Extendicare Announces 2013 Fourth Quarter and Year-end Results

MARKHAM, ONTARIO--(Marketwired - Feb 26, 2014) - Extendicare

Inc. ("Extendicare" or the "Company") (TSX:EXE) today reported

results for the fourth quarter and year ended December 31, 2013.

Results are presented in Canadian dollars unless otherwise

noted.

HIGHLIGHTS (variances exclude effect of foreign exchange)

Q4 Financial Results

- Revenue of $519.3 million in Q4 2013 included a $6.7 million

increase in same-facility operations over Q4 2012.

- In the United States, our average daily Medicare Part A rate in

Q4 2013 decreased by 0.3% over Q4 2012, and by 0.5% over Q3 2013.

Average daily Managed Care rate in Q4 2013 increased by 1.3% over

Q4 2013 and declined by 0.8% over Q3 2013.

- In Canada, the average daily revenue rate for our senior care

centers increased by 5.6% to $201.82 from $191.15 in Q4 2012, and

home health care volumes improved by 8.1%.

- Adjusted EBITDA of $32.1 million in Q4 2013, declined by $21.8

million over Q4 2012, and by $11.2 million over Q3 2013.

- Adjusted EBITDA included an increase in the provision for

self-insured liabilities of $14.3 million over Q4 2012 and $6.3

million over Q3 2013.

- Adjusted EBITDA margin of 6.2% in Q4 2013, down from 10.7% in

Q4 2012 and from 8.5% in Q3 2013.

- AFFO was $10.4 million ($0.119 per basic share) in Q4 2013

compared to $26.8 million ($0.312 per basic share) in Q4 2012 and

$20.4 million ($0.235 per basic share) in Q3 2013.

2013 Financial Results

- Revenue of $2,024.4 million included a $19.6 million increase

in same-facility operations over 2012.

- In the United States, our average daily revenue rates for

Medicare Part A and Managed Care in 2013 increased by 1.9% and

2.5%, respectively, over 2012.

- In Canada, the average daily revenue rate for our senior care

centers increased by 3.8% to $194.33 from $187.24 in 2012, and home

health care volumes improved by 5.2%.

- Adjusted EBITDA of $155.7 million in 2013 declined by $30.0

million, due to an increase in provision for self-insured

liabilities and lower U.S. census levels.

- EBITDA margin of 7.7% in 2013 compared to 9.0% in 2012.

- AFFO was $71.1 million ($0.820 per basic share) in 2013

compared to $84.6 million ($0.994 per basic share) in 2012.

- Distributions in 2013 totalled $52.0 million, representing

approximately 73% of AFFO for the same period. Since May 2013, the

Company has been paying a monthly dividend of $0.04 per share, or

$0.48 per share per annum.

STRATEGIC REVIEW UPDATE

As previously disclosed in May 2013, the board of directors of

the Company (the "Board"), through its strategic committee (the

"Strategic Committee"), has been undertaking a review of strategic

alternatives relating to a separation of the Company's Canadian and

U.S. businesses that would be in the best interests of the Company

and would reasonably be expected to enhance shareholder value. With

the assistance of CitiGroup Global Markets Inc., as a financial

advisor, the Company has studied various alternatives extensively

and analyzed relevant considerations, including valuation,

taxation, curtailment of future liability costs, and strategic

implications of each option.

Extendicare confirms that the Strategic Committee continues its

work on this initiative and that the Company is currently

negotiating with one party towards a transaction that may involve

the lease and/or sale of some or all of our U.S. assets or

business. There is no certainty that a transaction will be

completed in the near term, if at all. Material details will be

disclosed to the public when available.

PROVISION FOR SELF-INSURED LIABILITIES

The results of our independent actuarial review completed at

year end necessitated the continued strengthening of our reserves

this quarter. For 2013, we recorded a provision for self-insured

liabilities of US$52.9 million (US$9.4 million, US$9.2 million,

US$14.0 million and US$20.3 million in each quarter, respectively).

Approximately US$22.2 million of the US$52.9 million provision

recorded in 2013 related to our former Kentucky operations, as we

continue to process the settlement of those claims. Of the balance

of the provision of US$30.7 million, approximately US$5.7 million

related to the strengthening of prior years' reserves in other

states, and US$25.0 million related to potential claims for the

current 2013 period.

MEDICARE UPDATES

At the end of 2013, Medicare's SGR (sustainable growth rate) was

extended through March 31, 2014, to prevent schedule cuts to

physician reimbursement and out-patient therapy rates, known in the

industry as the "Doc Fix". The U.S. Congress is currently weighing

alternatives beyond March, and is expected to implement either a

nine-month fix or a more permanent solution to this annual

discussion.

On February 11, 2014, the U.S. Congress passed legislation

raising the debt ceiling limit allowing the U.S. government to

continue to pay its bills, with no further increases needed, until

March of 2015.

2013 FOURTH QUARTER FINANCIAL REVIEW

|

TABLE 1 |

Q4 |

|

Q4 |

|

Q3 |

|

|

(millions of dollars unless otherwise noted) |

2013 |

|

2012 |

|

2013 |

|

|

Revenue |

|

|

|

|

|

|

|

U.S. operations (US$) |

307.2 |

|

313.6 |

|

309.0 |

|

| U.S.

operations (C$) |

322.3 |

|

310.8 |

|

321.0 |

|

|

Canadian operations |

197.0 |

|

186.2 |

|

187.6 |

|

|

Total Revenue |

519.3 |

|

497.0 |

|

508.6 |

|

|

Adjusted EBITDA (1) |

|

|

|

|

|

|

|

U.S. operations (US$) |

12.0 |

|

33.9 |

|

22.6 |

|

| U.S.

operations (C$) |

12.7 |

|

33.7 |

|

23.6 |

|

|

Canadian operations |

19.4 |

|

19.2 |

|

19.4 |

|

|

Total Adjusted EBITDA |

32.1 |

|

52.9 |

|

43.0 |

|

|

Adjusted EBITDA margin |

6.2 |

% |

10.7 |

% |

8.5 |

% |

|

Average U.S./Canadian dollar exchange rate |

1.0489 |

|

0.9916 |

|

1.0385 |

|

| (1) Refer to discussion of non-GAAP measures. |

2013 Fourth Quarter Comparison to 2012 Fourth Quarter

Consolidated revenue from continuing operations improved by $4.6

million this quarter, excluding a $17.7 million positive effect of

a weaker Canadian dollar. The impact of: leasing out our Kentucky

centers in the latter half of 2012; opening two new nursing centers

in northern Ontario; discontinuing home health care operations in

Alberta; classifying 11 U.S. skilled nursing centers in various

states as held for sale; and closing a rehabilitation hospital in

Michigan (collectively referred to as "non same-facility

operations"), resulted in lower revenue of $2.1 million between

periods. Revenue from our remaining operations (referred to as

"same-facility operations") improved by $6.7 million, due to an

improvement from our Canadian operations, partially offset by lower

revenue from our U.S. operations.

