European Residential Real Estate Investment Trust ("ERES" or the

"REIT") (TSX: ERE.UN) announced today its results for the year

ended December 31, 2024.

ERES’s audited consolidated annual financial

statements and management's discussion and analysis ("MD&A")

for the year ended December 31, 2024 can be found at

www.eresreit.com or under ERES's profile at SEDAR+ at

www.sedarplus.ca.

SIGNIFICANT EVENTS AND

HIGHLIGHTS

Strategic Initiatives Update

- In December 2024, through a number

of transactions, the REIT disposed of a total of 3,267 suites in

the Netherlands for €768.3 million (excluding transaction costs and

other adjustments).

- The REIT declared and paid a

special cash distribution of €1.00 per Unit, totalling €234.4

million (including distributions on Class B LP Units), in December

2024, funded by proceeds from dispositions.

- On September 13, 2024, the REIT

disposed of a commercial building being part of its German property

for €8.6 million (excluding transaction costs and other

adjustments).

- On July 15, 2024, the REIT disposed

of 19 residential properties containing 464 suites in the

Netherlands for €100.7 million (excluding transaction costs and

other adjustments) and one office building being part of a

residential property in the Netherlands for gross proceeds of €1.1

million.

- On June 18, 2024, the REIT disposed

of one residential property containing 66 suites in the Netherlands

for €14.2 million (excluding transaction costs and other

adjustments).

- During the year ended December 31,

2024, the REIT disposed of 80 individual suites, which generated

€22.8 million in gross proceeds.

Operating Metrics

- Strong operating results continued

into 2024, fuelled by strong rental growth. Same property portfolio

Occupied Average Monthly Rents ("Occupied AMR") increased by 6.8%,

from €1,166 as at December 31, 2023, to €1,245 as at December 31,

2024, demonstrating the REIT's continued achievement of rental

growth.

- Same property turnover was 12.4%

for the year ended December 31, 2024, with rental uplift on

turnover of 15.2%, compared to rental uplift of 21.5% on same

property turnover of 17.4% in the prior year.

- Same property occupancy for the

residential properties decreased to 94.9% as at December 31, 2024,

compared to 99.2% as at December 31, 2023, primarily related to

suites intentionally held vacant to maximize value. Same property

occupancy for commercial properties decreased to 91.3% as at

December 31, 2024, from 100.0% as at December 31, 2023, due to the

expiration of one of the commercial

leases.

- Same property Net Operating Income

("NOI") increased by 3.1% for the year ended December 31, 2024

compared to the prior year, primarily driven by higher monthly

rents on the same property portfolio and further supported by the

REIT's extensive protection from inflation and strong cost

control.

Financial Performance

- Diluted Funds From Operations

("FFO") per Unit for the year ended December 31, 2024 decreased by

4.3%, compared to the prior year, primarily due to lower total

portfolio NOI as a result of dispositions, partially offset by

lower interest costs being incurred following repayment of debt

using proceeds from dispositions.

- Diluted Adjusted Funds From

Operations ("AFFO") per Unit for the year ended December 31, 2024

decreased by 7.3%, compared to the prior year, due to the same

reasons mentioned above for the decrease in diluted FFO per Unit as

well as an increase in actual non-discretionary capital

investments.

Financial Position and Liquidity

- Liquidity improved significantly

from the prior year end by €103.9 million as a result of proceeds

from dispositions being partially used to repay the Revolving

Credit Facility.

- During the year ended December 31,

2024, the REIT repaid €544.4 million of mortgages payable with a

weighted average effective interest rate of 2.15%, including €476.9

million resulting from dispositions.

- On June 19, 2024, the REIT amended

its Revolving Credit Facility to replace the Canadian Dollar

Offered Rate with the Canadian Overnight Repo Rate Average as the

benchmark interest rate for Canadian dollar borrowings, if any. The

amendment also extended the maturity date of the Revolving Credit

Facility from January 26, 2026 to June 14, 2027.

- On April 30, 2024, the REIT renewed

the mortgage financing on one of its commercial properties for a

one-year period ending March 31, 2025, with a total principal

amount of €14.4 million and interest rate at three-month Euro

Interbank Offered Rate plus a margin of 2.0%.

- On March 27, 2024, the REIT renewed

the mortgage financing on one of its commercial properties for a

three-year period ending March 27, 2027, with a total principal

amount of €18.7 million and a fixed contractual interest rate of

4.70%.

- Debt coverage metrics are within

covenant thresholds, with interest and debt service coverage ratios

of 3.2x and 2.6x, respectively, and adjusted debt to gross book

value ratio standing at 39.7%.

- As at December 31, 2024, the REIT's

mortgage profile had a weighted average term to maturity of 2.5

years and a weighted average effective interest rate of 2.27%.

Significant Subsequent Events

- Subsequent to the year ended

December 31, 2024 and as at the date of this press release, the

REIT has disposed of additional 279 suites in the Netherlands for

€56.2 million (excluding transaction costs and other

adjustments).

- On January 7, 2025, the Board of

Trustees held a special meeting of Unitholders to amend the REIT's

Declaration of Trust to provide the Board of Trustees with the

authority (i) to sell all or substantially all of the assets of the

REIT in one or more transactions at such times and on such terms

and conditions as determined by the Board, (ii) to distribute the

net proceeds of any such sales to Unitholders in the amounts and at

the times determined by the Board, and (iii) to wind-up, liquidate,

dissolve or take any such similar action to terminate the REIT on

such terms and conditions determined by the Board, in each case

without any requirement for further Unitholder approval (subject to

applicable securities laws). The amendments were approved at the

special meeting.

- The Board of Trustees has also

approved a reduction in monthly distributions, from €0.01 per Unit

to €0.005 per Unit, effective January 2025, implemented to better

align distributions with the operations of the REIT's remaining

portfolio.

