Imperial Metals Corporation (the “Company”)

(TSX:III) reports financial results for the three and six months

ended June 30, 2019, as summarized in this release and discussed in

detail in the Management’s Discussion & Analysis. The Company’s

financial results are prepared in accordance with International

Financial Reporting Standards. The reporting currency of the

Company is the Canadian (“CDN”) Dollar.

QUARTER HIGHLIGHTS

FINANCIAL

On March 10, 2019, the Company entered into an

agreement to sell a 70% interest in the Red Chris mine to Newcrest.

In accordance with IFRS, the Company has classified Red Chris mine

as a discontinued operation effective January 1, 2019 and asset

held for sale as at June 30, 2019, and the prior year comparative

quarter consolidated statement of income (loss) has been restated

accordingly.

Total revenue increased to $83.6 million in the

June 2019 quarter compared to $80.1 million in the 2018 comparative

quarter, an increase of $3.5 million or 4.4%.

Revenue from the Red Chris mine in the June 2019

quarter was $61.9 million compared to $57.3 million in the 2018

comparative quarter. This increase was attributable to a higher

quantity of copper concentrate sold along with slightly higher gold

prices partially offset by lower copper prices and a negative

revenue revaluation.

Revenue from the Mount Polley mine in the June

2019 quarter was $21.7 million compared to $22.8 million in the

2018 comparative quarter. The decrease was attributable to lower

sales volumes and metal prices.

In the June 2019 quarter there were 3.1

concentrate shipments from the Red Chris mine (2018-2.6 concentrate

shipments) and 0.7 concentrate shipments from the Mount Polley mine

(2018-0.7 concentrate shipment). Variations in revenue are impacted

by the timing and quantity of concentrate shipments, metal prices

and exchange rates, and period end revaluations of revenue

attributed to concentrate shipments where copper and gold prices

will settle at a future date.

The London Metals Exchange cash settlement

copper price per pound averaged US$2.77 in the June 2019 quarter

compared to US$3.12 in the 2018 comparative quarter. The London

Metals Exchange cash settlement gold price per troy ounce averaged

US$1,310 in the June 2019 quarter compared to US$1,306 in the 2018

comparative quarter. The average CDN/US Dollar exchange rate was

1.338 in the June 2019 quarter, 3.6% higher than the exchange rate

of 1.291 in the June 2018 quarter. In CDN Dollar terms the average

copper price in the June 2019 quarter was CDN$3.71 per pound

compared to CDN$4.03 per pound in the 2018 comparative quarter, and

the average gold price in the June 2019 quarter was CDN$1,752 per

ounce compared to CDN$1,686 per ounce in the 2018 comparative

quarter.

Revenue in the June 2019 quarter decreased by

$4.8 million due to a negative revenue revaluation as compared to a

$6.9 million negative revenue revaluation in the 2018 comparative

quarter. Revenue revaluations are the result of the metal prices on

the settlement date and/or the current period balance sheet date

being higher or lower than when the revenue was initially recorded

or the metal prices at the last balance sheet date and finalization

of contained metal as a result of final assays.

Net loss from continuing operations for the June

2019 quarter was $9.7 million ($0.08 per share) compared to net

loss of $22.4 million ($0.19 per share) in the 2018 comparative

quarter. The decrease in net loss of $12.7 million was primarily

due to the following factors:

- Loss from mine operations went from a loss of $1.2 million in

June 2018 to a loss of $2.2 million in June 2019, an increase in

loss of $1.0 million.

- Interest expense went from $18.3 million in June 2018 to $18.1

million in June 2019, a decrease in loss of $0.2 million.

- Foreign exchange gains/losses went from a loss of $9.2 million

in June 2018 to a gain of $9.1 million in June 2019, a decrease in

loss of $18.3 million. The average CDN/US Dollar exchange rate in

the June 2019 quarter was 1.338 compared to an average of 1.291 in

the 2018 comparative quarter.