Revenue from U.S. operations declined by US$6.4 million to

US$307.2 million in the 2013 fourth quarter compared to US$313.6

million in the 2012 fourth quarter. Non same-facility operations

generated revenue of US$18.1 million this quarter compared to

US$19.8 million in the 2012 fourth quarter, for a net decline of

US$1.7 million. Revenue from same-facility operations declined by

US$4.7 million between periods, primarily due to the impact of

lower census levels of US$7.4 million and a decrease in prior

period revenue of US$3.0 million (a charge of US$0.7 million this

quarter compared to a receipt of US$2.3 million in the 2012 fourth

quarter), partially offset by a net increase in average rates of

US$5.6 million and higher other revenue of US$0.1 million.

Revenue from Canadian operations grew by $10.8 million to $197.0

million in the 2013 fourth quarter from $186.2 million in the 2012

fourth quarter. For purposes of discussing the variances in our

results, the operations of all six of our Sault Ste. Marie and

Timmins area nursing centers, consisting of two new nursing centers

that opened in 2013, three that were closed and one that was

downsized, are classified as "non same-facility". In addition, we

no longer provide home health care services in Alberta, and

therefore, these operations have also been classified as "non

same-facility". The non same-facility operations generated revenue

of $9.4 million this quarter compared to $10.1 million in the 2012

fourth quarter, for a net decrease of $0.7 million. Revenue from

same-facility operations improved by $11.5 million between periods,

primarily due to funding enhancements, the timing of recognition of

revenue under the Ontario envelope system, a favourable prior

period revenue settlement adjustment of $1.2 million, and higher

volumes from our Ontario home health care operations of 8.1%.

Consolidated Adjusted EBITDA from continuing operations was

$32.1 million this quarter compared to $52.9 million in the 2012

fourth quarter, representing 6.2% and 10.7% of revenue,

respectively. Excluding a $1.0 million positive effect of a weaker

Canadian dollar, Adjusted EBITDA declined by $21.8 million, of

which $21.7 million was from same-facility operations. The U.S.

operations contributed $22.2 million, or US$22.2 million, to this

decline and was partially offset by a $0.5 million improvement from

the Canadian operations.

Adjusted EBITDA from U.S. operations declined by US$21.9 million

to US$12.0 million this quarter from US$33.9 million in the 2012

fourth quarter, representing 3.9% and 10.8% of revenue,

respectively. Adjusted EBITDA from non same-facility operations

increased by US$0.2 million (US$2.7 million contribution this

quarter compared to US$2.5 million in the same 2012 period).

Adjusted EBITDA from same-facility operations decreased by US$22.1

million as a result of higher costs of US$17.4 million and lower

revenue of US$4.7 million. Operating, administrative and lease

costs from same-facility operations increased by US$17.4 million,

primarily due to a US$14.3 million increase in the provision for

self-insured liabilities, a US$4.8 million increase in labour costs

primarily due to a change in vacation policy that favourably

impacted the 2012 fourth quarter, and other cost increases of

US$0.3 million, partially offset by a refund of prior period

charges of US$2.0 million recorded in the 2013 fourth quarter.

Adjusted EBITDA from Canadian operations was $19.4 million this

quarter compared to $19.2 million in the 2012 fourth quarter,

representing 9.9% and 10.3% of revenue, respectively. Adjusted

EBITDA from non same-facility operations declined by $0.3 million

($0.8 million contribution this quarter compared to $1.1 million in

the same 2012 period). Adjusted EBITDA from same-facility

operations improved by $0.5 million as a result of revenue

improvements of $11.5 million, partially offset by cost increases

of $11.0 million.

2013 Fourth Quarter Comparison to 2013 Third Quarter

In comparison to the 2013 third quarter, consolidated revenue

from continuing operations this quarter improved by $7.5 million,

excluding a $3.2 million positive effect of a weaker Canadian

dollar. Revenue from the Canadian operations increased by $9.4

million due to timing of recognition under the Ontario nursing

center envelope system and increased home health care volumes.

Revenue from the U.S. operations declined primarily due to lower

prior period settlement adjustments.

Consolidated Adjusted EBITDA from continuing operations was

$32.1 million this quarter compared to $43.0 million in the 2013

third quarter, representing 6.2% and 8.5% of revenue, respectively.

Excluding a $0.3 million positive effect of a weaker Canadian

dollar, Adjusted EBITDA declined by $11.2 million between

periods.

Adjusted EBITDA from U.S. operations declined by US$10.6 million

to US$12.0 million this quarter from US$22.6 million in the 2013

third quarter, and represented 3.9% and 7.3% of revenue,

respectively. Same-facility operations contributed US$9.9 million

to the decline resulting from cost increases of US$9.4 million and

lower revenue of US$0.5 million between quarters. Revenue was

impacted by a decrease in prior period settlement adjustments of

US$3.1 million, partially offset by improvements in overall census

and average rates. Operating, administrative and lease costs

increased by US$9.4 million between quarters, which included a

higher provision for self-insured liabilities of US$6.3 million and

increased labour-related costs of US$3.8 million.

Adjusted EBITDA from Canadian operations was unchanged at $19.4

million this quarter compared to the 2013 third quarter,

representing 9.9% and 10.3% of revenue, respectively. Revenue

improvements of $9.4 million were offset by cost increases,

primarily due to the timing of spending under the Ontario nursing

center envelope system, a seasonal increase in utility costs, and

higher administrative costs between quarters.

