Imperial Reports Production for Second Quarter 2024

25 July 2024 - 7:52AM

Imperial Metals Corporation (“Imperial” or the

“Company”) (TSX:III) reports quarterly copper and gold production

from the Mount Polley and Red Chris mines. Imperial’s production

for the second quarter was 15.501 million pounds copper and 13,768

ounces gold, of which 9.281 million pounds copper and 10,009 ounces

gold were produced at Mount Polley and 6.219 million pounds copper

and 3,759 ounces gold from Imperial’s 30% share of Red Chris mine

production. Copper production was up 26% from the 12.353 million

pounds copper produced in the first quarter 2024 and gold

production was up 7% from the 12,861 ounces gold produced in the

first quarter 2024.

Mount Polley Mine

Mount Polley metal production for the second

quarter of 2024 was 9.281 million pounds copper and 10,009 ounces

gold, compared to 7.355 million pounds copper and 10,009 ounces

gold produced during the first quarter of 2024.

Mill throughput in the second quarter 2024 was

up 3%, with 1.714 million tonnes being treated compared with 1.671

million tonnes treated in the first quarter of 2024. Copper

production in the second quarter of 2024 was up by 26% largely on

higher grade of 0.294% copper versus 0.251% copper in the first

quarter of 2024. Gold production was the same for each of the first

and second quarters of 2024.

For the first six months of 2024, copper

production was up 21% compared to the same period last year with

20% increase in throughput while gold production was down 1%, with

lower gold grades and recovery offsetting the higher

throughput.

|

Mount Polley mine production |

Three Months Ended June 30 |

|

Six Months Ended June 30 |

|

|

2024 |

2023 |

|

2024 |

2023 |

|

Ore milled - tonnes |

1,714,330 |

1,430,842 |

|

3,385,835 |

2,820,478 |

| Ore milled per calendar day -

tonnes |

18,839 |

15,724 |

|

18,603 |

15,583 |

| Grade % - copper |

0.294 |

0.280 |

|

0.273 |

0.275 |

| Grade g/t - gold |

0.263 |

0.324 |

|

0.272 |

0.318 |

| Recovery % - copper |

83.4 |

79.9 |

|

81.6 |

80.5 |

| Recovery % - gold |

69.2 |

68.3 |

|

67.6 |

69.8 |

| Copper - 000’s pounds |

9,281 |

7,063 |

|

16,637 |

13,741 |

| Gold -

ounces |

10,009 |

10,185 |

|

20,018 |

20,165 |

Tailings removal from the Springer Pit was

completed in May 2024. Stripping for Phase 5 pushback of the

Springer Pit continued, with most of the non-acid generating rock

from this pushback being delivered to the tailings dam for buttress

construction.

Red Chris Mine

Red Chris production (100%) for the second

quarter of 2024 was 20.731 million pounds copper and 12,531 ounces

gold compared to 16.660 million pounds copper and 9,507 ounces gold

during the first quarter of 2024.

In the second quarter of 2024, Red Chris copper

production was up 24% compared to the first quarter of 2024. The

increase in copper production was a result of an 8% increase in

copper grade (0.47% vs 0.43%) and a 19% increase in throughput

(27,357 tpd vs. 23,081 tpd). Gold production in the second quarter

of 2024 was up 32% (12,531 oz vs 9,507 oz) from the first quarter

of 2024 as result of the increased gold grades (0.30 g/t gold vs

0.26 g/t gold) and higher throughput.

For the first six months of 2024, copper

production was up 48% compared to the same period last year on

higher copper grades and gold production was down 9% on lower gold

grades.

|

100% Red Chris mine production |

Three Months Ended June 30 |

|

Six Months Ended June 30 |

|

|

2024 |

2023 |

|

2024 |

2023 |

|

Ore milled - tonnes |

2,489,532 |

2,357,656 |

|

4,589,886 |

4,448,428 |

| Ore milled per calendar day -

tonnes |

27,357 |

25,908 |

|

25,219 |

24,577 |

| Grade % - copper |

0.466 |

0.348 |

|

0.450 |

0.337 |

| Grade g/t - gold |

0.302 |

0.343 |

|

0.284 |

0.328 |

| Recovery % - copper |

81.1 |

75.9 |

|

82.1 |

76.6 |

| Recovery % - gold |

51.8 |

52.6 |

|

52.6 |

51.5 |

| Copper - 000’s pounds |

20,731 |

13,729 |

|

37,392 |

25,319 |

| Gold -

ounces |

12,531 |

13,680 |

|

22,038 |

24,176 |

The technical and scientific information related

to the Company’s mineral projects has been reviewed and approved by

Brian Kynoch, P.Eng., President of Imperial Metals, the designated

Qualified Person as defined by National Instrument 43-101.

About Imperial

Imperial is a Vancouver based exploration, mine

development and operating company with holdings that include the

Mount Polley mine (100%), the Huckleberry mine (100%), and the Red

Chris mine (30%). Imperial also holds a portfolio of 23 greenfield

exploration properties in British Columbia.

Company Contacts

Brian Kynoch | President |

604.669.8959Darb S. Dhillon | Chief Financial

Officer | 604.669.8959

Cautionary Note Regarding

Forward-Looking Statements

Certain information contained in this news

release are not statements of historical fact and are

“forward-looking” statements. Forward-looking statements relate to

future events or future performance and reflect Imperial

management’s expectations or beliefs regarding future events and

include, but are not limited to, statements regarding Imperial’s

expectations and timing with respect to copper and gold production

from the Mount Polley and Red Chris mines; and Imperial’s current

and planned exploration drilling programs.

In certain cases, forward-looking statements can

be identified by the use of words such as "plans", "expects" or

"does not expect", "is expected", "outlook", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates" or "does not

anticipate", or "believes", or variations of such words and phrases

or statements that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved" or the negative of these terms or comparable terminology.

By their very nature forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of Imperial to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements.

In making the forward-looking statements in this

news release, Imperial has applied certain factors and assumptions

that are based on information currently available to Imperial as

well as Imperial’s current beliefs and assumptions. These factors

and assumptions and beliefs and assumptions include, the risk

factors detailed from time to time in Imperial’s interim and annual

financial statements and management’s discussion and analysis of

those statements, all of which are filed and available for review

on SEDAR+ at www.sedarplus.ca. Although Imperial has attempted to

identify important factors that could cause actual actions, events

or results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, imperialmetals.com events or results not to be as

anticipated, estimated or intended, many of which are beyond

Imperial’s ability to control or predict. There can be no assurance

that forward-looking statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements and all

forward-looking statements in this news release are qualified by

these cautionary statements.

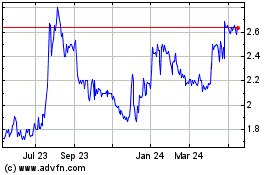

Imperial Metals (TSX:III)

Historical Stock Chart

From Feb 2025 to Mar 2025

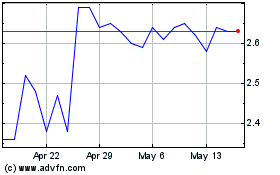

Imperial Metals (TSX:III)

Historical Stock Chart

From Mar 2024 to Mar 2025