Intermap Technologies Corporation (TSX: IMP)

(“

Intermap” or the “

Company”), a

global leader in 3D geospatial products and intelligence solutions,

today announced the closing of its previously announced “bought

deal” LIFE offering and concurrent private placement (together, the

“

Offerings”). The Company entered into an

underwriting and agency agreement with Beacon Securities Limited

(“

Beacon” or the “

Underwriter”)

whereby the Company issued a total of (i) 2,957,000 Class “A”

common shares of the Company (“

Common Shares”) at

a price of C$2.25 per Common Share (the “

Offering

Price”) for aggregate gross proceeds of C$6,653,250 (the

“

LIFE Offering”), including the full exercise

of the Underwriter’s option, pursuant to the “listed issuer

financing exemption” under Part 5A.2 of National Instrument 45-106

– Prospectus Exemptions (“

NI 45-106”); and (ii)

2,047,225 Common Shares at the Offering Price for aggregate gross

proceeds of C$4,606,256.25 (the “

Concurrent

Private Placement”), pursuant to other prospectus

exemptions under NI 45-106.

The Company intends to use the aggregate net

proceeds of the Offerings for working capital and execution of

government contracts. With increased capital, Intermap plans to

accelerate its programs and augment its services.

In connection with the Offerings, the Company

paid to Beacon cash commissions equal to C$675,570.37 and an

advisory fee of C$13,500. The Company also issued Beacon 177,420

non-transferrable compensation options in respect of the LIFE

Offering (the “LIFE Offering Options”) and 122,834

non-transferrable compensation options in respect of the Concurrent

Private Placement (the “Private Placement

Options”, and together with the LIFE Offering Options, the

“Compensation Options”). Each Compensation Option

entitles the holder thereof to purchase one Common Share from the

Company, at US$1.56850 in respect of the LIFE Offering Options and

US$1.67306 in respect of the Private Placement Options, on or

before February 20, 2027.

The Common Shares sold pursuant to the LIFE

Offering will not be subject to a hold period in Canada. The Common

Shares sold pursuant to the Concurrent Private Placement are

subject to the statutory hold period of four months and one day

from the date of issuance in accordance with applicable Canadian

securities laws.

The securities described herein have not been,

and will not be, registered under the U.S. Securities Act of 1933,

as amended (the “1933 Act”), or any state

securities laws, and accordingly, may not be offered or sold within

the United States except in compliance with the registration

requirements of the 1933 Act and applicable state securities

requirements or pursuant to exemptions therefrom. This news release

shall not constitute an offer to sell or the solicitation of an

offer to buy nor shall there be any sale of the securities in the

United States or in any other jurisdiction in which such offer,

solicitation or sale would be unlawful.

Intermap Reader

Advisory Certain information provided in this news

release, including reference to the availability of proceeds from

the Offerings and the intended use of proceeds in the Offerings in

connection therewith, constitutes forward-looking statements. The

words “will”, “intends”, “expected to”, “subject to” and similar

expressions are intended to identify such forward-looking

statements. Although Intermap believes that these statements are

based on information and assumptions which are current, reasonable

and complete, these statements are necessarily subject to a variety

of known and unknown risks and uncertainties. Intermap’s

forward-looking statements are subject to risks and uncertainties

pertaining to, among other things, cash available to fund

operations, availability of capital, revenue fluctuations, the

nature of government contracts, including changing political

circumstances in the relevant jurisdictions, economic conditions,

loss of key customers, retention and availability of executive

talent, competing technologies, common share price volatility, loss

of proprietary information, software functionality, internet and

system infrastructure functionality, information technology

security, breakdown of strategic alliances, and international and

political considerations, as well as those risks and uncertainties

discussed Intermap’s Annual Information Form for the year ended

December 31, 2023 and other securities filings. While the Company

makes these forward-looking statements in good faith, should one or

more of these risks or uncertainties materialize, or should

underlying assumptions prove incorrect, actual results may vary

significantly from those expected. Accordingly, no assurances can

be given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do so, what

benefits that the Company will derive therefrom. All subsequent

forward-looking statements, whether written or oral, attributable

to Intermap or persons acting on its behalf are expressly qualified

in their entirety by these cautionary statements. The

forward-looking statements contained in this news release are made

as at the date of this news release and the Company does not

undertake any obligation to update publicly or to revise any of the

forward-looking statements made herein, whether as a result of new

information, future events or otherwise, except as may be required

by applicable securities law.

About Intermap

TechnologiesFounded in 1997 and headquartered in Denver,

Colorado, Intermap (TSX: IMP) is a global leader in geospatial

intelligence solutions, focusing on the creation and analysis of 3D

terrain data to produce high-resolution thematic models. Through

scientific analysis of geospatial information and patented sensors

and processing technology, the Company provisions diverse,

complementary, multi-source datasets to enable customers to

seamlessly integrate geospatial intelligence into their workflows.

Intermap’s 3D elevation data and software analytic capabilities

enable global geospatial analysis through artificial intelligence

and machine learning, providing customers with critical information

to understand their terrain environment. By leveraging its

proprietary archive of the world’s largest collection of

multi-sensor global elevation data, the Company’s collection and

processing capabilities provide multi-source 3D datasets and

analytics at mission speed, enabling governments and companies to

build and integrate geospatial foundation data with actionable

insights. Applications for Intermap’s products and solutions

include defense, aviation and UAV flight planning, flood and

wildfire insurance, disaster mitigation, base mapping,

environmental and renewable energy planning, telecommunications,

engineering, critical infrastructure monitoring, hydrology, land

management, oil and gas and transportation.

For more information, please

visit www.intermap.com or

contact:Jennifer BakkenExecutive Vice President and

CFOCFO@intermap.com+1 (303) 708-0955

Sean PeasgoodInvestor RelationsSean@SophicCapital.com+1 (647)

260-9266

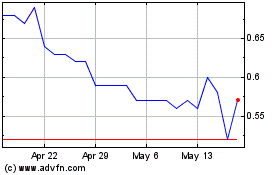

Intermap Technologies (TSX:IMP)

Historical Stock Chart

From Feb 2025 to Mar 2025

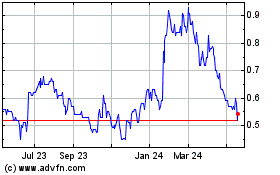

Intermap Technologies (TSX:IMP)

Historical Stock Chart

From Mar 2024 to Mar 2025