Pieridae Energy Limited (“Pieridae” or the “Company”)

(PEA.TO) announces the release of its third quarter

2022 financial and operating results, highlighted by year-over-year

improvement in financial metrics such as Revenue, Net Operating

Income and Adjusted Funds Flow and continued debt reduction. A full

version of Pieridae’s management’s discussion and analysis

(“MD&A”) and unaudited interim condensed consolidated financial

statements and notes thereto for the fiscal period ended September

30, 2022 are available at www.pieridaeenergy.com and on SEDAR

at www.sedar.com.

Highlights

During Q3 2022 Pieridae:

- Generated quarterly Revenue of

$113.3 million up 39% from $81.3 million in the comparable period

in 2021;

- Generated quarterly Net Operating

Income1 of $30.0 million ($0.19 per basic and fully diluted share)

up 67% from $17.9 million in the comparable period in 2021;

- Generated Adjusted Funds Flow from

Operations1 of $22.2 million, up 102% from $11.0 million in Q3

2021;

- Realized net loss of $1.6 million

($0.01 per basic and fully diluted share), an improvement of 89%

from a net loss of $14.8 million ($0.09 per basic and fully diluted

share) in the comparable period in 2021;

- Produced 35,959

boe/d (weighted 84% to natural gas) down 5% from the comparable

period in 2021, due primarily to the previously discussed

re-injection of ethane volumes into the sales gas stream, and

management’s decision to shut-in a portion of production for a

short period in response to volatile AECO gas prices during the

quarter; and

- Repaid $15.3 million

of senior secured term loan, reducing the amount due at maturity to

$227.8 million2.

“During the third quarter we generated strong

cash flow despite volatile commodity prices and the decision to

curtail production for a short time in August. We also reduced our

debt by $15 million during the quarter,” said Pieridae’s Chief

Executive Officer Alfred Sorensen. “Additionally, we are pleased to

report that subsequent to the end of the third quarter, the Company

commenced its previously announced Fall drilling program in the

Brown Creek / Stolberg area.”

