Platinum Group Metals Ltd. Completes Maseve Mine Sale

26 April 2018 - 10:22PM

Platinum Group Metals Ltd. (PTM:TSX) (NYSE

American:PLG) (“Platinum Group” “PTM” or the “Company”) reports the

completion of the previously announced sale of 100% of the equity

in Maseve Investments 11 (Pty) Ltd. (“Maseve”), the holding company

of the Maseve Mine, and all shareholder loans owed by Maseve, to

Royal Bafokeng Platinum Limited (“RBPlat”). Aggregate

consideration for the sale consisted of 4,871,335 RBPlat common

shares, which have been delivered, and the agreement to the release

of an environmental bond posted by the Company in Rand, currently

worth approximately US$4.7 million1, following RBPlat’s replacement

of the environmental bond for Maseve. Of the 4,871,335 RBPlat

common shares issued in connection with the sale of Maseve, 347,056

were delivered in trust for a minority shareholder of Maseve.

The Company will no longer be responsible for care and maintenance

costs or the ongoing operations or commitments of Maseve.

The Company intends to pay all of its net

proceeds from this transaction, which may take several months to be

fully realized into cash, to reduce outstanding indebtedness

pursuant to a secured loan facility (the “LMM Facility”) with

Liberty Metals & Mining Holdings, LLC (“LMM”).

About Platinum Group Metals

Ltd.

Platinum Group is focused on, and is the

operator of, the Waterberg Project, a bulk mineable underground

deposit in northern South Africa. Waterberg was discovered by the

Company. Waterberg has potential to be a low cost dominantly

palladium mine and Impala Platinum Holdings Limited, a smelter and

refiner of platinum group metals, recently made a strategic

investment in the Waterberg Project.

On behalf of the Board of

Platinum Group Metals Ltd.

R. Michael JonesPresident, CEO and Director

For further information

contact: R. Michael Jones,

President or Kris Begic, VP, Corporate

Development Platinum Group Metals Ltd.,

Vancouver Tel: (604) 899-5450 / Toll Free:

(866) 899-5450

www.platinumgroupmetals.net

Disclosure

The Toronto Stock Exchange and the NYSE American

LLC have not reviewed and do not accept responsibility for the

accuracy or adequacy of this news release, which has been prepared

by management.

This press release contains forward-looking

information within the meaning of Canadian securities laws and

forward-looking statements within the meaning of U.S. securities

laws (collectively “forward-looking statements”). Forward-looking

statements are typically identified by words such as: believe,

expect, anticipate, intend, estimate, plans, postulate and similar

expressions, or are those, which, by their nature, refer to future

events. All statements that are not statements of historical fact

are forward-looking statements. Forward-looking statements in this

press release include, without limitation, the Company’s receipt

and the amount of the remaining proceeds of the Maseve Sale

Transaction; the Company’s realization and intended use of proceeds

derived from the Maseve Sale Transaction; repayment of

indebtedness; and the Waterberg Project’s potential to be a bulk

mineable, low-cost dominantly palladium mine. Although the Company

believes the forward-looking statements in this press release are

reasonable, it can give no assurance that the expectations and

assumptions in such statements will prove to be correct. The

Company cautions investors that any forward-looking statements by

the Company are not guarantees of future results or performance and

that actual results may differ materially from those in

forward-looking statements as a result of various factors,

including delays in, or the inability to receive, the remaining

proceeds of the Maseve Sale Transaction or to realize on the

proceeds thereof; additional financing requirements and the

uncertainty of future financing; the Company’s history of losses;

the Company’s inability to generate sufficient cash flow or raise

sufficient additional capital to make payment on its indebtedness,

and to comply with the terms of such indebtedness; the LMM Facility

is, and any new indebtedness may be, secured and the Company has

pledged its shares of PTM RSA, and PTM RSA has pledged its shares

of Waterberg JV Resources (Pty) Limited (“Waterberg JV

Co.”) to Liberty Metals & Mining Holdings, LLC, a

subsidiary of LMM, under the LMM Facility, which potentially could

result in the loss of the Company’s interest in PTM RSA and the

Waterberg Project in the event of a default under the LMM Facility

or any new secured indebtedness; the Company’s negative cash flow;