"We're very proud of what we were able to

accomplish in 2024, with over €900 million in strategic

dispositions that reduced our residential portfolio in the

Netherlands from nearly 7,000 suites at the start of the year to

approximately 3,000 as of December 31, 2024,” commented Mark

Kenney, Chief Executive Officer. “We were able to transact on these

sales at pricing at or above previously reported fair values,

generating significant capital that we used to strengthen our

balance sheet and fund a special cash distribution to Unitholders

of €1.00 per Unit. We're determined to do everything we can to see

this sound execution of our strategy continue in the new year, as

we seek to surface incremental value and maximize returns for our

Unitholders in 2025."

"After paying down mortgage debt associated with

our dispositions, we used part of the net proceeds to prepay

certain additional mortgages maturing in the near-term,” added

Jenny Chou, Chief Financial Officer. “In doing so, we headed into

this year with approximately €34 million in mortgage principal

maturing, which compares to €227 million that we originally had

maturing in 2025, as of prior year end. In addition, we paid down

all amounts outstanding on the REIT's Revolving Credit Facility,

and, in aggregate, we significantly lowered our leverage with an

adjusted debt to gross book value ratio of 39.7% as of current year

end, down from 57.6% as of December 31, 2023. Operationally, on the

same property portfolio, our occupied AMR grew by 6.8% and our NOI

margin was solid at 76.6% for 2024, and we'll continue to focus on

realizing these robust results for the remaining portfolio moving

forward."

"We have been reiterating that our mission is

the maximization of value for Unitholders, and we believe that this

past year, we have evidenced our true commitment to that

objective," said Gina Parvaneh Cody, Chair of the Board. "We were

pleased to have commenced the new year with a special meeting of

Unitholders, in which a resolution to amend the REIT's Declaration

of Trust was passed. This provided the Board with maximum

flexibility in assessing and executing on the most attractive

opportunities available, so that we can continue to cover

significant ground on the execution of our strategy in the year

ahead. We are confident in the management team we have in place at

ERES to do just that, in a responsible, disciplined and timely

manner, and we are looking forward to seeing further generation of

Unitholder returns in 2025."

OPERATING RESULTS

Rental Rates

|

Total Property Portfolio |

Suite Count |

Occupied AMR/ABR1 |

Occupancy % |

|

As at December 31, |

2024 |

2023 |

2024 |

2023 |

AMR |

|

2024 |

2023 |

| |

|

|

€ |

€ |

% Change |

|

|

|

|

Residential Properties |

3,009 |

6,886 |

1,222 |

1,063 |

15.0 |

|

94.6 |

98.5 |

|

Commercial Properties2 |

|

|

17.9 |

19.4 |

(7.7 |

) |

91.3 |

100.0 |

|

1 |

Average In-Place Base Rent ("ABR"). |

| 2 |

Represents 392,904 square feet

("sq. ft.") of commercial gross leasable area ("GLA") as at

December 31, 2024 (December 31, 2023 — 450,911 sq. ft.). |

|

Same Property Portfolio |

Suite Count1 |

Occupied AMR/ABR |

Occupancy % |

|

As at December 31, |

|

2024 |

2023 |

AMR |

|

2024 |

2023 |

| |

|

€ |

€ |

% Change |

|

|

|

|

Residential Properties |

2,698 |

1,245 |

1,166 |

6.8 |

|

94.9 |

99.2 |

|

Commercial Properties2 |

|

17.9 |

20.2 |

(11.4 |

) |

91.3 |

100.0 |

|

1 |

Same property suite count includes all suites owned by the REIT as

at both December 31, 2024 and December 31, 2023, and excludes

properties and suites disposed of or classified as assets held for

sale as at December 31, 2024. |

| 2 |

Includes 392,904 sq. ft. of same property commercial GLA, which

excludes commercial GLA disposed of since December 31, 2023. |

Occupied AMR for the same property portfolio

increased by 6.8% compared to €1,166 as at December 31, 2023,

mainly driven by indexation, turnover and the conversion of

regulated suites to liberalized suites. The REIT's achievement of

strong growth in rental revenues demonstrates its ability to

consistently operate in a complex and fluid regulatory regime. The

Occupied ABR for the commercial properties for the same property

portfolio decreased from €20.2 as at December 31, 2023 to €17.9 as

at December 31, 2024, primarily due to a reduction in rent after

lease renewal in one of the commercial properties.