- Tax recovery went from $10.7 million in June 2018 to $4.0

million in June 2019, an increase in loss of $6.7 million.

Cash flow from continuing operations was $0.2

million in the June 2019 quarter compared to $0.8 million in the

2018 comparative quarter. Cash flow is a measure used by the

Company to evaluate its performance, however, it is not a term

recognized under IFRS. The Company believes cash flow is useful to

investors and it is one of the measures used by management to

assess the financial performance of the Company.

Capital expenditures attributed to continuing

operations was $0.6 million in the June 2019 quarter, down from

$3.4 million in the 2018 comparative quarter. The reduction was due

to placing Mount Polley on care and maintenance.

At June 30, 2019, the Company has not hedged any

copper, gold or CDN/US Dollar exchange. Quarterly revenues will

fluctuate depending on copper and gold prices, the CDN/US Dollar

exchange rate, and the timing of concentrate sales, which is

dependent on concentrate production and the availability and

scheduling of transportation.

OPERATIONS

Red Chris Mine(1)

Red Chris second quarter metal production was

17.60 million pounds copper and 7,580 ounces gold. Copper

production was up from the first quarter by 26%, while gold

production was down by 10%. Gold production was down on lower grade

as virtually all mill feed came from the Main zone, with less feed

coming from the mid pit area where gold grades are higher. Metal

recoveries were 76.20% copper and 42.56% gold, compared to 73.84%

copper and 48.06% gold achieved in the first quarter.

(1) The Red Chris Mine was classified as a discontinued

operation effective January 1, 2019 and the comparative period has

been restated accordingly.

|

|

Three Months Ended June 30 |

|

Six Months Ended June 30 |

|

|

2019 |

2018 |

|

2019 |

2018 |

| Ore milled - tonnes |

2,694,090 |

2,529,951 |

|

5,062,427 |

5,120,442 |

| Ore milled per calendar day –

tonnes |

29,605 |

27,802 |

|

27,969 |

28,290 |

| Grade % - copper |

0.389 |

0.283 |

|

0.366 |

0.366 |

| Grade g/t - gold |

0.206 |

0.241 |

|

0.216 |

0.276 |

| Recovery % - copper |

76.20 |

72.96 |

|

75.18 |

75.59 |

| Recovery % - gold |

42.56 |

43.94 |

|

45.27 |

45.89 |

| Copper – 000’s pounds |

17,599 |

11,510 |

|

30,700 |

31,235 |

| Gold – ounces |

7,580 |

8,614 |

|

15,897 |

20,829 |

| Silver

– ounces |

30,427 |

19,388 |

|

53,054 |

54,270 |

The Company is working to obtain the necessary

approvals and consents for the previously announced sale of a 70%

interest in the Red Chris project to Newcrest Mining Limited.

Several factors that contributed to a strong

production improvement in the quarter include:

- Improved primary haul truck fleet availability that enabled pit

production targets to be met and targeted copper and gold grades

were delivered.

- Unscheduled downtime was reduced substantially and a 91.6%

plant availability was achieved versus the 89.6% budgeted.

- During the quarter, tonnes per operating hour (TPOH) averaged

1,348, a 12.6% increase from the prior quarter’s average of 1,197

TPOH.

- With the better availability and processing rate, 2.694 million

tonnes were treated compared to 2.368 million tonnes in the

previous quarter, a 14% increase.

- Copper recovery improved and averaged 76.2% versus the previous

quarter’s average of 73.8%.

During the third quarter Red Chris management

plans to focus on:

- Maximizing throughput through optimization of the pebble

crusher and other debottlenecking initiatives to increase

throughput rates. These efforts are achieving the desired result;

for the first 20 days in July the plant treated an average of 1,454

TPOH, and on July 19, 2019 set a new record for daily throughput of

38,823 tonnes.

- Completion of the tailings dam construction using both Red

Chris equipment and personnel, and TNDC (a Tahltan construction

company).

- Confirm that installation of additional column cell residence

time would improve plant recoveries by completing a program of test

work using a recently installed pilot sized cleaning cell in the

circuit.

