Storm Resources Ltd. (TSX VENTURE:SRX)

PRESIDENT'S MESSAGE

HIGHLIGHTS

-- On August 17, 2010, Storm Resources Ltd. ("Storm" or the "Company")

commenced operations after certain assets were transferred to Storm

under the Plan of Arrangement involving the sale of Storm Exploration

Inc. to ARC Energy Trust. The assets transferred to Storm included

approximately 117,200 net acres of undeveloped land in the Horn River

Basin, Cabin/Kotcho/Junior and Umbach areas in North East British

Columbia and in the Red Earth area of Alberta. In addition, Storm

received share ownership positions in Storm Gas Resource Corp.,

Bellamont Exploration Ltd., Bridge Energy ASA and Chinook Energy Inc.

plus a cash payment of $9.4 million.

-- Also on August 17, 2010, Storm completed a private placement of 2.3

million common shares, at a price of $3.28 per share, with directors,

officers, and employees, for proceeds totaling $7.5 million.

-- On September 21, 2010, 6.6 million warrants which had been issued to

Storm Exploration Inc. shareholders under the Plan of Arrangement with

ARC Energy Trust, were exercised at a price of $3.28 per share for

proceeds totaling $21.5 million. This represented approximately 99% of

the warrants outstanding. All warrants have either been exercised or

have expired.

-- During the quarter, capital expenditures totaled $3.4 million which

included completing a horizontal well at Umbach (1.0 net) and

preparatory work for the first Horn River Basin horizontal (0.4 net)

which was spudded early in October.

-- At September 30, 2010, funds available for investment totaled $34.4

million and the publicly listed securities owned by Storm had an

estimated market value of $16.2 million (proceeds from the possible

future sale of these securities may also be used to finance the

company's capital programs).

OPERATIONS REVIEW

In the Horn River Basin ("HRB") of North East British Columbia, the first

horizontal well (0.4 net) has been cased at A-11-A/94-O-9 after drilling 1,800

metres laterally into the Muskwa and Otter Park shales (spudded October 6). The

rig will move to drill a second horizontal (0.4 net) from an adjacent surface

location which is expected to spud in late November. Drilling each horizontal is

estimated to cost between $4.0 and $5.5 million ($1.6 to $2.2 million net).

Completion of the first horizontal with 12 fracture stimulations is planned for

early December and the second horizontal will be completed next summer depending

on results from the first horizontal and natural gas prices. As a result of

rainy weather delaying the drilling of the first horizontal, the completion of

this well in December has increased the estimated completion cost to $12.0 to

$14.0 million ($4.8 to $5.6 million net). Cost of completing the second

horizontal next summer with 12 fracture stimulations is estimated to be $9.0 to

$10.0 million ($3.6 to $4.0 million net). An additional $10.0 million ($4.0

million net) will be invested this winter to construct associated infrastructure

including roads, a wellsite facility, pipelines and a dehydration/compression

facility with capacity for 20 Mmcf per day of raw gas. A total of $40 to $50

million gross is expected to be invested over the next 12 months to validate the

commerciality of Storm's HRB shale lands which total 25,000 net undeveloped

acres. First gas sales from a successful horizontal well is possible by March

2011, but it will be several months later before we have enough production

history to determine the economics associated with larger scale development.

At Umbach in North East British Columbia, the horizontal gas well (1.0 net) that

was drilled in July was completed in September with 7 fracture treatments, each

with 100 tons of sand. Results from the completion are currently being

evaluated. This completion fulfilled a farm-in commitment and by so doing Storm

has earned 8,100 net acres of undeveloped land (27 gross sections with Storm

average working interest of 43%).

In the Junior area of North East British Columbia, Storm has 33 net sections

which have potential to be developed with horizontal wells in the Jean Marie

formation. This is based on mapping and proximity to offsetting horizontals

which are producing from the Jean Marie formation. The estimated cost to drill,

complete, and tie in a horizontal well on our lands is expected to be $2.1

million and, based on offsetting wells, first-year rates are expected to average

800 to 1,400 Mcf/d with 1.0 to 1.5 Bcf of recoverable raw gas per horizontal

well. Initial drilling density would be one horizontal well per section. Two

horizontal locations have been licensed to test the economics associated with

larger scale development. Both will be drilled when sufficient discretionary

cash flow is available which is primarily dependent on an improvement in natural

gas prices. No activity is planned for this area at this time.

At Red Earth, Storm is participating at a 20% working interest in two horizontal

wells (0.4 net) targeting light oil in the Slave Point formation. Expected gross

cost to drill, complete and equip each horizontal is $4.2 million. Based on the

performance of offsetting horizontals, production in the first year could

average 80 to 100 barrels per day.

INVESTMENTS

Storm has share ownership positions in one private company and three publicly

traded companies. These shareholdings were transferred to Storm under the Plan

of Arrangement with ARC Energy Trust. The value of the share positions in the

three public companies totaled $16.2 million at the end of the third quarter and

these securities could possibly be sold in the future with the proceeds being

used to finance the Company's capital programs.

Storm Gas Resource Corp. ("SGR")

SGR is a private company formed in June 2007, to pursue unconventional gas

opportunities in the HRB and elsewhere. Storm's share ownership position totals

2.5 million shares, representing 22% ownership of SGR. Currently, SGR's land

position totals 83,644 acres with 53,065 acres in the HRB. At the end of the

third quarter of 2010, SGR's balance sheet showed a cash position of $24.6

million.

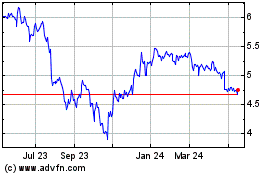

Chinook Energy Inc. ("Chinook")

Storm holds 4.5 million shares of Chinook which is a TSX-listed oil and gas

exploration and production company (symbol 'CKE') based in Calgary with

operations focused in Tunisia and Western Canada. Storm Exploration Inc. had

previously owned 4.5 million shares of Storm Ventures International Inc. ("SVI")

which were converted into shares of Chinook when SVI and Iteration Energy Ltd.

completed a business combination on June 29, 2010.

Bridge Energy ASA ("Bridge")

Storm holds 1.05 million common shares of Bridge (symbol 'Bridge' on the Oslo

Stock Exchange), a Norwegian based exploration and production company with

production of approximately 1,500 Boe per day, several development opportunities

in the UK sector of the North Sea, and a number of exploratory leads in the

Norwegian sector of the North Sea. Bridge is the result of a business

combination whereby SVI's United Kingdom North Sea assets were combined with a

private Norwegian based company in March 2010. SVI received 28,776,000 common

shares of Bridge which were then distributed to SVI shareholders, including SEO.

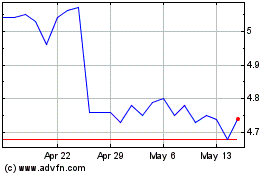

Bellamont Exploration Ltd. ("Bellamont")

Storm holds 5.08 million shares of Bellamont, a TSX-listed oil and gas

exploration and production company, as a result of a disposition of non-core

properties by Storm Exploration Inc. in the Grande Prairie area in November

2009.