2013 FINANCIAL REVIEW

|

TABLE 2 |

Year ended December 31 |

|

|

(millions of dollars unless otherwise noted) |

2013 |

|

2012 |

|

|

Revenue |

|

|

|

|

|

U.S. operations (US$) |

1,234.6 |

|

1,309.0 |

|

| U.S.

operations (C$) |

1,271.5 |

|

1,308.5 |

|

|

Canadian operations |

752.9 |

|

728.9 |

|

|

Total Revenue |

2,024.4 |

|

2,037.4 |

|

|

Adjusted EBITDA (1) |

|

|

|

|

|

U.S. operations (US$) |

81.4 |

|

111.1 |

|

| U.S.

operations (C$) |

83.8 |

|

111.0 |

|

|

Canadian operations |

71.9 |

|

72.2 |

|

|

Total Adjusted EBITDA |

155.7 |

|

183.2 |

|

|

Adjusted EBITDA margin |

7.7 |

% |

9.0 |

% |

|

Average U.S./Canadian dollar exchange rate |

1.0299 |

|

0.9996 |

|

| (1) Refer to discussion of non-GAAP measures. |

|

Consolidated revenue from continuing operations for the year

ended December 31, 2013, declined by $50.4 million, excluding a

$37.4 million positive effect of the weaker Canadian dollar. Non

same-facility operations contributed $70.0 million to the decline

in revenue between periods, largely due to the ceasing of

operations in Kentucky. Revenue from same-facility operations grew

by $19.6 million, with an improvement from the Canadian operations

of $25.1 million partially offset by lower revenue from the U.S.

operations primarily due to lower census levels.

Consolidated Adjusted EBITDA from continuing operations declined

by $30.0 million, excluding a $2.5 million positive effect of the

weaker Canadian dollar, and was 7.7% and 9.0% of revenue,

respectively. Non same-facility operations contributed $5.3 million

to the decline between periods. Adjusted EBITDA from same-facility

operations decreased by $24.7 million, as a result of a $26.1

million decline from the U.S. operations, partially offset by a

$1.4 million improvement from the Canadian operations, as discussed

below.

Adjusted EBITDA from U.S. operations declined by US$29.7 million

to US$81.4 million in 2013 from US$111.1 million in 2012,

representing 6.6% and 8.5% of revenue, respectively. Adjusted

EBITDA from non same-facility operations declined by US$3.7 million

between years (US$13.1 million in 2013 compared to US$16.8 million

in 2012). Adjusted EBITDA from same-facility operations declined by

US$26.0 million as a result of lower revenue of US$5.4 million and

higher costs of US$20.6 million. The decline in revenue was due to

lower census of US$29.5 million, a decrease in prior period revenue

settlement adjustments of US$3.0 million, one less day this year of

US$2.8 million, and other items of US$6.0 million, partially offset

by higher average funding rates of US$35.9 million. Costs from

same-facility operations increased by US$20.6 million, primarily

due to an increase in the provision for self-insured liabilities of

US$18.4 million, a premium refund of US$3.5 million received in the

2012 first quarter, and other net cost increases of US$1.8 million,

partially offset by a refund of prior period charges of US$2.0

million, and lower labour-related costs of US$1.1 million, which

included favourable workers' compensation adjustments of US$2.7

million.

Adjusted EBITDA from Canadian operations was $71.9 million in

2013 compared to $72.2 million in 2012, representing 9.6% and 9.9%

of revenue, respectively. Non same-facility operations contributed

Adjusted EBITDA of $2.7 million this period compared to $4.4

million in 2012, for a net decline of $1.7 million between years,

of which $0.9 million was from the discontinuance of home health

care in Alberta and the balance related to the new centers in

northern Ontario. Improvements from same-facility operations of

$1.4 million resulted from higher revenue of $25.1 million,

partially offset by higher costs of $23.7 million. Revenue

improvements resulted from enhanced funding and a 5.2% increase in

Ontario home health care volumes, while cost increases included

higher labour-related costs of $18.6 million.

ADJUSTED FUNDS FROM OPERATIONS (AFFO)

AFFO was $10.4 million ($0.119 per basic share) in the 2013

fourth quarter compared to $26.8 million ($0.312 per basic share)

in the 2012 fourth quarter, representing a decrease of $16.8

million, excluding a $0.4 million positive effect of a weaker

Canadian dollar. This decline was primarily due to a decrease in

Adjusted EBITDA of $21.8 million, partially offset by the timing of

facility maintenance capital expenditures, which were lower by $3.0

million, reduced net interest costs and lower current income taxes.

Net interest costs were lower by $1.0 million as a result of our

debt refinancing. Current income taxes for the 2013 fourth quarter

were a recovery of $3.3 million compared to a recovery of $2.4

million in the 2012 fourth quarter. The 2013 and 2012 fourth

quarters were favourably impacted by book-to-file tax adjustments

of approximately $3.6 million and $4.0 million, respectively,

primarily related to our U.S. operations. Excluding these

book-to-file adjustments, current income taxes represented 2.3% and

5.2% of pre-tax funds from operations (FFO), respectively.

In comparison to AFFO in the 2013 third quarter of $20.4 million

($0.235 per basic share), AFFO this quarter decreased by $10.2

million, excluding a $0.2 million positive effect of a weaker

Canadian dollar. This decline was primarily due to a decrease in

Adjusted EBITDA of $11.2 million and increased facility maintenance

capital spending of $6.7 million, partially offset by lower current

income taxes due to the favourable book-to-file adjustments in the

2013 fourth quarter.

For the year ended December 31, 2013, AFFO was $71.1 million

($0.820 per basic share), compared to $84.6 million ($0.994 per

basic share) in 2012, representing a decrease of $14.5 million,

excluding a $1.0 million positive effect of a weaker Canadian

dollar. This decline was primarily due to a $30.0 million decrease

in Adjusted EBITDA, partially offset by the timing of facility

maintenance capital expenditures, which were lower by $8.1 million,

lower net interest costs of $4.5 million due to our debt

refinancing, and lower current income taxes. Current income taxes

were $4.7 million in 2013 compared to $7.0 million in 2012,

representing 6.6% and 7.3% of pre-tax FFO, respectively. Both years

were favourably impacted by book-to-file tax adjustments of

approximately $4.0 million in 2013 and $5.2 million in 2012. In

addition, the 2012 first quarter results included a non-taxable

premium refund of $3.5 million. Excluding these items, current

income taxes represented 12.3% of pre-tax FFO in 2013 compared to

10.8% in 2012.

