Kinross Gold Corporation (TSX: K, NYSE: KGC) (“Kinross” or the

“Company”) today is pleased to provide an update on the Great Bear

project (the “Project”), located in Red Lake, Ontario, Canada.

This news release contains forward-looking

information about expected future events and financial and

operating performance of the Company. We refer to the risks and

assumptions set out in our Cautionary Statement on Forward-Looking

Information located on page 13 of this release. All dollar amounts

are expressed in U.S. dollars, unless otherwise noted.

Kinross has completed a Preliminary Economic

Assessment (PEA) for the Great Bear project which supports the

Company’s acquisition thesis of a top tier high-margin operation in

a stable jurisdiction with strong infrastructure. Based on mineral

resources drilled to date, the PEA outlines a high-grade combined

open pit and underground mine with an initial planned mine life of

approximately 12 years and production cost of sales3 of $594 per

ounce. The Project is expected to produce over 500,000 ounces per

year at an all-in sustaining cost (AISC)1 of approximately $800 per

ounce during the first 8 years through a conventional, modest

capital 10,000 tonne per day (tpd) mill.

Kinross has also released an updated mineral

resource estimate increasing the inferred resource estimate by

568koz. to 3.884 Moz. which is in addition to the existing M&I

resource estimate of 2.738 Moz4. The mineral resource estimate and

PEA for the Great Bear project are available here.

CEO Commentary:

"This PEA marks an important milestone for Great

Bear and reaffirms our view of it as a high-quality asset with

robust economics and a clear path to become a world class operating

mine," said Paul Rollinson, Chief Executive Officer of Kinross Gold

Corporation. "The Project represents a strong combination of

high-margin production and modest capital requirements, with the

opportunity for significant resource growth in the future.

“This PEA represents the first view of unlocking

Great Bear’s full potential. Based on surface drilling to date, the

PEA provides an initial snapshot in time of the Project. The

ongoing drilling to depth has already shown multiple wide,

high-grade intercepts beyond the current resource used in the PEA.

This deep drilling from surface demonstrates the continuation of

mineralization at depth and the upside potential for further

resource and mine life additions in the future as we progress

exploration from depth.

“These positive results are underpinned by a

strong mining jurisdiction with a skilled labour pool and solid

regional infrastructure. We have both the financial and technical

resources to advance the development of this exciting new Project

in our portfolio."

________________________1 Annual production over

500,000 ounces for the first 8 years. 2 AISC is a non-GAAP

financial measure. The definition and purpose of this non-GAAP

financial measure is included on page 11 of this news release.

Non-GAAP financial measures and ratios have no standardized meaning

under IFRS and therefore, may not be comparable to similar measures

presented by other issuers. Please see average production cost of

sales in the table entitled “PEA study financial highlights” for

the related estimated GAAP financial measure.3 “Production cost of

sales per ounce” is defined as production cost of sales divided by

total ounces sold. In the PEA, production costs of sales is

referred to as production cash costs. 4 See the table below titled

“Great Bear Summary of project mineral resources” for grade and

quantity of mineral resource estimate.

Key PEA Highlights:

- The Great Bear PEA demonstrates a

top-tier high margin operation in a stable jurisdiction in Ontario,

Canada. The Project is located within the prolific Red Lake

Greenstone Belt 24 kilometres from Red Lake, a town with a long

history of mining, significant infrastructure including a paved

highway and provincial power lines, and access to experienced,

skilled labour.

- The results from the PEA affirm

that Great Bear has the potential to be a cornerstone asset with a

top tier production profile, low costs, and significant value.

