Fury Gold Mines Limited (TSX: FURY, NYSE American:

FURY) (

“Fury”) and

Quebec

Precious Metals Corporation (TSXV: QPM, FSE: YXEP, OTC-BB:

CJCFF) (“

QPM”) are pleased to

announce that they have entered into an arrangement agreement on

February 25, 2025 (the “

Arrangement Agreement”),

pursuant to which Fury has agreed to acquire all of the issued and

outstanding common shares of QPM, in exchange for common shares of

Fury by way of a plan of arrangement (the

“

Transaction”). The Transaction will create a

combined company that consolidates a prospective gold and critical

minerals exploration portfolio totalling over 157,000 hectares in

Quebec. Further details of the Transaction are outlined below.

Transaction Highlights:

- Deliver increased scale and

enhanced diversification with the addition of several prospective

gold and critical minerals exploration assets located in

Quebec.

- Provide synergy and cost savings

with Fury’s board and management team with a track record of

capital raising, discovery, exploration success, and community

engagement leading the combined company.

- The holders of the issued and

outstanding QPM Shares will receive 0.0741 Fury Shares for each one

(1) QPM Share held (the “Exchange Ratio”).

- The Exchange Ratio implies a price

of C$0.04 per QPM Share and a premium of approximately 33% based on

the closing prices of Fury and QPM on February 25, 2025.

The QPM project portfolio complements Fury’s

project pipeline in a region where Fury is extremely active. The

flagship Sakami project has seen nearly 50,000 metres (m) of

drilling with gold mineralization identified within two zones, La

Pointe and La Pointe Extension, along the boundary between the

Opinaca and the La Grande Geological sub-Provinces. In 2025, Fury

intends to rapidly advance targets at Sakami to the drilling stage

following a reinterpretation of the geology and geophysics paired

with systematic geochemical sampling.

Tim Clark, CEO of Fury, commented: “This

Transaction is an exciting opportunity given it doubles Fury’s land

package in the Eeyou Istchee territory in the James Bay Region of

Quebec and unites complementary assets, teams, and investor bases

which should ultimately increase shareholder value at both

companies. Combining QPM’s gold and critical minerals portfolio of

exploration projects with Fury’s projects and strong balance sheet

will not only help improve cost efficiency but also add to the

potential for new discoveries.”

Normand Champigny, CEO and Director of QPM,

commented: “We are very pleased to be entering this combination

with Fury. By combining with Fury, QPM’s shareholders will benefit

from the synergies and cost savings of leveraging the combined

company’s excellent management team for funding and obtaining

required permits to continue drilling at Sakami. We believe that

the Transaction with Fury offers for QPM shareholders a high

potential for share price appreciation in the current gold market

environment. The Transaction demonstrates the progress made with

our exploration work to date. Fury has the ability to rapidly

advance our assets to identify a large gold mineral resource.”

QPM Precious and Critical Minerals

Project Portfolio:

Gold and Lithium:QPM holds a highly prospective

land package covering approximately 70,900 hectares largely within

the emerging James Bay gold camp. The road-accessible Sakami

project is host to a 23 kilometre (km) long gold-bearing structural

corridor. Drilling to date at the La Pointe and La Pointe Extension

targets within this trend has identified gold mineralization across

widths of up to 75 m and to a depth of up to 500 m with reported

intercepts of 2.51 g/t gold (Au) over 54.65 m from drill hole

EX-10; 9.22 g/t Au over 12.55 m from drill hole EX-19 and 2.52 g/t

Au over 48.55 m from drill hole PT-16-92. The identified gold

mineralization at both La Pointe and La Pointe Extension remains

open to depth and along strike. Further south along the same

gold-bearing structure lies an intriguing undrilled coincident gold

in soil geochemical anomalies and Induce Polarization (IP)

geophysical chargeability anomaly with similar signature to the La

Pointe and La Pointe Extension targets.

The Elmer East project is host to an undrilled

4.2 km long east–west oriented gold and base metal bearing

structural trends known as the Lloyd showing where grab samples

have returned results of up to 68.10 g/t gold, 7.99% Zinc and 7,660

ppm Copper.

Spodumene bearing pegmatites have been

identified throughout the QPM land package with a recently

completed drilling campaign at the Ninaaskumuwin project where +20

m spodumene bearing pegmatites with vertical continuity of up to

150 m were intercepted in drilling late 2024 (analytical results

are pending at this time).