OUTLOOK

Capital investment in 2010 from August 17 to December 31 is expected to total

$18.0 million with $2.5 million allocated to land and asset acquisitions and

$15.5 million for drilling, completions, facilities, and tie-ins. In 2011,

capital investment is expected to total $19.0 million with $3.5 million

allocated to undeveloped land and asset acquisitions and $15.5 million for

drilling, completions, facilities, and tie-ins. This level of capital investment

is expected to result in production averaging 1,000 Boe per day in the fourth

quarter of 2011. Up to four gross wells (1.8 net) are planned for 2010 and three

gross wells (1.8 net) in 2011. Ultimately, capital allocation and the size of

the drilling program will depend on results, natural gas prices, and the size of

any asset or undeveloped land acquisitions. Our cash general and administrative

budget will be approximately $2.5 million per year. The current cash balance and

the possible sale of our share positions in the three public companies listed on

stock exchanges will be used to fund planned 2010 and 2011 capital expenditures.

Storm's undeveloped land position prospective for Devonian shales in the HRB

represents a substantial resource but exploitation will not be quick or easy

given the associated higher cost structure, various operational challenges, and

the continued volatility in natural gas prices. A core project area has been

identified which consists of 19 gross sections with an estimated 1.7 to 2.1

gross TCF of DPIIP in the Muskwa and Otter Park shales (internal estimate by

Storm management). Our near-term objective is to prove commerciality of this

core project area with two horizontal wells while longer term exploitation will

depend on natural gas prices.

In addition to advancing projects on our existing undeveloped lands, we have

been reviewing asset acquisition opportunities with a focus on adding near term

exploitation upside and cash flow to fund exploitation activities on our

existing asset base. Any potential asset acquisition would be funded in part

with existing unallocated cash, debt if available, and the possible sale of our

public company share positions.

Storm Resources Ltd. is the fourth 'Storm' and, as in the previous Storm

entities, our objective will be to generate accretive, per-share growth which

will involve pursuing specific opportunities based on finding and development

costs, netback, and rate of return. Although Storm is at an early stage, we have

significant capital resources ($50 million including cash and publicly listed

securities) which will be used to advance current projects and to fund potential

new ventures or acquisitions.

Respectfully,

Brian Lavergne, President and Chief Executive Officer

November 10, 2010

Boe Presentation - For the purpose of calculating unit revenues and costs,

natural gas is converted to a barrel of oil equivalent ("Boe") using six

thousand cubic feet ("Mcf") of natural gas equal to one barrel of oil unless

otherwise stated. Boe may be misleading, particularly if used in isolation. A

Boe conversion ratio of six Mcf to one barrel ("Bbl") is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. All Boe measurements and

conversions in this report are derived by converting natural gas to oil in the

ratio of six thousand cubic feet of gas to one barrel of oil. Mboe means 1,000

Boe.

Discovered Petroleum Initially in Place ("DPIIP") - Is defined in the COGEH

handbook as the quantity of hydrocarbons that are estimated to be in place

within a known accumulation. Original Gas in Place ("OGIP") is a more commonly

used industry term when referring to gas accumulations.

DPIIP is divided into recoverable and unrecoverable portions, with the estimated

future recoverable portion classified as reserves and contingent resources.

There is no certainty that it will be economically viable or technically

feasible to produce any portion of this DPIIP except for those portions

identified as proved or probable reserves.

Forward-Looking Statements - such statements made in this press release are

subject to the limitations set out in the Management's Discussion and Analysis

for the period to September 30, 2010.

MANAGEMENT'S DISCUSSION AND ANALYSIS

INTRODUCTION

Set out below is management's discussion and analysis ("MD&A") of financial and

operating results for Storm Resources Ltd. ("Storm" or the "Company") for the

period ended September 30, 2010. It should be read in conjunction with the

unaudited financial statements for the period from June 8, 2010 to September 30,

2010 and other operating and financial information included in this press

release. In addition, readers are directed to the discussion below regarding

Forward-Looking Statements, Boe Presentation and Non-GAAP Measurements.

The Company was incorporated on June 8, 2010 as 1541229 Alberta Ltd. with

nominal share capital and was inactive until August 17, 2010 when the Company

participated in a Plan of Arrangement (the "Arrangement") along with Storm

Exploration Inc ("SEO"), ARC Energy Trust ("ARC") and ARC Resources Ltd. The

Arrangement resulted in the sale of SEO to ARC and the spin out of the Company

as a junior exploration and development company. As part of the series of

transactions associated with the Arrangement, the Company issued shares in

exchange for certain assets as more fully described in Note 4 to the unaudited

financial statements as at and for the period ended September 30, 2010. On

August 31, 2010 the Company began trading on the TSX Venture Exchange under the

symbol "SRX". As operations began following the completion of the Arrangement,

the discussion of operations in this MD&A is for the approximate six week period

ended September 30, 2010.

This management's discussion and analysis is dated November 10, 2010. Unless

otherwise indicated all dollar amounts are in thousands.

LIMITATIONS

Basis of Presentation - Financial data presented below have largely been derived

from the Company's unaudited financial statements for the period from June 8,

2010 until September 30, 2010, prepared in accordance with International

Financial Reporting Standards ("IFRS"). Accounting policies adopted by the

Company are set out in Note 3 to the unaudited financial statements for the

period ended September 30, 2010. The reporting and the measurement currency is

the Canadian dollar. Unless otherwise indicated, tabular financial amounts,

other than per share amounts, are in thousands.

The Company's use of IFRS in the unaudited financial statements for the period

ended September 30, 2010 anticipates the mandatory adoption of IFRS in Canada,

effective for reporting periods ending after December 31, 2010. The Company has

received the necessary regulatory approvals for early adoption of IFRS.

Forward-Looking Statements - Certain information set forth in this document,

including management's assessment of Storm's future plans and operations,

contains forward-looking information (within the meaning of applicable Canadian

securities legislation). Such statements or information are generally

identifiable by words such as "anticipate", "believe", "intend", "plan",

"expect", "estimate", "budget", "outlook", "forecast" or other similar words and

include statements relating to or associated with individual wells, regions or

projects. Any statements regarding the following are forward-looking statements:

-- future crude oil or natural gas prices;

-- future production levels;

-- future revenues or costs or revenues or costs per commodity unit;

-- future capital expenditures and their allocation to specific exploration

and development activities;

-- future drilling;

-- future earnings;

-- future asset acquisitions or dispositions;

-- future sources of funding for capital program;

-- future decommissioning costs;

-- development plans;

-- ultimate recoverability of reserves or resources;

-- expected finding and development costs and operating costs;

-- estimates on a per-share basis;

-- dates or time periods by which certain geographical areas will be

developed; and

-- changes to any of the foregoing.

Statements relating to "reserves" or "resources" are forward-looking statements,

as they involve the implied assessment, based on estimates and assumptions, that

the reserves and resources described exist in the quantities predicted or

estimated, and can be profitably produced in the future.

