Condor Gold (AIM:CNR) (OTCQX:CNFGF) (TSX:COG) is pleased to

announce that a Public Consultation was held in the village of La

Cruz de La India on Friday 13 July 2018. The Ministry of

Environment and Natural Resources in Nicaragua (“MARENA”) has

completed a positive review of the additional technical studies

provided by the Company following a site visit inspection on 13

March 2018. The Company received written notification from

MARENA detailing the procedural requirements and the date for the

Public Consultation. See announcements on 26 February 2018, 15 May

2018 and 6 July 2018.

Condor has submitted an Environmental and Social

Impact Assessment (“ESIA”) to MARENA, which is part of an

application for an Environmental Permit, to construct and operate a

processing plant with capacity to process up to 2,800 tonnes per

day (“tpd”) or one million tonnes per annum (“tpa”).

Mark Child, Chairman and Chief Executive

Officer of Condor, commented:

“I am delighted that MARENA has completed a

positive review of the Environmental and Social Impact Assessment,

including amendments, and formally notified the Company to proceed

to a Public Consultation last Friday. The turn out was high,

a total of 499 people registered and attended the Public

Consultation at which the technical, environment and social aspects

of a new mine were presented and discussed in a transparent manner.

During presentations of the Project to community groups and

house-to-house visits the Company received over 600 applications

for new jobs.

“I remain confident that Condor is close to

receiving permitting approval for Mina La India, which is expected

to produce approximately 80,000 oz gold per annum from a single

open pit, represents a US$120 million investment and creates 1,000

new jobs. The next step is a review of the comments from the Public

Consultation process by the Inter-Institutional Committee, followed

by the grant of permits”.

Public Consultation

Following a positive review of the technical

studies in the ESIA, Condor received written notification from

MARENA detailing the procedural requirements and the date for the

Public Consultation. The Company provided due notice of the Public

Consultation by placing advertisements in the national newspapers

and on the local radio stations. Condor’s social team conducted 287

individual house-to-house visits explaining the Project to

villagers at La Cruz de La India and 3 nearby villages and handed

out leaflets detailing the re-designed mine infrastructure and

benefits of the mine. Furthermore, group meetings covered 411

people including landowners and artisanal miners. Banners

advertising the Public Consultation were posted in the village a

week prior to the Public Consultation.

The Public Consultation was attended by 499

people who voiced overwhelming support for a new mine. 600

people have registered for new jobs to work in the mine.

Condor is re-permitting an old mine, adjacent to

a former mining community, in which 40.5% of households can be

categorised as being in poverty. Noranda Mining produced an

estimated 576,000 ounces of gold with a grade of 13.4 g/t gold over

an 18-year period prior to the closure of the La India Mine in

1956. Since the closure of the mine, the village of La Cruz de La

India has hit hard times. It is located in a hilly, dry corridor of

Nicaragua with no alternative form of employment. An independent

economic report produced in October 2017 by FUNIDES, a local

economic study group, estimates the former mining town of La Cruz

de La India has a 40.5% Multi-Dimensional Poverty Index (the index

used by Santo et al. (2015) was used to measure the poverty of 17

Latin American countries and measures 5 wellbeing dimensions:

living conditions, basic services, income, education and

employment). The construction and operation of a new gold mine will

significantly reduce poverty, as it will create 1,000 jobs; for

every job in the mine there is an additional three to five times

more indirect jobs providing services to the mine.

During the past 12 months, Condor has

significantly increased and strengthened its social team.

Contributions to the local community have increased significantly

via the weekly distribution of 360 five-gallon drinking water

containers and material contributions to local healthcare,

education, sport, the elderly and artisanal miner projects.

The Company has listened to the concerns of the

local community and redesigned the mine site infrastructure to

avoid any resettlement.

The next step is a review of the comments from

the Public Consultation process by the Inter-Institutional

Committee, followed by the grant of permits.

