Melcor Reports First Quarter Results and Announces 12% Increase to Semi-Annual Dividend

10 May 2014 - 7:00AM

Marketwired Canada

Melcor Developments Ltd. (TSX:MRD), an Alberta-based real estate development and

asset management company, today reported results for the quarter ended March 31,

2014. Revenue was $32.01 million in Q1-2014 compared to $41.62 million in

Q1-2013. The decrease in revenue is primarily due to the timing of plan

registrations and land sales in the Community Development division. As a real

estate developer, quarterly comparison of results is not always meaningful.

Revenue and income can fluctuate significantly from period to period due to the

timing of plan registrations and land sales, the cyclical nature of real estate

and construction markets, the mix of lot sales and product types, and the mix of

joint arrangement sales activity.

Melcor earned net income of $6.86 million or $0.22 per share (basic) in Q1-2014,

compared to $12.62 million and $0.42 per share (basic) in Q1-2013. Adjusted

earnings, which reflect our proportionate interest in the earnings for the REIT,

were $9.77 million, a decrease of 22.6% over Q1-2013. Management believes that

adjusted earnings are a more accurate measure of operational and relative

performance.

Funds from operations (FFO) was $0.20 per share in Q1-2014 compared to $0.31 per

share in Q1-2013. FFO per share adjusts for all non-cash earnings items included

in income such as fair value adjustments on investment properties and

stock-based compensation expense.

Brian Baker, Melcor's President and Chief Executive Officer commented on the

quarter: "We are pleased with our Q1-2014 results. All operating divisions are

experiencing strong activity and we continue to execute successfully on our

business plan. We have grown our asset base both organically, through

third-party acquisition and via the synergies between Melcor and Melcor REIT. We

remain focused on obtaining planning approvals required for future projects and

we are well positioned for the 2014 construction season.

We remain confident in the year ahead and have increased our semi-annual

dividend by 12% to $0.28 per share."

First Quarter Highlights

-- Community Development revenues declined versus the comparative period

due to the timing of plan registrations and commercial and multi-family

land sales. Results remain on budget for 2014 and development activity

is strong, with 38 projects presently under active development.

-- Investment Property revenue increased as a result of 71% growth in

portfolio gross leasable area (GLA). Melcor REIT revenue also grew as a

result of growth in portfolio GLA.

-- Melcor REIT completed its third property acquisition since IPO with the

purchase of LC Industrial, a 67,610 sq. ft. industrial warehouse in

Lethbridge, Alberta, for $5.93 million.

-- Melcor REIT paid distributions of $0.05625 per trust unit in January,

February and March. Distributions made during each of the eleven months

of the REIT's operations represent a payout ratio of 88%.

-- Subsequent to the quarter, the REIT completed an offering of 1.9 million

trust units for gross proceeds of $20.24 million. Part of these proceeds

were used to purchase two properties from Melcor in exchange for $7.40

million in Class B LP Units and $6.10 million in cash.

-- We continued to invest in portfolio growth in our Investment Properties

and land inventory in the Community Development division. Subsequent to

the quarter, the following deals closed:

-- Investment Properties acquired two commercial properties in Arizona

for $11.11 million. The office buildings have a total of 59,220 sq.

ft. of GLA.

-- Community Development purchased 73.86 acres in Calgary and 36.91

acres in Lethbridge.

-- On May 9, 2014 we declared a semi-annual dividend of $0.28 per share,

payable on June 30, 2014 to shareholders of record on June 16, 2014. The

dividend is an eligible dividend for Canadian tax purposes.

Outlook

The majority of our assets are in Alberta, with steadily growing inventory in

the US. We believe the economic indicators in these regions provide a strong

business outlook for the foreseeable future.

-- Alberta fundamentals remain solid, with low unemployment rates, high net

in-migration, weekly earnings exceeding the national average, strong

capital investment, moderate inflation and relative stability in the

price of oil. These fundamentals create a favorable environment for both

residential and commercial property development.

