PERSEUS MINING’S HALF YEAR PROFIT UP 22% TO US$201M, NET

CASH & BULLION UP US$117M TO US$704M

Perth, Western Australia/ February 24,

2025/Mid-tier, gold producer, developer and explorer,

Perseus Mining Limited (ASX/TSX:PRU) is pleased to report material

improvements across all key financial metrics including revenue,

EBITDA, profit after tax, operating cash flow and net cash position

in its Interim Financial Report for the six months ending December

31, 2024 (H1 FY25).

HIGHLIGHTS

-

Revenue increased to US$581.8 million, up 19% on prior

corresponding period

-

EBITDA(1) up 26% to US$352.7 million on prior corresponding

period

-

Profit after Tax increased to US$201 million up 22% on prior

corresponding period

-

Operating cash flow increased to US$248 million, up 17% on prior

corresponding period

-

Total assets of US$2.1 billion; Net tangible assets of US$1.3

billion or US$0.97 per share

-

Net cash and bullion of US$704 million up by US$117 million from

June 30, 2024 balance

-

Zero debt with US$300 million undrawn debt capacity and US$67

million of marketable shares

-

Interim dividend of Australian dollar (AUD) 2.5 cents per share

declared, a 100% increase on H1 FY24 interim return

-

Perseus confirms market guidance for FY25 of 469,000 to 504,000oz

gold production at US$1,250 to US$1,280/oz AISC

Table 1: Summary of Financial

Performance for the six months ending December 31,

2024

|

METRIC |

US$(Million) |

US CENTS PER

SHARE(3) |

|

Revenue |

581.8 |

42.3 |

|

EBITDA(1) |

352.7 |

25.6 |

|

Profit after tax |

201.1 |

14.6 |

|

Operating cash flow (2) |

247.6 |

18.0 |

|

Net tangible assets |

1,338 |

97.3 |

|

Cash and bullion |

704 |

51.1 |

(1) Gross profit from operations before

depreciation and amortisation(2) Net cash inflows

from operating activities (3) Calculated using the

weighted average outstanding ordinary shares at 31 December 2024 of

1,375,822,145

COMMENTARY

During the six months to December 31, 2024,

Perseus continued to deliver on its promises, maintaining its

production levels and achieving its market guidance for both

production and costs. Despite seeing a slight increase in overall

costs due to inflationary pressures, Perseus has benefited from its

strong hedging strategy and improving gold price environment

resulting in the Group’s average sales price increasing at a

proportionately greater rate than its production costs.

Gold production for the Group during the half

year totalled 253,709 ounces at an All-In Site Cost (including

production costs, royalties and sustaining capital) (AISC) of

US$1,162 per ounce. This result included: 123,158 ounces produced

at Yaouré at an AISC of US$1,124 per ounce; 33,917 ounces produced

at Sissingué at an AISC of US$1,701 per ounce; and 96,634 ounces of

gold produced at Edikan at an AISC of US$1,022per ounce.

Gold sales by the Group during the half-year

totalled 245,518 ounces at an average sales price of US$2,350 per

ounce. This result included: 115,345 ounces sold by Yaouré at a

weighted average sales price of US$2,326 per ounce; 34,223 ounces

sold by Sissingué at a weighted average sales price of US$2,264 per

ounce; and 95,950 ounces sold by Edikan at an average sales price

of US$2,409 per ounce. During the six months, the Group sold 2%

less gold, at a price that was approximately 20% higher than in the

comparative period in 2023.

The Group’s net profit after tax for the

six-month period ended 31 December 2024 was up 22% on the previous

corresponding period to US$201.1 million (December 31, 2023:

US$164.7 million), after bringing to account a foreign exchange

gain of US$10.3 million (31 December 2023: US$2.7 million loss).

Gross profit from operations for the period ended 31 December 2024

was up 26% on the comparative period to US$265.3 million (December

31, 2023: US$210.3 million). These increases are largely

attributable to a 19% increase in revenue to $581.8 million

(December 31, 2023: US$489.0 million), with only a 10% increase in

cost of sales. This result represents the continued strong

contributions from Edikan and Yaouré, and improved profitability

for Sissingué.

The Group generated net cash from operating

activities for the half year ended December 31, 2024 of US$247.6

million, up 17% on the comparative period (December 31, 2023:

US$211.2 million).

