Perseus Mining March Quarterly Report

24 April 2024 - 8:40AM

MARCH 2024 QUARTER REPORT

Perseus Mining Delivers Another

Impressive Quarter

PERTH, Western Australia/ April 24,

2024/Perseus Mining Limited (“Perseus” or the “Company”)

(TSX & ASX: PRU) reports on its activities for the three

months’ period ended March 31, 2024 (the “Quarter”).

- Key operating indicators and

highlights for the March 2024 quarter

include:

|

PERFORMANCE INDICATOR |

UNIT |

SEPTEMBER 2023 QUARTER |

DECEMBER 2023 QUARTER |

MARCH 2024 QUARTER |

FINANCIAL YEAR (FY) 2024TO

DATE |

|

Gold recovered |

Ounces |

132,804 |

128,773 |

127,471 |

389,048 |

|

Gold poured |

Ounces |

132,717 |

128,339 |

128,356 |

389,412 |

|

Production Cost |

US$/ounce |

805 |

862 |

923 |

862 |

|

All-In Site Cost (AISC) |

US$/ounce |

937 |

1,023 |

1,091 |

1,016 |

|

Gold sales |

Ounces |

115,954 |

135,137 |

115,648 |

366,739 |

|

Average sales price |

US$/ounce |

1,936 |

1,963 |

2,025 |

1,974 |

|

Notional Cashflow |

US$ million |

132 |

122 |

119 |

373 |

- Gold production

of 127,471 ounces in the March 2024 quarter, with financial year to

date gold production of 389,048 ounces.

- March 2024

quarter weighted average AISC of US$1,091 per ounce, slightly above

the prior quarter, as foreshadowed last quarter.

- Perseus’s

strong operating performance is expected to continue for the

remainder of the June 2024 Half Year with gold production and AISC

guidance unchanged at 226,000-254,000 ounces at an AISC of US$1,180

to US$1,340.

- Average gold

sales price increased 3% quarter on quarter to US$2,025 per ounce,

while the quantity of gold sold reduced to 115,648 ounces due to

the timing of gold shipments and sales.

- Average

quarterly cash margin of US$934 per ounce of gold resulted in

notional operating cashflow of US$119 million in the quarter or

US$373 million for the nine-month period to March 31, 2024.

- Available cash

and bullion balance of US$702 million, plus US$74 million of listed

securities at quarter-end. Zero debt and US$300 million of undrawn

debt capacity available.

- Group 12-month

rolling average TRIFR at 1.02, slightly up from 0.89 in the

December 2023 quarter.

- A Cooperation

Agreement was signed with Ajlan & Bros Mining & Metals

Company, the mining division of a Kingdom of Saudi Arabia based

investment conglomerate company, Ajlan & Bros, to investigate

exploration and development opportunities on the Nubian and Arabian

Shield regions.

- Perseus’s

takeover offer for OreCorp Limited advanced materially during the

quarter with the OreCorp Board endorsing the offer. Subsequent to

quarter end, Perseus’s ownership of OreCorp advanced beyond 90%

enabling compulsory acquisition of outstanding shares to

begin.

Group Gold Production and Cost Market

Guidance

Forecast group gold production and AISC for the June 2024 half

year and full 2024 financial year are shown in Table

1 below. This guidance is unchanged from what was

previously provided to the market.

Table 1: Production and Cost Guidance

|

PARAMETER |

UNITS |

DECEMBER 2023 HALF YEAR

(ACTUAL) |

JUNE 2024

HALF YEARFORECAST |

2024 FINANCIAL YEAR FORECAST |

|

|

Yaouré Gold Mine |

|

|

|

|

|

Production |

Ounces |

134,379 |

100,000 to 113,000 |

235,000 to 247,000 |

|

|

All-in Site Cost |

USD per ounce |

805 |

$1,150 to $1,300 |

$900 to $1,000 |

|

|

Sissingué Gold Mine |

|

|

|

|

|

Production |

Ounces |

28,551 |

36,000 to 41,000 |

65,000 to 69,000 |

|

|

All-in Site Cost |

USD per ounce |

1,719 |

$1,450 to $1,650 |

$1,400 to $1,500 |

|

|

Edikan Gold Mine |

|

|

|

|

|

Production |

Ounces |

98,647 |

90,000 to 100,000 |

191,000 to 201,000 |

|

|

All-in Site Cost |

USD per ounce |

1,003 |

$1,100 to $1,250 |

$1,000 to $1,100 |

|

|

PERSEUS GROUP |

|

|

|

|

|

|

Production |

Ounces |

261,577 |

226,000 to 254,000 |

491,000 to 517,000 |

|

|

All-in Site Cost |

USD per ounce |

979 |

$1,180 to $1,340 |

$1,000 to $1,100 |

|

Competent Person Statement

All production targets referred to in this release are

underpinned by estimated Ore Reserves which have been prepared by

competent persons in accordance with the requirements of the JORC

Code.

Edikan

The information in this release that relates to

the Open Pit and Underground Mineral Resources and Ore Reserve at

Edikan was updated by the Company in a market announcement “Perseus

Mining updates Mineral Resources and Ore Reserves” released on 24

August 2023. The Company confirms that all material assumptions

underpinning those estimates and the production targets, or the

forecast financial information derived therefrom, in that market

release continue to apply and have not materially changed. The

Company further confirms that material assumptions underpinning the

estimates of Ore Reserves described in “Technical Report — Edikan

Gold Mine, Ghana” dated 7 April 2022 continue to apply.

