Imperial Metals Corporation (the “Company”)

(TSX:III) reports financial results for its fiscal year ended

December 31, 2023.

| Select Annual

Financial Information |

Year Ended December 31 |

|

|

expressed in thousands, except share and per share amounts |

2023 |

|

2022 |

|

2021 |

|

|

Operations: |

|

|

|

|

Total revenues |

$344,455 |

|

$172,797 |

|

$133,591 |

|

|

Net loss |

$(36,715 |

) |

$(75,975 |

) |

$(26,070 |

) |

|

Net loss per share |

$(0.23 |

) |

$(0.51 |

) |

$(0.19 |

) |

|

Diluted loss per share |

$(0.23 |

) |

$(0.51 |

) |

$(0.19 |

) |

|

Adjusted net loss(1) |

$(36,092 |

) |

$(95,598 |

) |

$(23,181 |

) |

|

Adjusted net loss per share(1) |

$(0.23 |

) |

$(0.64 |

) |

$(0.17 |

) |

|

Adjusted EBITDA(1) |

$24,876 |

|

$(63,131 |

) |

$11,553 |

|

|

Cash earnings(1)(2) |

$23,557 |

|

$(52,873 |

) |

$11,034 |

|

|

Cash earnings per share(1)(2) |

$0.15 |

|

$(0.36 |

) |

$0.08 |

|

|

Working capital deficiency |

$(167,597 |

) |

$(65,091 |

) |

$(19,060 |

) |

|

Total assets |

$1,411,990 |

|

$1,299,702 |

|

$1,186,341 |

|

|

Total debt (including current portion)(3) |

$319,787 |

|

$197,788 |

|

$34,975 |

|

|

|

|

|

|

|

|

|

|

(1) Refer to table in section Non-IFRS Financial Measures of the

December 31, 2023 Management’s Discussion & Analysis for

further details. |

|

(2) Cash earnings is defined as the cash flow from operations

before the net change in non-cash working capital balances, income

and mining taxes, and interest paid. Cash earnings per share is

defined as cash earnings divided by the weighted average number of

common shares outstanding during the year. |

|

(3) Total debt consists of banker’s acceptances, debentures,

advanced development loan, and equipment loans and leases. |

| Select

Items Affecting Net Loss |

| presented on an after-tax

basis |

Year Ended December 31 |

|

|

|

2023 |

|

2022 |

|

2021 |

|

| |

(000’s) |

|

(000’s) |

|

(000’s) |

|

| Net loss before undernoted

items |

$(5,429 |

) |

$(67,063 |

) |

$(24,337 |

) |

|

Interest expense |

(31,332 |

) |

(8,921 |

) |

(1,497 |

) |

|

Foreign exchange gain (loss) on debt |

46 |

|

9 |

|

(236 |

) |

| Net Loss |

$(36,715 |

) |

$(75,975 |

) |

$(26,070 |

) |

| |

|

|

|

|

|

|

Total revenue increased to $344.5 million in

2023 compared to $172.8 million in 2022, an increase of $171.7

million or 99%.

Revenue from the Mount Polley mine in 2023 was

$233.3 million compared to $42.7 million in 2022, an increase of

$190.6 million. In 2023, the Mount Polley mine had 5.7 concentrate

shipments (2022-1.0 concentrate shipments). Mount Polley restarted

its operations in late June of 2022.

Revenue from the Red Chris mine in 2023 was

$109.8 million compared to $129.5 million in 2022, a decrease of

$19.7 million. In 2023, the Red Chris mine (100% basis) had 12.4

concentrate shipments (2022-14.6 concentrate shipments).

Variations in revenue are impacted by the

restart of operations, the timing and quantity of concentrate

shipments, metal prices and exchange rates, and period end

revaluations of revenue attributed to concentrate shipments where

copper and gold prices will settle at a future date.

The London Metals Exchange cash settlement

copper price per pound averaged US$3.85 in 2023 compared to US$4.00

in 2022. London Bullion Market Association, London gold price per

troy ounce averaged US$1,943 in 2023 compared to US$1,801 in 2022.

The average US/CDN dollar exchange rate in 2023 was 1.350 compared

to an average of 1.302 in 2022. In CDN dollar terms, the average

copper price in 2023 was CDN$5.19 per pound compared to CDN$5.21

per pound in 2022, and the average gold price in 2023 was CDN$2,622

per ounce compared to CDN$2,345 per ounce in 2022.