Subsequent to the quarter end, USW-Local 1937

was certified as bargaining agent for certain employees at the Red

Chris mine. This certification follows the reconsideration of a

previous decision by the Labour Relations Board. The company has

filed a petition seeking judicial review of the Labour Relations

Board's reconsideration decision.

Exploration, development and capital

expenditures were $11.7 million in the June 2019 quarter compared

to $12.1 million in the comparative 2018 quarter.

Mount Polley Mine

Mount Polley metal production for the two months

prior to the suspension of operations in late May 2019 was 1.52

million pounds copper and 4,472 ounces gold. Mill throughput from

the low grade stockpiles averaged 16,432 tonnes per calendar day

for April and May, and metal recoveries were 28.92% copper and

46.60% gold as low grade, oxidized stockpiles were treated.

|

|

Three Months Ended June 30 |

|

Six Months Ended June 30 |

|

|

2019* |

2018 |

|

2019* |

2018 |

| Ore milled - tonnes |

1,002,352 |

1,582,944 |

|

2,231,119 |

3,195,430 |

| Ore milled per calendar day –

tonnes |

16,432 |

17,395 |

|

14,776 |

17,654 |

| Grade % - copper |

0.238 |

0.180 |

|

0.229 |

0.190 |

| Grade g/t - gold |

0.298 |

0.261 |

|

0.283 |

0.291 |

| Recovery % - copper |

28.92 |

60.80 |

|

33.96 |

68.69 |

| Recovery % - gold |

46.60 |

68.64 |

|

52.33 |

71.48 |

| Copper – 000’s pounds |

1,520 |

3,819 |

|

3,825 |

9,191 |

| Gold – ounces |

4,472 |

9,110 |

|

10,619 |

21,390 |

| Silver

– ounces |

4,609 |

7,531 |

|

11,119 |

16,497 |

*production stated for period January 1-May 26,

2019

A care and maintenance team is in place to look

after the site and complete the final work on rehabilitation of

Hazeltine Creek during the suspension of operations. For the

quarter ended June 30, 2019, Mount Polley incurred idle mine costs

comprised of $0.8 million in operating costs and $0.5 million in

depreciation expense.

Exploration, development and capital

expenditures were $0.7 million in the June 2019 quarter compared to

$3.4 million in the comparative 2018 quarter.

Huckleberry Mine

Huckleberry continues to be on care and

maintenance. For the quarter ending June 30, 2019, Huckleberry

incurred idle mine costs comprised of $1.2 million in operating

costs and $0.2 million in depreciation expense.

EARNINGS AND CASH FLOW

During the first quarter of 2019, the Company

entered into an agreement for the sale of a 70% interest in the Red

Chris mine. The sale is expected to be completed in the third

quarter of 2019. As a result, this operation has been classified as

a discontinued operation effective January 1, 2019 and the

comparative periods have been restated.