The forward-looking statements are subject to known and unknown risks and

uncertainties and other factors which may cause actual results, levels of

activity and achievements to differ materially from those expressed or implied

by such statements. Such factors include the material risks described in this

MD&A under "Risk Assessment" and the material assumptions described under the

headings "Production and Revenue"; "Share-based Payments"; "Depreciation";

"Accretion"; Comprehensive Income (Loss)"; "Cash"; "Investments"; "Investment in

Associate"; "Accounts Payable and Accrued Liabilities"; "Decommissioning

Liability"; industry conditions, volatility of commodity prices, currency

fluctuations, imprecision of reserve estimates, environmental risks, competition

from other industry participants, the lack of availability of qualified

personnel or management, stock market volatility and ability to access

sufficient capital from internal and external sources. All of these caveats

should be considered in the context of current economic conditions, in

particular reduced prices for natural gas and the condition of financial

institutions and markets, each of which is outside the control of the Company.

Readers are advised that the assumptions used in the preparation of such

information, although considered reasonable at the time of preparation, may

prove to be imprecise and, as such, undue reliance should not be placed on

forward-looking statements. Storm's actual results, performance or achievement,

could differ materially from those expressed in, or implied by, these

forward-looking statements. Storm disclaims any intention or obligation to

publicly update or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, except as required under securities

law. References to forward-looking information are made in the press release

dated November 10, 2010 this MD&A forms part of. The forward-looking statements

contained herein are expressly qualified by this cautionary statement.

Boe Presentation - Natural gas is converted to a barrel of oil equivalent

("Boe") using six thousand cubic feet ("Mcf") of natural gas equal to one barrel

of oil unless otherwise stated. Boe may be misleading, particularly if used in

isolation. A Boe conversion ratio of six Mcf to one barrel ("Bbl") is based on

an energy equivalency conversion method primarily applicable at the burner tip

and does not represent a value equivalency at the wellhead. All Boe measurements

and conversions in this report are derived by converting natural gas to oil in

the ratio of six thousand cubic feet of gas to one barrel of oil.

Non-GAAP Measurements - Within management's discussion and analysis, there may

be references made to terms which are not recognized under GAAP. Specifically,

"funds from operations", "funds from operations per share" and netbacks do not

have any standardized meaning as prescribed by GAAP and are regarded as non-GAAP

measures. It is likely that these non-GAAP measurements may not be comparable to

the calculation of similar amounts for other entities. In particular, funds from

operations is not intended to represent, or be equivalent to, cash flow from

operating activities calculated in accordance with GAAP which appears on the

Company's statement of cash flows. Funds from operations and similar non-GAAP

terms are used to benchmark operations against prior periods and peer group

companies.

A reconciliation of funds from operations to cash flows from operating

activities is as follows:

June 8 to September 30, 2010

----------------------------------------------------------------------------

Cash flow from operating activities $ (245)

Net change in non-cash working capital items (3)

----------------------------------------------------------------------------

Non-GAAP funds from operations $ (248)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

OPERATIONAL AND FINANCIAL RESULTS

Production and Revenue

During the period to September 30, 2010, the Company had no production and no

production revenue.

Interest Income

Interest is received on cash on deposit with the Company's bankers, ATB Financial.

General and Administrative Costs

Compensation costs accounted for 68% of the charge for the period, with

accommodation costs accounting for an additional 19%.

Share-Based Payments

Share-based payments are non-cash charges which reflect the estimated value of

stock options issued to Storm's directors, officers and employees. The value of

the award is recognized as an expense over the period from the grant date to the

date of vesting of the award. During the period options in respect of

approximately two million shares were issued with an exercise price of $3.28.

This issue, considerable in size, formed part of the initial compensation

program put in place for directors, officers and staff for the newly established

business.

Depreciation

The charge for depreciation for the period relates to office equipment which is

depreciated over its estimated useful life. No depletion or depreciation is

provided in respect of intangible and tangible field assets as the Company has

no production and no facilities in use.

Accretion

Accretion represents the time value increase of the Company's decommissioning

liability for the period.

Investment Loss

As described in Notes 3 and 7 to the unaudited financial statements for the

period to September 30, 2010, the Company accounts for its investment in Storm

Gas Resource Corp. ("SGR") using the equity method, where the Company's pro rata

share of changes in SGR's equity is included in the determination of the

Company's net loss for the period. The investment loss recorded in the period

represents Storm's share of changes in SGR's equity from the date of completion

of the Arrangement to September 30, 2010.

Income Taxes

Due to uncertainty of realization, no deferred income tax asset has been set up

in respect of potential future income tax reductions resulting from the use of

the taxable loss for the period.

Comprehensive Income (Loss)

Comprehensive income (loss) comprises net loss for the period plus the

unrealized gains and losses resulting from the mark-to-market valuation of

certain assets and liabilities. For the period to September 30, 2010, Storm's

comprehensive income included adjustments to reflect the period end

mark-to-market valuation of listed securities as follows:

Gain(Loss) for Period

----------------------------------------------------------------------------

Bellamont Exploration Ltd. $ -

Bridge Energy ASA 469

Chinook Energy Inc. 450

----------------------------------------------------------------------------

Total $ 919

----------------------------------------------------------------------------

----------------------------------------------------------------------------

INVESTMENT AND FINANCING

Cash

The Company has cash on deposit derived from the following transactions:

Transaction Date Amount

----------------------------------------------------------------------------

Received under Arrangement August 17, 2010 $ 9,370

Proceeds of private placement August 17, 2010 7,544

Proceeds from exercise of warrants September 22, 2010 21,522

----------------------------------------------------------------------------

Total cash received 38,436

Cash outlays in period August 17 to

September 30, 2010 (606)

----------------------------------------------------------------------------

Cash at end of period $ 37,830

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Cash has been placed on deposit with the Company's bankers, ATB Financial.

Protection of principal is paramount; correspondingly the Company does not seek

to maximize interest and other income from investment of cash surplus to

immediate operating requirements. Monies on deposit with ATB Financial are

guaranteed by the Government of Alberta, which has a triple A credit rating.

Investments

The Company owns listed securities as set out below which are valued at the

closing price on the relevant stock exchange at September 30, 2010.

----------------------------------------------------------------------------

Value at

Number of Closing September

Holding Shares Exchange Price 30, 2010

----------------------------------------------------------------------------

Bellamont Class A 5,080,645 TSX-V $ 0.53 $ 2,693

Exploration Ltd. Common

Shares

Bridge Energy ASA Common 1,052,910 Oslo Bors $ 2.45 2,575

Shares Axess

Chinook Energy Inc. Common 4,500,001 TSX $ 2.42 10,890

Shares

----------------------------------------------------------------------------

$ 16,158

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Capital Outlays

Additions to exploration and evaluation assets in the period to

September 30, 2010 were as follows:

----------------------------------------------------------------------------

Fair value of exploration and evaluation assets transferred

under Arrangement $ 19,041

Land and lease 177

Drilling 480

Completions 2,579

Facilities 66

Acquisitions 2

Administrative equipment 120

----------------------------------------------------------------------------

Total capital expenditures in period 22,465

Decommissioning costs 998

Accumulated depreciation (2)

----------------------------------------------------------------------------

Total $ 23,461

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Investment in Associate

The company owns 2,500,000 common shares of Storm Gas Resources Corp,

representing a 22% interest. The Company accounts for its interest in SGR using

the equity method. The carrying amount of the Company's interest in SGR at

September 30, 2010 is $5.57 per share, representing the transfer amount under

the Arrangement, plus the Company's share of SGR's loss since August 17, 2010.