Revenue in 2023 decreased by a $7.6 million

negative revenue revaluation compared to a negative revenue

revaluation of $4.9 million in 2022. Revenue revaluations are the

result of the metal price on the settlement date and/or the current

period balance sheet date being higher or lower than when the

revenue was initially recorded or the metal price at the last

balance sheet date and finalization of contained metal as a result

of final assays and weights.

Net loss in 2023 was $36.7 million ($0.23 per

share) compared to net loss of $75.9 million ($0.51 per share) in

2022. The majority of the decrease in net loss of $38.8 million was

primarily due to the following factors:

- loss from mine operations reduced

to $13.7 million in 2023 from loss of $28.7 million in 2022, a

decrease in net loss of $15.0 million;

- mine restart costs went from $64.9

million in 2022 to $Nil in 2023, a decrease in net loss of $64.9

million, which was slightly offset by the increase of $2.2 million

in idle mine cost from $6.5 million in 2022 to $8.7 million in

2023;

- net gain on disposal of mineral

properties decreased by $17.8 million from $16.9 million in 2022 to

a loss of $0.9 million in 2023; and

- interest expense of $8.9 million in

2022 increased to $31.3 million in 2023, an increase of $22.4

million as a result of additional financing required to support

working capital and capital expenditures in 2023 at the Company’s

operating mines.

Capital expenditures including finance leases

were $137.3 million in 2023, down from $150.0 million in 2022.

Expenditures in 2023 included:

- $44.9 million in

exploration, an increase of $3.5 million in comparison to 2022 of

$41.4 million;

- $36.6 million for

tailings dam construction, a decrease of $0.1 million in comparison

to 2022 of $36.7 million;

- $12.6 million on

stripping costs, a decrease of $11.2 million in comparison to 2022

of $23.8 million; and

- investment in other

plant and equipment of $43.2 million, a decrease of $4.9 million in

comparison to 2022 of $48.1 million.

At December 31, 2023, the Company had $24.9 million in cash

compared to $27.5 million at December 31, 2022.

At December 31, 2023, the Company had not hedged

any copper, gold or US/CDN Dollar exchange. Revenues will fluctuate

depending on copper and gold prices, the US/CDN Dollar exchange

rate, and the timing of concentrate sales, which is dependent on

concentrate production and the availability and scheduling of

transportation.

NON-IFRS FINANCIAL MEASURES

The Company reports on four non-IFRS financial

measures: adjusted net loss, adjusted EBITDA, cash earnings and

cash cost per pound of copper produced, which are described in

detail below. The Company believes these measures are useful to

investors because they are included in the measures that are used

by management in assessing the financial performance of the

Company.

Adjusted net loss, adjusted EBITDA, cash

earnings and cash cost per pound of copper are not standardized

financial measures under IFRS and might not be comparable to

similar financial measures disclosed by other issuers.

Adjusted Net Loss and Adjusted Net Loss

Per Share

Adjusted net loss is derived from operating net

loss by removing the gains or loss, resulting from acquisition and

disposal of property, mark to market revaluation of derivative

instruments not related to the current period, net of tax,

unrealized foreign exchange gains or losses on long term debt, net

of tax and other non-recurring items. Adjusted net loss in 2023 was

$36.1 million ($0.23 per share) compared to an adjusted net loss of

$95.6 million ($0.64 per share) in 2022. We believe that the

presentation of Adjusted Net Loss helps investors better understand

the results of our normal operating activities and the ongoing cash

generating potential of our business.

Adjusted EBITDA

Adjusted EBITDA in 2023 was $24.9 million

compared to $(63.1) million in 2022. We define Adjusted EBITDA as

net loss before interest expense, taxes, depletion, and

depreciation, and as adjusted for certain other items.

Cash Earnings and Cash Earnings Per

Share

Cash earnings in 2023 was $23.6 million compared

to $(52.9) million in 2022. Cash earnings per share were $0.15 in

2023 compared to $(0.36) in 2022.

Cash earnings and cash earnings per share are

measures used by the Company to evaluate its performance; however,

they are not terms recognized under IFRS. We believe that the

presentation of cash earnings and cash earnings per share is

appropriate to provide additional information to investors about

how well the Company can earn cash to pay its debts and manage its

operating expenses and investment. Cash earnings is defined as cash

flow from operations before the net change in non-cash working

capital balances, income and mining taxes paid, and interest paid.

