Condor Gold (AIM:CNR) (OTCQX:CNDGF) (TSX:COG) is pleased to

announce its audited results for the year ended 31 December 2017.

HIGHLIGHTS

- £ 5.242M raised by way of a private placement of new ordinary

shares

- Approximately 2,000 meters drilling on 3 scout targets

completed on Real de la Cruz, Tatescame and Andrea

- 5,922 metre drill campaign completed at Mestiza.. The objective

of the drill campaign at Mestiza is to convert an historic

Soviet-era resource to NI 43-101 standard

- The highlight of the drill results on Mestiza is a high-grade

ore shoot in the Tatiana vein. This has a strike length of 450 m

and an estimated average true width of 2.2 m. The shoot can be

extrapolated approximately 200 m below surface; LIDC 344, which has

a drill width 3.30 m at 28.3 g/t gold, is 60 m vertically beneath

surface. LIDC 358, drill width of 3.55 m at 23.3 g/t gold, is

approximately 100 m vertically below LIDC 344

- Soil geochemistry survey completed in August 2017 over the

entire 313 km² of La India Project, included several high grade

rock chip samples of over 10g/t gold, highlighting several new

exploration targets

- Regional structural geological model updated highlighting two

major basement feeder zones, La India Corridor and the Andrea

Corridor, together with a linking structure in the South

- Significant progress made by the social team on gaining a

social licence to operate

- Secondary trading on the OTCQX Best Market in the U.S.

commenced in April 2017

- Conditional approval received to dual- list the Company’s

shares on the Toronto Stock Exchange

POST PERIOD HIGHLIGHTS

- Shares of the Company were dual-listed on the Toronto Stock

Exchange on 15 January 2018

- Roger Davey retired from the Board after 6 years and was

replaced by Andrew Cheatle, a Canadian resident and mining industry

professional

- La India Open pit was redesigned to avoid resettlement and a

corresponding amendment to the Environmental and Social Impact

Assessment, which forms a key part of the application for the

Environmental Permit, was submitted to the Ministry of the

Environment and Natural Resources

- Redesigned open pit is not expected to materially alter a

Pre-Feasibility Study open pit gold mineral reserve in the Probable

category of 6.9 Mt at 3.0 g/t gold for 675,000 oz gold, producing

80,000 oz gold per annum for seven years

CHAIRMAN’S STATEMENTFOR

THE YEAR ENDED 31 DECEMBER 2017

Dear Shareholder,

I am pleased to announce Condor Gold Plc’s

(“Condor” or “the Company” or “the Group”, www.condorgold.com)

annual report for the 12-month financial year to 31 December

2017. Following the release in December 2014 of a NI 43-101

technical report detailing a Pre-Feasibility Study (“PFS”) and two

Preliminary Economic Assessments (“PEAs”), the Company spent 2015,

2016 and 2017 executing a twin strategy of permitting the

construction and operation of a base case processing plant with

capacity of up to 2,800 tonnes per day (“tpd”) capable of producing

approximately 100,000 oz gold per annum and proving a major Gold

District at the 313km² La India Project, Nicaragua.

In November 2015, Condor formally submitted a

700-page Environmental and Social Impact Assessment (“ESIA”)

document, applying for an Environmental Permit to the Ministry of

the Environment and Natural Resources, Nicaragua (“MARENA”) for the

construction and operation of an open pit mine, a 2,800 tpd or 1

million tonnes per annum (“tpa”) CIL processing plant and

associated infrastructure at the La India Project. The application

envisaged the resettlement of approximately 330 houses or 1,000

people. The community resettlement combined with Presidential and

Mayoral elections has been the reason the permit has been delayed

18 months. Overall, the Government of Nicaragua has been supportive

of Condor building a new mine at the historic Mina La India.

On 26 February 2018, Condor announced that it

had formally submitted a 130 page amendment to the ESIA to MARENA,

to construct and operate a processing plant without the need to

resettle approximately 330 houses or 1,000 people. This followed

several months of discussions and collaborative meetings with

MARENA and the Ministry of Energy and Mines (“MEM”), such that the

technical components within the amended ESIA required by both

Ministries were agreed in advance and submitted in the final

amended application.