Background

An amendment to the ESIA to progress the La

India Project without the need for resettlement of the village of

La Cruz de La India (the “Village”) has been submitted to MARENA

(See RNS 28 February 2018). The main changes are a redesigned open

pit, the relocation of the processing plant 1,200 meters from the

Village, the possible elimination of the southern waste dump, the

elimination of the road diversion in year three of production and

the relocation of the explosives magazine. A five metre high berm

is planned between the re-designed open pit and the Village to

further reduce noise and dust pollution and provide a physical

barrier. The mine site infrastructure requirements will be reduced

by over 30% to approximately 500 hectares.

The La India open pit disclosed in the

Pre-Feasibility Study (“PFS”) has an existing probable mineral

reserve of 6.9 million tonnes (“Mt”) at 3.01 g/t gold for 675,000

oz gold, as set forth in the Technical Report (as defined below)

that was prepared in accordance with Canadian National Instrument

43-101 – Standards of Disclosure for Mineral Projects (“NI

43-101”). Revised mine scheduling studies have been significantly

advanced in recent months. Gold production is expected to be

approximately 80,000 oz gold per annum. The Company does not expect

that the changes to the La India Project as detailed in the amended

ESIA will materially change the mineral reserves, mineral resources

and the production rate disclosed in the Technical Report.

The amended ESIA describes a processing plant

that will have a capacity of up to 2,800 tpd (1.0 million tpa). The

amended ESIA continues to include processing of an additional

10,000 oz of gold p.a. sourced from artisanal miners through the

main processing plant.

The Current Situation in

Nicaragua

As a British company, Condor Gold believes in,

and promotes, constructive dialogue for a peaceful resolution of

the current political upheaval in Nicaragua. The Company's focus is

to support its 70 direct and indirect employees, and their

families, who have confirmed their desire to continue to work and

maintain stability within their communities as much as possible.

Condor has been operating in Nicaragua since 2006 and, as a

responsible gold exploration and development company, continues to

add value to the local communities and environment by generating

sustainable socio-economic and environmental benefits. Despite the

current political upheaval and civil disobedience in Nicaragua,

Condor has held very constructive meetings in recent months with

the key Ministries who are progressing Condor’s application for an

Environmental Permit for a new mine at Mina La India.

The new mine would create approximately 1,000

jobs during the construction period with priority given to the

local community. The upfront capital cost of approximately US$120

million would have a significant positive impact on the economy.

The Government and local communities would benefit significantly

from future royalties and taxes.

For further information please visit

www.condorgold.com or contact:

| Condor Gold

plc |

Mark Child,

Chairman and CEO+44 (0) 20 7493 2784 |

|

| Beaumont

Cornish Limited |

Roland Cornish and James Biddle+44 (0) 20 7628 3396 |

|

| Numis

Securities Limited |

John Prior

and James Black+44 (0) 20 7260 1000 |

|

|

Blytheweigh |

Tim Blythe,

Camilla Horsfall and Megan Ray+44 (0) 20 7138 3204 |

|

About Condor Gold plc:

Condor Gold plc was admitted to AIM on 31 May

2006. The Company is a gold exploration and development company

with a focus on Central America.

Condor published a Pre-Feasibility Study (“PFS”)

on its wholly owned La India Project in Nicaragua in December 2014,

as summarized in the Technical Report (as defined below). The PFS

details an open pit gold mineral reserve in the Probable category

of 6.9 Mt at 3.0 g/t gold for 675,000 oz gold, producing 80,000 oz

gold per annum for seven years. La India Project contains a mineral

resource in the Indicated category of 9.6 Mt at 3.5 g/t for 1.08

million oz gold and a total mineral resource in the Inferred

category of 8.5 Mt at 4.5 g/t for 1.23 million oz gold. The

Indicated mineral resource is inclusive of the mineral

reserve.

