DIRTT Environmental Solutions Ltd. (“DIRTT” or the “Company”, “we”,

“our”, “us” or “ours”) (TSX: DRT; OTC: DRTTF), a leader in

industrialized construction, today announced its financial results

for the three and six months ended June 30, 2024. All financial

information in this news release is presented in U.S. dollars,

unless otherwise stated.

Second Quarter 2024

Highlights

- Revenue of $41.2 million in the

second quarter of 2024, a decrease of 8% from the prior year

period.

- Gross profit increased to $15.4

million or 37.3% of revenue in the second quarter of 2024 from

$14.6 million or 32.5% of revenue in the second quarter of

2023.

- Net income after tax and net income

margin for the second quarter of 2024 of $0.6 million and 1.4%,

respectively, compared to net income after tax of $2.2 million and

net income margin of 4.9% in the second quarter of 2023.

- Adjusted EBITDA(1) was $3.2 million

(7.7% of revenue) in the second quarter of 2024, compared to $1.9

million (4.1% of revenue) in the second quarter of 2023.

- Liquidity, comprising unrestricted

cash and available borrowings, was $50.1 million at June 30, 2024

compared to $35.0 million at December 31, 2023.

- On August 2, 2024, the Company

announced and completed an agreement with 22NW Fund LP (“22NW”),

DIRTT’s largest shareholder, to purchase for cancellation an

aggregate of C$18,915,000 principal amount of DIRTT’s outstanding

6.00% convertible debentures due January 31, 2026 (the “January

Debentures”) at a purchase price of C$684.58 per C$1,000 principal

amount of January Debentures and C$13,638,000 principal amount of

DIRTT’s outstanding 6.25% convertible debentures due December 31,

2026 (the “December Debentures” and together with the January

Debentures, the “Debentures”) at a purchase price of C$665.64 per

C$1,000 principal amount of December Debentures, for an aggregate

purchase price of C$22,104,591.45, inclusive of a cash payment for

all accrued and unpaid interest up to, but excluding, the date on

which such Debentures were purchased by the Company (the “Debenture

Repurchase”). The purchase price of each series of Debentures

(excluding the cash payment for accrued and unpaid interest)

represented a discount of approximately 4% to the average trading

price of the applicable series of Debentures on the Toronto Stock

Exchange (the “TSX”) for the 20 trading days preceding August 2,

2024. Following the Debenture Repurchase, C$16,642,000 principal

amount of the January Debentures and C$15,587,000 principal amount

of the December Debentures remain outstanding, and 22NW no longer

holds any Debentures.

- On August 2, 2024, the Board of

Directors adopted an Amended and Restated Shareholder Rights Plan

which amends and restates the prior Shareholder Rights Plan adopted

on March 22, 2024. The Company also entered into a support and

standstill agreement (the “Support Agreement”) with 22NW and WWT

Opportunity #1 LLC, DIRTT’s second largest shareholder. The Support

Agreement replaces the previously announced support and standstill

agreement entered into with 22NW on March 22, 2024.

(1) See “Non-GAAP Financial Measures”

Management Commentary

Benjamin Urban, chief executive officer,

remarked “We believe we are making great progress in strengthening

our commercial organization with the objective of delivering

long-term sustainable revenue growth, and we are grateful to our

employees, our construction partners and others in our DIRTT

ecosystem for supporting us in our journey to excellence. As

participants in the construction cycle, it is important for us to

work on projects coming up in the next few years. We are pleased to

see our twelve-month pipeline grow 20% year-over-year and for our

full pipeline to have grown even more. This past quarter, DIRTT

started on one of the largest projects in our history in our

hometown of Calgary. Whilst commercial space has always been our

largest sector, we are seeing great opportunities for DIRTT in the

healthcare, education and government sectors as organizations

realize there is a better way to build.”

Fareeha Khan, chief financial officer, added

“The second quarter of 2024 marks our fifth consecutive quarter

with positive Adjusted EBITDA. DIRTT’s balance sheet has been

strengthened through the rights offering and issuer bid completed

earlier this year, and we believe the Debenture repurchase from

22NW completed on August 2, 2024 will benefit our shareholders and

remaining debenture holders. Further, our executive leadership team

is committed to supporting our commercial organization and to grow

DIRTT’s market share in the multibillion-dollar interior

construction market.”