Rare EarthsThe Heavy Rare Earth Elements (HREE)

Kipawa project (68% QPM, 32% Investissement Québec), 50 km east of

Temiscaming in southwestern Quebec, is host to a historical 2013

Proven and Probable reserves of 19.8 million tonnes grading 0.411%

total rare earth oxides (TREO). The road accessible project covers

an area of 4,300 hectares with good access to local

infrastructure.

Transaction Details

Pursuant to the terms and conditions of the

Arrangement Agreement, the holders of the issued and outstanding

QPM Shares will receive 0.0741 Fury Shares for each one (1) QPM

Share held (the “Exchange Ratio”). QPM stock

options and warrants that are outstanding at the time of completion

of the Transaction will become exercisable for Fury Shares on

substantially the same terms and conditions, with the number of

Fury Shares issuable on exercise and the exercise price adjusted in

accordance with the Exchange Ratio. The Transaction will be carried

out by way of a court-approved plan of arrangement under the Canada

Business Corporations Act.

The Exchange Ratio implies a price of C$0.04 per

QPM Share and a premium of approximately 33% based on the closing

prices of Fury and QPM on February 25, 2025 and a premium of

approximately 28% based on the 20-day volume weighted average

prices of Fury Shares and QPM Shares as of February 25, 2025. Upon

completion of the Transaction, existing Fury and QPM shareholders

would own approximately 95% and 5% of the combined company,

respectfully, on an undiluted basis.

Upon completion of the Transaction, Fury will

continue to be listed on the TSX and NYSE American under the same

Fury name and ticker symbol. The Arrangement Agreement contains

customary deal-protection provisions including a non-solicitation

covenant on the part of QPM and a right for Fury to match any

Superior Proposal (as defined in the Arrangement Agreement). Under

certain circumstances, either Fury or QPM would be entitled to a

termination fee of C$0.2 million.

Principal Conditions to

Completion

The completion of the Transaction is subject to

a number of terms and conditions, including without limitation the

following: (a) approval of a special majority of the QPM

shareholders, as described below; (b) acceptance of the relevant

stock exchanges (TSX, NYSE American and TSX Venture Exchange

(TSXV)); (c) approval of the Quebec Superior Court; (d) there being

no material adverse changes in respect of either Fury or QPM; and

other standard conditions of closing for a transaction of this

nature. There can be no assurance that all of the necessary

approvals will be obtained or that all conditions of closing will

be satisfied.

The Transaction is subject to the approval at a

special meeting of QPM shareholders by (i) 66 2/3% of the votes

cast by QPM shareholders, and (ii) a simple majority of the votes

cast by the QPM shareholders, excluding the votes cast by certain

persons as required by Multilateral Instrument 61-101

– Protection of Minority Securityholders in Special

Transactions. Fury and QPM are arm’s length parties and,

accordingly, the Transaction is not expected to be a related party

transaction. However, certain insiders of QPM will, as a condition

to completion, agree to convert certain liabilities into shares of

Fury to be issued upon completion of the Transaction. No finder’s

fees are being paid in connection with the Transaction. Officers

and directors along with certain key shareholders and insiders of

QPM who collectively control 17% of the QPM Shares on an undiluted

basis have entered into voting and support agreements pursuant to

which they have agreed to vote their shares in favour of the

Transaction.

None of the securities to be issued pursuant to

the Arrangement Agreement have been or will be registered under the

United States Securities Act of 1933, as amended (the "U.S.

Securities Act"), or any state securities laws, and any

securities issued in the Arrangement are anticipated to be issued

in reliance upon available exemptions from such registration

requirements pursuant to Section 3(a)(10) of the U.S. Securities

Act and applicable exemptions under state securities laws. This

press release does not constitute an offer to sell or the

solicitation of an offer to buy any securities.

Board of Directors and

Management

Upon closing of the Transaction, the board of

directors of Fury will remain unchanged to lead the combined

management and project teams. The head office will continue to be

in Toronto, Canada. Normand Champigny will be appointed as a

strategic advisor to Fury and Fury’s representative for the Kipawa

project.