the Company’s ability to continue as a going concern; completion of

the definitive feasibility study for the Waterberg Project, which

is subject to resource upgrade and economic analysis requirements;

uncertainty of estimated production, development plans and cost

estimates for the Waterberg Project; discrepancies between actual

and estimated mineral reserves and mineral resources, between

actual and estimated development and operating costs, between

actual and estimated metallurgical recoveries and between estimated

and actual production; the Company’s ability to regain compliance

with NYSE American continued listing requirements; fluctuations in

the relative values of the U.S. Dollar, the Rand and the Canadian

Dollar; volatility in metals prices; the failure of the Company

or the other shareholders to fund their pro rata share of

funding obligations for the Waterberg Project; any disputes or

disagreements with the other shareholders of Waterberg JV Co. or

Mnombo Wethu Consultants (Pty) Ltd. or former shareholders of

Maseve; the ability of the Company to retain its key management

employees and skilled and experienced personnel; contractor

performance and delivery of services, changes in contractors or

their scope of work or any disputes with contractors; conflicts of

interest; capital requirements may exceed its current expectations;

the uncertainty of cost, operational and economic projections; the

ability of the Company to negotiate and complete future funding

transactions and either settle or restructure its debt as required;

litigation or other administrative proceedings brought against the

Company; actual or alleged breaches of governance processes or

instances of fraud, bribery or corruption; exploration, development

and mining risks and the inherently dangerous nature of the mining

industry, and the risk of inadequate insurance or inability to

obtain insurance to cover these risks and other risks and

uncertainties; property and mineral title risks including defective

title to mineral claims or property; changes in national and local

government legislation, taxation, controls, regulations and

political or economic developments in Canada and South Africa;

equipment shortages and the ability of the Company to acquire

necessary access rights and infrastructure for its mineral

properties; environmental regulations and the ability to obtain and

maintain necessary permits, including environmental authorizations

and water use licences; extreme competition in the mineral

exploration industry; delays in obtaining, or a failure to obtain,

permits necessary for current or future operations or failures to

comply with the terms of such permits; risks of doing business in

South Africa, including but not limited to, labour, economic and

political instability and potential changes to and failures to

comply with legislation; and other risk factors described in

the Company’s most recent Form 20-F annual report, annual

information form and other filings with the U.S. Securities and

Exchange Commission (“SEC”) and Canadian securities regulators,

which may be viewed at www.sec.gov and www.sedar.com,

respectively. Proposed changes in the mineral law in South

Africa if implemented as proposed would have a material adverse

effect on the Company’s business and potential interest in

projects. Any forward-looking statement speaks only as of the date

on which it is made and, except as may be required by applicable

securities laws, the Company disclaims any intent or obligation to

update any forward- looking statement, whether as a result of new

information, future events or results or otherwise.

_______1 For more details please refer to the Financial

Statements and Management’s Discussion and Analysis for the six

months ended February 28, 2018, the Company’s Annual Report on Form

20-F and the Company’s Annual Information Form for the year ended

August 31, 2017.

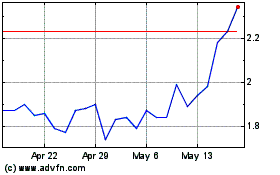

Platinum Group Metals (TSX:PTM)

Historical Stock Chart

From Mar 2025 to Apr 2025

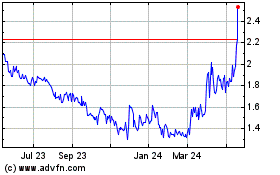

Platinum Group Metals (TSX:PTM)

Historical Stock Chart

From Apr 2024 to Apr 2025