Magna Recommends Rejection of "Mini-Tender" Offer

09 August 2024 - 8:00PM

Magna International Inc. (TSX: MG; NYSE: MGA) today reported that

it has received notice of an unsolicited mini-tender offer made by

TRC Capital Investment Corporation (“TRC Capital”) to purchase up

to 2,000,000 Magna Common Shares, or less than 1% of Magna’s

outstanding Common Shares, at a price of CDN $57.90 per share.

Magna cautions shareholders that the mini-tender offer has been

made at a price below recent market prices, representing a discount

of 4.49% to the closing price of Magna’s Common Shares on the

Toronto Stock Exchange (“TSX”) on July 29, 2024, the last trading

day before the mini-tender offer commenced. Although the offering

price represents a premium of 7.58% to yesterday’s closing price of

Magna Common Shares on the TSX of CDN $53.82, the offer is highly

conditional. TRC Capital’s offer states that it may withdraw its

offer if, among other things, the market price of Magna Common

Shares falls below CDN $57.58, for reference, the closing price on

the TSX for Magna Common Shares on August 8, 2024, was CDN $53.82,

which is already below this threshold; additionally, TRC Capital’s

offer is not fully funded and is conditioned upon receipt of

necessary financing on terms it deems reasonable in its sole

discretion.

Magna does not endorse TRC Capital’s unsolicited mini-tender

offer, is not affiliated or associated in any way with TRC Capital,

and unequivocally recommends shareholders reject the TRC Capital

offer.

TRC Capital has made many similar unsolicited mini-tender offers

for shares of other public companies. Mini-tender offers typically

seek to acquire less than 5% of a company’s outstanding shares,

thereby avoiding many disclosure and procedural requirements

applicable to formal take-over bids and tender offers under

Canadian and United States securities legislation. Both the

Canadian Securities Administrators (“CSA”) and the U.S. Securities

and Exchange Commission (“SEC”) recommend that investors exercise

caution with mini-tender offers and have expressed serious concerns

about mini-tender offers, including the possibility that investors

might tender to such offers without understanding the offer price

relative to the current market price of their securities.

Comments from the CSA on mini-tenders can be found on the

Ontario Securities Commission website at:

https://www.osc.ca/en/securities-law/instruments-rules-policies/6/61-301/csa-staff-notice-61-301-staff-guidance-practice-mini-tenders.

The SEC investor advisory regarding mini-tender offers can be

found at:http://www.sec.gov/investor/pubs/minitend.htm.

Magna urges shareholders to obtain current market quotations for

their shares, consult with their broker or financial advisor and

exercise caution with respect to TRC Capital’s offer. Magna

recommends that shareholders who have not responded to TRC

Capital’s mini-tender offer take no action. Shareholders who have

already tendered their shares should seek to withdraw them.

According to TRC Capital's offer documents, Magna shareholders who

deposit their shares in acceptance of the offer may withdraw their

shares at any time before August 30, 2024, by following the

procedures described in TRC Capital’s offer documents.

Magna requests that a copy of this press release be included

with all distributions of materials relating to TRC Capital’s

mini-tender offer related to Magna Common Shares.

INVESTOR CONTACTLouis Tonelli, Vice-President,

Investor Relations louis.tonelli@magna.com │ 905.726.7035

MEDIA CONTACT Tracy Fuerst, Vice-President,

Corporate Communications & PR tracy.fuerst@magna.com │

248.761.7004

OUR BUSINESS(1)Magna is more than one of the

world’s largest suppliers in the automotive space. We are a

mobility technology company built to innovate, with a global,

entrepreneurial-minded team of over 179,000(2) employees across 343

manufacturing operations and 105 product development, engineering

and sales centres spanning 28 countries. With 65+ years of

expertise, our ecosystem of interconnected products combined with

our complete vehicle expertise uniquely positions us to advance

mobility in an expanded transportation landscape.

For further information about Magna (NYSE:MGA; TSX:MG), please

visit www.magna.com or follow us on social.

(1) Manufacturing operations, product

development, engineering and sales centres include certain

operations accounted for under the equity method.(2) Number of

employees includes over 168,000 employees at our wholly owned or

controlled entities and over 11,000 employees at certain operations

accounted for under the equity method.

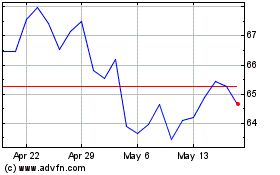

Magna (TSX:MG)

Historical Stock Chart

From Feb 2025 to Mar 2025

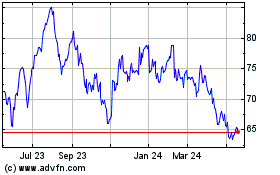

Magna (TSX:MG)

Historical Stock Chart

From Mar 2024 to Mar 2025