Fairfax Announces Intention to Redeem Cumulative Preferred Shares, Series C & D

29 November 2024 - 11:00PM

Fairfax Financial Holdings Limited (“

Fairfax”)

(TSX: FFH and FFH.U) today announced its intention to redeem all of

its 7,515,642 outstanding Cumulative 5-Year Rate Reset Preferred

Shares, Series C (the “

Series C Shares”) and all

of its 2,484,358 outstanding Cumulative Floating Rate Preferred

Shares, Series D (the “

Series D Shares” and,

together with the Series C Shares, the “

Preferred

Shares”) on December 31, 2024 (the “

Redemption

Date”) at a redemption price equal to C$25.00 per share,

for an aggregate total amount of approximately C$250 million,

together with all accrued and unpaid dividends up to but excluding

the Redemption Date (the “

Redemption Price”), less

any tax required to be deducted and withheld by Fairfax.

Formal notice will be delivered to the sole

registered holder of the Preferred Shares in accordance with the

terms of the Preferred Shares of the applicable series as set out

in Fairfax’s articles.

Separately from the Redemption Price, (i) the

final quarterly dividend of C$0.294313 per Series C Share will be

paid in the usual manner to holders of Series C Shares on December

31, 2024, and (ii) the final quarterly dividend of C$0.47858 per

Series D Share will be paid in the usual manner to holders of

Series D Shares December 30, 2024, in each case to shareholders of

record on December 13, 2024.

Fairfax intends to use a portion of the net

proceeds from the previously announced public offering of C$700

million aggregate principal amount of its Senior Notes to redeem

the outstanding Preferred Shares.

Non-registered holders of Preferred Shares

should contact their broker or other intermediary for information

regarding the redemption process for the series of Preferred Shares

in which they hold a beneficial interest. Fairfax’s transfer agent

for the Preferred Shares is Computershare Trust Company of Canada

(“Computershare”). Questions regarding the

redemption process may be directed to Computershare at

1-800-564-6253 or by email to

corporateactions@computershare.com.

Following the redemption on December 31, 2024,

the Series C Shares and the Series D Shares will be delisted from

and no longer trade on the Toronto Stock Exchange

(“TSX”).

Fairfax is a holding company which, through its

subsidiaries, is primarily engaged in property and casualty

insurance and reinsurance and the associated investment

management.

For further information contact: John Varnell,

Vice President, Corporate Development at (416) 367-4941

Certain statements contained herein may

constitute “forward-looking statements” and are made pursuant to

the “safe harbour” provisions of applicable Canadian securities

laws. Such forward-looking statements may include, among other

things, Fairfax’s intention to redeem the Preferred Shares and the

subsequent delisting thereof on the TSX. Such forward-looking

statements are subject to known and unknown risks, uncertainties

and other factors which may cause the actual results, performance

or achievements of Fairfax to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements. Such factors include, but are not

limited to: our ability to complete acquisitions and other

strategic transactions on the terms and timeframes contemplated,

and to achieve the anticipated benefits therefrom; a reduction in

net earnings if our loss reserves are insufficient; underwriting

losses on the risks we insure that are higher than expected; the

occurrence of catastrophic events with a frequency or severity

exceeding our estimates; changes in market variables, including

unfavourable changes in interest rates, foreign exchange rates,

equity prices and credit spreads, which could negatively affect our

operating results and investment portfolio; the cycles of the

insurance market and general economic conditions, which can

substantially influence our and our competitors’ premium rates and

capacity to write new business; insufficient reserves for asbestos,

environmental and other latent claims; exposure to credit risk in

the event our reinsurers fail to make payments to us under our

reinsurance arrangements; exposure to credit risk in the event our

insureds, insurance producers or reinsurance intermediaries fail to

remit premiums that are owed to us or failure by our insureds to

reimburse us for deductibles that are paid by us on their behalf;

our inability to maintain our long term debt ratings, the inability

of our subsidiaries to maintain financial or claims paying ability

ratings and the impact of a downgrade of such ratings on derivative

transactions that we or our subsidiaries have entered into; risks

associated with implementing our business strategies; the timing of

claims payments being sooner or the receipt of reinsurance

recoverables being later than anticipated by us; risks associated

with any use we may make of derivative instruments; the failure of

any hedging methods we may employ to achieve their desired risk

management objective; a decrease in the level of demand for

insurance or reinsurance products, or increased competition in the

insurance industry; the impact of emerging claim and coverage

issues or the failure of any of the loss limitation methods we

employ; our inability to access cash of our subsidiaries; an

increase in the amount of capital that we and our subsidiaries are

required to maintain and our inability to obtain required levels of

capital on favourable terms, if at all; the loss of key employees;

our inability to obtain reinsurance coverage in sufficient amounts,

at reasonable prices or on terms that adequately protect us; the

passage of legislation subjecting our businesses to additional

adverse requirements, supervision or regulation, including

additional tax regulation, in the United States, Bermuda, Canada or

other jurisdictions in which we operate; risks associated with

applicable laws and regulations relating to sanctions and corrupt

practices in foreign jurisdictions in which we operate; risks

associated with government investigations of, and litigation and

negative publicity related to, insurance industry practice or any

other conduct; risks associated with political and other

developments in foreign jurisdictions in which we operate; risks

associated with legal or regulatory proceedings or significant

litigation; failures or security breaches of our computer and data

processing systems; the influence exercisable by our significant

shareholder; adverse fluctuations in foreign currency exchange

rates; our dependence on independent brokers over whom we exercise

little control; operational, financial reporting and other risks

associated with IFRS 17 – Insurance Contracts; financial reporting

risks relating to deferred taxes associated with amendments to IAS

12 – Income Taxes; impairment of the carrying value of our

goodwill, indefinite-lived intangible assets or investments in

associates; our failure to realize deferred income tax assets;

technological or other change which adversely impacts demand, or

the premiums payable, for the insurance coverages we offer;

disruptions of our information technology systems; assessments and

shared market mechanisms which may adversely affect our insurance

subsidiaries; and risks associated with the conflicts in Ukraine

and Israel and the development of other geopolitical events and

economic disruptions worldwide. Additional risks and uncertainties

are described in our most recently issued Annual Report which is

available at www.fairfax.ca and on SEDAR+ at www.sedarplus.ca, and

in our base shelf prospectus (under “Risk Factors”) filed with the

securities regulatory authorities in Canada, which is available on

SEDAR+ at www.sedarplus.ca. Fairfax disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by applicable securities law.

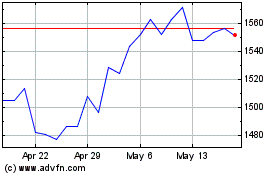

Fairfax Financial (TSX:FFH)

Historical Stock Chart

From Feb 2025 to Mar 2025

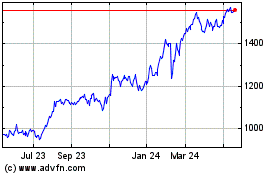

Fairfax Financial (TSX:FFH)

Historical Stock Chart

From Mar 2024 to Mar 2025