This amount should not be regarded as representative of the value of Storm's

investment in SGR. In addition to its investment in SGR, Storm has a direct 40%

working interest in undeveloped lands jointly acquired with SGR in the Horn

River Basin of northeastern British Columbia. This interest, together with

Storm's investment in SGR, provides the Company with 53% exposure to the

potential upside in the Horn River Basin lands. The Company also provides

management services to SGR and the amount billed for such services totaled

$33,000 for the period ended September 30, 2010.

Accounts Payable and Accrued Liabilities

Accounts payable and accrued liabilities include operating, administrative and

capital costs payable. Net payables in respect of cash calls issued to partners

regarding capital projects and estimates of amounts owing but not yet invoiced

to the Company have been included in accounts payable.

Decommissioning Liability

The Company's decommissioning liability represents the present value of

estimated future costs to be incurred to abandon and reclaim wells drilled on

lands transferred to the Company under the Arrangement. Changes in amount of the

liability between the Arrangement date and September 30, 2010, comprise the

present value of additional liabilities accruing to the Company as a result of

field activity during the period, less costs paid in settlement of abandonment

obligations, plus the time related increase in the present value of the

liability. The discount rate used to establish the present value is 4%. Future

costs to abandon and reclaim the Company's properties are based on an internal

evaluation, supported by external data from industry sources.

Shareholders' Equity

Details of share issuances in the period to September 30, 2010 are as follows:

----------------------------------------------------------------------------

Price

Number of per Gross

Nature of Transaction Shares Share Proceeds

----------------------------------------------------------------------------

June 8, 2010 Issued upon incorporation 1 $ 1.00 $ -

August 17,

2010 Issued to ARC Resources Ltd. 884,173 $ 3.28 2,900

August 17,

2010 Issued under the Arrangement 16,631,240 $ 3.28 54,700

August 17,

2010 Issued under private placement 2,300,000 $ 3.28 7,544

September 22,

2010 Issued upon exercise of warrants 6,561,556 $ 3.28 21,522

----------------------------------------------------------------------------

Total 26,376,970 $ 86,666

----------------------------------------------------------------------------

----------------------------------------------------------------------------

CONTRACTUAL OBLIGATIONS

In the course of its business, Storm enters into various contractual

obligations, including the following:

-- purchase of services;

-- royalty agreements;

-- operating agreements;

-- processing agreements;

-- right of way agreements; and

-- lease obligations for accommodation, office equipment and automotive

equipment.

All such contractual obligations reflect market conditions at the time of

contract and do not involve related parties except that SGR subleases office

space from the Company at the same rate as the Company's head lease. At present

the Company has no obligations with a term longer than twelve months.

CRITICAL ACCOUNTING ESTIMATES

Financial amounts included in this Management's Discussion and Analysis and in

the unaudited financial statements for the period ended September 30, 2010 are

based on accounting policies, estimates and judgments which reflect information

available to management at the time of preparation. Certain financial amounts

are derived from a fully completed transaction cycle, or are validated by events

subsequent to the end of the reporting date, or are based on established and

effective measurement and control systems. However, other amounts, as described

below, are based on estimations using information that involves a high degree of

measurement uncertainty which could have a material effect on Storm's operating

results and financial position.

Acquisition of Net Assets

The carrying amount of net assets acquired by the Company under the Arrangement

is based on management's estimate of the fair value of the net assets at the

time of closing of the Arrangement. The fair value of certain assets can be

established by reference to objective third party data, for example, cash and

listed securities. However, the estimated fair value of other assets acquired

under the Arrangement is based on management judgment which, in part, will

include references to third party data. Management's estimate of fair value may

differ from estimates of fair value determined by third parties and such

differences could be material.

Exploration and Evaluation Assets

At present the Company has no production and recovery of the Company's

investment in oil and gas properties is dependent on the future identification,

development and sale of hydrocarbons at a price sufficient to recover and

provide an acceptable return on the Company's existing and future investment.

The Company's properties are gas prone and recovery of the Company's investment

and the establishment of profitable operations is dependant on pricing for

natural gas increasing considerably from current levels.

Decommissioning Liability

Storm records as a liability the estimated fair value of obligations associated

with the decommissioning of field assets. Although the Company had no production

in the quarter to September 30, 2010, a provision is required for certain

standing wells, as well as an interest in a currently unused pipeline. The

carrying amount of exploration and evaluation assets is increased by an amount

equivalent to the liability. The decommissioning liability reflects estimated

costs to complete the abandonment and reclamation of field assets as well as the

estimated timing of the costs to be incurred in future periods. The liability is

increased each reporting period to reflect the passage of time, with the

accretion charged to earnings. The liability is also adjusted to reflect changes

in the amount and timing of the future retirement obligation and is reduced by

the amount of any costs incurred in the period. The amount of the

decommissioning liability, the charge for accretion and the charge for depletion

of the amount added to exploration and evaluation assets are subject to

uncertainty of estimation.

Income Taxes

The measurement of Storm's tax pools, losses and deferred tax assets and

liabilities requires interpretation of complex laws and regulations. All tax

filings and compliance with tax regulations are subject to audit and

reassessment, potentially several years after the initial filing. Accordingly,

actual income tax assets or liabilities may differ significantly from the

amounts initially estimated.

Share-Based Payments

To determine the charge for share-based payments, the Company estimates the fair

value of stock options at time of issue using assumptions regarding the life of

the option, dividend yields, interest rates and the volatility of the security

under option. Although the assumptions used to value a specific option remain

unchanged throughout the life of the option, assumptions may change with respect

to subsequent option grants. In addition, the assumptions used may not properly

represent the fair value of stock options at any time; as no alternative

valuation model is applied, the difference between the Company's estimation of

fair value and the actual value of the option is not measurable.

RISK ASSESSMENT

There are a number of risks facing participants in the Canadian oil and gas

industry. Some risks are common to all businesses while others are specific to

the industry. The following reviews a number of the identifiable business risks

faced by the Company. Business risks evolve constantly and additional risks

emerge periodically. The risks below are those identified by management at the

date of completion of this report, and may not describe all of the business

risks faced by the Company.

Exploration

Storm's exploration program requires sophisticated and scarce technical skills

as well as capital and access to land and equipment to generate and test

exploration ideas. Further, the drilling of an exploratory prospect frequently

does not result in the discovery of economical reserves. Storm endeavours to

minimize finding risk by ensuring that:

-- Where possible, prospects have multi-zone potential.

-- Activity is focused in core regions where expertise and experience can

be levered.

-- Prospects are internally generated.

-- Geophysical techniques such as seismic are utilized where appropriate

and available.

