MTY Food Group Inc. (“MTY”, “MTY Group” or the “Company”) (TSX:

MTY), one of the largest franchisors and operators of multiple

restaurant concepts worldwide, reported today financial results for

its fourth quarter of fiscal 2024 ended November 30, 2024.

“I’m happy to share that we expanded our

footprint in the fourth quarter, ending strong with a net store

opening of 13 locations. This positive store count is the result of

diligent team efforts at MTY, and we’re proud to be strengthening

our presence and increasing our availability to guests,” Eric

Lefebvre stated.

“Year over year, the fourth quarter saw organic

growth of system sales, with an improvement of 2% compared to Q4

2023,” Lefebvre continued. “These results were mainly attributable

to the impressive performance of our snack brands in the US and our

casual dining segment in Canada.”

“With regards to normalized adjusted EBITDA, I

would like to highlight the performance from our franchising

segment this quarter, with an 8% increase compared to Q4 2023. It

is a pleasure to see the dedicated work of our franchise owners and

MTY team reflected in these results,” Lefebvre noted.

|

Financial Highlights(in thousands of $,

except per share information) |

Q4-2024 |

Q4-2023 |

12 Months2024 |

12 Months2023 |

|

Revenue |

284,468 |

280,032 |

1,159,604 |

1,169,334 |

|

Adjusted EBITDA(1) |

58,796 |

60,365 |

263,037 |

270,746 |

|

Normalized adjusted EBITDA(1) |

59,419 |

60,365 |

264,532 |

271,904 |

|

Net (loss) income attributable to owners |

(55,299) |

16,444 |

24,170 |

104,082 |

|

Cash flows from operations |

43,716 |

47,764 |

204,807 |

184,586 |

|

Free cash flows net of lease payments(1) |

27,368 |

33,357 |

137,882 |

110,467 |

|

Free cash flows net of lease payments per diluted share(2) |

1.16 |

1.37 |

5.75 |

4.52 |

|

Net (loss) income per share, basic |

(2.34) |

0.67 |

1.01 |

4.26 |

|

Net (loss) income per share, diluted |

(2.34) |

0.67 |

1.01 |

4.25 |

|

System sales(3) |

1,371,900 |

1,341,600 |

5,635,700 |

5,641,200 |

|

Digital sales(3) |

286,900 |

265,400 |

1,118,500 |

1,027,400 |

(1) This is a non-GAAP measure. Please refer to

the “Non-GAAP Measures” section at the end of this press

release.(2) This is a non-GAAP ratio. Please refer to the “Non-GAAP

Ratios” section at the end of this press release.(3) This is a

supplementary financial measure. Please refer to the “Supplementary

Financial Measures” section at the end of this press release.

FOURTH QUARTER

RESULTS

Network

- At the end of the fourth quarter of

2024, MTY’s network had 7,079 locations in operation, of which

6,827 were franchised or under operator agreements and 252 were

corporate-owned. The geographical split among MTY’s locations

remained stable year-over-year at 57% in the US, 35% in Canada and

8% International.

- During the fourth

quarter of 2024, MTY’s network opened 92 locations (Q4 2023 – 94

locations) and closed 79 others (Q4 2023 – 97 locations) for a net

organic increase of 13 locations (Q4 2023 – decrease of 3

locations).

- System sales

increased by 2% year-over-year to reach $1.37 billion in the fourth

quarter of 2024 compared to $1.34 billion in prior year. The US

segment achieved overall sales growth, due to positive organic

growth of 2% as well as a positive impact of foreign exchange rates

while Canada achieved organic growth of 1% compared to prior

year.

- Same-store sales(1)

remained steady year-over-year in the fourth quarter with the US

showing a slight improvement of 0.1%.

(1) This is a supplementary financial measure.

Please refer to the “Supplementary Financial Measures” section at

the end of this press release.

Financial

- Company revenue

increased by 2% to reach $284.5 million in the fourth quarter,

primarily due to higher revenues from corporate stores. In Canada,

revenues from corporate stores almost doubled to reach $13.9

million year-over-year due to a net increase in such locations

while franchise operations decreased by 5% and food processing,

distribution and retail sales dropped by 10%. In the U.S. and

International segment, revenues increased mainly due to a 10%

increase from promotional funds and a 2% increase from franchise

operations.