Suite Turnovers

Total Portfolio Turnover

|

For the Three Months Ended December 31, |

2024 |

2023 |

|

|

Change in Monthly Rent |

Turnovers2 |

Change in Monthly Rent |

Turnovers2 |

|

|

% |

% |

% |

% |

|

Regulated suites turnover1 |

4.9 |

0.8 |

11.9 |

0.3 |

|

Liberalized suites turnover1 |

14.8 |

0.3 |

18.6 |

2.7 |

|

Regulated suites converted to liberalized suites1 |

14.8 |

0.2 |

41.8 |

0.4 |

|

Weighted average turnovers1 |

8.9 |

1.3 |

20.3 |

3.4 |

|

Weighted average turnovers excluding service charge

income |

9.6 |

1.3 |

19.2 |

3.4 |

|

1 |

Represents the percentage increase in monthly rent inclusive of

service charge income. |

| 2 |

Percentage of suites turned over

during the period based on the weighted average number of total

residential suites held during the period. |

|

For the Year Ended December 31, |

2024 |

2023 |

|

|

Change in Monthly Rent |

Turnovers2 |

Change in Monthly Rent |

Turnovers2 |

|

|

% |

% |

% |

% |

|

Regulated suites turnover1 |

8.6 |

1.7 |

10.5 |

1.1 |

|

Liberalized suites turnover1 |

13.1 |

4.6 |

17.7 |

11.0 |

|

Regulated suites converted to liberalized suites1 |

29.3 |

1.4 |

51.8 |

1.6 |

|

Weighted average turnovers1 |

14.9 |

7.7 |

20.4 |

13.8 |

|

Weighted average turnovers excluding service charge

income |

15.7 |

7.7 |

19.5 |

13.8 |

|

1 |

Represents the percentage increase in monthly rent inclusive of

service charge income. |

| 2 |

Percentage of suites turned over

during the year based on the weighted average number of total

residential suites held during the year. |

Same Property Turnover

|

For the Three Months Ended December 31, |

2024 |

2023 |

|

|

Change in Monthly Rent |

Turnovers2 |

Change in Monthly Rent |

Turnovers2 |

|

|

% |

% |

% |

% |

|

Regulated suites turnover1 |

4.9 |

1.7 |

17.2 |

0.1 |

|

Liberalized suites turnover1 |

14.8 |

0.6 |

18.7 |

4.3 |

|

Regulated suites converted to liberalized suites1 |

14.8 |

0.4 |

53.7 |

0.6 |

|

Weighted average turnovers1 |

8.9 |

2.7 |

21.2 |

5.0 |

|

Weighted average turnovers excluding service charge

income |

9.6 |

2.7 |

19.9 |

5.0 |

|

1 |

Represents the percentage increase in monthly rent inclusive of

service charge income. |

| 2 |

Percentage of suites turned over

during the period based on the weighted average number of same

property residential suites held during the period. |

|

For the Year Ended December 31, |

2024 |

2023 |

|

|

Change in Monthly Rent |

Turnovers2 |

Change in Monthly Rent |

Turnovers2 |

|

|

% |

% |

% |

% |

|

Regulated suites turnover1 |

8.7 |

3.2 |

13.0 |

0.7 |

|

Liberalized suites turnover1 |

12.9 |

6.9 |

18.3 |

14.9 |

|

Regulated suites converted to liberalized suites1 |

29.5 |

2.3 |

64.2 |

1.8 |

|

Weighted average turnovers1 |

15.2 |

12.4 |

21.5 |

17.4 |

|

Weighted average turnovers excluding service charge

income |

16.9 |

12.4 |

20.1 |

17.4 |

|

1 |

Represents the percentage increase in monthly rent inclusive of

service charge income. |

| 2 |

Percentage of suites turned over

during the year based on the weighted average number of same

property residential suites held during the year. |

Suite Renewals

Lease renewals generally occur on July 1 for

residential suites. On July 1, 2024, the REIT renewed leases for

94% of its residential suites, to which the average rental increase

due to indexation and household income adjustments was 5.5% (July

1, 2023 — renewal of 97% of its residential suites with 4.0%

average rental increase).

There was one lease renewal in the REIT's

commercial portfolio during the year ended December 31, 2024 (year

ended December 31, 2023 — one lease renewal).

Total Portfolio Performance

| |

Three Months Ended, |

Year Ended |

| |

December 31, |

December 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Operating Revenues (000s) |

€ |

20,641 |

|

€ |

24,717 |

|

€ |

92,968 |

|

€ |

95,684 |

|

|

NOI (000s) |

€ |

16,020 |

|

€ |

19,505 |

|

€ |

72,867 |

|

€ |

75,131 |

|

|

NOI Margin1 |

77.6 |

% |

78.9 |

% |

78.4 |

% |

78.5 |

% |

|

Weighted Average Number of Suites |

5,681 |

|

6,894 |

|

6,426 |

|

6,898 |

|

|

1 |

Excluding service charge income and expense, the total portfolio

NOI margin for the three months and year ended December 31, 2024

was 82.8% and 83.7%, respectively (three months and year ended

December 31, 2023 — 84.2% and 83.8%, respectively). |

The following table reconciles same property NOI

and NOI from dispositions and assets held for sale to total NOI,

for the three months and year ended December 31, 2024 and December

31, 2023.

|

(€ Thousands) |

Three Months Ended |

Year Ended |

| |

December 31, |

December 31, |

|

|

2024 |

2023 |

2024 |

2023 |

|

Same property NOI |

€ |

9,007 |

€ |

9,191 |

€ |

36,544 |

€ |

35,433 |

|

NOI from dispositions and assets held for sale |

7,013 |

10,314 |

36,323 |

39,698 |

|

Total NOI |

€ |

16,020 |

€ |

19,505 |

€ |

72,867 |

€ |

75,131 |

Same Property Portfolio

Performance1

| |

Three Months Ended, |

Year Ended |

| |

December 31, |

December 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Operating Revenues (000s) |

€ |

11,814 |

|

€ |

11,913 |

|

€ |

47,714 |

|

€ |

46,007 |

|

|

NOI (000s) |

€ |

9,007 |

|

€ |

9,191 |

|

€ |

36,544 |

|

€ |

35,433 |

|

|

NOI Margin2 |

76.2 |

% |

77.2 |

% |

76.6 |

% |

77.0 |

% |

|

1 |

Same property portfolio includes all properties and suites

continuously owned by the REIT since December 31, 2022, and

excludes properties, buildings and suites disposed of since

December 31, 2022 and properties classified as assets held for sale

as at December 31, 2024. For the years ended December 31, 2024 and

December 31, 2023, same property portfolio includes 2,698

residential suites and 392,904 sq. ft. of commercial GLA. |

| 2 |

Excluding service charge income

and expense, the same property portfolio NOI margin for the three

months and year ended December 31, 2024 was 83.9% and 84.6%,

respectively (three months and year ended December 31, 2023 — 85.1%

and 84.9%, respectively). |

For the three months ended December 31, 2024,

the same property NOI decreased by 2.0% from the comparable prior

year quarter and the NOI margin on the same property portfolio

decreased to 76.2% from 77.2% for the comparable prior year

quarter, mainly due to reduction in rent after lease renewal in one

of the commercial properties and intentional vacancies to maximize

value. However, the same property NOI increased by 3.1% for the

year ended December 31, 2024, compared to the prior year, primarily

driven by higher occupied AMR on the same property portfolio.