Disclaimer

Neither the contents of the Company's website

nor the contents of any website accessible from hyperlinks on the

Company's website (or any other website) is incorporated into, or

forms part of, this announcement.

Technical Information

Certain disclosure contained in this news

release of a scientific or technical nature has been summarized or

extracted from the technical report entitled “Technical Report on

the La India Gold Project, Nicaragua, December 2014”, dated

November 13, 2017 with an effective date of December 21, 2014 (the

“Technical Report”), prepared in accordance with NI 43-101. The

Technical Report was prepared by or under the supervision of Tim

Lucks, Principal Consultant (Geology & Project Management),

Gabor Bacsfalusi, Principal Consultant (Mining), Benjamin Parsons,

Principal Consultant (Resource Geology), each of SRK Consulting

(UK) Limited, and Neil Lincoln of Lycopodium Minerals Canada Ltd.,

each of whom is an independent Qualified Person as such term is

defined in NI 43-101.

David Crawford, Chief Technical Officer of the

Company and a Qualified Person as defined by NI 43-101, has

approved the written disclosure in this press release.

Forward Looking Statements

All statements in this press release, other than

statements of historical fact, are "forward-looking information"

with respect to the Company within the meaning of applicable

securities laws, including statements with respect to: the

technical viability and economic attractiveness of the redesigned

open pit, the impact of the redesigned open pit on the Company’s

mineral reserve, mineral resources, production rate and total

ounces of gold recoverable by the Company, the Company’s intention

to provide further details on mine scheduling, and estimates of

mineral resources and mineral reserves. Forward-looking information

is often, but not always, identified by the use of words such as

"seek", "anticipate", "plan", "continue", “strategies”, “estimate”,

"expect", "project", "predict", "potential", "targeting",

"intends", "believe", "potential", “could”, “might”, “will” and

similar expressions. Forward-looking information is not a guarantee

of future performance and is based upon a number of estimates and

assumptions of management at the date the statements are made

including, among others, assumptions regarding: future commodity

prices and royalty regimes; availability of skilled labour; timing

and amount of capital expenditures; future currency exchange and

interest rates; the impact of increasing competition; general

conditions in economic and financial markets; availability of

drilling and related equipment; effects of regulation by

governmental agencies; the receipt of required permits; royalty

rates; future tax rates; future operating costs; availability of

future sources of funding; ability to obtain financing and

assumptions underlying estimates related to adjusted funds from

operations. Many assumptions are based on factors and events that

are not within the control of the Company and there is no assurance

they will prove to be correct.

Such forward-looking information involves known

and unknown risks, which may cause the actual results to be

materially different from any future results expressed or implied

by such forward-looking information, including, risks related to:

mineral exploration, development and operating risks; estimation of

mineralisation, resources and reserves; environmental, health and

safety regulations of the resource industry; competitive

conditions; operational risks; liquidity and financing risks;

funding risk; exploration costs; uninsurable risks; conflicts of

interest; risks of operating in Nicaragua; government policy

changes; ownership risks; permitting and licencing risks; artisanal

miners and community relations; difficulty in enforcement of

judgments; market conditions; stress in the global economy; current

global financial condition; exchange rate and currency risks;

commodity prices; reliance on key personnel; dilution risk; payment

of dividends; as well as those factors discussed under the heading

“Risk Factors” in the Company’s long-form prospectus dated December

21, 2017, available under the Company’s SEDAR profile at

www.sedar.com.

Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate as actual results and future events could

differ materially from those anticipated in such statements. The

Company disclaims any intention or obligation to update or revise

any forward-looking information, whether as a result of new

information, future events or otherwise unless required by law.

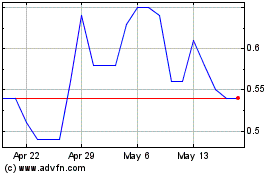

Condor Gold (TSX:COG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Condor Gold (TSX:COG)

Historical Stock Chart

From Dec 2023 to Dec 2024