The effective tax rates on our FFO can be impacted by:

adjustments to our estimates of annual deferred timing differences,

particularly when dealing with cash-based tax items versus

accounting accruals; changes in the proportion of earnings between

taxable and non-taxable entities; book-to-file adjustments for

prior year filings; and the ability to utilize loss carryforwards.

The restructuring of our Canadian legal entities, along with the

elimination of the income trust structure in July 2012, enhanced

our ability to utilize available non-capital loss carryforwards,

which reduced our Canadian current income taxes in the last half of

2012 and during 2013. Our Canadian non-capital loss carryforwards

were substantially utilized by the end of 2013. As a result, we

anticipate that our annual effective tax rate on FFO will increase

in 2014 to between 23% and 26%.

Facility maintenance capital expenditures were $12.2 million in

the 2013 fourth quarter, compared to $14.9 million in the 2012

fourth quarter and $5.5 million in the 2013 third quarter,

representing 2.4%, 3.0% and 1.1% of revenue, respectively. Facility

maintenance capital expenditures totalled $28.2 million in 2013

compared to $35.7 million in 2012, representing 1.4% and 1.8% of

revenue, respectively. These costs fluctuate on a quarterly basis

with the timing of projects and seasonality. It is our intention to

spend between 1.5% and 2.0% of revenue annually, which is

consistent with our objective to maintain and upgrade our centers.

In 2014, we are expecting to spend in the range of $38 million to

$43 million in facility maintenance capital expenditures and $15

million to $20 million in growth capital expenditures.

Distributions declared in 2013 totalled $52.0 million, or $0.60

per share, representing approximately 73% of AFFO of $71.1 million,

or $0.820 per basic share, compared to approximately 85% in 2012.

Since May 2013, the Company has been paying a monthly dividend of

$0.04 per share, or $0.48 per share per annum.

U.S. OPERATIONS KEY METRICS

Skilled Nursing Facility Revenue Rates

The CMS Medicare net market basket increases for October 1, 2012

and 2013, were 1.8% and 1.3%, respectively. However, our Medicare

Part A and Managed Care rates were adversely impacted by the

sequestration funding reduction of 2.0% effective April 1, 2013,

and our Medicare Part A funding has been impacted by a reduction in

co-insurance reimbursement for bad debts, which declined from 100%

to 88% on January 1, 2013, and to 76% on January 1, 2014. For the

2013 fourth quarter, our average daily Medicare Part A rate,

excluding prior period settlement adjustments, was US$468.78,

representing a decrease of 0.3% from US$470.21 in the 2012 fourth

quarter, primarily due to the impact of sequestration partially

offset by the market basket increase. In comparison to our average

daily Medicare Part A rate of US$471.20 in the 2013 third quarter,

our rate this quarter declined by 0.5%, primarily due to the

reduction in reimbursement for bad debts and a change in acuity

mix, partially offset by the net market basket increase. For 2013

compared to 2012, our average daily Medicare Part A rate increased

by 1.9% to US$470.21, primarily due to changes in acuity mix, with

the impact of the market basket increases being substantially

offset by sequestration and reductions in reimbursement for bad

debts.

For the 2013 fourth quarter, our average daily Managed Care

rate, excluding prior period settlement adjustments, was US$445.03,

representing an increase of 1.3% from US$439.41 in the 2012 fourth

quarter and a 0.8% decline from US$448.82 in the 2013 third

quarter, primarily due to changes in acuity mix. For 2013, our

average daily Managed Care rate increased by 2.5% to US$443.27.

Our average daily Medicaid rate, excluding prior period

settlement adjustments, increased this quarter by 3.5% to US$200.80

from US$194.03 in the 2012 fourth quarter, and by 0.5% from

US$199.76 in the 2013 third quarter. For 2013 compared to 2012, our

average daily Medicaid rate increased by 5.4% to US$199.07.

However, revenue from Medicaid rate increases was partially offset

by higher state provider taxes, resulting in a net increase of 5.0%

this year over 2012. In addition, during the 2012 fourth quarter,

we became eligible to receive Upper Payment Limit funding for all

of our centers in Indiana. Exclusive of this additional funding,

the net increase in Medicaid rates this year over 2012 was

3.2%.

Total and Skilled Census

Our same-facility ADC of 11,192 in the 2013 fourth quarter was

324 below the 2012 fourth quarter level of 11,516 due to lower

Medicaid ADC of 255, lower Skilled Mix ADC of 52, and lower

private/other ADC of 17. In comparison to the 2013 third quarter,

our same-facility ADC improved by 28 due to higher Skilled Mix ADC

of 23 and higher private/other ADC of 22, partially offset by lower

Medicaid ADC of 17. For 2013, our same-facility skilled nursing

center ADC declined by 2.7%, or 317 ADC to 11,288 from 11,605 in

2012 due to lower Skilled Mix ADC of 72 and lower Medicaid ADC of

248, partially offset by higher private/other ADC of three. Our

average same-facility occupancy was 83.4% this quarter compared to

85.1% in the 2012 fourth quarter, and 82.8% in the 2013 third

quarter. For 2013, our average occupancy from same-facility skilled

nursing center operations was 83.8% compared to 85.5% in 2012.

Our same-facility Skilled Mix ADC of 21.7% of our residents in

the 2013 fourth quarter improved over 21.6% in each of the 2012

fourth and 2013 third quarters.

CONFERENCE CALL AND WEBCAST

On February 27, 2014, at 10:00 a.m. (ET), we will hold a

conference call to discuss our 2013 fourth quarter and year-end

results. The call will be webcast live and archived in the

investors/presentations & webcasts section of our website at

www.extendicare.com. Alternatively, the call-in number is

1-866-696-5910 or 416-340-2217, conference ID number 7894126#. A

replay of the call will be available until midnight on March 14,

2014. To access the rebroadcast, dial 1-800-408-3053 or

905-694-9451, followed by the passcode 1390940#. Slides

accompanying remarks during the call will be posted to our website

as part of the live webcast. Also, a supplemental information

package containing historical quarterly financial results and

operating statistics can be found on the website under the

investors/financial reports section.

ABOUT US

Extendicare is a leading North American provider of post-acute

and long-term senior care services. Through our network of owned

and operated health care centers, our qualified and experienced

workforce of 35,300 individuals is dedicated to helping people live

better through a commitment to quality service that includes

skilled nursing care, rehabilitative therapies and home health care

services. Our 249 senior care centers in North America have

capacity to care for approximately 27,700 residents.