Cash earnings per share is the same measure divided by the weighted

average number of common shares outstanding during the year.

Cash Cost Per Pound of Copper Produced

Management uses this non-IFRS financial measure

to monitor operating costs and profitability. The Company is

primarily a copper producer and therefore calculates this non-IFRS

financial measure individually for its two operating copper mines,

Red Chris (30% share) and Mount Polley, and on a composite basis

for these mines.

Variations from period to period in the cash

cost per pound of copper produced are the result of many factors

including: grade, metal recoveries, amount of stripping charged to

operations, mine and mill operating conditions, labour and other

cost inputs, transportation and warehousing costs, treatment and

refining costs, the amount of by-product and other revenues, the

US$ to CDN$ exchange rate and the amount of copper produced.

Idle mine and mine restart costs during the

periods when the Huckleberry and Mount Polley mines are not in

operation have been excluded from the cash cost per pound of copper

produced.

|

Calculation of Cash Cost Per Pound of Copper Produced |

|

|

|

expressed in thousands of dollars, except cash cost per pound of

copper produced |

|

Year Ended December 31, 2023 |

|

|

|

Red Chris |

Mount Polley |

Composite |

|

|

Cash cost of copper produced in US$ |

$74,324 |

$64,144 |

$138,468 |

|

|

Copper produced – 000’s pounds |

17,116 |

30,146 |

47,262 |

|

|

Cash cost per lb copper produced in US$ |

$4.34 |

$2.13 |

$2.93 |

|

|

|

|

|

|

|

expressed in thousands of dollars, except cash cost per pound of

copper produced |

|

Year Ended December 31, 2022 |

|

| |

Red Chris |

Mount Polley(1) |

Composite |

|

|

Cash cost of copper produced in US$ |

$52,128 |

$33,891 |

$86,019 |

|

|

Copper produced – 000’s pounds |

20,281 |

6,206 |

26,487 |

|

|

Cash cost per lb copper produced in US$ |

$2.57 |

$5.46 |

$3.25 |

|

|

|

|

|

|

|

|

(1) Mount Polley mine operations were suspended in May

2019 and restarted in late June 2022. |

|

|

|

|

|

|

|

OPERATIONS

Mount Polley Mine

Q4 2023 vs Q3 2023

Mount Polley metal production for the fourth

quarter of 2023 was 8,347,900 pounds copper and 10,349 ounces gold,

compared to 8,056,570 pounds copper and 11,321 ounces gold produced

during the third quarter of 2023. Metal production increased by

3.6% for copper due to higher copper grades (0.302% copper,

increase of 3.0%) and dropped by 8.6% for gold due to lower gold

grades (0.286 g/t, decrease of 11.0%). During the fourth quarter of

2023, the throughput averaged 17,038 tonnes per day compared to

16,959 tonnes per day, copper recovery was 79.9% compared to 79.5%

and gold recovery was 71.8% compared to 70.1% in the third quarter

of 2023.

Mining of tailings from the Springer Pit

continued with 2.67 million cubic meters removed by December 31,

2023, representing about 80.0% of the total tailings required to be

removed since the removal of tailings began on May 8, 2023. The

tailings being removed are being dry stacked atop the Southeast

Rock Dump. The initial stripping of Springer Phase 5 pit began in

February 2024.

Year 2023 vs Year 2022

During the year ended December 31, 2023, the

total amount of 5,948,239 tonnes of ore were processed. Metal

production was 30,145,400 pounds of copper and 41,834 ounces of

gold. Copper recovery averaged 80.0% and gold recovery was 70.4%

from grades averaging 0.287% copper and 0.311 g/t gold.

|

|

Three Months Ended December 31 |

Year Ended December 31 |

|

|

|

2023 |

2022 |

2023 |

2022(1) |

|

|

Ore milled - tonnes |

1,567,491 |

1,084,016 |

5,948,239 |

2,068,830 |

|

| Ore milled per calendar day -

tonnes |

17,038 |

11,783 |

16,297 |

11,244 |

|

| Grade % - copper |

0.302 |

0.230 |

0.287 |

0.214 |

|

| Grade g/t - gold |

0.286 |

0.325 |

0.311 |

0.306 |

|

| Recovery % - copper |

79.9 |

68.9 |

80.0 |

63.5 |

|

| Recovery % - gold |

71.8 |

61.8 |

70.4 |

59.4 |

|

| Copper - 000’s pounds |

8,348 |

3,786 |

30,145 |

6,206 |

|

| Gold -

ounces |

10,349 |

6,995 |

41,834 |

12,078 |

|

| |

|

|

|

|

|

| (1) Mount Polley mine operations were suspended in

May 2019 and restarted in late June 2022. |

| |

|

|

|

|

|

Exploration, development, and capital

expenditures in 2023 were $35.5 million compared to $28.5 million

in the 2022 comparative year.