- The PEA mine plan demonstrates an

excellent estimated internal rate of return (IRR) and after-tax net

present value (NPV) at a range of gold prices.

|

PEA study physical

highlights5 |

|

Annual production (koz. / first 8 years) |

518 |

|

Annual production (koz. / life of mine average) |

431 |

|

Life of mine production (Moz. Au) |

5.3 |

|

Mill Processing rate (tpd) |

10,000 |

|

Underground peak mining rate (tpd) |

6,000 |

|

Life of mine tonnes processed (million tonnes) |

44.6 |

|

Average grade processed (g/t Au) |

3.87 |

|

Average recovery rate (% Au) |

95.7 |

|

PEA study financial highlights |

|

Average production cost of sales (per Au oz.)3,6 |

$594 |

|

Average all-in sustaining costs (per Au oz.)2,5 |

$812 |

|

Total initial construction capital cost (US$ millions) |

$1,181 |

|

Total capitalized mine development (US$ millions) |

$248 |

|

Total initial project capital (US$ millions) |

$1,429 |

|

Great Bear IRR and NPV estimates based on gold

price7,8,9,10 |

|

|

$1,900/oz. |

$2,500/oz. |

|

IRR |

24.3% |

35.5% |

|

NPV |

$1.9 billion |

$3.3 billion |

|

Payback period (years) |

2.7 |

1.7 |

________________________5 The PEA is

preliminary in nature and is based, in part, on Inferred Mineral

Resources. Inferred Mineral Resources are considered too

geologically speculative to have the economic considerations

applied to them that would enable them to be categorized as Mineral

Reserves. There is no certainty that the economic forecasts on

which the PEA is based will be realized.6 Average production cost

of sales and average AISC represent costs for projected production

for the life of mine.7 The economic analysis of the project was

carried out using a discounted cash flow approach on a pre-tax and

after-tax basis, based on a long-term gold price of $1,900/oz in

USD and cost estimates prepared in CAD.8 An exchange rate of 0.74

USD per 1.00 CAD was assumed to convert CAD market price

projections and particular components of the capital cost estimates

into USD.9 The IRR on total investment that is presented in the

economic analysis was calculated assuming 100% equity financing

except open pit fleet, though Kinross may decide in the future to

finance part of the project with debt financing. 10 The NPV was

calculated from the after-tax cash flow generated by the project,

based on a discount rate of 5% and a valuation date of January 1,

2026.

Mine Plan

The initial mine plan outlines concurrent open

pit and underground mining over the first 8 years followed by

combined underground mining and stockpile processing in years 8 to

12. The decision to mine the open pit and underground concurrently

from the start provides significant production flexibility and time

to continue exploration drilling from underground to further expand

the resource and mine life.

The PEA demonstrates an initial life-of-mine

(LOM) of approximately 12 years with total production of

approximately 5.3 Moz. of gold. However this represents a point in

time estimate of the mine plan and is only a window into the

long-term potential of the asset given the limitations of drilling

at depth from surface. Exploration drilling at depths up to 1,600

metres has already demonstrated continuation of high-grade

mineralization with strong widths well below the current PEA

inventory, highlighting the upside potential of this asset.

The high-grade open pit will be mined with a

dual fleet strategy to provide selective mining of the high-grade

material and lower cost mining of the waste, mining a peak of 26

million tonnes of material, and providing a peak of 9,000 tpd of

mineralized material.

Figure 1: Open Pit mining

plan

A figure accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/c0000d00-833d-44c3-bb2b-c9f6256efdf9

For the underground, the primary mining method

is long hole open stoping with paste backfill and cemented rock

fill. First stope production is expected to begin in 2029, subject

to permitting, and to continue for 12 years with a peak production

rate of 6,000 tpd, with potential to expand beyond this run rate as

extensions to the underground resource are targeted. At peak, the

underground will have a mining rate of 6,000 tpd between 2035 and

2038, producing an average of 327koz. per annum.

Figure 2: Underground mining

plan

A figure accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/db93d57c-524e-4059-a891-d0e374224711

The combination of the open pit and underground

production in the years 1 to 8 will allow for processing of

higher-grade material and stockpiling of the remaining feed to

supplement underground production in the latter years of the mine

life. This strategy drives a milled grade of 4.6 g/t in years 1 to

8 and an average production of 518koz. per annum over these

years.