Second Quarter 2024 Results

Second quarter 2024 revenue was $41.2 million, a

decrease of 8% from the second quarter of 2023. The decrease in

revenue was primarily the result of a higher rate of delayed

project start dates year-over-year as well as three projects – two

large healthcare projects and one large education project that were

completed in the second quarter of 2023. Those projects were not

repeated in the same period in 2024. The decrease in revenue was

offset by larger projects in the commercial sector and an increase

in volume in the government sector.

Second quarter 2024 gross profit and gross

profit margin were $15.4 million and 37.3% of revenue,

respectively, an increase from $14.6 million and 32.5% for the same

period of 2023. Second quarter 2024 Adjusted Gross Profit and

Adjusted Gross Profit Margin (see “Non-GAAP Financial Measures”)

were $16.2 million and 39.4% of revenue, respectively, compared to

$16.2 million and 36.2% in the prior year's second quarter. The

increase in gross profit margin was a result of improved material

optimization and reduced fixed costs.

Sales and marketing expenses decreased by $0.6

million to $6.1 million for the three months ended June 30, 2024

from $6.6 million for the three months ended June 30, 2023. The

decrease was driven by a $0.6 million decrease in pass through

charges, a $0.2 million decrease in travel, meals and

entertainment, a $0.3 million decrease in other individual costs,

and a $0.1 million decrease in salaries and benefits. These

decreases were offset by a $0.7 million increase in termination

benefits. Sales and marketing expenses in the second quarter of

2024 included $0.5 million of expenses related to our Connext

tradeshow and internal sales Masterclass events.

General and administrative expenses decreased by

$1.1 million to $4.4 million for the three months ended June 30,

2024 from $5.5 million for the three months ended June 30, 2023.

The decrease was primarily related to a $0.5 million decrease in

salaries and benefits costs, and a $0.3 million decrease in office

costs and communications costs.

Operations support is comprised primarily of

project managers, order entry and other professionals that

facilitate the integration of our construction partner project

execution and our manufacturing operations. Operations support

expenses for the three months ended June 30, 2024 were $1.8 million

aligned with $1.8 million for the comparative period of 2023.

Technology and development expenses increased by

$0.2 million to $1.4 million for the three months ended June 30,

2024, compared to $1.3 million for the three months ended June 30,

2023, primarily related to a $0.1 million increase in salaries and

benefits costs.

During the quarter, the Company incurred $0.2

million in reorganization costs, which related primarily to

movement of inventory from the Rock Hill facility.

Net income after tax for the second quarter of

2024 was $0.6 million compared to $2.2 million for the same period

of 2023. The decrease in net income is primarily the result of a

$6.1 million gain on sale of software and patents in the second

quarter of 2023, not repeated in the second quarter of 2024 and a

$0.3 million increase in income tax expense, offset by a $0.8

million higher gross profit margin (as explained above), a $2.5

million decrease in operating expenses, $1.0 million increase in

foreign exchange gain, a $0.4 million increase in interest income

and a $0.3 million decrease in interest expense.

Adjusted EBITDA (see “Non-GAAP Financial

Measures”) for the second quarter of 2024 was $3.2 million, or 7.7%

of revenue, an improvement of $1.3 million from $1.9 million, or

4.1% of revenue, for the second quarter of 2023. Higher Adjusted

EBITDA was mainly driven by cost reduction measures taken by the

Company over the past two years.