The same property NOI margin slightly decreased to 76.6% for the

year ended December 31, 2024, compared to 77.0% for the prior year,

mainly due to increases in repairs and maintenance costs and

insurance expense for the same property portfolio.

FINANCIAL PERFORMANCE

Funds from Operations and Adjusted Funds

from Operations

FFO is a measure of operating performance based

on the funds generated by the business before reinvestment or

provision for other capital needs. AFFO is a supplemental measure

which adjusts FFO for costs associated with certain capital

expenditures, leasing costs and tenant improvements. FFO and AFFO

as presented are in accordance with the most recent recommendations

of the Real Property Association of Canada ("REALpac"), with

the exception of certain adjustments made to the REALpac defined

FFO, which relate to (i) senior management termination and

retirement costs; (ii) gain from Unit Options forfeited on senior

management termination; (iii) mortgage repayment costs; (iv) costs

related to the concluded strategic review of the REIT; and (v)

expired base shelf prospectus fees. FFO and AFFO may not, however,

be comparable to similar measures presented by other real estate

investment trusts or companies in similar or different industries.

Management considers FFO and AFFO to be important measures of the

REIT’s operating performance. Please refer to "Basis of

Presentation and Non-IFRS Measures" within this press release for

further information.

A reconciliation of net loss and comprehensive

loss to FFO is as follows:

|

(€ Thousands, except per Unit amounts) |

Three Months Ended |

Year Ended |

|

|

December 31, |

December 31, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Net loss and comprehensive loss |