Select Quarter Financial

Information

| Expressed in thousands, except

share and per share amounts |

Three Months Ended June 30 |

Six Months Ended June 30 |

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

|

Continuing operations: |

|

|

|

|

|

Total revenues |

$21,673 |

|

$22,791 |

|

$35,476 |

|

$58,818 |

|

|

Net loss |

$(9,677 |

) |

$(22,390 |

) |

$(12,014 |

) |

$(53,468 |

) |

|

Net loss per share |

$(0.08 |

) |

$(0.19 |

) |

$(0.10 |

) |

$(0.46 |

) |

|

Diluted loss per share |

$(0.08 |

) |

$(0.19 |

) |

$(0.10 |

) |

$(0.46 |

) |

|

Adjusted net loss (1) |

$(18,651 |

) |

$(13,658 |

) |

$(30,040 |

) |

$(33,324 |

) |

|

Adjusted net loss per share (1) |

$(0.15 |

) |

$(0.12 |

) |

$(0.23 |

) |

$(0.28 |

) |

|

Adjusted EBITDA(1) |

$(16 |

) |

$1,287 |

|

$(3,573 |

) |

$6,367 |

|

|

Cash flow (1)(2) |

$207 |

|

$843 |

|

$232 |

|

$5,520 |

|

|

Cash flow per share (1)(2) |

$0.00 |

|

$0.01 |

|

$0.00 |

|

$0.04 |

|

|

|

|

|

|

|

|

Discontinued operations: |

|

|

|

|

|

Total revenues |

$61,945 |

|

$57,275 |

|

$124,823 |

|

$139,160 |

|

|

Net income (loss) |

$2,227 |

|

$(14,165 |

) |

$2,296 |

|

$747 |

|

|

Net income (loss per) share |

$0.02 |

|

$(0.12 |

) |

$0.02 |

|

$0.01 |

|

|

Diluted income (loss) per share |

$0.02 |

|

$(0.12 |

) |

$0.02 |

|

$0.01 |

|

|

Adjusted net income (loss) (1) |

$1,968 |

|

$(14,165 |

) |

$1,743 |

|

$747 |

|

|

Adjusted net income (loss) per share (1) |

$0.02 |

|

$(0.12 |

) |

$0.02 |

|

$0.00 |

|

|

Adjusted EBITDA(1) |

$3,506 |

|

$(3,417 |

) |

$14,059 |

|

$27,845 |

|

|

Cash flow (1)(2) |

$3,260 |

|

$(3,436 |

) |

$13,520 |

|

$27,845 |

|

|

Cash flow per share (1)(2) |

$0.03 |

|

$(0.03 |

) |

$0.11 |

|

$0.24 |

|

|

|

|

|

|

|

|

Working capital deficiency (3) |

$744,682 |

|

$791,538 |

|

$744,682 |

|

$791,538 |

|

|

Total assets |

$1,591,256 |

|

$1,661,947 |

|

$1,591,256 |

|

$1,661,947 |

|

| Total debt (including current

portion) |

$887,932 |

|

$856,802 |

|

$887,932 |

|

$856,802 |

|

|

|

|

(1) Refer to table under heading Non-IFRS Financial Measures

in MD&A for further details. |

|

(2) Cash flow is defined as the cash flow from operations

before the net change in non-cash working capital balances, income

and mining taxes, and interest paid. Cash flow per share is

defined as cash flow divided by the weighted average number of

common shares outstanding during the year. |

|

(3) Excludes assets and liabilities held for sale. |

Select Items Affecting Net Loss (presented on

an after-tax basis)

| expressed in thousands |

Three Months Ended June 30 |

Six Months Ended June 30 |

|

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

| Net income (loss) before

undernoted items from continuing operations |

$(7,330 |

) |

$4,582 |

|

$(14,722 |

) |

$2,592 |

|

| Interest expense |

|

(13,184 |

) |

|

(18,281 |

) |

|

(26,607 |

) |

|

(36,094 |

) |

| Recovery of BC Mineral taxes

including interest |

|

1,863 |

|

|

- |

|

|

11,288 |

|

|

- |

|

| Gain on sale of Sterling |

|

- |

|

|

175 |

|

|

- |

|

|

175 |

|

| Foreign exchange gain (loss) on

debt |

|

8,974 |

|

|

(8,866 |

) |

|

18,026 |

|

|

(20,141 |

) |

|

Net loss from continuing operations |

$(9,677 |

) |

$(22,390 |

) |

$(12,014 |

) |

$(53,468 |

) |

NON-IFRS FINANCIAL MEASURES

The Company reports four non-IFRS financial

measures: adjusted net income, adjusted EBITDA, cash flow and cash

cost per pound of copper produced. The Company believes these

measures are useful to investors because they are included in the

measures that are used by management in assessing the financial

performance of the Company.

Adjusted net income, adjusted EBITDA, and cash

flow are not generally accepted earnings measures and should not be

considered as an alternative to net income (loss) and cash flows as

determined in accordance with IFRS. As there is no standardized

method of calculating these measures, these measures may not be

directly comparable to similarly titled measures used by other

companies.

