Hammond Power Solutions Inc. Announces Quarter 4, 2013 Financial

Results Building for the Future

GUELPH, ONTARIO--(Marketwired - Mar 13, 2014) -

(Dollar amounts are

in thousands unless otherwise specified)

NOTE: ALL NUMBERS HAVE BEEN STATED

UNDER IFRS

Hammond Power

Solutions Inc. ("HPS") (TSX:HPS.A) a leading manufacturer of

dry-type and cast resin transformers and related magnetics, today

announced its financial results for the fourth quarter of 2013.

Bill Hammond,

Chairman & Chief Executive Officer of Hammond Power Solutions

Inc. commented, "Hammond Power Solutions has come through one of

the most challenging years since the recession started in 2008. A

number of unexpected circumstances as well as higher levels of

economic volatility buffeted our sales and profit performance

during 2013. We are confident that our financial strength, core

competencies and long term strategies will accelerate our growth as

the global recovery begins."

FOURTH QUARTER

RESULTS

Sales for the

quarter ended December 31, 2013 were $62,804 a slight increase of

$271 or 0.4% from the comparative quarter last year, which is

reflective of the impact of the continued demand for our product,

market share and favorable product mix. U.S. sales were stable at

$35,201 in Quarter 4, 2013, an increase of $637 or 1.8% from

Quarter 4, 2012. In 2013, sales to the U.S. market of $138,481

decreased by $6,604, or 4.6%, compared to 2012 sales of $145,085.

Canadian sales were $20,081 for the quarter, a decrease over

Quarter 4, 2012, of $4,052 or 16.8%. Year to date Canadian sale

were $79,766 in 2013 compared to $95,467 in 2012 a drop of $15,701

or 16.4%. International sales in Quarter 4, 2013 were $7,522 versus

$3,824 in Quarter 4, 2012, an increase of $3,698 or 96.7%.

International sales were $24,694 in 2013 compared to $16,824 in

2012, an increase of $7,870 or 46.8%.

The Company realized

an increase in bookings of 1.12% over Quarter 3, 2013 and an

increase of 2.7% as compared against Quarter 4, 2012. Due to the

softer North American, European and Asian economies, year-to-date

bookings were lower by 1.1%.

Quarter 4, 2013

gross margin dollars decreased by $529 compared to Quarter 4, 2012.

Gross margin rate decreased to 27.1% in Quarter 4, 2013 versus

28.1% in Quarter 4, 2012 as a result of market pricing pressures

and lower manufacturing throughput and were 25.0% year to date 2013

versus 25.2% year to date 2012.

Bill Hammond further

commented, "We are pleased with our solid gross margin rates for

the year. Despite a slower than expected economy, we continued to

increase our sales and market share through our U.S. distributor

channel. Our expanded channel and geographical presence will

benefit HPS even more as the U.S. economy begins to improve."

Total selling and

distribution expenses were $7,461 in Quarter 4, 2013 versus $6,773

in Quarter 4, 2012, an increase of $688 or 10.2%. These expenses

represent 11.9% of sales in Quarter 4, 2013 and 10.8% of sales in

Quarter 4, 2012. Year-to-date selling and distribution expenses

were $27,156 or 11.2% of sales in 2013, compared to $25,894 or

10.1% of sales in 2012.

The general and

administrative expenses for Quarter 4, 2013 totaled $5,394, a

slight increase of $171 or 3.2% when compared to Quarter 4, 2012

expenses of $5,223. This represents 8.6% of sales in Quarter 4,

2013 as compared to 8.4% of sales in Quarter 4, 2012. Year-to-date

general and administrative expenses were $22,409 or 9.2% of sales

in 2013, compared to $20,714 or 8.0% of sales in 2012.

Earnings from

operations were $4,157 in Quarter 4, 2013 versus $5,545 in Quarter

4, 2013, a decrease of $1,388 or 25.0% and were $11,036

year-to-date in 2013, as compared to $18,180 in 2012, a decrease of

$7,144 or 39.3%.

Interest expense for

Quarter 4, 2013 finished at $155 and was comparable to $146 in

Quarter 4, 2012. Year-to-date interest cost was $860, an increase

of $165 when compared to the 2012 year-to-date expense of $695. The

increase in interest expense year-to-date was a result of higher

operating debt levels related to the assumption of debt associated

with the Italian acquisition in the year.

There was a foreign

exchange gain of $217 in the Quarter 4, 2013 versus $393 in Quarter

4, 2012 and a foreign exchange loss in 2013 of $80 related

primarily to the transactional exchange gain or loss pertaining to

the Company's U.S. dollar trade accounts payable in Canada,

compared to a foreign exchange gain of $775 in 2012.

Net earnings for

Quarter 4, 2013 decreased by $1,835, finishing at $2,895 compared

to net earnings of $4,730 in Quarter 4, 2012. Year-to-date net

earnings were $6,104 in 2013 and $12,611 in 2012, a decrease of

$6,507 or 51.6. This decrease is mostly due to lower sales in the

year.

Net cash used in

operating activities for Quarter 4, 2013 was $2,819 versus cash

generated of $10,461 in Quarter 4, 2012, a decrease of $13,280 as a

result of lower net earnings. Year-to-date cash generated by

operating activities was $620 in 2013 and $21,371 in 2012, a change

of $20,751.