Transaction Timeline

Pursuant to the Arrangement Agreement and

subject to satisfying all necessary conditions and receipt of all

required approvals, the parties anticipate completion of the

Transaction by the end of April 2025. An Information Circular will

be sent to QPM shareholders in March and filed at www.sedarplus.com

in furtherance of the required QPM shareholders meeting which

circular will contain all material details about the Transaction.

The Transaction is not subject to approval by the shareholders of

Fury. Following completion of the Transaction, QPM Shares will be

delisted from the TSXV and QPM will cease to be a reporting issuer

under Canadian securities laws.

Recommendations by the Boards of

Directors

After consultation with its legal advisors, the

board of directors of Fury unanimously approved entering into the

Arrangement Agreement. After consultation with its legal advisors,

the board of directors of QPM unanimously approved entering into

the Arrangement Agreement and unanimously recommended that QPM

shareholders vote in favour of the Transaction.

Counsel and Advisor

McMillan LLP is acting as legal counsel to Fury.

BCF Business Law are acting as legal counsel to QPM. Evans and

Evans Inc. has provided a fairness opinion to the QPM Board

confirming that, in Evans and Evans’ view, the Transaction is, from

a financial point of view, fair to QPM Shareholders.

Normand Champigny, Eng., CEO and Director of

QPM, is a qualified person within the meaning of National

Instrument 43-101 on standards of disclosure for mineral projects.

He has reviewed and approved the technical information contained in

this press release.

About Fury Gold Mines

LimitedFury Gold Mines Limited is a Canadian-focused

exploration company positioned in two prolific mining regions

across the country and holds an approximate 51 million common share

position in Dolly Varden Silver Corp. (approximately 16% of issued

shares). Led by a management team and board of directors with

proven success in financing and advancing exploration assets, Fury

intends to grow its multi-million-ounce gold platform through

rigorous project evaluation and exploration excellence. Fury is

committed to upholding the highest industry standards for corporate

governance, environmental stewardship, community engagement and

sustainable mining. For more information on Fury Gold Mines, visit

www.furygoldmines.com.

About Quebec Precious Metals

Corporation

QPM has a large land position in the highly

prospective Eeyou Istchee James Bay territory, Quebec, near Newmont

Corporation’s Éléonore gold mine. QPM focuses on advancing its

Sakami gold project and its newly discovered, drill-ready

Ninaaskuwin lithium showing on the Elmer East project. In addition,

QPM holds a 68% interest in the Kipawa rare earths project located

near Temiscaming, Quebec.

Neither the TSX nor its Regulations Services

Provider (as that term is defined in the policies of the TSX)

accepts responsibility for the adequacy or accuracy of this news

release.

For further information on Fury Gold

Mines Limited, please contact:Margaux Villalpando,

Investor RelationsTel: (844) 601-0841Email: info@furygoldmines.com

Website: www.furygoldmines.com

For more information about QPM, please

contact: Normand Champigny, Chief Executive Officer Tel.:

(514) 979-4746Email: nchampigny@qpmcorp.ca

Forward-Looking InformationThis

press release contains "forward-looking information" within the

meaning of applicable Canadian securities laws. Any statements that

express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions

or future events. These particularly pertain to the outlook for

completion of the proposed Transaction and synergies that might

arise from it.

Although Fury and QPM have attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking information including the uncertainty of the

shareholder and regulatory approval process the two companies face

and many other risks described in our recent securities filings

available at www.sedarplus.ca.

There may also be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate, and actual results and future events could

differ materially from those anticipated in such information.

Accordingly, readers should not place heavy reliance on

forward-looking information. Neither Fury nor QPM undertake to

update any forward-looking information except in accordance with

applicable securities laws.

No regulatory authority has approved the

contents of this news release.

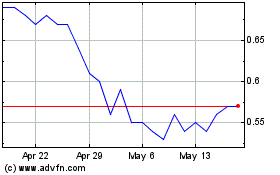

Fury Gold Mines (TSX:FURY)

Historical Stock Chart

From Feb 2025 to Mar 2025

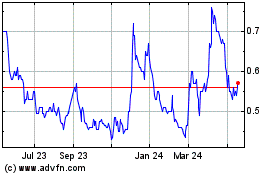

Fury Gold Mines (TSX:FURY)

Historical Stock Chart

From Mar 2024 to Mar 2025