The general feedback from MEM, MARENA and local

stakeholders has been that permitting will be much easier now that

the mine has been redesigned to proceed without resettling 1,000

people. Condor’s technical team has redesigned La India open pit

and believe it is both technically viable and economically

attractive, should future funding be received, to proceed with a

redesigned open pit that does not require community resettlement.

It includes the relocation of the processing plant approximately

1,200 metres from the village. A 5 metre high berm is planned

between the redesigned open pit and the village to reduce noise and

dust pollution. Mine scheduling studies are on-going, and further

details will be provided in due course. Condor does not anticipate

a material change in the total ounces of gold expected to be

recoverable from the redesigned open pit compared to the open pit

disclosed in the PFS. The PFS details an open pit gold mineral

reserve in the Probable category of 6.9 Mt at 3.0 g/t gold for

675,000 oz gold, producing 80,000 oz gold per annum for seven

years.

The revised ESIA document considers the

environmental and social impacts of gold production from the La

India Open Pit mine plan, which is a single pit, detailed in the NI

43-101 compliant PFS released in December 2014 and the Whittle

Enterprise Optimisation study which was finalised on 22 January

2016. The ESIA draws on data from 15 different environmental and

social baseline studies, some of which commenced in 2013. In

addition to describing the potential impacts of a future commercial

mine on the environment, the ESIA also contains detailed

environmental management plans and social management plans to

monitor and control any such impacts.

The ESIA describes a processing plant that will

have a capacity of up to 2,800 tpd 1.0 million tpa with an upfront

capital cost of approximately US$120M. All-in-sustaining-cash-costs

are circa US$700 per oz gold. The ESIA includes processing of an

additional 10,000oz of gold p.a. from artisanal miners through the

main processing plant, but the artisanal miners’ ore is excluded

from the PFS, PEAs and Optimisation Studies.

During 2017, SRK Consulting (UK) Ltd. completed

two scoping level studies each aimed at examining the likely

production scenarios in the event that the mineral resource in the

3 main vein sets of La India, America and Mestiza is increased from

2.1M oz gold to 3M oz gold. The studies conclude that the 3 vein

sets could be mined simultaneously from a combination of open pit

and underground mining methods and possibly double the annual

production rate.

Condor has been working on a land acquisition

programme for over 4 years and plans to acquire approximately 600

hectares of rural land for the production scenario in the PFS.

ProNicaragua is assisting with a clean up of land titles.

During 2017, the Company purchased 150 hectares of rural land. Two

independent valuations have been conducted and a strategy is being

implemented to secure the rural land by paying 10% of the purchase

price of land to landowners, who grant Condor an option to purchase

the rural land for a two-year period. Offers to purchase the land

have been made to all landowners; at the time of writing 30% have

accepted.

Exploration activities during 2017 followed a

dual approach of exploration or scout drilling which targeted new

areas within the La India Project and regional exploration,

primarily focussed on identifying targets for hidden deep-seated

gold mineralisation.

On 31st March 2017, Condor commenced an initial

2,000m drilling programme on Mestiza to test the historic Soviet

mineral resource and went on to complete almost 6,000m drilling on

Mestiza by August 2017. The aim was to convert the upper portion of

the Soviet mineral resource to a NI 43-101-standard Inferred

Mineral Resource. This is significant for four reasons:

- Soviet-backed drilling in 1991 supported a Soviet-style mineral

resource of 2,392kt at 10.2 g/t gold for 785,694oz gold at Mestiza.

Note that the Company is not treating this historical estimate as

current mineral resources or mineral reserves. It is superseded by

the mineral resources reported herein. Condor has used the Soviet

data, and subsequent drilling undertaken by Canadian companies, to

plan a drill programme to convert the upper portion of the Soviet

resource to Western standards.

- Mestiza already hosts a NI 43-101-compliant Inferred Mineral

Resource of 1,490kt at 7.47g/t for 333,000oz gold. However, this is

excluded from the current PFS and PEA Studies at the La India

Project.

- There is a high possibility of bringing additional high grade

gold ore from Mestiza into a future mine plan, feeding a

centralised processing plant.

- There is the possibility of a third feeder pit on Mestiza.

The Mestiza Vein Set is excluded from the PFS.

It is encouraging that Micon International’s 1998 report on the

Espinito-Mendoza Concession concluded that the property has good

potential to become a small (500 to 800tpd), low cost

mine.