€ |

(52,390 |

) |

€ |

(35,917 |

) |

€ |

(64,288 |

) |

€ |

(114,229 |

) |

|

Adjustments: |

|

|

|

|

|

Net movement in fair value of investment properties and assets held

for sale |

(13,873 |

) |

35,337 |

|

(62,022 |

) |

230,229 |

|

|

Net movement in fair value of Class B LP Units |

(86,511 |

) |

8,218 |

|

(31,042 |

) |

(46,299 |

) |

|

Fair value adjustments of Unit-based compensation liabilities |

362 |

|

(194 |

) |

1,517 |

|

(1,311 |

) |

|

Interest expense on Class B LP Units |

146,302 |

|

4,261 |

|

159,085 |

|

17,044 |

|

|

Deferred income tax expense (recovery) |

4,396 |

|

(10,538 |

) |

15,268 |

|

(59,679 |

) |

|

Foreign exchange loss (gain)1 |

— |

|

224 |

|

442 |

|

(568 |

) |

|

Net loss on derivative financial instruments |

3,088 |

|

6,304 |

|

7,128 |

|

9,244 |

|

|

Net transaction losses and other activities2 |

2,567 |

|

950 |

|

4,619 |

|

2,765 |

|

|

Tax related to dispositions3 |

3,124 |

|

234 |

|

4,521 |

|

314 |

|

|

Mortgage repayment costs4 |

1,344 |

|

— |

|

2,512 |

|

— |

|

|

Gain from Unit Options forfeited on senior management

termination5 |

— |

|

— |

|

(1,552 |

) |

— |

|

|

Senior management termination and retirement costs6 |

— |

|

— |

|

— |

|

74 |

|

|

FFO |

€ |

8,409 |

|

€ |

8,879 |

|

€ |

36,188 |

|

€ |

37,584 |

|

|

FFO per Unit – diluted7 |

€ |

0.036 |

|

€ |

0.038 |

|

€ |

0.154 |

|

€ |

0.161 |

|

|

|

|

|

|

|

|

Total monthly distributions declared8 |

€ |

7,030 |

|

€ |

7,002 |

|

€ |

28,089 |

|

€ |

27,949 |

|

|

FFO payout ratio8 |

83.6 |

% |

78.9 |

% |

77.6 |

% |

74.4 |

% |

|

1 |

Relates to foreign exchange movements recognized on remeasurement

of Unit-based compensation liabilities as well as on remeasurement

of the REIT's US$ draw on the Revolving Credit Facility as part of

effective hedging. |

| 2 |

Represent transaction costs

incurred on dispositions, gain on the assumption by the purchaser

of liabilities related to assets held for sale, costs associated

with the concluded strategic review of the REIT and expired base

shelf prospectus fees. |

| 3 |

Included in current income tax

expense in the consolidated statements of net loss and

comprehensive loss. |

| 4 |

Relate to repayment penalties and

write-off of deferred financing costs and fair value adjustment

related to mortgages repaid. |

| 5 |

Represents Unit-based

compensation financial liabilities written off during the year

ended December 31, 2024, due to Unit Options forfeited as a result

of senior management termination. |

| 6 |

Relate to €59 of accelerated

vesting of previously granted Unit Options and €15 in associated

legal fees for the year ended December 31, 2023. |

| 7 |

Includes Class B LP Units and the

dilutive impact of unexercised Unit Options and RURs. |

| 8 |

Includes interest on Class B LP

Units and excludes the special distribution declared and paid in

December 2024. |

|

The table below illustrates a reconciliation of the REIT's FFO and

AFFO: |

| |

|

|

|

|

| |

Three Months Ended |

Year Ended |

|

(€ Thousands, except per Unit amounts) |

December 31, |

December 31, |

|

|

2024 |

|

2023¹ |

|

2024 |

|

2023¹ |

|

|

FFO |

€ |

8,409 |

|

€ |

8,879 |

|

€ |

36,188 |

|

€ |

37,584 |

|

|

Adjustments: |

|

|

|

|

|

Actual non-discretionary capital investments |

(1,765 |

) |

(763 |

) |

(3,005 |

) |

(2,149 |

) |

|

Leasing cost reserve2 |

(128 |

) |

(139 |

) |

(510 |

) |

(556 |

) |

|

AFFO |

€ |

6,516 |

|

€ |

7,977 |

|

€ |

32,673 |

|

€ |

34,879 |

|

|

AFFO per Unit – diluted3 |

€ |

0.028 |

|

€ |

0.034 |

|

€ |

0.139 |

|

€ |

0.150 |

|

|

|

|

|

|

|

|

Total monthly distributions declared4 |

€ |

7,030 |

|

€ |

7,002 |

|

€ |

28,089 |

|

€ |

27,949 |

|

|

AFFO payout ratio4 |

107.9 |

% |

87.8 |

% |

86.0 |

% |

80.1 |

% |

|

1 |

Certain 2023 comparative figures have been restated to conform with

current period presentation. |

| 2 |

Leasing cost reserve is based on

annualized 10-year forecast of external leasing costs on the

commercial properties. |

| 3 |

Includes Class B LP Units and the

dilutive impact of unexercised Unit Options and RURs. |

| 4 |

Include interest on Class B LP

Units and exclude the special distribution declared and paid in

December 2024. |

Diluted FFO per Unit for the three months and

year ended December 31, 2024 decreased by 5.3% and 4.3%,

respectively, compared to the prior year period, primarily due to

lower total portfolio NOI as a result of dispositions, partially

offset by lower interest costs being incurred following the

repayment of debt with net disposition proceeds received. Diluted

AFFO per Unit for the three months and year ended December 31, 2024

decreased by 17.6% and 7.3%, respectively, compared to the prior

year period, due to the increase in actual non-discretionary

capital investments as a result of seasonality and the same reasons

for the decrease in diluted FFO per Unit.

Net Asset Value

Net Asset Value ("NAV") represents total

Unitholders' equity per the REIT's consolidated balance sheets,

adjusted to include or exclude certain amounts in order to provide

what management considers to be a key measure of the residual value

of the REIT to its Unitholders as at the reporting date. NAV is

therefore used by management on both an aggregate and per Unit

basis to evaluate the net asset value attributable to Unitholders,

and changes thereon based on the execution of the REIT's strategy.

While NAV is calculated based on items included in the consolidated

financial statements or supporting notes, NAV itself is not a

standardized financial measure under IFRS and may not be comparable

to similarly termed financial measures disclosed by other real

estate investment trusts or companies in similar or different

industries. Please refer to the "Basis of Presentation and Non-IFRS

Measures" section within this press release for further

information.

|

A reconciliation of Unitholders' equity to NAV is as follows: |

| |

|

|

|

(€ Thousands, except per Unit amounts) |

|

As at |

December 31, 2024 |

|

December 31, 2023 |

|

|

Unitholders' equity |

€ |

261,024 |

|

€ |

427,247 |

|

|

Class B LP Units |

219,512 |

|

250,554 |

|

|

Unit-based compensation financial liabilities |

623 |

|

187 |

|

|

Net deferred income tax liability1 |

11,025 |

|

14,869 |

|

|

Net derivative financial asset2 |

(5,925 |

) |

(15,901 |

) |

|

NAV |

€ |

486,259 |

|

€ |

676,956 |

|

|

NAV per Unit – diluted3 |

€ |

2.07 |

|

€ |

2.90 |

|

|

NAV per Unit – diluted (in

C$)3,4 |

C$ |

3.09 |

|

C$ |

4.24 |

|

|

1 |

Represents deferred income tax liabilities of €18,925 net of

deferred income tax assets of €7,900 as at December 31, 2024

(December 31, 2023 — deferred income tax liabilities of €28,217 net

of deferred income tax assets of €13,348). |

| 2 |

Represents non-current and current derivative financial assets of

€5,904 and €21, respectively, as at December 31, 2024 (December 31,

2023 — non-current derivative financial assets of €15,901). |

| 3 |

Includes Class B LP Units and the dilutive impact of unexercised

Unit Options and RURs. |

| 4 |

Based on the foreign exchange rate of 1.4929 on December 31,

2024 (foreign exchange rate of 1.4626 on December 31, 2023). |

Other Financial Highlights

|

|

Three Months Ended |

Year Ended |

| |

December 31, |

December 31, |

|

|

2024 |

2023 |

2024 |

2023 |

|

Weighted Average Number of Units – Diluted (000s)1 |

234,616 |

233,348 |

234,260 |

232,867 |

|

As at |

December 31, 2024 |

December 31, 2023 |

|

Closing Price of REIT Units3, 4 |

€ |

2.55 |

€ |

1.76 |

|

Closing Price of REIT Units (in C$)4 |

C$ |

3.80 |

C$ |

2.58 |

|

Market Capitalization (millions)2, 3, 4 |

€ |

597 |

€ |

412 |

|

Market Capitalization (millions in C$)2, 4 |

C$ |

891 |

C$ |

602 |

|

1 |

Includes Class B LP Units and the dilutive impact of unexercised

Unit Options and RURs. |

| 2 |

Includes Class B LP Units. |

| 3 |

Based on the foreign exchange

rate of 1.4929 on December 31, 2024 (foreign exchange rate of

1.4626 on December 31, 2023). |

| 4 |

The December 31, 2024

closing price of REIT Units and market capitalization did not

reflect the €1.00 per Unit special distribution paid on the same

date with the ex-distribution date of January 2, 2025. |

FINANCIAL POSITION

|

As at |

December 31, 2024 |

|

December 31, 2023 |

|

|

Ratio of Adjusted Debt to Gross Book Value1 |

39.7 |

% |

57.6 |

% |

|

Weighted Average Mortgage Effective Interest Rate4 |

2.27 |

% |

2.07 |

% |

|

Weighted Average Mortgage Term (years) |

2.5 |

|

2.9 |

|

|

Debt Service Coverage Ratio (times)1,2 |

2.6 |

x |

2.4 |

x |

|

Interest Coverage Ratio (times)1,2 |

3.2 |

x |

2.9 |

x |

|

Available Liquidity (000s)3 |

€ |

132,770 |

|

€ |

28,893 |

|

|

1 |

Please refer to the "Basis of Presentation and Non-IFRS Measures"

