Canadian Apartment Properties Real Estate Investment Trust

(“

CAPREIT”) (TSX:CAR.UN) announced today that

certain subsidiaries of European Residential Real Estate Investment

Trust (TSX:ERE.UN) (“

ERES”) have entered into

agreements to sell 3,179 residential suites in the Netherlands (the

“

Residential Dispositions”) and have closed on the

disposition of one commercial building in Germany for aggregate

proceeds, net of certain adjustments, of approximately $1.1

billion. Amounts disclosed herein exclude transaction costs and

other customary adjustments, and are presented in Canadian dollars

based on a Euro foreign exchange rate of 1.51 on September 13,

2024.

In connection with the Residential Dispositions,

ERES announced that a portion of the net proceeds from the sales

are expected to be used to fund the payment of a special cash

distribution of an estimated $1.13 per ERES Unit and ERES Limited

Partnership’s exchangeable Class B LP Unit (together, the

“ERES Units”), payable to holders of the ERES

Units of record at a date to be determined (the “Special

Distribution”, and together with the Residential

Dispositions, the “Transactions”). Based on

CAPREIT’s effective interest in ERES of approximately 65%, CAPREIT

expects to receive approximately $172 million from the Special

Distribution following the closing of the Residential

Dispositions.

In connection with and following completion of

the Residential Dispositions, ERES also announced that it intends

to reduce its monthly rate of distribution by approximately

50%.

The Residential Dispositions are in part subject

to compliance with the Dutch Competition Act, as well as other

closing conditions. Subject to the receipt of all regulatory

approvals and satisfaction of closing conditions for each of the

Residential Dispositions, ERES announced that closings are

anticipated by, or before, early Q1 2025. There can be no assurance

that all conditions of closing will be obtained, satisfied or

waived. Further details of the Transactions have been provided by

ERES in its press release dated September 16, 2024.

CAPREIT intends to utilize the proceeds from the

Special Distribution: (1) to repay certain amounts drawn on its

revolving credit facility; (2) to fund future acquisitions of

on-strategy rental properties in Canada; and (3) for general

business purposes, which may include capital expenditures, debt

repayment and the repurchase of CAPREIT’s Trust Units under its

normal course issuer bid.

“The sale of approximately half of ERES’s

residential suites is not only generating liquidity, which ERES can

use to reduce its leverage and solidify its balance sheet, but it

also returns meaningful capital to its Unitholders to reallocate as

they see fit,” commented Mark Kenney, President and Chief Executive

Officer of CAPREIT. “This will afford CAPREIT the ability to

redeploy the proceeds of the Special Distribution into

highest-value alternatives that are aligned with our strategy.

Ultimately, these dispositions by ERES will substantially reduce

CAPREIT’s non-core investment segment and surface capital that can

be put towards the continued upgrading of its Canadian apartment

portfolio.”

“The Transactions achieve a multitude of

strategic objectives for both ERES and CAPREIT, and unlock

significant value for all Unitholders,” added Gina Parvaneh Cody,

Chair of the Board of Trustees of CAPREIT. “The Board is excited

about the strong progress that CAPREIT has made so far this year on

its portfolio repositioning and capital reallocation initiatives,

and we continue to support this strategy.”

ABOUT CAPREITCAPREIT is

Canada’s largest publicly traded provider of quality rental

housing. As at June 30, 2024, CAPREIT owns approximately 64,200

residential apartment suites, townhomes and manufactured home

community sites well-located across Canada and the Netherlands,

with approximately $16.6 billion of investment properties in Canada

and Europe. For more information about CAPREIT, its business and

its investment highlights, please visit our website at

www.capreit.ca and our public disclosure which can be found under

our profile on SEDAR+ at www.sedarplus.ca.

CAUTIONARY STATEMENTS REGARDING

FORWARD-LOOKING STATEMENTSCertain statements contained in

this press release constitute forward-looking statements within the

meaning of applicable Canadian securities laws. Forward-looking

statements generally can be identified by the use of

forward-looking terminology such as “outlook”, “objective”, “may”,

“will”, “expect”, “intent”, “estimate”, “anticipate”, “believe”,

“consider”, “should”, “plans”, “predict”, “estimate”, “forward”,

“potential”, “could”, “likely”, “approximately”, “scheduled”,

“forecast”, “variation” or “continue”, or similar expressions

suggesting future outcomes or events. Forward-looking statements in

this press release include, but are not limited, statements with

respect to the expected completion and timing of the Residential

Dispositions, the intended use of proceeds from the Residential

Dispositions and the amount and timing of the Special Distribution.

The forward-looking statements made in this press release reflect

CAPREIT’s current expectations and projections about future results

and events based on information available to CAPREIT as of the date

on which such statements are made. Actual results and developments

are likely to differ, and may differ materially, from those

expressed or implied by the forward-looking statements contained in

this press release. Any number of factors could cause actual

results to differ materially from these forward-looking statements.

Although CAPREIT believes that the expectations reflected in

forward-looking statements contained herein are reasonable, it can

give no assurances that the expectations of any forward-looking

statements will prove to be correct. Accordingly, readers should

not place undue reliance on such forward-looking statements.

Forward looking statements in this press release

are subject to certain risks and uncertainties, many of which are

beyond CAPREIT’s control, which could result in actual results

differing materially from these forward-looking statements. These

risks and uncertainties include, but are not limited to, the risks

and uncertainties described under the heading “Risks and

Uncertainties” in CAPREIT’s 2023 Annual Report and under the

heading “Risk Factors” in CAPREIT’s Annual Information Form for the

year ended December 31, 2023, each of which is available under

CAPREIT’s profile on SEDAR+ at www.sedarplus.ca.

Except as specifically required by applicable

Canadian securities law, CAPREIT does not undertake any obligation

to update or revise publicly any forward-looking statements,

whether as a result of new information, future events or otherwise,

after the date on which the statements are made or to reflect the

occurrence of unanticipated events. These forward-looking

statements should not be relied upon as representing CAPREIT’s

views as of any date subsequent to the date of this press

release.

For more information, please

contact:

|

CAPREITDr. Gina Parvaneh Cody Chair of the Board of Trustees (437)

219-1765 |

|

CAPREITMr. Mark KenneyPresident & Chief Executive Officer(416)

861-9404 |

|

|

|

|

|

CAPREITMr. Stephen CoChief Financial Officer(416) 306-3009 |

|

CAPREITMr. Julian SchonfeldtChief Investment Officer(647)

535-2544 |

|

|

|

|

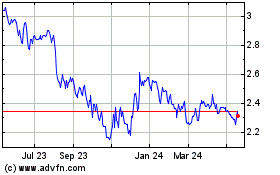

European Residetial Real... (TSX:ERE.UN)

Historical Stock Chart

From Jan 2025 to Feb 2025

European Residetial Real... (TSX:ERE.UN)

Historical Stock Chart

From Feb 2024 to Feb 2025