Selected Q3 2022 Operational &

Financial Results

|

|

2022 |

|

2021 |

|

2020 |

|

|

($ 000 unless otherwise stated) |

Q3 |

Q2 |

Q1 |

Q4 |

Q3 |

Q2 |

Q1 |

Q4 |

|

Production |

|

|

|

|

|

|

|

|

|

Natural gas (mcf/day) |

181,030 |

|

178,918 |

|

187,719 |

|

198,596 |

|

191,439 |

|

194,232 |

|

215,179 |

|

212,220 |

|

|

Condensate (bbl/day) |

2,911 |

|

2,864 |

|

3,201 |

|

2,851 |

|

2,555 |

|

2,950 |

|

3,158 |

|

3,259 |

|

|

NGLs (bbl/day) |

2,876 |

|

3,695 |

|

6,003 |

|

5,354 |

|

4,133 |

|

3,083 |

|

4,975 |

|

6,171 |

|

|

Sulphur (tonne/day) |

1,312 |

|

1,530 |

|

1,599 |

|

1,185 |

|

1,518 |

|

1,710 |

|

1,713 |

|

1,829 |

|

|

Total production (boe/d) |

35,959 |

|

36,378 |

|

40,491 |

|

41,304 |

|

38,595 |

|

38,404 |

|

43,997 |

|

44,800 |

|

|

Financial |

|

|

|

|

|

|

|

|

|

Realized natural gas price before physical commodity

contracts ($/mcf) |

4.38 |

|

7.13 |

|

4.66 |

|

4.62 |

|

3.58 |

|

3.10 |

|

3.12 |

|

1.96 |

|

|

Realized natural gas price after physical

commodity contracts ($/mcf) |

3.62 |

|

4.67 |

|

4.08 |

|

3.67 |

|

2.7 |

|

2.59 |

|

2.63 |

|

2.16 |

|

|

Benchmark natural gas price ($/mcf) |

4.28 |

|

7.22 |

|

4.75 |

|

4.69 |

|

3.59 |

|

3.11 |

|

3.16 |

|

2.67 |

|

|

Realized condensate price before physical

commodity contracts ($/bbl) |

103.71 |

|

132.60 |

|

112.09 |

|

91.69 |

|

85.25 |

|

76.72 |

|

68.85 |

|

53.48 |

|

|

Realized condensate price after physical commodity

contracts ($/bbl) |

105.82 |

|

116.61 |

|

106.13 |

|

69.71 |

|

65.33 |

|

68.08 |

|

58.4 |

|

53.48 |

|

|

Benchmark condensate price ($/bbl) |

115.66 |

|

132.49 |

|

122.62 |

|

100.1 |

|

70.25 |

|

64.82 |

|

59.05 |

|

56.01 |

|

|

Net income (loss) |

(1,573 |

) |

22,982 |

|

10,549 |

|

4,661 |

|

(14,846 |

) |

(10,058 |

) |

(19,547 |

) |

(45,968 |

) |

|

Net income (loss) per share, basic |

(0.01 |

) |

0.15 |

|

0.07 |

|

0.03 |

|

(0.09 |

) |

(0.06 |

) |

(0.12 |

) |

(0.29 |

) |

|

Net income (loss) per share, diluted |

(0.01 |

) |

0.14 |

|

0.07 |

|

0.03 |

|

(0.09 |

) |

(0.06 |

) |

(0.12 |

) |

(0.29 |

) |

|

Net operating income (loss) (1) |

30,014 |

|

55,969 |

|

47,295 |

|

30,845 |

|

17,920 |

|

14,444 |

|

20,876 |

|

12,829 |

|

|

Cashflow provided by (used in) operating activities |

9,899 |

|

34,922 |

|

3,212 |

|

21,139 |

|

6,885 |

|

12,093 |

|

11,000 |

|

2,362 |

|

|

Adjusted funds flow from operations (1) |

22,224 |

|

48,710 |

|

45,144 |

|

23,317 |

|

10,981 |

|

8,516 |

|

14,878 |

|

8,535 |

|

|

Total assets |

473,642 |

|

499,580 |

|

552,781 |

|

622,540 |

|

560,782 |

|

575,690 |

|

557,696 |

|

612,651 |

|

|

Working capital (deficit) surplus |

(63,245 |

) |

(61,634 |

) |

(64,413 |

) |

(87,665 |

) |

(52,534 |

) |

(47,862 |

) |

(28,314 |

) |

(19,615 |

) |

|

Capital expenditures |

7,216 |

|

9,739 |

|

3,534 |

|

1,493 |

|

9,852 |

|

17,959 |

|

5,668 |

|

8,926 |

|

|

Development expenses |

- |

|

- |

|

- |

|

225 |

|

783 |

|

(4,862 |

) |

8,604 |

|

8,682 |

|

(1) Refer to the “non-GAAP measures” section of

the Company’s Q3 2022 MD&A.

Operating Netback

|

|

2022 |

|

2021 |

|

|

($ per BOE) |

Q3 |

Q2 |

Q1 |

Q4 |

Q3 |

Q2 |

Q1 |

|

Revenue before physical commodity contracts |

35.54 |

|

52.94 |

|

37.04 |

|

33.53 |

|

27.40 |

|

24.28 |

|

23.82 |

|

|

Loss on physical commodity contracts |

(3.64 |

) |

(13.34 |

) |

(3.18 |

) |

(6.04 |

) |

(5.69 |

) |

(3.86 |

) |

(3.19 |

) |

|

Third party processing and other income |

2.34 |

|

2.27 |

|

1.75 |

|

0.88 |

|

1.19 |

|

1.47 |

|

1.48 |

|

|

Royalties |

(6.33 |

) |

(7.08 |

) |

(5.25 |

) |

(4.65 |

) |

(1.70 |

) |

(1.11 |

) |

(0.97 |

) |

|

Operating |

(17.36 |

) |

(16.00 |

) |

(15.72 |

) |

(14.17 |

) |

(14.84 |

) |

(15.41 |

) |

(14.70 |

) |

|

Transportation |

(1.48 |

) |

(1.89 |

) |

(1.66 |

) |

(1.42 |

) |

(1.32 |

) |

(1.24 |

) |

(1.17 |

) |

|

Netback ($/boe) |

9.07 |

|

16.90 |

|

12.98 |

|

8.13 |

|

5.04 |

|

4.13 |

|

5.27 |

|

Commodity Pricing and Hedge

PositionCommencing the third week of August 2022, daily

AECO spot prices dropped significantly as a result of pipeline

maintenance on TC Energy’s Nova Gas Transmission Line (“NGTL”) and

Enbridge’s Transportation South (“T-South”) systems, an unplanned

compressor failure in Alberta and restrictions to gas storage

injections. These pipelines connect most of the natural gas

production in Western Canada to domestic and export markets, and

the pipeline downtime created negative AECO spot prices as volumes

were unable to be transported to local and international terminals.