Figure 3: Concurrent Open Pit and

Underground Gold Production

A figure accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/5e007df4-b44f-49a2-86f8-dc548712d631

Figure 4: Mill Throughput

A figure accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/0eaceeda-6b16-47d2-b979-b54899734d36

|

Open pit mining operations |

|

LOM material mined |

187.9 Mt |

|

LOM plant feed mined |

24.3 Mt |

|

Average grade |

3.0 g/t Au |

|

Strip ratio |

6.7 (waste: plant feed) |

|

Peak mining rate (all materials) |

26.2 Mtpa |

|

Mining unit cost (including capitalized mining) |

$3.59 ($/t mined) |

|

Underground mining operations |

|

LOM plant feed mined |

20.3 Mt |

|

Average grade |

4.9 g/t Au |

|

Steady State Mining Rate (plant feed) |

6,000 tpd |

|

Mining unit cost (excluding capitalized mining) |

$68.70 ($/t processed) |

Mill, Processing and Tailings

Design

For the PEA, a conventional milling circuit for

free milling mineralization was selected, targeting an average

processing rate of 10,000 tpd. This scale of plant configuration

simplifies construction, drives high margins and production scale

in the early years with selective processing of higher-grade

material when mining both open pit and underground, and avoids

oversizing the mill for a potential underground only scenario in

the latter years of the mine life at Great Bear.

Kinross has completed a comprehensive

metallurgical test work program including detailed chemical head

analysis, mineralogy, gold deportment, comminution, and leaching

and gravity recovery testing across a selection of composite

samples. The results of the test work program indicated clean

metallurgy with no deleterious elements and very strong recoveries,

with average LOM recovery of 95.7% projected in the PEA. The clean

metallurgy and conventional circuit are expected to further de-risk

project construction and execution.

Based on the metallurgical test results, Great

Bear’s processing plant has been designed as a conventional circuit

with a proposed flowsheet including semi-autogenous grinding (SAG)

and ball milling, pebble crushing, gravity concentration, leaching

followed by carbon-in-pulp adsorption (CIP), elution,

electrowinning, and smelting to produce gold doré.

|

Key Processing Data |

|

Mill processing rate (tpd) |

10,000 |

|

Total plant feed (Mt) |

44.6 |

|

LOM avg. feed grade (g/t Au) |

3.87 |

|

LOM contained gold (Moz) |

5.5 |

|

LOM avg. recovery (% Au) |

95.7 |

|

LOM recovered gold (Moz) |

5.3 |

Kinross has invested substantial effort into

early technical studies and design for tailings processing and

management facilities at Great Bear leveraging the best available

technologies to ensure the highest environmental standards.

As a result, the PEA design includes the

addition of a desulphurization flotation circuit to remove

sulphides and render the tailings non-acid generating, and a

rigorous design criteria for all tailings storage facilities at the

site.

As well, the LP Viggo Pit has been pulled

forward to be mined during project construction in order to provide

a robust in-pit tailings storage facility for the sulphide

concentrate from the desulphurization flotation circuit,

eliminating the need for a dam to impound the sulphide

concentrate.

Capital Expenditure

The total initial construction capital is

forecasted at $1.2 billion. Capitalized mine development prior to

commercial production is expected to be approximately $250 million,

comprised of $105 million related to open pit mining and $143

million related to underground capital development which will

support higher production in the early years. The majority of the

capitalized open pit mining is driven by the strategic decision to

pull forward mining of the Viggo pit during construction to provide

low-cost construction rock, early mill feed and a robust in-pit

solution for the tailings concentrate.

Within the construction capital, the site

development, water treatment and infrastructure area includes the

truck shop, admin facilities, and camp. It also includes state of

the art water treatment including ultra-filtration and a robust

site-wide water management strategy to ensure the highest

environmental standards.

Additionally, the capital estimate includes

indirect and contingency costs, where indirect and owner costs are

40% of total direct costs and the contingency is 22%,

providing further confidence in the PEA’s total estimate.

The Project’s capital requirements are expected

to be manageable for Kinross and are forecasted within the

Company’s planned annual capex profile in the range of $1 billion.