In April 2017, Condor completed a regional soil

geochemistry survey designed to look for high-level, epithermal

pathfinder elements above hidden deep-seated epithermal gold

mineralisation. Following the 71km² multi-element soil survey

carried out in 2015 a further 109km² was completed in 2016, with

the balance of the entire 313km² of the La India Project concession

package completed by April 2017. The interpretation of the soil

geochemistry, in conjunction with the field mapping, has

highlighted several areas for follow up exploration.

The International Finance Corporation (“IFC”),

the private sector investment body of the World Bank, was a 7.33%

shareholder in the Company at 31st December 2017. Condor is

committed to complying with IFC Performance Standards, which are an

international benchmark for identifying and managing environmental

and social risk. Condor has put considerable time and effort into

fulfilling the requirements of an Environmental Social Action Plan

(ESAP), which was agreed to with the IFC as part of their

investment process.

La India Project has now met the conditions of

the agreed ESAP. The Company’s fulfilment of the ESAP items, to the

satisfaction of the IFC, is establishing the basis for the

sustainability of a future mine at the La India Project, whose

development is subject to obtaining all required permits and

compliance with IFC performance standards applicable to that stage.

Implementation of the IFC Performance Standards help Condor manage

and improve our environmental and social performance through an

outcomes-based approach and also provide a solid base from which

the company may increase the sustainability of its business

operations and provides benefits for all shareholders.

In October 2017, Mr Aiser Sarria joined Condor

Gold as General Manager, Mina La India. Mr Sarria joins Condor from

B2Gold where he was Projects and Mine Superintendent at El Limon

Mine, which is only 35 miles away from La India Project. He has the

relevant experience of open pit and underground mining to progress

Mina La India through permitting, additional technical studies and

construction. In November 2017, Mr Jeffrey Karoly joined Condor

Gold as Chief Financial Officer. Mr Karoly has extensive experience

at CFO-level in listed companies, with a particular focus on South

America since spending time there with Anglo American. He has

first-hand experience of maintaining AIM/TSX dual listings and was

instrumental in Condor’s dual listing on the TSX in January

2018.

Turning to the financial results for the year

2017, the loss for the year was £3,023,615 (2016:£7,682,231). The

Company raised £5.242 million during the financial period. The

increase in cash and cash equivalents over the year was £362,651

(2016: increase of £141,900). The net cash balance at 31st

December 2017 was £946,261

In 2017, the Company announced it had raised

£5.242m by way of a private placement of 8,454,733 new ordinary

shares at a placement price of 62 pence. A one-half warrant, which

is unlisted, was attached to each placement share. A total of

4,227,364 warrants were issued with an exercise price of 93 pence

and a 2 year life. If exercised in full, the warrants would raise

gross proceeds of £3,931,449

The twin strategy for 2018 remains to obtain the

Environmental Permit for a base case of a 2,800tpd processing plant

for a single open pit at La India, with the capacity to produce

approximately 100,000oz gold per annum and to demonstrate a major

Gold District at La India Project. On the grant of the permits,

Condor envisages a 12 month study period followed by an 18 to 24

month construction period. During the 12 month study period,

subject to funding, the Company has exploration drill plans

targeted to add 1million ounces of gold to the global mineral

resource through extensions to known mineralisation and determine

whether feeder pits can be added to the PFS as well as progress the

main La India open pit from PFS to FS.

