Newmont Completes the Sale of Musselwhite, Éléonore, and CC&V

04 March 2025 - 1:00AM

Business Wire

Received $1.7 Billion in Cash Proceeds to Date

in 20251

Newmont Corporation (NYSE: NEM, TSX: NGT, ASX: NEM, PNGX: NEM)

(“Newmont” or the “Company”) announced today that it has completed

the previously disclosed sales of three non-core operations,

including the Musselwhite and Éléonore operations in Canada and the

Cripple Creek & Victor (“CC&V”) operation in Colorado,

USA.

“Today, I am pleased to announce the successful divestment of

three more of our non-core assets, generating total after-tax cash

proceeds of $1.7 billion before closing adjustments,” said Tom

Palmer, Newmont’s President and Chief Executive Officer. “We

look forward to completing the remaining two asset sales and expect

to receive an approximate $0.8 billion in after-tax cash proceeds

during the first half of 2025 for those assets. The closing of

these transactions completes a significant portion of our strategic

portfolio optimization, initiated in early-2024, and enables us to

further strengthen our investment-grade balance sheet and continue

returning capital to shareholders through ongoing share

repurchases.”

Total gross proceeds from announced divestitures are expected to

total up to $4.3 billion, which includes $3.8 billion from non-core

divestitures and $527 million from the sale of other

investments.

Newmont expects to close the sale of its Akyem operation in

Ghana and its Porcupine operation in Canada during the first half

of 2025. As previously announced, the sale of these assets is

expected to generate up to $1.4 billion in gross proceeds, detailed

as follows:

- Up to $1.0 billion from the sale of the Akyem operation,

including $900 million in cash consideration due upon closing and a

further $100 million is expected to be received upon the

satisfaction of certain conditions.

- Up to $425 million from the sale of the Porcupine operation,

including $200 million in cash consideration and $75 million equity

consideration due upon closing. The Company also expects to receive

up to $150 million in deferred cash consideration.

About Newmont

Newmont is the world’s leading gold company and a producer of

copper, zinc, lead, and silver. The Company’s world-class portfolio

of assets, prospects and talent is anchored in favorable mining

jurisdictions in Africa, Australia, Latin America & Caribbean,

North America, and Papua New Guinea. Newmont is the only gold

producer listed in the S&P 500 Index and is widely recognized

for its principled environmental, social, and governance practices.

Newmont is an industry leader in value creation, supported by

robust safety standards, superior execution, and technical

expertise. Founded in 1921, the Company has been publicly traded

since 1925.

At Newmont, our purpose is to create value and improve lives

through sustainable and responsible mining. To learn more about

Newmont’s sustainability strategy and initiatives, go to

www.newmont.com.

Cautionary Statement Regarding Forward-Looking

Statements

This news release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbor

created by such sections and other applicable laws. Where a

forward-looking statement expresses or implies an expectation or

belief as to future events or results, such expectation or belief

is expressed in good faith and believed to have a reasonable basis.

However, such statements are subject to risks, uncertainties and

other factors, which could cause actual results to differ

materially from future results expressed, projected or implied by

the forward-looking statements. Forward-looking statements in this

news release include, without limitation, (i) expectations

regarding the pending sales of Porcupine and Akyem, including,

without limitation, expectations regarding timing and closing of

the pending transactions, including receipt of required approvals

and satisfaction of closing conditions; (ii) expectations regarding

receipt of any deferred contingent cash consideration in the future

and gross consideration estimates; (iii) future strategic portfolio

optimization, (iv) future financial conditions and balance sheet

strength, (v) future return of capital to shareholders, including

share repurchases, and (vi) other statements regarding future

events or results. Estimates or expectations of future events or

results are based upon certain assumptions, which may prove to be

incorrect. Assumptions include, but are not limited to: (i) certain

exchange rate assumptions approximately consistent with current

levels; (ii) certain price assumptions for gold, copper, silver,

zinc, lead and oil; (iii) all closing conditions being satisfied,

and (iv) conditions necessary for receipt of contingent

consideration being met in the future. See the September 10, 2024

press release for further details re the agreement to divest Telfer

and Havieron, the October 8, 2024 press release for further details

re the agreement to divest Akyem, the November 18, 2024 press

release for further details re the agreement to divest Musslewhite,

the November 25, 2024 press release for further details re the

agreement to divest Éléonore, the December 6, 2024 press release

for further details re the agreement to divest CC&V, and the

January 27, 2025 press release for further details re the agreement

to divest Porcupine. Each are available on Newmont’s website. For a

discussion of risks and other factors that might impact future

looking statements , see the Company’s Annual Report on Form 10-K

for the year ended December 31, 2024 filed with the U.S. Securities

and Exchange Commission (the “SEC”) on February 21, 2025, under the

heading “Risk Factors" (including without limitation under the

subheading the headings "Assets held for sale may not ultimately be

divested and we may not receive any or all deferred consideration"

and "The Company’s asset divestitures place demands on the

Company’s management and resources, the sale of divested assets may

not occur as planned or at all, and the Company may not realize the

anticipated benefits of such divestitures" ), available on the SEC

website or at www.newmont.com. Investors are also cautioned that

the extent to which the Company repurchases its shares, and the

timing of such repurchases, will depend upon a variety of factors,

including trading volume, market conditions, legal requirements,

business conditions and other factors. The repurchase program may

be discontinued at any time, and the program does not obligate the

Company to acquire any specific number of shares of its common

stock or to repurchase the full $2.0 billion amount during the

authorization period. The Company does not undertake any obligation

to release publicly revisions to any “forward-looking statement,”

including, without limitation, outlook, to reflect events or

circumstances after the date of this news release, or to reflect

the occurrence of unanticipated events, except as may be required

under applicable securities laws. Investors should not assume that

any lack of update to a previously issued “forward-looking

statement” constitutes a reaffirmation of that statement.

1 Represents after-tax cash proceeds before closing

adjustments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250303230880/en/

Investor Contact – Global Neil Backhouse

investor.relations@newmont.com

Investor Contact – Asia Pacific Natalie Worley

apac.investor.relations@newmont.com

Media Contact – Global Shannon Lijek

globalcommunications@newmont.com

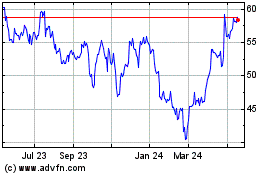

Newmont (TSX:NGT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Newmont (TSX:NGT)

Historical Stock Chart

From Mar 2024 to Mar 2025