Non-GAAP Measures

Extendicare assesses

and measures operating results and financial position based on

performance measures referred to as "Adjusted EBITDA", "earnings

(loss) from continuing operations before separately reported

items", "Funds from Operations", and "Adjusted Funds from

Operations". These are not measures recognized under GAAP and do

not have standardized meanings prescribed by GAAP. These non-GAAP

measures are presented in this document because either: (i)

management believes that they are a relevant measure of the ability

of Extendicare to make cash distributions; or (ii) certain ongoing

rights and obligations of Extendicare may be calculated using these

measures. Such non-GAAP measures may differ from similar

computations as reported by other issuers and, accordingly, may not

be comparable to similarly titled measures as reported by such

issuers. They are not intended to replace earnings (loss) from

continuing operations, net earnings (loss), cash flow, or other

measures of financial performance and liquidity reported in

accordance with GAAP. Reconciliations of these non-GAAP measures

from net earnings and/or from net cash from operations, where

applicable, are provided in this press release on the face of the

Consolidated Statements of Earnings and on the Supplemental

Information page. Detailed descriptions of these terms can be found

in the disclosure documents filed by Extendicare with the

securities regulatory authorities, available at www.sedar.com and

on Extendicare's website at www.extendicare.com.

Forward-looking Statements

Information provided by Extendicare from time to time,

including this release, contains or may contain forward-looking

statements concerning anticipated financial events, results,

circumstances, economic performance or expectations with respect to

Extendicare and its subsidiaries, including, without limitation,

statements regarding its business operations, business strategy,

and financial condition. Forward-looking statements can be

identified because they generally contain the words "expect",

"intend", "anticipate", "believe", "estimate", "project", "plan" or

"objective" or other similar expressions or the negative thereof.

Forward-looking statements reflect management's beliefs and

assumptions and are based on information currently available, and

Extendicare assumes no obligation to update or revise any

forward-looking statement, except as required by applicable

securities laws. These statements are not guarantees of future

performance and involve known and unknown risks, uncertainties and

other factors that may cause actual results, performance or

achievements of Extendicare to differ materially from those

expressed or implied in the statements. Given these risks and

uncertainties, readers are cautioned not to place undue reliance on

Extendicare's forward-looking statements. Further information can

be found in the disclosure documents filed by Extendicare with the

securities regulatory authorities, available at www.sedar.com and

on Extendicare's website at www.extendicare.com.

Visit Extendicare's Website at www.extendicare.com

| Extendicare Inc. |

|

| Consolidated Statements of Earnings |

|

|

|

|

|

|

|

|

|

|

| (in thousands of Canadian dollars) |

Three months ended December 31 |

|

Twelve months ended December 31 |

|

|

2013 |

|

2012 |

|

2013 |

|

2012 |

|

| Revenue |

|

|

|

|

|

|

|

|

| Nursing and assisted living centers |

|

|

|

|

|

|

|

|

|

United States |

307,922 |

|

296,208 |

|

1,216,569 |

|

1,259,858 |

|

|

Canada |

149,677 |

|

140,681 |

|

568,870 |

|

550,302 |

|

| Home health − Canada |

44,717 |

|

43,692 |

|

174,087 |

|

170,343 |

|

| Health technology services − United States |

5,494 |

|

7,041 |

|

22,348 |

|

25,453 |

|

| Outpatient therapy − United States |

3,290 |

|

2,775 |

|

13,360 |

|

13,229 |

|

| Rent, management, consulting and other services |

8,274 |

|

6,637 |

|

29,231 |

|

18,228 |

|

| Total revenue |

519,374 |

|

497,034 |

|

2,024,465 |

|

2,037,413 |

|

| Operating expenses |

468,855 |

|

426,921 |

|

1,793,368 |

|

1,780,019 |

|

| Administrative costs |

15,443 |

|

14,465 |

|

64,258 |

|

63,155 |

|

| Lease costs |

2,923 |

|

2,710 |

|

11,096 |

|

10,986 |

|

| Total expenses |

487,221 |

|

444,096 |

|

1,868,722 |

|

1,854,160 |

|

| Adjusted EBITDA(1) |

32,153 |

|

52,938 |

|

155,743 |

|

183,253 |

|

| Depreciation and amortization |

19,949 |

|

18,990 |

|

77,929 |

|

76,805 |

|

| Loss (gain) from asset impairment, disposals and other

items |

8,335 |

|

(367 |

) |

9,641 |

|

7,930 |

|

| Earnings before net finance costs and income taxes |

3,869 |

|

34,315 |

|

68,173 |

|

98,518 |

|

| Finance costs |

|

|

|

|

|

|

|

|

|

Interest expense |

15,954 |

|

16,538 |

|

63,416 |

|

65,306 |

|

|

Interest income |

(1,369 |

) |

(1,221 |

) |

(4,638 |

) |

(3,565 |

) |

|

Accretion costs |

863 |

|

695 |

|

3,380 |

|

2,302 |

|

|

Fair value adjustments |

(103 |

) |

2,313 |

|

(3,099 |

) |

(4,823 |

) |

|

Loss on foreign exchange and financial instruments |

1 |

|

- |

|

519 |

|

1,103 |

|

| Net finance costs |

15,346 |

|

18,325 |

|

59,578 |

|

60,323 |

|

| Earnings (loss) before income taxes |

(11,477 |

) |

15,990 |

|

8,595 |

|

38,195 |

|

| Income tax expense (recovery) |

|

|

|

|

|

|

|

|

| Current |

(3,330 |

) |

(2,400 |

) |

4,547 |

|

5,178 |

|

| Deferred |

(349 |

) |

3,836 |

|

(1,204 |

) |

5,394 |

|

|

(3,679 |

) |

1,436 |

|

3,343 |

|

10,572 |

|

| Earnings (loss) from continuing operations |

(7,798 |

) |

14,554 |

|

5,252 |

|

27,623 |

|

| Discontinued operations |

- |

|

72 |

|

- |

|

35,033 |

|

| Net earnings (loss) |

(7,798 |

) |

14,626 |

|

5,252 |

|

62,656 |

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) from continuing operations |