The 2024 production target for Mount Polley is

30.0-33.0 million pounds copper and 35,000-40,000 ounces gold.

Red Chris Mine

Q4 2023 vs Q3 2023

Red Chris production (100%) for the 2023 fourth

quarter was 17,979,508 pounds copper, an increase of 31.0% compared

to 13,753,075 pounds copper produced in the third quarter of 2023

and 11,822 ounces gold, an increase of 18.0% compared to the 10,048

ounces gold in the third quarter of 2023. Metal production

increased for both copper and gold due to higher grades, better

recoveries and increased throughput.

Year 2023 vs Year 2022

Red Chris metal production (100% basis) for 2023

was 57,051,467 pounds copper and 46,046 ounces gold, a decrease of

15.6% and 27.7% respectively from 67,604,485 pounds copper and

63,658 ounces gold produced in 2022. The decrease of metal

production in 2023 was due to lower grades, lower gold recovery

partially offset by higher copper recovery.

Imperial’s 30% portion of Red Chris mine for

2023 was 17,115,440 pounds copper and 13,814 ounces gold.

Newmont Mining Corporation (“Newmont”) guidance

for Red Chris mine production (100%) is 85.0 million pounds of

copper and 57,000 ounces of gold for the calendar year 2024.

|

100% Red Chris mine production |

Three Months Ended December 31 |

Year Ended December 31 |

|

|

|

2023 |

2022 |

2023 |

2022 |

|

|

Ore milled - tonnes |

2,529,481 |

2,390,084 |

9,266,769 |

9,457,303 |

|

| Ore milled per calendar day -

tonnes |

27,494 |

25,979 |

25,388 |

25,910 |

|

| Grade % - copper |

0.398 |

0.339 |

0.356 |

0.421 |

|

| Grade g/t - gold |

0.269 |

0.386 |

0.295 |

0.382 |

|

| Recovery % - copper |

81.08 |

73.4 |

78.5 |

77.0 |

|

| Recovery % - gold |

54.1 |

49.0 |

52.4 |

54.8 |

|

| Copper - 000’s pounds |

17,980 |

13,107 |

57,051 |

67,604 |

|

| Gold -

ounces |

11,822 |

14,518 |

46,046 |

63,658 |

|

| |

|

|

|

|

|

Imperial’s 30% share of exploration,

development, and capital expenditures was $100.3 million in 2023

compared to $118.2 million in the 2022 comparative year.

Block Cave Feasibility Study

At Red Chris, progress towards block cave mining

is advancing with the exploration decline at 3,958 metres and the

conveyor decline at 957 metres as of December 31, 2023. Newmont

plans to provide a schedule for the completion of the feasibility

study for the East Zone block cave project (the “Block Cave

Feasibility Study”) and an update of the Red Chris Mineral

Resources estimate that includes the drilling in the East Ridge in

2023, which will provide further clarity on the size and scale of

this prospect.

The exploration program continued at Red Chris

with a total of 30,910 meters drilled in 2023. The recent focus has

been on infill drilling in the East Zone from underground.

Huckleberry Mine

Huckleberry operations ceased in August 2016 and

the mine remains on care and maintenance status.

Site personnel continue to focus on maintaining

site access, water management, maintenance of site infrastructure

and equipment, and mine permit compliance. Work is also planned in

2024 to investigate and update the tailings facility design for

Huckleberry.

In 2023, Huckleberry incurred idle mine costs

comprised of $7.7 million in operating costs and $1.0 million in

depreciation expense, which is an increase from $5.6 million in

operating costs and $0.8 million in depreciation in comparison to

2022.

Exploration, development, and capital

expenditures in 2023 were $0.7 million compared to $2.8 million in

2022.

