Parex Announces Strategic Acquisition of Verano to Consolidate its Working Interest in Southern Llanos Blocks LLA-32 and LLA-34

13 May 2014 - 9:33PM

Marketwired Canada

NOT FOR DISTRIBUTION OR FOR DISSEMINATION IN THE UNITED STATES

Parex Resources Inc. ("Parex" or the "Company") (TSX:PXT) and Verano Energy

Limited ("Verano") are pleased to announce that they have entered into an

agreement whereby Parex has agreed to purchase all of the issued and outstanding

common shares of Verano, a private oil company with operations in Colombia (the

"Transaction") for a total net consideration of CAD$198 million or CAD$1.25 per

Verano share, pursuant to a plan of arrangement (the "Arrangement") under the

Business Corporations Act (Alberta). The Transaction consolidates the Company's

core Southern Llanos area by acquiring additional working interests in Blocks

LLA-32, LLA-34, and in LLA-17, where significant exploration and appraisal

success has been demonstrated, and will result in Parex assuming operatorship of

Block LLA-32.

Under the terms of the Arrangement, Verano shareholders will receive CAD$76

million (33.3%) in cash and CAD$153 million (66.7%) in the form of Parex common

shares. Based on the 20-day weighted average trading price of Parex shares

ending May 9, 2014 of CAD$10.88, approximately 14.03 million Parex shares will

be issued to Verano shareholders pursuant to the terms of the Arrangement. Parex

will assume the working capital surplus of Verano, estimated to be CAD$30

million at closing and the remaining cash consideration will be funded by Parex

from its existing working capital and undrawn credit facilities, which totaled

approximately USD$158 million as at March 31, 2014.

Strategic Rationale

The Transaction will substantially grow current production and cash flow for

Parex while maintaining Parex' significant financial flexibility. Additionally,

the Transaction builds on the exploration and development success Parex has

demonstrated in the Southern Llanos, increases the Company's working interest in

key growth oriented existing blocks, and allows Parex to assume operatorship on

LLA-32 where significant exploration success has been realized in 2014 and

additional exploration remains. Parex' increased working interests before

royalties ("WI") in the acquired blocks are below:

----------------------------------------------------------------------------

Block Parex WI Acquisition WI Post Acquisition WI

----------------------------------------------------------------------------

LLA-17 40% 23% 63%

----------------------------------------------------------------------------

LLA-32 30% 40% 70%

----------------------------------------------------------------------------

LLA-34 45% 10% 55%

----------------------------------------------------------------------------

In the first half of 2014, blocks LLA-32 and LLA-34 have experienced strong

exploration and appraisal results, with additional high impact drilling and

completion activity approved and planned by Parex for the second half of 2014 as

follows:

----------------------------------------------------------------------------

Block Field/Well Status GLJ Report Dec. 31, 2013

----------------------------------------------------------------------------

LLA-32

----------------------------------------------------------------------------

Tested 3,555 bopd;

to produce with ESP

Kananaskis-1 on long-term test Not evaluated

----------------------------------------------------------------------------

Cased - ready to

Calona-1 test Not evaluated

----------------------------------------------------------------------------

Testing operations

Carmentea-1 underway Not evaluated

----------------------------------------------------------------------------

Additional 3 development/appraisal

wells approved for 2014 n/a

----------------------------------------------------------------------------

LLA-34

----------------------------------------------------------------------------

Included in 2P; Included

Tua-6 Producing in 3P

----------------------------------------------------------------------------

Cased - ready to Included in 2P; Included

Tigana-2 test in 3P

----------------------------------------------------------------------------

Testing operations Excluded in 2P; Included

Tigana-3 underway in 3P

----------------------------------------------------------------------------

Cased - ready to Excluded in 2P; Excluded

Tigana-Norte-1 test in 3P

----------------------------------------------------------------------------

Tigana Drilling operations Excluded in 2P; Excluded

SurOeste-1 underway in 3P

----------------------------------------------------------------------------

Additional 2 exploration & 7

development/appraisal wells approved

for 2014 n/a

----------------------------------------------------------------------------

Parex expects the Block LLA-32 Kananaskis-1 discovery to commence light oil

production shortly. The Mirador Formation tested an average of 3,555 bopd of 30

degrees API oil over an 8 hour period under natural flowing conditions with a

final water-cut of 0.8% and a total of 1,186 barrels of oil was recovered. An

ESP in the Mirador has been installed. In addition the Une and two zones in the

Gacheta Formation tested gas and minor amounts of condensate. The Company

believes that the tested gas could be used as a field power source to reduce

operating expenses in the future, consistent with Parex' current operations in

its operated Las Maracas and Kona fields.

Acquisition Summary

The Acquisition has the following characteristics:

-- Production (current): 2,200 bopd

-- Production (expected at close): 4,000 bopd

-- Proved plus Probable Reserves (2P, Dec. 31, 2013)(1): 3.5 MMbbl

-- Proved plus Probable plus Possible Reserves (3P, Dec. 31, 2013)(1): 5.4

MMBbl

-- As previously announced Parex intends to release an updated

corporate reserve report effective June 30, 2014 of the combined

Parex and Verano companies.