Outlook- DIRTT's Journey to

Excellence

In the second quarter of 2024, we released an

investor presentation, DIRTT’s “Journey to Excellence”,

highlighting DIRTT’s organizational improvements since the changes

in our Board of Directors and executive leadership in 2022. Midway

through 2022, DIRTT reported gross profit margin and Adjusted Gross

Profit Margin of 11.5% and 18.3%, respectively, a net loss of $42.3

million and Adjusted EBITDA Margin of (25.8)% on $83.0 million of

revenue for the six months ended June 30, 2022. Two years later,

DIRTT is reporting gross profit margin and Adjusted Gross Profit

Margin of 36.6% and 38.7%, respectively, and net income of $3.6

million and Adjusted EBITDA Margin of 7.1% on $82.0 million of

revenue for the six months ended June 30, 2024. We were able to

expand Adjusted Gross Profit Margins even as the aluminum market

experienced pricing volatility in the second quarter of 2024, due

to our operational strategy and the risk management strategies we

have in place. DIRTT’s journey to excellence is still in its early

stages, and while we are proud of the progress we have made to

date, we have more to do in order to realize the Company’s

long-term vision of significant growth in revenue and

profitability.

DIRTT operates in the multibillion-dollar

interior construction industry, with end customers looking for ways

to save money, save time, and meet their sustainability goals. We

believe our business proposition of a better, more sustainable way

to build is becoming even more relevant and necessary as

prioritizing environmental, social and governance issues becomes a

focus for companies across North America. Over time, our goal is

for DIRTT to gain market share and outpace the growth of the

construction industry.

At June 30, 2024, we held $39.5 million in cash

on hand with total liquidity (inclusive of borrowing availability)

of $50.1 million. Improved operational results have also led to

consistent positive cash flow. We have strengthened our balance

sheet through the C$30 million rights offering and the retirement

of, at the date of this release, 59% of the total debt we held

coming into 2024. We believe these transactions put DIRTT in a

position to achieve a debt to Adjusted EBITDA ratio of 1x or lower

in 2025. Based on current projections, DIRTT is expected to be in a

position to pay off or refinance its remaining Debentures when they

come due.

Our operations team remains focused on their

journey to zero defects, missed deliveries, and workplace injuries.

In the three months ended June 30, 2024, our total recordable

incident rate (TRIF) rate was 0.99, which is 78% below the industry

average. Our on-time in full (OTIF) delivery performance was 99.7%.

We have a 10-day lead time from final order to product shipment. We

believe we are well positioned to increase output while delivering

quality products, on time and in full, to our end customers.

With these operational and financial

achievements complete, our focus turns to accelerating revenue

growth in all sectors – commercial, healthcare, educational and

government. In the second quarter of 2024, we secured a large

contract in the aviation industry, demonstrating how DIRTT’s

solutions are agnostic to industries as well as reinforcing our

continued diversification across verticals and broadening the

addressable market into areas we have not historically pursued.

Further, we are building our commercial organization to ensure

support in our go-to-market efforts for our construction partners

to tap into the multibillion-dollar interior construction industry.

DIRTT’s Board of Directors and management team remain focused on

strengthening the Company’s competitive advantages, product

portfolio and go-to-market strategy.

DIRTT innovates by identifying the needs of the

market and of our customers and through collaborating with

world-class firms to solve industry problems. During the second

quarter of 2024, we introduced several new products into the market

including Spectra Double pane butt-hinge, curved glass corners, our

telescoping walls and Class A timber solutions. At our Connext

tradeshow in Chicago, we transformed our DIRTT Experience Center by

showcasing improved innovative products for all verticals. At

Connext, we also released the Clinical Observation Vertical Exam

(the “COVE™”), a new innovative product designed to help improve

patient care in emergency rooms. We built the COVE™ in

collaboration with HKS, a leading global architecture and design

firm that focuses on innovative healthcare design.

We are also investing in our proprietary design

integration software, ICE® (“ICE software”). We efficiently

integrate the design, configurations, and virtual reality

visualization process while also automating the manufacturing

process. Use of the ICE software provides design and cost

certainty, which we believe is a game changer in an industry where

costs frequently change as a project progresses. The ICE team has

been working on modernizing the ICE platform, and earlier this

week, we released the new ICE Manager and purpose-built designer

application Design Editor, two new and foundational pieces of the

ICE architecture moving forward. These new applications will allow

us to push out more frequent releases to the business in the

form of new products, features and enhancements. This will allow us

to improve the end user experience. This modernization of ICE also

provides us with the opportunity to commercialize the technology to

a broader customer base, which we believe will provide us with

additional revenue opportunities.