- Normalized adjusted

EBITDA, which excludes acquisition-related expenses and SAP project

implementation costs, decreased by 2% year-over-year to $59.4

million in the fourth quarter of 2024 primarily due to a decrease

in corporate store EBITDA resulting from higher wages and supply

chain costs due to inflation.

- Net (loss) income

attributable to owners totaled $(55.3) million, or $(2.34) per

share ($(2.34) per diluted share), in the fourth quarter compared

to $16.4 million, or $0.67 per share ($0.67 per diluted share), for

the same period in 2023. The year-over-year decrease can mainly be

attributed to impairment charges on property, plant and equipment,

intangibles assets and goodwill and foreign exchange losses of

$26.3 million taken primarily on intercompany loans which is offset

by gain on translation on the consolidated statement of

comprehensive income

- Impairment charges

on property, plant and equipment, intangible assets and goodwill of

$64.6 million were taken mostly on goodwill related to the Papa

Murphy's brand due to lower than expected past performance and

lower expected future growth.

LIQUIDITY AND CAPITAL RESOURCES

- In the fourth

quarter of 2024, cash flows generated by operating activities

amounted to $43.7 million compared to $47.8 million in the fourth

quarter of 2023. The decrease was mainly driven by lower segment

EBITDA and slightly higher incomes taxes paid.

- MTY reimbursed

$17.5 million of its long-term debt, paid $6.6 million in dividends

to shareholders, and repurchased 314,700 shares for a total

consideration of $14.0 million in the fourth quarter of 2024.

- As at November 30,

2024, MTY had $50.4 million of cash on hand and long-term debt of

$706.6 million, mainly in the form of bank facilities and

promissory notes on acquisitions. The Company also had a revolving

credit facility with an authorized amount of $900.0 million, of

which CAD$8.0 million and US$497.2 million had been drawn at

quarter-end. Hedging strategies, including three three-year and one

two-year fixed interest rate swaps, have provided the Company with

quarterly savings of approximately $0.8 million on interest

payments.

DIVIDEND PAYMENT

On January 22, 2025, MTY declared a quarterly

dividend payment of $0.33 per common share. The dividend will be

paid on February 14, 2025 to shareholders registered in the

Company's records at the end of the business day on

February 4, 2025.

CONFERENCE CALL

The MTY Group will hold a conference call to

discuss its results on February 14, 2025, at 8:30 AM Eastern

Time. Interested parties can join the call by dialing

1-866-777-2509 (North America callers) or 1-412-317-5413

(International callers). Parties unable to call in at this time may

access a recording by calling 1-855-669-9658 (Canada toll free)

1-877-344-7529 (US Toll Free) or 1-412-317-0088 (International

participants) and entering the passcode 2833596.

ABOUT MTY FOOD GROUP INC.

MTY Group franchises and operates quick-service,

fast casual and casual dining restaurants under 85 different

banners in Canada, the US and Internationally. Based in Montreal,

MTY is a family whose heart beats to the rhythm of its brands, the

very soul of its multi-branded strategy. For over 45 years, it has

been increasing its presence by delivering new concepts of

restaurants, making acquisitions, and forging strategic alliances,

which have allowed it to reach new heights year after year. By

combining new trends with operational know-how, the brands forming

the MTY Group now touch the lives of millions of people every year.

With 7,079 locations, the many flavours of the MTY Group hold the

key to responding to the different tastes and needs of today’s

consumers as well as those of tomorrow.