Adjusted Net Loss and Adjusted Net Loss

per Share

Adjusted net loss from continuing operations in

the June 2019 quarter was $16.7 million ($0.13 per share) compared

to an adjusted net loss of $13.7 million ($0.12 per share) in the

2018 comparative quarter. Adjusted net loss reflects the financial

results excluding the effect of items not settling in the current

period and non-recurring items. Adjusted net loss is calculated by

removing the gains or losses, resulting from mark to market

revaluation of derivative instruments, net of tax, unrealized

foreign exchange gains or losses on non-current debt, net of tax

and other adjustments.

Adjusted EBITDA

Adjusted EBITDA from continuing operations in

the June 2019 quarter was a loss of $nil compared to a loss of $1.2

million in the 2018 comparative quarter. We define Adjusted EBITDA

as net income (loss) before interest expense, taxes, depletion and

depreciation, and as adjusted for certain other items.

Cash Flow and Cash Flow Per

Share

Cash flow in the June 2019 quarter from

continuing operations was $0.2 million compared to $1.0 million in

the 2018 comparative quarter. Cash flow per share was $0.00 in the

June 2019 quarter compared to $0.01 in the 2018 comparative

quarter.

Cash flow and cash flow per share are measures

used by the Company to evaluate its performance however they are

not terms recognized under IFRS. Cash flow is defined as cash flow

from operations before the net change in non-cash working capital

balances, income and mining taxes, and interest paid and cash flow

per share is the same measure divided by the weighted average

number of common shares outstanding during the year.

Cash Cost Per Pound of Copper

Produced

The cash cost per pound of copper produced is a

non-IFRS financial measure that does not have a standardized

meaning under IFRS, and as a result may not be comparable to

similar measures presented by other companies. Management uses this

non-IFRS financial measure to monitor operating costs and

profitability. The Company is primarily a copper producer and

therefore calculates this non-IFRS financial measure individually

for its three copper mines, Red Chris, Mount Polley and

Huckleberry, and on a composite basis for these mines.

The cash cost per pound of copper produced is

derived from the sum of cash production costs, transportation and

offsite costs, treatment and refining costs, royalties, net of

by-product and other revenues, divided by the number of pounds of

copper produced during the period.

Variations from period to period in the cash

cost per pound of copper produced are the result of many factors

including: grade, metal recoveries, amount of stripping charged to

operations, mine and mill operating conditions, labour and other

cost inputs, transportation and warehousing costs, treatment and

refining costs, the amount of by-product and other revenues, the

US$ to CDN$ exchange rate and the amount of copper produced. Idle

mine costs during the periods when the Huckleberry and Mount Polley

mines were not in operation have been excluded from the cash cost

per pound of copper produced.