We believe that DIRTT has significant untapped

manufacturing capacity that can serve a multiple of our current

revenue base. Improvements of our cost structure, including a

materially reduced fixed cost base, and incremental growth in

revenue will help us achieve gross profit margin expansion and

substantial flow through to Adjusted EBITDA and free cash flow. We

do not expect a material increase in capital expenditures in the

short-term. After the debenture repurchases completed in 2024, our

annual interest expense will halve to $1.5 million. As at June 30,

2024, we had C$110.1 million of non-capital loss carry-forwards in

Canada and $51.6 million of non-capital loss carry-forwards in the

United States. These loss carry-forwards will begin to expire in

2035.

DIRTT could not have achieved the past two years

of organizational improvements without the support of our resilient

and talented employee base. We are working to improve our employee

experiences and make DIRTT an employer of choice. Our employees are

key to the future success of DIRTT.

As we look forward to 2025, we are observing

positive indicators of our revenue growth focus. Our year-over-year

12-month pipeline has grown 20% and our multi-year pipeline has

grown even more. Our projected revenue and Adjusted EBITDA for the

remainder of 2024 and 2025 are:

- Third Quarter 2024 Revenue: $40-44

million

- 2024 Revenue: $165-175 million

- 2024 Adjusted EBITDA: $12-15

million

- 2025 Revenue: $194-209 million

- 2025 Adjusted EBITDA: $18-25

million

| |

As at June 30, |

|

As at December 31, |

|

|

2024 |

|

2023 |

| Market capitalization(1) |

80,362 |

|

38,244 |

| Add: Total debt(2)(3) |

46,572 |

|

56,108 |

| Less: Unrestricted cash(2) |

39,529 |

|

24,744 |

| Enterprise Value |

87,405 |

|

69,608 |

| |

|

|

|

| |

|

|

|

| Adjusted EBITDA Multiple for 2025 |

4.1x |

|

|

| Revenue Multiple for 2025 |

0.4x |

|

|

| |

|

|

|

|

(1)Market capitalization is calculated by multiplying the closing

share price by the number of outstanding shares at June 30, 2024

and December 31, 2023, respectively. (The closing share price at

June 28, 2024 was C$0.57 ($0.42) and outstanding shares were

192,967,643. The closing share price at December 29, 2023 was

C$0.48 ($0.36) and outstanding shares were 105,377,667). |

|

(2)Total debt and Unrestricted cash do not consider the impacts of

the Debenture Repurchase on August 2, 2024. Refer to Note 18 of the

interim condensed consolidated financial statements. |

|

(3)Total debt includes Long-term debt and Current portion of

long-term debt and accrued interest on the balance sheet as at June

30, 2024 and December 31, 2023, respectively. |

| |

As explained above, with minimal capital

expenditure needs in the short term and the availability of tax

losses, we expect most of our Adjusted EBITDA will flow through to

free cash flow. DIRTT’s enterprise value at June 30, 2024 before

retiring half of our outstanding debentures was $87 million on a

fully diluted basis, which values DIRTT at approximately 0.4x the

midpoint of 2025 sales guidance and 4.1x the midpoint of 2025

Adjusted EBITDA guidance. We believe the Company will have less

than one turn of financial leverage by the end of 2025 and that

DIRTT is now a credit worthy company and we expect to have improved

access to traditional bank lines.

Conference Call and Webcast

Details

A conference call and webcast for the investment

community is scheduled for August 8, 2024 at 08:00 a.m. MDT (10:00

a.m. EDT). The call and webcast will be hosted by Benjamin Urban,

chief executive officer, and Fareeha Khan, chief financial

officer.

The call is being webcast live on the Company’s

website at dirtt.com/investors. Alternatively, click here to listen

to the live webcast. The webcast is listen-only.

A webcast replay of the call will be available

on DIRTT’s website.