Commodity Price Fluctuations

In the event that the Company identifies hydrocarbons of sufficient quantity and

quality and successfully brings them on stream, it will face a pricing

environment which is volatile and subject to a myriad of factors, largely out of

the Company's control. Low prices, particularly for the Company's expected

primary product, natural gas, will have a material effect on the Company's

re-investment capacity, and hence ultimate growth potential and profitability.

Low prices will also limit access to capital, both equity and debt.

Adverse Well or Reservoir Performance

Changes in productivity in wells and pools developed and brought on stream by

the Company in future periods could result in termination or limitation of

production, or acceleration of decline rates, resulting in reduced overall

corporate volumes and revenues. In addition, new wells, particularly new wells

in the Horn River Basin, the Company's primary investment focus, tend to produce

at high initial rates followed by rapid declines until a flattening decline

profile emerges. There is a risk that the sustainable decline profile which

eventually emerges is sub-economic. In addition, the Horn River Basin is in the

early stage of development and there is a risk that circumstances may emerge

which will adversely affect reservoir performance.

Field Operations

Storm's current and future exploration, development and production activities

involve the use of heavy equipment and the handling of potentially volatile

liquids and gases. Catastrophic events such as well blowouts, explosions and

fires within pipeline, gathering, or facility infrastructure, as well as failure

of mechanical equipment, could lead to releases of liquids or gases, spills,

personal injuries and damage to the environment, as well as uncontrolled cost

escalation. With support from suitably qualified external parties, the Company

has developed and implemented policies and procedures to mitigate environmental,

health and safety risks. These policies and procedures include the use of formal

corporate policies, emergency response plans, and other policies and procedures

reflecting best oil field practices. These policies and procedures are subject

to periodic review. Storm also manages environmental and safety risks by

maintaining its operations to a high standard and complying with all provincial

and federal environmental and safety regulations.

The Company's primary investment focus, the Horn River Basin in northeastern

British Columbia, is a remote and climatically hostile area. As a relatively new

area of activity for the oil and gas industry in Canada, access and production

facilities require considerable new investment to support expansion of

production, which is not necessarily applicable to more mature producing areas.

In addition, supervision and maintenance of production facilities is likely to

be more expensive than in existing and more southerly producing areas.

Storm maintains industry-specific insurance policies, including, in future,

business interruption on production facilities. Although the Company believes

its current insurance coverage corresponds to industry standards, there is no

guarantee that such coverage will be available in the future, and if it is, at a

cost acceptable to the Company, or that existing coverage will necessarily

extend to all circumstances or incidents resulting in loss.

Environmental

The Company's operations are subject to extensive environmental regulation which

are addressed through formal polices and procedures and application of best

field practices. In addition, the Company's primary area of focus, the Horn

River Basin in northeastern British Columbia, involves the exploitation of,

potentially, several shale gas formations. Development of shale gas is

relatively new and involves horizontal drilling and fracturing applications

specific to shale formations. Fracturing involves the use of large quantities of

liquids and chemicals, whose use and subsequent disposal has resulted in the

emergence of environmental concerns, primarily in more heavily populated areas

elsewhere in North America. In addition, exploitation of shale gas in the Horn

River Basin suggests that management of carbon dioxide volumes produced

concurrently with natural gas may become an operational issue.

The evolution of environmental regulation, in particular as it relates to shale

gas exploitation, cannot be predicted at this stage. Nevertheless it is

reasonable to expect that management of environmental issues and societal

expectations will become an increasingly important part of the Company's

business, with a corresponding effect on costs.

In Company-specific environmental concerns, increasing public and political

focus on climate change and its possible amelioration may cause changes in

demand for the Company's products and the introduction of regulations which may

result in changes to the Company's operating practices as well as additional and

unforeseeable costs. Changes in public policy over the next several years, and

the effect on the Company, cannot be determined at this stage, but given that

the Company is a producer of primary hydrocarbons it is likely that its business

will be subject to increased regulation and potentially subject to additional

taxes and costs.

Industry Capacity Constraints

High levels of field activity can result in shortages of services, products,

equipment, or manpower in many or all necessary components of the exploration

and development cycle. Increased demand leads to higher land and service costs

during peak activity periods. Competition in the Canadian oil and gas industry,

particularly in recent years, has been considerable. Although current economic

conditions suggest an easing of competitive conditions in the short and medium

term, competition in the Company's most prospective areas continues to be

intense. Storm's competitors include companies with far greater resources,

including access to capital. Storm competes by maintaining a large inventory of

self-generated exploration and development locations, by acting as operator

where possible, and through facility access and ownership. Storm also seeks to

mitigate such risks through careful management of key supplier relationships.

Capital Programs

Capital expenditures are designed to accomplish two main objectives, being the

generation of short and medium term cash flow from development activities, and

expansion of future cash flow from the discovery of reserves through

exploration. The Company focuses its activity in core areas, which allows it to

leverage its experience and knowledge, and will act as operator wherever

possible. The Company uses farmouts to minimize risk on plays it considers

higher risk or where total capital invested exceeds an acceptable level. In

addition, Storm may enter into hedging agreements in support of capital

programs, particularly when cash flow for any period is anticipated to be lower

than capital expenditures. Current capital programs are being financed from

existing cash resources. Failure to develop producing wells and an acceptable

level of cash flow will result in the exhaustion of available cash or near cash

resources and will require the Company to seek additional capital which may not

be available, or only available on terms dilutive to existing shareholders. In

addition, although the Company at present has no bank debt, future credit

availability from the Company's bankers will also be necessary to support

capital programs and any changes to credit availability may have an effect on

both the size of the Company's future capital program and the timing of

expenditures.

Acquisitions

The Company's objective of rapid and controlled growth is, in part, supported

through carefully selected and managed acquisitions. Acquisitions have to be

acceptably priced and production should provide acceptable netbacks, or provide

identifiable opportunities to increase value. Under current natural gas prices,

properties providing a reasonable netback are difficult to identify. An

acquisition should also offer potential for near and medium term development and

be in areas where the Company can readily add to the acquired land position.

Processing and transportation infrastructure must also be in place, or within

the Company's financial capacity to construct.

Reserve Estimates

Estimates of economically recoverable oil and natural gas reserves and natural

gas liquids, and related future net cash flows, are based upon a number of

variable factors and assumptions. These include commodity prices, production,

future development and operating costs and potential changes to the Company's

operations arising from regulatory or fiscal changes. All of these estimates may

vary from actual results, with the result that estimates of recoverable oil and

natural gas reserves attributable to any property are subject to revision. In

future the Company's actual production, revenues, taxes, development and

operating expenditures associated with its reserves may vary from such

estimates, and such variances may be material.

Production

Production of oil and natural gas reserves at an acceptable level of

profitability may not be possible during periods of low commodity prices. The

Company will attempt to mitigate this risk by focusing on high netback

opportunities and will act as operator where possible, thus allowing the Company

to manage costs, timing, method and marketing of production. Production risk is

also addressed by concentrating exploration efforts in regions where

infrastructure will be Storm owned or readily accessible at an acceptable cost.