-- Operating Netback(2 ): $60-$70 per bbl

1. Reserves are Gross Company Reserves as evaluated by GLJ Petroleum Consultants

Ltd. ("GLJ") as of December 31 2013. Gross Company Reserves are Verano's working

interest reserves before the deduction of royalties.

2. Based on expected average prices for Q3/Q4 2014 and historical Parex operated

production, transportation and royalty expenses.

Guidance Update

As previously announced Parex has projected its Q2 2014 production to be

19,000-19,500 bopd, prior to the Transaction. At the end of Q2 2014 after

assessing the initial production results of its current inventory of

non-producing wells, Parex expects to:

-- update and increase its full year production guidance;

-- revise and increase its full year capital program in line with year-to-

date exploration success, production growth, strong netbacks and

addition of new properties including additional working interest

acquired through the Transaction; and

-- release a mid-year independent reserve evaluation.

At the closing of the Transaction Parex will assume operatorship of Block LLA-32

and this will enable the Company to forecast more accurately the remaining 2014

capital expenditures, production expenses and production.

Plan of Arrangement

Pursuant to the agreement governing the Arrangement ("Arrangement Agreement"),

Parex and Verano have agreed that the Transaction will be completed by way of

plan of arrangement under the Business Corporations Act (Alberta).

The board of directors of Verano has unanimously approved the Arrangement and

the entering into of the Arrangement Agreement and recommended that Verano

shareholders vote in favour of the Arrangement. The board of directors of Verano

has received a verbal fairness opinion from TD Securities Inc. that the

consideration to be received by Verano shareholders pursuant to the Transaction

is fair, from a financial point of view, to the Verano shareholders. Holders of

greater than 20% of the shares of Verano have entered into agreements with Parex

pursuant to which they have agreed to vote their shares in favour of the

Transaction.

The Arrangement Agreement provides for non-solicitation covenants of Verano,

subject to the fiduciary obligations of the board of directors of Verano, and

the right of Parex to match any Superior Proposal (as defined in the Arrangement

Agreement) within three business days. The Arrangement Agreement also provides

for industry standard mutual non-completion fees in the event that the

Transaction is not completed or is terminated by either party in certain

circumstances.

The Arrangement Agreement provides that the completion of the Transaction is

subject to certain conditions, including the receipt of all required regulatory

approvals, including the approval of the TSX of the listing of the Parex shares

to be issued in the Transaction, the approval of the shareholders of Verano and

the approval of the Court of Queen's Bench of Alberta. A management information

circular and proxy statement outlining the details of the Arrangement Agreement

and the Transaction will be mailed by Verano to the holders of the Verano shares

in late May 2014 for a Verano shareholder meeting to be held in June 2014, at

which meeting Verano shareholders will vote on the Arrangement and related

matters. The Arrangement is expected to close in late June 2014.

Financial Advisors

FirstEnergy Capital Corp. acted as the financial advisor to Parex with respect

to the Transaction. TD Securities Inc. acted as the financial and strategic

advisor and KES VII Capital acted as the strategic advisor to Verano with

respect to the Transaction.

This news release does not constitute an offer to sell securities, nor is it a

solicitation of an offer to buy securities, in any jurisdiction.

Reserve Advisory

"Proved" reserves are those reserves that can be estimated with a high degree of

certainty to be recoverable. It is likely that the actual remaining quantities

recovered will exceed the estimated proved reserves.

"Probable" reserves are those additional reserves that are less certain to be

recovered than proved reserves. It is equally likely that the actual remaining

quantities recovered will be greater or less than the sum of the estimated

proved plus probable reserves.

"Possible" reserves are those additional reserves that are less certain to be

recovered than probable reserves. There is a 10 percent probability that the

quantities actually recovered will equal or exceed the sum of proved plus

probable plus possible reserves. It is unlikely that the actual remaining

quantities recovered will exceed the sum of the estimated proved plus probable

plus possible reserves.

The recovery and reserve estimates of crude oil reserves provided are estimates

only, and there is no guarantee that the estimated reserves will be recovered.

Actual crude oil reserves may be greater than or less than the estimates

provided.

The reserves information contained in this press release has been prepared in

accordance with National Instrument 51-101 ("NI 51-101"). Note in respect of

reserves stated herein on a company interest basis, that "company interest" is

not defined in NI 51-101 and accordingly reserves expressed herein on such basis

may not be comparable to estimates of "gross" reserves prepared in accordance

with NI 51-101 or to other issuers' estimates of company interest reserves.

Advisory on Forward Looking Statements

Certain information regarding Parex set forth in this document contains

forward-looking statements that involve substantial known and unknown risks and

uncertainties. The use of any of the words "plan", "expect", "prospective",

"project", "intend", "believe", "should", "anticipate", "estimate" or other

similar words, or statements that certain events or conditions "may" or "will"

occur are intended to identify forward-looking statements. Such statements

represent Parex' internal projections, estimates or beliefs concerning, among

other things, future growth, results of operations, production, future capital

and other expenditures (including the amount, nature and sources of funding

thereof), competitive advantages, plans for and results of drilling activity,

environmental matters, business prospects and opportunities. These statements

are only predictions and actual events or results may differ materially.