CONDOR GOLD PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOMEFOR THE YEAR ENDED 31 DECEMBER

2017

| |

|

|

Year

Ended31.12.17 |

|

|

Year

Ended31.12.16 |

|

| |

|

|

£ |

|

|

£ |

|

| Administrative expenses |

|

|

(3,023,953 |

) |

|

(3,618,877 |

) |

| |

|

|

|

|

|

| Impairment of El Salvador assets |

|

|

- |

|

|

(4,065,086 |

) |

| |

|

|

|

|

|

| Operating loss |

|

|

(3,023,953 |

) |

|

(7,683,963 |

) |

| |

|

|

|

|

|

| Finance income |

|

|

338 |

|

|

1,732 |

|

| |

|

|

|

|

|

| Loss before income tax |

|

|

(3,023,615 |

) |

|

(7,682,231 |

) |

| |

|

|

|

|

|

| Income tax expense |

|

|

- |

|

|

- |

|

| |

|

|

|

|

|

| Loss for the year |

|

|

(3,023,615 |

) |

|

(7,682,231 |

) |

| |

|

|

|

|

|

| Other comprehensive income: |

|

|

|

|

|

| |

|

|

|

|

|

| Other comprehensive income to be reclassified to profit

or loss in subsequent periods: |

|

|

|

|

|

| Currency translation differences |

|

|

(57,303 |

) |

|

(918,254 |

) |

| Other comprehensive (loss) / income for the

year |

|

|

(57,303 |

) |

|

(918,254 |

) |

| |

|

|

|

|

|

| Total comprehensive loss for the

year |

|

|

(3,080,918 |

) |

|

(8,600,485 |

) |

| |

|

|

|

|

|

|

|

Loss attributable to: |

|

|

|

|

|

|

Non-controlling interest |

|

|

- |

|

|

(513 |

) |

| Owners of

the parent |

|

|

(3,023,615 |

) |

|

(7,681,718 |

) |

| |

|

|

|

(3,023,615 |

) |

|

(7,682,231 |

) |

| |

|

|

|

|

|

|

|

Total comprehensive loss attributable to: |

|

|

|

|

|

|

Non-controlling interest |

|

|

(6,352 |

) |

|

(1,692 |

) |

| Owners of

the parent |

|

|

(3,074,566 |

) |

|

(8,598,793 |

) |

| |

|

|

|

(3,080,918 |

) |

|

(8,600,485 |

) |

| |

|

|

|

|

|

|

|

Loss per share expressed in pence per share: |

|

|

|

|

|

| Basic and

diluted (in pence) |

|

|

(5.04 |

) |

|

(14.52 |

) |

| |

|

|

|

|

|

|

CONDOR GOLD PLC

CONSOLIDATED STATEMENT OF FINANCIAL

POSITIONAS AT 31 DECEMBER 2017

|

|

|

31.12.17 |

|

|

31.12.16 |

|

|

|

|

£ |

|

|

£ |

|

|

ASSETS: |

|

|

|

|

|

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

|

|

Property, plant and equipment |

|

271,319 |

|

|

234,390 |

|

|

Intangible assets |

|

18,927,968 |

|

|

15,924,194 |

|

|

|

|

|

|

|

|

|

|

19,199,287 |

|

|

16,158,584 |

|

|

CURRENT ASSETS |

|

|

|

|

| Trade

and other receivables |

|

320,974 |

|

|

545,251 |

|

| Cash

and cash equivalents |

|

946,261 |

|

|

583,610 |

|

|

|

|

|

|

|

|

|

|

1,267,235 |

|

|

1,128,861 |

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

20,466,522 |

|

|

17,287,445 |

|

|

|

|

|

|

|

|

LIABILITIES: |

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

| Trade

and other payables |

|

445,030 |

|

|

351,551 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

445,030 |

|

|

351,551 |

|

|

|

|

|

|

|

|

NET CURRENT ASSETS |

|

822,205 |

|

|

777,310 |

|

|

|

|

|

|

|

|

NET ASSETS |

|

20,021,492 |

|

|

16,935,894 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY ATTRIBUTABLE TO OWNERS OF THE