MINE SITE EXPLORATION

Mount Polley Mine

In early 2023, two phases of diamond drilling

were completed at Mount Polley Mine in an underexplored area

between the Springer and Cariboo mineralized zones. The first phase

consisted of five drill holes totaling 2,720 metres and the second

phase consisted of 10 drill holes totaling 2,885 metres, for a

total of 5,605 metres of diamond drilling in this area. Drilling is

planned for early 2024 to follow up on the successful drill program

conducted at Mount Polley in 2023.

The results of the 2023 program included some

higher-grade intervals highlighted by the 162.5 metre interval

grading 0.5% copper and 0.52 g/t gold from 30 metres in SD-23-167.

The Springer zone contains most of the reserves in the current mine

plan. Historic drilling in the Springer zone confirms that the

mineralization continues 250 metres below the currently planned

Springer Pit and that it is open to the east.

Huckleberry Mine

In early 2023, samples from the 2022 rock

sampling program received hyperspectral analysis and

interpretation, which helped generate 2023 drilling targets.

In late summer of 2023, a diamond drilling and

rock sampling program was conducted on the Huckleberry Property.

Five drill holes totaling 2,031 metres were completed at Whiting

Creek, which is located about 8 kilometres north of Huckleberry

Mine, and 44 rock samples were collected across three zones on the

property. This program continued to test geophysical and

geochemical anomalies that were generated from work completed from

2021-2023.

In the fall of 2023, all five drill collars and

an additional 15 historic drill collars were surveyed using a

Trimble Base Station and Rover RTK system to improve the location

accuracy.

While historic drill holes in the Creek Zone

intersected copper and molybdenum within the Whiting Creek Stock,

intercepts from 2023 drilling confirmed that the surrounding

altered volcanics can host significant mineralization. This is an

important discovery as the highest copper concentrations and the

majority of production at the Huckleberry mine has come from the

altered contact volcanics. Additionally, intercepts from hole

CW-23-01B identified a chalcocite enriched zone in the upper

fractured rock and has expanded known copper mineralization 450

metres to the west. The 2023 drill results include an intercept of

52.6 metres grading 0.45% copper and 1.29 g/t silver starting from

the top of bedrock at a depth of 67.4 metres.

TECHNICAL INFORMATION

The technical and scientific information related

to the Company’s mineral projects has been reviewed and approved by

Brian Kynoch, P.Eng., President of Imperial Metals, and is a

designated Qualified Person as defined by NI 43-101.

Jim Miller-Tait, P.Geo. Vice President

Exploration with Imperial Metals, is the designated Qualified

Person as defined by National Instrument 43-101 for Red Chris,

Mount Polley and Huckleberry mines exploration programs.

FOURTH QUARTER RESULTS FROM

OPERATIONS

Revenue in the fourth quarter of 2023 was $87.6

million compared to $61.6 million in 2022. Sales revenue is

recorded when title for concentrate is transferred on ship loading.

Variations in revenue are impacted by the timing and quantity of

concentrate shipments, metal prices and exchange rates, and period

end revaluations of revenue attributed to concentrate shipments

where copper and gold prices will settle at a future date along

with finalization of contained metals as a result of final

assays.

The Company recorded a net loss of $10.5 million

($0.06 per share) in the fourth quarter of 2023 compared to net

loss of $11.8 million ($0.08 per share) in the prior year

quarter.

Expenditures for exploration and ongoing capital

projects at Mount Polley, Red Chris and Huckleberry totalled $30.7

million during the three months ended December 31, 2023, compared

to $37.5 million in the 2022 comparative quarter.

OUTLOOK

Corporate and Operations

At December 31, 2023, the Company had not hedged

any copper, gold, or US$/CDN$ exchange. Quarterly revenues will

fluctuate depending on copper and gold prices, the US$/CDN$

exchange rate, and the timing of concentrate sales, which is

dependent on concentrate production and the availability and

scheduling of transportation.

Newmont guidance for Red Chris mine production

(100%) is 85.0 million pounds of copper and 57,000 ounces of gold

for the calendar year 2024.

The Company will need to conclude further

financing arrangements to fund its share of cost of the ongoing

development of a block cave mine at Red Chris.

Exploration

Imperial maintains a large portfolio of

greenfield exploration properties in British Columbia. These

properties have defined areas of mineralization and exploration

potential. Management continues to evaluate various opportunities

to advance many of these properties.