section of this press release for further information. |

| 2 |

Based on trailing four quarters. |

| 3 |

Includes cash and cash equivalents of €7.8 million and unused

credit facility capacity of €125.0 million as at December 31,

2024 (cash and cash equivalents of €6.9 million and unused credit

facility capacity of €22.0 million as at December 31, 2023). |

| 4 |

Includes impact of deferred financing costs, fair value adjustment

and interest rate swaps. |

For the year ended December 31, 2024, ERES's

liquidity substantially improved by €103.9 million, as compared to

the prior year end, as a result of the Revolving Credit Facility

balance paid down in entirety using disposition proceeds. The

REIT's immediately available liquidity of €132.8 million as at

December 31, 2024 excludes the €25.0 million accordion feature on

the Revolving Credit Facility, acquisition capacity on the Pipeline

Agreement and alternative promissory note arrangements with

CAPREIT. As at December 31, 2024, the REIT's mortgage profile had a

weighted average term to maturity of 2.5 years and fixed interest

payment terms for substantially all of its mortgages at a low

weighted average effective interest rate of 2.27%. This is further

reinforced by compliant debt coverage metrics, with debt and

interest service coverage ratios of 2.6x and 3.2x, respectively,

and adjusted debt to gross book value ratio well within its target

range at 39.7%.

Management aims to maintain an optimal degree of

debt to gross book value of the REIT’s assets, depending on a

number of factors at any given time. Capital adequacy is monitored

against investment and debt restrictions contained in the REIT’s

most recently amended and restated declaration of trust (the

"Declaration of Trust") and the amended and renewed credit

agreement dated June 19, 2024 between the REIT and three Canadian

chartered banks, providing access to up to €125.0 million with an

accordion feature to increase the limit a further €25.0 million

upon satisfaction of conditions set out in the agreement and the

consent of applicable lenders (the "Revolving Credit

Facility").

The REIT manages its overall liquidity risk by

maintaining sufficient available credit facility and available cash

on hand to fund its ongoing operational and capital commitments and

distributions to Unitholders.

DISTRIBUTIONS

During the year ended December 31, 2024, the

REIT declared monthly distributions of €0.01 per Unit (being

equivalent to €0.12 per Unit annualized). Such distributions are

paid to Unitholders of record on each record date, on or about the

15th day of the month following the record date. The REIT intends

to continue to make regular monthly distributions, subject to the

discretion of its Board of Trustees.

On December 16, 2024, the REIT declared a

special cash distribution of €1.00 per Unit, which was subject to

the TSX's "due bill" trading procedures, meaning that the special

distribution was payable to Unitholders of the REIT on the payment

date of December 31, 2024. The special distribution did not qualify

for the REIT's Distribution Reinvestment Plan (the "DRIP").

Effective January 2025, the REIT reduced its monthly distribution

by 50% to €0.005 per Unit to better align distributions with the

operations of the REIT's remaining portfolio.

The REIT has announced that the DRIP has been

terminated effective January 16, 2025. As a result, the DRIP will

not be available for the REIT's monthly distributions paid on and

after January 16, 2025.

CONFERENCE CALL

A conference call hosted by Mark Kenney, Chief

Executive Officer and Jenny Chou, Chief Financial Officer, will be

held on Thursday, February 13, 2025 at 9:00 am EST. The

telephone numbers for the conference call are: Canadian Toll Free:

+1 (833) 950-0062 / International Toll: +1 (929) 526-1599. The

conference call access code is 278125.

The call will also be webcast live and

accessible through the ERES website at www.eresreit.com — click on

"Investor Info" and follow the link at the top of the page. A

replay of the webcast will be available for one year after the

webcast at the same link.

The slide presentation to accompany management's

comments during the conference call will be available on the ERES

website an hour and a half prior to the conference call.

ABOUT EUROPEAN RESIDENTIAL REAL ESTATE

INVESTMENT TRUST

ERES is an unincorporated, open-ended real

estate investment trust. ERES's REIT Units are listed on the TSX

under the symbol ERE.UN. ERES is Canada’s only European-focused

multi-residential REIT, with a current portfolio of high-quality,

multi-residential real estate properties in the Netherlands. As at

December 31, 2024, ERES owned 3,009 residential suites, including

311 suites classified as assets held for sale, and ancillary retail

space located in the Netherlands, and owned one commercial property

in Germany and one commercial property in Belgium, with a total

fair value of approximately €838.7 million, including approximately

€64.7 million of assets held for sale.

ERES’s registered and principal business office

is located at 11 Church Street, Suite 401, Toronto, Ontario M5E

1W1.

For more information please visit our website at

www.eresreit.com.

BASIS OF PRESENTATION AND NON-IFRS

MEASURES

Unless otherwise stated, all amounts included in

this press release are in thousands of Euros ("€"), the functional

currency of the REIT. The REIT's audited consolidated annual

financial statements and the notes thereto for the year ended

December 31, 2024, are prepared in accordance with International

Financial Reporting Standards ("IFRS"). Financial information

included within this press release does not contain all disclosures

required by IFRS, and accordingly should be read in conjunction

with the REIT's audited consolidated annual financial statements

and MD&A for the year ended December 31, 2024, which are

available on the REIT's website at www.eresreit.com and on SEDAR+

at www.sedarplus.ca.

Consistent with the REIT's management framework,

management uses certain financial measures to assess the REIT's

financial performance, which are not in accordance with IFRS

("Non-IFRS Measures"). Since these Non-IFRS Measures are not

recognized under IFRS, they may not be comparable to similar

measures reported by other issuers. The REIT presents Non-IFRS

Measures because management believes Non-IFRS Measures are relevant

measures of the ability of the REIT to earn revenue, generate

sustainable economic earnings, and to evaluate its performance and

financial condition. The Non-IFRS Measures should not be construed

as alternatives to the REIT's financial position, net income or

cash flows from operating activities determined in accordance with

IFRS as indicators of the REIT’s performance or the sustainability

of distributions. For full definitions of these measures, please

refer to "Non-IFRS Measures" in Section I and Section IV of the

REIT's MD&A for the year ended December 31, 2024.