Statement of

Operations(Unaudited - Stated in thousands of U.S.

dollars)

|

|

For the Three MonthsEnded June 30, |

|

|

For the Six MonthsEnded June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Product revenue |

40,176 |

|

|

43,534 |

|

|

79,215 |

|

|

79,010 |

|

| Service revenue |

1,025 |

|

|

1,219 |

|

|

2,833 |

|

|

2,451 |

|

| Total revenue |

41,201 |

|

|

44,753 |

|

|

82,048 |

|

|

81,461 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Product cost of sales |

25,389 |

|

|

29,484 |

|

|

50,381 |

|

|

56,907 |

|

| Service cost of sales |

437 |

|

|

712 |

|

|

1,644 |

|

|

1,315 |

|

| Total cost of sales |

25,826 |

|

|

30,196 |

|

|

52,025 |

|

|

58,222 |

|

| Gross profit |

15,375 |

|

|

14,557 |

|

|

30,023 |

|

|

23,239 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

| Sales and marketing |

6,062 |

|

|

6,626 |

|

|

11,982 |

|

|

12,141 |

|

| General and administrative |

4,391 |

|

|

5,501 |

|

|

8,957 |

|

|

11,334 |

|

| Operations support |

1,841 |

|

|

1,822 |

|

|

3,616 |

|

|

3,812 |

|

| Technology and development |

1,436 |

|

|

1,277 |

|

|

2,687 |

|

|

2,816 |

|

| Stock-based compensation |

427 |

|

|

678 |

|

|

1,102 |

|

|

1,474 |

|

| Reorganization |

202 |

|

|

1,465 |

|

|

340 |

|

|

2,536 |

|

| Impairment charge on Rock Hill facility |

- |

|

|

- |

|

|

530 |

|

|

- |

|

| Related party expense (recovery) |

- |

|

|

(532 |

) |

|

- |

|

|

1,524 |

|

| Total operating expenses |

14,359 |

|

|

16,837 |

|

|

29,214 |

|

|

35,637 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

1,016 |

|

|

(2,280 |

) |

|

809 |

|

|

(12,398 |

) |

| Government subsidies |

- |

|

|

88 |

|

|

- |

|

|

236 |

|

| Gain on extinguishment of convertible debt |

- |

|

|

- |

|

|

2,931 |

|

|

- |

|

| Gain on sale of software and patents |

- |

|

|

6,145 |

|

|

- |

|

|

6,145 |

|

| Foreign exchange gain (loss) |

358 |

|

|

(620 |

) |

|

1,277 |

|

|

(881 |

) |

| Interest income |

482 |

|

|

106 |

|

|

971 |

|

|

110 |

|

| Interest expense |

(945 |

) |

|

(1,233 |

) |

|

(1,999 |

) |

|

(2,440 |

) |

| |

(105 |

) |

|

4,486 |

|

|

3,180 |

|

|

3,170 |

|

| Net income (loss) before tax |

911 |

|

|

2,206 |

|

|

3,989 |

|

|

(9,228 |

) |

| Income taxes |

|

|

|

|

|

|

|

|

|

|

|

| Current and deferred income tax expense |

315 |

|

|

- |

|

|

348 |

|

|

- |

|

| |

315 |

|

|

- |

|

|

348 |

|

|

- |

|

| Net income (loss) after tax |

596 |

|

|

2,206 |

|

|

3,641 |

|

|

(9,228 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per share - basic |

0.00 |

|

|

0.02 |

|

|

0.02 |

|

|

(0.08 |

) |

| Net income (loss) per share - diluted |

0.00 |

|

|

0.01 |

|

|

0.02 |

|

|

(0.08 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of shares

outstanding (in thousands) |

|

|

|

|

|

|

|

| Basic |

192,031 |

|

|

114,447 |

|

|

187,849 |

|

|

113,082 |

|

| Diluted |

310,088 |

|

|

342,521 |

|

|

305,869 |

|

|

113,082 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures

Our interim condensed consolidated financial

statements are prepared in accordance with accounting principles

generally accepted in the United States of America (“GAAP”). These

GAAP financial statements include non-cash charges and other

charges and benefits that we believe are unusual or infrequent in

nature or that we believe may make comparisons to our prior or

future performance difficult.