PARENT |

|

|

|

|

|

Called up share capital |

|

12,273,077 |

|

|

10,582,129 |

|

| Share

premium |

|

32,426,049 |

|

|

28,875,061 |

|

|

Exchange difference reserve |

|

581,575 |

|

|

632,526 |

|

|

Retained earnings |

|

(25,174,153 |

) |

|

(23,075,118 |

) |

|

|

|

|

|

|

|

|

|

20,106,548 |

|

|

17,014,598 |

|

|

|

|

|

|

|

|

Non-controlling interest |

|

(85,056 |

) |

|

(78,704 |

) |

|

|

|

|

|

|

|

|

|

20,021,492 |

|

|

16,935,894 |

|

| |

| The financial statements were approved and authorised

for issue by the Board of directors on 23 March 2018 and were

signed on its behalf by: |

| M L

Child – Chairman |

|

Company No: 05587987 |

|

CONDOR GOLD PLC

CONSOLIDATED STATEMENT OF CHANGES IN

EQUITYAS AT 31 DECEMBER 2017

|

|

Share

Capital |

Share premium |

Legal reserve |

Exchange difference reserve |

Retained earnings |

Total |

Non Controlling Interest |

Total Equity |

|

|

|

£ |

£ |

£ |

£ |

£ |

£ |

£ |

£ |

|

| At 1

January 2016 |

|

|

|

|

|

|

|

|

|

|

Comprehensive income: |

9,161,463 |

27,442,728 |

71 |

|

1,549,601 |

|

(17,893,453 |

) |

20,260,410 |

|

(77,012 |

) |

20,183,398 |

|

|

| Loss

for the year |

- |

- |

- |

|

- |

|

(7,681,718 |

) |

(7,681,718 |

) |

(513 |

) |

(7,682,230 |

) |

|

| Other

comprehensive income: |

|

|

|

|

|

|

|

|

|

|

Currency translation differences |

- |

- |

- |

|

(917,075 |

) |

- |

|

(917,075 |

) |

(1,179 |

) |

(918,254 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Total

comprehensive income |

- |

- |

- |

|

(917,075 |

) |

(7,681,718 |

) |

(8,598,793 |

) |

(1,692 |

) |

(8,600,484 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustment |

- |

- |

(71 |

) |

- |

|

- |

|

(71 |

) |

- |

|

(71 |

) |

|

| New

shares issued |

1,420,666 |

1,432,333 |

- |

|

- |

|

- |

|

2,852,999 |

|

- |

|

2,852,999 |

|

|

| Share

based payment |

- |

- |

- |

|

- |

|

2,500,053 |

|

2,500,053 |

|

- |

|

2,500,053 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| At 31

December 2016 |

10,582,129 |

28,875,061 |

- |

|

632,526 |

|

(23,075,118 |

) |

17,014,598 |

|

(78,704 |

) |

16,935,894 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income: |

|

|

|

|

|

|

|

|

|

| Loss

for the year |

- |

- |

- |

|

- |

|

(3,023,615 |

) |

(3,023,615 |

) |

- |

|

(3,023,615 |

) |

|

| Other

comprehensive income: |

|

|

|

|

|

|

|

|

|

|

Currency translation differences |

- |

- |

- |

|

(50,951 |

) |

- |

|

(50,951 |

) |

(6,352 |

) |

(57,303 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Total

comprehensive income |

- |

- |

- |

|

(50,951 |

) |

(3,023,615 |

) |

(3,074,566 |

) |

(6,352 |

) |

(3,080,918 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| New

shares issued |

1,690,948 |

3,550,988 |

- |

|

- |

|

- |

|

5,241,936 |

|

- |

|

5,241,936 |

|

|

| Share

based payment |

- |

- |

- |

|

- |

|

924,580 |

|

924,580 |

|

- |

|

924,580 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| At 31

December 2017 |

12,273,077 |

32,426,049 |

- |

|

581,575 |

|

(25,174,153 |

) |

20,106,548 |

|

(85,056 |

) |

20,021,492 |

|

|

CONDOR GOLD PLC

COMPANY STATEMENT OF FINANCIAL

POSITIONAS AT 31 DECEMBER 2017

|

|

|

31.12.17 |

|

31.12.16 |

|

|

|

£ |

|

£ |

|

ASSETS: |

|

|

|

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

Property, plant and equipment |

|

1,472 |

|

2,667 |

|

Investments |

|

751,977 |

|

565,355 |

| Other

receivables |

|

22,329,897 |

|

18,594,762 |

|

|

|

23,083,346 |

|

19,162,784 |

|

CURRENT ASSETS |

|

|

|

|

| Other

receivables |

|

71,392 |

|

31,378 |

| Cash

and cash equivalents |

|

913,257 |