Although the Company's management believes that the expectations reflected in

the forward-looking statements are reasonable, it cannot guarantee future

results, levels of activity, performance or achievement since such expectations

are inherently subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Many factors could cause Parex'

actual results to differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, Parex.

In particular, forward-looking statements contained in this document include,

but are not limited to, statements with respect to the effects of the

Arrangement on Parex and its business, including expected increases in

production and cash flow, increases in working interests in certain blocks in

Colombia and the expected assumption of operatorship of Block LLA-32; the

consideration to be issued in the Arrangement by Parex and the manner by which

the cash consideration will be funded by Parex; the nature of the drilling and

completion activity planned by Parex for the second half of 2014; the timing for

the Block LLA-32 Kananaskis-1 well to commence production; the use by Parex of

tested gas as a field power source; the matters set forth herein under the

heading "Guidance Update"; the performance characteristics of the Company's oil

properties; supply and demand for oil; financial and business prospects and

financial outlook; results of drilling and testing, results of operations;

drilling plans; activities to be undertaken in various areas; capital plans in

Colombia and exit rate production; timing of drilling and completion; and

planned capital expenditures and the timing thereof. In addition, statements

relating to "reserves" or "resources" are by their nature forward-looking

statements, as they involve the implied assessment, based on certain estimates

and assumptions that the resources and reserves described can be profitably

produced in the future. The recovery and reserve estimates of Parex' reserves

provided herein are estimates only and there is no guarantee that the estimated

reserves will be recovered.

These forward-looking statements are subject to numerous risks and

uncertainties, including but not limited to, the impact of general economic

conditions in Canada, Colombia and Trinidad & Tobago; industry conditions

including changes in laws and regulations including adoption of new

environmental laws and regulations, and changes in how they are interpreted and

enforced, in Canada, Colombia and Trinidad & Tobago; competition; lack of

availability of qualified personnel; the results of exploration and development

drilling and related activities; obtaining required approvals of regulatory

authorities, in Canada, Colombia and Trinidad & Tobago; risks associated with

negotiating with foreign governments as well as country risk associated with

conducting international activities; volatility in market prices for oil;

fluctuations in foreign exchange or interest rates; environmental risks; changes

in income tax laws or changes in tax laws and incentive programs relating to the

oil industry; ability to access sufficient capital from internal and external

sources; the risks that any estimate of potential net oil pay is not based upon

an estimate prepared or audited by an independent reserves evaluator; that there

is no certainty that any portion of the hydrocarbon resources will be

discovered, or if discovered that it will be commercially viable to produce any

portion thereof; and other factors, many of which are beyond the control of the

Company. Readers are cautioned that the foregoing list of factors is not

exhaustive. Additional information on these and other factors that could effect

Parex' operations and financial results are included in reports on file with

Canadian securities regulatory authorities and may be accessed through the SEDAR

website (www.sedar.com).

Although the forward-looking statements contained in this document are based

upon assumptions which Management believes to be reasonable, the Company cannot

assure investors that actual results will be consistent with these

forward-looking statements. With respect to forward-looking statements contained

in this document, Parex has made assumptions regarding: current commodity prices

and royalty regimes; availability of skilled labour; timing and amount of

capital expenditures; future exchange rates; the price of oil; the impact of

increasing competition; conditions in general economic and financial markets;

availability of drilling and related equipment; effects of regulation by

governmental agencies; receipt of all required approvals for the Transaction;

royalty rates, future operating costs, and other matters. Management has

included the above summary of assumptions and risks related to forward-looking

information provided in this document in order to provide shareholders with a

more complete perspective on Parex' current and future operations and such

information may not be appropriate for other purposes. Parex' actual results,

performance or achievement could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no assurance can

be given that any of the events anticipated by the forward-looking statements

will transpire or occur, or if any of them do, what benefits Parex will derive.

These forward-looking statements are made as of the date of this document and

Parex disclaims any intent or obligation to update publicly any forward-looking

statements, whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities laws.

Neither the TSX nor its Regulation Services Provider (as that term is defined in

the policies of the TSX) accepts responsibility for the adequacy or accuracy of

this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Parex Resources Inc.

Mike Kruchten

Vice-President Corporate Planning and Investor Relations

(403) 517-1733

Investor.relations@parexresources.com

Verano Energy Limited

Kristen Bibby

Vice President, Finance and Chief Financial Officer

(403) 984-4224

ir@veranoenergy.com

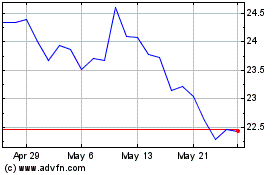

Parex Resources (TSX:PXT)

Historical Stock Chart

From May 2024 to Jun 2024

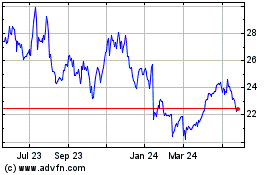

Parex Resources (TSX:PXT)

Historical Stock Chart

From Jun 2023 to Jun 2024