NON-GAAP MEASURES

Adjusted EBITDA (revenue less operating

expenses), normalized adjusted EBITDA (revenue less operating

expenses excluding transaction costs related to acquisitions and

SAP project implementation costs) and free cash flows net of lease

payments (net cash flows provided by operating activities, used in

additions to property, plant and equipment and intangible assets

and provided by proceeds on disposal of property, plant and

equipment; and net of lease payments) are non-GAAP (generally

accepted accounting principles) measures, do not have a

standardized meaning prescribed by GAAP and are therefore unlikely

to be comparable to similar measures presented by other issuers.The

Company believes that adjusted EBITDA is a useful metric because it

is consistent with the indicators management uses internally to

measure the Company’s performance, to prepare operating budgets and

to determine components of executive compensation. The Company

believes that normalized adjusted EBITDA is a useful metric for the

same reasons as adjusted EBITDA, without including the impact of

transaction costs related to acquisitions or SAP project

implementation costs, which vary in occurrence and in amount. The

Company believes that free cash flows net of lease payments is a

useful metric because they provide the Company with a measure

related to decision-making about cash-intensive matters such as

capital expenditures, compensation, and potential acquisitions. The

Company also believes that these measures are used by securities

analysts, investors and other interested parties and that these

measures allow them to compare the Company’s operations and

financial performance from period to period. These measures provide

them with a supplemental measure of the operating performance and

financial position and thus highlight trends in the core business

that may not otherwise be apparent when relying solely on GAAP

measures.Refer to the “Compliance with International Financial

Reporting Standards” section of the Company’s Management's

Discussion and Analysis of the financial position and financial

performance (“MD&A”).

NON-GAAP RATIOS

Free cash flows net of lease payments per

diluted share (free cash flows net of lease payments divided by

diluted shares) and normalized adjusted EBITDA as a % of revenue

(normalized adjusted EBITDA divided by revenue) are non-GAAP

ratios, do not have a standardized meaning prescribed by GAAP and

are therefore unlikely to be comparable to similar measures

presented by other issuers. The Company believes that free cash

flows net of lease payments per diluted share is a useful metric

because it is used by securities analysts, investors and other

interested parties as a measure of the Company’s cash flows that

are available to be distributed to debt and equity shareholders,

including to pay debt, to pay dividends, and to repurchase shares.

The Company believes that normalized adjusted EBITDA as a % of

revenue is a useful metric because it is consistent with the

indicators management uses internally to measure the Company’s

profitability from operations, including to gauge the effectiveness

of cost management measures, as well as provides a measure of the

Company’s performance that does not include the impact of

transaction costs related to acquisitions, which may vary in

occurrence and in amount. Refer to the “Compliance with

International Financial Reporting Standards” section of the

Company’s MD&A.

SUPPLEMENTARY FINANCIAL

MEASURES

Management discloses supplementary financial

measures as they have been identified as relevant metrics to

evaluate the performance of the Company. These include system sales

(sales of all existing restaurants including those that have closed

or have opened during the period, as well as the sales of new

concepts acquired from the closing date of the transaction and

forward), digital sales (sales made by customers through online

ordering platforms), and same-store sales (comparative sales

generated by stores that have been open for at least 13 months or

that have been acquired more than 13 months ago).

FORWARD-LOOKING STATEMENTS

Certain information in this press release may

constitute "forward-looking" information that involves known and

unknown risks, uncertainties, future expectations and other

factors, which may cause the actual results, performance or

achievements of the Company or industry to be materially different

from any future results, performance or achievements expressed or

implied by such forward-looking information. When used in this

press release, this information may include words such as

"anticipate", "estimate", "may", "will", "expect", "believe",

"plan" and other terminology.

This information reflects current expectations

regarding future events and operating performance and speaks only

as of the date of this press release. Except as required by law,

the Company assumes no obligation to update or revise

forward-looking information to reflect new events or circumstances.

Additional information is available in the Company’s MD&A,

which can be found on SEDAR+ at

www.sedarplus.ca.

Note to readers: The MD&A,

condensed interim consolidated financial statements and notes

thereto for the fourth quarter ended November 30, 2024, are

available on the SEDAR+ website at

www.sedarplus.ca and on the Company’s website

at www.mtygroup.com.

Source: MTY Food Group Inc.

Contacts:

Eric Lefebvre, CPA, MBA

Chief Executive Officer

Tel: (514) 336-8885

ir@mtygroup.com

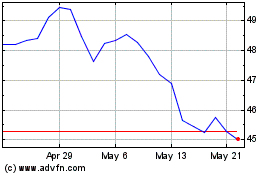

MTY Food (TSX:MTY)

Historical Stock Chart

From Jan 2025 to Feb 2025

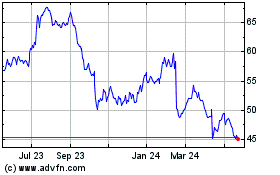

MTY Food (TSX:MTY)

Historical Stock Chart

From Feb 2024 to Feb 2025