|

543,198 |

|

|

|

984,649 |

|

574,576 |

|

|

|

|

|

|

|

TOTAL ASSETS |

|

24,067,995 |

|

19,737,360 |

|

|

|

|

|

|

|

LIABILITIES: |

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

| Trade

and other payables |

|

302,286 |

|

186,232 |

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

302,286 |

|

186,232 |

|

|

|

|

|

|

|

NET CURRENT ASSETS |

|

682,363 |

|

388,344 |

|

|

|

|

|

|

|

NET ASSETS |

|

23,765,709 |

|

19,551,128 |

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

Called up share capital |

|

12,273,077 |

|

10,582,129 |

| Share

premium |

|

32,426,049 |

|

28,875,061 |

|

Retained earnings |

|

(20,933,417) |

|

(19,906,062) |

|

|

|

|

|

|

|

TOTAL EQUITY |

|

23,765,709 |

|

19,551,128 |

CONDOR GOLD PLC

COMPANY STATEMENT OF CHANGES IN

EQUITYAS AT 31 DECEMBER 2017

|

|

|

|

Share capital |

Share

premium |

Retained earnings |

Total |

|

|

|

|

£ |

£ |

£ |

£ |

|

|

|

|

|

|

|

|

| At 1

January 2016 |

|

|

9,161,463 |

27,442,728 |

(13,896,671 |

) |

22,707,520 |

|

|

|

|

|

|

|

|

|

|

Comprehensive income: |

|

|

|

|

|

|

| Loss

for the period |

|

|

- |

- |

(8,509,435 |

) |

(8,509,435 |

) |

|

|

|

|

|

|

|

|

| Total

comprehensive income |

|

|

- |

- |

(8,509,435 |

) |

(8,509,435 |

) |

|

|

|

|

|

|

|

|

| New

shares issued |

|

|

1,420,666 |

1,432,333 |

- |

|

2,852,999 |

|

| Share

based payment |

|

|

- |

- |

2,500,044 |

|

2,500,044 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| At 31

December 2016 |

|

|

10,582,129 |

28,875,061 |

(19,906,062 |

) |

19,551,128 |

|

|

|

|

|

|

|

|

|

|

Comprehensive income: |

|

|

|

|

|

|

| Loss

for the period |

|

|

- |

- |

(1,951,935 |

) |

(1,951,935 |

) |

|

|

|

|

|

|

|

|

| Total

comprehensive income |

|

|

- |

- |

(1,951,935 |

) |

(1,951,935 |

) |

|

|

|

|

|

|

|

|

| New

shares issued |

|

|

1,690,948 |

3,550,988 |

- |

|

5,241,936 |

|

| Share

based payment |

|

|

- |

- |

924,580 |

|

924,580 |

|

|

|

|

|

|

|

|

|

| At 31

December 2017 |

|

|

12,273,077 |

32,426,049 |

(20,933,417 |

) |

23,765,709 |

|

|

|

|

|

|

|

|

|

|

|

CONDOR GOLD PLC

CONSOLIDATED STATEMENT OF CASH

FLOWS FOR THE YEAR ENDED 31 DECEMBER

2017

|

|

|

31.12.17 |

|

|

31.12.16 |

|

|

|

|

£ |

|

|

£ |

|

|

Cash flows from operating activities |

|

|

|

|

| Loss

before tax |

|

(3,023,615 |

) |

|

(7,682,231 |

) |

| Share

based payment |

|

924,580 |

|

|

2,500,053 |

|

|

Depreciation charges |

|

88,800 |

|

|

47,897 |

|

|

Impairment charge of intangible fixed assets |

|

- |

|

|

33,975 |

|

|

Exchange differences |

|

(54,365 |

) |

|

- |

|

|

Finance income |

|

(338 |

) |

|

(1,732 |

) |

| Write

off of El Salvador |

|

- |

|

|

4,063,136 |

|

|

|

|

(2,249,156 |

) |

|

(1,038,902 |

) |

|

|

|

|

|

|

|

Decrease in trade and other receivables |

|

224,274 |

|

|

392,942 |

|

|

Increase / (Decrease) in trade and other payables |

|

93,480 |

|

|

(206,772 |

) |

|

|

|

|

|

|

| Net

cash absorbed in operating activities |

|

(1,931,402 |

) |

|

(852,732 |

) |

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

(Purchase)/disposal of tangible fixed assets |

|

(128,667 |

) |

|

32,593 |

|

|

Purchase of intangible fixed assets |

|

(2,635,336 |

) |

|

(1,892,692 |

) |

|

Interest received |

|

338 |

|

|

1,732 |

|

|

|

|

|

|

|

| Net

cash absorbed in investing activities |

|

(2,947,883 |

) |

|

(1,858,367 |

) |

|

|

|

|

|

|

|

Cash flows from financing activitiesNet proceeds

from share issue |

|

5,241,936 |

|

|

2,852,999 |

|

|

|

|

|

|

|

| Net

cash from financing activities |