Subsequently, current AECO prices have rebounded, however, AECO

prices have remained volatile through September and October as

further maintenance on the NGTL system was completed.

Notwithstanding the fluctuation in the daily

spot AECO pricing during the quarter, the AECO monthly natural gas

price index increased 19% in the third quarter of 2022 compared to

2021. Average North American crude oil prices increased 30% in the

third quarter of 2022 compared to the third quarter of 2021 based

on persistent supply constraints and market uncertainty due to

ongoing geopolitical events.

Pieridae’s realized prices reflect the mix of

spot sales and physical forward sales contracts consistent with the

Company’s hedging policy. In the nine months ended September 30,

2022, volumes sold under physical forward sales contracts

represented 61% of total production and 43% of total revenue.

|

Nine months ended September 30, 2022 |

Average Realized Prices |

Benchmark Prices |

|

Natural Gas before physical commodity contracts ($/mcf) (1) |

5.37 |

5.41 |

|

Natural Gas after physical commodity contracts ($/mcf) (1) |

4.12 |

5.41 |

|

Condensate before physical commodity contracts ($/bbl) (2) |

115.89 |

123.56 |

|

Condensate after physical commodity contracts ($/bbl) (2) |

109.37 |

123.56 |

|

Sulphur ($/tonne) (3) |

47.93 |

395.61 |

(1) AECO 5A benchmark price ($/mcf) assuming a

1.0551 gj/Mcf conversion rate(2) Condensate

benchmark price ($/bbl)(3) Sulphur ($/tonne)

Pieridae’s outstanding physical forward sales

contracts are currently as follows:

|

after September 30, 2022 |

Natural Gas |

Condensate |

|

$/gj |

gj/d |

$/bbl |

bbl/d |

|

Q4 2022 |

4.47 |

98,641 |

130.543 |

1,000 |

|

Q1 2023 |

5.40 |

44,139 |

103.244 |

700 |

|

Q2 2023 |

4.82 |

27,500 |

103.244 |

700 |

|

Q3 2023 |

4.82 |

27,500 |

103.244 |

700 |

|

Q4 2023 |

4.82 |

9,266 |

- |

- |

Pieridae’s outstanding financial risk management

contracts are currently as follows:

|

|

AECO Swap |

WTI Swap |

C5 WTI Differential Swap |

|

$/gj |

gj/d |

$/bbl |

bbl/d |

$/bbl |

bbl/d |

|

Q4 2022 |

5.54 |

842 |

- |

- |

- |

|

- |

|

Q1 2023 |

5.54 |

2,500 |

107.64 |

500 |

(4.67 |

) |

500 |

|

Q2 2023 |

3.94 |

2,500 |

107.64 |

500 |

(4.67 |

) |

500 |

|

Q3 2023 |

- |

- |

107.64 |

500 |

(4.67 |

) |

500 |

Pieridae will continue to hedge in order to

mitigate commodity price volatility and protect the cash flow

required to fund the Company’s facility maintenance capital

requirements, debt service obligations and capital development

program while allowing the Company to participate in future

commodity price upside.

Production Production in the

third quarter of 2022 averaged 35,959 boe/d, a 5% decrease from

38,595 boe/d in Q3 2021, due to re-injection of ethane volumes into

the gas stream and temporary shut-in of production due to AECO spot

price volatility.

Pieridae had approximately 54% of its natural

gas production hedged during the month of August. However, Pieridae

determined it was prudent to temporarily shut-in certain gas wells

during this period of extremely low spot AECO prices. As a result,

the Company shut-in unhedged gas volumes (750 boe/d) for several

days in our Lynx, Palliser, Moose and Tay areas.

As previously mentioned, Pieridae has

re-injected liquid ethane (“C2”) back into the natural gas sales

stream at two gas processing facilities during the quarter forgoing

C2 production of approximately 1,800 - 2,300 boe/d but increasing

the heat content and value of the gas stream, resulting in no

material impact to revenue. Pieridae expects to continue

re-injecting liquid ethane into the gas stream for the remainder of

the year and into 2023.