As a result, we also provide financial

information in this news release that is not prepared in accordance

with GAAP and should not be considered as an alternative to the

information prepared in accordance with GAAP. Management uses these

non-GAAP financial measures in its review and evaluation of the

financial performance of the Company. We believe that these

non-GAAP financial measures also provide additional insight to

investors and securities analysts as supplemental information to

our GAAP results and as a basis to compare our financial

performance period-over-period and to compare our financial

performance with that of other companies. We believe that these

non-GAAP financial measures facilitate comparisons of our core

operating results from period to period and to other companies by

removing the effects of our capital structure (net interest income

on cash deposits, interest expense on outstanding debt and debt

facilities, or foreign exchange movements), asset base

(depreciation and amortization), tax consequences, reorganization

expense, one-time non-recurring charges or gains (such as gain on

sale of software and patents and gain on extinguishment of

convertible debt), and stock-based compensation. We remove the

impact of foreign exchange gain (loss) from Adjusted EBITDA.

Foreign exchange gains and losses can vary significantly

period-to-period due to the impact of changes in the U.S. and

Canadian dollar exchange rates on foreign currency denominated

monetary items on the balance sheet and are not reflective of the

underlying operations of the Company. In periods where production

levels are abnormally low, unallocated overheads are recognized as

an expense in the period in which they are incurred. In addition,

management bases certain forward-looking estimates and budgets on

non-GAAP financial measures, primarily Adjusted EBITDA. We have not

reconciled non-GAAP forward-looking measures, including Adjusted

EBITDA guidance, to its corresponding GAAP measures due to the high

variability and difficulty in making accurate forecasts and

projections, particularly with respect to non-operating income and

expenditures, which are difficult to predict and subject to

change.

Government subsidies, depreciation and

amortization, stock-based compensation expense, reorganization

expense, foreign exchange gains and losses and impairment charges

are excluded from our non-GAAP financial measures because

management considers them to be outside of the Company’s core

operating results, even though some of those receipts and expenses

may recur, and because management believes that each of these items

can distort the trends associated with the Company’s ongoing

performance. We believe that excluding these receipts and expenses

provides investors and management with greater visibility to the

underlying performance of the business operations, enhances

consistency and comparativeness with results in prior periods that

do not, or future periods that may not, include such items, and

facilitates comparison with the results of other companies in our

industry.

The following non-GAAP financial measures are

presented in this news release, and a description of the

calculation for each measure is included.

|

Adjusted Gross Profit |

Gross profit before deductions for depreciation and

amortization |

|

|

|

|

Adjusted Gross Profit Margin |

Adjusted Gross Profit divided by revenue |

|

|

|

|

EBITDA |

Net income before interest, taxes, depreciation and

amortization |

|

|

|

|

Adjusted EBITDA |

EBITDA adjusted to remove foreign exchange gains or losses;

impairment charges; reorganization expenses; stock-based

compensation expense; government subsidies; one-time, non-recurring

charges and gains; and any other non-core gains or losses |

|

|

|

|

Adjusted EBITDA Margin |

Adjusted EBITDA divided by revenue |

|

|

|

You should carefully evaluate these non-GAAP

financial measures, the adjustments included in them, and the

reasons we consider them appropriate for analysis supplemental to

our GAAP information. Each of these non-GAAP financial measures has

important limitations as an analytical tool due to exclusion of

some but not all items that affect the most directly comparable

GAAP financial measures. You should not consider any of these

non-GAAP financial measures in isolation or as substitutes for an

analysis of our results as reported under GAAP. You should also be

aware that we may recognize income or incur expenses in the future

that are the same as, or similar to, some of the adjustments in

these non-GAAP financial measures. Because these non-GAAP financial

measures may be defined differently by other companies in our

industry, our definitions of these non-GAAP financial measures may

not be comparable to similarly titled measures of other companies,

thereby diminishing their utility.