|

Cash Cost Per Pound of Copper Produced expressed in thousands,

except cash cost per pound of copper produced |

|

|

Three Months Ended June 30, 2019 |

|

|

Red Chris* |

Mount Polley** |

Composite |

|

Cash cost of copper produced in US$ |

$44,772 |

$2,675 |

$47,238 |

|

Copper produced – pounds |

17,599 |

1,520 |

19,119 |

|

Cash cost per lb copper produced in US$ |

$2.54 |

$1.76 |

$2.47 |

|

|

Three Months Ended June 30, 2018 |

|

|

Red Chris* |

Mount Polley** |

Composite |

|

Cash cost of copper produced in US$ |

$36,119 |

$4,763 |

$40,882 |

|

Copper produced – pounds |

11,510 |

3,819 |

15,329 |

|

Cash cost per lb copper produced in US$ |

$3.14 |

$1.25 |

$2.67 |

|

|

Six Months Ended June 30, 2019 |

|

|

Red Chris* |

Mount Polley** |

Composite |

|

Cash cost of copper produced in US$ |

$79,942 |

$12,429 |

$92,352 |

|

Copper produced – pounds |

30,700 |

3,825 |

34,525 |

|

Cash cost per lb copper produced in US$ |

$2.60 |

$3.25 |

$2.67 |

|

|

Six Months Ended June 30, 2018 |

|

|

Red Chris* |

Mount Polley** |

Composite |

|

Cash cost of copper produced in US$ |

$70,415 |

$12,198 |

$82,614 |

|

Copper produced – pounds |

31,235 |

9,191 |

40,426 |

|

Cash cost per lb copper produced in US$ |

$2.25 |

$1.33 |

$2.04 |

* The Red Chris Mine was classified as a

discontinued operation effective January 1, 2019 and prior periods

have been restated.** The Mount Polley Mine is a continuing

operation. The mine was placed on care and maintenance on May 26,

2019.

For detailed information, refer to Imperial’s 2019 Second

Quarter Report available on imperialmetals.com and sedar.com.

About Imperial

Imperial is a Vancouver based exploration, mine

development and operating company. The Company, through its

subsidiaries, owns the Red Chris, Mount Polley and Huckleberry

copper mines in British Columbia. Imperial also holds a 50%

interest in the Ruddock Creek lead/zinc property. In March 2019,

Imperial announced an agreement with Newcrest Mining Limited to

sell a 70% interest in Red Chris to Newcrest, for US$806.5 million,

while retaining a 30% interest in the mine. The Company and

Newcrest will form a joint venture for the operation of the Red

Chris mine going forward, with Newcrest acting as the operator.

Company Contacts

Brian Kynoch | President |

604.669.8959Andre Deepwell | Chief Financial

Officer | 604.488.2666Sabine Goetz

| Shareholder Communications |

604.488.2657 | investor@imperialmetals.com

FORWARD-LOOKING STATEMENTS & RISKS

NOTICE

The information in this news release provides a

summary review of the Company’s operations and financial position

as at and for the quarter ended June 30, 2019, and plans for the

future based on facts and circumstances as of August 14, 2019.

Except for statements of historical fact relating to the Company,

certain information contained herein constitutes forward-looking

information which are prospective in nature and reflect the current

views and/or expectations of Imperial. Often, but not always,

forward-looking information can be identified by the use of

statements such as "plans", "expects" or "does not expect", "is

expected", "scheduled", "estimates", "forecasts", "projects",

"intends", "anticipates" or "does not anticipate", or "believes",

or variations of such words and phrases or statements that certain

actions, events or results "may", "could", "should", "would",

"might" or "will" be taken, occur or be achieved. Such information

in this document includes, without limitation, statements

regarding: expectations that the agreement to sell a 70% interest

in the Company’s Red Chris mine to Newcrest will successfully close

resulting in the joint venture between the parties for the

operation of the Red Chris asset going forward, with Newcrest

acting as operator and the timing thereof; expectations regarding

the care and maintenance activities at Mount Polley; expectations

regarding debottlenecking initiatives, tailings dam construction

and test work programs at Red Chris; production and marketing;

capital expenditures; adequacy of funds for projects and

liabilities; the receipt of necessary regulatory permits, approvals

or other consents; outcome and impact of litigation; cash flow;

working capital requirements; the requirement for additional

capital; results of operations, production, revenue, margins and

earnings; future prices of copper and gold; future foreign currency

exchange rates and impact; future accounting changes; and future

prices for marketable securities.