|

5,241,936 |

|

|

2,852,999 |

|

|

|

|

|

|

|

|

Increase in cash and cash equivalents |

|

362,651 |

|

|

141,900 |

|

|

|

|

|

|

|

| Cash

and cash equivalents at beginning of year |

|

583,610 |

|

|

1,105,457 |

|

|

Exchange (loss)/gains in cash and bank |

|

- |

|

|

(663,747 |

) |

|

|

|

|

|

|

| Cash

and cash equivalents at end of year |

|

946,261 |

|

|

583,610 |

|

|

|

|

|

|

|

CONDOR GOLD PLC

COMPANY STATEMENT OF CASH

FLOWSFOR THE YEAR ENDED 31 DECEMBER

2017

| |

|

Year

Ended |

|

|

Year

Ended |

|

| |

|

31.12.17 |

|

|

31.12.16 |

|

| |

|

£ |

|

|

£ |

|

| Cash flows from operating

activities |

|

|

|

|

| Loss before tax |

|

(1,951,935 |

) |

|

(8,509,435 |

) |

| Share based payment |

|

740,362 |

|

|

2,377,414 |

|

| Depreciation charges |

|

1,196 |

|

|

1,542 |

|

| Finance income |

|

(338 |

) |

|

(1,722 |

) |

| Write off of El Salvador |

|

- |

|

|

3,211,018 |

|

| |

|

(1,210,715 |

) |

|

(2,921,183 |

) |

| |

|

|

|

|

| Increase / (decrease) in trade and other

receivables |

|

(40,014 |

) |

|

2,130,675 |

|

| Decrease / (increase) in trade and other payables |

|

116,054 |

|

|

(293,941 |

) |

| |

|

|

|

|

| Net cash from/(absorbed) in operating activities |

|

76,040 |

|

|

(1,084,449 |

) |

| |

|

|

|

|

| Cash flows from investing

activities |

|

|

|

|

| Interest received |

|

338 |

|

|

1,722 |

|

| Purchase of tangible fixed assets |

|

- |

|

|

(2,905 |

) |

| Loans to subsidiaries |

|

(3,735,135 |

) |

|

(2,170,364 |

) |

| Purchase of fixed asset investments |

|

(2,405 |

) |

|

(136,891 |

) |

| |

|

|

|

|

| Net cash absorbed in investing activities |

|

(3,737,202 |

) |

|

(2,308,438 |

) |

| |

|

|

|

|

| Cash flows from financing

activities |

|

|

|

|

|

|

| Proceeds from share issue |

|

5,241,936 |

|

|

2,852,999 |

|

| |

|

|

|

|

| Net cash from financing activities |

|

5,241,936 |

|

|

2,852,999 |

|

| |

|

|

|

|

| Increase / (Decrease) in cash and cash equivalents |

|

370,059 |

|

|

(539,888 |

) |

| |

|

|

|

|

|

| Cash and

cash equivalents at beginning of year |

|

543,198 |

|

|

1,083,086 |

|

| |

|

|

|

|

| Cash and cash equivalents at end of year |

|

913,257 |

|

|

543,198 |

|

| |

|

|

|

|

A copy of the audited annual report to 31st

December 2017 together with Management’s Discussion and Analysis

are available on the Company’s website at www.condorgold.com

and on Sedar at www.Sedar.com and will be posted to shareholders as

appropriate.

For further information please visit

www.condorgold.com or contact:

| Condor

Gold plc |

Mark

Child, Chairman and CEO+44 (0) 20 7493 2784 |

|

| Beaumont

Cornish Limited |

Roland Cornish and James Biddle+44 (0) 20 7628 3396 |

|

| Numis

Securities Limited |

John

Prior and James Black+44 (0) 20 7260 1000 |

|

|

Blytheweigh |

Tim

Blythe, Camilla Horsfall and Megan Ray+44 (0) 20 7138 3204 |

|

About Condor Gold plc:

Condor Gold plc was admitted to AIM on 31 May

2006. The Company is a gold exploration and development company

with a focus on Central America.

Condor published a PFS on its wholly owned La

India Project in Nicaragua in December 2014, as summarized in the

Technical Report (as defined below). The PFS details an open pit

gold mineral reserve in the Probable category of 6.9 Mt at 3.0 g/t

gold for 675,000 oz gold, producing 80,000 oz gold per annum for

seven years. La India Project contains a mineral resource in the

Indicated category of 9.6 Mt at 3.5 g/t for 1.08 million oz gold

and a total mineral resource in the Inferred category of 8.5 Mt at

4.5 g/t for 1.23 million oz gold. The Indicated mineral resource is

inclusive of the mineral reserve.