Foothills Drilling

ProgramSubsequent to quarter end, the Company commenced

its three well drilling program at Brown Creek and Stolberg in our

Central Alberta Foothills area. The project will incur gross

development capital costs during Q4 2022 and Q1 2023 of

approximately $27 million. Successful wells in these reservoirs

provide significant upside potential of up to 39 additional

drilling opportunities in the Central AB Foothills core area.

2022 Guidance

|

($ 000s unless otherwise noted) |

Revised 2022 Guidance |

Previous 2022 Guidance |

|

Low |

High |

Low |

High |

|

Total production (boe/d) |

37,500 |

39,500 |

37,500 |

39,500 |

|

Net operating income (1)(2) |

160,000 |

180,000 |

150,000 |

180,000 |

|

Implied operating netback ($/boe) (2) |

12.00 |

14.00 |

12.00 |

14.00 |

|

Sustaining capital expenditures (3) |

17,000 |

22,000 |

17,000 |

22,000 |

|

Development capital expenditures (4) |

20,000 |

25,000 |

25,000 |

30,000 |

(1) Refer to the “non-GAAP measures” section of the

Company’s Q3 2022 MD&A.(2) 2022 outlook assumes average

2022 AECO price of $5.22/Mcf and average 2022 WTI price of

USD$90.11/bbl and accounts for fixed price forward commodity sales

contracts as of September 30, 2022(3) Comprised of facility

maintenance and turnaround capital expenditures(4) Comprised

of seismic, development and land capital expenditures

Pieridae’s priority is on improving financial

flexibility by strengthening the balance sheet while sustaining

production, implementing cost control initiatives, optimizing

infrastructure logistics and executing non-core asset

dispositions.

The Company’s 2022 development capital program

guidance range has been decreased and narrowed to $20 - 25 million

reflecting small reductions in scope of optimization work and

rescheduling of costs related to the Fall drilling program into the

first quarter of 2023.

Conference Call DetailsA

conference call to discuss the results will be held for the

investment community on Thursday November 10, 2022 at 8.30 a.m.

MDT/10.30 a.m. EDT. To participate in the conference webcast or

call, you are asked to register using one of the links provided

below. Details regarding the webcast or call will be provided to

you upon registration.

Webcast participants registration

URL: https://edge.media-server.com/mmc/p/7auri9ww

Live call participants registration

URL: https://register.vevent.com/register/BI2beb5d0ec7e844ceb99e6b15fcb3c019

About PieridaePieridae is a

Canadian energy company headquartered in Calgary, Alberta that was

founded in 2011. Through a number of corporate and asset

acquisitions, we have grown into a significant upstream and

midstream producer with assets concentrated in the Canadian

Foothills, producing conventional natural gas, NGLs, condensate and

sulphur. Pieridae provides the energy to fuel people’s daily lives

while supporting the environment and the transition to a

lower-carbon economy. Pieridae’s common shares trade on the TSX

under the symbol “PEA”.

For further information, visit

www.pieridaeenergy.com, or please contact:

| Alfred Sorensen, Chief Executive Officer |

Adam Gray, Chief Financial Officer |

| Telephone: (403) 261-5900 |

Telephone: (403) 261-5900 |

| |

|

| Investor Relations |

|

| investors@pieridaeenergy.com |

|

| |

|

Forward-Looking

StatementsCertain statements contained herein may

constitute "forward-looking statements" or "forward-looking

information" within the meaning of applicable securities laws

(collectively "forward-looking statements"). Words such as "may",

"will", "should", "could", "anticipate", "believe", "expect",

"intend", "plan", "potential", "continue", "shall", "estimate",

"expect", "propose", "might", "project", "predict", "forecast" and

similar expressions may be used to identify these forward-looking

statements.

Forward-looking statements involve significant

risk and uncertainties. A number of factors could cause actual

results to differ materially from the results discussed in the

forward-looking statements including, but not limited to, risks

associated with oil and gas exploration, development, exploitation,

production, marketing and transportation, loss of markets,

volatility of commodity prices, currency fluctuations, imprecision

of resources estimates, environmental risks, competition from other

producers, incorrect assessment of the value of acquisitions,

failure to realize the anticipated benefits or synergies from

acquisitions, delays resulting from or inability to obtain required

regulatory approvals and ability to access sufficient capital from

internal and external sources and the risk factors outlined under

"Risk Factors" and elsewhere herein. The recovery and resources

estimate of Pieridae's reserves provided herein are estimates only

and there is no guarantee that the estimated resources will be

recovered. As a consequence, actual results may differ materially

from those anticipated in the forward-looking statements.