Forward-looking information is not based on

historical facts, but rather on then current expectations, beliefs,

assumptions, estimates and forecasts about the business and the

industry and markets in which the Company operates, including, but

not limited to, assumptions that: the agreement to sell a 70%

interest in the Company’s Red Chris mine to Newcrest will

successfully close within necessary time frames, enabling the

Company to satisfy its debt obligations and repay its credit

facilities as they become due; the Company will have access to

capital as required and will be able to fulfill its funding

obligations as the Red Chris minority joint venture partner; the

Company will be able to advance and complete remaining planned

rehabilitation activities within expected timeframes; there will be

no significant delay or other material impact on the expected

timeframes or costs for completion of rehabilitation of the Mount

Polley mine and implementation of Mount Polley’s long term water

management plan; the Company’s initial rehabilitation activities at

Mount Polley will be successful in the long term; all required

permits, approvals and arrangements to proceed with planned

rehabilitation and Mount Polley’s long term water management plan

will be obtained in a timely manner; there will be no material

operational delays at the Red Chris mine; equipment will operate as

expected; there will not be significant power outages; there will

be no material adverse change in the market price of commodities

and exchange rates; the Red Chris mine will achieve expected

production outcomes (including with respect to mined grades and

mill recoveries and access to water as needed). Such statements are

qualified in their entirety by the inherent risks and uncertainties

surrounding future expectations. We can give no assurance that the

forward-looking information will prove to be accurate.

Forward-looking information involves known and

unknown risks, uncertainties and other factors which may cause

Imperial’s actual results, revenues, performance or achievements to

be materially different from any future results, performance or

achievements expressed or implied by the statements constituting

forward-looking information. Important risks that could cause

Imperial’s actual results, revenues, performance or achievements to

differ materially from Imperial’s expectations include, among other

things: the risk that the agreement to sell a 70% interest in the

Company’s Red Chris mine to Newcrest will not successfully close

within necessary time frames, jeopardizing the Company’s ability to

satisfy its debt obligations and repay its credit facilities as

they become due, and undermining the Company’s ability to continue

as a going concern; the risk that the Company’s ownership of the

Red Chris mine may be diluted over time should it not have access

to capital as required and will not be able to meet its funding

obligations as the Red Chris minority joint venture partner; that

additional financing that may be required may not be available to

Imperial on terms acceptable to Imperial or at all; uncertainty

regarding the outcome of sample testing and analysis being

conducted on the area affected by the Mount Polley Breach; risks

relating to the timely receipt of necessary approvals and consents

to proceed with the rehabilitation plan and Mount Polley’s long

term water management plan; risks relating to the remaining costs

and liabilities and any unforeseen longer-term environmental

consequences arising from the Mount Polley Breach; uncertainty as

to actual timing of completion of rehabilitation activities and the

implementation of Mount Polley’s long term water management plan;

risks relating to the impact of the Mount Polley Breach on

Imperial’s reputation; the quantum of claims, fines and penalties

that may become payable by Imperial and the risk that current

sources of funds are insufficient to fund liabilities; risks that

Imperial will be unsuccessful in defending against any legal claims

or potential litigation; risks of protesting activity and other

civil disobedience restricting access to the Company’s properties;

failure of plant, equipment or processes to operate in accordance

with specifications or expectations; cost escalation,

unavailability of materials and equipment, labour unrest, power

outages, and natural phenomena such as weather conditions and water

shortages negatively impacting the operation of the Red Chris mine;

changes in commodity and power prices; changes in market demand for

our concentrate; inaccurate geological and metallurgical

assumptions (including with respect to the size, grade and

recoverability of mineral reserves and resources); and other

hazards and risks disclosed within the MD&A for the three and

six months ended June 30, 2019 and other public filings, available

on Imperial’s profile at sedar.com. For the reasons set forth

above, investors should not place undue reliance on forward-looking

information. Imperial does not undertake to update any

forward-looking information, except in accordance with applicable

securities laws.

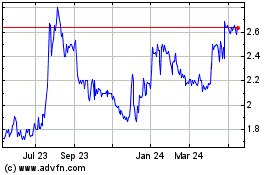

Imperial Metals (TSX:III)

Historical Stock Chart

From Oct 2024 to Nov 2024

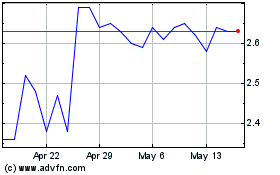

Imperial Metals (TSX:III)

Historical Stock Chart

From Nov 2023 to Nov 2024