Kinross is confident it can continue to prioritize its investment

grade balance sheet and comfortably fund Great Bear, along with

other planned capital spending.

|

Great Bear capital cost estimates(US$

millions) |

|

Direct Capital Costs |

|

|

Mine equipment |

$85 |

|

|

Site development, water treatment and infrastructure |

$239 |

|

|

UG Infrastructure |

$49 |

|

|

Processing |

$217 |

|

|

Power |

$47 |

|

|

Tailings management facility |

$52 |

|

|

Total Direct Costs |

$689 |

|

|

Indirect |

$276 |

|

|

Contingency |

$216 |

|

Total Initial Construction Capital

Cost |

$1,181 |

|

|

Capitalized open pit mining |

$105 |

|

|

Capitalized underground development |

$143 |

|

Total Capitalized Mine Development |

$248 |

|

Total Initial Project Capital |

$1,429 |

|

Life of Mine Sustaining Capital |

$1,034 |

|

Total Growth Capital |

$9711 |

Next Steps and Permitting

Kinross is continuing to progress work in

several areas across the Project, for both the advanced

exploration program (AEX) and the Main Project. Both the AEX

and Main Project remain subject to permitting, which continues to

advance. The AEX permitting is a provincial process

and Kinross is working closely with the authorities on finalizing

the permits. The Main Project’s permitting is

mainly a federal permitting review process driven by the

Impact Assessment Agency of Canada (IAAC), with some

provincial permitting components. Kinross was pleased to

recently receive the Tailored Impact Statement Guidelines from

IAAC, which will assist with completing the draft Impact

Statement.

For the AEX, detailed engineering,

execution planning, and procurement continues to progress well. The

Company is targeting to commence surface works in 2024,

subject to receiving provincial permits.

For the Main

Project, Kinross expects to advance

engineering definition and execution planning following

the selection of design partners later this year. Work on

permitting of the Main Project

is ongoing and will require federal review under the

Impact Assessment Act. An Impact Statement is currently in

process and is expected to be submitted to the IAAC next

year.

Kinross has actively engaged and consulted with

Indigenous communities and organizations and has commenced

negotiations of a Project Agreement with its First Nations

partners, Lac Seul and Wabauskang, on whose traditional

territories the Great Bear project is located.

________________________11 The long-term power

supply strategy for the Project is to obtain enough power supply

from the Ontario power grid to avoid self-generation and the use of

natural gas. To secure the necessary grid power supply, Kinross

estimates it will need to make a capital contribution of

approximately $97 million.

Resource update and

exploration

The Mineral Resources12 at the property have

been estimated for three zones: LP, Hinge, and Limb. As of April 2,

2024, approximately 568,000 ounces of inferred resources have been

added from the LP zone to the total resource compared to year end

2023, bringing the total inferred resource to 3.9 Moz., in addition

to 2.7 Moz. of M&I resources.

Mineral resources have been calculated at a gold

price of $1,700 and the open pit reflects a $1,400 pit shell. The

open pit cutoff grade is 0.55 g/t and the underground cut off grade

of is 2.3 g/t for the main LP zone. The $1,400 pit shell has been

chosen as this represents the optimal trade-off point at which

underground extraction below the pit shows higher potential margins

then deepening the open pit.

|

Great Bear Summary of project mineral

resources13,14,15,16,17,18(as

at April 2, 2024) |

|

Classification |

Tonnes |

Grade |

Gold Ounces |

|

(000) |

|

(g/t Au) |

(000) |

|

|

Measured |

1,556 |

|

3.04 |

152 |

|

|

Indicated |

28,711 |

|

2.80 |

2,586 |

|

|

TOTAL M&I |

30,267 |

|

2.81 |

2,738 |

|

|

Inferred |

25,480 |

|

4.74 |

3,884 |

|

Given the Company’s current understanding of the

orogenic system, and the significant high-grade extensions realized

at the main LP zone, Kinross expects the strong grades to continue

as drilling extends deeper. To date, Kinross has completed more

than 420 kilometres of drilling on the property and results have

been very strong, supporting the Company’s view that high-grade

mineralization extends at depth and indicating the potential for

resource growth over time.