Where not otherwise disclosed, reconciliations

for certain Non-IFRS Measures included within this press release

are provided below.

Adjusted Debt and Adjusted Debt

Ratio

The REIT's Declaration of Trust requires

compliance with certain financial covenants, including the Ratio of

Adjusted Debt to Gross Book Value. Management uses Adjusted Total

Debt as defined by Declaration of Trust and the Ratio of Adjusted

Debt to Gross Book Value as indicators in assessing if the debt

level maintained is sufficient to provide adequate cash flows for

distributions.

A reconciliation from total debt is as

follows:

|

(€ Thousands) |

|

As at |

December 31, 2024 |

|

December 31, 2023 |

|

|

Mortgages payable1 |

€ |

344,181 |

|

€ |

889,749 |

|

|

Revolving Credit Facility2 |

(290 |

) |

102,741 |

|

|

Total Debt |

€ |

343,891 |

|

€ |

992,490 |

|

|

|

|

|

|

Fair value adjustment on mortgages payable |

(92 |

) |

(816 |

) |

|

Adjusted Total Debt as Defined by Declaration of

Trust |

€ |

343,799 |

|

€ |

991,674 |

|

|

Gross Book Value3 |

€ |

865,374 |

|

€ |

1,722,684 |

|

|

Ratio of Adjusted Debt to Gross Book Value |

39.7 |

% |

57.6 |

% |

| 1 |

Represents

non-current and current mortgages payable of €310,682 and €33,499,

respectively, as at December 31, 2024 (December 31, 2023 —

€809,215 and €80,534, respectively). |

| 2 |

Negative balance as at December 31, 2024 represents unamortized

deferred loan costs. |

| 3 |

Gross Book Value is defined by the REIT's Declaration of Trust

as the gross book value of the REIT's assets as per the REIT's

financial statements, determined on a fair value basis for

investment properties and assets held for sale. |

Adjusted Earnings Before Interest, Tax,

Depreciation, Amortization and Fair Value

Adjusted Earnings Before Interest, Tax,

Depreciation, Amortization and Fair Value ("EBITDAFV") is

calculated as prescribed in the REIT's Revolving Credit Facility

for the purpose of determining the REIT's Debt Service Coverage

Ratio and Interest Coverage Ratio, and is defined as net income

(loss) attributable to Unitholders, reversing, where applicable,

income taxes, interest expense, depreciation expense, amortization

expense, impairment, adjustments to fair value, transaction gain

(loss), costs associated with repayment of mortgages and other

adjustments as permitted in the REIT's Revolving Credit Facility.

Management believes Adjusted EBITDAFV is useful in assessing the

REIT's ability to service its debt, finance capital expenditures

and provide for distributions to its Unitholders.

A reconciliation of net (loss) income and

comprehensive (loss) income to Adjusted EBITDAFV is as follows:

|

(€ Thousands) |

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

Q4 24 |

|

Q3 24 |

|

Q2 24 |

|

Q1 24 |

|

Q4 23 |

|

Q3 23 |

|

Q2 23 |

|

Q1 23 |

|

|

Net (loss) income and comprehensive (loss) income |

€ |

(52,390 |

) |

€ |

(52,126 |

) |

€ |

17,407 |

|

€ |

22,821 |

|

€ |

(35,917 |

) |

€ |

24,784 |

|

€ |

3,252 |

|

€ |

(106,348 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Net movement in fair value of investment properties and assets held

for sale |

(13,873 |

) |

(39,352 |

) |

(11,107 |

) |

2,310 |

|

35,337 |

|

24,768 |

|

45,398 |

|

124,726 |

|

|

Net movement in fair value of Class B LP Units |

(86,511 |

) |

80,240 |

|

(5,506 |

) |

(19,265 |

) |

8,218 |

|

(39,339 |

) |

(31,964 |

) |

16,786 |

|

|

Fair value adjustments of Unit-based compensation liabilities |

362 |

|

203 |

|

(226 |

) |

1,178 |

|

(194 |

) |

(463 |

) |

(513 |

) |

(141 |

) |

|

Net loss (gain) on derivative financial instruments |

3,088 |

|

4,480 |

|

198 |

|

(638 |

) |

6,304 |

|

640 |

|

(728 |

) |

3,028 |

|

|

Foreign exchange loss (gain) |

— |

|

— |

|

228 |

|

214 |

|

224 |

|

213 |

|

210 |

|

(1,215 |

) |

|

Interest expense on Class B LP Units |

146,302 |

|

4,261 |

|

4,261 |

|

4,261 |

|

4,261 |

|

4,261 |

|

4,261 |

|

4,261 |

|

|

Interest on mortgages payable |

3,301 |

|

4,373 |

|

4,832 |

|

4,558 |

|

4,608 |

|

4,607 |

|

3,843 |

|

3,777 |

|

|

Interest on Revolving Credit Facility |

528 |

|

734 |

|

1,210 |

|

1,335 |

|

1,422 |

|

1,336 |

|

1,237 |

|

797 |

|

|

Interest on promissory notes |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