(7,798 |

) |

14,554 |

|

5,252 |

|

27,623 |

|

| Add (deduct): |

|

|

|

|

|

|

|

|

| Fair value adjustment on convertible debentures, net of

tax |

(103 |

) |

2,313 |

|

(3,099 |

) |

(4,823 |

) |

| Loss on foreign exchange and financial instruments, net

of tax |

1 |

|

- |

|

519 |

|

1,103 |

|

| Loss (gain) from asset impairment, disposals and other

items, net of tax |

6,007 |

|

(367 |

) |

7,662 |

|

5,629 |

|

| Earnings (loss) from continuing operations before

separately reported items |

(1,893 |

) |

16,500 |

|

10,334 |

|

29,532 |

|

| (1)Refer to discussion of non-GAAP

measures. |

|

|

|

|

|

| Extendicare Inc. |

| Consolidated Statements of Financial Position |

|

|

|

| (in thousands of Canadian dollars, unless otherwise

noted) |

December 31 2013 |

December 31 2012 |

| Assets |

|

|

| Current assets |

|

|

|

Cash

and short-term investments |

95,999 |

71,398 |

|

Restricted cash |

18,668 |

28,680 |

|

Accounts receivable, less allowance |

210,795 |

209,518 |

|

Income taxes recoverable |

9,395 |

4,149 |

|

Other current assets |

61,893 |

31,408 |

| Total current assets |

396,750 |

345,153 |

| Non-current assets |

|

|

|

Property and equipment, including construction-in-progress

of $6,514 and $62,688, respectively |

1,152,007 |

1,181,596 |

|

Goodwill and other intangible assets |

79,229 |

82,793 |

|

Other

assets |

213,571 |

176,457 |

|

Deferred tax assets |

7,531 |

21,917 |

|

Total non-current assets |

1,452,338 |

1,462,763 |

| Total Assets |

1,849,088 |

1,807,916 |

| Liabilities and Equity |

|

|

| Current liabilities |

|

|

|

Accounts payable |

31,030 |

35,508 |

|

Accrued liabilities |

214,715 |

202,913 |

|

Accrual for self-insured liabilities |

28,052 |

21,888 |

|

Current portion of long-term debt |

148,051 |

93,448 |

|

Income taxes payable |

10,430 |

9,377 |

|

Total current liabilities |

432,278 |

363,134 |

| Non-current liabilities |

|

|

|

Provisions |

28,801 |

26,851 |

|

Accrual for self-insured liabilities |

87,257 |

74,042 |

|

Long-term debt |

1,016,785 |

1,038,787 |

|

Other

long-term liabilities |

46,147 |

48,025 |

|

Deferred tax liabilities |

199,954 |

202,417 |

|

Total non-current liabilities |

1,378,944 |

1,390,122 |

| Total liabilities |

1,811,222 |

1,753,256 |

| Shareholders' equity |

37,866 |

54,660 |

| Total Liabilities and Equity |

1,849,088 |

1,807,916 |

|

|

|

| Closing U.S./Cdn. dollar exchange rate |

1.0636 |

0.9949 |

|

|

| Extendicare Inc. |

|

| Consolidated Statements of Cash Flows |

|

|

|

|

|

|

|

|

|

|

| (in thousands of Canadian dollars) |

Three months ended December 31 |

|

Twelve months ended December 31 |

|

|

2013 |

|

2012 |

|

2013 |

|

2012 |

|

| Operating Activities |

|

|

|

|

|

|

|

|

| Net earnings (loss) |

(7,798 |

) |

14,626 |

|

5,252 |

|

62,656 |

|

| Adjustments for: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

19,949 |

|

18,991 |

|

77,929 |

|

76,805 |

|

|

Provision for self-insured liabilities |

21,130 |

|

5,960 |

|

54,482 |

|

40,807 |

|

|

Payments for self-insured liabilities |

(5,607 |

) |

(6,770 |

) |

(42,720 |

) |

(23,933 |

) |

|

Deferred taxes |

(349 |

) |

3,660 |

|

(1,204 |

) |

5,263 |

|

|

Current taxes |

(3,330 |

) |

(2,296 |

) |

4,547 |

|

26,729 |

|

|

Loss (gain) from asset impairment, disposals and other items |

8,335 |

|

(367 |

) |

9,641 |

|

7,930 |

|

|

Gain from asset disposals from discontinued operations |

- |

|

- |

|

- |

|

(56,453 |

) |

|

Net finance costs |

15,346 |

|

18,325 |

|

59,578 |

|

60,323 |

|

|

Interest capitalized |

(59 |

) |

(526 |

) |

(1,232 |

) |

(873 |

) |

|

Other |

(2 |

) |

(610 |

) |

(335 |

) |

(406 |

) |

|

47,615 |

|

50,993 |

|

165,938 |

|

198,848 |

|

| Net change in operating assets and liabilities |

|

|

|

|

|

|

|

|

|

Accounts receivable |

(21,932 |

) |

3,665 |

|

6,246 |

|

21,111 |

|

|

Other current assets |

2,905 |

|

379 |

|

4,541 |

|

759 |

|

|

Accounts payable and accrued liabilities |

8,465 |

|

3,451 |

|

(15,882 |

) |

(31,701 |

) |

|

37,053 |

|

58,488 |

|

160,843 |

|

189,017 |

|

| Interest paid |

(14,831 |

) |

(16,999 |

) |

(59,585 |

) |

(60,276 |

) |

| Interest received |

1,387 |

|

1,209 |

|

4,657 |

|

3,509 |

|

| Income taxes paid |

815 |

|

(1,374 |

) |

(7,999 |

) |

(23,463 |

) |

| Net cash from operating activities |

24,424 |

|

41,324 |

|

97,916 |

|

108,787 |

|

| Investing Activities |

|

|

|

|

|

|

|

|

| Purchase of property, equipment and software |

(12,793 |

) |

(33,723 |

) |

(55,753 |

) |

(84,103 |

) |

| Net proceeds from dispositions |

2,507 |

|

- |

|

3,671 |

|

56,323 |

|

| Other assets |

1,787 |

|

446 |

|

1,646 |

|

(5,363 |

) |

| Net cash from investing activities |

(8,499 |

) |

(33,277 |

) |

(50,436 |

) |

(33,143 |

) |

| Financing Activities |

|

|

|

|

|

|

|

|

| Issue of long-term debt, excluding line of credit |

8,229 |