Sissingué, Fimbiasso and Bagoé

The information in this release that relates to

the Mineral Resources and Ore Reserve at the Sissingué complex was

updated by the Company in a market announcement “Perseus Mining

updates Mineral Resources and Ore Reserves” released on 24 August

2023. The Company confirms that all material assumptions

underpinning those estimates and the production targets, or the

forecast financial information derived therefrom, in that market

release continue to apply and have not materially changed. The

Company further confirms that material assumptions underpinning the

estimates of Ore Reserves described in “Technical Report —

Sissingué Gold Project, Côte d’Ivoire” dated 29 May 2015 continue

to apply.

Yaouré

The information in this release that relates to

the Open Pit and Underground Mineral Resources and Ore Reserve at

Yaouré was updated by the Company in a market announcement “Perseus

Mining announces Open Pit and Underground Ore Reserve update at

Yaouré” released on 23 August 2023. The Company confirms that all

material assumptions underpinning those estimates and the

production targets, or the forecast financial information derived

therefrom, in that market release continue to apply and have not

materially changed. The Company further confirms that material

assumptions underpinning the estimates of Ore Reserves described in

“Technical Report — Yaouré Gold Project, Côte d’Ivoire” dated 19

December 2023 continue to apply.

Meyas Sand Gold Project

The information in this report that relates to

the mineral resources and probable reserves of the Meyas Sand Gold

Project was first reported by the Company in a market announcement

“Perseus Enters Into Agreement to Acquire Orca Gold Inc.” released

on 28 February 2022. The Company confirms it is not in possession

of any new information or data relating to those estimates that

materially impacts of the reliability of the estimate of the

Company’s ability to verify the estimate as a mineral resource or

ore reserve in accordance with Appendix 5A (JORC Code) and the

information in that original market release continues to apply and

have not materially changed. These estimates are prepared in

accordance with Canadian National Instrument 43-101 standards and

have not been reported in accordance with the JORC Code. A

competent person has not done sufficient work to classify the

resource in accordance with the JORC Code and it is uncertain that

following evaluation and/or further exploration work that the

estimate will be able to be reported as a mineral resource or ore

reserve in accordance with the JORC Code. This release and all

technical information regarding Orca’s NI 43-101 have been reviewed

and approved by Adrian Ralph, a Qualified Person for the purposes

of NI 43-101.

Caution Regarding Forward Looking

Information:

This report contains forward-looking information

which is based on the assumptions, estimates, analysis and opinions

of management made in light of its experience and its perception of

trends, current conditions and expected developments, as well as

other factors that management of the Company believes to be

relevant and reasonable in the circumstances at the date that such

statements are made, but which may prove to be incorrect.

Assumptions have been made by the Company regarding, among other

things: the price of gold, continuing commercial production at the

Yaouré Gold Mine, the Edikan Gold Mine and the Sissingué Gold Mine

without any major disruption, the receipt of required governmental

approvals, the accuracy of capital and operating cost estimates,

the ability of the Company to operate in a safe, efficient and

effective manner and the ability of the Company to obtain financing

as and when required and on reasonable terms. Readers are cautioned

that the foregoing list is not exhaustive of all factors and

assumptions which may have been used by the Company. Although

management believes that the assumptions made by the Company and

the expectations represented by such information are reasonable,

there can be no assurance that the forward-looking information will

prove to be accurate. Forward-looking information involves known

and unknown risks, uncertainties, and other factors which may cause

the actual results, performance or achievements of the Company to

be materially different from any anticipated future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others,

the actual market price of gold, the actual results of current

exploration, the actual results of future exploration, changes in

project parameters as plans continue to be evaluated, as well as

those factors disclosed in the Company's publicly filed documents.

The Company believes that the assumptions and expectations

reflected in the forward-looking information are reasonable.

Assumptions have been made regarding, among other things, the

Company’s ability to carry on its exploration and development

activities, the timely receipt of required approvals, the price of

gold, the ability of the Company to operate in a safe, efficient

and effective manner and the ability of the Company to obtain

financing as and when required and on reasonable terms. Readers

should not place undue reliance on forward-looking information.

Perseus does not undertake to update forward-looking information,

except in accordance with applicable securities laws.

|

ASX/TSX CODE: PRUCAPITAL

STRUCTURE:Ordinary shares: 1,373,791,215Performance

rights: 9,969,110REGISTERED OFFICE:Level 2437

Roberts RoadSubiaco WA 6008Telephone: +61 8 6144

1700www.perseusmining.com |

DIRECTORS:Mr Jeff QuartermaineChairman & CEOMs

Amber BanfieldNon-Executive Director Ms Elissa

CorneliusNon-Executive DirectorMr Dan LougherNon-Executive

DirectorMr John McGloinNon-Executive DirectorMr David

RansomNon-Executive Director |

CONTACTS:Jeff

QuartermaineChairman &

CEOjeff.quartermaine@perseusmining.comStephen

FormanInvestor Relations+61 484 036

681stephen.forman@perseusmining.comNathan

RyanCorporate Relations+61 420 582

887nathan.ryan@nwrcommunications.com.au |

- 20240424 TSX Release_Quarterly Report FY24-Q3_final

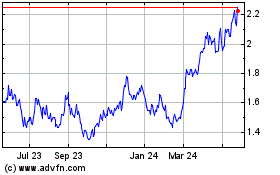

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Dec 2024 to Jan 2025

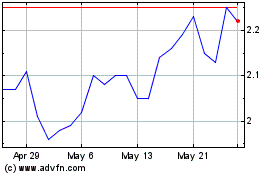

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Jan 2024 to Jan 2025