As at December 31, 2024, Perseus had cash

on-hand of US$628.5 million (June 30, 2024: US$536.9 million), and

29,078 ounces of gold bullion (June 30, 2024: 21,570 ounces) valued

at US$76 million (June 30, 2024: US$50.3 million). Perseus also

owns US$67 million of investments in listed securities. At the end

of the period, the Group had net assets of US$1,878.3 million (June

30, 2024: US$1,780.0 million) and an excess of current assets over

current liabilities of US$659.7 million (June 30, 2024: US$544.1

million). The Group’s net assets increased compared with the prior

year predominantly due to an increase in its cash balance as a

result of its strong operating margin, as well as an increase in

its inventory balances, due to a buildup of stockpiles.

Group Gold Production and Cost Market

Guidance

Forecast group gold production and AISC for the

June 2025 half year (2H FY25) and full 2025 financial year (FY25)

are shown in the table below.

|

PARAMETER |

UNITS |

DECEMBER 2024 HALF

YEAR(ACTUAL) |

JUNE 2025 HALF YEARFORECAST |

2025 FINANCIAL YEARFORECAST |

|

Yaouré Gold Mine |

|

|

|

|

Production |

Ounces |

123,158 |

120,000 - 135,000 oz |

243,158 – 258,158 oz |

|

All-in Site Cost |

USD per ounce |

1,124 |

US$1,215 – 1,315 per/oz |

US$1,160 – 1,210/oz |

|

Edikan Gold Mine |

|

|

|

|

Production |

Ounces |

96,634 |

75,000 - 85,000 oz |

172,634 – 182,634 oz |

|

All-in Site Cost |

USD per ounce |

1,022 |

US$1,325 – 1,425/oz |

US$1,150 – 1,190/oz |

|

Sissingué Gold Complex |

|

|

|

|

Production |

Ounces |

33,917 |

20,000 - 30,000 oz |

53,917 – 63,917 oz |

|

All-in Site Cost |

USD per ounce |

1,701 |

US$2,100 – 2,200/oz |

US$1,880 – 1,900/oz |

|

PERSEUS GROUP |

|

|

|

|

|

Production |

Ounces |

253,709 |

215,000 - 250,000 ounces |

469,709 – 504,709 ounces |

|

All-in Site Cost |

USD per ounce |

1,162 |

US$1,360 – 1,435 per ounce |

US$1,250 – 1,280 per ounce |

Perseus’s CEO Jeff Quartermaine

said:

“With this result, Perseus has continued to

cement its position as one of the more profitable mid-tier gold

producers on a global scale, with its gold production of 253,709

ounces at an all-in site cost of US$1,162 per ounce during the

December 2024 Half Year, translating to a strong performance across

all key financial metrics.

Our after-tax earnings of US$201 million for the

six-month period was an excellent result, as was our operating

cashflow of US$248 million for the period. By December 31, 2024

Half Year, our net tangible assets had increased to US$1.34 billion

including cash and bullion on hand of US$704 million, US$67 million

of marketable securities, no debt but undrawn debt capacity of

US$300 million.

In addition, in recognition of the improving

financial position of the Company, we have increased our interim

dividend to AUD 2.5 cents per share, while maintaining a balanced

capital structure which enables us to continue to enhance the

quality of our asset portfolio through future growth.”

This market announcement was authorised

for release by the Board of Directors of Perseus Mining

Limited.

IMPORTANT NOTICES

COMPETENT PERSON STATEMENT

All production targets referred to in this release are

underpinned by estimated Ore Reserves which have been prepared by

competent persons in accordance with the requirements of the JORC

Code.

Edikan

The information in this release that relates to

the Open Pit and Underground Mineral Resources and Ore Reserve at

Edikan was updated by the Company in a market announcement “Perseus

Mining updates Mineral Resources and Ore Reserves” released on

21August 2024. The Company confirms that all material assumptions

underpinning those estimates and the production targets, or the

forecast financial information derived therefrom, in that market

release continue to apply and have not materially changed. The

Company further confirms that material assumptions underpinning the

estimates of Ore Reserves described in “Technical Report — Edikan

Gold Mine, Ghana” dated 7 April 2022 continue to apply.