Exploration at Red Chris for 2024 will be

focused on further definition of the East Ridge zone.

Exploration diamond drilling is planned for

early 2024 at Mount Polley to continue following the new zones

delineated from 2023 diamond drilling.

At Huckleberry, in 2024 the exploration program

will focus on additional diamond drilling following up on the

success of the 2023 program.

Acquisitions

Management continues to evaluate potential

acquisitions.

---

For detailed information, refer to Imperial’s 2023 Management

Discussion and Analysis available on imperialmetals.com and

sedarplus.ca.

About Imperial

Imperial is a Vancouver-based exploration, mine

development and operating company with holdings that include the

Mount Polley mine (100%), the Huckleberry mine (100%), and the Red

Chris mine (30%). Imperial also holds a portfolio of 23 greenfield

exploration properties in British Columbia.

Company Contacts

Brian Kynoch | President |

604.669.8959Darb S. Dhillon | Chief Financial

Officer | 604.488.2658

Cautionary Note Regarding

Forward-Looking Statements

Certain information contained in this news

release are not statements of historical fact and are

“forward-looking” statements. Forward-looking statements relate to

future events or future performance and reflect Company

management’s expectations or beliefs regarding future events and

include, but are not limited to, future impacts and the ability to

continue operations subject to the governmental or non-governmental

restrictions imposed as a result of communicable and infectious

diseases and their related outbreaks or pandemics, like the

COVID-19 pandemic (“Outbreaks”); changes to the Company’s business

and operations in order to minimize the risks to employees,

communities and other stakeholders; the effectiveness of

preventative measures put in place by the Company and Newmont,

including the implementation of a communicable disease management

plan; potential impact of violations to acts and regulations with

respect to such preventative measures; expectations regarding the

care and maintenance activities at the Huckleberry mine;

expectations and timing regarding current and future exploration

and drilling programs at the Red Chris, Mount Polley and

Huckleberry mines; expectations regarding completion of the Block

Cave Feasibility Study and timing thereof; expectations regarding

update of the Red Chris Mineral Resources estimate; expectations

regarding recovery, throughput and mined grades for copper and

gold; the continued increase in metal production due to higher

grades and throughput; the removal of the Mount Polley mine

tailings from the Springer Pit; capital expenditures; adequacy of

funds for projects and liabilities; expectations regarding the

issuances of non-convertible debentures including with respect to

the date of maturity, interest payable and timing thereof; outcome

and impact of litigation; potential claims and probability of

material loss or judgment against the Company; cash flow; working

capital requirements; the requirement for additional funding for

capital projects; the ability for the Company to continue as a

going concern, including sufficient funding of the Company’s

obligations as they come due; results and targets of operations,

production, revenue, margins and earnings; future prices of copper

and gold; future foreign currency exchange rates, including its

impact on derivative instruments; volatility of the Company’s

income or loss from derivative instruments; liquidation of

marketable securities; and the use of non-IFRS financial measures

including adjusted net loss, adjusted EBITDA, cash earnings and

cash cost per pound of copper.

Forward-looking information is not based on

historical facts, but rather on then current expectations, beliefs,

assumptions, estimates and forecasts about the business and the

industry and markets in which the Company operates, including, but

not limited to, assumptions that: the scope and duration of

Outbreaks, and their impact on our business will not be significant

and the Company’s operations will be able to return to normal as

they subside; the Company will have access to capital as required

and will be able to fulfill its funding obligations as the Red

Chris minority joint venture partner; there are risks related to

holding non-majority investment interests in the Red Chris mine

Joint Venture; the Company will be able to advance and complete

remaining planned rehabilitation activities within expected

timeframes; there will be no significant delay or other material

impact on the expected timeframes or costs for completion of

rehabilitation of the Mount Polley and Huckleberry mines; the

Company’s rehabilitation activities at Mount Polley and Huckleberry

will be successful in the long term; all required permits,

approvals and arrangements to proceed with planned rehabilitation

at Huckleberry will be obtained in a timely manner; there will be

no material operational or exploration delays at the Red Chris and

Mount Polley mines; there will be no material delay in the receipt

of the Red Chris Block Cave Feasibility Study and subsequent,

related expansion plans; equipment will operate as expected; there

will not be significant power outages; there will be no material

adverse change in the market price of commodities and exchange

rates; and the Red Chris and Mount Polley mines will achieve

expected production outcomes (including with respect to mined

grades and mill recoveries and access to water as needed) with no

material delays, shutdowns, property damage and/or loss as a result

of climate change impacts, such as (but not limited to) those

arising from wildfires, flooding and mudslides. Such statements are

qualified in their entirety by the inherent risks and uncertainties

surrounding future expectations. We can give no assurance that the

forward-looking information will prove to be accurate.

