Globex Options Bald Hill Antimony Property

10 September 2024 - 11:00PM

GLOBEX MINING ENTERPRISES INC. (GMX – Toronto Stock

Exchange, G1MN – Frankfurt, Stuttgart, Berlin, Munich, Tradegate,

Lang & Schwarz, LS Exchange, TTMzero, Düsseldorf and Quotrix

Düsseldorf Stock Exchanges and GLBXF – OTCQX

International in the US) is pleased to inform shareholders

that it has optioned its Bald Hill antimony property (Bald Hill)

located in Queens County, New Brunswick, to

Superior Mining

International Corp. (SUI-V). Under terms of the option

agreement,

Globex shall receive $680,000 in cash, and

2,000,000 shares over a four-year period and a minimum aggregate of

$4,600,000 will be spent on the property. Globex will retain a 3.5%

Gross Metal Royalty, 0,5% of which may be purchased for

$500,000. Click here to view Superior Mining International

Corp’s news release.

The property consisting of 26 claims, covers a

number of antimony occurrences, including previous trenching by

Rockport Mining Corp. which returned up to 43% Sb over 2.0

m and 2.90% Sb over 8.18 m. Shallow drilling by widely

spaced holes is reported to have extended the zone over a 450 m

strike length and to a depth of 300 m.

An NI 43-101 Technical Report in 2010 by

Conestoga-Rovers and Associates of Fredericton, New Brunswick, for

Rockport Mining Corp., authored by Heather MacDonald, MSc., P.Geo.

reported “Based upon 16 widely spaced drill holes totaling 3,554

metres and 609 assays, an antimony zone of 450 metres in length was

outlined including intersections of up to 11.7% Sb over 4.51 metres

core length.”

The report further states “The potential tonnage

and grade of a potential mineral deposit at the Bald Hill Property

which is the target of further exploration, is expressed as ranges

in the Table 6 below. The potential quantity and grade is

conceptual in nature as there has been insufficient exploration to

define a mineral resource and it is uncertain if further

exploration will result in the target being delineated as a mineral

resource.”

|

Table 6Potential Quantity and Grade

Ranges |

|

|

|

|

|

ZONE |

METRIC TONNES |

GRADE (Sb %) |

|

Main Zone |

700,000 to 900,000 |

4.33% to 5.40% |

|

Parallel Zone |

25,000 to 100,000 |

2.13% to 3.19% |

|

Total: |

725,000 to 1,000,000 |

4.11% to 5.32% |

A subsequent NI 43-101 report titled: National

Instrument 43-101 Technical Report: Bald Hill Antimony Project

(claim group 5061) Southern New-Brunswick, Canada, NTS Map Sheet

21G/09 and 21H/12, Prepared for Tri-Star Antimony Canada Inc. by

Peter Banks, B.Sc., P.Geo. and John Langton, M.Sc., P.Geo. of MRB

& Associates, October 28th, 2014 dealt with addition

exploration work and conclusions derived from the work up to that

date as reported in brief under “Interpretations and Conclusions”

and reproduced below.

“Rockport’s drilling on the Bald Hill main grid

has confirmed the Sb mineralization over a significant area of

approximately 700 m on surface and to 300 m depth.

Surface mineralization and soil geochemical anomalies indicate that

the mineralization extends for at least 1.5 km, along strike from

the delineated mineralized zones. The 2014 trenching program,

centered approximately 1.0 km along strike to the southeast from

the main Bald Hill occurrences, exposed new antimony mineralization

grading 9.04% Sb over 2.60 metres.”

Globex regards the property as highly prospective.

The recent termination of antimony exports by China, the world’s

largest exporter, bodes well for the price going forward.

“In addition to the on-site exploration

programs, preliminary processing and metallurgical test-work of

Bald Hill lithological drill-core and bulk samples was carried out.

This work comprised bulk mineralogy, basic chemical profiling,

textural features of the ore minerals and preliminary analysis of

liberation characteristics and amenability of the ore to gravity

concentration and/or flotation, preliminary ore-characterization,

mineralogical and chemical profiling, and optical ore

examinations.”

“The work completed by Rockport on the

Bald Hill Project substantiates the occurrence of a potential

resource of economically interesting antimony mineralization. The

Project is a valid exploration target that remains largely untested

with respect to its full dimensions and its regional structural

relationships.”

In 2021, Globex undertook a small drill program

which returned the following results:

| Hole

BH21-25 |

1.34% Sb over 3.6 m starting at 310.5 m |

| Hole BH21-27 |

2.67% Sb over 2.7 m starting at 112.2 m and |

| |

1.73% Sb over 3.3 m starting at 124.7 m |

| Hole BH21-28 |

4.71% Sb over 10.2 m starting at 109.5 m |

| |

|

Globex regards this property as highly prospective and the

recent termination of antimony exports by China, the largest

exporter, bodes well for the price going forward.

This press release was written by Jack Stoch, P.

Geo., President and CEO of Globex in his capacity as a Qualified

Person (Q.P.) under NI 43-101.

|

We Seek Safe Harbour. |

Foreign Private Issuer 12g3 – 2(b) |

|

|

CUSIP Number 379900 50 9LEI 529900XYUKGG3LF9PY95 |

|

For further information, contact: |

|

Jack Stoch, P.Geo., Acc.Dir.President & CEOGlobex Mining

Enterprises Inc.86, 14th StreetRouyn-Noranda, Quebec Canada J9X

2J1 |

Tel.: 819.797.5242Fax: 819.797.1470

info@globexmining.com www.globexmining.com |

Forward-Looking Statements:

Except for historical information, this news release may contain

certain “forward-looking statements”. These statements may involve

a number of known and unknown risks and uncertainties and other

factors that may cause the actual results, level of activity and

performance to be materially different from the expectations and

projections of Globex Mining Enterprises Inc. (“Globex”). No

assurance can be given that any events anticipated by the

forward-looking information will transpire or occur, or if any of

them do so, what benefits Globex will derive therefrom. A more

detailed discussion of the risks is available in the “Annual

Information Form” filed by Globex on SEDAR at www.sedar.com.

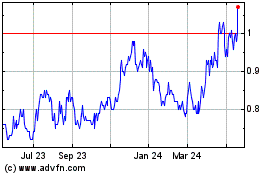

Globex Mining Enterprises (TSX:GMX)

Historical Stock Chart

From Oct 2024 to Nov 2024

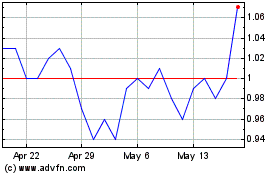

Globex Mining Enterprises (TSX:GMX)

Historical Stock Chart

From Nov 2023 to Nov 2024