Sissingué, Fimbiasso and Bagoé

The information in this release that relates to

the Mineral Resources and Ore Reserve at the Sissingué complex was

updated by the Company in a market announcement “Perseus Mining

updates Mineral Resources and Ore Reserves” released on 21 August

2024. The Company confirms that all material assumptions

underpinning those estimates and the production targets, or the

forecast financial information derived therefrom, in that market

release continue to apply and have not materially changed. The

Company further confirms that material assumptions underpinning the

estimates of Ore Reserves described in “Technical Report —

Sissingué Gold Project, Côte d’Ivoire” dated 29 May 2015 continue

to apply.

Yaouré

The information in this release that relates to

the Open Pit and Underground Mineral Resources and Ore Reserve at

Yaouré was updated by the Company in a market announcement “Perseus

Mining updates Mineral Resources and Ore Reserves” released on 21

August 2024. The Company confirms that all material assumptions

underpinning those estimates and the production targets, or the

forecast financial information derived therefrom, in that market

release continue to apply and have not materially changed. The

Company further confirms that material assumptions underpinning the

estimates of Ore Reserves described in “Technical Report — Yaouré

Gold Project, Côte d’Ivoire” dated 19 December 2023 continue to

apply.

CAUTION REGARDING FORWARD LOOKING

INFORMATION:

This report contains forward-looking information

which is based on the assumptions, estimates, analysis and opinions

of management made in light of its experience and its perception of

trends, current conditions and expected developments, as well as

other factors that management of the Company believes to be

relevant and reasonable in the circumstances at the date that such

statements are made, but which may prove to be incorrect.

Assumptions have been made by the Company regarding, among other

things: the price of gold, continuing commercial production at the

Yaouré Gold Mine, the Edikan Gold Mine and the Sissingué Gold Mine

without any major disruption, the receipt of required governmental

approvals, the accuracy of capital and operating cost estimates,

the ability of the Company to operate in a safe, efficient and

effective manner and the ability of the Company to obtain financing

as and when required and on reasonable terms. Readers are cautioned

that the foregoing list is not exhaustive of all factors and

assumptions which may have been used by the Company. Although

management believes that the assumptions made by the Company and

the expectations represented by such information are reasonable,

there can be no assurance that the forward-looking information will

prove to be accurate. Forward-looking information involves known

and unknown risks, uncertainties, and other factors which may cause

the actual results, performance or achievements of the Company to

be materially different from any anticipated future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others,

the actual market price of gold, the actual results of current

exploration, the actual results of future exploration, changes in

project parameters as plans continue to be evaluated, as well as

those factors disclosed in the Company's publicly filed documents.

The Company believes that the assumptions and expectations

reflected in the forward-looking information are reasonable.

Assumptions have been made regarding, among other things, the

Company’s ability to carry on its exploration and development

activities, the timely receipt of required approvals, the price of

gold, the ability of the Company to operate in a safe, efficient

and effective manner and the ability of the Company to obtain

financing as and when required and on reasonable terms. Readers

should not place undue reliance on forward-looking information.

Perseus does not undertake to update forward-looking information,

except in accordance with applicable securities laws.

|

ASX/TSX CODE: PRUCAPITAL

STRUCTURE:Ordinary shares: 1,372,184,529Performance

rights: 10,383,593REGISTERED OFFICE:Level 2437

Roberts RoadSubiaco WA 6008Telephone: +61 8 6144

1700www.perseusmining.com |

DIRECTORS:Rick MenellNon-Executive ChairmanJeff

QuartermaineManaging Director & CEO Amber BanfieldNon-Executive

DirectorElissa CorneliusNon-Executive DirectorDan

LougherNon-Executive DirectorJohn McGloinNon-Executive

Director |

CONTACTS:Jeff

QuartermaineManaging Director &

CEOjeff.quartermaine@perseusmining.comStephen

FormanInvestor Relations+61 484 036

681stephen.forman@perseusmining.comNathan

RyanMedia Relations+61 420 582

887nathan.ryan@nwrcommunications.com.au |

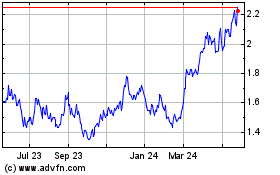

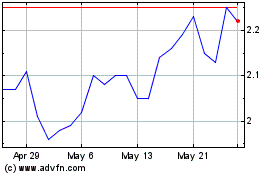

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Jan 2025 to Feb 2025

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Feb 2024 to Feb 2025