Forward-looking information involves known and

unknown risks, uncertainties and other factors which may cause

Imperial’s actual results, revenues, performance or achievements to

be materially different from any future results, performance or

achievements expressed or implied by the statements constituting

forward-looking information. Important risks that could cause

Imperial’s actual results, revenues, performance or achievements to

differ materially from Imperial’s expectations include, among other

things: the risk that the Company’s beneficial interest of the Red

Chris mine may be diluted over time should it not have access to

capital as required and will not be able to meet its funding

obligations as the Red Chris minority joint venture partner; the

risk that the Red Chris Block Feasibility Study is not finalized in

a timely manner or at all, thereby materially or indefinitely

delaying anticipated Red Chris expansion plans; additional

financing that may be required may not be available to Imperial on

terms acceptable to Imperial or at all; risks relating to the

timely receipt of necessary approvals and consents to proceed with

the rehabilitation plan at Huckleberry; risks relating to mining

operations and mine restart timelines; uncertainty regarding

general economic conditions; uncertainty regarding the short-term

and long-term impact of Outbreaks on the Company’s operations and

investments and on the global economy and metals prices generally,

risks that Outbreaks may adversely impact copper and gold prices,

our ability to transport or market our concentrate, cause

disruptions in our supply chains and create volatility in commodity

prices and demand; risks relating to the potential ineffectiveness

of the measures taken in response to Outbreaks; risks associated

with competition within the mining industry; the Company’s

dependency on third party smelters; risks relating to trade

barriers; the quantum of claims, fines and penalties that may

become payable by Imperial and the risk that current sources of

funds are insufficient to fund liabilities; risks that Imperial

will be unsuccessful in defending against any legal claims or

potential litigation; risks of protesting activity and other civil

disobedience restricting access to the Company’s properties;

failure of plant, equipment or processes to operate in accordance

with specifications or expectations; cost escalation,

unavailability of materials and equipment, labour unrest, power

outages, climate change impacts, such as (but not limited to) those

arising from wildfires, flooding and mudslides and other natural

phenomena such as weather conditions and water shortages,

negatively impacting the operation of the Red Chris and Mount

Polley mines and potentially causing material delays, shutdowns,

property damage and/or loss; changes in commodity and power prices;

changes in market demand for our concentrate; inaccurate geological

and metallurgical assumptions (including with respect to the size,

grade and recoverability of mineral reserves and resources);

uncertainty relating to mineral resource and mineral reserve

estimates; uncertainty relating to production estimates; risks

associated with mineral exploration and project development;

fluctuations in exchange rates and interest rates; risks associated

with permitting and government regulations; environmental and

health and safety matters; risks relating to joint venture

projects; risks relating to foreign operations; dependence on key

management personnel; taxation risk; conflicts of interest; cyber

threats and potential adverse impacts from the global incorporation

of artificial intelligence and machine learning into business

processes; credit risk related to cash, trade and other

receivables, and future site reclamation deposits; risks relating

to the use of derivative contracts and other hazards and risks

disclosed within the Company’s interim and annual financial

statements and management’s discussion and analysis of those

statements, all of which are filed and available for review on

SEDAR+ at www.sedarplus.ca.

Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended, many of which are beyond the Company’s ability to control

or predict. There can be no assurance that forward-looking

statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking statements and all forward-looking statements in

this news release are qualified by these cautionary statements.

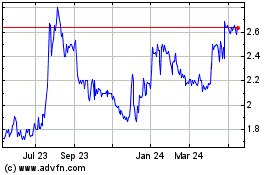

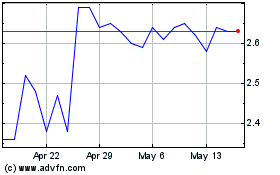

Imperial Metals (TSX:III)

Historical Stock Chart

From Nov 2024 to Dec 2024

Imperial Metals (TSX:III)

Historical Stock Chart

From Dec 2023 to Dec 2024