|

36,812 |

|

95,703 |

|

329,720 |

|

| Repayment of long-term debt, excluding line of

credit |

(11,697 |

) |

(114,749 |

) |

(84,101 |

) |

(254,468 |

) |

| Issue on line of credit |

- |

|

4,839 |

|

- |

|

63,964 |

|

| Repayment on line of credit |

(1,061 |

) |

(3,014 |

) |

(6,179 |

) |

(108,846 |

) |

| Decrease (increase) in restricted cash |

(7,064 |

) |

(4,584 |

) |

9,799 |

|

(11,832 |

) |

| Decrease (increase) in investments held for

self-insured liabilities |

(4,599 |

) |

(12,279 |

) |

6,908 |

|

(31,603 |

) |

| Dividends/distributions paid |

(8,881 |

) |

(14,425 |

) |

(45,534 |

) |

(56,980 |

) |

| Financing costs |

(116 |

) |

(1,204 |

) |

(2,065 |

) |

(13,101 |

) |

| Other |

(35 |

) |

2 |

|

5 |

|

(4 |

) |

| Net cash from financing activities |

(25,224 |

) |

(108,602 |

) |

(25,464 |

) |

(83,150 |

) |

|

|

|

|

|

|

|

|

|

| Increase (decrease) in cash and cash equivalents |

(9,299 |

) |

(100,555 |

) |

22,016 |

|

(7,506 |

) |

| Cash and cash equivalents at beginning of period |

104,132 |

|

171,439 |

|

71,398 |

|

80,018 |

|

| Foreign exchange gain (loss) on cash held in foreign

currency |

1,166 |

|

514 |

|

2,585 |

|

(1,114 |

) |

| Cash and cash equivalents at end of period |

95,999 |

|

71,398 |

|

95,999 |

|

71,398 |

|

|

|

| Extendicare Inc. |

|

| Financial and Operating Statistics |

|

|

|

|

|

|

|

|

|

|

| (amounts in Canadian dollars, unless otherwise

noted) |

Three months ended December 31 |

|

Twelve months ended December 31 |

|

|

2013 |

|

2012 |

|

2013 |

|

2012 |

|

| U.S. Skilled Nursing Center Statistics |

|

|

|

|

|

|

|

|

|

|

|

|

|

Percent of Revenue by Payor Source (same-facility basis, excluding

prior period settlement adjustments) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare (Parts A and B) |

|

28.6 |

% |

|

29.9 |

% |

|

29.9 |

% |

|

31.3 |

% |

|

Managed Care |

|

10.9 |

|

|

10.3 |

|

|

10.8 |

|

|

10.5 |

|

|

Skilled mix |

|

39.5 |

|

|

40.2 |

|

|

40.7 |

|

|

41.8 |

|

|

Private/other |

|

10.0 |

|

|

9.6 |

|

|

9.5 |

|

|

9.2 |

|

|

Quality mix |

|

49.5 |

|

|

49.8 |

|

|

50.2 |

|

|

51.0 |

|

|

Medicaid |

|

50.5 |

|

|

50.2 |

|

|

49.8 |

|

|

49.0 |

|

|

|

100.0 |

|

|

100.0 |

|

|

100.0 |

|

|

100.0 |

|

|

Average Daily Census by Payor Source (same-facility basis) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

|

1,696 |

|

|

1,778 |

|

|

1,785 |

|

|

1,867 |

|

|

Managed Care |

|

735 |

|

|

705 |

|

|

743 |

|

|

733 |

|

|

Skilled mix |

|

2,431 |

|

|

2,483 |

|

|

2,528 |

|

|

2,600 |

|

|

Private/other |

|

1,218 |

|

|

1,235 |

|

|

1,189 |

|

|

1,186 |

|

|

Quality mix |

|

3,649 |

|

|

3,718 |

|

|

3,717 |

|

|

3,786 |

|

|

Medicaid |

|

7,543 |

|

|

7,798 |

|

|

7,571 |

|

|

7,819 |

|

|

|

11,192 |

|

|

11,516 |

|

|

11,288 |

|

|

11,605 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Revenue per Resident Day by Payor Source (excluding prior

period settlement adjustments) (US$) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare Part A only |

$ |

468.78 |

|

$ |

470.21 |

|

$ |

470.21 |

|

$ |

461.45 |

|

|

Medicare (Parts A and B) |

|

508.95 |

|

|

510.68 |

|

|

511.84 |

|

|

508.92 |

|

|

Managed Care |

|

445.03 |

|

|

439.41 |

|

|

443.27 |

|

|

432.38 |

|

|

Private/other |

|

247.79 |

|

|

235.69 |

|

|

244.60 |

|

|

235.39 |

|

|

Medicaid |

|

200.80 |

|

|

194.03 |

|

|

199.07 |

|

|

188.87 |

|

|

Weighted average |

|

267.51 |

|

|

261.78 |

|

|

268.44 |

|

|

258.66 |

|

| Average Occupancy (excluding managed centers)

(same-facility basis) |

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. skilled nursing centers |

|

83.4 |

% |

|

85.1 |

% |

|

83.8 |

% |

|

85.5 |

% |

| U.S. assisted living centers |

|

76.3 |

|

|

76.1 |

|

|

78.1 |

|

|

69.9 |

|

| Canadian centers |

|

98.2 |

|

|

98.7 |

|

|

97.8 |

|

|

97.9 |

|

| Purchase of Property, Equipment and Software

(thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

| Growth expenditures |

$ |

598 |

|

$ |

19,332 |

|

$ |

28,747 |

|

$ |

49,253 |

|

| Facility maintenance |

|

12,254 |

|

|

14,917 |

|

|

28,238 |

|

|

35,723 |

|

| Deduct: capitalized interest |

|

(59 |

) |

|

(526 |

) |

|

(1,232 |

) |

|

(873 |

) |

|

$ |

12,793 |

|

$ |

33,723 |

|

$ |

55,753 |

|

$ |

84,103 |

|

| Segmented Adjusted Funds from

Operations(thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

| United States (US$) |

$ |

2,689 |

|

$ |

20,764 |

|

$ |

32,787 |

|

$ |

51,400 |

|

| United States (C$) |

|

2,961 |

|

|

20,674 |

|

|

33,767 |

|

|

51,382 |

|

| Canada |

|

7,450 |

|

|

6,088 |

|

|

37,347 |

|

|

33,187 |

|

|

$ |

10,411 |

|

$ |

26,762 |

|

$ |

71,114 |

|

$ |

84,569 |

|

| Average U.S./Cdn. dollar exchange rate |

|

1.0489 |

|

|

0.9916 |

|

|

1.0299 |

|

|

0.9996 |

|

Extendicare Inc.

