

|

|

326,755 |

|

| TOTAL

LIABILITIES AND SHAREHOLDERS’ EQUITY |

$ |

726,675 |

|

|

$ |

707,920 |

|

| Number of common shares issued

and outstanding |

|

11,765,055 |

|

|

|

11,802,364 |

|

|

CALIAN GROUP LTD. |

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF NET

PROFIT |

|

For the three months ended December 31, 2024 and

2023 |

|

(Canadian dollars in thousands, except per share

data) |

| |

|

|

|

| |

Three months ended |

| |

December 31, |

|

|

2024 |

|

|

2023 |

|

Revenue |

$ |

185,047 |

|

|

$ |

179,179 |

|

| Cost of

revenues |

|

126,246 |

|

|

|

120,961 |

|

| Gross

profit |

|

58,801 |

|

|

|

58,218 |

|

| |

|

|

|

| Selling, general and

administrative |

|

38,105 |

|

|

|

34,145 |

|

| Research and development |

|

2,896 |

|

|

|

2,719 |

|

| Share

based compensation |

|

1,091 |

|

|

|

1,190 |

|

| Profit before under

noted items |

|

16,709 |

|

|

|

20,164 |

|

| |

|

|

|

| Restructuring expense |

|

692 |

|

|

|

— |

|

| Depreciation and

amortization |

|

11,540 |

|

|

|

9,006 |

|

| Mergers and acquisition

costs |

|

2,320 |

|

|

|

1,980 |

|

|

Profit before interest income and income tax

expense |

|

2,157 |

|

|

|

9,178 |

|

| |

|

|

|

| Interest expense |

|

1,783 |

|

|

|

1,547 |

|

| Income tax expense |

|

1,350 |

|

|

|

2,106 |

|

|

NET PROFIT (LOSS) |

$ |

(976) |

|

|

$ |

5,525 |

|

| |

|

|

|

| Net profit (loss) per

share: |

|

|

|

|

Basic |

$ |

(0.08) |

|

|

$ |

0.47 |

|

|

Diluted |

$ |

(0.08) |

|

|

$ |

0.46 |

|

|

CALIAN GROUP LTD. |

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

For the three months ended December 31, 2024 and

2023 |

|

(Canadian dollars in thousands) |

| |

|

|

|

|

|

| |

Three months ended |

| |

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| CASH FLOWS GENERATED FROM

(USED IN) OPERATING ACTIVITIES |

|

|

|

|

|

| Net profit |

$ |

(976 |

) |

|

$ |

5,525 |

|

| Items not affecting cash: |

|

|

|

|

|

|

Interest expense |

|

1,295 |

|

|

|

1,098 |

|

|

Changes in fair value related to contingent earn-out |

|

558 |

|

|

|

726 |

|

|

Lease obligations interest expense |

|

488 |

|

|

|

449 |

|

|

Income tax expense |

|

1,350 |

|

|

|

2,106 |

|

|

Employee share purchase plan expense |

|

174 |

|

|

|

162 |

|

|

Share based compensation expense |

|

917 |

|

|

|

1,013 |

|

|

Depreciation and amortization |

|

11,540 |

|

|

|

9,006 |

|

|

Deemed compensation |

|

1,563 |

|

|

|

604 |

|

|

|

|

16,909 |

|

|

|

20,689 |

|

| Change in non-cash working

capital |

|

|

|

|

|

|

Accounts receivable |

|

(167 |

) |

|

|

(11,189 |

) |

|

Work in process |

|

232 |

|