Kinross’ 2023 and 2024 exploration program

resulted in the addition of significant ounces at improved grades

compared with the initial project mineral resource declared at year

end 2022, with the bulk of additions in the high-grade underground

between 500 metres and 1 kilometre.

This recent drilling, highlighted by the deepest

hole drilled on the property to date, which returned 3.8 metres at

a grade of 9.5 g/t at nearly 1.6 kilometres vertical depth at the

LP zone, demonstrates the impressive continuity of this

system. Exploration drilling at Great Bear continues to see

success beyond the PEA inventory. Drill holes BR-888 and BR-888C2

are the deepest drill holes on the property to date and have

intersected high grade mineralization 1,600 metre vertically below

surface.

Furthermore, exploration drilling at both the

Discovery and Yauro zones have also intersected mineralization

beyond the PEA inventory. Drill hole BR-770C3 intersected 22.7

metres at 6.51 g/t at Yauro and BR-896 intersected 5.4 metres at

7.82 g/t at Discovery. These drill holes demonstrate the successful

expansion of mineralization through drilling, not just at depth,

but along strike and linking zones.

________________________12 Mineral Resources are

stated in accordance with CIM (2014) Definitions as incorporated by

reference into NI 43-101. Mineral Resources are estimated for the

LP zone and satellite Hinge and Limb zones and have an effective

date of April 2, 2024.13 Mineral resources estimated according to

CIM (2014) Definitions.14 Mineral resources estimated at a gold

price of $1,700 per ounce.15 Open pit mineral resources are

reported within optimized pit shells at a cut-off grade of 0.55 g/t

Au.16 Underground mineral resources are reported within underground

reporting shapes at cut-off grades of 2.3 g/t Au for the LP zone,

2.5 g/t Au for the Limb zone, and 2.4 g/t for the Hinge zone. An

incremental cut-off grade of 1.7 g/t Au was used at the LP zone for

areas that do not require additional development. 17 Mineral

resources that are not mineral reserves do not have demonstrated

economic viability. 18 Numbers may not add due to rounding.

Figure 5: Resource Growth - continuing to see high-grade

intercepts outside of the PEA inventory

A figure accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/b9aaeb87-b9e5-4fdd-989a-1c6282633600

The PEA represents a point in time estimate and

is only a window into the long-term potential of the asset given

the indications of continued mineralization at depth. As a result,

the Company is focused on progressing the AEX to begin drilling

underground to continue unlocking the full potential of the

asset.

In 2024, the Company will continue to focus

drilling to link zones at depth at LP and further directional work

at Hinge and Limb. Exploration will also focus resources on

brownfield exploration work on the newly expanded ~120 square

kilometre land package to look for additional open pit and

underground opportunities.

Great Bear Technical Presentation

details

In connection with this news release, Kinross

will hold a conference call and audio webcast on Tuesday, September

10, 2024, at 9:00 a.m. EDT, followed by a question-and-answer

session. To access the call, please dial:

To access the call:

Webcast Link:

https://meetings.lumiconnect.com/400-478-546-594

Canada & US toll-free:

1-866-613-0812Outside of Canada & US:

647-694-2812

Replay (available 30 days after the call):

Canada & US toll-free: 1

(877) 454-9859 Outside of Canada & US: (647)

483-1416 Passcode: 4887947

You may also access the conference call on a

listen-only basis via webcast at our website www.kinross.com. The

audio webcast will be archived on www.kinross.com.

About Kinross Gold

Corporation

Kinross is a Canadian-based global senior gold

mining company with operations and projects in the United States,

Brazil, Mauritania, Chile and Canada. Our focus is on delivering

value based on the core principles of responsible mining,

operational excellence, disciplined growth, and balance sheet

strength. Kinross maintains listings on the Toronto Stock Exchange

(symbol: K) and the New York Stock Exchange (symbol: KGC).