Overall cash

balances net of debt bank lines of credit resulted in net debt of

$15,959 as at December 31 2013, a decrease of $17,111 as compared

to a net cash balance of $1,152 as at December 31, 2012. This is

primarily reflecting acquisition activity, capital investment and

debt repayment in the year.

The Company

continued with its regular quarterly dividend program, paying five

cents ($0.05) per Class A Subordinate Voting Share of HPS and five

cents ($0.05) per Class B Common Share of HPS on December 30, 2013.

Year to date, the Company has paid a quarterly cash dividend of

twenty cents ($0.20) per Class A Subordinate Voting Share and

twenty cents ($0.20) per Class B Common Share.

Mr. Hammond

concluded, "We continue to implement operational and strategic

initiatives to grow our sales, control our expenses, manage the

company and build for the future."

FINANCIAL

RESULTS

| THREE MONTHS ENDED: |

| (dollars in thousands) |

|

|

|

|

December 31, 2013 |

|

December 31, 2012 |

|

Change |

|

Sales |

$ |

62,804 |

|

$ |

62,533 |

|

$ |

271 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from Operations |

$ |

4,157 |

|

$ |

5,545 |

|

$ |

(1,388 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Exchange Gain |

$ |

(217 |

) |

$ |

(393 |

) |

$ |

(176 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net Earnings |

$ |

2,895 |

|

$ |

4,730 |

|

$ |

(1,835 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.25 |

|

$ |

0.41 |

|

$ |

(0.16 |

) |

|

Diluted |

$ |

0.25 |

|

$ |

0.41 |

|

$ |

(0.16 |

) |

|

Cash (used) generated by Operations |

$ |

(2,819 |

) |

|

$10,461 |

|

$ |

(13,280 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| TWELVE MONTHS ENDED: |

|

| (dollars in thousands) |

|

|

|

|

|

|

December 31, 2013 |

|

December 31, 2012 |

|

Change |

|

Sales |

$ |

242,941 |

|

$ |

257,376 |

|

$ |

(14,435 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from Operations |

$ |

11,036 |

|

$ |

18,180 |

|

$ |

(7,144 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Exchange Loss/(Gain) |

$ |

80 |

|

$ |

(775 |

) |

$ |

(855 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net Earnings |

$ |

6,104 |

|

$ |

12,611 |

|

$ |

(6,507 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.52 |

|

$ |

1.08 |

|

$ |

(0.56 |

) |

|

Diluted |

$ |

0.52 |

|

$ |

1.08 |

|

$ |

(0.56 |

) |

|

Cash generated by Operations |

$ |

620 |

|

$ |

21,371 |

|

$ |

(20,751 |

) |

|

|

|

|

|

|

|

|

|

|

|

TELECONFERENCE

Hammond Power

Solutions Inc. will hold a conference call on Friday, March 14,

2014 at 10:00 a.m. EST, to discuss the Company's financial results

for the fourth quarter 2013.

Listeners may attend

the conference by dialing:

| 1-416-340-2216 / 1-866-226-1792 / 1-800-9559-6849 |

|

|

Instant Replay |

|

|

| Dial

in numbers |

|

905-694-9451 or 1-800-408-3053 |

| Pass

code |

|

7239947 |

| End

date |

|

March

28, 2014 |

Caution Regarding

Forward-Looking Information

This press release

contains forward-looking statements that involve a number of risks

and uncertainties, including statements that relate to among other

things, HPS' strategies, intentions, plans, beliefs, expectations

and estimates, and can generally be identified by the use of words

such as "may", "will", "could", "should", "would", "likely",

"expect", "intend", "estimate", "anticipate", "believe", "plan",

"objective" and "continue" and words and expressions of similar

import. Although HPS believes that the expectations reflected in

such forward-looking statements are reasonable, such statements

involve risks and uncertainties, and undue reliance should not be

placed on such statements. Certain material factors or assumptions

are applied in making forward-looking statements, and actual

results may differ materially from those expressed or implied in

such statements. Important factors that could cause actual results

to differ materially from expectations include but are not limited

to: general business and economic conditions (including but not

limited to currency rates); changes in laws and regulations; legal

and regulatory proceedings; and the ability to execute strategic

plans. HPS does not undertake any obligation to update publicly or

to revise any of the forward-looking statements contained in this

document, whether as a result of new information, future events or

otherwise, except as required by law.

ABOUT HAMMOND POWER

SOLUTIONS INC.

Hammond Power

Solutions Inc. (TSX:HPS.A) is a North American leader for the

design and manufacture of dry-type custom electrical engineered

magnetics, electrical dry-type and cast resin transformers. Leading

edge engineering capabilities, high quality products, and

responsive service to customers' needs have all served to establish

HPS as a technical and innovative leader in the electrical and

electronic industries.

HPS has operations

in Canada, the United States, Mexico, India and Italy.

Hammond Power Solutions Inc.Dawn HendersonManager Investor

Relations(519) 822-2441 x414ir@hammondpowersolutions.com

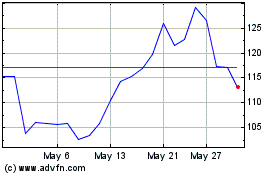

Hammond Power Solutions (TSX:HPS.A)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hammond Power Solutions (TSX:HPS.A)

Historical Stock Chart

From Dec 2023 to Dec 2024