Ivanhoe Electric Announces Pricing of Initial Public Offering

28 June 2022 - 12:04PM

Ivanhoe Electric Inc. (“Ivanhoe Electric”), a U.S.-based minerals

exploration and development company, announced today the pricing of

its initial public offering of 14,388,000 shares of its common

stock at a price of US$11.75 per share. The gross proceeds from the

offering are expected to be approximately US$169.1 million, before

deducting underwriting discounts and commissions and estimated

offering expenses payable by Ivanhoe Electric. In addition, Ivanhoe

Electric has granted the underwriters a 30-day option to purchase

up to an additional 2,158,200 shares of common stock at the initial

public offering price, less underwriting discounts and commissions.

The shares are expected to begin trading on the NYSE American

and the Toronto Stock Exchange on June 28, 2022 under the ticker

symbol “IE”. The offering is expected to close on June 30, 2022,

subject to customary closing conditions.

Ivanhoe Electric intends to use the net proceeds of the offering

to fund certain payments to acquire or maintain its mineral and

property rights to its material and key mineral properties, to

further its metals exploration activities at all of its mineral

properties, to construct and deploy additional sets of its Typhoon™

electrical pulse-powered geophysical surveying transmitter

technology, as well as working capital and general and

administrative costs.

BMO Capital Markets and Jefferies are acting as the lead

bookrunners for the offering. J.P. Morgan is acting as a joint

bookrunner for the offering. Raymond James, RBC Capital Markets and

Scotiabank are acting as co-managers for the offering.

The offering is being made only by means of a prospectus. Copies

of the prospectus relating to the offering may be obtained from BMO

Capital Markets Corp., Attn: Equity Syndicate Department, 151 W

42nd Street, 32nd Floor, New York, NY 10036, telephone: (800)

414-3627, email: bmoprospectus@bmo.com; or Jefferies LLC, Attn:

Equity Syndicate Prospectus Department, 520 Madison Avenue, New

York, NY 10022, by telephone: 1-877-821-7388 or by email:

Prospectus_Department@Jefferies.com.

A registration statement relating to these securities has been

filed with, and declared effective by, the U.S. Securities and

Exchange Commission. Ivanhoe Electric has also obtained a receipt

for a final base PREP prospectus filed with the securities

commissions or similar securities regulatory authorities in each of

the provinces of Canada (except Québec) on the date hereof. A copy

of the supplemented PREP prospectus containing pricing information

and other important information relating to the shares of common

stock may, when available, be obtained from the underwriters at the

addresses set out above and will be available on the SEDAR website

at www.sedar.com and the EDGAR website at

www.sec.gov/edgar under Ivanhoe Electric’s profile.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Ivanhoe Electric

Ivanhoe Electric Inc. is a United States domiciled technology

and metals company that is re-inventing mining for the

electrification of everything. Ivanhoe Electric represents the

confluence of advanced exploration technologies (Typhoon™ and

Computational Geosciences Inc.), electric metals projects focused

in the United States and renewable energy storage solutions (VRB

Energy Inc. – vanadium flow batteries). Ivanhoe Electric is

uniquely positioned to support American supply chain independence

by delivering the critical metals necessary for electrification of

the economy.

Forward-Looking Statements

This press release contains statements that constitute “forward

looking information” and “forward-looking statements” within the

meaning of U.S. and Canadian securities laws. All statements other

than statements of historical facts contained in this press

release, including statements regarding the expected closing date

of the offering and the use of proceeds from the offering are

forward-looking statements. Forward-looking statements are based on

management’s beliefs and assumptions and on information currently

available to management. Such statements are subject to risks and

uncertainties, and actual results may differ materially from those

expressed or implied in the forward-looking statements due to

various factors, including changes in the prices of copper or other

metals Ivanhoe Electric is exploring for, the results of

exploration activities, significant risk and hazards associated

with mining operations, extensive regulation by the U.S. government

as well as local governments; the impact of political, economic and

other uncertainties associated with operating in foreign countries,

and the impact of the COVID-19 pandemic and the global economy.

These factors should not be construed as exhaustive and should be

read in conjunction with the other cautionary statements described

in Ivanhoe Electric’s registration statement on Form S-1, as

amended, filed with the U.S. Securities and Exchange Commission and

base PREP prospectus filed with Canadian securities commissions.

Ivanhoe Electric expressly disclaims any obligation or undertaking

to update the forward-looking statements contained in this press

release to reflect any change in its expectations or any change in

events, conditions, or circumstances on which such statements are

based unless required to do so by applicable law. No assurance can

be given that such future results will be achieved. Forward-looking

statements speak only as of the date of this press release. We

caution you not to place undue reliance on these forward-looking

statements.

Media Contact

Evan YoungVice President, Corporate

DevelopmentEvan.Y@ivanhoeelectric.com604-598-8765

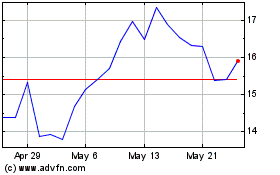

Ivanhoe Energy (TSX:IE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ivanhoe Energy (TSX:IE)

Historical Stock Chart

From Feb 2024 to Feb 2025