Media Contact Victoria

BarringtonSenior Director, Corporate Communicationsphone:

647-788-4153victoria.barrington@kinross.com

Investor Relations ContactDavid

ShaverSenior Vice-President phone:

416-365-2761david.shaver@kinross.com

APPENDIX A

Non-GAAP financial measures

The Company has included certain non-GAAP

financial measures in this document. These financial measures are

not defined under IFRS and should not be considered in isolation.

The Company believes that these financial measures, together with

financial measures determined in accordance with IFRS, provide

investors with an improved ability to evaluate the underlying

performance of the Company. The inclusion of these financial

measures is meant to provide additional information and should not

be used as a substitute for performance measures prepared in

accordance with IFRS. These financial measures are not necessarily

standard and therefore may not be comparable to other issuers.

All-in sustaining cost

All in sustaining cost is a non-GAAP financial

measure calculated based on guidance published by the World Gold

Council (“WGC”). The WGC is a market development organization for

the gold industry and is an association whose membership comprises

leading gold mining companies including Kinross. Although the WGC

is not a mining industry regulatory organization, it worked closely

with its member companies to develop these metrics. Adoption of the

all-in sustaining cost metric is voluntary and not necessarily

standard, and therefore, this measure presented by the Company may

not be comparable to similar measures presented by other issuers.

The Company believes that the all-in sustaining cost measure

complements existing measures and ratios reported by Kinross.

All-in sustaining cost includes both operating

and capital costs required to sustain gold production on an ongoing

basis. Sustaining operating costs represent expenditures expected

to be incurred at Great Bear that are considered necessary to

maintain production. Sustaining capital represents expected capital

expenditures comprising mine development costs, including

capitalized waste, and ongoing replacement of mine equipment and

other capital facilities, and does not include expected capital

expenditures for major growth projects or enhancement capital for

significant infrastructure improvements.

APPENDIX B

Proposed Site Layout

A figure accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/a13ccfc5-3edf-4be5-85ed-f1c17ae69f9c

APPENDIX C

Cautionary statement on forward-looking

information

All statements, other than statements of historical fact,

contained or incorporated by reference in this news release

including, but not limited to, any information as to the future

financial or operating performance of Kinross, constitute

“forward-looking information” or “forward-looking statements”

within the meaning of certain securities laws, including the

provisions of the Securities Act (Ontario) and the provisions for

“safe harbor” under the United States Private Securities Litigation

Reform Act of 1995 and are based on expectations, estimates and

projections as of the date of this news release. Forward-looking

statements contained in this news release include, without

limitation, statements with respect to: the calculation of mineral

resources at the project and the possibility of eventual economic

extraction of minerals from the project; the identification of

future mineral resources at the project; the Company’s ability to

convert existing mineral resources into categories of mineral

resources or mineral reserves of increased geological confidence;

the projected yearly gold production profile from both open pit and

underground operations, all-in sustaining costs, mill throughput

and average grades; future plans for exploration drilling; the

projected economics of the project, including total gold sales,

margins, taxes, average annual production, the net present value of

the project, the internal rate of return on the project, project

payback period, average yearly free cash flow, life of mine unit

costs, projected mine life, the total initial capital and

sustaining capital required; the project design, including the

location of the tailings management facility, process plant,

infrastructure area, stockpile areas, the anticipated advanced

exploration site and the proposed open pit and underground mine

plans; the project development timeline to production including the

Company’s work relating to its Impact Statement and permitting

future phases of the project and development and construction of

and production at the project, including the possibility of

constructing either or both of an open pit and underground mines;

the timing of and future prospects for exploration and any

expansion of the project, including upside associated with the

project’s land package and via exploration at depth beneath the

proposed underground mine; the potential for expanding the initial

mineral resource and the potential for identifying additional

mineralization in areas of intercepts and conceptual areas for

extension and expansion; potential recovery rates or processing

techniques; and the Company’s plans to construct an exploration

decline. The words “believe”, “conceptual”, “expect”, “future”,

“plan”, “potential”, “progress”, “prospective”, “target”, “view”