Forward-looking statements are based on a number

of factors and assumptions which have been used to develop such

forward-looking statements, but which may prove to be incorrect.

Although Pieridae believes that the expectations reflected in such

forward-looking statements are reasonable, undue reliance should

not be placed on forward-looking statements because Pieridae can

give no assurance that such expectations will prove to be correct.

In addition to other factors and assumptions which may be

identified in this document, assumptions have been made regarding,

among other things: the impact of increasing competition; the

general stability of the economic and political environment in

which Pieridae operates; the timely receipt of any required

regulatory approvals; the ability of Pieridae to obtain qualified

staff, equipment and services in a timely and cost efficient

manner; the ability of the operator of the projects which Pieridae

has an interest in, to operate the field in a safe, efficient and

effective manner; the ability of Pieridae to obtain financing on

acceptable terms; the ability to replace and expand oil and natural

gas resources through acquisition, development and exploration; the

timing and costs of pipeline, storage and facility construction and

expansion and the ability of Pieridae to secure adequate product

transportation; future commodity prices; currency, exchange and

interest rates; the regulatory framework regarding royalties, taxes

and environmental matters in the jurisdictions in which Pieridae

operates; timing and amount of capital expenditures, future sources

of funding, production levels, weather conditions, success of

exploration and development activities, access to gathering,

processing and pipeline systems, advancing technologies, and the

ability of Pieridae to successfully market its oil and natural gas

products.

Readers are cautioned that the foregoing list of

factors is not exhaustive. Additional information on these and

other factors that could affect Pieridae's operations and financial

results are included in reports on file with Canadian securities

regulatory authorities and may be accessed through the SEDAR

website (www.sedar.com), and at Pieridae's website

(www.pieridaeenergy.com). Although the forward-looking statements

contained herein are based upon what management believes to be

reasonable assumptions, management cannot assure that actual

results will be consistent with these forward-looking statements.

Investors should not place undue reliance on forward-looking

statements. These forward-looking statements are made as of the

date hereof and Pieridae assumes no obligation to update or review

them to reflect new events or circumstances except as required by

Applicable Securities Laws.

Forward-looking statements contained herein

concerning the oil and gas industry and Pieridae's general

expectations concerning this industry are based on estimates

prepared by management using data from publicly available industry

sources as well as from reserve reports, market research and

industry analysis and on assumptions based on data and knowledge of

this industry which Pieridae believes to be reasonable. However,

this data is inherently imprecise, although generally indicative of

relative market positions, market shares and performance

characteristics. While Pieridae is not aware of any misstatements

regarding any industry data presented herein, the industry involves

risks and uncertainties and is subject to change based on various

factors.

Additional Reader

AdvisoriesBarrels of oil equivalent (“boe”) may be

misleading, particularly if used in isolation. A boe conversion

ratio of 6 Mcf: 1 boe is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead.

Abbreviations

|

Natural Gas |

Oil |

|

mcf |

thousand cubic feet |

bbl/d |

barrels per day |

|

mcf/d |

thousand cubic feet per day |

boe/d |

barrels of oil equivalent per

day |

|

mmcf/d |

million cubic feet per day |

WCS |

Western Canadian Select |

|

AECO |

Alberta benchmark price for natural gas |

WTI |

West Texas Intermediate |

Neither TSX nor its Regulation Services

Provider (as that term is defined in policies of the TSX) accepts

responsibility for the adequacy or accuracy of this

release.

1 Refer to the “non-GAAP measures” section of the Company’s Q3

2022 MD&A.2 Includes $50 million non interest-bearing deferred

fee due at maturity3 Condensate forward sale contracts settled

against C$WTI before the condensate differential4 Condensate

forward sale contracts settled against C$C5 after the condensate

differential

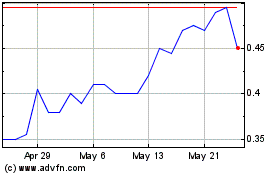

Pieridae Energy (TSX:PEA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Pieridae Energy (TSX:PEA)

Historical Stock Chart

From Dec 2023 to Dec 2024