|

|

(898 |

) |

|

Prepaid expenses and other |

|

(2,739 |

) |

|

|

(74 |

) |

|

Inventory |

|

(6,241 |

) |

|

|

(2,590 |

) |

|

Accounts payable and accrued liabilities |

|

(858 |

) |

|

|

15,516 |

|

|

Unearned contract revenue |

|

1,294 |

|

|

|

206 |

|

|

|

|

8,430 |

|

|

|

21,660 |

|

|

Interest paid |

|

(1,783 |

) |

|

|

(1,547 |

) |

|

Income tax paid |

|

(2,265 |

) |

|

|

(2,575 |

) |

| |

|

4,382 |

|

|

|

17,538 |

|

| CASH FLOWS GENERATED FROM

(USED IN) FINANCING ACTIVITIES |

|

|

|

|

|

|

Issuance of common shares net of costs |

|

881 |

|

|

|

694 |

|

|

Dividends |

|

(3,292 |

) |

|

|

(3,314 |

) |

|

Draw on debt facility |

|

26,000 |

|

|

|

56,000 |

|

|

Payment of lease obligations |

|

(1,442 |

) |

|

|

(1,171 |

) |

|

Repurchase of common shares |

|

(4,926 |

) |

|

|

(1,357 |

) |

| |

|

17,221 |

|

|

|

50,852 |

|

| CASH FLOWS USED IN INVESTING

ACTIVITIES |

|

|

|

|

|

|

Business acquisitions |

|

(11,215 |

) |

|

|

(47,457 |

) |

|

Property, plant and equipment |

|

(1,136 |

) |

|

|

(2,400 |

) |

| |

|

(12,351 |

) |

|

|

(49,857 |

) |

| |

|

|

|

|

|

| NET CASH INFLOW (OUTFLOW) |

$ |

9,252 |

|

|

$ |

18,533 |

|

| CASH

AND CASH EQUIVALENTS, BEGINNING OF PERIOD |

|

51,788 |

|

|

|

33,734 |

|

| CASH

AND CASH EQUIVALENTS, END OF PERIOD |

$ |

61,040 |

|

|

$ |

52,267 |

|

| |

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Measures to Most Comparable

IFRS Measures

These non-GAAP measures are mainly derived from

the consolidated financial statements, but do not have a

standardized meaning prescribed by IFRS; therefore, others using

these terms may calculate them differently. The exclusion of

certain items from non-GAAP performance measures does not imply

that these are necessarily nonrecurring. From time to time, we may

exclude additional items if we believe doing so would result in a

more transparent and comparable disclosure. Other entities may

define the above measures differently than we do. In those cases,

it may be difficult to use similarly named non-GAAP measures of

other entities to compare performance of those entities to the

Company’s performance.

Management believes that providing certain

non-GAAP performance measures, in addition to IFRS measures,

provides users of the Company’s financial reports with enhanced

understanding of the Company’s results and related trends and

increases transparency and clarity into the core results of the

business. Adjusted EBITDA excludes items that do not reflect, in

our opinion, the Company’s core performance and helps users of our

MD&A to better analyze our results, enabling comparability of

our results from one period to another.