The following table presents a reconciliation

for the three and six months ended June 30, 2024 and 2023 of EBITDA

and Adjusted EBITDA to our net income (loss) after tax, which is

the most directly comparable GAAP measure for the periods

presented, and of Adjusted EBITDA Margin to net income (loss)

margin:

(Unaudited - Stated in thousands of U.S.

dollars)

| |

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

($ in thousands) |

|

|

($ in thousands) |

|

| Net income (loss) after

tax for the period |

596 |

|

|

2,206 |

|

|

3,641 |

|

|

(9,228 |

) |

| Add back (deduct): |

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

945 |

|

|

1,233 |

|

|

1,999 |

|

|

2,440 |

|

| Interest income |

(482 |

) |

|

(106 |

) |

|

(971 |

) |

|

(110 |

) |

| Tax expense |

315 |

|

|

- |

|

|

348 |

|

|

- |

|

| Depreciation and

amortization |

1,521 |

|

|

2,524 |

|

|

3,055 |

|

|

5,199 |

|

| EBITDA |

2,895 |

|

|

5,857 |

|

|

8,072 |

|

|

(1,699 |

) |

| Foreign exchange (gain) loss |

(358 |

) |

|

620 |

|

|

(1,277 |

) |

|

881 |

|

| Stock-based compensation |

427 |

|

|

678 |

|

|

1,102 |

|

|

1,474 |

|

| Government subsidies |

- |

|

|

(88 |

) |

|

- |

|

|

(236 |

) |

| Related party expense (recovery)

(2) |

- |

|

|

(532 |

) |

|

- |

|

|

1,524 |

|

| Reorganization expense(3) |

202 |

|

|

1,465 |

|

|

340 |

|

|

2,536 |

|

| Gain on sale of software and

patents(3) |

- |

|

|

(6,145 |

) |

|

- |

|

|

(6,145 |

) |

| Gain on extinguishment of

convertible debt(3) |

- |

|

|

- |

|

|

(2,931 |

) |

|

- |

|

| Impairment charge on Rock Hill

facility (3) |

- |

|

|

- |

|

|

530 |

|

|

- |

|

| Adjusted

EBITDA |

3,166 |

|

|

1,855 |

|

|

5,836 |

|

|

(1,665 |

) |

| Net Income (Loss)

Margin(1) |

1.4 |

% |

|

4.9 |

% |

|

4.4 |

% |

|

(11.3 |

)% |

| Adjusted EBITDA

Margin |

7.7 |

% |

|

4.1 |

% |

|

7.1 |

% |

|

(2.0 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

(1) Net income (loss) after tax divided by

revenue.(2) The related party transaction is a non-recurring

transaction that is not core to our business and is excluded from

the Adjusted EBITDA calculation (Refer to Note 17 of the interim

condensed consolidated financial statements).(3) Reorganization

expenses, the gain on sale of software and patents, the gain on

extinguishment of convertible debt and the impairment charge on the

Rock Hill facility are not core to our business and are therefore

excluded from the Adjusted EBITDA calculation (Refer to Note 4,

Note 5 and Note 6 of the interim condensed consolidated financial

statements).

The following table presents a reconciliation

for the three and six months ended June 30, 2024 and 2023 of

Adjusted Gross Profit to our gross profit and Adjusted Gross Profit

Margin to gross profit margin, which is the most directly

comparable GAAP measures for the periods presented:

(Unaudited - Stated in thousands of U.S.

dollars)

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

($ in thousands) |

|

|

($ in thousands) |

|

| Gross

profit |

15,375 |

|

|

14,557 |

|

|

30,023 |

|

|

23,239 |

|

| Gross profit

margin |

37.3 |

% |

|

32.5 |

% |

|

36.6 |

% |

|

28.5 |

% |

| Add: Depreciation and

amortization expense |

845 |

|

|

1,643 |

|

|

1,689 |

|

|

3,425 |

|

| Adjusted Gross

Profit |

16,220 |

|

|

16,200 |

|

|

31,712 |

|

|

26,664 |

|

| Adjusted Gross Profit

Margin |

39.4 |

% |

|

36.2 |

% |

|

38.7 |

% |

|

32.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

Special Note Regarding Forward-Looking

Statements

Certain statements contained in this news

release are “forward-looking statements” within the meaning of

“safe harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995 and Section 21E of the Securities