and “upside” or variations of or similar such words and phrases or

statements that certain actions, events or results “may”, “could”,

“will” or “would” occur, and similar expressions identify

forward-looking statements. Forward-looking statements are

necessarily based upon a number of estimates and assumptions that,

while considered reasonable by Kinross as of the date of such

statements, are inherently subject to significant business,

economic and competitive uncertainties and contingencies. The

estimates, models and assumptions of Kinross referenced, contained

or incorporated by reference in this news release, which may prove

to be incorrect, include, but are not limited to, the various

assumptions set forth herein and in our Annual Information Form

dated March 27, 2024 and our full-year 2023 Management’s Discussion

and Analysis as well as: (1) there being no significant disruptions

affecting the activities of the Company whether due to extreme

weather events and other or related natural disasters, labour

disruptions, supply disruptions, power disruptions, damage to

equipment or otherwise; (2) permitting and development of the

project being consistent with the Company’s expectations; (3)

political and legal developments in Ontario and Canada being

consistent with its current expectations; (4) the accuracy of the

current mineral resource estimates of the Company (including but

not limited to ore tonnage and ore grade estimates); (5) certain

price assumptions for gold and silver and foreign exchange rates;

(6) Kinross’ future relationship with the Wabauskang and Lac Seul

First Nations and other Indigenous groups being consistent with the

Company’s expectations; and (7) inflation and prices for diesel,

natural gas, fuel oil, electricity and other key supplies being

approximately consistent with anticipated levels. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward-looking statements. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements.

Forward-looking statements are provided for the purpose of

providing information about management’s expectations and plans

relating to the future. All of the forward-looking statements made

in this news release are qualified by these cautionary statements

and those made in our other filings with the securities regulators

of Canada and the United States including, but not limited to, the

cautionary statements made in the “Risk Factors” section of our

Annual Information Form dated March 27, 2024, and the “Risk

Analysis” section of our full year 2023 Management’s Discussion

& Analysis. These factors are not intended to represent a

complete list of the factors that could affect Kinross. Kinross

disclaims any intention or obligation to update or revise any

forward-looking statements or to explain any material difference

between subsequent actual events and such forward looking

statements, except to the extent required by applicable law.

Certain forward-looking statements in this press release may

also constitute a “financial outlook” within the meaning of

applicable securities laws. A financial outlook involves statements

about the Company’s prospective financial performance, financial

position or cash flows and is based on and subject to the

assumptions about future economic conditions and courses of action

and the risk factors described above in respect of forward-looking

information generally, as well as any other specific assumptions

and risk factors in relation to such financial outlook noted in

this press release. Such assumptions are based on management’s

assessment of the relevant information currently available, and any

financial outlook included in this press release is provided for

the purpose of helping viewers understand the Company’s current

expectations and plans for the future. Viewers are cautioned that

reliance on any financial outlook may not be appropriate for other

purposes or in other circumstances and that the risk factors

described above, or other factors may cause actual results to

differ materially from any financial outlook. The actual results of

the Company’s operations will likely vary from the amounts set

forth in any financial outlook and such variances may be

material.

Other information

Where we say “we”, “us”, “our”, the “Company”, or “Kinross” in

this news release, we mean Kinross Gold Corporation and/or one or

more or all of its subsidiaries, as may be applicable. The

technical information about the Company’s mineral properties

contained in this news release has been prepared under the

supervision of Mr. Nicos Pfeiffer who is a “qualified person”

within the meaning of National Instrument 43-101.

Source: Kinross Gold Corporation

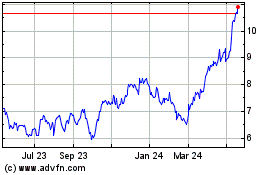

Kinross Gold (TSX:K)

Historical Stock Chart

From Feb 2025 to Mar 2025

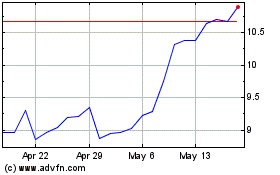

Kinross Gold (TSX:K)

Historical Stock Chart

From Mar 2024 to Mar 2025