70 |

|

234 |

|

|

Amortization |

621 |

|

176 |

|

138 |

|

144 |

|

246 |

|

150 |

|

202 |

|

173 |

|

|

Transaction losses |

2,567 |

|

1,547 |

|

380 |

|

125 |

|

58 |

|

19 |

|

— |

|

— |

|

|

Costs associated with repayment of mortgages |

1,306 |

|

1,206 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

Income tax expense (recovery) |

8,796 |

|

10,481 |

|

5,253 |

|

1,308 |

|

(8,143 |

) |

(5,081 |

) |

(9,647 |

) |

(30,718 |

) |

|

Adjusted EBITDAFV |

€ |

14,097 |

|

€ |

16,223 |

|

€ |

17,068 |

|

€ |

18,351 |

|

€ |

16,424 |

|

€ |

15,895 |

|

€ |

15,621 |

|

€ |

15,360 |

|

|

Cash taxes |

(4,400 |

) |

(1,756 |

) |

(2,436 |

) |

(1,978 |

) |

(2,395 |

) |

(1,251 |

) |

(1,235 |

) |

(1,209 |

) |

|

Tax related to dispositions |

3,124 |

|

277 |

|

731 |

|

389 |

|

234 |

|

80 |

|

— |

|

— |

|

|

Adjusted EBITDAFV less cash taxes |

€ |

12,821 |

|

€ |

14,744 |

|

€ |

15,363 |

|

€ |

16,762 |

|

€ |

14,263 |

|

€ |

14,724 |

|

€ |

14,386 |

|

€ |

14,151 |

|

|

|

|

|

|

|

|

|

|

|

|

Principal amortization

repayments1 |

€ |

444 |

|

€ |

444 |

|

€ |

444 |

|

€ |

444 |

|

€ |

550 |

|

€ |

550 |

|

€ |

549 |

|

€ |

549 |

|

|

1 |

For use in the Debt Service Coverage Ratio calculation. |

Debt Service Coverage Ratio

The Debt Service Coverage Ratio is defined as

Adjusted EBITDAFV less cash taxes, divided by the sum of interest

expense (including on mortgages payable, Revolving Credit Facility

and promissory notes) and all regularly scheduled principal

amortization repayments made with respect to indebtedness during

the period (other than any balloon, bullet or similar principal

payable at maturity or which repays such indebtedness in full). The

Debt Service Coverage Ratio is calculated as prescribed in the

REIT's Revolving Credit Facility, and is based on the trailing four

quarters. Management believes the Debt Service Coverage Ratio is

useful in determining the ability of the REIT to service the

principal and interest requirements of its outstanding debt.

|

(€ Thousands) |

|

As at |

December 31, 2024 |

December 31, 2023 |

|

Adjusted EBITDAFV less cash taxes1 |

€ |

59,690 |

|

€ |

57,524 |

|

Debt service payments1,2 |

€ |

22,647 |

|

€ |

24,129 |

|

Debt Service Coverage Ratio (times) |

2.6x |

2.4x |

| 1 |

For the

trailing 12 months ended. |

| 2 |

Include principal amortization repayments as well as interest

on mortgages payable, Revolving Credit Facility and promissory

notes, and exclude interest expense on Class B LP Units. |

Interest Coverage Ratio

The Interest Coverage Ratio is defined as

Adjusted EBITDAFV divided by interest expense (including on

mortgages payable, Revolving Credit Facility and promissory notes).

The Interest Coverage Ratio is calculated as prescribed in the

REIT's Revolving Credit Facility, and is based on the trailing four

quarters. Management believes the Interest Coverage Ratio is useful

in determining the REIT's ability to service the interest

requirements of its outstanding debt.

|

(€ Thousands) |

|

As at |

December 31, 2024 |

December 31, 2023 |

|

Adjusted EBITDAFV1 |

€ |

65,739 |

€ |

63,300 |

|

Interest expense1,2 |

€ |

20,871 |

€ |

21,931 |

|

Interest Coverage Ratio (times) |

3.2x |

2.9x |

|

1 |

For the trailing 12 months ended. |

| 2 |

Includes interest on mortgages

payable, Revolving Credit Facility and promissory notes, and

excludes interest expense on Class B LP Units. |

FORWARD-LOOKING DISCLAIMER

Certain statements contained in this press

release constitute forward-looking statements within the meaning of

applicable Canadian securities laws which reflect the REIT’s

current expectations and projections about future results.

Forward-looking statements generally can be identified by the use

of forward-looking terminology such as “outlook”, “objective”,

“may”, “will”, “expect”, “intend”, “estimate”, “anticipate”,

“believe”, “consider”, “should”, "plan", “predict”, “forward”,

“potential”, “could”, "would", "should", "might", “likely”,

“approximately”, “scheduled”, “forecast”, “variation”, "project",

"budget" or “continue”, or similar expressions suggesting future

outcomes or events. Management's estimates, beliefs and assumptions

are inherently subject to significant business, economic,

competitive and other uncertainties and contingencies regarding

future events and, as such, are subject to change. Although the

forward-looking statements contained in this press release are

based on assumptions and information that are available to

management as of the date on which the statements are made in this

press release, including current market conditions and management's

assessment of disposition and other opportunities that are or may

become available to the REIT, which are subject to change,

management believes these statements have been prepared on a

reasonable basis, reflecting the REIT's best estimates and

judgement. However, there can be no assurance that forward-looking

statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in this press

release. Accordingly, readers should not place undue reliance on

forward-looking statements. For a detailed discussion of risks and

uncertainties affecting the REIT, refer to the Risks and

Uncertainties section in the MD&A contained in the REIT's 2024

Annual Report.

Except as specifically required by applicable

Canadian securities law, the REIT does not undertake any obligation

to update or revise publicly any forward-looking statements,

whether as a result of new information, future events or otherwise,

after the date on which the statements are made or to reflect the

occurrence of unanticipated events. These forward-looking

statements should not be relied upon as representing the REIT’s

views as of any date subsequent to the date of this press

release.

For further information:

| Mark

Kenney |

Jenny

Chou |

| Chief Executive Officer |

Chief Financial Officer |

| Email: m.kenney@capreit.net |

Email: j.chou@capreit.net |

Category: Earnings

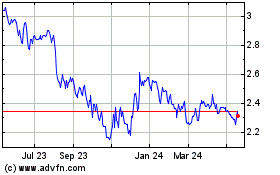

European Residetial Real... (TSX:ERE.UN)

Historical Stock Chart

From Jan 2025 to Feb 2025

European Residetial Real... (TSX:ERE.UN)

Historical Stock Chart

From Feb 2024 to Feb 2025