Financial and Liquidity Risks

The Company faces a number of financial risks over which it has no control, such

as commodity prices, exchange rates, interest rates, access to credit and

capital markets, as well as changes to government regulations and tax and

royalty policies. The Company uses the following guidelines to address financial

exposure:

-- Internally available cash and marketable securities provide the initial

source of funding on which the Company's capital expenditure program is

based.

-- Debt, if available, may be utilized to expand capital programs,

including acquisitions, when it is deemed appropriate and where debt

retirement can be controlled.

-- Equity, including flow-through shares, if available on acceptable terms,

may be raised to fund acquisitions.

-- Farmouts of projects may be arranged if management considers that a

project requires too much capital or where the project affects the

Company's risk profile.

Marketing Risks

Markets for future production of oil and natural gas are outside the Company's

capacity to control or influence and can be affected by events such as weather,

regional, national and international supply and demand imbalances, geopolitical

events, currency fluctuation, introduction of new, or termination of existing

supply arrangements, as well as downtime due to facility maintenance or damage.

The Company will attempt to mitigate these risks as follows:

-- Natural gas properties are developed in areas where there is or will be

suitable processing and pipeline infrastructure.

-- Financial instruments may be used to manage commodity price volatility

when the Company has capital programs, including acquisitions, whose

cost exceeds near term projected cash flows.

-- The Company will delay tie in of new wells or shut in production if an

acceptable netback cannot be realized.

Access to Debt and Equity and Going Concern

The Company's cash and potential proceeds from the sale of listed securities are

sufficient to fund our existing capital budget. Nevertheless, available cash is

finite and investment must result in production being brought on stream, the

generation of cash flow, and the identification of proven and probable reserves.

The Company's current asset base cannot be used as security for bank financing,

which for junior oil and gas companies like Storm, is conventionally a loan,

renewable annually, which is based on anticipated future cash flows.

Correspondingly, the emergence of profitable operations, from investment of

existing cash and proceeds from the sale of listed securities, is essential if

the Company is to receive bank financing to expand future operations. Proceeds

from the sale of listed securities are dependent on a continuing liquid market

for the shares of each company. It should also be recognized that the size of

the Company's holdings in each entity may make the shareholdings difficult to

sell within a reasonable time, or saleable only at a significant discount to

quoted prices.

Concurrent with the completion of the Arrangement, the Company completed two

equity placements. The first was a private placement of the maximum amount of

2.3 million shares to directors, officers and employees, with the second being

the issue of 6.6 million shares upon the exercise of warrants issued to existing

shareholders. The take up of the warrants was 99%. Both transactions were priced

at $3.28 per share and aggregate gross proceeds amounted to $29 million.

Although these share sales show considerable support for the Company in the

equity markets, such support will only be sustainable if the Company can execute

a successful investment program. Even if profitable operations do emerge, the

Company will be exposed to changes in the equity markets, which could result in

equity not being available, or only available under conditions which are

dilutive to existing shareholders. The inability of the Company to develop

profitable operations, with the consequent exclusion from debt and equity

markets, will result in the Company being unable to continue as a going concern.

Extraordinary Circumstances

Storm's operations and its financial condition may be affected by uncontrollable

and unpredictable circumstances such as weather patterns, changes in

contractual, regulatory or fiscal terms, exclusion from third party pipelines or

facilities, or actions by certain groups such as industry organizations, local

communities, or militant groups.

INTERNATIONAL FINANCIAL REPORTING STANDARDS

The Canadian Institute of Chartered Accountants, the primary source for

accounting standards in Canada, proposes to implement International Financial

Reporting Standards ("IFRS") as part of Canadian GAAP. Such standards have been

established cooperatively by many countries and have widespread application to

financial reporting throughout the world. The effective date of introduction for

IFRS in Canada is proposed for reporting periods beginning after December 31,

2010. Rather than apply existing Canadian GAAP to financial statements for the

reporting periods ended September 30, 2010 and December 31, 2010, then adopt

IFRS for all subsequent reporting periods, the Company elected to adopt IFRS

with immediate effect, as permitted under NI 51-107 and has applied for and

received the necessary regulatory approvals for early adoption.

With respect to implementation of IFRS, the Company recruited appropriately

qualified staff and identified external resources to assist in the process. Key

elements of the implementation plan to IFRS included: staff education; choosing

among policies permitted under IFRS; evaluating the effect of adoption on the

Company's information technology and data systems and internal control over

financial reporting and disclosure controls and procedures; alignment of

internal and outsourced processes, applications and internal controls; external

and internal communications; and liaison with peers, industry groups and

professional advisors.

As discussed in Note 2, the Company elected to adopt IFRS at inception. The

following table provides a brief summary of the primary financial statement line

items affected by IFRS and the impact on Storm's financial statement

presentation, measurement and disclosure:

Financial Statement Effect on Financial

Category Change Under IFRS Statements of Storm

----------------------------------------------------------------------------

Exploration and Under Canadian GAAP, E&E New line item on the

evaluation ("E&E") assets were accounted for Statement of Financial

assets using the full-cost rules Position

and grouped with property

and equipment. Exploration More disclosure required

and evaluation in both Accounting

expenditures are now Policies and &E notes to

segregated from the financial statements

development and producing

assets until commercial

production commences, at

which time, the assets are

tested for impairment and

the recoverable amount

transferred to property

and equipment.

----------------------------------------------------------------------------

Exploration and E&E assets are only tested If an indicator of

evaluation ("E&E") for impairment when impairment exists, assets

assets indicators of impairment in that area must be

exist. written down to their net

recoverable amount and the

Under full-cost rules, difference charged as

E&E assets were excluded impairment expense on the

from the ceiling test statement of income.

calculation.

More note disclosure

required in the event of

a write-down

----------------------------------------------------------------------------

Property and Development and producing Multiple depletion

Equipment assets to be allocated calculations will be

into cash generating units required at each reporting

("CGUs") and depleted at period once production

the CGU level. commences.

----------------------------------------------------------------------------

Property and Depletion can be Use of proved plus

Equipment calculated using either probable reserves in

proven or proved plus depletion calculation will

probable reserves. reduce depletion expense.

----------------------------------------------------------------------------

Property and Gains and losses on Gains and losses on

Equipment dispositions will be property sales may be a

measured and recognized in frequent income statement

the statement of income. item, leading to a more

There is no de minimis erratic earnings profile.

rule as previously existed

under Canadian GAAP.

----------------------------------------------------------------------------

Property and Impairment test will be Impairment tests will be

Equipment calculated at the CGU more difficult to pass as

level. Changes to the less profitable areas can

impairment calculation no longer be sheltered by

methodology are also more successful ones.

required.

----------------------------------------------------------------------------

Share-Based Payments Stock options that vest in The graded vesting rules

installments are valued result in higher share-

separately. based payment expense in

the earlier years of the

amortization period.

----------------------------------------------------------------------------

ADDITIONAL INFORMATION

Additional information relating to the Company can be viewed at www.sedar.com or

on the Company's website at www.stormresourcesltd.com. Information can also be

obtained by contacting the Company at Storm Resources Ltd., 800, 205 - 5th

Avenue SW, Calgary, Alberta, T2P 2V7.