Disclaimer

Neither the contents of the Company's website

nor the contents of any website accessible from hyperlinks on the

Company's website (or any other website) is incorporated into, or

forms part of, this announcement.

Technical Information

Certain disclosure contained in this news

release of a scientific or technical nature has been summarized or

extracted from the technical report entitled “Technical Report on

the La India Gold Project, Nicaragua, December 2014”, dated

November 13, 2017 with an effective date of December 21, 2014 (the

“Technical Report”), prepared in accordance with NI 43-101. The

Technical Report was prepared by or under the supervision of Tim

Lucks, Principal Consultant (Geology & Project Management),

Gabor Bacsfalusi, Principal Consultant (Mining), Benjamin Parsons,

Principal Consultant (Resource Geology), each of SRK Consulting

(UK) Limited, and Neil Lincoln of Lycopodium Minerals Canada Ltd.,

each of whom is an independent Qualified Person as such term is

defined in NI 43-101.

A PFS on open-pit mining at La India and two

supplementary Expansion Scenarios which explored the possibility of

including two additional satellite open pits, and underground

mining beneath the La India and America open pits, as summarized in

the Technical Report, were released with an effective date of 21st

December 2014. To comply with Canadian securities law requirements,

the two Expansion Scenarios were prepared to replace the original

PEAs contained within the technical report prepared in 2014.

Investors are advised to rely exclusively on the Expansion

Scenarios disclosed in the Technical Report and not the PEAs.

David Crawford, Chief Technical Officer of the

Company and a Qualified Person as defined by NI 43-101, has

approved the written disclosure in this press release.

Forward Looking Statements

All statements in this press release, other than

statements of historical fact, are "forward-looking information"

with respect to the Company within the meaning of applicable

securities laws, including statements with respect to: the

technical viability and economic attractiveness of the redesigned

open pit at La India Project, the impact of the redesigned open pit

on the Company’s mineral reserve, mineral resources, production

rate and total ounces of gold recoverable by the Company; the

Company’s ability to increase production rates at La India Project;

targeting additional mineral resources and expansion of deposits;

the Company’s expectations, strategies and plans for La India

Project, including the Company’s planned exploration and

development activities; the results of future exploration and

drilling and estimated completion dates for certain milestones;

successfully adding or upgrading mineral resources and successfully

developing new deposits; the timing, receipt and maintenance of

approvals, licences and permits from the Nicaraguan government and

from any other applicable government, regulator or administrative

body, including, but not limited to, the Environmental Permit;

production and processing estimates; future financial or operating

performance and condition of the Company and its business,

operations and properties; estimates of mineral resources and

mineral reserves; and any other statement that may predict,

forecast, indicate or imply future plans, intentions, levels of

activity, results, performance or achievements.

Such forward-looking information involves known

and unknown risks, which may cause the actual results to be

materially different from any future results expressed or implied

by such forward-looking information, including, risks related to:

mineral exploration, development and operating risks; estimation of

mineralisation, resources and reserves; environmental, health and

safety regulations of the resource industry; competitive

conditions; operational risks; liquidity and financing risks;

funding risk; exploration costs; uninsurable risks; conflicts of

interest; risks of operating in Nicaragua; government policy

changes; ownership risks; permitting and licencing risks; artisanal

miners and community relations; difficulty in enforcement of

judgments; market conditions; stress in the global economy; current

global financial condition; exchange rate and currency risks;

commodity prices; reliance on key personnel; dilution risk; payment

of dividends; as well as those factors discussed under the heading

“Risk Factors” in the Company’s long-form prospectus dated December

21, 2017, available under the Company’s SEDAR profile at

www.sedar.com.

Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate as actual results and future events could

differ materially from those anticipated in such statements. The

Company disclaims any intention or obligation to update or revise

any forward-looking information, whether as a result of new

information, future events or otherwise unless required by law.

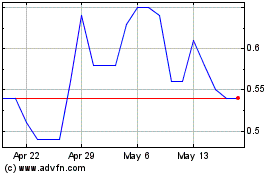

Condor Gold (TSX:COG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Condor Gold (TSX:COG)

Historical Stock Chart

From Dec 2023 to Dec 2024