Transaction boosts CI’s U.S. assets to

US$115 billion, making U.S. wealth management CI’s largest business

line

CI Financial Corp. (“CI”) (TSX: CIX; NYSE: CIXX) and Columbia

Pacific of Seattle today announced a strategic relationship in

which CI will invest in the continued growth of Columbia Pacific’s

world-class wealth management and alternative asset management

firms.

Under the agreements, CI will acquire Columbia Pacific Wealth

Management (“CPWM”), which has US$6.4 billion in total assets under

management and provides a full range of wealth management solutions

to high-net-worth and ultra-high-net-worth clients on the West

Coast and across the United States. Additionally, CI will acquire a

minority stake in Columbia Pacific Advisors, LLC (“CPA”), an

alternative asset management firm that manages US$3.5 billion in

total assets under management across a broad selection of

institutional-caliber real estate private equity, direct lending,

opportunistic and hedged strategies.

“Columbia Pacific has built remarkable wealth management and

alternative asset management businesses centered on delivering the

best possible outcomes for their clients and investors,” said Kurt

MacAlpine, Chief Executive Officer of CI Financial. “Their success

has been driven by highly skilled and committed leadership teams

with extensive experience in financial services and other

businesses. The cultural alignment and shared vision for growth

make this an exciting opportunity for CI as we continue to attract

the best firms in the business to CI Private Wealth.”

“CI’s investment is evidence of the success of our deliberate

and long-term strategy to build enduring wealth management and

alternative asset management businesses,” said Alex Washburn,

Co-Founder and Managing Partner of CPWM and CPA. “This partnership

will also broaden the resources and support available to Columbia

Pacific as we continue to enhance the universe of investment

opportunities for the families we advise. CI has earned a

reputation for investing in best-in-class teams, and we are

thrilled to partner with them as they make a permanent investment

in our companies. On behalf of our executive teams, I would like to

thank our colleagues at CPWM and CPA for their drive, commitment

and continuing focus on delivering outstanding service and

performance to our clients and investors. We are just getting

started!”

Columbia Pacific Wealth Management

CPWM serves high-net-worth and ultra-high-net-worth individuals

and families and select institutions from offices in Seattle and

San Francisco. It provides comprehensive wealth management

services, including retirement, estate, tax, and cash flow

planning, risk management, and investment management, including

alternative, ESG, and impact investing. CPWM is led by Managing

Partners Alex Washburn and Peder Schmitz, President Derek Crump,

and Tyler Gaspard. The company was founded by Mr. Washburn, Mr.

Schmitz, Stan Baty, and Dan Baty.

As part of the transaction, CPWM owners will become equity

partners in CI Private Wealth, the private partnership that holds

CI’s broader U.S. wealth management business.

“CPWM, with its comprehensive approach to wealth planning and a

loyal, growing client base, is a fantastic fit with the other

high-quality RIAs at CI Private Wealth and is another significant

step forward in building the leading wealth management platform for

high-net-worth and ultra-high-net-worth families in the U.S,” said

Mr. MacAlpine. “The decision by CPWM partners to take individual

ownership stakes in CI Private Wealth not only shows their

dedication to the continued success of their current clients, but

their dedication to the growth and development of the broader

partnership.”

“We’re excited by the opportunity to invest in the growth of CI

Private Wealth and to work alongside other exceptional, like-minded

firms to offer the best in wealth management services,” said Mr.

Washburn.

Columbia Pacific Advisors

CPA provides alternative investment strategies that include real

estate private equity, direct lending to real estate, commercial,

and industrial businesses, opportunistic and hedged strategies. The

quality of the firm’s strategies has attracted clients from the

U.S. and internationally, including individuals and institutions

such as pension funds and sovereign wealth funds. CPA has

participated in over $10 billion in transactions since its

inception.

CPA, founded in 2006 by Mr. Washburn, Managing Partner, Stan

Baty, Managing Partner, and Dan Baty, identified a need to deliver

institutional-level alternative investment management in the

Pacific Northwest. The firm leverages the founders’ extensive

experience in real estate and private markets investments.

Following the completion of the Columbia Pacific transactions,

the leadership teams at CPWM and CPA will remain in place.

When these and other outstanding transactions are completed,

CI’s U.S. wealth management assets are expected to be approximately

US$115 billion (C$147 billion). As a result, U.S. wealth management

will become CI’s largest business line by assets, exceeding core

asset management and Canadian wealth management. CI’s total assets

globally are expected to reach approximately US$293 billion (C$375

billion).

Columbia Pacific will also deepen CI’s presence in the Pacific

Northwest and on the West Coast, following CI’s October agreement

to invest in McCutchen Group, LLC, a Seattle-based registered

investment advisor focused on ultra-high-net-worth clients.