Statement of Financial Position

($000s) (unaudited) September 30, 2010

----------------------------------------------------------------------------

ASSETS

----------------------------------------------------------------------------

Current

Cash $ 37,830

Accounts receivable 195

Investments (Note 6) 16,158

Prepaids and other 274

----------------------------------------------------------------------------

54,457

Investment in associate (Note 7) 13,925

Exploration and evaluation assets (Note 5) 23,461

----------------------------------------------------------------------------

$ 91,843

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

----------------------------------------------------------------------------

Current

Accounts payable and accrued liabilities $ 3,620

----------------------------------------------------------------------------

3,620

Decommissioning liability (Note 8) 1,003

----------------------------------------------------------------------------

4,623

----------------------------------------------------------------------------

Shareholders' equity

Share capital (Note 10) 86,581

Contributed surplus (Note 11) 126

Retained earnings (deficit) (406)

Accumulated other comprehensive income (deficit) 919

----------------------------------------------------------------------------

87,220

----------------------------------------------------------------------------

$ 91,843

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Statement of Comprehensive Income (Loss)

Inception,

June 8, 2010 to

($000s except per-share amounts) (unaudited) September 30, 2010

----------------------------------------------------------------------------

Revenue

Interest income $ 19

----------------------------------------------------------------------------

19

----------------------------------------------------------------------------

Expenses

General and administrative 267

Share-based payments 126

Depreciation 2

Accretion 5

----------------------------------------------------------------------------

400

----------------------------------------------------------------------------

Income (loss) before the following: (381)

Investment gain (loss) (Note 7) (25)

----------------------------------------------------------------------------

Net income (loss) for the period (406)

Unrealized gain (loss) on investments available for sale

(Note 6) 919

----------------------------------------------------------------------------

Other comprehensive income 919

----------------------------------------------------------------------------

Comprehensive income (loss) for the period $ 513

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income (loss) per share (Note 12)

- basic $ (0.05)

- diluted $ (0.05)

Statement of Changes in Equity

Inception, June 8, 2010 to

($000s) (unaudited) September 30, 2010

----------------------------------------------------------------------------

Accumulated

Retained Other

Share Contributed Earnings Comprehensive Total

Capital Surplus (Deficit) Income Equity

----------------------------------------------------------------------------

Balance, beginning of

period $ - $ - $ - $ - $ -

Net loss for the period - - (406) - (406)

Issue of common shares

(Note 10) 86,666 - - - 86,666

Share issue costs (Note

10) (85) - - - (85)

Share-based payments

(Note 11) - 126 - - 126

Unrealized gain on

investments available

for sale (Note 13) - - - 919 919

----------------------------------------------------------------------------

Balance, end of period $86,581 $ 126 $ (406) $ 919 $87,220

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Statement of Cash Flows

Inception,

June 8, 2010 to

($000s) (unaudited) September 30, 2010

----------------------------------------------------------------------------

Operating activities

Net income (loss) for the period $ (406)

Non-cash items:

Investment loss (gain) (Note 7) 25

Depreciation and accretion 7

Share-based payments 126

----------------------------------------------------------------------------

Funds from operations (248)

Net change in non-cash working capital items (Note 16) 3

----------------------------------------------------------------------------

(245)

----------------------------------------------------------------------------

Financing activities

Cash transferred under Plan of Arrangement (Notes 1 and 4) 9,370

Issue of common shares - net of expenses 28,981

----------------------------------------------------------------------------

38,351

----------------------------------------------------------------------------

Investing activities

Additions to exploration and evaluation assets (Note 5) (3,424)

Net change in non-cash working capital items (Note 16) 3,148

----------------------------------------------------------------------------

(276)

----------------------------------------------------------------------------

Change in cash during the period 37,830

Cash, beginning of period -

----------------------------------------------------------------------------

Cash, end of period $ 37,830

----------------------------------------------------------------------------

----------------------------------------------------------------------------

NOTES TO THE FINANCIAL STATEMENTS

From inception, June 8, 2010 to September 30, 2010

Tabular amounts in Cdn$ thousands, except per share amounts

(unaudited)

1. REPORTING ENTITY

Storm Resources Ltd. (the "Company" or "Storm"), is an oil and gas exploration

and development company incorporated in the province of Alberta, Canada on June

8, 2010 and is listed on the TSX Venture Exchange under the symbol "SRX". The

Company operates in the provinces of Alberta and British Columbia and its office

is located at 800, 205 - 5th Avenue S.W., Calgary, Alberta.

The Company became a reporting issuer pursuant to a plan of arrangement (the

"Arrangement") involving ARC Energy Trust ("ARC"), ARC Resources Ltd., Storm

Exploration Inc. ("SEO") and the Company. Under the Arrangement, which was

completed on August 17, 2010, 884,173 common shares were issued to ARC and

16,631,241 common shares and 6,653,161 warrants to purchase common shares of the

Company were issued to shareholders of SEO in exchange for undeveloped lands and

facility interests in northeastern British Columbia and Alberta, various

corporate investments and $9.4 million in cash (see Note 4).

2. BASIS OF PRESENTATION

Statement of Compliance

The financial statements have been prepared in accordance with International

Financial Reporting Standards ("IFRS") as issued by the International Accounting

Standards Board ("IASB") and Interpretations of the International Financial

Reporting Interpretations Committee ("IFRIC") and adopted by the Canadian

Institute of Chartered Accountants ("CICA"), including IAS 34. The Company

received approval from the Canadian Securities Administrators under National

Instrument 52-107, Acceptable Accounting Principles, Auditing Standards and

Reporting Currency ("NI 52-107") to adopt IFRS as of June 8, 2010, the date of

Storm's incorporation.

The financial statements were authorized for issue by the Board of Directors on

November 10, 2010.

Going Concern

These financial statements have been prepared on a going concern basis, which

implies the Company will continue to realize its assets and discharge its

liabilities in the normal course of business. Although the Company has, at

September 30, 2010, considerable cash reserves and various marketable

securities, its continuance as a going concern is dependent upon the ability of

the Company to attain profitable operations or to obtain additional financing.

The outcome of these matters cannot be predicted at the present time. These

financial statements do not include any adjustments to the recoverability and

classification of recorded asset amounts and classification of liabilities that

might be necessary should the Company be unable to continue as a going concern.

The emergence of profitable operations requires that reserves in economic

quantities be identified and brought into production and sold at an acceptable

price. This will require the dedication of part or all of the Company's existing

cash resources and, if required, additional equity, to be raised under future

market conditions. As part of management of capital, the Company prepares an

annual budget, periodically updated, for approval of the Board of Directors,

which aligns spending programs with available cash resources and identifies

future capital requirements.

Basis of Measurement

The Company's financial statements have been prepared on the historical cost

basis, except for certain financial assets and financial liabilities, which are

measured at fair value, as explained in Note 13.

Use of Estimates and Judgements

The preparation of the financial statements in accordance with IFRS requires

management to make judgements, estimates and assumptions that affect the

reported amounts of assets, liabilities, income and expenses. Actual results may

differ from these estimates.