-- The US continues its moderate economic recovery with some lingering

uncertainty, but with an increasing sense of optimism.

Our key differentiators are our financial strength, diversified business model,

proven track record and the experience and integrity of our personnel.

MD&A and Financial Statements

Information included in this press release is a summary of results. It should be

read in conjunction with Melcor's consolidated financial statements and

management's discussion and analysis for the three-months ended March 31, 2014,

which can be found on the company's website at www.Melcor.ca or on SEDAR

(www.sedar.com).

About Melcor Developments Ltd.

Melcor is a diversified real estate development and management company with a

rich heritage of integrity and innovation in real estate since 1923.

Through integrated operating divisions, Melcor manages the full life cycle of

real estate development: acquiring raw land, community planning, construction

and development, and managing revenue-producing office, retail and residential

assets. Melcor develops and manages mixed-use residential communities, business

and industrial parks, office buildings, retail commercial centres and golf

courses.

Melcor is committed to building communities that enrich quality of life -

communities where people live, work, shop and play.

Melcor's headquarters are located in Edmonton, Alberta, with regional offices

throughout Alberta and British Columbia. Company developments span western

Canada and the US. Melcor has been a public company since 1968 and trades on the

Toronto Stock Exchange (TSX:MRD).

Forward-Looking Statements

In order to provide our investors with an understanding of our current results

and future prospects, our public communications often include written or verbal

forward-looking statements.

Forward-looking statements are disclosures regarding possible events,

conditions, or results of operations that are based on assumptions about future

economic conditions, courses of action and include future-oriented financial

information.

This news release and other materials filed with the Canadian securities

regulators contain statements that are forward-looking. These statements

represent Melcor's intentions, plans, expectations, and beliefs and are based on

our experience and our assessment of historical and future trends, and the

application of key assumptions relating to future events and circumstances.

Future-looking statements may involve, but are not limited to, comments with

respect to our strategic initiatives for 2014 and beyond, future development

plans and objectives, targets, expectations of the real estate, financing and

economic environments, our financial condition or the results of or outlook of

our operations.

By their nature, forward-looking statements require assumptions and involve

risks and uncertainties related to the business and general economic

environment, many beyond our control. There is significant risk that the

predictions, forecasts, valuations, conclusions or projections we make will not

prove to be accurate and that our actual results will be materially different

from targets, expectations, estimates or intentions expressed in forward-looking

statements. We caution readers of this document not to place undue reliance on

forward-looking statements. Assumptions about the performance of the Canadian

and US economies and how this performance will affect Melcor's business are

material factors we consider in determining our forward-looking statements. For

additional information regarding material risks and assumptions, please see the

discussion under Business Environment and Risk in our annual MD&A.

Readers should carefully consider these factors, as well as other uncertainties

and potential events, and the inherent uncertainty of forward-looking

statements. Except as may be required by law, we do not undertake to update any

forward-looking statement, whether written or oral, made by the company or on

its behalf.

FOR FURTHER INFORMATION PLEASE CONTACT:

Business Contact: Melcor Developments Ltd.

Brian Baker

Chief Executive Officer

780.423.6931

info@melcor.ca

Investor Relations: Melcor Developments Ltd.

Jonathan Chia, CA

Chief Financial Officer

1.855.673.6931

ir@melcor.ca

www.melcor.ca

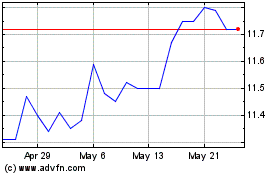

Melcor Developments (TSX:MRD)

Historical Stock Chart

From May 2024 to Jun 2024

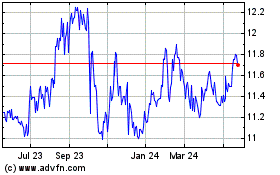

Melcor Developments (TSX:MRD)

Historical Stock Chart

From Jun 2023 to Jun 2024