Berkshire Global Advisors LP served as exclusive financial

advisor to CPWM and CPA, and Stradley Ronon Stevens & Young,

LLP acted as legal advisor. CI’s legal advisor was Hogan Lovells US

LLP. The transactions are expected to close later this month,

subject to regulatory and other customary closing conditions.

Financial terms were not disclosed.

Asset amounts as at November 30, 2021.

About CI Financial

CI Financial Corp. is an independent company offering global

asset management and wealth management advisory services. CI

managed and advised on approximately C$338.1 billion (US$264.6

billion) in client assets as at November 30, 2021. CI’s primary

asset management businesses are CI Global Asset Management (CI

Investments Inc.) and GSFM Pty Ltd., and it operates in Canadian

wealth management through CI Assante Wealth Management (Assante

Wealth Management (Canada) Ltd.), CI Private Counsel LP, Aligned

Capital Partners Inc., CI Direct Investing (WealthBar Financial

Services Inc.), and CI Investment Services Inc.

CI’s U.S. wealth management businesses consist of Barrett Asset

Management, LLC, BDF LLC, Budros, Ruhlin & Roe, Inc., Bowling

Portfolio Management LLC, Brightworth, LLC, The Cabana Group, LLC,

Congress Wealth Management, LLC, Dowling & Yahnke, LLC, Doyle

Wealth Management, LLC, Matrix Capital Advisors, LLC, McCutchen

Group LLC, One Capital Management, LLC, Portola Partners Group LLC,

Radnor Financial Advisors, LLC, The Roosevelt Investment Group,

LLC, RGT Wealth Advisors, LLC, Segall Bryant & Hamill, LLC,

Stavis & Cohen Private Wealth, LLC, and Surevest LLC.

CI is listed on the Toronto Stock Exchange under CIX and on the

New York Stock Exchange under CIXX. Further information is

available at www.cifinancial.com.

This press release contains forward-looking statements

concerning anticipated future events, results, circumstances,

performance or expectations with respect to CI Financial Corp.

(“CI”) and its products and services, including its business

operations, strategy and financial performance and condition.

Forward-looking statements are typically identified by words such

as “believe”, “expect”, “foresee”, “forecast”, “anticipate”,

“intend”, “estimate”, “goal”, “plan” and “project” and similar

references to future periods, or conditional verbs such as “will”,

“may”, “should”, “could” or “would”. These statements are not

historical facts but instead represent management beliefs regarding

future events, many of which by their nature are inherently

uncertain and beyond management’s control. Although management

believes that the expectations reflected in such forward-looking

statements are based on reasonable assumptions, such statements

involve risks and uncertainties. The material factors and

assumptions applied in reaching the conclusions contained in these

forward-looking statements include that the acquisitions of CPWM,

CPA, RegentAtlantic Capital, LLC, Gofen and Glossberg, LLC, and

R.H. Bluestein & Co. will be completed and their asset levels

will remain stable, that the investment fund industry will remain

stable and that interest rates will remain relatively stable.

Factors that could cause actual results to differ materially from

expectations include, among other things, general economic and

market conditions, including interest and foreign exchange rates,

global financial markets, changes in government regulations or in

tax laws, industry competition, technological developments and

other factors described or discussed in CI’s disclosure materials

filed with applicable securities regulatory authorities from time

to time. The foregoing list is not exhaustive and the reader is

cautioned to consider these and other factors carefully and not to

place undue reliance on forward-looking statements. Other than as

specifically required by applicable law, CI undertakes no

obligation to update or alter any forward-looking statement after

the date on which it is made, whether to reflect new information,

future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211213006097/en/

Investor Relations Jason Weyeneth, CFA Vice-President,

Investor Relations & Strategy 416-681-8779 jweyeneth@ci.com

Media Relations United States Trevor Davis, Gregory

FCA for CI Financial 443-248-0359 cifinancial@gregoryfca.com

Canada Murray Oxby Vice-President, Corporate Communications

416-681-3254 moxby@ci.com

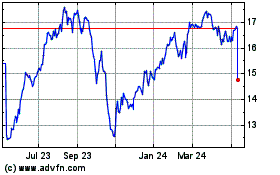

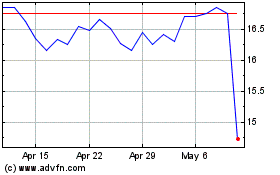

CI Financial (TSX:CIX)

Historical Stock Chart

From Oct 2024 to Nov 2024

CI Financial (TSX:CIX)

Historical Stock Chart

From Nov 2023 to Nov 2024