Estimates and underlying assumptions are continuously reviewed. Changes to

accounting estimates are recognized in the period in which the estimates are

revised.

Information about critical judgments in applying accounting policies that have

the most significant effect on the amounts recognized in the financial

statements is included in the following notes to the financial statements:

-- Note 3 - Classification and valuation of exploration and evaluation

assets

-- Note 8 - Decommissioning liability

-- Note 9 - Valuation and utilization of tax losses

-- Note 11 - Measurement of share-based payments

-- Note 13 - Valuation of financial instruments

3. SIGNIFICANT ACCOUNTING POLICIES

Jointly Controlled Assets and Operations

Substantially all of the Company's exploration and production activities are

conducted under joint operating agreements, whereby two or more parties jointly

control the assets. These financial statements reflect only the Company's share

of these jointly controlled assets and, once production commences, a

proportionate share of the relevant revenue and related costs.

Investment in Associates

An associate is an entity over which the Company has significant influence, but

not control, over financing and operations. The investment in associated

companies is initially recognized at cost and subsequently accounted for using

the equity method, with the Company's share of changes in equity of associates

recognized in the statement of income.

The Company assesses at each reporting period whether there is any objective

evidence that its interests in associates are impaired. If impaired, the

carrying value of the Company's share of the underlying assets of associates is

written down to its estimated recoverable amount and the amount of the

write-down charged to the statement of income.

Oil and Gas Exploration and Evaluation Expenditures

Oil and gas exploration and evaluation ("E&E") expenditures are accounted for in

accordance with IFRS 6, Exploration for and Evaluation of Mineral Resources,

whereby costs associated with the exploration for and evaluation of oil and gas

reserves are accumulated on an area-by-area basis and are capitalized as either

tangible or intangible E&E assets when incurred. Costs incurred in advance of

land acquisition are charged to the statement of income; however, all other

costs, including directly attributable general and administrative costs, are

added to E&E assets.

At each reporting date, E&E assets are reviewed for indicators of impairment

and, if circumstances suggest that the carrying amount of a particular area

exceeds its recoverable amount, the associated cost is written down to its

estimated recoverable amount and the difference is accounted for as impairment

expense on the statement of income. Once commercial production commences in a

specific area, the associated E&E assets are tested for impairment and the

estimated recoverable amount is transferred to property and equipment. If, at

any time, it is determined that the Company has no future exploration plans and

commercial production cannot be achieved in relation to an area, the associated

costs are written down to the estimated recoverable amount or fully

de-recognized and the amount of the write-down is expensed as impairment on the

statement of income.

No depletion or depreciation is provided for exploration and evaluation assets.

Property and Equipment

Property and equipment, which includes oil and natural gas development and

production assets, represents costs incurred in developing oil and natural gas

reserves and maintaining or enhancing production from such reserves. Future

decommissioning costs, related to producing assets, are also capitalized to

property and equipment. Property and equipment is carried at cost, less

accumulated depletion and depreciation and accumulated impairment losses.

Gains and losses on disposal of property and equipment are determined as the

difference between proceeds from disposal and the carrying amount of the asset

sold and are recognized as other income or other expense in the statement of

income.

Depletion and Depreciation

The net carrying value of the intangible oil and gas assets is depleted using

the unit-of-production method based on estimated proven and probable oil and

natural gas reserves, taking into account the future development costs required

to produce the reserves.

Proven and probable reserves are determined by independent engineers in

accordance with Canadian National Instrument 51-101. Production and reserves of

natural gas are converted to equivalent barrels of crude oil on the basis of six

thousand cubic feet of gas to one barrel of oil. Changes in estimates used in

prior periods, such as proved and probable reserves, that affect the

unit-of-production calculations do not give rise to prior year adjustments and

are dealt with on a prospective basis.

Processing facilities and well equipment will be depreciated on a straight-line

basis over the estimated useful life of the facilities and equipment. Where

facilities and equipment includes major components having different useful

lives, they are depreciated separately.

Depreciation rates, useful lives and residual values are reviewed at each

reporting date.

Impairment

The carrying amounts of property and equipment are reviewed at each reporting

date to determine whether there is any indication of impairment. If such an

indication exists, the estimated recoverable amount is calculated. For the

purpose of impairment testing, property and equipment assets are grouped

together into the smallest group of assets that generates cash inflows that are

largely independent of the cash flows of other assets or group of assets (the

"cash generating unit" or "CGU"). The recoverable amount of an asset or CGU is

the greater of its value in use and its fair value less cost to sell. In

assessing value in use, the estimated future cash flows are adjusted for the

risks specific to the asset group and are discounted to their present value

using a pre-tax discount rate that reflects current market assumptions regarding

the time value of money. Fair value less costs to sell is the amount obtainable

from the sale of an asset or CGU in an arm's length transaction between

knowledgeable, willing parties, less the costs of disposal. An impairment loss

is recognized in the statement of income if the carrying amount of an asset or

CGU exceeds its estimated recoverable amount.

Impairment losses previously recognized are assessed at each reporting date for

indications that the loss has decreased or no longer exists. An impairment loss

is reversed to the extent that the asset's new carrying amount does not exceed

the original carrying amount, net of related accumulated depletion and

depreciation, if there has been an increase in the estimate of the recoverable

amount.

Decommissioning Liability

Decommissioning liabilities are measured as the present value of management's

best estimate of the expenditure required to settle the decommissioning

liability at the reporting date using a risk-free discount rate. This estimate

is recognized when a legal or constructive obligation arises and is capitalized

as part of E&E assets or property and equipment. The amount capitalized to

property and equipment is amortized on a unit-of-production basis as part of

depreciation and depletion. Subsequent to the initial measurement, the

obligation is adjusted at the end of each period to reflect the passage of time

and changes in the estimated future costs underlying the obligation. The

increase in the balance due to the passage of time is charged to accretion

expense whereas increases or decreases due to changes in the estimated future

costs are capitalized. Actual costs incurred upon settlement of the

decommissioning obligations are charged against the liability or expensed if

greater than the liability.

Share-Based Payments

The Company has issued options to acquire common shares to directors, officers

and employees of the Company. These options are accounted for using the

fair-value method which estimates the value of the options at the date of the

grant using the Black-Scholes option pricing model. The fair value thus

established is recognized as compensation expense over the vesting period of the

options with an equivalent increase to contributed surplus. A forfeiture rate is

estimated on the grant date and is subsequently adjusted to reflect the actual

number of options that vest.

Financial Instruments

Financial assets and liabilities are recognized when the Company becomes a party

to the contractual provisions of the instrument. Financial assets are

derecognized when the rights to receive cash flows from the assets have expired,

or when the Company has transferred substantially all risks and rewards of

ownership.

Financial assets and liabilities are offset and the net amount reported in the

statement of financial position when there is a legally enforceable right to

offset the recognized amounts, and there is an intention to settle on a net

basis, or realize the asset and settle the liability simultaneously.

Cash and cash equivalents

Cash and cash equivalents comprise cash on hand and other short-term highly

liquid investments. Due to the short-term nature of cash and cash equivalents,

its carrying value approximates fair value.