Exchange Act of 1934 and “forward-looking information” within the

meaning of applicable Canadian securities laws. All statements,

other than statements of historical fact included in this news

release, regarding our strategy, future operations, financial

position, estimated revenues and losses, projected costs,

prospects, plans and objectives of management are forward-looking

statements. When used in this news release, the words “anticipate,”

“believe,” “expect,” “estimate,” “intend,” “plan,” “project,”

“outlook,” “may,” “will,” “should,” “would,” “could,” “can,”

“continue,” the negatives thereof, variations thereon and other

similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

such identifying words. In particular and without limitation, this

news release contains forward-looking information pertaining to our

expectations regarding third quarter 2024, 2024 and 2025 revenues;

2024 and 2025 Adjusted EBITDA; the importance of sustainability in

the interior construction industry; future revenues, Adjusted

EBITDA, unrestricted cash, activity levels and the timing thereof;

project delivery and the timing thereof; implementation of our

strategic plan, including the effects of our improved cost

structure; profitable future growth; the effects of our strategic

initiatives and the timing thereof; general economic conditions,

including in the construction industry, and rising interest rates;

our beliefs about our twelve-month forward sales and qualified

leads pipeline; large projects and the timing and revenue as a

result thereof; our beliefs about the impact of future revenue on

cash flow; raw material costs and their effect on DIRTT; the

continued reduction of DIRTT’s debt; DIRTT’s continued journey to

excellence; our ability to weather economic conditions and invest

in technology and commercial organizations; and the continued

evaluation of our cost structure.

Forward-looking statements are based on certain

estimates, beliefs, expectations, and assumptions made in light of

management’s experience and perception of historical trends,

current conditions and expected future developments, as well as

other factors that may be appropriate.

Forward-looking statements necessarily involve

unknown risks and uncertainties, which could cause actual results

or outcomes to differ materially from those expressed or implied in

such statements. Due to the risks, uncertainties, and assumptions

inherent in forward-looking information, you should not place undue

reliance on forward-looking statements. Factors that could have a

material adverse effect on our business, financial condition,

results of operations and growth prospects include, but are not

limited to, risks described under the section titled “Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31,

2023, filed with the U.S. Securities and Exchange Commission (the

“SEC”) and applicable securities commissions or similar regulatory

authorities in Canada on February 21, 2024 as supplemented by our

Quarterly Report on Form 10-Q for the quarter ended June 30, 2024

filed with the SEC and applicable securities commissions or similar

regulatory authorities in Canada on August 7, 2024.

Our past results of operations are not

necessarily indicative of our future results. You should not rely

on any forward-looking statements, which represent our beliefs,

assumptions and estimates only as of the dates on which they were

made, as predictions of future events. We undertake no obligation

to update these forward-looking statements, even though

circumstances may change in the future, except as required under

applicable securities laws. We qualify all of our forward-looking

statements by these cautionary statements.

About DIRTT Environmental

Solutions

DIRTT is a leader in industrialized

construction. DIRTT’s system of physical products and digital tools

empowers organizations, together with construction and design

leaders, to build high-performing, adaptable, interior

environments. Operating in the workplace, healthcare, education,

and public sector markets, DIRTT’s system provides total design

freedom, and greater certainty in cost, schedule, and outcomes.

DIRTT's interior construction solutions are designed to be highly

flexible and adaptable, enabling organizations to easily

reconfigure their spaces as their needs evolve. Headquartered in

Calgary, AB Canada, DIRTT trades on the Toronto Stock Exchange

under the symbol “DRT”.

FOR FURTHER INFORMATION PLEASE CONTACT

ir@dirtt.com

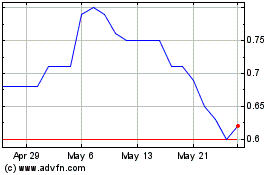

DIRTT Environmental Solu... (TSX:DRT)

Historical Stock Chart

From Oct 2024 to Nov 2024

DIRTT Environmental Solu... (TSX:DRT)

Historical Stock Chart

From Nov 2023 to Nov 2024