Supplemental Information - FFO and AFFO

The following table provides a reconciliation of Adjusted EBITDA

to Funds from Operations (FFO) and Adjusted Funds from Operations

(AFFO) for the periods ended December 31, 2013 and 2012.(1)

|

(in thousands of Canadian dollars unless otherwise

noted) |

Three months ended December 31 |

|

Twelve months ended December 31 |

|

|

|

2013 |

|

2012 |

|

2013 |

|

2012 |

|

|

Adjusted EBITDA from continuing operations |

32,153 |

|

52,938 |

|

155,743 |

|

183,253 |

|

|

Depreciation for furniture, fixtures, equipment and computers |

(5,407 |

) |

(5,748 |

) |

(22,018 |

) |

(23,580 |

) |

|

Accretion costs |

(863 |

) |

(695 |

) |

(3,380 |

) |

(2,302 |

) |

|

Interest expense, net |

(14,585 |

) |

(15,317 |

) |

(58,778 |

) |

(61,741 |

) |

|

|

11,298 |

|

31,178 |

|

71,567 |

|

95,630 |

|

|

Current income tax expense (recovery) (2) |

3,307 |

|

2,400 |

|

(4,741 |

) |

(6,948 |

) |

|

FFO (continuing operations) |

14,605 |

|

33,578 |

|

66,826 |

|

88,682 |

|

|

Amortization of financing costs |

1,713 |

|

1,666 |

|

7,119 |

|

5,274 |

|

|

Principal portion of government capital funding payments |

940 |

|

687 |

|

3,389 |

|

2,756 |

|

|

Additional maintenance capital expenditures (3) |

(6,847 |

) |

(9,169 |

) |

(6,220 |

) |

(12,143 |

) |

|

AFFO (continuing operations) |

10,411 |

|

26,762 |

|

71,114 |

|

84,569 |

|

|

AFFO (discontinued operations) |

- |

|

- |

|

- |

|

- |

|

|

AFFO |

10,411 |

|

26,762 |

|

71,114 |

|

84,569 |

|

|

Per Basic Share/Unit ($) |

|

|

|

|

|

|

|

|

|

FFO (continuing operations) |

0.167 |

|

0.393 |

|

0.770 |

|

1.043 |

|

|

AFFO (continuing operations) |

0.119 |

|

0.312 |

|

0.820 |

|

0.994 |

|

|

AFFO |

0.119 |

|

0.312 |

|

0.820 |

|

0.994 |

|

|

Per Diluted Share/Unit ($) |

|

|

|

|

|

|

|

|

|

FFO (continuing operations) |

0.168 |

|

0.362 |

|

0.756 |

|

0.988 |

|

|

AFFO (continuing operations) |

0.124 |

|

0.292 |

|

0.784 |

|

0.945 |

|

|

AFFO |

0.124 |

|

0.292 |

|

0.784 |

|

0.945 |

|

|

Distributions declared |

10,462 |

|

18,021 |

|

52,023 |

|

71,497 |

|

|

Distributions declared per share/unit ($) |

0.1200 |

|

0.2100 |

|

0.6000 |

|

0.8400 |

|

|

Basic weighted average number of shares/units

(thousands) |

87,140 |

|

85,736 |

|

86,738 |

|

85,039 |

|

|

Diluted weighted average number of shares/units

(thousands) |

104,109 |

|

105,254 |

|

103,708 |

|

100,420 |

|

| (1) "Adjusted EBITDA", "funds from operations" and

"adjusted funds from operations" are not recognized measures under

GAAP and do not have a standardized meaning prescribed by GAAP.

Refer to the discussion of non-GAAP measures. |

|

| (2) Excludes current tax with respect to the loss

(gain) from derivative financial instruments, foreign exchange,

asset impairment, disposals and other items that are excluded from

the computation of AFFO. |

|

| (3) Represents total facility maintenance capital

expenditures less depreciation for furniture, fixtures, equipment

and computers already deducted in determining FFO. |

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Cash Provided by Operating Activities to

AFFO |

Three months ended December 31 |

|

Twelve months ended December 31 |

|

|

(in thousands of Canadian dollars) |

2013 |

|

2012 |

|

2013 |

|

2012 |

|

|

Net cash from operating activities |

24,424 |

|

41,324 |

|

97,916 |

|

108,787 |

|

|

Add (Deduct): |

|

|

|

|

|

|

|

|

|

Net change in operating assets and liabilities, including interest

and taxes |

12,845 |

|

(1,856 |

) |

9,668 |

|

5,436 |

|

|

Current tax on fair value adjustments, gain/loss on foreign

exchange, financial instruments, asset impairment, disposals and

other items |

(23 |

) |

104 |

|

(194 |

) |

19,781 |

|

|

Net provisions and payments for self-insured liabilities |

(15,523 |

) |

810 |

|

(11,762 |

) |

(16,874 |

) |

|

Depreciation for furniture, fixtures, equipment and computers |

(5,407 |

) |

(5,748 |

) |

(22,018 |

) |

(23,580 |

) |

|

Principal portion of government capital funding payments |

940 |

|

687 |

|

3,389 |

|

2,756 |

|

|

Other |

2 |

|

610 |

|

335 |

|

406 |

|

|

Additional maintenance capital expenditures |

(6,847 |

) |

(9,169 |

) |

(6,220 |

) |

(12,143 |

) |

|

AFFO |

10,411 |

|

26,762 |

|

71,114 |

|

84,569 |

|

Extendicare Inc.Dylan MannSenior Vice President and Chief

Financial Officer(414) 908-8623(905)

470-4003dmann@extendicare.comwww.extendicare.com

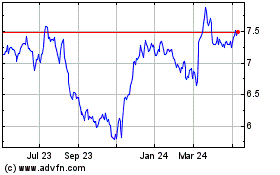

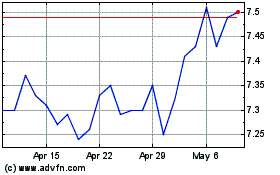

Extendicare (TSX:EXE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Extendicare (TSX:EXE)

Historical Stock Chart

From Mar 2024 to Mar 2025