Adjusted EBITDA

| |

|

|

|

|

|

Three months ended |

| |

|

December 31, |

|

|

|

2024 |

|

|

|

20231 |

|

| Net profit |

$ |

(976 |

) |

|

$ |

5,525 |

|

| Share based compensation |

|

1,091 |

|

|

|

1,190 |

|

| Restructuring expense |

|

692 |

|

|

|

— |

|

| Depreciation and

amortization |

|

11,540 |

|

|

|

9,006 |

|

| Mergers and acquisition

costs |

|

2,320 |

|

|

|

1,980 |

|

| Interest expense |

|

1,783 |

|

|

|

1,547 |

|

| Income

tax |

|

1,350 |

|

|

|

2,106 |

|

|

Adjusted EBITDA |

$ |

17,800 |

|

|

$ |

21,354 |

|

| |

|

|

|

|

|

|

|

Adjusted Net Profit and Adjusted EPS

| |

|

|

|

|

|

Three months ended |

| |

|

December 31, |

|

|

|

2024 |

|

|

|

20231 |

|

| Net profit |

$ |

(976 |

) |

|

$ |

5,525 |

|

| Share based compensation |

|

1,091 |

|

|

|

1,190 |

|

| Restructuring expense |

|

692 |

|

|

|

— |

|

| Mergers and acquisition

costs |

|

2,320 |

|

|

|

1,980 |

|

|

Amortization of intangibles |

|

7,334 |

|

|

|

5,325 |

|

| Adjusted net profit |

|

10,461 |

|

|

|

14,020 |

|

| Weighted average number of

common shares basic |

|

11,773,465 |

|

|

|

11,812,574 |

|

|

Adjusted EPS Basic |

|

0.89 |

|

|

|

1.19 |

|

|

Adjusted EPS Diluted |

$ |

0.88 |

|

|

$ |

1.17 |

|

| |

|

|

|

|

|

|

|

Operating Free Cash Flow

| |

|

|

|

|

|

Three months ended |

| |

|

December 31, |

|

|

|

2024 |

|

|

|

20231 |

|

| Cash flows generated from

operating activities (free cash flow) |

$ |

4,382 |

|

|

$ |

17,538 |

|

| Adjustments: |

|

|

|

|

|

|

M&A costs included in operating activities |

|

199 |

|

|

|

650 |

|

|

Change in non-cash working capital |

|

8,479 |

|

|

|

(971) |

|

| Operating free cash flow |

$ |

13,060 |

|

|

$ |

17,217 |

|

| Operating free cash flow per

share - basic |

|

1.11 |

|

|

|

1.46 |

|

| Operating free cash flow per

share - diluted |

|

1.10 |

|

|

|

1.44 |

|

|

Operating free cash flow conversion |

|

73 |

% |

|

|

81 |

% |

| |

|

|

|

|

|

|

|

Net Debt to Adjusted EBITDA

| |

|

|

|

|

| |

December 31, |

|

|

September 30, |

|

|

|

2024 |

|

|

|

20231 |

|

|

Cash |

$ |

61,040 |

|

|

$ |

52,267 |

|

|

Debt facility |

|

115,750 |

|

|

|

93,750 |

|

|

Net debt (net cash) |

|

54,710 |

|

|

|

41,483 |

|

|

Trailing twelve month adjusted EBITDA |

|

88,602 |

|

|

|

65,987 |

|

|

Net debt to adjusted EBITDA |

|

0.6 |

|

|

|

0.6 |

|

| |

|

|

|

|

|

|

|

Operating free cash flow measures the company’s

cash profitability after required capital spending when excluding

working capital changes. The Company’s ability to convert adjusted

EBITDA to operating free cash flow is critical for the long term

success of its strategic growth. These measurements better align

the reporting of our results and improve comparability against our

peers. We believe that securities analysts, investors and other

interested parties frequently use non-GAAP measures in the

evaluation of issuers. Management also uses non-GAAP measures in

order to facilitate operating performance comparisons from period

to period, prepare annual operating budgets and assess our ability

to meet our capital expenditure and working capital requirements.

Non-GAAP measures should not be considered a substitute for or be

considered in isolation from measures prepared in accordance with

IFRS. Investors are encouraged to review our financial statements

and disclosures in their entirety and are cautioned not to put

undue reliance on non-GAAP measures and view them in conjunction

with the most comparable IFRS financial measures. The Company has

reconciled adjusted profit to the most comparable IFRS financial

measure as shown above.

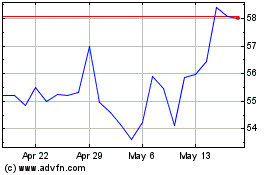

Calian (TSX:CGY)

Historical Stock Chart

From Jan 2025 to Feb 2025

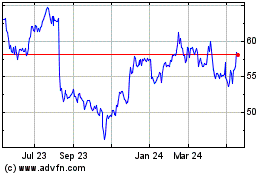

Calian (TSX:CGY)

Historical Stock Chart

From Feb 2024 to Feb 2025