ERES REIT Provides Update on Proposed Mid-Market Regulation in the Netherlands

10 January 2023 - 12:00AM

European Residential Real Estate Investment Trust (TSX:ERE.UN,

“

ERES” or the “

REIT”) announced

today that on December 9, 2022, the Minister of Housing published

details regarding the proposed regulation of mid-priced rental

homes in the Netherlands and amendments to the Housing Evaluation

System, to become effective from January 1, 2024.

The proposed legislation will further divide the

residential rental market into three segments: (1) the pre-existing

regulated segment; (2) a new regulated mid-market segment; and (3)

the remaining unregulated, or liberalized, segment. The new

mid-market regulation will apply to units with up to 187 “Points”

as per the Housing Evaluation System (woningwaarderingsstelsel or

“WWS”), effective for all new leases commencing on or after January

1, 2024 (i.e., for occupied units, the regulation will only take

effect upon turnover). Pertinent specifications of the envisaged

regulation of mid-priced rental homes, as announced through the

Minister of Housing’s letter to Parliament, are detailed as

follows:

- The maximum starting rent that can

be charged for a mid-market rental unit will be determined by the

number of Points allocated to such unit, pursuant to the parameters

of the existing Housing Evaluation System (as amended, as outlined

below).

- With maximum rents subject to

regular indexation on July 1st of every year to adjust for

inflation, it is expected that 187 Points will correspond to a

starting rent ceiling of approximately €1,100 per month, in

accordance with the Points system that will be in effect on January

1, 2024.

- Indexation of the mid-market rental

segment will be capped at the annual wage development figure

(loonontwikkelingscijfer) + 0.5% (but not to exceed the rent

ceiling as determined by the WWS Points).

Furthermore, the current Housing Evaluation

System will be amended by the following key modifications:

- More Points will be awarded for

units with an energy label of A or higher, while Points will be

deducted for units with an energy label of E, F or G (potentially

mitigated by a subsidy that will be made available to landlords for

the purpose of improving the sustainability of existing

units).

- Additional Points will be

attributed to individual outdoor spaces by using a graduated scale

with increments of 5 square metres (previously 25 square

metres).

- The cap on the number of Points

which can be contributed from property value (based on the Wet

Waardering Onroerende Zaken or “WOZ” value) at 33% of the total

number of Points of the unit will be made applicable to rental

units with 187 Points or more (an increase from its current

application to rental units with 142 Points or more, thereby

additionally exempting the new mid-market sector).

- Effective for a temporary period of

10 years, a surcharge of 5% on the maximum starting rents as per

the Housing Evaluation System will apply to newly-built units

classified in the mid-market segment, for which construction

commenced before January 1, 2025, and was completed after January

1, 2024.

The REIT has assessed the impact of the above

developments and determined that approximately one-quarter of its

portfolio would be affected by the mid-market measures. On

implementation to new leases from January 1, 2024 onward, the

expected rent differential, representing approximately 4% of

annualized in-place rent for the total portfolio, will be incurred

upon turnover of the mid-market units, and absorbed over an

estimated period of three to five years. Notwithstanding the

regulatory changes highlighted above, the REIT anticipates that it

will continue to achieve rent growth within or in excess of its

target range of 3% to 4%.

In step with the historically progressive nature

of the Dutch regulatory regime, the proposed mid-market regulation

is intended to be temporary, to apply only as long as necessary to

alleviate the worsening of the housing shortage. As the proposals

prescribed in the letter to Parliament have yet to be adopted by

the Dutch government, they may be subject to change. Draft

legislation is expected to be published in early 2023.

The REIT also announced today that on January 1,

2023, legislation entered into force pursuant to which indexation

for Liberalized Suites will be capped at the lower of (i) CPI + 1%

or (ii) the annual wage development figure

(loonontwikkelingscijfer) + 1% (effective until April 30, 2024). In

line with this development and given the high inflation rates

prevalent throughout the past year, the Dutch government determined

that the maximum rent indexation as of July 1, 2023, will be set at

(i) 3.1% for Regulated Suites, equivalent to the annual wage

development figure, and (ii) 4.1% for Liberalized Suites, based on

the annual wage development figure + 1%.

In accordance with the above, the REIT expects

to realize an average rental increase due to indexation of

approximately 3.8% across the total residential portfolio

(inclusive of all Regulated Suites and Liberalized Suites), driving

rent growth in 2023 toward the high end of its target range. This

excludes the effects of turnover which, historically, have

contributed significantly to additional growth.

Ultimately, the REIT anticipates that it will

continue to achieve a net operating income margin within its

presently projected range of 76% to 79% of operating revenues

(including service charges), which is even further reinforced by

the abolition of the landlord levy tax that became effective on

January 1, 2023.

“One of the cornerstones of ERES’s competitive

edge is its demonstrated proficiency in profitably navigating an

extremely complex residential regulatory framework, and notably one

which has been continuously evolving,” commented Phillip Burns,

Chief Executive Officer. “These iterations characterize the next

chapters of that ongoing evolution. In parallel, ERES will continue

to leverage its experience and platform capabilities to adapt and

drive robust rent growth, as we have accomplished to date.”

About ERES

ERES is an unincorporated, open-ended real

estate investment trust. ERES’s Units are listed on the TSX under

the symbol ERE.UN. ERES is Canada’s only European-focused,

multi-residential REIT, with a current initial focus on investing

in high-quality, multi-residential real estate properties in the

Netherlands. ERES owns a portfolio of 158 multi-residential

properties, comprised of 6,900 suites and ancillary retail space

located in the Netherlands, and owns one office property in Germany

and one office property in Belgium.

ERES’s registered and principal business office

is located at 11 Church Street, Suite 401, Toronto, Ontario M5E

1W1.

For more information, please visit our website

at www.eresreit.com.

Cautionary Statements Regarding

Forward-Looking Statements

All statements in this press release that do not

relate to historical facts constitute forward-looking statements.

These statements represent ERES’s intentions, plans, expectations

and beliefs and are subject to certain risks and uncertainties that

could result in actual results differing materially from these

forward-looking statements. These risks and uncertainties are more

fully described in regulatory filings that can be obtained on SEDAR

at www.sedar.com.

For further information

| ERESMr.

Phillip BurnsChief Executive

Officer416.354.0167p.burns@eresreit.com |

ERESMs. Jenny

ChouChief Financial Officer416.354.0188j.chou@eresreit.com |

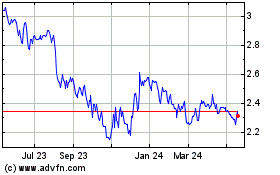

European Residetial Real... (TSX:ERE.UN)

Historical Stock Chart

From Jan 2025 to Feb 2025

European Residetial Real... (TSX:ERE.UN)

Historical Stock Chart

From Feb 2024 to Feb 2025